Nyheter

David Hargreaves on Energy, week 45 2013

No apologies for banging on about oil presently; it is the mining and commodities driver. OPEC has belatedly acknowledged that the US shale oil revolution is a threat to its global dominance of the crude market. It cannot be a coincidence that “Sovereign Wealth Funds” ie government held cash from Saudi Arabia, Kuwait, Qatar, Bahrain are casting their net over other-and offshore-assets. OPEC acknowledged that demand for its crude will fall below 30M bbls/day in 2014 and maybe take until 2020 to recover, all (or mostly) because of US shale oil production. OPEC’s 2013 annual outlook, just published, still tries to downplay the role of the new product. It looks for an average $40/bbl until 2010 then a steady climb. We wish it well. Our money is still on $80 if the lid can be kept on Iran and its politics.

No apologies for banging on about oil presently; it is the mining and commodities driver. OPEC has belatedly acknowledged that the US shale oil revolution is a threat to its global dominance of the crude market. It cannot be a coincidence that “Sovereign Wealth Funds” ie government held cash from Saudi Arabia, Kuwait, Qatar, Bahrain are casting their net over other-and offshore-assets. OPEC acknowledged that demand for its crude will fall below 30M bbls/day in 2014 and maybe take until 2020 to recover, all (or mostly) because of US shale oil production. OPEC’s 2013 annual outlook, just published, still tries to downplay the role of the new product. It looks for an average $40/bbl until 2010 then a steady climb. We wish it well. Our money is still on $80 if the lid can be kept on Iran and its politics.

The UK Energy Fiasco would be comic if it were not tragic. Consumers are being subjected to arbitrary tariff increases of up to 10% per year and the threat of power cuts this winter. Why? The coal-fired stations (50% of total load) are facing closure because they do not meet EU pollution standards. Most of the nuclear ones are old and creaking too.

We plan to build a new one – Hinkley Point, which will be done by the French and Chinese who are developing a guaranteed tariff that will double (yes double) the price we currently pay per kilowatt hour. It gets better. The North Sea is rapidly running out of oil and gas so we are in hock to Qatar and Norway. Oh, we are the largest wind farmer in the world but subsidise that industry up to its armpits and load the cost on households. What is left? We have 500 years of coal supply but that is smelly, so no go. We think we have a lot of shale gas too. Yet the PPP (Professional Protesting People) are winning the day to prevent it being exploited. If you were given a grant to organize chaos you could not compete with this one. BP, one of the largest oil producers, capitalized at £40bn, not only produced a solid Q3 income statement but the promise of shareholder goodies to come. The quarterly dividend was advanced to 9.5c (+5.6%) and share buy backs are in the wind. It is on the divestment trail to fund this and will go easy on new project spending. All this, despite the Gulf of Mexico disaster. The shares rose 25p to 478p from end October with serious commentators rating them a ‘hold’.

Oil. Brent crude marker held at last week’s level of $104.90 as the US and Iran threaten an agreement of sorts on the latter’s nuclear policy. Israel is not pleased, but that country had best beware. When America withdraws its awesome military presence from the Middle East, as it progressively will, diplomacy will be the name of the game, or the unthinkable will ensue.

[hr]

About David Hargreaves

David Hargreaves is a mining engineer with over forty years of senior experience in the industry. After qualifying in coal mining he worked in the iron ore mines of Quebec and Northwest Ontario before diversifying into other bulk minerals including bauxite. He was Head of Research for stockbrokers James Capel in London from 1974 to 1977 and voted Mining Analyst of the year on three successive occasions.

Since forming his own metals broking and research company in 1977, he has successfully promoted and been a director of several public companies. He currently writes “The Week in Mining”, an incisive review of world mining events, for stockbrokers WH Ireland. David’s research pays particular attention to steel via the iron ore and coal supply industries. He is a Chartered Mining Engineer, Fellow of the Geological Society and the Institute of Mining, Minerals and Materials, and a Member of the Royal Institution. His textbook, “The World Index of Resources and Population” accurately predicted the exponential rise in demand for steel industry products.

Nyheter

Europas största tillverkare av elbilsbatterier överväger att ställa om till batterier för villor

Koreanska LG Energy Solution är den största tillverkaren av elbilsbatterier i Europa. Nu överväger företaget att ställa om produktionen vid sin fabrik i Polen till att i stället producera batterier för stationär lagring av elektricitet, exempelvis för hushåll.

Fabriken i Polen med 6 600 anställda har en kapacitet på 100 000 elbilsbatterier per år, men efterfrågan på marknaden är svag. Samtidigt har Polens snabba utbyggnad av solenergi gjort att landets elnät har blivit obalanserat och ett behov av batterier har uppstått.

