Analys

Gold and oil ETP inflows benefiting from heightened geopolitical risks

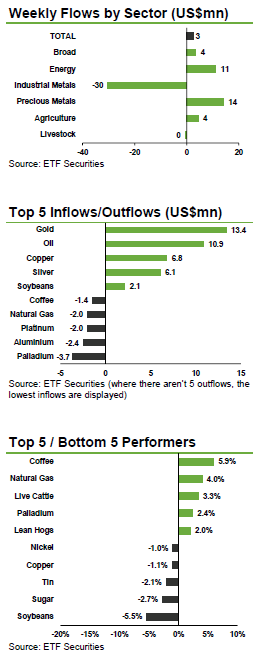

Investors’ focus remained on geopolitical risks last week, with gold and oil ETPs seeing the 7th consecutive week of inflows, as the Ukrainian-Russian conflict escalates. Russian posturing appears to be escalating and increasingly questioning Ukrainian sovereignty and the UN has urged Western nations to intervene. While oil and gold prices are yet to react to heightened risks, investors are rebuilding hedges into their portfolios.

Investors’ focus remained on geopolitical risks last week, with gold and oil ETPs seeing the 7th consecutive week of inflows, as the Ukrainian-Russian conflict escalates. Russian posturing appears to be escalating and increasingly questioning Ukrainian sovereignty and the UN has urged Western nations to intervene. While oil and gold prices are yet to react to heightened risks, investors are rebuilding hedges into their portfolios.

Geopolitical risks drive the 7th consecutive week of inflows into long gold and oil ETPs. Long oil ETPs saw US$11.8mn of inflows, as the Ukrainian-Russian conflict escalates. The United Nations accused Russia of having more than 1000 regular troops in the Ukraine, pressuring Western countries to intervene. While both oil and gold prices are yet to react to heightened geopolitical risks, investors have been building positions as a hedge against further deterioration of the situation in Eastern Europe and the Middle East. Russia is the world’s 2nd biggest oil producer after Saudi Arabia, accounting for 13% of global oil output and 16% of world total exports in 2013. Should Russia ban oil exports, it is unlikely that Saudi Arabia capacity to fully compensate for the loss in production. With the EIA forecasting a 9,000 barrel a day surplus in 2014, the loss of a portion of the 10.7mn barrels a day from Russia could have a substantial impact on prices. Meanwhile, long gold ETPs saw US$13.4mn of inflows last week, as investors become increasingly defensive.

Geopolitical risks drive the 7th consecutive week of inflows into long gold and oil ETPs. Long oil ETPs saw US$11.8mn of inflows, as the Ukrainian-Russian conflict escalates. The United Nations accused Russia of having more than 1000 regular troops in the Ukraine, pressuring Western countries to intervene. While both oil and gold prices are yet to react to heightened geopolitical risks, investors have been building positions as a hedge against further deterioration of the situation in Eastern Europe and the Middle East. Russia is the world’s 2nd biggest oil producer after Saudi Arabia, accounting for 13% of global oil output and 16% of world total exports in 2013. Should Russia ban oil exports, it is unlikely that Saudi Arabia capacity to fully compensate for the loss in production. With the EIA forecasting a 9,000 barrel a day surplus in 2014, the loss of a portion of the 10.7mn barrels a day from Russia could have a substantial impact on prices. Meanwhile, long gold ETPs saw US$13.4mn of inflows last week, as investors become increasingly defensive.

Profit taking prompts US$3.7mn of outflows from ETFS Physical Palladium (PHPD). Palladium ETPs have seen over US$100mn of outflows over the past months as fears of trade sanctions against Russia, palladium biggest producer, drove the price higher. While palladium is likely to continue being buoyed by potential supply disruptions in Russia, we believe platinum underperformance is excessive and anticipate the spread between the two metals will widen over the next few months.

ETFS Copper (COPA) sees fifth weekly inflow, totalling of US$6.9mn, as US growth picks up pace. The US Department of Commerce revised Q2 growth upwards to 4.2% from 4.0%, on stronger business spending and exports. We believe fears of copper oversupply are overblown and that copper remains attractive at current price levels. We expect investors are now beginning to focus on tightening supply-demand conditions and we expect the copper price to rebound to around US$7,500. Meanwhile, profit taking drove US$2.5mn of outflows from ETFS Aluminium (ALUM) as the price hit US$2,100 for the first time in 18 months.

