Nyheter

David Hargreaves on Metals and Minerals, week 3 2012

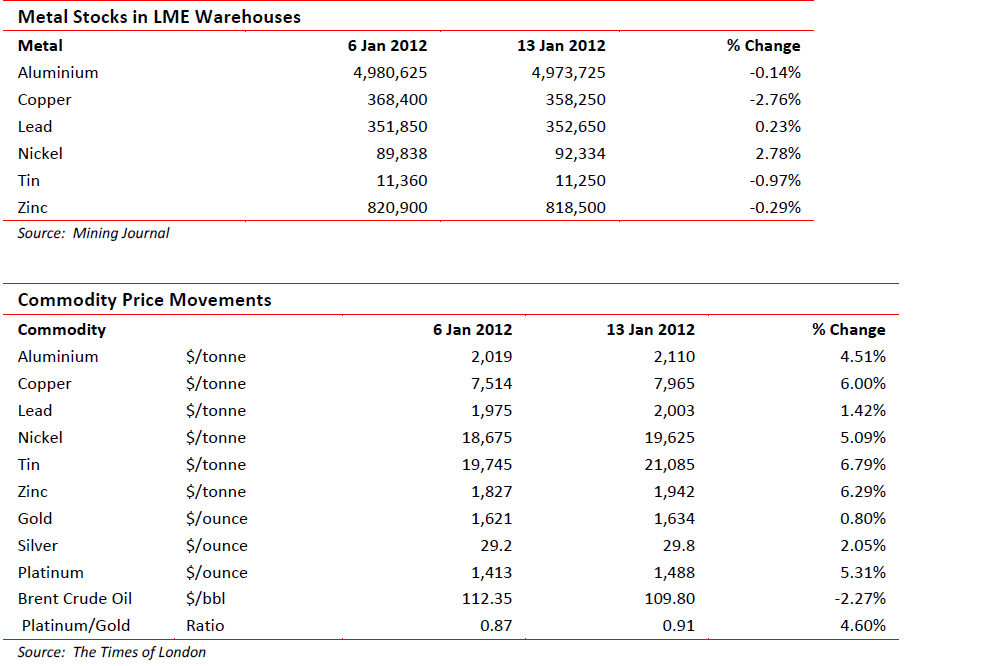

Exchange Traded Metals

Exchange Traded Metals

The sector rallied on better economic sentiment and the sharing of our view that the world is bigger than the Euro. Neither will we spin anti-clockwise down the vortex of life just because the French debt has been downgraded. Warehouse stocks did not join the euphoria.

Alumina from Coal Ash? There is nothing new in the world, only someone willing to promote it. We produce that versatile metal aluminium in a 3-stage process starting with a cheap and cheerful raw material bauxite, which is high in the starter ingredient aluminium oxide, Al2O3. As the miners found out when they attempted a cartel in the 1960’s, it is not the only available substance. Clays and coal ash are also rich in it. So the Chinese (who else?) have decided to throw some of their vast surplus dollars into producing alumina, the half-way house, from coal ash. The company doing so is Shenhua, China’s largest coal producer. Makes sense so far. Now Mineweb reports that they are throwing $21.4bn at a project based at a coal mine of theirs in Inner Mongolia. The maths are a bit askew.

- World production of aluminium = 40Mt/y

- World bauxite usage = 200Mt/y

- Aluminium content of bauxite = 20%

- Now the Aluminium content of coal ash is only 5%.

So you would need 200Mt x (20 ÷ 5) = 800Mt of ash. Thermal coal runs about 10% ash, so you would need to burn 800 x 10 = 8000Mt/y of power station coal to replace the bauxite. The power station burn is about 3,500Mt, so coal ash could in theory make a 60-65%, a hole in the bauxite market. But they are spending $21bn to find out if and how. We wish them luck. It would seriously upset Rio Tinto, Alcoa, Vale, BHPB and the Government of Guinea, if it worked, because they are big bauxite miners. You can also extract gold from seawater but that is another story.

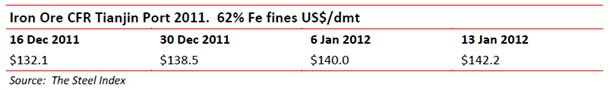

Bulk Minerals

Precious Metals

It is a quiet week when gold does not merit at least a page. It flirted around last week, but did not run a temperature.

There may be an upward, speculative run now the Euro has been semi-trashed by S&P, but we think that will be all. The CEO of London market gold fixer Sharps Pixley came back from China last week. His findings, chronicled by Mineweb, are well worth a browse. He thinks the Chinese are on the move as buyers, both the Central Bank and the populace. He tells you what we repeatedly tell you, that for China’s central reserves to challenge those of the USA (or France, Germany or Japan), they have a long way to go. He also notes that with an export ban in place, what goes to China, stays in China.

