Nyheter

Additional cuts is positive for the market and a gift to US/Canada

Additional cuts of 1.2 m bl/d in June from Saudi/Kuwait/UAE yesterday failed to rejoice the oil market and the Brent crude oil price fell 4.3% instead. Today though oil prices are firming a little but the price action (Brent) seems to be centered around the $30/bl mark right now. A depressing thought for OPEC+ must be that side-lined production in the magnitude of 3.5 – 4.5 m bl/d in the US/Canada will be the first to reap the rewards of the production cuts by OPEC+.

The Brent crude July contract yesterday moved to an intraday high of $31.47/bl (+1.6%) on the announcement that Saudi Arabia will cut an additional 1 m bl/d in June with Kuwait and UAE also chipping in additional cuts of about 100 k bl/d each. The joy didn’t last and in the end the contract fell back 4.3% on the day to a close of $29.63/bl along with negative equities and concerns over renewed virus outbreaks.

This morning Brent is inching 1.7% higher to $30.1/bl with the June WTI contract a little bit feistier gaining 2.7% to $24.8/bl. Overall market sentiment is on the negative side with lower equities and metals so oil is mostly going up on its own today. Market is obviously far from certain that the additional cuts announced yesterday will be able to drive the oil price materially higher but is today the conclusion that yes, the additional cuts are naturally positive on the margin.

The announcement yesterday was that Saudi/Kuwait/UAE will together make an additional 1.2 m bl/d cut in June versus already pledge cuts with Saudi cutting 1 m bl/d more to 7.5 m bl/d, Kuwait 0.08 m bl/d to 2.1 m bl/d and UAE 0.1 m bl/d to 2.35 m bl/d. Political pressure from the US, strained state finances in Saudi/Kuwait/UAE and a wish to re-balance the oil market and revive oil prices as quickly as possible lay behind the announcement.

It is very difficult to cut production with good results if you haven’t got a tailwind of strengthening oil demand to help you. The demand part of the equation is still a big uncertainty. Oil demand is now naturally coming back from the abyss in March/April as we get gradual reopening. But these re-openings look like they will be riddled with start/stop issues as virus infections blossom up again. How fast and how far back towards normal demand we can get is today the biggest uncertainty and a key ingredient for OPEC+ success. But demand will of course rebound both back to 100 m bl/d and beyond eventually. The key question now is how much and how fast.

But deepening production cuts now is also tricky for OPEC+. If they are successful in balancing the market, flattening the crude oil price curve and thus drive the front-month crude oil price higher then this will likely very quickly revive the 3.5 – 4.5 m bl/d of side-lined supply in the US & Canada. Thus, all Saudi/Kuwait/UAE will have achieved by cutting an additional 1.2 m bl/d is to let side-lined production in the US & Canada back into the market. Again, without being able to drive the oil price much higher.

This poses a key question: Who shall be first out to put volumes back into the market as demand revives? Side-lined US & Canadian oil wells or OPEC+ production cuts? Right now, it looks like OPEC+ or at least Saudi/Kuwait/UAE are following a strategy where shut-in production outside of OPEC+ are to be placed back in the market first.

Then on to the next step. Will OPEC+ then hold on to production cuts in order to opt for price rather than volume once the oil price moves back to $50/bl thus once again chase the oil price to $60/bl and $70/bl by holding back supply? If so, this would again give preference to shale oil volume rebound in exchange for a higher oil price to OPEC+. Such a next step looks much less likely because Russia made it very clear in March that they are basically done chasing price in exchange for gradual loss of market share to OPEC+ and more market share to US shale oil.

It is hard to conclude otherwise than that the global oil market is gradually mending with rebounding demand on the one hand and cuts to production, lost supply or shut in supply on the other.

But a sense of futility must clearly be felt by Saudi/Kuwait/UAE the moment in time when 3.5 – 4.5 m bl/d of side-lined production in the US/Canada are placed back into the market in response to their deepening production cuts. Because that is likely now what is going to happen as they ”succeed” with their cuts.

