Analys

Platina rekylerar upp efter nedgången i mars

När vi analyserade Platina den 28 februari var nivån 1707 USD/oz och vår inställning att en rekyl ned kom allt närmare. Anledningen till detta var den stora uppgång på 29 procent som platina uppvisat mellan den 29 december till den 23 februari.

När vi analyserade Platina den 28 februari var nivån 1707 USD/oz och vår inställning att en rekyl ned kom allt närmare. Anledningen till detta var den stora uppgång på 29 procent som platina uppvisat mellan den 29 december till den 23 februari.

Vi arbetade med 1665-1675 USD/oz som ett viktigt stöd och detta var också nivån för en ny signal. När denna nivå bröts, var rekylen ned påbörjad och det var därför dags att lätta på innehaven för de kortsiktiga placerarna. Vid ett genombrott av stödet fick vi signaler om fortsatta nedgångar till i första hand 1575-1590 USD/oz.

Vi ser nu tillbaka på den senaste månadens rörelser och kan då konstatera att Platina satte en topp på 1739 USD/oz den 29 februari, alltså dagen efter vår förra analys. Där startade den förväntade nedgången och redan den 5 mars bröts vårt stöd och vi fick signalen om att uppgången var över – i alla fall för denna gång.

En konsolidering med en svag dragning nedåt har kännetecknat rörelserna under mars och den lägsta noteringen fick vi den 22 mars, då platina noterades i 1604 USD/oz som lägst. Det återstod alltså i det läget ungefär 1 procent till det stödområde vi pekade ut redan för en månad sedan.

Vi justerar idag stödet något till 1590-1605 USD/oz (se diagrammet) och detta område kan komma att testas flera gånger innan det är dags för ett försök till en mer stabil och långsiktig uppgång igen.

På kort sikt är det dock dags för en rekyl upp, där 1670 USD/oz blir lite extra intressant att bevaka. Skulle Platina visa på större styrka i denna rekyl upp, kan även 1710 USD/oz komma att testas, men senast där bör Platina vända nedåt igen för att testa det stöd som vi pekat ut här ovanför.

På lång sikt är det fortfarande toppen från den 23 augusti 2011 som hägrar. Denna kom in på 1918 USD/oz och är därför ett mål, även om det finns många motstånd och hinder på vägen som kan sätta stopp för våra planer.

Du kan handla PLATINA med följande minifutures:

Uppgång MINILONG PLAT H med en hävstång kring 5,74

Nedgång: MINISHRT PLAT H med en hävstång kring 4,36

Läs mer om minifutures på RBS hemsida

[box]Denna analys publiceras på Råvarumarknaden.se med tillstånd och i samarbete med Axier Equities.[/box]

Ansvarsfriskrivning

Den tekniska analysen har producerats av Axier Equities. Informationen är rapporterad i god tro och speglar de aktuella åsikterna hos medarbetarna, dessa kan ändras utan varsel. Axier Equities tar inget ansvar för handlingar baserade på informationen.

Om Axier Equities

Axier Equities erbjuder såväl institutionella placerare som privatpersoner den erfarenhet, kompetens och analysredskap som krävs för en trygg och effektiv handel på de finansiella marknaderna. Axier Equities erbjuder ingen handel, vare sig för egen räkning eller för kunder utan arbetar endast med finansiell marknadsföring och informationshantering. Företagets kunder får dessutom ta del av deras analysprodukter som till exempel det fullständiga morgonbrevet med ytterligare kommentarer och prognoser. Varje vecka tillkommer minst 30 analyser i Axier Equities analysarkiv. För ytterligare information se Axier Equities hemsida.

Analys

Tariffs deepen economic concerns – significantly weighing on crude oil prices

Brent crude prices initially maintained the gains from late March and traded sideways during the first two trading days in April. Yesterday evening, the price even reached its highest point since mid-February, touching USD 75.5 per barrel.

However, after the U.S. president addressed the public and unveiled his new package of individual tariffs, the market reacted accordingly. Overnight, Brent crude dropped by close to USD 4 per barrel, now trading at USD 71.6 per barrel.

