Analys

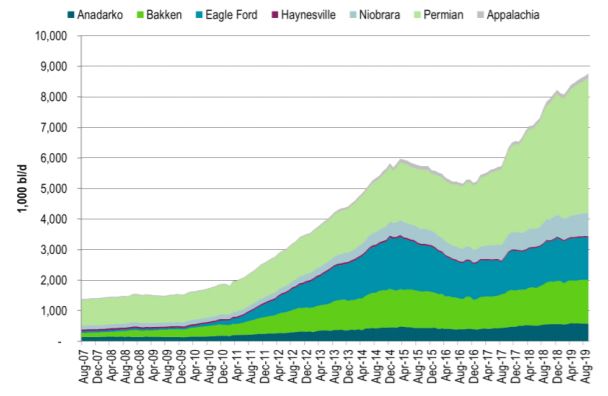

Shale producers ramp up production as pipes to Gulf opens

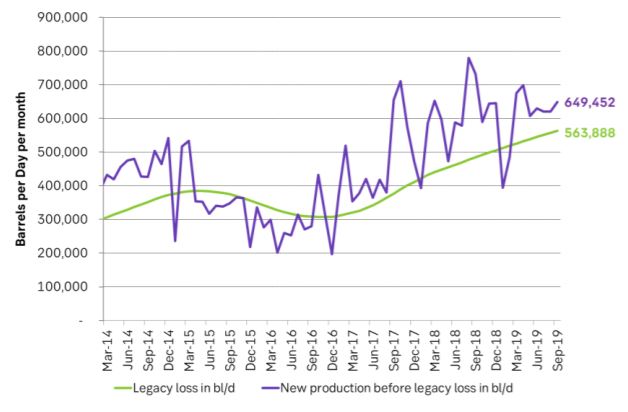

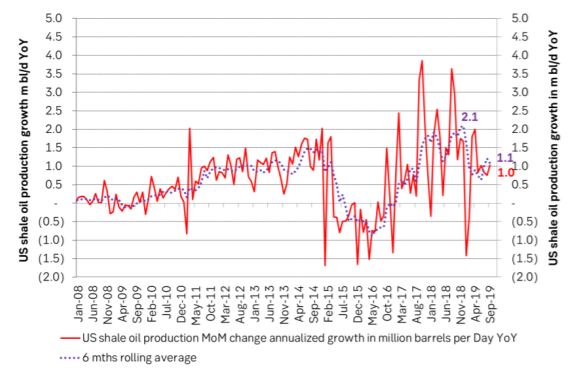

Yesterday’s report on US shale oil drilling from the EIA was mostly depressing reading for global oil producers. It showed that the completion of wells rose to 1411 wells in July (+19 MoM) and the highest nominal level since early 2015. As a result the marginal, annualized US shale oil production growth rate rose to a projected 1.0 m bl/d in September which was up from a growth rate of 0.6 m bl/d.

Shale oil producers drilled fewer wells (down 31 to 1311 wells) which is consistent with the ongoing decline in drilling rigs which have declined by 124 rigs to 764 oil rigs since November last year. With a productivity of about 1.5 drilled wells per drilling rig in operation this means that close to 200 fewer wells are being drilled today.

Instead producers are focusing on completing wells. Drilling less and completing more meant that the number of drilled but uncompleted wells declined by 100 wells to 8,108. The DUC inventory is still 2,850 wells higher than the low point in late 2016. This means that producers can continue to throw out drilling rigs while still maintaining or increasing the number of wells completed per month and thus increase production.

The hope has been that the declining drilling rig count which now has been ongoing for 9 months with investors rioting against producers losing money demanding spending discipline, positive cash flow and profits would now start to materialize into a declining rate of well completions as well. This would naturally lead to softer production growth or even production decline.

In the previous report the estimated marginal, annualized production growth rate was only 0.6 m bl/d. We estimated then that it would only take a reduction in monthly well completions of 109 wells in order to drive US shale oil production to zero growth. I.e. it would not take much to drive growth to zero. Well completions per month would only have to decline from 1383 in June to 1274 and voila US shale oil production growth would have halted to zero. That did not happen. Instead the well completion rose to 1411 in July thus driving estimated the marginal, annualized production growth rate to 1.0 m bl/d in September.

