Nyheter

David Hargreaves on Metals and Minerals, week 2 2012

Metals and Minerals

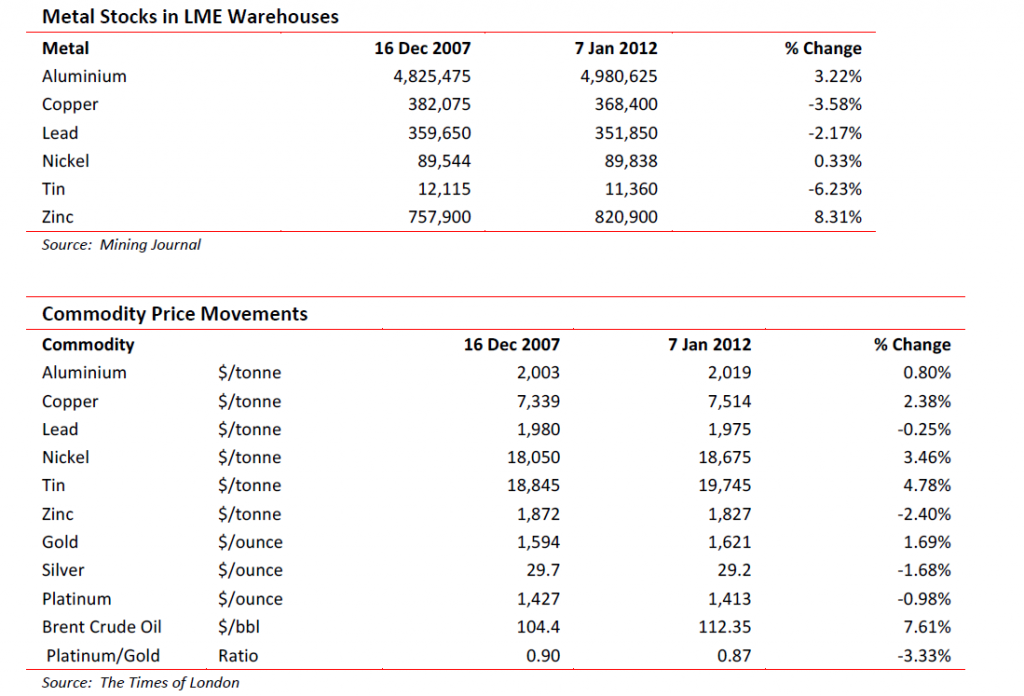

Exchange Traded Metals

It is a proven fact that traded metals do not hold strong religious beliefs. So they exited Christmas and New Year in the same mood that they entered. They mirrored the mood of the economy. It there is to be a recovery – not just this one, any one – the basic steel industry metals kick start it, for roads and building work. Then come the non-ferrous for manufacturing cars and consumer goods, followed by the minors for the clever, high technology end. Last but not least we have the pure indulgences, like diamonds. So it was. Both coal (3%) and iron ore (1%) nudged up last week, the exchanged traded metals hardly moved and the minors were down to neutral. So no runaway recovery posted yet. LME warehouse stocks were indicative. We are conditioning ourselves to aluminium, nickel and zinc being in structural surplus and copper being tight. The stocks concurred. Copper’s fall of almost 4% contrasted with aluminium’s rise of over 3%.

Both were overshadowed by zinc, which rose a full 8%, to over 820,000 tonnes, or 25 days’ world consumption. That is still only a half of the hapless aluminium at 46 days. Tin could be of interest. Stocks at 11,360t are only 11 days’ supply.

The price is level across the 15-month contract spread and could move into a backwardation. It has been a long time since the metals offered these opportunities. Copper could tighten further, although the knowledgeable Simon Hunt, of SH Strategic Services, warns that much of its surplus can be laid at the doorstep of speculators and investors (spot the difference?). On the physical front, Peru, world No 3 miner (8% of total), is still grappling with environmentalists. Then to Indonesia. There Freeport McMoran has settled (or so it thought) a long running violent dispute at its giant Grasberg Mine only to be told the workers are demanding payment for the three months they were on strike. Interesting people, workers. Met one once.

