Nyheter

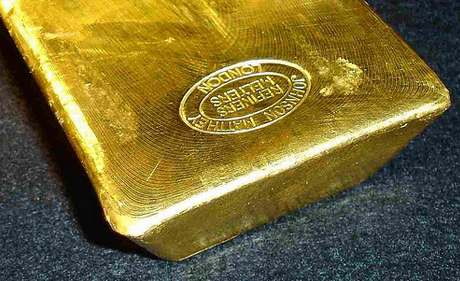

Pressure on truth about gold

– wouldn’t you like to know whether the gold is there? –

WHY IS IT SO DIFFICULT TO GIVE US THE PROOF?

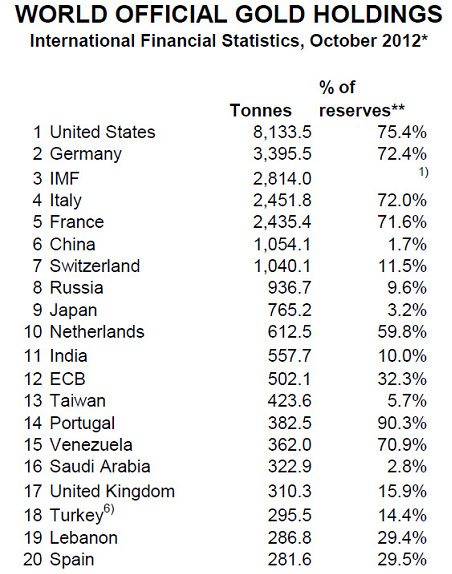

In April of this year, I published a GOLDVIEW ALERT report that informed you about “FAKE GOLD BARS IN FORT KNOX!” and asked the question “What’s next?”. Well, in the last few months, we have seen several reports that reflected a serious international concern about the presence and well-being of gold reserves. Politicians in countries like the UK, Switzerland, France, Germany, the Netherlands have asked questions in their parliament and the press about the desirability to repatriate their country’s gold reserves to within their own borders and vaults.

In Germany, it even came to a court case and the court eventually issued an order to the Bundesbank to undertake an audit of its gold reserves to assure that the nearly 3,400 tons of gold is in fact is there where we think it is. Not only did the court question the practice of relying on a written confirmation from the foreign central banks that hold the gold into their custody, but also demanded that the ‘authenticity and weight’ would be checked. You would think that the BDR’s government would instruct the Central Bank’s officials to take action in order to satisfy the general unrest and doubts and ask the necessary proof from the Bank of England, the Bank of France and the US Federal Reserve, where most of the German gold is stored. Not really so, they only announced that the Bundesbank has begun a process of shipping 50 (!) tons per year from the Fed back to Germany for the next three years. This is hardly reassuring because it is so easy to comply with. The Federal Reserve Bank of New York is supposed to hold over 1,500 tons of German gold, representing almost half of its total reserves, in vaults that are situated at the fifth subfloor of the bank’s building on Liberty Street, 25m below street level and 15m below sea level, resting on the bedrock of Manhattan Island. In other words, the Bundesbank has given the Fed 30 years to prove that all the supposed gold is there…….

Another spicy fact is that tourists are allowed to venture below street level to see the vault but only to see the enormous steel cylinder that pivots like a door in a 140-ton steel-and-concrete frame. But the owners of the gold are not even allowed to view their own gold. “Following numerous enquiries”, some staff members of the Bundesbank were allowed to see the gold storage facility in 2007 but they only made it to the anteroom of the German reserves. Another visit was allowed in May 2011, this time to some auditors of the Bundesbank. Of the 9 compartments in which the German gold bars are densely stacked, only 1 was opened to pull out a few bars and weigh them. This reluctant attitude of the Fed caused one of the Bundesbank board members to say “I would like more transparency on this issue”. Whether he will get this reassurance at any given time, is utmost doubtful. To illustrate the extreme sensitivity of the US authorities in this matter may serve that in the last few decades, practically no one has been allowed to view the US’ own gold reserves that are stored in Fort Knox. To remind you, that is where the shipments came from in which the fake gold bars were found (see the April 2012 GOLDVIEW ALERT).

