Nyheter

David Hargreaves on Iron ore, week 14 2012

Iron Ore continues to dominate news in the bulk trade, as befits a mineral whose output is measured at over one billion tonnes per year and growing at over 6% annually. That alone is the combined exports of Canada and South Africa.

Iron Ore continues to dominate news in the bulk trade, as befits a mineral whose output is measured at over one billion tonnes per year and growing at over 6% annually. That alone is the combined exports of Canada and South Africa.

Of greatest importance is that as an export-driven trade, critical to producers such as Australia, Brazil, India and the CIS. Further, almost 60% of all is destined for China and 20% for Japan and South Korea. The market is effectively polarised.

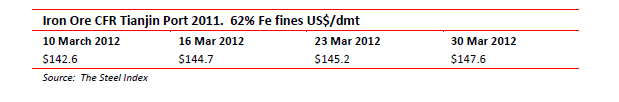

Contract pricing ruled for many years in annual bargains driven by the above importers and the major producing companies Vale SA (24% world production), Rio Tinto (14%) and BHPB (10%). Now it has all but broken down and been replaced by reference to the spot market. The growth of that mechanism owes much to the development of diversified production bases in West Africa and continued growth in the established mining locations. Much has been made of the possible economic slowdown in China. In context, this means that last year’s 9.3% increase may only be 8% this year. That is still another 80Mtpy. There are warnings of the spot price softening but this has not been borne out. It further nudged up to $145.2/t thisweek even as new investment and output news flows in. Increasingly, users are investing in mines to secure supplies.

- Japanese trader Marubeni is teaming up with South Korea’s steel maker Posco and ship builder STX to buy 30% of the Roy Hill project in Australia, whose plan is to hit 55Mtpy by 2014. That works out at about $220/t of output or 1.50 x the sales price.

- AIM listed but with loftier ambitions, London Mining (285p; Hi-Lo 438p-256p) is now fully funded to boost capacity at its Marampa, Sierra Leone mine to 5Mtpy. It has an offtake agreement with trading company Vitol. It also has an offtake contract with Glencore. Both have prepayment clauses. There is a further target of 9Mtpy.

Iron ore pricing. Wood MacKenzie sees iron ore supply and demand coming into balance over the next few years and the price slowly to decline. Their range is $157/t in 2012, $155/t in 2013 and $140/t in 2014. They warn of projects in the riskier and less developed regions suffering. Demand growth in China is pitched at 5% per year. They look for coking coal, essential to steel making, to average $200-215/t in the next few years.

Chrome Ore. A much misunderstood metal, its major end use is as ferro-chrome for use in steel making, particularly the stainless variety. This is achieved by mixing the ore with iron and coke, a relatively expensive process but with a resultant price enhancement. Resources are not a problem, measuring over 300 years at present rates of usage. However they lie selectively in RSA (70%) Russia and CIS (10%) and Zimbabwe (10%). South Africa has long been the dominant producer, but its share of supply as ferro-chrome (as opposed to chrome ore) has slipped from 50% in 2001 to 42% now, with China’s share up in the same period from 5% to 25%. Much of China’s output arises from raw ore shipped from RSA. This has been noticed in high places. They tell us the industry employs 200,000 people and its exports are worth R42bn to GDP. So there is a call to slap a duty of $100/t on raw chrome exports, to encourage local beneficiation. Problem: it is energy intensive and to show the comic-tragic nature of the situation, even as the call went out for the export tax, at least one ferrochrome producer was cutting back on its electricity usage at the behest of power generator Eskom. You can’t have your pasties and eat them, chaps

[hr]

About David Hargreaves

David Hargreaves is a mining engineer with over forty years of senior experience in the industry. After qualifying in coal mining he worked in the iron ore mines of Quebec and Northwest Ontario before diversifying into other bulk minerals including bauxite. He was Head of Research for stockbrokers James Capel in London from 1974 to 1977 and voted Mining Analyst of the year on three successive occasions.

Since forming his own metals broking and research company in 1977, he has successfully promoted and been a director of several public companies. He currently writes “The Week in Mining”, an incisive review of world mining events, for stockbrokers WH Ireland. David’s research pays particular attention to steel via the iron ore and coal supply industries. He is a Chartered Mining Engineer, Fellow of the Geological Society and the Institute of Mining, Minerals and Materials, and a Member of the Royal Institution. His textbook, “The World Index of Resources and Population” accurately predicted the exponential rise in demand for steel industry products.

