Nyheter

David Hargreaves on Precious Metals week 37 2013

As ever Gold dominates the sector. Yet the price gyrations have slowed and, barring a Syria debacle, a $1350-1450/oz price band looks set for some time, with short term trading the order of the day.

As ever Gold dominates the sector. Yet the price gyrations have slowed and, barring a Syria debacle, a $1350-1450/oz price band looks set for some time, with short term trading the order of the day.

Mining Journal held its Gold and Precious Metals Seminar in London September 6th, its second of the year. A panel of precious metal gurus concurred on the long-term shifts in attitudes towards the precious, particularly gold. The geographical emphasis switches from West to East. China and India now account for over a half of the purchases of the metal. Importantly these transactions put it into ‘safe’ long term hands. An intriguing question left hanging was whether the government of China will make a move towards increasing its relatively small holdings as a preliminary step towards breaking its link with the US dollar. A full report of the seminar, written by David Hargreaves, who chaired the meeting, will appear in next week’s Mining Journal.

Evidence, perhaps, of the East-West shift is that the demand for US gold coins fell to a six year low, down 77% in August to just 11,500oz, from 39,000oz in like 2012 and 55,500 in July. The sales of silver eagle coins also dropped 17.75% to 3.6 million ounces. Gold Eagle sales ran at 100,000 per month in the first seven months of 2013. Much, say those who claim to know, rests on will the US or will it not, intervene in Syria. More in Countries. But no stopping China. Despite being the largest miner of gold it is now eclipsing India as the major importer. Customs reports show an intake of 493 tonnes in H1 (2012, H1 = 239t). Total domestic consumption for H1 was reported 706t, a jump of 54%. Annualised, this is over a half of world newly mined supply. Total demand, which amounts to c 4000t worldwide, is made up of c. 2800t new and 1200t recycled. Much of the latter arises in the West.

WIM says: This is a fluid situation. There is a direct contrast between the Chinese government clearly encouraging gold holding by its citizens but India, for balance-of-payments reasons, actively discouraging it.

Where Will Lie the Balance in Supply and Demand? When the price of gold was fixed at $35/oz in 1934, most trade transactions had the backing of the metal. For that to happen again the price would now have to be c. $10,000/oz.

The prospect is encouraging new production despite the travails of major mines such as Barrick, Newmont and Anglo. Australia’s mines upped their output 6% in Q4 2013 to 67t, making 259t for the year, almost 10% of total mined. Star performers included Evolution, St. Barbara and Newcrest.

India’s balance of payments problem cannot, unlike gold, be swept under the bed. It is a unique case. The country has long been the major importer but also manufactures jewellery which it exports at added value. Sadly, much of the imported gold goes under and stays under, the bed. India has further problems with imports (see Countries) but is targeting gold, big time. The Reserve Bank (RBC) is tightening the screws like a demented carpenter. It is trying to restrict imports by increasing taxation and regulating flows. Whilst this may have a net effect, it is encouraging illicit dealing, smuggling and like skulduggery. Perversely, it is hurting exports of jewellery. These fell 70% in July because of a shortage of gold. They were $441M compared with $1500M in like 2012.

Gold and Local Currencies. We have not awarded a SOTBO* for some time, but here we go. A well-known and offquoted correspondent on Mineweb says if selected currencies cheapen, the price of gold in these countries will rise.

Have we missed something? He also says it will affect silver. Hadn’t thought of that.

South Africa’s Gold Wage Negotiations, we report on in more detail in Countries. Suffice here to say they are reaching a compromise at c. 8%.

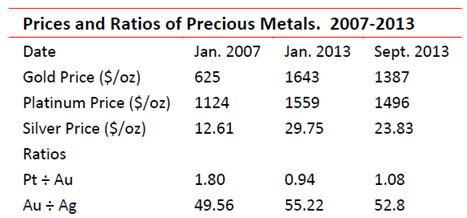

Platinum sees its premium to gold slipping, but it has been there before.

To remind:

Reasons for the swings abound. Platinum and silver have an industrial component; gold does not. The rise in the use of Pt and Pd in autocatalysis created a shortage. This was progressively filled by aggressive expansion in the major producing country, South Africa plus copious supplies from Russia. Silver, despite its supporting remains hostage to the gold price.

WIM says: Given that industrial peace may be returning to RSA, we expect Pt and Ad to slip to discount to gold once more, particularly if the Middle East problems escalate.

*SOTBO: Statement of the Blinding Obvious.

[hr]

About David Hargreaves

David Hargreaves is a mining engineer with over forty years of senior experience in the industry. After qualifying in coal mining he worked in the iron ore mines of Quebec and Northwest Ontario before diversifying into other bulk minerals including bauxite. He was Head of Research for stockbrokers James Capel in London from 1974 to 1977 and voted Mining Analyst of the year on three successive occasions.