Price correction drives the highest inflows since May 2014 into ETFS Soybeans (SOYB). Soybeans price tumbled to a nearly 4-year low last week, on record crop expectations from the US. About 70% of soybeans in the main growing areas were deemed in good or excellent condition as of August 24. This is the highest level seen since 1992 at this time of the year. However, early signs of Sudden Death Syndrome (SDS), a disease that contaminates the crop, showed up in the Midwest over the past week and threatens to drastically reduced yields. With soybean prices having lost over 18% since the beginning of the year, investors are starting to rebuild positions.

Key events to watch this week. Bank of England, the European Central Bank and the Bank of Japan will all be holding policy meetings this week. The focus will likely be on the ECB following Draghi’s dovish speech in Jackson Hole two weeks ago. Jobs are a key concern for policymakers and US non-farm payrolls later this week are expected to show the US recovery remains robust. Manufacturing data will also be released this week for China, India, the Eurozone, the UK and the US, to gauge the relative pace of the global recovery.

Analys

Are Ukraine’s attacks on Russian energy infrastructure working?

Brent crude rose 1.6% yesterday. After trading in a range of USD 66.1 – 68.09/b it settled at USD 67.63/b. A level which we are well accustomed to see Brent crude flipping around since late August. This morning it is trading 0.5% higher at USD 68/b. The market was expecting an increase of 230 kb/d in Iraqi crude exports from Kurdistan through Turkey to the Cheyhan port but that has so far failed to materialize. This probably helped to drive Brent crude higher yesterday. Indications last evening that US crude oil inventories likely fell 3.8 mb last week (indicative numbers by API) probably also added some strength to Brent crude late in the session. The market continues to await the much heralded global surplus materializing as rising crude and product inventories in OECD countries in general and the US specifically.

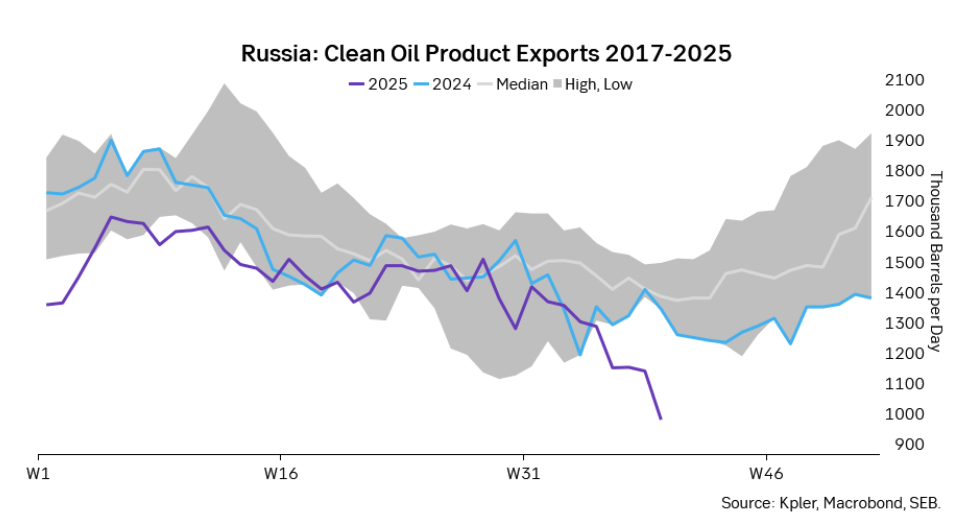

The oil market is starting to focus increasingly on the successful Ukrainian attacks on Russian oil infrastructure. Especially the attacks on Russian refineries. Refineries are highly complex and much harder to repair than simple crude oil facilities like export pipelines, ports and hubs. It can take months and months to repair complex refineries. It is thus mainly Russian oil products which will be hurt by this. First oil product exports will go down, thereafter Russia will have to ration oil product consumption domestically. Russian crude exports may not be hurt as much. Its crude exports could actually go up as its capacity to process crude goes down. SEB’s Emerging Market strategist Erik Meyersson wrote about the Ukrainian campaign this morning: ”Are Ukraine’s attacks on Russian energy infrastructure working?”. Phillips P O’Brian published an interesting not on this as well yesterday: ”An Update On The Ukrainian Campaign Against Russian Refineries”. It is a pay-for article, but it is well worth reading. Amongst other things it highlights the strategic focus of Ukraine towards Russia’s energy infrastructure. A Ukrainian on the matter also put out a visual representation of the attacks on twitter. We have not verified the data representation. It needs to be interpreted with caution in terms of magnitude of impact and current outage.