For those of you who may suspect that I am one of the convinced believers in the big conspiracy theory like some others are, let me be clear at this point: I am not convinced but suspicious. That is why I do want to be realistic and signal the possibility that there is such a conspiracy existing. I have seen too many signs of incomprehensible movements in the world of gold and gold trading to be completely comfortable and trusting. There are just too many secrets and unanswered questions. And yes, referring to what I said in the heading of this editorial, I would like to know whether the gold is there where we believe it is and I just refuse to understand why it is so difficult to give us convincing proof, if and when all the gold is there that is supposed to be there.

The other day, someone from Canada asked me why European countries would hold gold abroad and suggested the second world war could be the reason. I really didn’t know the answer but it could indeed very well be that it originates from that. Not surprisingly, the USA was the preferred and safest place to be as people in those days had a blind trust in them. But the world has changed since then and politicians in several European countries have been getting uncomfortable with the idea to have their gold in foreign vaults. The US has lost a lot of their credibility and is no longer blindly accepted as the ultimate safe haven.

Germany has not been the only country that wondered about the safety of its gold reserves. Also in the UK, France, Switzerland and the Netherlands have been talking about repatriating some or most of their gold from the Fed, Austria had parliamentary debates about asking their gold back from the UK, Romania has demanded their gold back from Russia and outside of Europe, Venezuela and Ecuador have contemplated to ask their gold to be returned from the UK and USA.

In March 2012, I already paid attention and expressed by doubts and concern about this highly sensitive matter. The above signalled silence is the reason for me to bring up this subject again at this time. Gold is still the basis of the world’s financial system. Not as it used to be but still to a certain extent. What other security is there? And what is the security worth if not all the gold is there where governments say it is?

It is not only me that is cautious in believing the official statements about the international gold reserves as they are reported and in the actual presence of them. Actually, I am in very good company. GATA‘s Chris Powell and Bill Murphy are the clearest and most outspoken advocates on the presence of gold; actually, they were one of the first, if not the first to express their suspicions and earned more recognition as they brought more specific information to the world’s attention. For your information, it is not only me that is cautious in believing the official statements about the international gold reserves as they are reported and in the actual presence of them. Actually, I am in very good company. More recently, other well-regarded gold commentators elaborated on the subject too.

On October 2, Eric Sprott and David Baker of Sprott Asset Management LP issued an article with as title “Do Western Central Banks Have Any Gold Left?” in which they extensively questioned the presence of those gold reserves. Very worthwhile reading from investment people that have earned their reputation to be very realistic at all times but don’t shy away from bringing up itchy issues. You can find the article here.

And read what Louis Golino wrote for CoinWeek: On October 29, John Embry, chief investment strategist of Sprott Asset Management, told King World News that “I firmly believe that if you look at all of the Western central banks, and the gold they allegedly own, I believe a significant portion of that is not in their vaults.” Embry also stated, “So they can say all they want, but in the end the truth will be revealed by the lack of physical gold in the market as they run out of enough gold to keep the price under control.” Here is the link to see the interview at King World News.

What puzzles and frightens me, is that we do hear about those expressions from time to time but we do hear a lot less about the actual outcome and returning actions. It is most probable that there is not only widespread concern about the safety of the Central Bank’s gold reserves, it even looks like the politicians and bank officials are also afraid about the outcome. Understandably so, because just imagine, what will happen if indeed it turns out that not all the gold is there where we think it is? I would like to hear anyone’s guess what the gold price will be then………

But as always, not everybody cares about these kind of things. Or rather, it is quite common that almost everybody doesn’t want to know about these matters. Read Louis Colino again: Yet many mainstream analysts continue to downplay the significance of this matter. For example, John Carney of CNBC said when reporting on the German gold audit request that it does not matter whether the gold actually exists or not. He maintained that if the Federal Reserve says it is there, that is all that counts: “In reality, it does not matter one bit whether the Federal Reserve Bank of New York actually has the German central bank’s gold or whether the gold is pure. As long as the Fed says it is there, it is as good as there for all practical purposes to which it might be put. It can be sold, leased out, used as collateral, employed to extinguish liabilities and counted as bank capital just the same whether it exists or not.” My comment can only be that ignorance is bliss, sleep tight and don’t have bad dreams, John….

