Nyheter

David Hargreaves on Exchange Precious Metals, week 18 2014

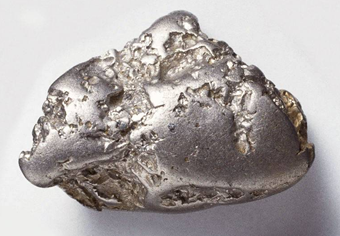

No, gold is not going up is it? It laboured all week on the downside and platinum, despite the worsening RSA strike situation, only marginally stretches its premium. Silver clings to its lifebelt. We have only passing sympathy for the bulls (and you know who you are), because despite what is occurring in the world’s hotspots (see Energy) this is becoming an economic, not a military, battlefield. Gold closed last week at $1301/oz and this at $1281/oz Not huge move, but a downside indicative. As a simple soul, WIM goes for $1200 as a base. More informed guesses reach below. Morgan Stanley has now run alongside Goldman Sachs with predictions of $1108 for H2 2014 and $1138 for 2015.

WIM says: We agree with the trend, but such precision smacks of Chartism. As students of history know, the Chartists ended up with ropes around their necks. It is much about the US Federal Reserve continuing its tapering policy. Not to be outdone, ABN AMRO goes for $1000 by end of this year.

LMBA, in a pooled-analysts’ view, did a year and $1000. We hope you will forgive WIM for sticking to simple numbers, like $1200. It is easy on the mental arithmetic. Much of the bearishness rests of the prospect of Chinese demand – rampant in the past few years – slackening as that country comes to grips with a weakening economy, with its currency, the yen, falling further against the US dollar. Overall, the upturn in world economic activity is seen as a most bearish factor for gold. The metal does not carry interest, shares do.

Platinum. The price drag with gold remains telling. We now see the Pt/Au ratio back at 1.13, compared with its late 2012 level of 0.92, a discount. Much of course is about the strike in RSA. That shows all the symptoms of becoming bloody. It enters its 14th week (a long time without a wage packet) and Federal elections are due on May 7th. So a Pt price bounce is on the cards.

The platinum saga rolls on.

Workers’ unions were born of necessity and miners were early ones to deliver. Hard, demanding industries to that. When disputes with management arise, the right to strike is the ultimate bargaining chip. Sometimes it gets used wrongly and it is often the result of a lack of an economic grip by the opposing sides. The current RSA platinum field strike is classic. The metal was in oversupply, there are large surface stocks, the price was under pressure and cost were rising. A new union, AMCU sprang up, achieved a majority of membership at the big mine. It demanded not a cost of living increase but a doubling of wages. The companies’ first response was 10% per year for three years; plus benefits. The union struck and the strike is now in its 14th week. Negotiations have broken down and violence hovers.

It is felt that a lot of the miners would return on the offered terms but the block vote holds sway. So the bosses are attempting to contact them individually. As the platinum price closed at $1425 on Friday evening, a tad down on the week, we do not sense panic. But we do smell fear. This is colouring in elections of May 7th, next Wednesday, and could shape the world perspective on South Africa as an investment destination.

Then Gold? The London PM Fix at $1281, is but $20 adrift on the week, at 1.5%, but adrift it is. Major movers are calling it down. Meanwhile the major gold miners are beginning to chalk up losses. Yamana Gold (YRI.TX C$819; Hi-Lo C$13.16-7.93) is congratulating itself on the capture of 50% of Osisko Mining and its Canadian Malartic Mine but has chalked up a Q1 loss of c. $30M for 2014. The reasons are ominous: lower prices, lower sales and higher costs.

(Thinks: Time for some housekeeping?). It places great hope on its J/V with Agnico-Eagle on Osisko. Not all is gloom.

For the year it looks to 1.4M gold equivalent ounces (GEO), with silver and copper adding to the pot. All sustaining cash costs were $975/oz. The net loss of US $28.7M is 4c per share in Q1. Indicatively it looks more at its Cerro-Moto gold and silver project in Argentina than its Brazilian prospects.

WIM says: We might let the dust settle here for a while.

[hr]

About David Hargreaves

David Hargreaves is a mining engineer with over forty years of senior experience in the industry. After qualifying in coal mining he worked in the iron ore mines of Quebec and Northwest Ontario before diversifying into other bulk minerals including bauxite. He was Head of Research for stockbrokers James Capel in London from 1974 to 1977 and voted Mining Analyst of the year on three successive occasions.