Complex Russian oil refineries are sitting ducks in the new, modern long-range drone war. Ukraine is building a range of new weapons as well according to O’Brian. The problem with attacks on Russian refineries is thus on the rise. This will likely be an escalating problem for Russia. And oil products around the world may rise versus the crude oil price while the crude oil price itself may not rise all that much due to this.

Russian clean oil product exports as presented by SEB’s Erik Meyersson in his note this morning.

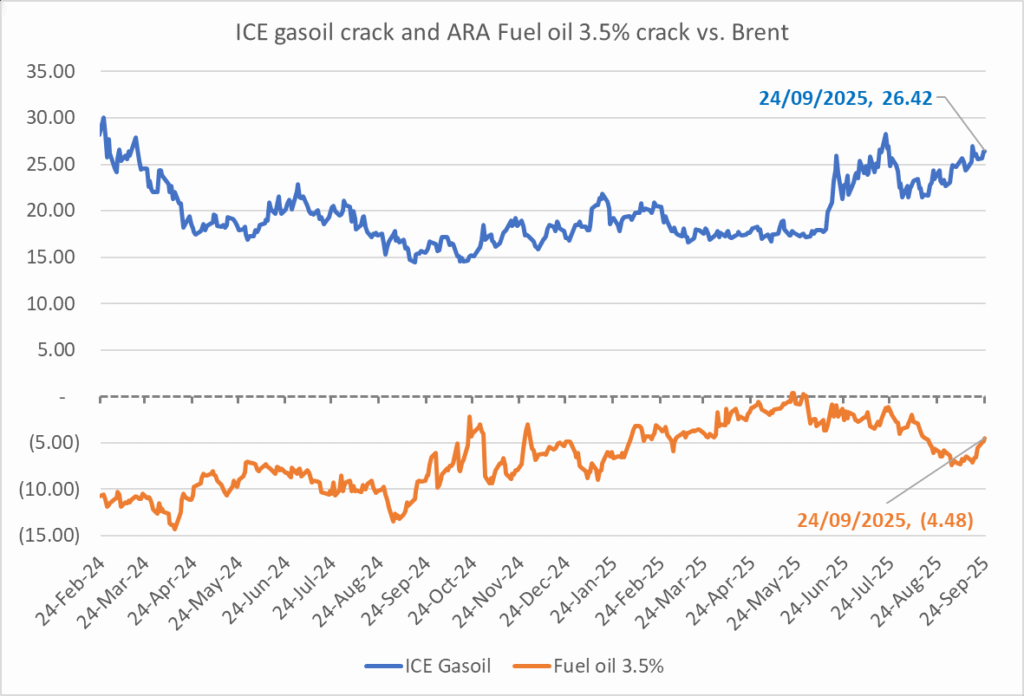

The ICE Gasoil crack and the 3.5% fuel oil crack has been strengthening. The 3.5% crack should have weakened along with rising exports of sour crude from OPEC+, but it hasn’t. Rather it has moved higher instead. The higher cracks could in part be due to the Ukrainian attacks on Russian oil refineries.

Ukrainian inhabitants graphical representation of Ukrainian attacks on Russian oil refineries on Twitter. Highlighting date of attacks, size of refineries and distance from Ukraine. We have not verified the detailed information. And you cannot derive the amount of outage as a consequence of this.