Polen presenterade förra veckan ett bidrag för privatpersoner att installera batterier. Budgeten för bidraget är 400 miljoner zloty, motsvarande en dryg miljard kronor. Man tillade dock att det bara är ett liten försmak av landets ambitioner.

Bloomberg skriver att grannlandet Tyskland har 500 000 installationer av batterier för stationär lagring i villor.

Nyheter

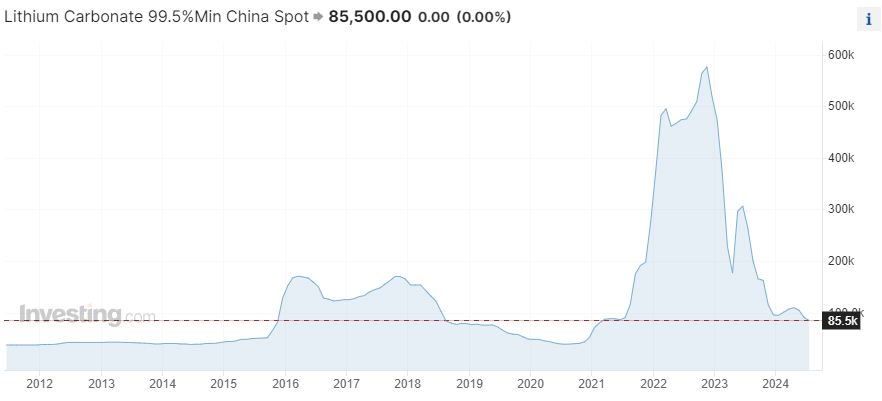

Priset på litium fortsätter att falla, överutbud i flera år framåt

Priset på batterimetallen litium rusade i höjden för ett par år sedan och världen var bekymrad över hur vi skulle kunna få fram tillräckligt av metallen. Nu när vi tittar i backspegeln så kan vi se att produktionen konstant har ökat samtidigt som elbilsmarknaden inte har växt lika snabbt som tidigare förväntat, även om den växer i högt tempo.

Det spås inte heller bli någon brist på litium under kommande år, det öppnas löpande nya gruvor och överutbudet spås öka, inte minska, de kommande åren.

Nedan är en graf över priset på litiumkarbonat i valutan yuan.

Nyheter

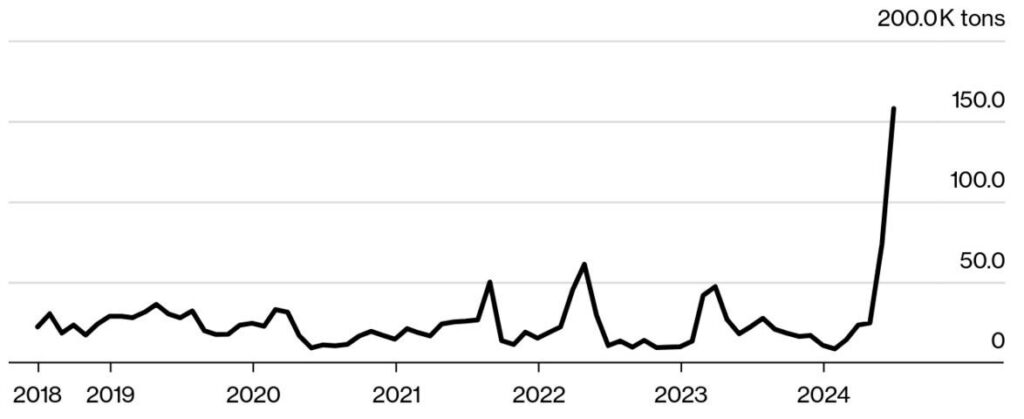

Koppar från kinesiska lager flödar ut på marknaden

Spekulationerna var många varför Kina köpte så mycket koppar i början av året trots att landets ekonomi går på halvfart. En stor spekulation var att landet skulle devalvera sin valuta och då var det bättre för aktörer att ha koppar än pengar på bankkontot.

Någon större devalvering kom aldrig. Nu flödar i stället all denna koppar ut på marknaden igen. Nedan är en graf över Kinas export av koppar.

-

Nyheter7 dagar sedan

Nyheter7 dagar sedanDe tre bästa råvaruvaruaktierna just nu

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanLundin Mining vill köpa Filo Corp tillsammans med BHP

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanAfrica Oil är bra att köpa anser Stifel som inleder analysbevakning

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanStor risk att Africa Energy inte överlever det kommande året

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanFirst Nordic Metals har fyra prospekteringsprojekt i Sverige

-

Analys4 veckor sedan

Analys4 veckor sedanBrent crude inching higher on optimism that US inflationary pressures are fading

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanUniper satsar på att göra elektrobränsle av sin elektricitet

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanTre bra aktier inom olja och oljeservice i Kanada