Aluminium’s woes continue. Alcoa, the world’s No 2 refiner with 12% global output, is to cut its smelting capacity by 12% because of low prices. About 25% of all world production runs at a loss below $2500/t. It is presently just over $2000. Will the others, UC Rusal (10%), Rio Tinto (9%) and Chalco (8%) follow suit?

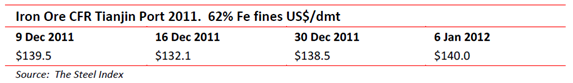

Bulk minerals

Precious Metals

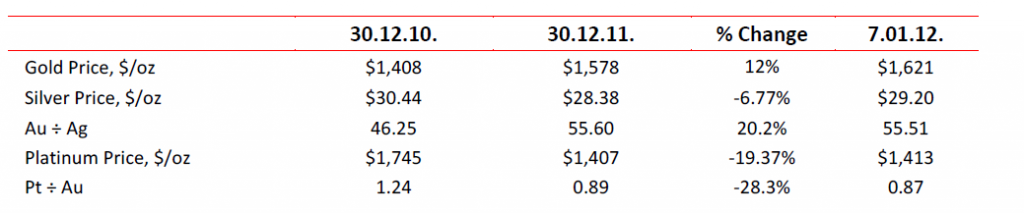

So a leading analyst tells us silver hit an all time high in 2011. Can’t fault that, but so did gold and platinum. Then which did best and why and will the same factors drive 2013?

Well there are as many forecasts as there are analysts but the gold $5000/oz, silver $200/oz and platinum-in-orbit boys are back behind the barricades. We incline to the downside view of floors around $1400-1450, $20-25 and 1250-1300.

Why? this is much about the Euro and the world will not come to an end whatever the outcome of that sad saga. If the world economy DOES turn down, then silver and platinum will follow it as industrial metals. If it turns up, so will inflation and interest rates. The attractions of gold will diminish. An increasingly ventilated idea is that China will spend some of its $3.2 x 10¹² FOREX reserves buying gold ready for the People’s Republic taking over from the USA. We pointed out some time ago that it is not really do-able. It would buy them about 62,000 tonnes at $1600/oz but would curtail their financial raping and pillaging of Africa. They would need to buy at least 8000 tonnes to overtake what Fort Knox has, then think what it would do to the price. We prefer Plan B, which is allowing their citizens to buy it as a safe haven and take it off them when the need arises. If it worked for the US and Germany, why not China? Annual gold output is c.2600 tonnes, so where would it all come from?

Our friend Adrian Day of Day Asset Management is bullish for gold with caveats. He notes wealth is shifting from West to East (where they have a different take on hoarding and with good reason) and that investors are waiting for a floor. Like a boxer who has gone on too long? He also looks as we do for shares to outperform the metal on the upside. But there has to be an upside. Any more on the down and the shares will fall further.

The Banks Get Coy on gold. Two of Britain’s biggest banks, HSBC and Barclays, have backed off mega upside projections for 2012. HSBC rests at $1825. Barclays comes in at $1875. But J P Morgan Chase, with Morgan Stanley and Société Generale, are for it to be ‘well above’ $2000. Ever thought of taking up darts? It would be uncharitable to suggest the big boys are talking up their own books now, wouldn’t it?

Minor Metals

[hr]

About David Hargreaves

David Hargreaves is a mining engineer with over forty years of senior experience in the industry. After qualifying in coal mining he worked in the iron ore mines of Quebec and Northwest Ontario before diversifying into other bulk minerals including bauxite. He was Head of Research for stockbrokers James Capel in London from 1974 to 1977 and voted Mining Analyst of the year on three successive occasions.

