Nyheter

David Hargreaves on Exchange Traded Metals, week 44 2013

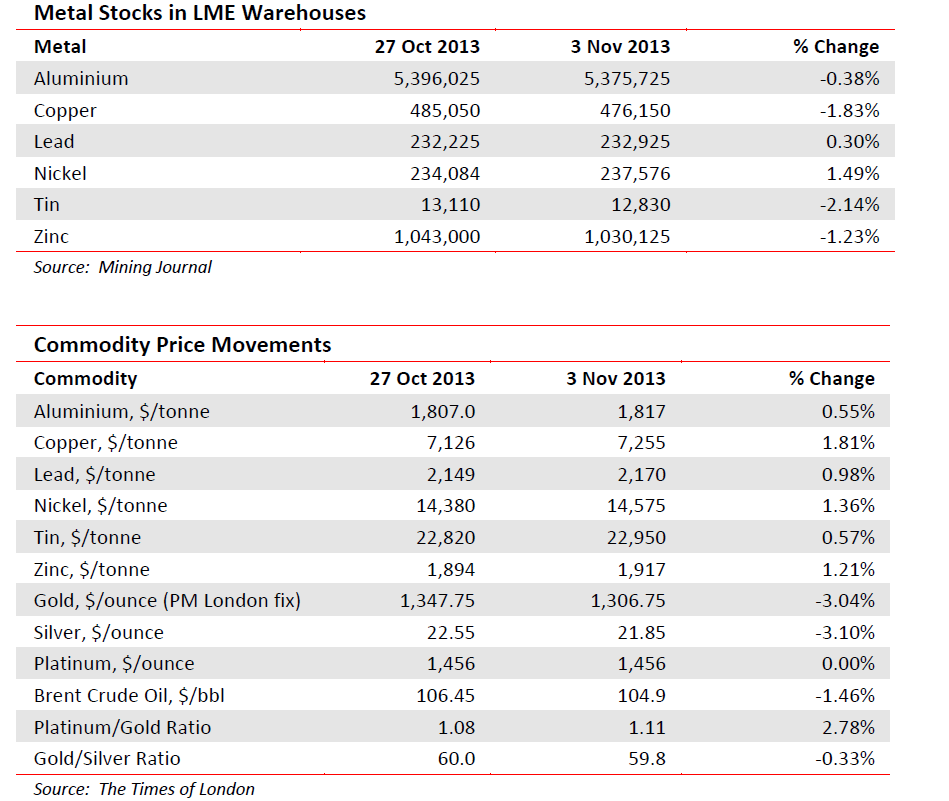

Should we be worried that normality is returning? Prices move up and stocks move down? It happened again this week. On the gentle side, but it happened. Now since the producers are not cohesive (no women and children first), but the above is happening, we must conclude that demand is picking up, must we not? Yet whilst there is no production restraint being shown, new projects are slowing. These take years to bring to production now, so a long term view has to be taken. Consensus is that we still face a long haul through 2014. This is supported by UBS Global Analysts who have made 10-12% cuts to their 2013-2016 forecasts. Now they see: nickel $14,773/t (was $15,435/t), Aluminium $1840/t ($1940/t). Tellingly with the nuclear fuel, they had been bullish on Japan switching the post-Fukushima lights back on in 2014, but think this will stumble. Thus $48/lb as opposed to $53/lb.

Should we be worried that normality is returning? Prices move up and stocks move down? It happened again this week. On the gentle side, but it happened. Now since the producers are not cohesive (no women and children first), but the above is happening, we must conclude that demand is picking up, must we not? Yet whilst there is no production restraint being shown, new projects are slowing. These take years to bring to production now, so a long term view has to be taken. Consensus is that we still face a long haul through 2014. This is supported by UBS Global Analysts who have made 10-12% cuts to their 2013-2016 forecasts. Now they see: nickel $14,773/t (was $15,435/t), Aluminium $1840/t ($1940/t). Tellingly with the nuclear fuel, they had been bullish on Japan switching the post-Fukushima lights back on in 2014, but think this will stumble. Thus $48/lb as opposed to $53/lb.

Nickel remains a troubled Metal. Its major discovery was in Sudbury, Canada during the driving of the trans-Canada railway in the mid-late 19th century (full history on request). Now the whole world produces it and Canada is but the No 5 miner at 5% of world total. In there are Vale SA and Xstrata, whose new step-parent, Glencore, is a major trader.

Such is the oversupply and the age and depth of the Sudbury mines, that lesser companies might have thrown-in the proverbial. But wait a minute, Out of those pits also comes about 4.0% of all the world’s platinum as a by-product, a sweetener. Given the state of the Pt market and the political wranglings in major producing countries RSA and Zimbabwe, it is worth a second look. Is this lost on major end users such as Johnson-Matthey and the motor manufacturers? Just a thought.