Auto demand adds to pressure on platinum. Worldwide, there is a switch to diesel and alternatively-fuelled cars versus petrol models. This means better fuel efficiencies and less pressure on autocatalysts. It adds to the woes of South Africa’s platinum miners, but if they cut back, a shortage will drive up the price again. Not an argument to buy Pt shares.

AIM-listed Pan African Resources (15.25p; Hi-Lo 17.0-9.5) gets a buy signal in Shares Magazine. It is RSA-based and has both a mining operation at Barberton (95,000oz/yr) plus a recycling facility. It also pays a dividend, yield 5.3% at the current share price. There’s a novelty. Now it just happens that AIM-listed Goldplat is South African based, does recycling and has a primary gold mine in Kenya! Hmmmmm.

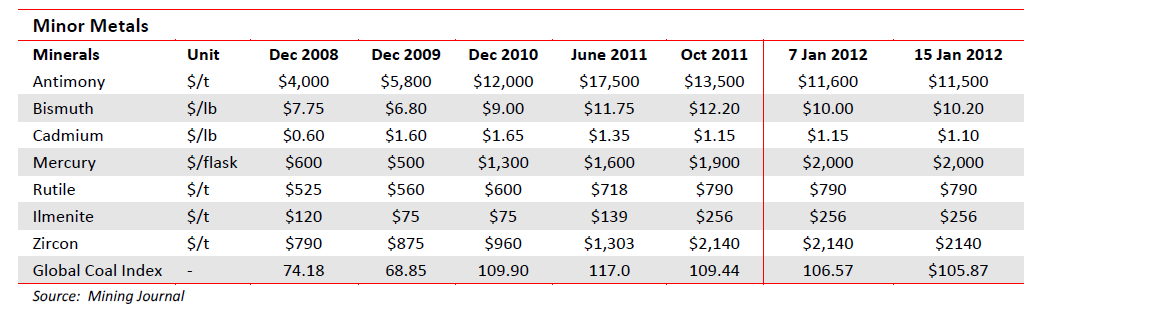

Minor Metals

Little change on the week but the disparities between a year ago, six months ago and now are significant, as the table below shows:

Antimony has trebled in price in 3 years (from $4000/t but has lost 34% from its exceptional $17,500t level in June 2011.

Produced largely now by China, but with growing supplies from the former Soviet Republics it had been subjected to lower Chinese offerings but these have now improved. Its usage is dominated as a flame retardant and lead substitute.

Bismuth remains in obvious over supply with producers China, Korea and Bolivia having large offerings. We may see further weakness. Cadmium, that most versatile of minors, from food additives to dyestuffs and metal plating, remains somewhat in oversupply.

Cobalt, at $13.50-14.50/lb has picked up a little. Its supply still remains in the grip of DRC and Zambian miners with China’s intake on the rise. Mercury, despite environmental pressure, remains in big-demand as an amalgam in gold refining, particularly in small scale and artisanal workings. The EU has an export ban on the metal and prices seem destined for move on the upside.

[hr]

About David Hargreaves

David Hargreaves is a mining engineer with over forty years of senior experience in the industry. After qualifying in coal mining he worked in the iron ore mines of Quebec and Northwest Ontario before diversifying into other bulk minerals including bauxite. He was Head of Research for stockbrokers James Capel in London from 1974 to 1977 and voted Mining Analyst of the year on three successive occasions.

Since forming his own metals broking and research company in 1977, he has successfully promoted and been a director of several public companies. He currently writes “The Week in Mining”, an incisive review of world mining events, for stockbrokers WH Ireland. David’s research pays particular attention to steel via the iron ore and coal supply industries. He is a Chartered Mining Engineer, Fellow of the Geological Society and the Institute of Mining, Minerals and Materials, and a Member of the Royal Institution. His textbook, “The World Index of Resources and Population” accurately predicted the exponential rise in demand for steel industry products.

Nyheter

USA ska införa 50 procent tull på koppar

USA:s president Donald Trump har precis meddelat att landet ska införa en tull på 50 procent på basmetallen koppar. Priset på råvarubörsen i USA stiger omgående med 10 procent.

USA har viss inhemsk produktion av koppar, men den inhemska efterfrågan överstiger produktionen. Därför måste landet importera koppar för att täcka behovet, särskilt för användning inom elnät, elektronik, byggindustri och fordonssektorn. De största exportörerna till USA är Chile, Kanada, Mexiko och Peru.

När tullar av denna typ införs uppstår prisskillnader i världen. Handlar man koppar på börsen är det därför viktigt att veta vilken börs man handlar på eller om man använder certifikat så är det viktigt att veta vilka underliggande värdepapper de följer.

Sedan är det som alltid med Trump, begreppet är som bekant TACO, Trump Always Chickens Out. Man ska alltså inte ta några definitiva stora beslut baserat på vad han säger. Saker och ting kan ändra sig från dag till dag.