Since forming his own metals broking and research company in 1977, he has successfully promoted and been a director of several public companies. He currently writes “The Week in Mining”, an incisive review of world mining events, for stockbrokers WH Ireland. David’s research pays particular attention to steel via the iron ore and coal supply industries. He is a Chartered Mining Engineer, Fellow of the Geological Society and the Institute of Mining, Minerals and Materials, and a Member of the Royal Institution. His textbook, “The World Index of Resources and Population” accurately predicted the exponential rise in demand for steel industry products.

Nyheter

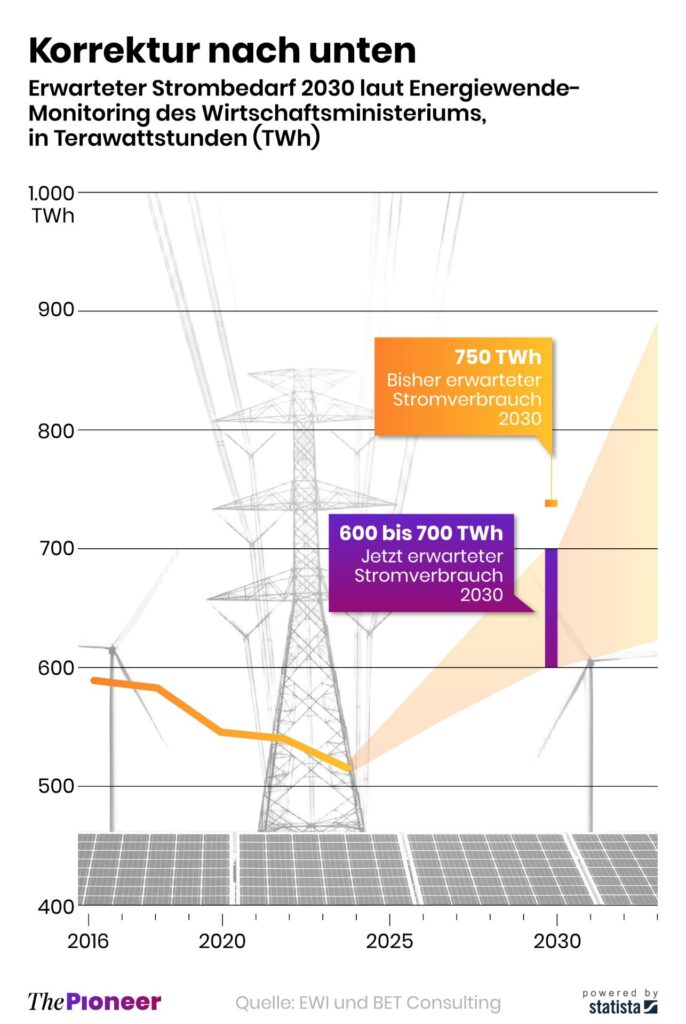

Tyskland har så höga elpriser att företag inte har råd att använda elektricitet

Tyskland har skrivit ner prognosen på hur mycket elektricitet landet kommer att behöva 2030. Hittills har prognosen varit 750 TWh, vilken nu har skrivits ner till 600-700 TWh,

Det kan vid en första anblick låta positivt. Men orsaken är inte att effektiviseringar. Utan priserna är så pass höga att företag inte har råd att använda elektriciteten. Elintensiv industri flyttar sin verksamhet till andra länder och få företag satsar på att etablera energikrävande verksamhet i landet.

Tyskland har inte heller någon plan för att förändra sin havererade energipolitik. Eller rättare sagt, planen är att uppfinna fusionskraft och använda det som energikälla. Något som dock inte löser problemet på några årtionden.

Nyheter

Kinas elproduktion slog nytt rekord i augusti, vilket även kolkraft gjorde

Kinas officiella statistik för elproduktion har släppts för augusti och den visar att landet slog ett nytt rekord. Under augusti producerades 936 TWh elektricitet.