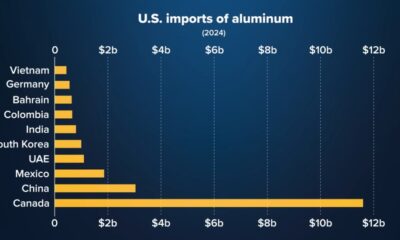

Key takeaways from the speech include a baseline tariff rate of 10% for all countries. Additionally, individual reciprocal tariffs will be imposed on countries with which the U.S. has the largest trade deficits. Many Asian economies end up at the higher end of the scale, with China facing a significant 54% tariff. In contrast, many North and South American countries are at the lower end, with a 10% tariff rate. The EU stands at 20%, which, while not unexpected given earlier signals, is still disappointing, especially after Trump’s previous suggestion that there might be some easing.

Once again, Trump has followed through on his promise, making it clear that he is serious about rebalancing the U.S. trade position with the world. While some negotiation may still occur, the primary objective is to achieve a more balanced trade environment. A weaker U.S. dollar is likely to be an integral part of this solution.

Yet, as the flow of physical goods to the U.S. declines, the natural question arises: where will these goods go? The EU may be forced to raise tariffs on China, mirroring U.S. actions to protect its industries from an influx of discounted Chinese goods.

Initially, we will observe the effects in soft economic data, such as sentiment indices reflecting investor, industry, and consumer confidence, followed by drops in equity markets and, very likely, declining oil prices. This will eventually be followed by more tangible data showing reductions in employment, spending, investments, and overall economic activity.

Ref oil prices moving forward, we have recently adjusted our Brent crude price forecast. The widespread imposition of strict tariffs is expected to foster fears of an economic slowdown, potentially reducing oil demand. Macroeconomic uncertainty, particularly regarding tariffs, warrants caution regarding the pace of demand growth. Our updated forecast of USD 70 per barrel for 2025 and 2026, and USD 75 per barrel for 2027, reflects a more conservative outlook, influenced by stronger-than-expected U.S. supply, a more politically influenced OPEC+, and an increased focus on fragile demand.

___

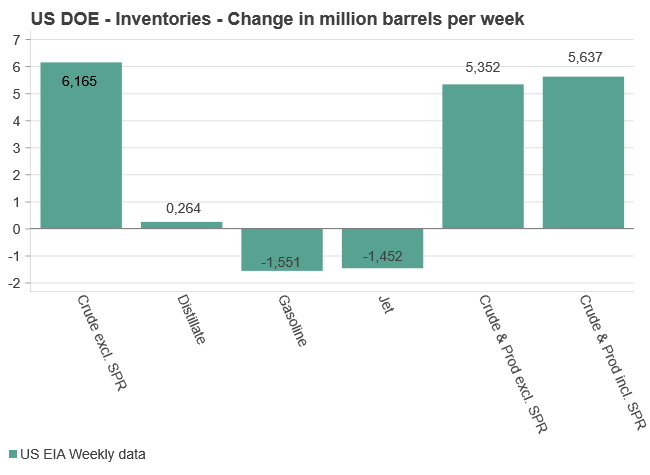

US DOE data:

Last week, U.S. crude oil refinery inputs averaged 15.6 million barrels per day, a decrease of 192 thousand barrels per day from the previous week. Refineries operated at 86.0% of their total operable capacity during this period. Gasoline production increased slightly, averaging 9.3 million barrels per day, while distillate (diesel) production also rose, averaging 4.7 million barrels per day.

U.S. crude oil imports averaged 6.5 million barrels per day, up by 271 thousand barrels per day from the prior week. Over the past four weeks, imports averaged 5.9 million barrels per day, reflecting a 6.3% year-on-year decline compared to the same period last year.

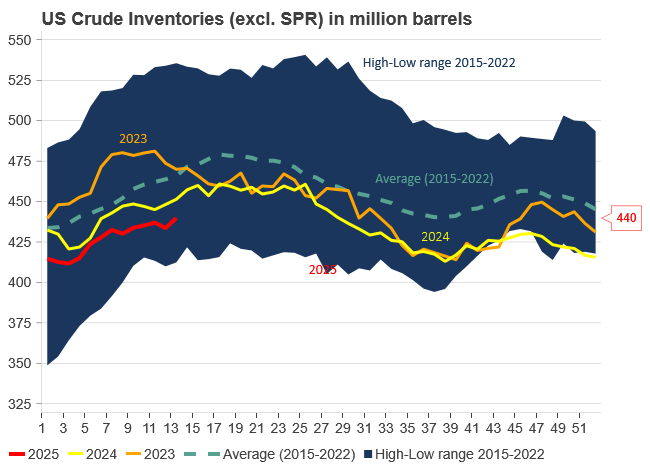

The focus remains on U.S. crude and product inventories, which continue to impact short-term price dynamics in both WTI and Brent crude. Total commercial petroleum inventories (excl. SPR) increased by 5.4 million barrels, a modest build, yet insufficient to trigger significant price movements.