I truly do hope that I have not scared you too much and have given you too many reasons to panic. Most probably not as we human beings have the ability to take distance from subjects that can be hardly believed to be true. But December is the appropriate month to make room for having serious thoughts about all kinds of things of life. It is also the month that we can make wishes, especially for the coming New Year. So, let me share with you one of the wishes that are on my list, not on the top of it but at a prominent place:

[quote]let 2013 be the year that will give us more insight, more comfort and more answers on the whereabouts and presence of the world’s gold reserves and the necessary proof that the gold reserves are safely stored in the vaults where we all have been trusting they are.[/quote]

Explor Resources, Exploring properties until they are ready to become somebody else’s mine

TSXV:EXS – December 12, 2012: C$0.105

shares outstanding 148.9 million – fully diluted 188.0 million

Explor Resources is not a company that is in the news daily. When you meet Explor’s President Chris Dupont and hear him talk about how he operates the company and what he aims to accomplish, you come to understand that he finds the work more important than the marketing. In a no-nonsense but very dedicated manner he elaborates on the company, its philosophy and its projects. Clear, solid and refreshing.

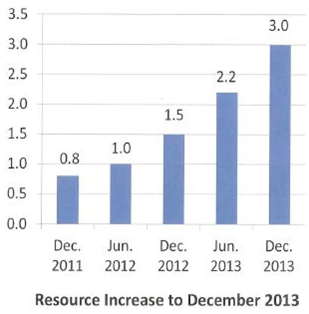

Explor has a portfolio of 6 active exploration properties in the famous the Abitibi Greenstone Belt in Ontario and Quebec and 13 inventory properties in Ontario, Quebec, Saskatchewan and New Brunswick. Explor is not an exploration company that has an ultimate goal to become a producer. The objective is to work on a prospective property in a recognized mining environment and explore it until it is ready to become some other company’s mine. Chris has done it before and he is on his way to do it again with Explor’s flagship Timmins Porcupine West property in Ontario. Enjoying approximately 90% of the total corporate spending, this property has been the subject over 100,000m of diamond drilling, resulting in a NI43-101 resource of 212,800 ounces of gold Indicated and 814,000 ounces Inferred. Drilling is continuing to target high grade intersections and expand resource base-tonnage. As the chart reflects, Explor expects the total resource to increase to 1.5 million ounces by the end of this year and to 3.0 million ounces by the end of 2013.

Before Explor acquired the property in July 2009, previous owners Dome Mines, Teck, Cameco and Tom Exploration completed 30,000m of drilling, all up to 300m average vertical depth. Explor is focusing on vertical depths from 600 to 900m, and several high grade gold zones have been encountered so far. Indicative of the grades are the 6.14g/t over 4.5m and the 7.64g/t over 6.0m that were reported recently.

In my view, Explor Resources is a perfect example of what we know as a pure and is very well managed. The TWP property bears a strong resemblance to the nearby Hollinger-McIntyre Mine which produced over 30 million ounces. It is in the right area and the achieved exploration results indicate the company has a high quality and very promising project on hand. I will be happy to report the further progress to you over the next 12 months!

Orvana Minerals We don’t explore, we build, operate and expand mines”

TSX:ORV – December 12, 2012: C$0.78

shares outstanding 136.6 million – fully diluted 143.0 million

What Orvana’s President and CEO Bill Williams means when he says that he is not exploring, is that Orvana does not have a portfolio of exploration projects from which a future producer may arise. The company explores at the mines it owns. Orvana has what it calls a ‘Multi Project Producer Strategy’ with becoming a multi-mine gold and copper producer as objective. However, this is not about having plans for the future, it is already reality: two of the three Orvana projects are in production and the third one is scheduled to be commissioned by 2015.

Orvana’s flagship project is the El Valle-Boinás/Carlés mine which it acquired in September 2009. The mine is situated in the Rio Narcea Gold Belt of northern Spain and was previously mined by Rio Narcea Gold Mines. Orvana upgraded the reserve estimate and cash-flow forecast and outlined a 10 year mine life with an average annual production of 73,000 ounces of gold and 2,570 tonnes of copper. Commercial production started in August 2011 and as the company’s fiscal year is ending per September 30, the figures of the first full year of operation are awaited and projected at 47,500 ounces of gold, 4.4 million pounds of copper and 125,000 of silver.

