Nyheter

David Hargreaves on Precious Metals, week 24 2014

This week gold flirted with the upside of its recent $1250/oz downturn, buoyed by the Iraq problem. This countered the continued good economic news coming out of the USA and Europe. Not so the PGMs where the strike continues in the South African mines. New Minister NR, had got stuck in early into negotiations between the rampaging union AMCU and the intransigent companies Anglo Plats, Lonmin and Impala. Now he has pulled out of his role as mediator in the five month strike. So would we. If the companies agree to a progressive deal, as demanded, to double wages it will affect the whole of South African industry and greatly damage its investment potential. Government knows this.

The country suffers neither rampant inflation nor a soaring bank rate; just in some quarters, a lack of reality. There is no sign of surface supplies running out. So whilst palladium has witnessed an analyst-inspired rush of blood we do not see it lasting.

Platinum and Palladium. In producing our weekly figures we use the closing London prices, official. These do not always reflect late trading particularly in New York. There was a sharp fall on Friday following news that SA union AMCU had taken an “in principle” deal to its workers. Don’t tell us common sense has broken out. It meant that on the week, platinum fell almost 1% but palladium – the investors’ darling – over 3%. The Pt/Au ratio also fell a full three points to 1.13 and gold surged a full $25/oz on Iraqi problems. WIM says: Now if the lads return to work, all 70,000 of them, metal will flow again and there will be downward pressure on price. Purists will contend that the deficit will be there still, so prices could remain high. The largest manufacturer/consumer, Johnson Matthey, says this year will see deficits of 1.22Moz Pt and 1.61Moz Pd, the 8th year in a row of such.

WIM says: Now as these are two industrially used metals (Pt 70% and Pd 90%), it is just not possible to run 8 years deficits without it coming from someplace other than mining. Russia has long held palladium stockpiles and recycling plays an increasing role irrespective, these two metals are still in hock to gold.

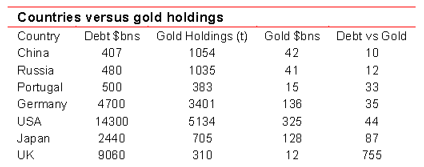

So nobody spotted the flaw in the gold table, why the percentage of its F/X a country holds in the metal does not alone signify. Of course it all hangs on what your total reserves are. 100% of nothing is still nothing eh? Then your indebtedness comes into it too. No point having a burgeoning bank account if you owe the balance to someone else is there? Gets even more complex: If your non-gold reserves are held in somebody else’s currency, whose? Malawi kwacha? Zimbabwe dollars? Now how much in foreign things you hold depends to an extent on your size and position in the world. More than anything it hangs on your ability to run a profitable show. (Thinks: is this going somewhere?) let’s run some numbers:

As a major trading nation you run external debt and you might be called upon today, perhaps in a hurry. How can you pay? Well gold is a safe bet. Now how much gold do you have to stack against what you owe? Here goes:

*We take the value of gold at $1250/oz which equates to c. $40M per tonne. So does this all signify, or is it just a bit of fun? We welcome correspondence on the topic. The UK is having a strong economic run, yet look at its ratio.

Conclusion? Yes there is a role for gold in the monetary system but it is far from mathematically defined.

*The lower the debt vs gold ratio the better your position.

The case for silver. This rests on the metal being “precious” in a chemical sense, having good anti-corrosion characteristics, resistance to most acids and so on. It is formidably linked to gold because of these and its price reacts accordingly. Yet it is more common, massively so. Silver has been mined in quantity since recorded history and its 1/66 price ratio to its sister metal probably means that if we can identify 150,000t of gold on surface, we can possibly touch for 10 million tonnes of silver. Now that is just too much to get excited about. Before gold became popular, countries adopted a “silver standard” for their currencies. The coin in your hand had a tangible value. The USA based its system on the silver dollar, not gold. So much is history. WIM says: The day of silver will not come again. It will remain a slave to gold; get used to it.

China and its Gold Resources. Having – we – hope – debunked the myth that the world is running out of raw materials, we get down to the cost of producing them. This is a feature of price. China is the world’s largest gold producer, at 430t or 15% of total mined output, but does it have the resources to continue at this rate? We are indebted to an intuitive article by L. Williams of Mineweb this week who reminds: China’s gold resources are put at 8200t, exceeded only by South Africa at 31,000t. The trick is, at what price are they economic? Separately we look at how a country’s gold holdings affect its economic status. China’s inventory is only declared at just over 1000 tonnes.

Is this a real figure? Is something afoot? WIM says: The gold market is on the move, but this is not a solicitation to buy the metal-yet.

The London Gold Fix is 95 years old. It has stood the test of time but is now under pressure. Of the five banks which meet twice daily to determine how the metal is priced, Deutsche Bank has bailed out. They cannot find a buyer for their seat. Time was (watch that rocking chair), there would have been a stampede. Pricing mechanisms are changing and not necessarily for the better. It seems, it we believe report, that the LME has thrown its hat into the ring. Now that hallowed institution is owned by Hong Kong interests. Hmm!

[hr]

About David Hargreaves

David Hargreaves is a mining engineer with over forty years of senior experience in the industry. After qualifying in coal mining he worked in the iron ore mines of Quebec and Northwest Ontario before diversifying into other bulk minerals including bauxite. He was Head of Research for stockbrokers James Capel in London from 1974 to 1977 and voted Mining Analyst of the year on three successive occasions.