Commercial crude oil inventories (excl. SPR) rose by 6.2 million barrels, in line with the 6-million-barrel build forecasted by the API. With this latest increase, U.S. crude oil inventories now stand at 439.8 million barrels, which is 4% below the five-year average for this time of year.

Gasoline inventories decreased by 1.6 million barrels, exactly matching the API’s reported decline of 1.6 million barrels. Diesel inventories rose by 0.3 million barrels, which is close to the API’s forecast of an 11-thousand-barrel decrease. Diesel inventories are currently 6% below the five-year average.

Over the past four weeks, total products supplied, a proxy for U.S. demand, averaged 20.1 million barrels per day, a 1.2% decrease compared to the same period last year. Gasoline supplied averaged 8.8 million barrels per day, down 1.9% year-on-year. Diesel supplied averaged 3.8 million barrels per day, marking a 3.7% increase from the same period last year. Jet fuel demand also showed strength, rising 4.2% over the same four-week period.

Analys

Brent on a rollercoaster between bullish sanctions and bearish tariffs. Tariffs and demand side fears in focus today

Brent crude rallied to a high of USD 75.29/b yesterday, but wasn’t able to hold on to it and closed the day at USD 74.49/b. Brent crude has now crossed above both the 50- and 100-day moving average with the 200dma currently at USD 76.1/b. This morning it is trading a touch lower at USD 74.3/b

Brent riding a rollercoaster between bullish sanctions and bearish tariffs. Biden sanctions drove Brent to USD 82.63/b in mid-January. Trump tariffs then pulled it down to USD 68.33/b in early March with escalating concerns for oil demand growth and a sharp selloff in equities. New sanctions from Trump on Iran, Venezuela and threats of such also towards Russia then drove Brent crude back up to its recent high of USD 75.29/b. Brent is currently driving a rollercoaster between new demand damaging tariffs from Trump and new supply tightening sanctions towards oil producers (Iran, Venezuela, Russia) from Trump as well.

’Liberation day’ is today putting demand concerns in focus. Today we have ’Liberation day’ in the US with new, fresh tariffs to be released by Trump. We know it will be negative for trade, economic growth and thus oil demand growth. But we don’t know how bad it will be as the effects comes a little bit down the road. Especially bad if it turns into a global trade war escalating circus.

Focus today will naturally be on the negative side of demand. It will be hard for Brent to rally before we have the answer to what the extent these tariffs will be. Republicans lost the Supreme Court race in Wisconsin yesterday. So maybe the new Tariffs will be to the lighter side if Trump feels that he needs to tread a little bit more carefully.

OPEC+ controlling the oil market amid noise from tariffs and sanctions. In the background though sits OPEC+ with a huge surplus production capacity which it now will slice and dice out with gradual increases going forward. That is somehow drowning in the noise from sanctions and tariffs. But all in all, it is still OPEC+ who is setting the oil price these days.

US oil inventory data likely to show normal seasonal rise. Later today we’ll have US oil inventory data for last week. US API indicated last night that US crude and product stocks rose 4.4 mb last week. Close to the normal seasonal rise in week 13.

Analys

Oil gains as sanctions bite harder than recession fears

Higher last week and today as sanctions bite harder than recession fears. Brent crude gained 2% last week with a close on Friday of USD 73.63/b. It traded in a range of USD 71.8-74.17/b. It traded mostly higher through the week despite sharp, new selloffs in equities along with US consumer expectations falling to lowest level since 2013 (Consumer Conf. Board Expectations.) together with signals of new tariffs from the White House. Ahead this week looms the ”US Liberation Day” on April 2 when the White House will announce major changes in the country’s trade policy. Equity markets are down across the board this morning while Brent crude has traded higher and lower and is currently up 0.5% at USD 74.0/b at the moment.

