Nyheter

Wood McKenzie on iron ore prices

Wood MacKenzie analysts’ speaking at the Reuters Mining Summit predicted that “while iron ore supply is set to grow relatively quickly, the rate of demand growth from steel makers is expected to fall.”

Wood MacKenzie analysts’ speaking at the Reuters Mining Summit predicted that “while iron ore supply is set to grow relatively quickly, the rate of demand growth from steel makers is expected to fall.”

At the same time “steel production in top producer China will grow by about 5 percent in the next few years, down from double-digit growth in the last decade. This is due to overcapacity in the market which has squeezed the steelmakers’ margins and is forcing them to reduce capacity or shut down some furnaces.”

Their Iron Ore principal analyst said of the iron ore market “you have got this turning point on the horizon when this wall or wave of supply hits the market. Historically we tend to keep pushing that further and further out because we tend to underestimate how challenging it is to bring on this new supply. To some extent the story has changed a bit now because when you look at the new supply scheduled to come on stream a lot of it is in the hands of the major producers who are well financed and well positioned and committed to invest through the cycle almost regardless of prices.”

Hence they forecast average annual prices for ore with 62% iron content will fall from about US$159 a tonne cost-and-freight China in 2011, to $157 in 2012, $155 in 2013 and $140 in 2014.

Wood MacKenzie have some interesting views her for a fact but we feel that they misses the big picture. We agree that there are some big names behind some big future projects but some of these are in difficult locations such as West Africa (political risk and logistics) or like Baffinland (logistics). It also ignores the departure of India as an exporter.

Nyheter

Vad guldets uppgång egentligen betyder för världen

Guldpriset har nyligen nått rekordnivåer, över 4 000 dollar per uns. Denna uppgång är inte bara ett resultat av spekulation, utan speglar djupare förändringar i den globala ekonomin. Bloomberg analyserar hur detta hänger samman med minskad tillit till dollarn, geopolitisk oro och förändrade investeringsmönster.

Guldets roll som säker tillgång har stärkts i takt med att förtroendet för den amerikanska centralbanken minskat. Osäkerhet kring Federal Reserves oberoende, inflationens utveckling och USA:s ekonomiska stabilitet har fått investerare att söka alternativ till fiatvalutor. Donald Trumps handelskrig har också bidragit till att underminera dollarns status som global reservvaluta.

Samtidigt ökar den geopolitiska spänningen, särskilt mellan USA och Kina. Kapitalflykt från Kina, driven av oro för övertryckta valutor och instabilitet i det finansiella systemet, har lett till ökad efterfrågan på guld. Även kryptovalutor som bitcoin stiger i värde, vilket tyder på ett bredare skifte mot hårda tillgångar.

Bloomberg lyfter fram att derivatmarknaden för guld visar tecken på spekulativ överhettning. Positioneringsdata och avvikelser i terminskurvor tyder på att investerare roterar bort från aktier och obligationer till guld. ETF-flöden och CFTC-statistik bekräftar denna trend.

En annan aspekt är att de superrika nu köper upp alla tillgångsslag – aktier, fastigheter, statsobligationer och guld – vilket bryter mot traditionella investeringslogiker där vissa tillgångar fungerar som motvikt till andra. Detta tyder på att marknaden är ur balans och att kapitalfördelningen är skev.

Sammanfattningsvis är guldets prisrally ett tecken på en värld i ekonomisk omkalibrering. Det signalerar misstro mot fiatvalutor, oro för geopolitisk instabilitet och ett skifte i hur investerare ser på risk och trygghet.

Nyheter

Spotpriset på guld över 4300 USD och silver över 54 USD

Guldpriset stiger i ett spektakulärt tempo, nya rekord sätts nu på löpande band. Terminspriset ligger oftast före i utvecklingen, men ikväll passerade även spotpriset på guld 4300 USD per uns. Guldet är just nu som ett ångande tåg som det hela tiden skyfflas in mer kol i. En praktisk fördel med ett högre pris är att det totala värdet på guld även blir högre, vilket gör att centralbanker och privatpersoner kan placera mer pengar i guld.

Även spotpriset på silver har nu passerat 54 USD vilket innebär att alla pristoppar från Hunt-brödernas klassiska squeeze på silver har passerats med marginal. Ett högt pris på guld påverkar främst köpare av smycken, men konsekvensen av ett högt pris på silver är betydligt mer kännbar. Silver är en metall som används inom många olika industrier, i allt från solceller till medicinsk utrustning.

Nyheter

Guld och silver stiger hela tiden mot nya höjder

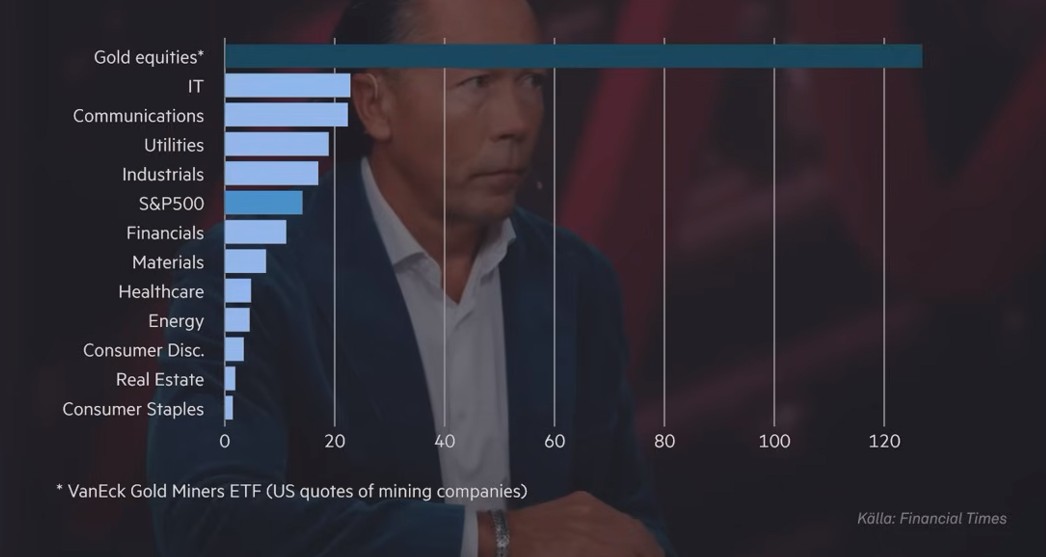

Priserna på guld och silver stiger hela tiden mot nya höjder. Eric Strand går här igenom vilka faktorerna som ligger bakom uppgångarna och vad som kan hända framöver. Han får även kommentera aktier inom guldgruvbolag som har haft en bättre utveckling än nästan allt annat. Han säger bland annat att uppgången kommer från låga nivåer och att det i genomsnitt är en mycket högre kvalitet på ledningarna för bolagen idag.

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanOPEC+ missar produktionsmål, stöder oljepriserna

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanEtt samtal om guld, olja, fjärrvärme och förnybar energi

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanGoldman Sachs höjer prognosen för guld, tror priset når 4900 USD

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanGuld nära 4000 USD och silver 50 USD, därför kan de fortsätta stiga

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanBlykalla och amerikanska Oklo inleder ett samarbete

-

Analys4 veckor sedan

Analys4 veckor sedanAre Ukraine’s attacks on Russian energy infrastructure working?

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanGuldpriset uppe på nya höjder, nu 3750 USD

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanEtt samtal om guld, olja, koppar och stål