Nyheter

Year-End Commodities Outlook

CPM Group’s analysts and advisors are asked about our expectations for commodities markets and prices for the coming year at this point. Below is a brief overview of the company’s analyses of some of the key points on which the markets currently are focusing.

CPM Group’s analysts and advisors are asked about our expectations for commodities markets and prices for the coming year at this point. Below is a brief overview of the company’s analyses of some of the key points on which the markets currently are focusing.

Commodities have enjoyed remarkably strong price increases since the turn of the century. In 2011, prices of various commodities reached what appears to have been at least near-term peaks and have since been trending lower. CPM Group expects this downward shift in price levels to continue for many commodities, including gold, silver, oil, and various base metals, in the coming year.

Through the remainder of 2012 commodities prices appear vulnerable to declines from present levels. Investors are showing some fatigue and increasing hesitancy about remaining long many commodities. They are concerned about the effects on commodities prices of any further weakness in the economies of the United States, China, India, and Europe, both on gold and silver, and on industrial commodities.

For some industrial commodities, like platinum, palladium, and some base metals, these dips could represent compelling entry points for medium to long term long positions.

Gold and the Fiscal Cliff

Gold prices may be weak for an extended period, possibly averaging 1.0% lower in 2013 from 2012 levels. Prices averaged $1,670 this year through 17 December, up 6.3% from the similar period a year ago. Gold is expected to trade between $1,550 and $1,750 from now through February.

Investors are expected to be more price-sensitive to gold prices in 2013, a theme that began to emerge in the last four months of 2011 and now seems to be firmly entrenched in this market. This price sensitivity is expected to result in lower highs and lower lows in intraday prices throughout next year.

Some investors, and gold marketing groups, have suggested that the fiscal cliff facing the U.S. economy could be bullish for gold and commodities. Actually, it seems that the fiscal policy decisions and resolutions of these issues most likely will have negative price implications for both gold and commodities. Gold prices in fact may be supported in December by investor nervousness over the resolution of this political melodrama, but once the soap opera in Washington has played its last scenes out, the actual economic consequences may be seen as disinflationary and thus not positive for gold.

The resolution of the fiscal cliff will involve some combination of reduced government spending and increased taxes, albeit the extent of spending reductions and tax increases are uncertain. This resolution will result in an economic reality of disinflationary, possibly recessionary, pressures on economic activity. That is negative for gold and silver, as financial assets. It also is negative for industrial commodities in the medium term. The difference between a worst case scenario – falling off the cliff – and a best case scenario in which the U.S. government makes some substantive reductions in government spending and increases in taxes in a sensible way (as opposed to those outlined in the mandatory cuts and tax increases that constitute the looming cliff) is a matter of degrees. There is no bullish outcome for industrial commodities, gold, or silver, in any of the reasonably expected political and fiscal outcomes of the current budgetary talks in Washington. Because a fiscal cliff resolution is inherently negative for short-term economic growth, with the degree by which it will be negative being uncertain, we are bearish on many commodities during the first half of 2013, excluding various commodities whose fundamentals are expected to override short-term turbulence in the commodities sector.

Platinum and Palladium

South African platinum group metals mine output is declining around 12% in 2012. This loss of mine production, an anticipated 15% to 25% increase in operating costs at South African PGM mines for 2012, multi-year deferments of project development, and continuing healthy growth in demand for these metals are expected to contribute to higher prices for an extended period.

Platinum and palladium both are expected to perform well in 2013, however CPM Group is cautious on these markets in the near to medium term, given expectations of weak economic activity in the first half of the year.

Base Metals and China

China’s government is focused on stabilizing real economic growth over the medium to long term, targeting real GDP growth of between 7.5% and 8.5%. CPM Group expects China to succeed in this effort. Demand for base metals will benefit from this stabilization, helping support prices of base metals next year. Investors in North America and Europe will be expected to misunderstand Chinese economic developments and overreact, bidding base metals prices higher.

Fundamentally, lead prices appear most likely to increase at a healthy pace next year, with the other LME-traded base metals facing annual surpluses that could keep prices flat at 2012 annual average levels.