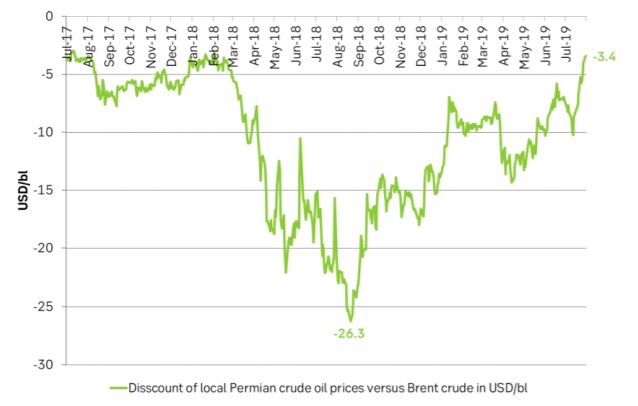

Last year we witnessed that the local, Permian (Midland) crude oil price traded at a discount of as much as $26/bl below the Brent crude oil price as production was locked in both Permian and Cushing. So far this year the discount has mostly been varying between -$15/bl and -$5/bl. The writing on the wall for Permian shale oil producers has been that if they accelerated completions and production they would just kill the local price and the marginal value of production.

Now however transportation capacity out of the Permian is rapidly opening up to the US Gulf. The Cactus II (670 k bl/d) from the Permian to Corpus Christi (US Gulf) opened in early August and much more is coming later this year and early next year. As a result the local Permian crude oil price is now only -$3.4/bl below the Brent crude oil price. And even more important is that Permian producers now know that they can ramp up well completions and production without killing the local crude oil price.

Permian producers are moving from an obvious price setter position locally in the Permian to a perceived global oil price taker. Though in fact they will in the end also be the price setter in the global market place if they just ramp up well completions and production.

Our fear as well as OPEC’s fear and global oil producers fear is that Permian shale oil producers now will focus intensely on well completions. They have 3,999 drilled but uncompleted wells to draw down and they can now accelerate production without the risk of killing the local oil price. Well completions are after all equal to production and production is money in the pocket while drilling in itself is only spending.

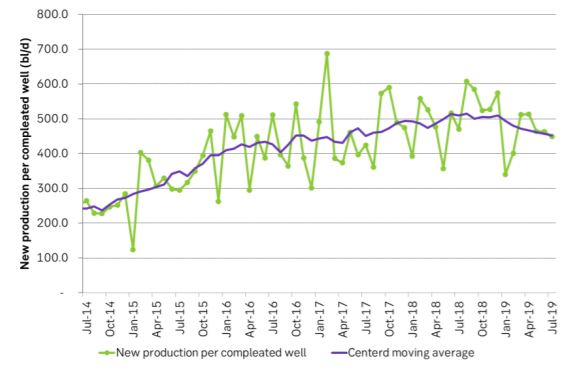

There were a few positive elements in yesterday’s numbers seen from the eyes of global oil producers. Increased well completion was basically a Permian thing with completions on average declining elsewhere. Productivity of new wells continued to decline. This is counter to the headline productivity numbers from the US EIA. EIA is calculating drilling rig productivity and not well productivity. In addition they are not adjusting for a build or a draw in the DUC inventory. When the number of DUCs is increasing they under estimate drilling productivity and when the number of DUCs is declining they over estimate drilling productivity. They do not specify well productivity though which is declining in our numbers.

Ch1: The local Permian crude oil price discount to Brent crude has rapidly evaporated as the Cactus II from Permian to Corpus Christi has opened up. Now Permian producers can ramp up well completions without the risk of killing the local oil price.

Ch2: Drilling continued to decline but well completions rose to the highest nominal rate since early 2015. When drilling has declined long enough it is clear that well completions will have to decline as well. With a large DUC inventory we do however seem to be far from that point in time yet. The US DUC inventory stood at 8,108 in July, up 2,850 since late 2016.