The second operating mine is the low-cost Don Mario mine in Bolivia, Orvana’s original producing mine. The Don Mario has three main mineral deposits of which the first two zones were depleted in 2009 and 2011 after having produced respectively over 420,000 and nearly 50,000 ounces of gold. The third deposit, the Upper Mineralized Zone, started up in April 2011, reached commercial production in January 2012 and is expected to be in production until 2019. The production in FY 2012 is estimated to have reached 12,500 ounces of gold, 12,127 pounds of copper and 575,000 ounces of silver.

Orvana’s third project is the Copperwood, located in the Upper Peninsula of the State of Michigan, USA, some 30km southwest of the inactive White Pine mine where over 1.7 million tonnes of copper and over 4.5 million ounces of silver were produced between 1953 and 1996. Since Orvana acquired the project in 2008, sufficient drilling was completed to estimate a NI43-101 compliant resource. The Copperwood is scheduled to run for a 13-year mine life with an annual production of 852,000 pounds of copper at cash costs of $1.25 per pound. Commissioning is expected in 2015.

I look forward to be writing about this company because I like the project mix with a significantly growing gold and copper production over the next few years, spread geographically over Spain, Bolivia and the USA. The El Valle-Boinás/Carlés mine makes the company a major European gold producer and fits my special interest in the Iberian peninsula whereas the Copperwood represents an interest in the re-emerging mining industry of the United States. For the FY2013, Orvana forecasts total production of 75,000 ounces of gold, 18 million pounds of copper and 850,000 ounces of silver. I am sure there will be more good things to report over the next 12 months!

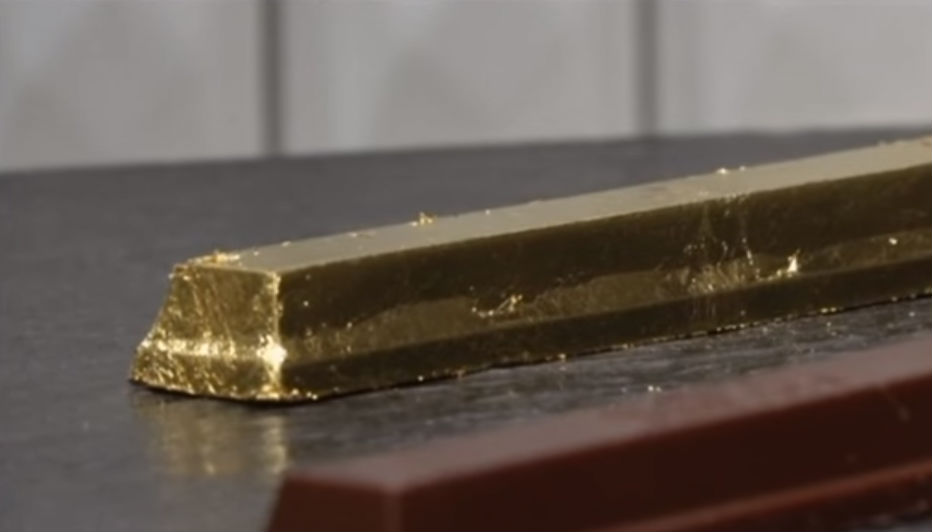

After expressing my serious concern about the presence of the world’s gold reserves, meant as another signal of the growing uncertainties about our most precious of the precious metals, I feel I should give you some comfort. What better comfort can I give you than a rare visit to one of the most guarded and secret bank vaults, the one of the Bank of England?

Just a few days ago, I came across a highly interesting video on You Tube, which gives a view on a part of the £197 billion ($315 billion) worth of gold that is supposedly held there. The film is made by Brady Haran and features Professor Martyn Poliakoff, I hope they would allow directing you to that interesting view. It is so illustrative of what we are talking about all the time. I am sure you will agree with me that seeing so much gold is doing something with us. Hope you find it an interesting experience too!

My best wishes for a good end of this year and a good start for the next one! And looking forward to bring more interesting reports to you in the future!