Aluminium. The desperate state of the market continues. Weighing on it is the complexity of its 3-stage process, from bauxite, to alumina, to smelted metal. The former can only be mined where you find it but the other two, energy intensive, tend to be converted where power is cheap. That largely means hydro. At the critical, refined sources, 35% is controlled by just four companies: Rio Tinto, Alcoa, UC Rusul and China’s Chalco. Quebec, where Alcoa has a major base, has always drawn relatively cheap power from the Hudson Bay plants. These plan a rate hike and Alcoa, naturally, is protesting. We speak of an annual capacity of almost 700,000/year. Only 2% of world capacity, but it would send a signal round the industry if Alcoa refused to bite. Could it afford to do so? The same company has also decided to sell its Italian plant to the Swiss group. Klesch. This ran from some years on preferential power tariffs, the name of the game in high-energy businesses. Now the Italian government wants them back.

WIM says: Where is Sig. Berlusconi now we need him?

Indonesia continues to play games with tin, that most indispensible metal where it is No 2 producer (30%) and major exporter (40%). The major importers include USA and Japan. So when Indonesia arbitrarily slapped an export ban on all-unrefined products (it does not have the smelter capacity), this upset the world trade balance. It goes someway to explaining why LME stocks of the refined metal are only 14 days’ supply. It compounded this by declaring that its relatively new exchange would be the only one authorised to do bargaining business. This one will run and short of the authorities wakening to reality (like squeezed spot – 3 month margins), it will intensify.

[hr]

About David Hargreaves

David Hargreaves is a mining engineer with over forty years of senior experience in the industry. After qualifying in coal mining he worked in the iron ore mines of Quebec and Northwest Ontario before diversifying into other bulk minerals including bauxite. He was Head of Research for stockbrokers James Capel in London from 1974 to 1977 and voted Mining Analyst of the year on three successive occasions.

Since forming his own metals broking and research company in 1977, he has successfully promoted and been a director of several public companies. He currently writes “The Week in Mining”, an incisive review of world mining events, for stockbrokers WH Ireland. David’s research pays particular attention to steel via the iron ore and coal supply industries. He is a Chartered Mining Engineer, Fellow of the Geological Society and the Institute of Mining, Minerals and Materials, and a Member of the Royal Institution. His textbook, “The World Index of Resources and Population” accurately predicted the exponential rise in demand for steel industry products.

Nyheter

Blykalla, Evroc och Studsvik vill bygga kärnkraftsdrivna datacenter i Sverige

Blykalla, Evroc och Studsvik har undertecknat ett samförståndsavtal för att undersöka möjligheten att utveckla Sveriges första kärnkraftsdrivna datacenter vid Studsviks licensierade kärnkraftsanläggning i Nyköping.

Blykalla utvecklar avancerade blykylda kärnreaktorer för att leverera säker, kostnadseffektiv och hållbar basenergi. Evroc bygger hyperscale-moln- och AI-infrastruktur för att driva Europas digitala framtid. Studsvik driver en licensierad kärnkraftsanläggning i Nyköping och tillhandahåller livscykeltjänster för kärnkraftssektorn, inklusive bränsle, material och avfallshantering. Tillsammans kombinerar de teknik, infrastruktur och anläggningsexpertis för att påskynda utbyggnaden av kärnkraftsdrivna datacenter.

Det finns en växande internationell efterfrågan på kärnkraftsdrivna datacenter, driven av parallella krav från AI och elektrifiering. Med sin kapacitet att leverera ren, pålitlig baskraft och inbyggd redundans är små modulära reaktorer särskilt väl lämpade för att möta detta behov.

Belastar inte elnätet

En stor fördel med att bygga datacenter och kärnkraftverk bredvid varandra är att elnätet inte belastas. Det gör totalpriset för elektriciteten blir lägre, samtidigt som det inte tillkommer investeringskostnader för operatören av elnätet.

Vill etablera Sverige som en föregångare

Med detta avtal strävar parterna efter att etablera Sverige som en föregångare i denna globala omställning, genom att utnyttja Studsviks licensierade anläggning, Evrocs digitala infrastruktur och Blykallas avancerade SMR-teknik.

”Detta samarbete är en möjlighet för Sverige att bli ledande inom digital infrastruktur. Det ger oss möjlighet att visa hur små modulära reaktorer kan tillhandahålla den stabila, fossilfria energi som krävs för AI-revolutionen”, säger Jacob Stedman, vd för Blykalla. ”Studsviks anläggning och evrocs ambitioner erbjuder rätt förutsättningar för ett banbrytande projekt.”