Ch3: This is driving estimated new production in September up and away from losses in existing production. Thus marginal annualized production growth accelerated to 1.0 m bl/d in September.

Ch4: Marginal, annualized shale oil production growth rose to an estimated 1.0 m bl/d per year. Clearly down from the extremely strong production growth last year of up to 2 m bl/d growth rate. But still up versus last months report of a rate of 0.6 m bl/d per year with hopes then that the rate would decline further.

Ch5: Overall well productivity continued to deteriorate with latest 7 data points all below the average of the previous 7 points. This could be a function of the DUC inventory draw down. When the inventory rose producers took every 10th well and put it into the DUC inventory. It is logical that producers threw the 10% least promissing wells into the DUC inventory. This then led to an overestimation of the well productivity. Now that the DUC inventory is drawing down producers will have a 20% share of less performing wells. Thus further DUC inventory draw should lead to further overall well productivity.

Ch6: US shale oil production growth has slowed. Could it accelerate again now that pipes out of the Permian are opening up?

Analys

OPEC+ in a process of retaking market share

Oil prices are likely to fall for a fourth straight year as OPEC+ unwinds cuts and retakes market share. We expect Brent crude to average USD 55/b in Q4/25 before OPEC+ steps in to stabilise the market into 2026. Surplus, stock building, oil prices are under pressure with OPEC+ calling the shots as to how rough it wants to play it. We see natural gas prices following parity with oil (except for seasonality) until LNG surplus arrives in late 2026/early 2027.

Oil market: Q4/25 and 2026 will be all about how OPEC+ chooses to play it

OPEC+ is in a process of unwinding voluntary cuts by a sub-group of the members and taking back market share. But the process looks set to be different from 2014-16, as the group doesn’t look likely to blindly lift production to take back market share. The group has stated very explicitly that it can just as well cut production as increase it ahead. While the oil price is unlikely to drop as violently and lasting as in 2014-16, it will likely fall further before the group steps in with fresh cuts to stabilise the price. We expect Brent to fall to USD 55/b in Q4/25 before the group steps in with fresh cuts at the end of the year.

Natural gas market: Winter risk ahead, yet LNG balance to loosen from 2026

The global gas market entered 2025 in a fragile state of balance. European reliance on LNG remains high, with Russian pipeline flows limited to Turkey and Russian LNG constrained by sanctions. Planned NCS maintenance in late summer could trim exports by up to 1.3 TWh/day, pressuring EU storage ahead of winter. Meanwhile, NE Asia accounts for more than 50% of global LNG demand, with China alone nearing a 20% share (~80 mt in 2024). US shale gas production has likely peaked after reaching 104.8 bcf/d, even as LNG export capacity expands rapidly, tightening the US balance. Global supply additions are limited until late 2026, when major US, Qatari and Canadian projects are due to start up. Until then, we expect TTF to average EUR 38/MWh through 2025, before easing as the new supply wave likely arrives in late 2026 and then in 2027.

Analys

Manufacturing PMIs ticking higher lends support to both copper and oil

Price action contained withing USD 2/b last week. Likely muted today as well with US closed. The Brent November contract is the new front-month contract as of today. It traded in a range of USD 66.37-68.49/b and closed the week up a mere 0.4% at USD 67.48/b. US oil inventory data didn’t make much of an impact on the Brent price last week as it is totally normal for US crude stocks to decline 2.4 mb/d this time of year as data showed. This morning Brent is up a meager 0.5% to USD 67.8/b. It is US Labor day today with US markets closed. Today’s price action is likely going to be muted due to that.