Since forming his own metals broking and research company in 1977, he has successfully promoted and been a director of several public companies. He currently writes “The Week in Mining”, an incisive review of world mining events, for stockbrokers WH Ireland. David’s research pays particular attention to steel via the iron ore and coal supply industries. He is a Chartered Mining Engineer, Fellow of the Geological Society and the Institute of Mining, Minerals and Materials, and a Member of the Royal Institution. His textbook, “The World Index of Resources and Population” accurately predicted the exponential rise in demand for steel industry products.

Nyheter

Samtal om flera delar av råvarumarknaden

Ett samtal som sammanfattar ett relativt stabilt halvår på råvarumarknaden trots volatilitet och geopolitiska spänningar som sannolikt fortsätter in i andra halvan av året. Vi bjuds även på kommentarer från Carlos Mera, Rabobanks analyschef för jordbrukssektorn och Kari Kangas, skogsanalytiker.

Nyheter

Jonas Lindvall är tillbaka med ett nytt oljebolag, Perthro, som ska börsnoteras

Jonas Lindvall, ett välkänt namn i den svenska olje- och gasindustrin, är tillbaka med ett nytt företag – Perthro AB – som nu förbereds för notering i Stockholm. Med över 35 års erfarenhet från bolag som Lundin Oil, Shell och Talisman Energy, och som medgrundare till energibolag som Tethys Oil och Maha Energy, är Lindvall redo att än en gång bygga ett bolag från grunden.

Tillsammans med Andres Modarelli har han startat Perthro med ambitionen att bli en långsiktigt hållbar och kostnadseffektiv producent inom upstream-sektorn – alltså själva oljeutvinningen. Deras timing är strategisk. Med ett inflationsjusterat oljepris som enligt Lindvall är lägre än på 1970-talet, men med fortsatt växande efterfrågan globalt, ser de stora möjligheter att förvärva tillgångar till attraktiva priser.

Perthro har redan säkrat bevisade oljereserver i Alberta, Kanada – en region med rik oljehistoria. Bolaget tittar även på ytterligare projekt i Oman och Brasilien, där Lindvall har tidigare erfarenhet. Enligt honom är marknadsförutsättningarna idealiska: världens efterfrågan på olja ökar, medan utbudet inte hänger med. Produktionen från befintliga oljefält minskar med cirka fem procent per år, samtidigt som de största oljebolagen har svårt att ersätta de reserver som produceras.

”Det här skapar en öppning för nya aktörer som kan agera snabbare, tänka långsiktigt och agera med kapitaldisciplin”, säger Lindvall.

Perthro vill fylla det växande gapet på marknaden – med fokus på hållbar tillväxt, hög avkastning och effektiv produktion. Med Lindvalls meritlista och branschkunskap hoppas bolaget nu kunna bli nästa svenska oljebolag att sätta avtryck på världskartan – och på börsen.

Nyheter

Oljan, guldet och marknadens oroande tystnad

Oljepriset är åter i fokus på grund av kriget i Mellanöstern. Är marknadens tystnad om de stora riskerna, det som vi egentligen verkligen bör oroa oss för? Och varför funderar Tyskland på att plocka hem sin guldreserv från New York? I veckans avsnitt av Världsekonomin pratar Katrine Kielos och Henrik Mitelman om olja, tystnad och guld. Europa är ju mer beroende av oljepriset än USA, hur orolig ska man vara för att det stiger? En krönika i Financial Times lyfte nyligen “marknadens oroande tystnad”, den syftade på skillnaden mellan den dystra geopolitiska utvecklingen i världen och en marknad som samtidigt återhämtat sig 20 procent sen början av april, trots tullkriget. Vad säger marknadens tystnad egentligen? I Tyskland pågår en debatt om att plocka hem sin guldreserv från USA. Handlar det om bristande förtroende för Donald Trump – och kan det rentav ha något med “hämndskatten” att göra?

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanStor uppsida i Lappland Guldprospekterings aktie enligt analys

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanBrookfield ska bygga ett AI-datacenter på hela 750 MW i Strängnäs

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanSommaren inleds med sol och varierande elpriser

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanOPEC+ ökar oljeproduktionen trots fallande priser

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanSilverpriset släpar efter guldets utveckling, har mer uppsida

-

Analys4 veckor sedan

Analys4 veckor sedanBrent needs to fall to USD 58/b to make cheating unprofitable for Kazakhstan

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanTradingfirman XTX Markets bygger datacenter i finska Kajana för 1 miljard euro

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanUppgången i oljepriset planade ut under helgen