Since forming his own metals broking and research company in 1977, he has successfully promoted and been a director of several public companies. He currently writes “The Week in Mining”, an incisive review of world mining events, for stockbrokers WH Ireland. David’s research pays particular attention to steel via the iron ore and coal supply industries. He is a Chartered Mining Engineer, Fellow of the Geological Society and the Institute of Mining, Minerals and Materials, and a Member of the Royal Institution. His textbook, “The World Index of Resources and Population” accurately predicted the exponential rise in demand for steel industry products.

Nyheter

Sommarvädret styr elpriset i Sverige

Många verksamheter tar nu ett sommaruppehåll och ute värmer solen, det är gott om vatten och vinden blåser. Lägre efterfrågan på el och goda förutsättningar för kraftproduktionen höll ner elpriserna under juni.

Elpriset på den nordiska elbörsen Nord Pool (utan påslag och exklusive moms) i elområde 1 och 2 (Norra Sverige) blev för juni 3,05 respektive 4,99 öre/kWh, vilket är rekordlågt och de lägsta på minst 25 år.

– Elpriset påverkas av en rad faktorer men vädret väger tyngst. På sommaren minskar efterfrågan på el och många verksamheter har ett uppehåll. Detta tillsammans med goda förutsättningar inom kraftproduktionen påverkar elpriset nedåt, säger Jonas Stenbeck, privatkundschef Vattenfall Försäljning Norden.

Den hydrologiska balansen, måttet för att uppskatta hur mycket vatten som finns lagrat ovanför kraftstationerna, ligger över normal nivå, särskilt i norra Skandinavien. Tillgängligheten för kärnkraften i Norden är just nu 82 procent av installerad effekt.

– De goda nordiska produktionsförutsättningarna gör elpriserna mindre känsliga för förändringar i omvärlden, säger Jonas Stenbeck.

Priserna på olja och gas kan dock ändras snabbt med anledning av en turbulent omvärld. På kontinenten har efterfrågan på gas sjunkit och nytt solkraftsrekord för Tyskland sattes på midsommarafton med en produktion på 52,5 GW.

– Många av de goda elvanor vi skaffade oss under elpriskrisen verkar leva kvar och gör nytta även på sommaren. De svenska hushållens elförbrukning under 2024 var faktiskt den lägsta detta millenium, säger Jonas Stenbeck.

| Medelspotpris | Juni 2024 | Juni 2025 |

| Elområde 1, Norra Sverige | 24,04 öre/kWh | 3,05 öre/kWh |

| Elområde 2, Norra Mellansverige | 24,04 öre/kWh | 4,99 öre/kWh |

| Elområde 3, Södra Mellansverige | 27,27 öre/kWh | 22,79 öre/kWh |

| Elområde 4, Södra Sverige | 62,70 öre/kWh | 40,70 öre/kWh |

Nyheter

Samtal om flera delar av råvarumarknaden

Ett samtal som sammanfattar ett relativt stabilt halvår på råvarumarknaden trots volatilitet och geopolitiska spänningar som sannolikt fortsätter in i andra halvan av året. Vi bjuds även på kommentarer från Carlos Mera, Rabobanks analyschef för jordbrukssektorn och Kari Kangas, skogsanalytiker.

Nyheter

Jonas Lindvall är tillbaka med ett nytt oljebolag, Perthro, som ska börsnoteras

Jonas Lindvall, ett välkänt namn i den svenska olje- och gasindustrin, är tillbaka med ett nytt företag – Perthro AB – som nu förbereds för notering i Stockholm. Med över 35 års erfarenhet från bolag som Lundin Oil, Shell och Talisman Energy, och som medgrundare till energibolag som Tethys Oil och Maha Energy, är Lindvall redo att än en gång bygga ett bolag från grunden.

Tillsammans med Andres Modarelli har han startat Perthro med ambitionen att bli en långsiktigt hållbar och kostnadseffektiv producent inom upstream-sektorn – alltså själva oljeutvinningen. Deras timing är strategisk. Med ett inflationsjusterat oljepris som enligt Lindvall är lägre än på 1970-talet, men med fortsatt växande efterfrågan globalt, ser de stora möjligheter att förvärva tillgångar till attraktiva priser.

Perthro har redan säkrat bevisade oljereserver i Alberta, Kanada – en region med rik oljehistoria. Bolaget tittar även på ytterligare projekt i Oman och Brasilien, där Lindvall har tidigare erfarenhet. Enligt honom är marknadsförutsättningarna idealiska: världens efterfrågan på olja ökar, medan utbudet inte hänger med. Produktionen från befintliga oljefält minskar med cirka fem procent per år, samtidigt som de största oljebolagen har svårt att ersätta de reserver som produceras.

”Det här skapar en öppning för nya aktörer som kan agera snabbare, tänka långsiktigt och agera med kapitaldisciplin”, säger Lindvall.

Perthro vill fylla det växande gapet på marknaden – med fokus på hållbar tillväxt, hög avkastning och effektiv produktion. Med Lindvalls meritlista och branschkunskap hoppas bolaget nu kunna bli nästa svenska oljebolag att sätta avtryck på världskartan – och på börsen.

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanStor uppsida i Lappland Guldprospekterings aktie enligt analys

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanBrookfield ska bygga ett AI-datacenter på hela 750 MW i Strängnäs

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanSilverpriset släpar efter guldets utveckling, har mer uppsida

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanUppgången i oljepriset planade ut under helgen

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanLåga elpriser i sommar – men mellersta Sverige får en ökning

-

Analys3 veckor sedan

Analys3 veckor sedanVery relaxed at USD 75/b. Risk barometer will likely fluctuate to higher levels with Brent into the 80ies or higher coming 2-3 weeks

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanMahvie Minerals växlar spår – satsar fullt ut på guld

-

Nyheter1 vecka sedan

Nyheter1 vecka sedanOljan, guldet och marknadens oroande tystnad