Analys

Crude oil comment: Iran 180 degrees?

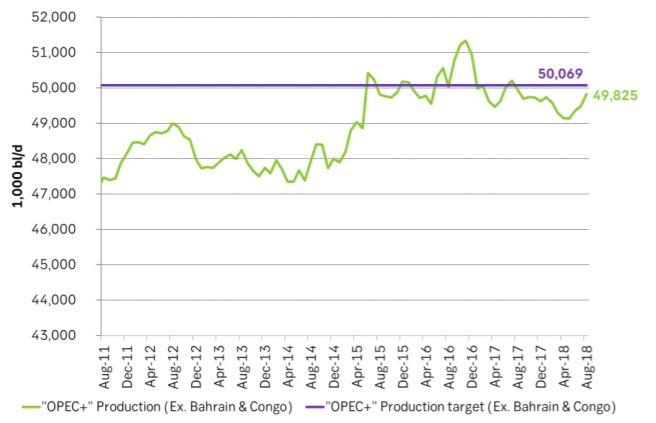

If you mess with the Middle East then the most natural thing to expect is that you will get a high oil price in return. Donald Trump of course knows this but he still tries to fight it as he whish for a lower oil price leading into the US mid-term election. Last week ahead of the Algerian OPEC/non-OPEC JMMC weekend-meeting he verbally charged into the market again. But it was to no help as the group of producers promised no more than they already had promised earlier. “OPEC+” produced 49.8 m bl/d in Aug (ex. Bahrain & Congo in lack of good data) while its pledged target is 50.1 m bl/d.

If you mess with the Middle East then the most natural thing to expect is that you will get a high oil price in return. Donald Trump of course knows this but he still tries to fight it as he whish for a lower oil price leading into the US mid-term election. Last week ahead of the Algerian OPEC/non-OPEC JMMC weekend-meeting he verbally charged into the market again. But it was to no help as the group of producers promised no more than they already had promised earlier. “OPEC+” produced 49.8 m bl/d in Aug (ex. Bahrain & Congo in lack of good data) while its pledged target is 50.1 m bl/d.

Oil importing and oil consuming countries have always been fearful that the oil rich Middle East countries could cut off oil supply and thereby drive their economies to a grinding halt. They have been fearful of a repeat of oil supply being chocked off like in the 70ies and 80ies. Deliberate or not. Fearful of a Mid-East oil embargo.

These days Donald Trump is playing hard ball with Iran: “We’ll drive your oil exports to zero unless you renegotiate the JCPOA nuclear deal”. Feeling confident that the US these days is almost self-sufficient with oil. What if Iran took him up on this and instead turned it around with Iran saying: “There will be no oil exports out of Iran at all unless the US ratifies the JCPOA deal again as is”.

It is true that the US is getting close to self-sufficiency in terms of oil supply. As such Donald Trump can feel confident versus challenging Iran. The US economy and its consumers are however still exposed to high oil prices. And Donald Trump is especially exposed and vulnerable right now leading up to the US mid-term election on November 6th which is just two days after the US sanctions against Iran kicks in fully and legally. Donald Trump probably wants low oil prices, low gasoline prices, happy consumers and happy voters leading up to the mid-term elections.

It is however doubtful that the US as well as Donald Trump really want low oil prices in the longer term as it is really high prices which will make the US totally hydrocarbon liquid independent in not too long. But in the short term to November 6th he probably wants to see muted oil prices. There is thus probably a brief window of opportunity where Iran could turn the situation around 180˚ from being a victim of oil sanctions from the US to instead playing hard ball right back and declare an oil embargo to the world. After all Iran is one of the key oil suppliers in the world. It is also on good terms with Iraq with which it potentially could persuade to cooperate for a few months. And in the current fairly tight oil market it would not take much oil off the market to drive the oil price spiky higher.