New US sanctions towards Iran and Venezuela and threats of new sanctions towards Russia. New sanctions on Venezuela and Iran are helping to keep the market tight. Oil production in Venezuela reached 980 kb/d in February following a steady rise from 310 kb/d in mid-2020 while it used to produce 2.3 mb/d up to 2016. Trump last week allowed Chevron to import oil from Venezuela until 27 May. But he also said that any country taking oil or gas from Venezuela after 2 April will face 25% tariffs on any goods exported into the US. Trump is also threatening to sanction Russian oil further if Putin doesn’t move towards a peace solution with Ukraine.

The OPEC+ to meet on Saturday 5 April to decide whether to lift production in May or not. The OPEC+ Joint Ministerial Monitoring Committee will meet on Saturday 5 April to review market conditions, compliance by the members versus their production targets and most importantly decide whether they shall increase production further in May following first production hike in April. We find it highly likely that they will continue to lift production also in May.

OPEC(+) crashed the oil price twice to curb US shale, but it kicked back quickly. OPEC(+) has twice crashed the oil price in an effort to hurt and disable booming US shale oil production. First in 2014/15/16 and then in the spring of 2020. The first later led to the creation of OPEC+ through the Declaration of Cooperation (DoC) in the autumn of 2016. The second was in part driven by Covid-19 as well as a quarrel between Russia and Saudi Arabia over market strategy. But the fundamental reason for that quarrel and the crash in the oil price was US shale oil producers taking more and more market share.

The experience by OPEC+ through both of these two events was that US shale oil quickly kicked back even bigger and better yielding very little for OPEC+ to cheer about.

OPEC+ has harvested an elevated oil price but is left with a large spare capacity. The group has held back large production volumes since Spring 2020. It yielded the group USD 100/b in 2022 (with some help from the war in Ukraine), USD 81/b on average in 2023/24 and USD 75/b so far this year. The group is however left with a large spare capacity with little room to place it back into the market without crashing the price. It needs non-OPEC+ in general and US shale oil especially to yield room for it to re-enter.

A quick crash and painful blow to US shale oil is no longer the strategy. The strategy this time is clearly very different from the previous two times. It is no longer about trying to give US shale oil producers a quick, painful blow in the hope that the sector will stay down for an extended period. It is instead a lengthier process of finding the pain-point of US shale oil players (and other non-OPEC+ producers) through a gradual increase in production by OPEC+ and a gradual decline in the oil price down to the point where non-OPEC+ in general and US liquids production especially will gradually tick lower and yield room to the reentry of OPEC+ spare capacity. It does not look like a plan for a crash and a rush, but instead a tedious process where OPEC+ will gradually force its volumes back into the market.

Where is the price pain-point for US shale oil players? The Brent crude oil price dropped from USD 84/b over the year to September last year to USD 74/b on average since 1 September. The values for US WTI were USD 79/b and USD 71/b respectively. A drop of USD 9/b for both crudes. There has however been no visible reaction in the US drilling rig count following the USD 9/b fall. The US drilling rig count has stayed unchanged at around 480 rigs since mid-2024 with the latest count at 484 operating rigs. While US liquids production growth is slowing, it is still set to grow by 580 kb/d in 2025 and 445 kb/d in 2026 (US EIA).

US shale oil average cost-break-even at sub USD 50/b (BNEF). Industry says it is USD 65/b. BNEF last autumn estimated that all US shale oil production fields had a cost-break-even below USD 60/b with a volume weighted average just below USD 50/b while conventional US onshore oil had a break-even of USD 65/b. A recent US Dallas Fed report which surveyed US oil producers did however yield a response that the US oil industry on average needed USD 65/b to break even. That is more than USD 15/b higher than the volume weighted average of the BNEF estimates.