Since forming his own metals broking and research company in 1977, he has successfully promoted and been a director of several public companies. He currently writes “The Week in Mining”, an incisive review of world mining events, for stockbrokers WH Ireland. David’s research pays particular attention to steel via the iron ore and coal supply industries. He is a Chartered Mining Engineer, Fellow of the Geological Society and the Institute of Mining, Minerals and Materials, and a Member of the Royal Institution. His textbook, “The World Index of Resources and Population” accurately predicted the exponential rise in demand for steel industry products.

Nyheter

Gruvbolaget Boliden överträffade analytikernas förväntningar

Gruvbolaget Boliden överträffade analytikernas förväntningar med bred marginal när man presenterade resultatet för det tredje kvartalet. Mikael Staffas, vd för Boliden, kommenterar kvartalet och hur han ser på råvarumarknaden och bolagets olika gruvprojekt.

Nyheter

Australien och USA investerar 8,5 miljarder USD för försörjningskedja av kritiska mineraler

USA:s president Donald Trump och Australiens premiärminister Anthony Albanese undertecknade på måndagen ett avtal som ska tillföra miljarder dollar till projekt inom kritiska mineraler.

Länderna kommer tillsammans att bidra med 1-3 miljarder dollar till projekten under de kommande sex månaderna. Den totala projektportföljen är värd 8,5 miljarder dollar, enligt regeringarna.

Galliumraffinaderi med kapacitet för 5x USA:s efterfrågan

Som en del av avtalet kommer det amerikanska försvarsdepartementet även att investera i ett galliumraffinaderi i västra Australien med en kapacitet på 100 ton per år. För närvarande importerar USA omkring 21 ton gallium, vilket motsvarar hela den inhemska konsumtionen, enligt den amerikanska geologiska myndigheten.

Initiativet kommer samtidigt som Kina har infört exportrestriktioner på vissa mineraler, däribland sällsynta jordartsmetaller, som är avgörande för tillverkningen av elektronik och elmotorer. Gallium används till exempel i mikrovågskretsar samt blå och violetta lysdioder (LED), vilka kan användas för att skapa kraftfulla lasrar.

Nyheter

Vad guldets uppgång egentligen betyder för världen

Guldpriset har nyligen nått rekordnivåer, över 4 000 dollar per uns. Denna uppgång är inte bara ett resultat av spekulation, utan speglar djupare förändringar i den globala ekonomin. Bloomberg analyserar hur detta hänger samman med minskad tillit till dollarn, geopolitisk oro och förändrade investeringsmönster.

Guldets roll som säker tillgång har stärkts i takt med att förtroendet för den amerikanska centralbanken minskat. Osäkerhet kring Federal Reserves oberoende, inflationens utveckling och USA:s ekonomiska stabilitet har fått investerare att söka alternativ till fiatvalutor. Donald Trumps handelskrig har också bidragit till att underminera dollarns status som global reservvaluta.

Samtidigt ökar den geopolitiska spänningen, särskilt mellan USA och Kina. Kapitalflykt från Kina, driven av oro för övertryckta valutor och instabilitet i det finansiella systemet, har lett till ökad efterfrågan på guld. Även kryptovalutor som bitcoin stiger i värde, vilket tyder på ett bredare skifte mot hårda tillgångar.

Bloomberg lyfter fram att derivatmarknaden för guld visar tecken på spekulativ överhettning. Positioneringsdata och avvikelser i terminskurvor tyder på att investerare roterar bort från aktier och obligationer till guld. ETF-flöden och CFTC-statistik bekräftar denna trend.

En annan aspekt är att de superrika nu köper upp alla tillgångsslag – aktier, fastigheter, statsobligationer och guld – vilket bryter mot traditionella investeringslogiker där vissa tillgångar fungerar som motvikt till andra. Detta tyder på att marknaden är ur balans och att kapitalfördelningen är skev.

Sammanfattningsvis är guldets prisrally ett tecken på en värld i ekonomisk omkalibrering. Det signalerar misstro mot fiatvalutor, oro för geopolitisk instabilitet och ett skifte i hur investerare ser på risk och trygghet.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanOPEC+ missar produktionsmål, stöder oljepriserna

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanGoldman Sachs höjer prognosen för guld, tror priset når 4900 USD

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanBlykalla och amerikanska Oklo inleder ett samarbete

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanGuld nära 4000 USD och silver 50 USD, därför kan de fortsätta stiga

-

Analys4 veckor sedan

Analys4 veckor sedanAre Ukraine’s attacks on Russian energy infrastructure working?

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanLeading Edge Materials är på rätt plats i rätt tid

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanEtt samtal om guld, olja, koppar och stål

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanNytt prisrekord, guld stiger över 4000 USD