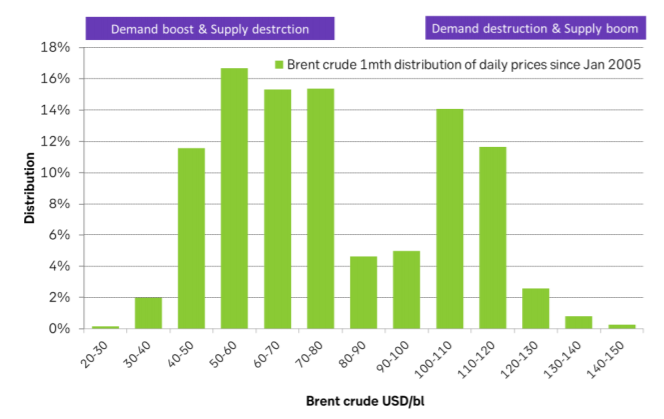

In terms of oil prices there is suddenly a lot of talk about $100/bl. And it is of course some merit to it. Market is getting tight as we lose more and more supply from Iran and Venezuela. If we look at the price distribution of daily Brent crude oil front month prices since January 2005 till today we see that the price rarely stays in the price range from $80 – 100/bl. It has historically either been lower or higher. This is of course purely statistical and to a large degree a play with numbers. Nonetheless it does make some sense logically.

The oil market is basically hardly ever in balance. It is either too much or too little. It is very hard to balance it just right. That means that the oil market naturally will move between the two extremes of

- Low price: “Demand boost & Supply destruction”, or

- High price: “Supply boost & Demand destruction”

And since 2005 the middle ground between these two seems to be the $80 – 100/bl range where it is neither of the two.

So those who are calling out for $100/bl should probably, statistically lift their target to a range of $100 – 120/bl.

We have currently no strong view for $100/bl but in general our view is that “OPEC+” is getting less and less control of upside price risk as its reserve capacity increasingly is eroded.

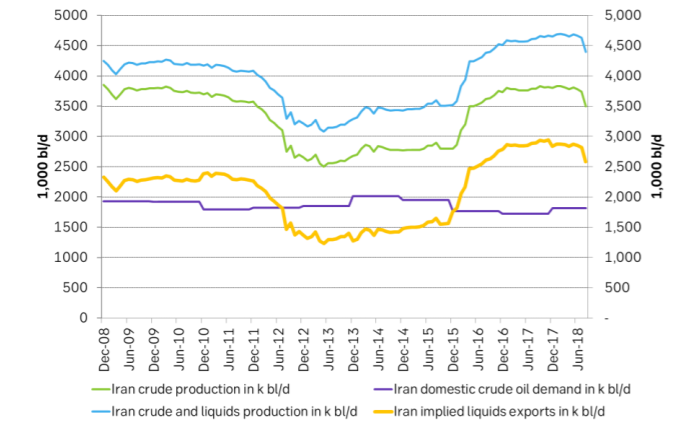

If Iran decides to play hard ball with the US and give Donald Trump what he is asking for: “No exports out of Iran” then Iran still has some 2.5 m bl/d of hydro carbon liquids exports which it could halt. That would definitely drive the oil price to $120/bl or higher in today’s market.

Ch1: Distribution of daily Brent crude oil prices. Not a lot from $80 – 100/bl as the oil market is normally either in surplus or deficit

Ch2: Production of “OPEC+” got close to the pledged target in August. No promises of more than that as of yet.

Ch3: Iran production, consumption and implied exports. Exports have fallen some 500 k bl/d but there is still another 2.5 m bl /d at stake

Analys

OPEC+ in a process of retaking market share

Oil prices are likely to fall for a fourth straight year as OPEC+ unwinds cuts and retakes market share. We expect Brent crude to average USD 55/b in Q4/25 before OPEC+ steps in to stabilise the market into 2026. Surplus, stock building, oil prices are under pressure with OPEC+ calling the shots as to how rough it wants to play it. We see natural gas prices following parity with oil (except for seasonality) until LNG surplus arrives in late 2026/early 2027.

Oil market: Q4/25 and 2026 will be all about how OPEC+ chooses to play it

OPEC+ is in a process of unwinding voluntary cuts by a sub-group of the members and taking back market share. But the process looks set to be different from 2014-16, as the group doesn’t look likely to blindly lift production to take back market share. The group has stated very explicitly that it can just as well cut production as increase it ahead. While the oil price is unlikely to drop as violently and lasting as in 2014-16, it will likely fall further before the group steps in with fresh cuts to stabilise the price. We expect Brent to fall to USD 55/b in Q4/25 before the group steps in with fresh cuts at the end of the year.

Natural gas market: Winter risk ahead, yet LNG balance to loosen from 2026

The global gas market entered 2025 in a fragile state of balance. European reliance on LNG remains high, with Russian pipeline flows limited to Turkey and Russian LNG constrained by sanctions. Planned NCS maintenance in late summer could trim exports by up to 1.3 TWh/day, pressuring EU storage ahead of winter. Meanwhile, NE Asia accounts for more than 50% of global LNG demand, with China alone nearing a 20% share (~80 mt in 2024). US shale gas production has likely peaked after reaching 104.8 bcf/d, even as LNG export capacity expands rapidly, tightening the US balance. Global supply additions are limited until late 2026, when major US, Qatari and Canadian projects are due to start up. Until then, we expect TTF to average EUR 38/MWh through 2025, before easing as the new supply wave likely arrives in late 2026 and then in 2027.