Nyheter

Ryska staten siktar på att konfiskera en av landets största guldproducenter

En våg av panik sprider sig bland Moskvas elit sedan Vladimir Putins regim inlett en dramatisk offensiv för att beslagta tillgångarna hos Konstantin Strukov – en av Rysslands rikaste affärsmän och ägare till landets största guldgruvföretag, Yuzhuralzoloto. Åtgärden ses som ett tydligt tecken på hur långt Kreml är villigt att gå för att säkra ekonomiska resurser i takt med att kostnaderna för kriget i Ukraina stiger.

Strukovs förmögenhet, som uppskattas till över 3,5 miljarder dollar, byggdes upp under decennier i nära relation med maktens centrum i Ryssland. Men den 5 juli stoppades hans privatjet från att lyfta mot Turkiet. Enligt flera ryska medier deltog den federala säkerhetstjänsten FSB i ingripandet, och Strukovs pass beslagtogs. Händelsen ska vara kopplad till en omfattande rättsprocess där åklagare kräver att hela hans företagsimperium förverkas – med hänvisning till påstådd korruption och användning av skalbolag och familjemedlemmar för att dölja tillgångar.

Företaget själva förnekar att något inträffat och kallar rapporteringen för desinformation. De hävdar att Strukov befann sig i Moskva hela tiden. Trots det bekräftar rättsdokument att både han och hans familj förbjudits att lämna landet, och att myndigheterna snabbt verkställt beslutet.

Det som nu sker är en del av ett större mönster i ett Ryssland präglat av krigsekonomi: staten tar tillbaka kontrollen över strategiska sektorer som guld, olja och försvarsindustri – industrier som nu allt mer mobiliseras för att finansiera och stödja krigsinsatsen. Intressant nog handlar det inte om att Strukov ska ha varit illojal mot regimen – tvärtom har han varit en lojal allierad, med politiska uppdrag knutna till Putins parti. Men lojalitet räcker inte längre som skydd.

Medan tidigare utrensningar ofta riktade sig mot krigskritiker eller de som flydde landet, drivs dagens tillgångsövertaganden av något mer fundamentalt: ekonomisk nöd. De växande sanktionerna har nästan helt strypt inflödet av utländskt kapital. Statens oljeintäkter minskar och budgetunderskotten växer. Putins lösning är att vända sig inåt – till de oligarker han själv lyfte fram – för att fylla statskassan.

Det här är inte ett enskilt fall. På senare tid har flera framstående affärspersoner hamnat i plötsliga rättsliga tvister, omkommit under mystiska omständigheter eller sett sina bolag tas över av staten. Den oskrivna överenskommelsen som länge gällde i Putins Ryssland – rikedom i utbyte mot lojalitet – håller på att kollapsa.

Den 8 juli väntar en rättsförhandling som kan avgöra framtiden för Strukovs affärsimperium. Men budskapet till Rysslands näringslivselit är redan tydligt: ingen är för rik, för lojal eller för nära den politiska makten för att gå säker. I ett Ryssland där kriget kräver allt större uppoffringar riskerar oligarker att snabbt förvandlas till måltavlor.

Nyheter

Hur säkrar vi Sveriges tillgång till kritiska metaller och mineral i en ny geopolitisk verklighet?

När världsläget förändras ställs Europas beroende av metaller och mineral på sin spets. Geopolitiska spänningar, handelskonflikter och ett mer oförutsägbart USA gör att vi inte längre kan ta gamla allianser för givna. Samtidigt kontrolleras en stor del av de kritiska råvarorna vi är beroende av av andra makter – inte minst Kina. Vad händer med Sveriges industriella förmåga i ett läge där importen stryps? Hur påverkas försvarsindustrin av Kinas exportrestriktioner? Är EU:s nya råvarupolitik tillräcklig för att minska sårbarheten – eller krävs ytterligare statliga insatser och beredskapslagring? Svemin anordnade den 25 juni ett seminarium som bestod av bestod av deltagare från myndigheter, politik och industri. Man diskuterar Sveriges och EU:s strategiska vägval i en ny global verklighet – och vad som krävs för att säkra tillgången till metaller när vi behöver dem som mest.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanStor uppsida i Lappland Guldprospekterings aktie enligt analys

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanSilverpriset släpar efter guldets utveckling, har mer uppsida

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanUppgången i oljepriset planade ut under helgen

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanMahvie Minerals växlar spår – satsar fullt ut på guld

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanLåga elpriser i sommar – men mellersta Sverige får en ökning

-

Analys3 veckor sedan

Analys3 veckor sedanVery relaxed at USD 75/b. Risk barometer will likely fluctuate to higher levels with Brent into the 80ies or higher coming 2-3 weeks

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanOljan, guldet och marknadens oroande tystnad

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanJonas Lindvall är tillbaka med ett nytt oljebolag, Perthro, som ska börsnoteras