Nyheter

Samtal om flera delar av råvarumarknaden

Ett samtal som sammanfattar ett relativt stabilt halvår på råvarumarknaden trots volatilitet och geopolitiska spänningar som sannolikt fortsätter in i andra halvan av året. Vi bjuds även på kommentarer från Carlos Mera, Rabobanks analyschef för jordbrukssektorn och Kari Kangas, skogsanalytiker.

Nyheter

Jonas Lindvall är tillbaka med ett nytt oljebolag, Perthro, som ska börsnoteras

Jonas Lindvall, ett välkänt namn i den svenska olje- och gasindustrin, är tillbaka med ett nytt företag – Perthro AB – som nu förbereds för notering i Stockholm. Med över 35 års erfarenhet från bolag som Lundin Oil, Shell och Talisman Energy, och som medgrundare till energibolag som Tethys Oil och Maha Energy, är Lindvall redo att än en gång bygga ett bolag från grunden.

Tillsammans med Andres Modarelli har han startat Perthro med ambitionen att bli en långsiktigt hållbar och kostnadseffektiv producent inom upstream-sektorn – alltså själva oljeutvinningen. Deras timing är strategisk. Med ett inflationsjusterat oljepris som enligt Lindvall är lägre än på 1970-talet, men med fortsatt växande efterfrågan globalt, ser de stora möjligheter att förvärva tillgångar till attraktiva priser.

Perthro har redan säkrat bevisade oljereserver i Alberta, Kanada – en region med rik oljehistoria. Bolaget tittar även på ytterligare projekt i Oman och Brasilien, där Lindvall har tidigare erfarenhet. Enligt honom är marknadsförutsättningarna idealiska: världens efterfrågan på olja ökar, medan utbudet inte hänger med. Produktionen från befintliga oljefält minskar med cirka fem procent per år, samtidigt som de största oljebolagen har svårt att ersätta de reserver som produceras.

”Det här skapar en öppning för nya aktörer som kan agera snabbare, tänka långsiktigt och agera med kapitaldisciplin”, säger Lindvall.

Perthro vill fylla det växande gapet på marknaden – med fokus på hållbar tillväxt, hög avkastning och effektiv produktion. Med Lindvalls meritlista och branschkunskap hoppas bolaget nu kunna bli nästa svenska oljebolag att sätta avtryck på världskartan – och på börsen.

Nyheter

Oljan, guldet och marknadens oroande tystnad

Oljepriset är åter i fokus på grund av kriget i Mellanöstern. Är marknadens tystnad om de stora riskerna, det som vi egentligen verkligen bör oroa oss för? Och varför funderar Tyskland på att plocka hem sin guldreserv från New York? I veckans avsnitt av Världsekonomin pratar Katrine Kielos och Henrik Mitelman om olja, tystnad och guld. Europa är ju mer beroende av oljepriset än USA, hur orolig ska man vara för att det stiger? En krönika i Financial Times lyfte nyligen “marknadens oroande tystnad”, den syftade på skillnaden mellan den dystra geopolitiska utvecklingen i världen och en marknad som samtidigt återhämtat sig 20 procent sen början av april, trots tullkriget. Vad säger marknadens tystnad egentligen? I Tyskland pågår en debatt om att plocka hem sin guldreserv från USA. Handlar det om bristande förtroende för Donald Trump – och kan det rentav ha något med “hämndskatten” att göra?

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanStor uppsida i Lappland Guldprospekterings aktie enligt analys

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanBrookfield ska bygga ett AI-datacenter på hela 750 MW i Strängnäs

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanSommaren inleds med sol och varierande elpriser

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanSilverpriset släpar efter guldets utveckling, har mer uppsida

-

Analys4 veckor sedan

Analys4 veckor sedanBrent needs to fall to USD 58/b to make cheating unprofitable for Kazakhstan

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanTradingfirman XTX Markets bygger datacenter i finska Kajana för 1 miljard euro

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanUppgången i oljepriset planade ut under helgen

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanLåga elpriser i sommar – men mellersta Sverige får en ökning