Henk J. Krasenberg

[hr]

European Gold Centre

European Gold Centre analyzes and comments on gold, other metals & minerals and international mining and exploration companies in perspective to the rapidly changing world of economics, finance and investments. Through its publications, The Centre informs international investors, both institutional and private, primarily in Europe but also worldwide, who have an interest in natural resources and investing in resource companies.

The Centre also provides assistance to international mining and exploration companies in building and expanding their European investor following and shareholdership.

Henk J. Krasenberg

After my professional career in security analysis, investment advisory, porfolio management and investment banking, I made the decision to concentrate on and specialize in the world of metals, minerals and mining finance. From 1983 to 1992, I have been writing and consulting about gold, other metals and minerals and resource companies.

The depressed metal markets of the early 1990’s led me to a temporary shift. I pursued one of my other hobbies and started an art gallery in contemporary abstracts, awaiting a new cycle in metals and mining. That started to come in the early 2000’s and I returned to metals and mining in 2002 with the European Gold Centre.

With my GOLDVIEW reports, I have built an extensive institutional investor following in Europe and more of a private investor following in the rest of the world. In 2007, I introduced my MINING IN AFRICA publication, to be followed by MINING IN EUROPE in 2010 and MINING IN MEXICO in 2012.

For more information: www.europeangoldcentre.com

Nyheter

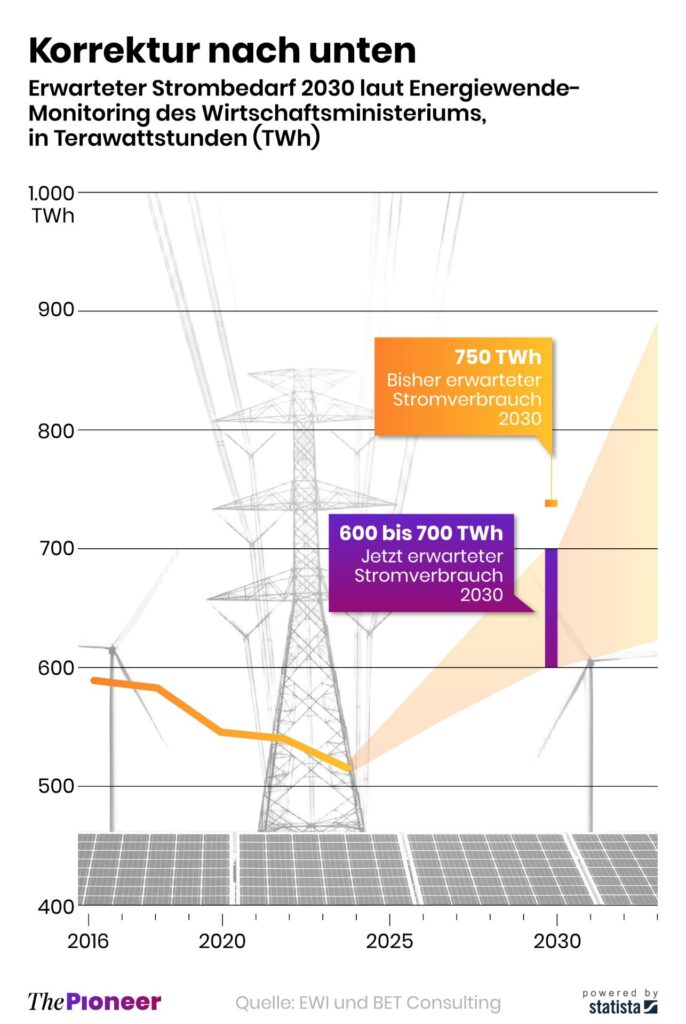

Tyskland har så höga elpriser att företag inte har råd att använda elektricitet

Tyskland har skrivit ner prognosen på hur mycket elektricitet landet kommer att behöva 2030. Hittills har prognosen varit 750 TWh, vilken nu har skrivits ner till 600-700 TWh,

Det kan vid en första anblick låta positivt. Men orsaken är inte att effektiviseringar. Utan priserna är så pass höga att företag inte har råd att använda elektriciteten. Elintensiv industri flyttar sin verksamhet till andra länder och få företag satsar på att etablera energikrävande verksamhet i landet.

Tyskland har inte heller någon plan för att förändra sin havererade energipolitik. Eller rättare sagt, planen är att uppfinna fusionskraft och använda det som energikälla. Något som dock inte löser problemet på några årtionden.