Analys

Manufacturing PMIs ticking higher lends support to both copper and oil

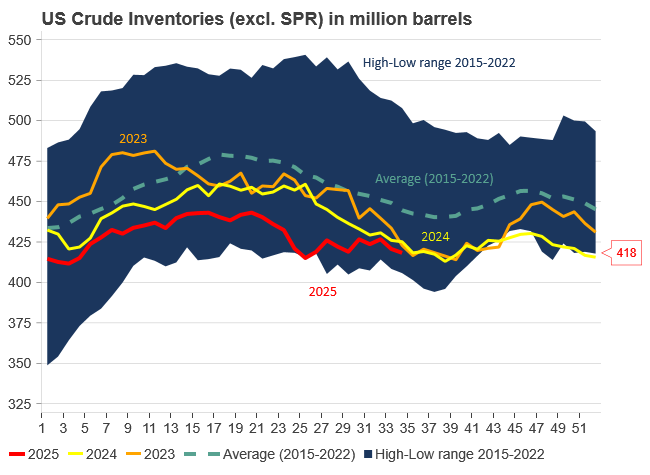

Price action contained withing USD 2/b last week. Likely muted today as well with US closed. The Brent November contract is the new front-month contract as of today. It traded in a range of USD 66.37-68.49/b and closed the week up a mere 0.4% at USD 67.48/b. US oil inventory data didn’t make much of an impact on the Brent price last week as it is totally normal for US crude stocks to decline 2.4 mb/d this time of year as data showed. This morning Brent is up a meager 0.5% to USD 67.8/b. It is US Labor day today with US markets closed. Today’s price action is likely going to be muted due to that.

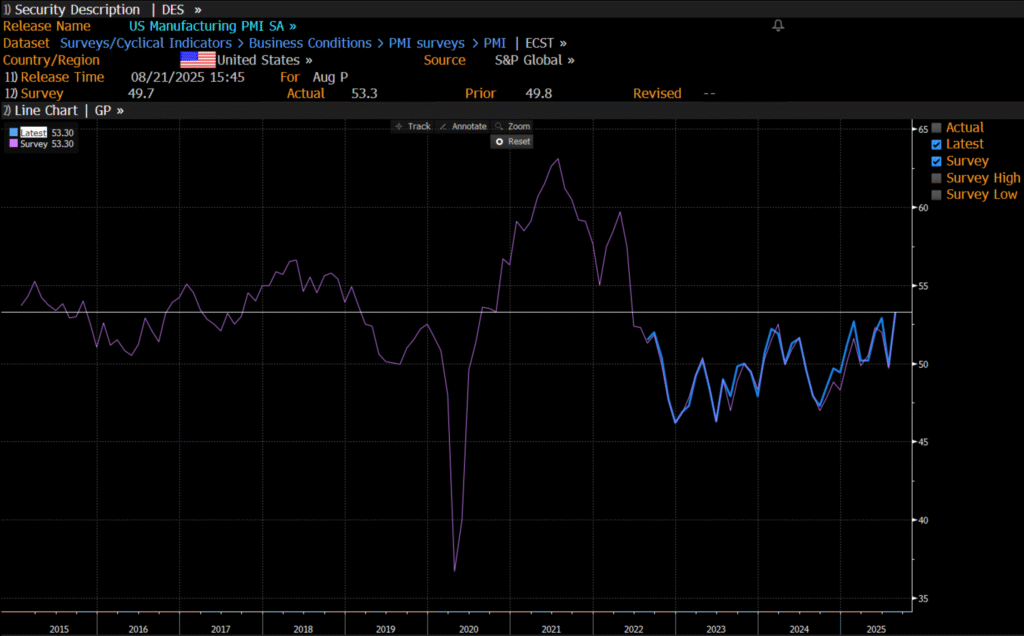

Improving manufacturing readings. China’s manufacturing PMI for August came in at 49.4 versus 49.3 for July. A marginal improvement. The total PMI index ticked up to 50.5 from 50.2 with non-manufacturing also helping it higher. The HCOB Eurozone manufacturing PMI was a disastrous 45.1 last December, but has since then been on a one-way street upwards to its current 50.5 for August. The S&P US manufacturing index jumped to 53.3 in August which was the highest since 2022 (US ISM manufacturing tomorrow). India manufacturing PMI rose further and to 59.3 for August which is the highest since at least 2022.