Petroleum

Strong oil production growth from unconventional sources in the United States has weighed on WTI oil prices in 2012. This trend is likely to continue into 2013, albeit at slower rates. Stagnant to lower oil demand in most major industrialized economies could dampen some positive sentiment with regards to improving Chinese demand. Thus, WTI oil is expected to trade largely in a range of $82 and $95 in 2013. Brent oil may decline relative to WTI but stabilize at around $100 or so.

[box]Denna analys är producerad av CPM Group och publiceras med tillstånd på Råvarumarknaden.se.[/box]

Disclaimer

Copyright CPM Group 2012. Not for reproduction or retransmission without written consent of CPM Group. Market Commentary is published by CPM Group and is distributed via e-mail. The views expressed within are solely those of CPM Group. Such information has not been verified, nor does CPM make any representation as to its accuracy or completeness.

Any statements non-factual in nature constitute only current opinions, which are subject to change. While every effort has been made to ensure that the accuracy of the material contained in the reports is correct, CPM Group cannot be held liable for errors or omissions. CPM Group is not soliciting any action based on it. Visit www.cpmgroup.com for more information.

Nyheter

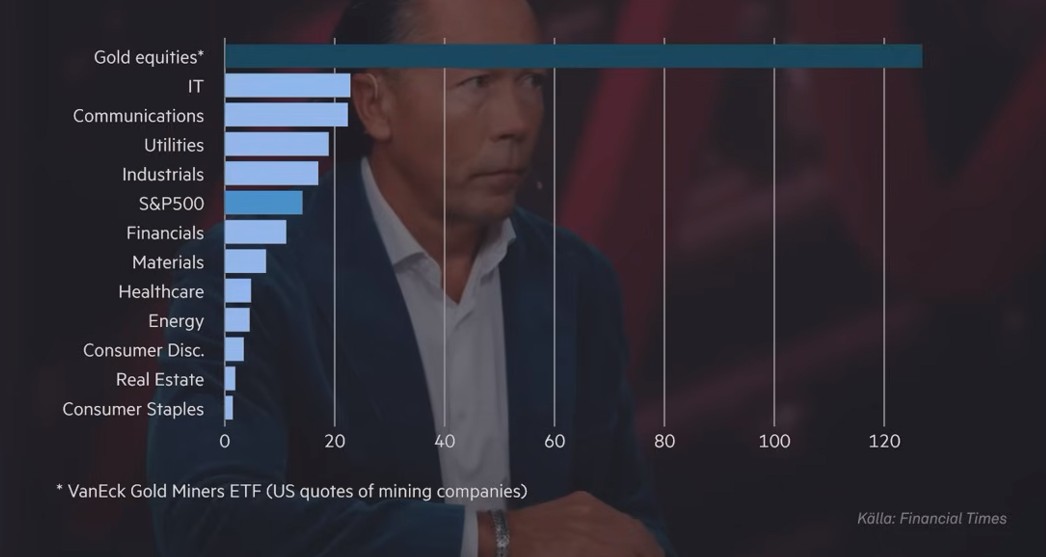

Guld och silver stiger hela tiden mot nya höjder

Priserna på guld och silver stiger hela tiden mot nya höjder. Eric Strand går här igenom vilka faktorerna som ligger bakom uppgångarna och vad som kan hända framöver. Han får även kommentera aktier inom guldgruvbolag som har haft en bättre utveckling än nästan allt annat. Han säger bland annat att uppgången kommer från låga nivåer och att det i genomsnitt är en mycket högre kvalitet på ledningarna för bolagen idag.

Nyheter

Samtal om sällsynta jordartsmetaller, guld och silver

Samtal om sällsynta jordartsmetaller, guld och silver, samt gruvbolag. Clara My Lernborg på EFN ger sin syn på sällsynta jordartsmetaller som blivit centrala i den globala geopolitiken. Sarah Tomlinson på Metals Focus ger sin syn på guld. Eric Strand på AuAg Fonder ger sin syn på guld, silver och relaterade gruvbolagsaktier.