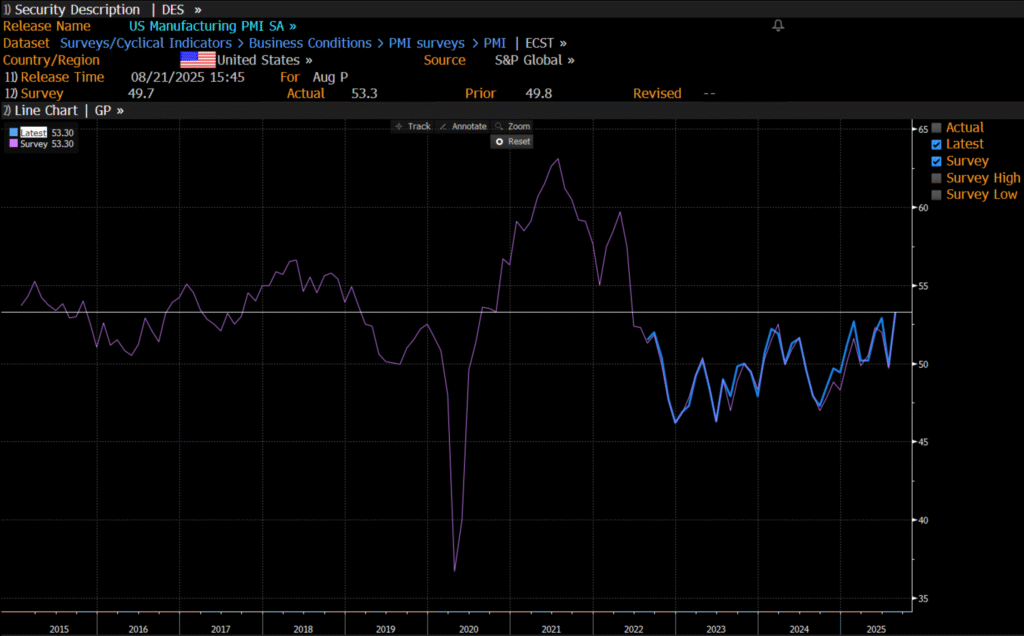

Improving manufacturing readings. China’s manufacturing PMI for August came in at 49.4 versus 49.3 for July. A marginal improvement. The total PMI index ticked up to 50.5 from 50.2 with non-manufacturing also helping it higher. The HCOB Eurozone manufacturing PMI was a disastrous 45.1 last December, but has since then been on a one-way street upwards to its current 50.5 for August. The S&P US manufacturing index jumped to 53.3 in August which was the highest since 2022 (US ISM manufacturing tomorrow). India manufacturing PMI rose further and to 59.3 for August which is the highest since at least 2022.

Are we in for global manufacturing expansion? Would help to explain copper at 10k and resilient oil. JPMorgan global manufacturing index for August is due tomorrow. It was 49.7 in July and has been below the 50-line since February. Looking at the above it looks like a good chance for moving into positive territory for global manufacturing. A copper price of USD 9935/ton, sniffing at the 10k line could be a reflection of that. An oil price holding up fairly well at close to USD 68/b despite the fact that oil balances for Q4-25 and 2026 looks bloated could be another reflection that global manufacturing may be accelerating.

US manufacturing PMI by S&P rose to 53.3 in August. It was published on 21 August, so not at all newly released. But the US ISM manufacturing PMI is due tomorrow and has the potential to follow suite with a strong manufacturing reading.