Are we in for global manufacturing expansion? Would help to explain copper at 10k and resilient oil. JPMorgan global manufacturing index for August is due tomorrow. It was 49.7 in July and has been below the 50-line since February. Looking at the above it looks like a good chance for moving into positive territory for global manufacturing. A copper price of USD 9935/ton, sniffing at the 10k line could be a reflection of that. An oil price holding up fairly well at close to USD 68/b despite the fact that oil balances for Q4-25 and 2026 looks bloated could be another reflection that global manufacturing may be accelerating.

US manufacturing PMI by S&P rose to 53.3 in August. It was published on 21 August, so not at all newly released. But the US ISM manufacturing PMI is due tomorrow and has the potential to follow suite with a strong manufacturing reading.

Analys

Crude stocks fall again – diesel tightness persists

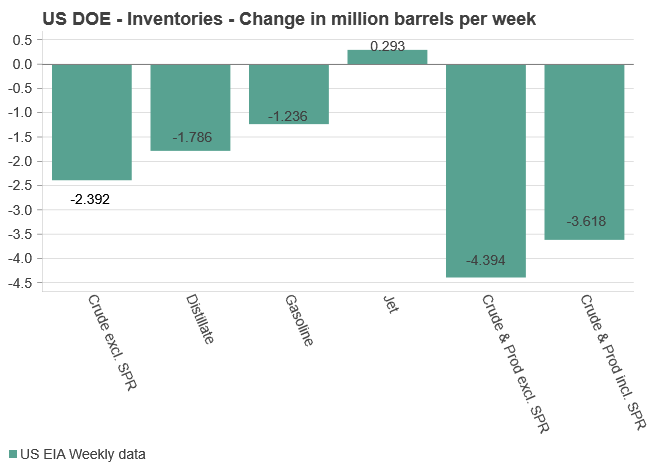

U.S. commercial crude inventories posted another draw last week, falling by 2.4 million barrels to 418.3 million barrels, according to the latest DOE report. Inventories are now 6% below the five-year seasonal average, underlining a persistently tight supply picture as we move into the post-peak demand season.

While the draw was smaller than last week’s 6 million barrel decline, the trend remains consistent with seasonal patterns. Current inventories are still well below the 2015–2022 average of around 449 million barrels.

Gasoline inventories dropped by 1.2 million barrels and are now close to the five-year average. The breakdown showed a modest increase in finished gasoline offset by a decline in blending components – hinting at steady end-user demand.

Diesel inventories saw yet another sharp move, falling by 1.8 million barrels. Stocks are now 15% below the five-year average, pointing to sustained tightness in middle distillates. In fact, diesel remains the most undersupplied segment, with current inventory levels at the very low end of the historical range (see page 3 attached).

Total commercial petroleum inventories – including crude and products but excluding the SPR – fell by 4.4 million barrels on the week, bringing total inventories to approximately 1,259 million barrels. Despite rising refinery utilization at 94.6%, the broader inventory complex remains structurally tight.

On the demand side, the DOE’s ‘products supplied’ metric – a proxy for implied consumption – stayed strong. Total product demand averaged 21.2 million barrels per day over the last four weeks, up 2.5% YoY. Diesel and jet fuel were the standouts, up 7.7% and 1.7%, respectively, while gasoline demand softened slightly, down 1.1% YoY. The figures reflect a still-solid late-summer demand environment, particularly in industrial and freight-related sectors.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanOmgående mångmiljardfiasko för Equinors satsning på Ørsted och vindkraft

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanMeta bygger ett AI-datacenter på 5 GW och 2,25 GW gaskraftverk

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanGuld stiger till över 3500 USD på osäkerhet i världen

-

Analys4 veckor sedan

Analys4 veckor sedanWhat OPEC+ is doing, what it is saying and what we are hearing

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanAker BP gör ett av Norges största oljefynd på ett decennium, stärker resurserna i Yggdrasilområdet

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanLyten, tillverkare av litium-svavelbatterier, tar över Northvolts tillgångar i Sverige och Tyskland

-

Analys2 veckor sedan

Analys2 veckor sedanBrent sideways on sanctions and peace talks

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanEtt samtal om koppar, kaffe och spannmål