Nyheter

Kinas elproduktion slog nytt rekord i augusti, vilket även kolkraft gjorde

Kinas officiella statistik för elproduktion har släppts för augusti och den visar att landet slog ett nytt rekord. Under augusti producerades 936 TWh elektricitet.

Stephen Stapczynski på Bloomberg lyfter fram att det är ungefär lika mycket som Japan producerar per år, vilket innebär är de producerar ungefär lika mycket elektricitet per invånare.

Kinas elproduktion kom i augusti från:

| Fossil energi | 67 % |

| Vattenkraft | 16 % |

| Vind och Sol | 13 % |

| Kärnkraft | 5 % |

Stapczynskis kollega Javier Blas uppmärksammar även att det totala rekordet inkluderade ett nytt rekord för kolkraft. Termisk energi (där nästan allting är kol) producerade 627,4 TWh under augusti. Vi rapporterade tidigare i år att Kina under första kvartalet slog ett nytt rekord i kolproduktion.

Nyheter

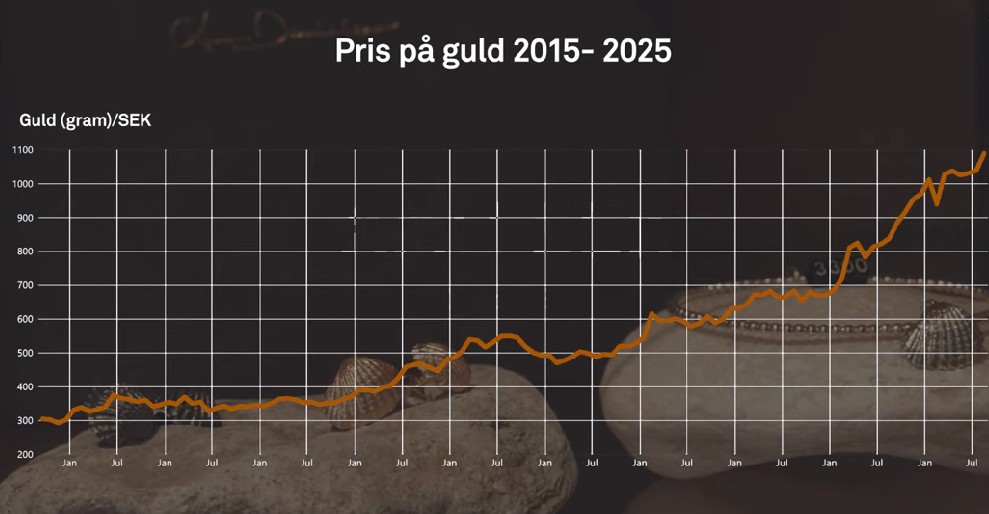

Det stigande guldpriset en utmaning för smyckesköpare

Guldpriset når hela tiden nya höjder och det märks för folk när de ska köpa smycken. Det gör att butikerna måste justera upp sina priser löpande och kunder funderar på om det går att välja något med lägre karat eller mindre diamant. Anna Danielsson, vd på Smyckevalvet, säger att det samtidigt gör att kunderna får upp ögonen för värdet av att äga guld. Det högre guldpriset har även gjort att gamla smycken som ligger hemma i folks byrålådor kan ha fått ett överraskande högt värde.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanMeta bygger ett AI-datacenter på 5 GW och 2,25 GW gaskraftverk

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanAker BP gör ett av Norges största oljefynd på ett decennium, stärker resurserna i Yggdrasilområdet

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanSommarens torka kan ge högre elpriser i höst

-

Analys4 veckor sedan

Analys4 veckor sedanBrent edges higher as India–Russia oil trade draws U.S. ire and Powell takes the stage at Jackson Hole

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanMahvie Minerals är verksamt i guldrikt område i Finland

-

Analys4 veckor sedan

Analys4 veckor sedanIncreasing risk that OPEC+ will unwind the last 1.65 mb/d of cuts when they meet on 7 September

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanNeil Atkinson spår att priset på olja kommer att stiga till 70 USD

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanEurobattery Minerals satsar på kritiska metaller för Europas självförsörjning