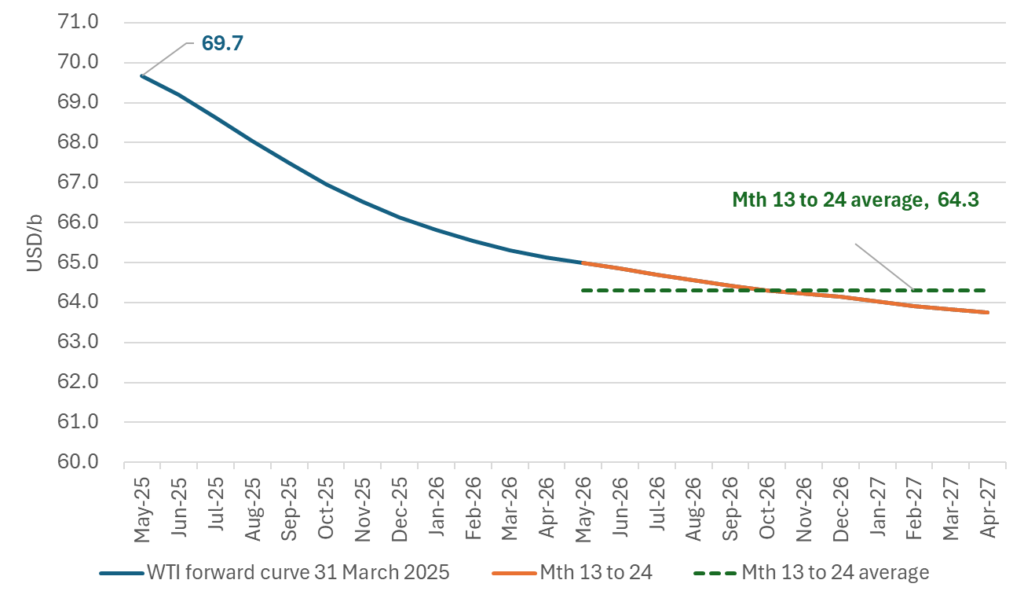

The WTI 13-to-24-month strip is at USD 64/b. Probably the part of the curve controlling activity. As such it needs to move lower to curb US shale oil activity. The WTI price is currently at USD 69.7/b. But the US shale oil industry today works on a ”12-month drilling first, then fracking after” production cycle. When it considers whether to drill more or less or not, it is typically on a deferred 12-month forward price basis. The average WTI price for months 13 to 24 is today USD 64/b. The price signal from this part of the curve is thus already down at the pain-point highlighted by the US shale oil industry. In order to yield zero growth and possibly contraction in US shale oil production, this part of the curve needs to move below that point.

The real pain-point is where we’ll see US drilling rig count starting to decline. We still don’t know whether the actual average pain-point is around USD 50/b as BNEF estimate it is or whether it is closer to USD 65/b which the US shale oil bosses say it is. The actual pain-point is where we’ll see further decline in US drilling rig count. And there has been no visible change in the rig count since mid-2024. The WTI 13-to-24-month prices need to fall further to reveal where the US shale oil industry’ actual pain-point is. And then a little bit more in order to slow production growth further and likely into some decline to make room for reactivation of OPEC+ spare capacity.

The WTI forward price curve. The average of 13 to 24 month is now USD 64.3/b.

The average 13-to-24-month prices on the WTI price curve going back to primo January 2022. Recently dropping below USD 65/b for some extended period.

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanUSA är världens största importör av aluminium

-

Analys4 veckor sedan

Analys4 veckor sedanOversold. Rising 1-3mth time-spreads. Possibly rebounding to USD 73.5/b before downside ensues

-

Analys3 veckor sedan

Analys3 veckor sedanCrude oil comment: Unable to rebound as the US SPX is signaling dark clouds on the horizon

-

Analys3 veckor sedan

Analys3 veckor sedanCrude oil comment: Not so fragile yet. If it was it would have sold off more yesterday

-

Nyheter2 veckor sedan

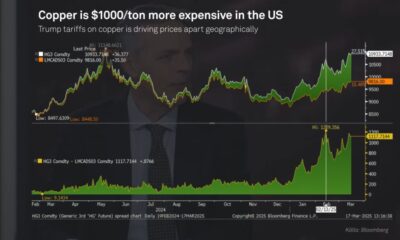

Nyheter2 veckor sedanPriset på koppar skiljer sig åt efter tariffer

-

Analys2 veckor sedan

Analys2 veckor sedanOil prices climb, but fundamentals will keep rallies in check

-

Analys2 veckor sedan

Analys2 veckor sedanCrude oil comment: Ticking higher as tariff-panic eases. Demand growth and OPEC+ will be key

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanPå 15 år eldar Kina lika mycket kol som USA gjort under hela sin historia