Samförståndsavtalet fastställer en ram för samarbete mellan de tre parterna. Målet är att utvärdera den kommersiella och tekniska genomförbarheten av att samlokalisera datacenter och SMR på Studsviks licensierade anläggning, samarbeta med kommuner och markägare samt definiera hur en framtida kommersiell struktur för elköpsavtal skulle kunna se ut.

”Den ständigt växande efterfrågan på AI understryker det akuta behovet av att snabbt bygga ut en massiv hyperskalig AI-infrastruktur. Genom vårt samarbete med Blykalla och Studsvik utforskar vi en modell där Sverige kan ta ledningen i byggandet av en klimatneutral digital infrastruktur”, kommenterar Mattias Åström, grundare och VD för Evroc.

”Studsvik erbjuder en unik plattform med anläggningsinfrastruktur och unik kompetens för att kombinera avancerad kärnkraft med nästa generations industri. Detta samförståndsavtal är ett viktigt steg för att utvärdera hur sådana synergier kan realiseras i Sverige”, kommenterar Karl Thedéen, vd för Studsvik.

Parterna kommer nu att inrätta en gemensam styrgrupp för att utvärdera anläggningen och affärsmodellen, med målet att inleda formella partnerskapsförhandlingar senare i år. Deras fortsatta samarbete ska möjliggöra ren och säker energi för Europas AI-infrastruktur och digitala infrastruktur.

Nyheter

Toppmöte om framtidens kärnkraft runt Östersjön hölls idag

Sveriges regering arrangerade på tisdagen ett toppmöte om framtidens kärnkraft i Östersjöregionen tillsammans med Finland. Ministrar från Polen, Lettland och Estland deltog, liksom investerare, banker och kärnkraftsbolag. EFN:s reporter Thomas Arnroth rapporterar från mötet.

Energi- och näringsminister Ebba Busch betonade att målet är att göra Sverige till regionens ledande kärnkraftsnation och en hub för kärnkraft i Östersjöområdet.

Tanken är att länderna ska samarbeta och se regionen som en gemensam marknad, vilket kan påskynda och sänka kostnaderna för nya reaktorer. Kunskap kan användas gemensamt över hela regionen och en reaktortyp skulle bara behöva godkännas en gång.

Nyheter

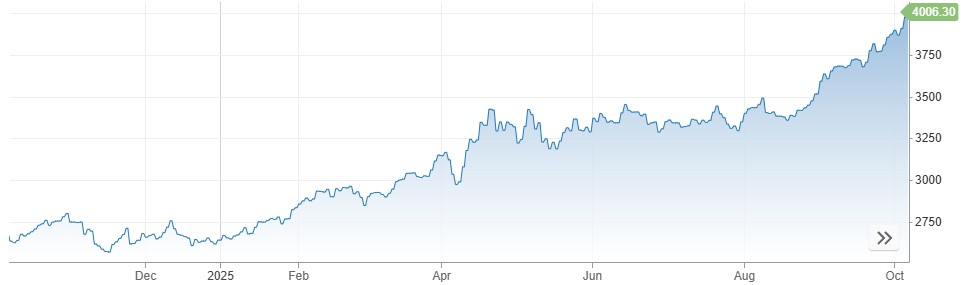

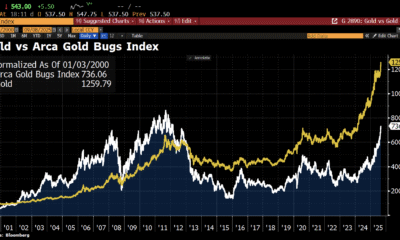

Nytt prisrekord, guld stiger över 4000 USD

Priset på guld på CME-börsen steg precis för första gången någonsin över 4000 USD per uns. Detta efter att både investerare och centralbanker söker en trygg hamn, om än av delvis olika orsaker. Vi har tidigare idag rapporterat att Goldman Sachs skruvat upp sin guldprognos för slutet av 2026 till 4900 USD per uns.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanMahvie Minerals i en guldtrend

-

Analys4 veckor sedan

Analys4 veckor sedanVolatile but going nowhere. Brent crude circles USD 66 as market weighs surplus vs risk

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanAktier i guldbolag laggar priset på guld

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanKinas elproduktion slog nytt rekord i augusti, vilket även kolkraft gjorde

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanTyskland har så höga elpriser att företag inte har råd att använda elektricitet

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanGuld når sin högsta nivå någonsin, nu även justerat för inflation

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanDet stigande guldpriset en utmaning för smyckesköpare

-

Analys4 veckor sedan

Analys4 veckor sedanWaiting for the surplus while we worry about Israel and Qatar