Analys

Crude stocks fall again – diesel tightness persists

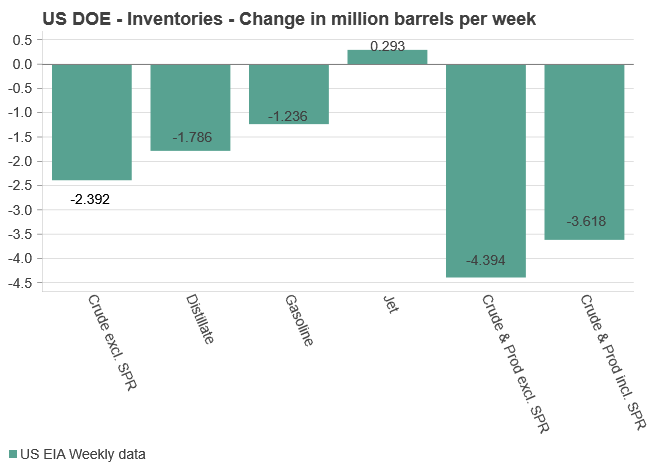

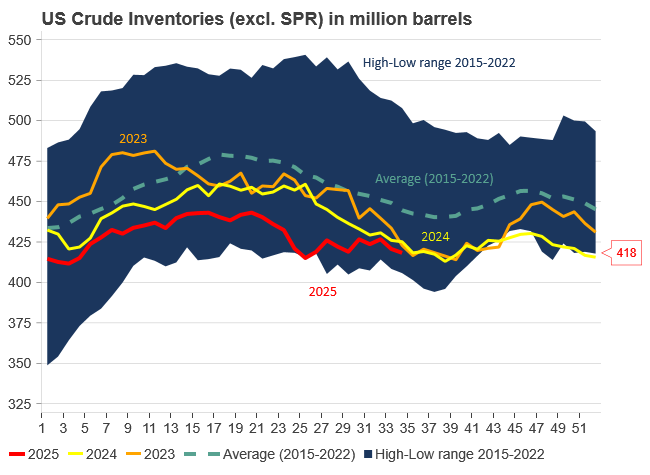

U.S. commercial crude inventories posted another draw last week, falling by 2.4 million barrels to 418.3 million barrels, according to the latest DOE report. Inventories are now 6% below the five-year seasonal average, underlining a persistently tight supply picture as we move into the post-peak demand season.

While the draw was smaller than last week’s 6 million barrel decline, the trend remains consistent with seasonal patterns. Current inventories are still well below the 2015–2022 average of around 449 million barrels.

Gasoline inventories dropped by 1.2 million barrels and are now close to the five-year average. The breakdown showed a modest increase in finished gasoline offset by a decline in blending components – hinting at steady end-user demand.

Diesel inventories saw yet another sharp move, falling by 1.8 million barrels. Stocks are now 15% below the five-year average, pointing to sustained tightness in middle distillates. In fact, diesel remains the most undersupplied segment, with current inventory levels at the very low end of the historical range (see page 3 attached).

Total commercial petroleum inventories – including crude and products but excluding the SPR – fell by 4.4 million barrels on the week, bringing total inventories to approximately 1,259 million barrels. Despite rising refinery utilization at 94.6%, the broader inventory complex remains structurally tight.

On the demand side, the DOE’s ‘products supplied’ metric – a proxy for implied consumption – stayed strong. Total product demand averaged 21.2 million barrels per day over the last four weeks, up 2.5% YoY. Diesel and jet fuel were the standouts, up 7.7% and 1.7%, respectively, while gasoline demand softened slightly, down 1.1% YoY. The figures reflect a still-solid late-summer demand environment, particularly in industrial and freight-related sectors.

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanOmgående mångmiljardfiasko för Equinors satsning på Ørsted och vindkraft

-

Nyheter4 veckor sedan

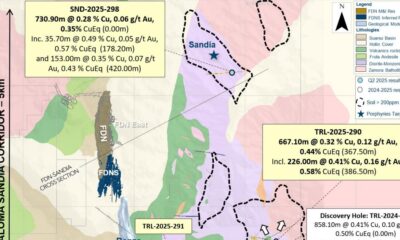

Nyheter4 veckor sedanLundin Gold hittar ny koppar-guld-fyndighet vid Fruta del Norte-gruvan

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanMeta bygger ett AI-datacenter på 5 GW och 2,25 GW gaskraftverk

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanGuld stiger till över 3500 USD på osäkerhet i världen

-

Analys3 veckor sedan

Analys3 veckor sedanWhat OPEC+ is doing, what it is saying and what we are hearing

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanAlkane Resources och Mandalay Resources har gått samman, aktör inom guld och antimon

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanAker BP gör ett av Norges största oljefynd på ett decennium, stärker resurserna i Yggdrasilområdet

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanLyten, tillverkare av litium-svavelbatterier, tar över Northvolts tillgångar i Sverige och Tyskland