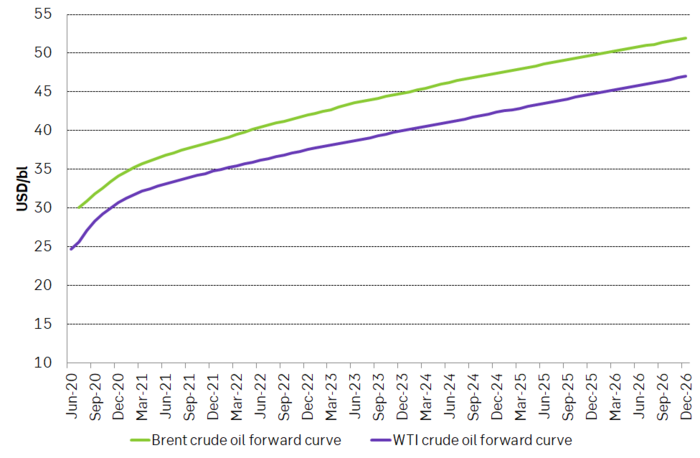

Forward crude oil curves for Brent and WTI. As the oil market starts to balance and inventories starts to draw down the front-end of these curves will move higher and the curves will flatten. This will help to revive side-lined production in the US/Canada in the magnitude of 3.5 – 4.5 m bl/d.

Nyheter

Ett samtal om guld, silver, olja och skog

Ett samtal om råvarorna guld, silver, olja och skog. Experter som ger sin syn i programmet är Daniel Karlgren, investeringschef på Captor, Rhona O’Connell, chef för marknadsanalys på Stone X och Ole Hansen råvarustrategichef på Saxo Bank.

Rhona O’Connell beskriver silver som en “askungenmetall”, en metall som ibland behandlas som industriråvara och ibland som ädelmetall. Panelen håller med om att volatiliteten är extrem och att prisrörelser ofta drivs av spekulation snarare än fundamenta. Likviditeten gör att silver snabbt stiger och lika snabbt faller.

Nyheter

Gruvbolaget Boliden överträffade analytikernas förväntningar

Gruvbolaget Boliden överträffade analytikernas förväntningar med bred marginal när man presenterade resultatet för det tredje kvartalet. Mikael Staffas, vd för Boliden, kommenterar kvartalet och hur han ser på råvarumarknaden och bolagets olika gruvprojekt.

Nyheter

Australien och USA investerar 8,5 miljarder USD för försörjningskedja av kritiska mineraler

USA:s president Donald Trump och Australiens premiärminister Anthony Albanese undertecknade på måndagen ett avtal som ska tillföra miljarder dollar till projekt inom kritiska mineraler.

Länderna kommer tillsammans att bidra med 1-3 miljarder dollar till projekten under de kommande sex månaderna. Den totala projektportföljen är värd 8,5 miljarder dollar, enligt regeringarna.

Galliumraffinaderi med kapacitet för 5x USA:s efterfrågan

Som en del av avtalet kommer det amerikanska försvarsdepartementet även att investera i ett galliumraffinaderi i västra Australien med en kapacitet på 100 ton per år. För närvarande importerar USA omkring 21 ton gallium, vilket motsvarar hela den inhemska konsumtionen, enligt den amerikanska geologiska myndigheten.

Initiativet kommer samtidigt som Kina har infört exportrestriktioner på vissa mineraler, däribland sällsynta jordartsmetaller, som är avgörande för tillverkningen av elektronik och elmotorer. Gallium används till exempel i mikrovågskretsar samt blå och violetta lysdioder (LED), vilka kan användas för att skapa kraftfulla lasrar.

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanGoldman Sachs höjer prognosen för guld, tror priset når 4900 USD

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanBlykalla och amerikanska Oklo inleder ett samarbete

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanGuld nära 4000 USD och silver 50 USD, därför kan de fortsätta stiga

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanLeading Edge Materials är på rätt plats i rätt tid

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanNytt prisrekord, guld stiger över 4000 USD

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanEtt samtal om guld, olja, koppar och stål

-

Analys4 veckor sedan

Analys4 veckor sedanOPEC+ will likely unwind 500 kb/d of voluntary quotas in October. But a full unwind of 1.5 mb/d in one go could be in the cards

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanVad guldets uppgång egentligen betyder för världen