Analys

Market waiting and watching for when seasonally softer demand meets rising OPEC+ supply

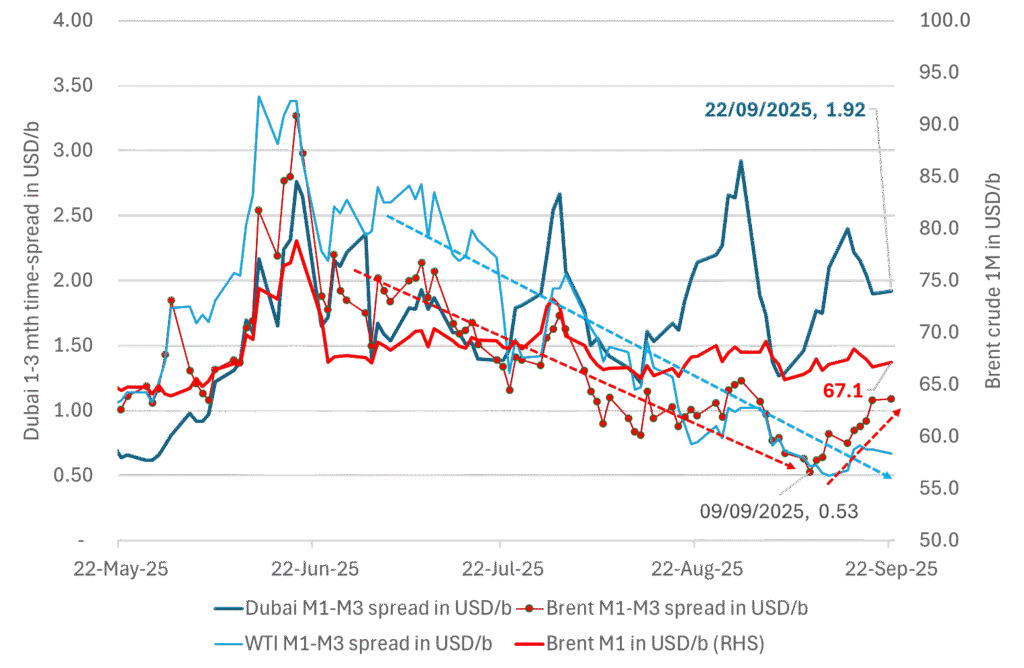

Brent down 0.5% last week with a little bounce this morning. Brent crude fell 0.5% last week to USD 66.68/b with a high of the week of USD 68/69/b set early in the week and the low of USD 66.44/b on Friday. This morning it is up 0.6% and trading at USD 67.1/b and just three dollar below the year to date average of USD 70/b.

The Dubai crude curve is holding strong. Flat prices will move lower when/if that starts to weaken. The front-end of the Brent crude oil curve has been on a strengthening path since around 10 September, but the front-month contract is more or less at the same level as 10 September. But the overall direction since June has been steadily lower. The recent strengthening in the front-end of the Brent curve is thus probably temporary. The WTI curve has also strengthened a little but much less visibly. What stands out is the robustness in the front-end of the Dubai crude curve. With tapering crude burn for power in the Middle East as we move away from the summer heat together with increasing production by OPEC+, one should have expected to see a weakening in the Dubai curve. The 1 to 3mth Dubai time-spread is however holding strong at close to USD 2/b. When/if the Dubai front-end curve starts to weaken, that is probably when we’ll see flat prices start to taper off and fall lower. Asian oil demand in general and Chinese stockpiling specifically is probably what keeps the the strength in the front-end of the Dubai curve elevated. It is hard to see Brent and WTI prices move significantly lower before the Dubai curve starts to give in.