Stephen Stapczynski på Bloomberg lyfter fram att det är ungefär lika mycket som Japan producerar per år, vilket innebär är de producerar ungefär lika mycket elektricitet per invånare.

Kinas elproduktion kom i augusti från:

| Fossil energi | 67 % |

| Vattenkraft | 16 % |

| Vind och Sol | 13 % |

| Kärnkraft | 5 % |

Stapczynskis kollega Javier Blas uppmärksammar även att det totala rekordet inkluderade ett nytt rekord för kolkraft. Termisk energi (där nästan allting är kol) producerade 627,4 TWh under augusti. Vi rapporterade tidigare i år att Kina under första kvartalet slog ett nytt rekord i kolproduktion.

Nyheter

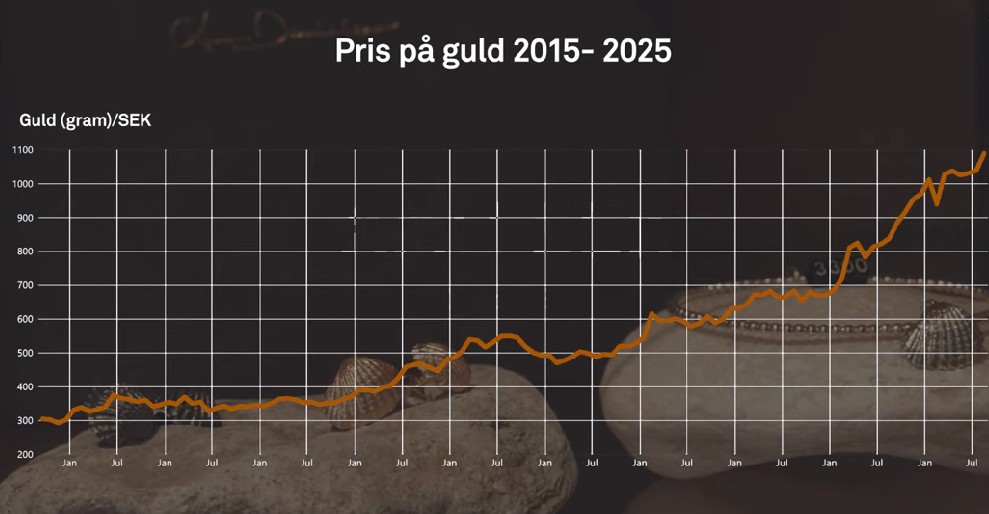

Det stigande guldpriset en utmaning för smyckesköpare

Guldpriset når hela tiden nya höjder och det märks för folk när de ska köpa smycken. Det gör att butikerna måste justera upp sina priser löpande och kunder funderar på om det går att välja något med lägre karat eller mindre diamant. Anna Danielsson, vd på Smyckevalvet, säger att det samtidigt gör att kunderna får upp ögonen för värdet av att äga guld. Det högre guldpriset har även gjort att gamla smycken som ligger hemma i folks byrålådor kan ha fått ett överraskande högt värde.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanMeta bygger ett AI-datacenter på 5 GW och 2,25 GW gaskraftverk

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanAker BP gör ett av Norges största oljefynd på ett decennium, stärker resurserna i Yggdrasilområdet

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanEtt samtal om koppar, kaffe och spannmål

-

Analys4 veckor sedan

Analys4 veckor sedanBrent sideways on sanctions and peace talks

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanSommarens torka kan ge högre elpriser i höst

-

Analys4 veckor sedan

Analys4 veckor sedanBrent edges higher as India–Russia oil trade draws U.S. ire and Powell takes the stage at Jackson Hole

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanMahvie Minerals är verksamt i guldrikt område i Finland

-

Analys3 veckor sedan

Analys3 veckor sedanIncreasing risk that OPEC+ will unwind the last 1.65 mb/d of cuts when they meet on 7 September