Nyheter

Brookfield köper bränsleceller för 5 miljarder USD av Bloom Energy för att driva AI-datacenter

Brookfield och Bloom Energy inleder ett partnerskap där Brookfield i den första fasen köper bränsleceller för 5 miljarder USD av Bloom Energy för att driva AI-datacenter. Bränslecellerna kommer att installeras bakom elmätarna och AI-datacentren kommer således inte att belasta eller vara beroende av elnätet.

Partnerskapet markerar den första fasen i en gemensam vision om att bygga AI-datacenter som kan möta den snabbt växande efterfrågan på beräkningskapacitet och energi inom artificiell intelligens.

AI-datacenter kräver infrastruktur som integrerar beräkningskraft, energi, datacenterarkitektur och kapital på ett tätt och effektivt sätt. Bloom Energys bränsleceller levererar pålitlig, skalbar och lokal energi som snabbt kan tas i drift utan beroende av traditionella elnät. Brookfield tillför världsledande kompetens inom infrastrukturutveckling och finansiering.

I kärnan av det nya partnerskapet kommer Brookfield att investera upp till 5 miljarder dollar för att införa Blooms avancerade bränslecellsteknik. Bolagen samarbetar aktivt kring utformning och leverans av AI-datacenter globalt – inklusive en europeisk anläggning som kommer att offentliggöras innan årets slut.

”AI-infrastruktur måste byggas som en fabrik – med syfte, hastighet och skala,” säger KR Sridhar, grundare, ordförande och vd för Bloom Energy. ”Till skillnad från traditionella fabriker kräver AI-fabriker enorm energitillgång, snabb etablering och realtidsanpassning till belastning – något som gamla elnät inte klarar av. Den effektiva AI-fabriken uppnås genom att energi, infrastruktur och beräkningskraft designas i harmoni från dag ett. Det är den principen som styr vårt samarbete med Brookfield när vi omformar framtidens datacenter. Tillsammans skapar vi en ny ritning för hur AI skalas upp med kraft.”

”Energilösningar bakom mätaren är avgörande för att överbrygga elnätsgapet för AI-fabriker,” säger Sikander Rashid, global chef för AI-infrastruktur på Brookfield. ”Blooms avancerade bränslecellsteknik ger oss en unik möjlighet att designa och bygga moderna AI-fabriker med ett helhetsperspektiv på energibehov. Som världens största investerare inom AI-infrastruktur tillför detta partnerskap ett kraftfullt nytt verktyg till vår globala tillväxtstrategi – särskilt i en marknad där tillgången till elnät är begränsad.”

AI-datacenter i USA förväntas använda 100 gigawatt vid 2035

Enligt prognosoer väntas elförbrukningen från AI-datacenter i USA växa exponentiellt och överstiga 100 gigawatt till 2035. Bränsleceller har blivit en nyckellösning för att möta detta problem, och partnerskapet mellan Bloom Energy och Brookfield är utformat för att hantera just detta energigap.

Bloom Energy har erfarenhet

Bloom Energy har redan installerat hundratals megawatt av sin bränslecellsteknik i datacenter och levererar el till några av världens mest kritiska digitala infrastrukturer genom partnerskap med American Electric Power (AEP), Equinix och Oracle.

Brookfield är en jätte inom digital infrastruktur

Detta partnerskap utgör Brookfields första investering inom sin dedikerade AI-infrastruktur-strategi, som fokuserar på investeringar i stora AI-datacenter, energilösningar, beräkningsinfrastruktur och strategiska kapitalpartnerskap. Strategin bygger vidare på Brookfields erfarenhet av att ha investerat över 100 miljarder dollar i digital infrastruktur globalt.

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanOPEC+ missar produktionsmål, stöder oljepriserna

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanEtt samtal om guld, olja, fjärrvärme och förnybar energi

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanGuld nära 4000 USD och silver 50 USD, därför kan de fortsätta stiga

-

Analys3 veckor sedan

Analys3 veckor sedanAre Ukraine’s attacks on Russian energy infrastructure working?

-

Nyheter1 vecka sedan

Nyheter1 vecka sedanGoldman Sachs höjer prognosen för guld, tror priset når 4900 USD

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanBlykalla och amerikanska Oklo inleder ett samarbete

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanGuldpriset uppe på nya höjder, nu 3750 USD

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanEtt samtal om guld, olja, koppar och stål