The 1mth to 3mth time spreads of Brent, WTI and Dubai in USD/b

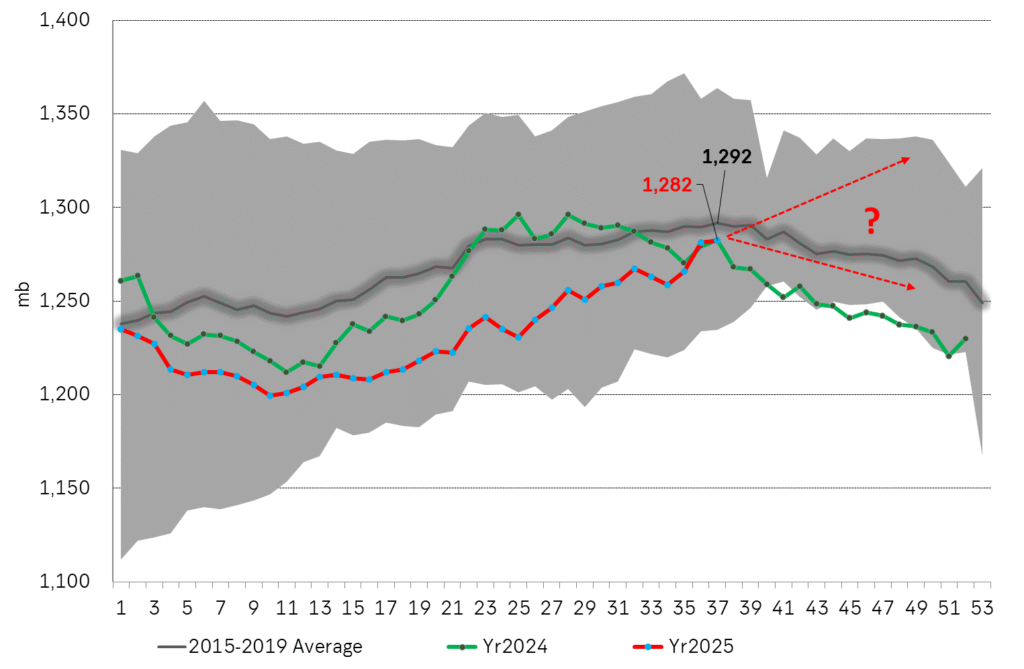

If US oil stocks continues higher in Q4 we’ll start to feel the bearish pressure more intensely. US commercial crude and product stocks have been below normal and below levels from last year as well all until now. Inventories have been rising since week 10 and steadily faster than the normal seasonal trend and today are finally on par with last year and only 10 mb below normal. From here to the end of the year is however is the interesting part as inventories normally decline from now to the end of the year. If US inventories instead continues to rise, then the divergence with normal inventories will be very explicit and help to drive the price lower. So keep a keen eye on US commercial inventories in the coming weeks for such a possible divergence.

US Commercial crude and product stocks in million barrels.

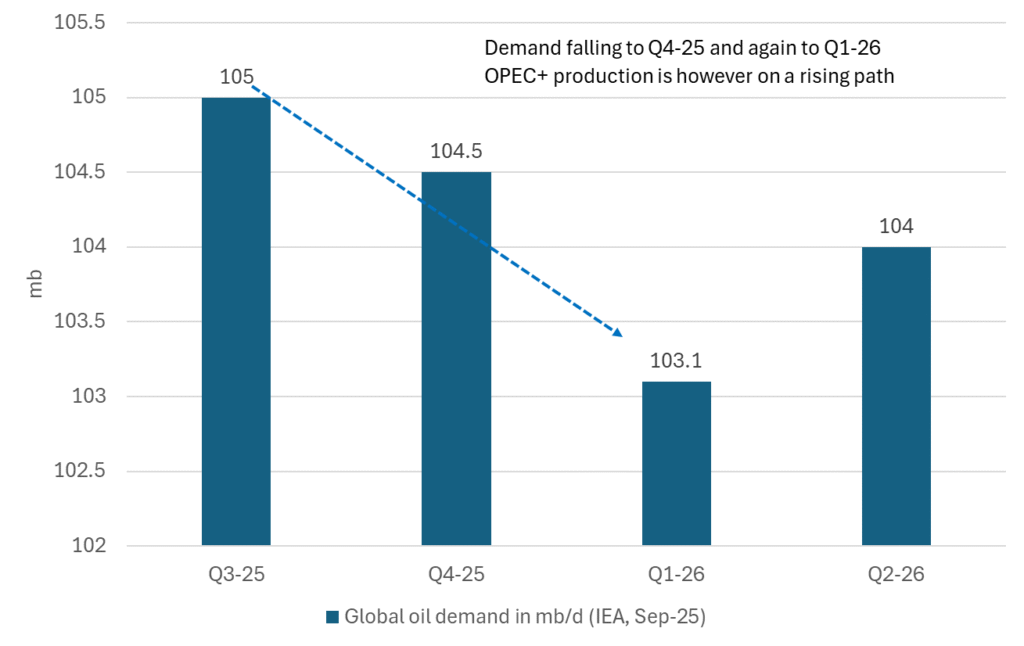

Falling seasonal demand and rising OPEC+ supply will likely drive oil lower in Q4-25. The setup for the oil market is that global oil demand is set to taper off from Q3 to Q4 and again to Q1-26. At the same time production by OPEC+ is on a rising path. The big question this is of course if China will stockpile the increasing surplus or whether the oil price will be pushed lower into the 50ies. We believe the latter.

Outlook for global oil demand by IEA in the OMR September report

Analys

Brent crude ticks higher on tension, but market structure stays soft

Brent crude has climbed roughly USD 1.5-2 per barrel since Friday, yet falling USD 0.3 per barrel this mornig and currently trading near USD 67.25/bbl after yesterday’s climb. While the rally reflects short-term geopolitical tension, price action has been choppy, and crude remains locked in a broader range – caught between supply-side pressure and spot resilience.

Prices have been supported by renewed Ukrainian drone strikes targeting Russian infrastructure. Over the weekend, falling debris triggered a fire at the 20mtpa Kirishi refinery, following last week’s attack on the key Primorsk terminal.

Argus estimates that these attacks have halted ish 300 kbl/d of Russian refining capacity in August and September. While the market impact is limited for now, the action signals Kyiv’s growing willingness to disrupt oil flows – supporting a soft geopolitical floor under prices.

The political environment is shifting: the EU is reportedly considering sanctions on Indian and Chinese firms facilitating Russian crude flows, while the U.S. has so far held back – despite Bessent warning that any action from Washington depends on broader European participation. Senator Graham has also publicly criticized NATO members like Slovakia and Hungary for continuing Russian oil imports.

It’s worth noting that China and India remain the two largest buyers of Russian barrels since the invasion of Ukraine. While New Delhi has been hit with 50% secondary tariffs, Beijing has been spared so far.

Still, the broader supply/demand balance leans bearish. Futures markets reflect this: Brent’s prompt spread (gauge of near-term tightness) has narrowed to the current USD 0.42/bl, down from USD 0.96/bl two months ago, pointing to weakening backwardation.

This aligns with expectations for a record surplus in 2026, largely driven by the faster-than-anticipated return of OPEC+ barrels to market. OPEC+ is gathering in Vienna this week to begin revising member production capacity estimates – setting the stage for new output baselines from 2027. The group aims to agree on how to define “maximum sustainable capacity,” with a proposal expected by year-end.

While the IEA pegs OPEC+ capacity at 47.9 million barrels per day, actual output in August was only 42.4 million barrels per day. Disagreements over data and quota fairness (especially from Iraq and Nigeria) have already delayed this process. Angola even quit the group last year after being assigned a lower target than expected. It also remains unclear whether Russia and Iraq can regain earlier output levels due to infrastructure constraints.

Also, macro remains another key driver this week. A 25bp Fed rate cut is widely expected tomorrow (Wednesday), and commodities in general could benefit a potential cut.

Summing up: Brent crude continues to drift sideways, finding near-term support from geopolitics and refining strength. But with surplus building and market structure softening, the upside may remain capped.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanMahvie Minerals är verksamt i guldrikt område i Finland

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanEurobattery Minerals satsar på kritiska metaller för Europas självförsörjning

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanNeil Atkinson spår att priset på olja kommer att stiga till 70 USD

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanGuldpriset kan närma sig 5000 USD om centralbankens oberoende skadas

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanMahvie Minerals i en guldtrend

-

Analys3 veckor sedan

Analys3 veckor sedanOPEC+ in a process of retaking market share

-

Nyheter2 veckor sedan

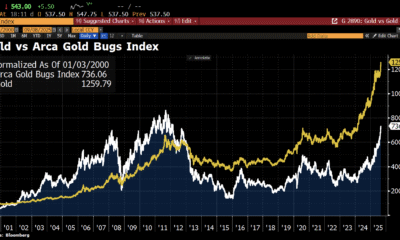

Nyheter2 veckor sedanAktier i guldbolag laggar priset på guld

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanOPEC signalerar att de inte bryr sig om oljepriset faller kommande månader