Nyheter

David Hargreaves on Precious Metals week 13 2012

Another subdued week saw gold nudge down but reassert its premium to platinum, momentarily. Warren B and the Week in Mining have not reached the smug stage – long way to go – but the entry of Ben Bernanke, Chairman of the Fed adds an interesting dimension. In a lecture last week at George Washington University he rubbished the gold standard and counselled strongly against any notion of returning to one. His reasons were sound enough on the surface.

- The strength of the gold standard is also its weakness. Because the money supply is determined by the supply of gold, it cannot be adjusted to response to changing economic conditions.

- He also waxed about fixed exchange rates, speculative attacks and swapping paper for gold.

- But let’s give it a try, shall we?

- Our starting point is 130,000t of gold on the surface, which is about 4 billion ounces.

- World GDP is c. $80,000bn. So for gold to be the official currency again, we should have to call it at 80 ÷ 4 = $20,000 per ounce.

- Yet GDP means trade. For every buyer there is a seller. So $10,000 per ounce would suffice.

- Now would GDP is rising annually (says Wikipedia) at c. 6% per year, so an extra $5800bn in 2012. Well, at $10,000/oz that is 16,000t. But divided by 2 again for two way trade and we get 8000t new supply needed. If gold hit $10,000/g our money would be on newly mined supply doing likewise.

- This assumes a full gold standard. Partial backing is not out of the equation. They call it the fiscal ratio.

So we remain short term bears of the gold price, it will take only one more Greek haircut to put remonetisation back in the frame. What Ben B. Appears to infer is that printing paper is the only recourse. That’s fine as long as it leans back on some collateral.

India and gold are inseparable. India’s Central Bank, the RBI, holds only 558t, less than 2% of world central holdings, valued at only 8% of its total reserves, but its private citizens probably have more than the rest of the planet’s combined.

Much is held in jewellery form and they like to use it as collateral. A roaring trade has built up via non-banking finance companies using the mechanism. It worries the RBI to the extent that it demands they apply a loan-to-value ratio not exceeding 60% on jewellery and not to lend at all against bullion and coins. Bit of an oddity, the latter.

Platinum Resurfaces. If a single company stands out in the PGM manufacturing sector it is UK based Johnson Matthey, the world’s largest producer of auto catalysts and much more besides. In an interview with Mining Weekly, JM’s publications manager gave his view on the market for the metal which summarises as:

- The strong price performance this year, up from $1407/oz to almost $2000/oz before a pullback to a recent $1634/oz owed much to supply disruptions in RSA, the major miner, but also apprehension about the Zimbabwe situation.

- Demand is now reasserting itself, particularly in North America and with a least a partial resolution to the Greek debt crisis.

- The climate is not good for attracting investment in either RSA or Zimbabwe, so limited scope for increased output in 2012 at least.

- The demand outlook is improved in North America (14% of Pt and 20% Pd demand) and at last in Japan, post – Fukushima.

- The Gold Bulls are not chewing grass.

- BMO: The next time gold really starts a run, its got nothing to stop it.

- Aurizon Gold: (gold has): nothing to stop it.

- GFMS: Gold to average $1800/oz this year despite big supply surplus. (How can something nobody uses be in surplus?)

India’s gold imports are now subject to a possible hike in tax which is making sections of commerce howl. They speak of moving up from 2% to 4%. Imports could reach $100bn by 2015-16. At today’s price that is over 1800t, against newly mined world output of c. 2600t.

[hr]

About David Hargreaves

David Hargreaves is a mining engineer with over forty years of senior experience in the industry. After qualifying in coal mining he worked in the iron ore mines of Quebec and Northwest Ontario before diversifying into other bulk minerals including bauxite. He was Head of Research for stockbrokers James Capel in London from 1974 to 1977 and voted Mining Analyst of the year on three successive occasions.

Since forming his own metals broking and research company in 1977, he has successfully promoted and been a director of several public companies. He currently writes “The Week in Mining”, an incisive review of world mining events, for stockbrokers WH Ireland. David’s research pays particular attention to steel via the iron ore and coal supply industries. He is a Chartered Mining Engineer, Fellow of the Geological Society and the Institute of Mining, Minerals and Materials, and a Member of the Royal Institution. His textbook, “The World Index of Resources and Population” accurately predicted the exponential rise in demand for steel industry products.

Nyheter

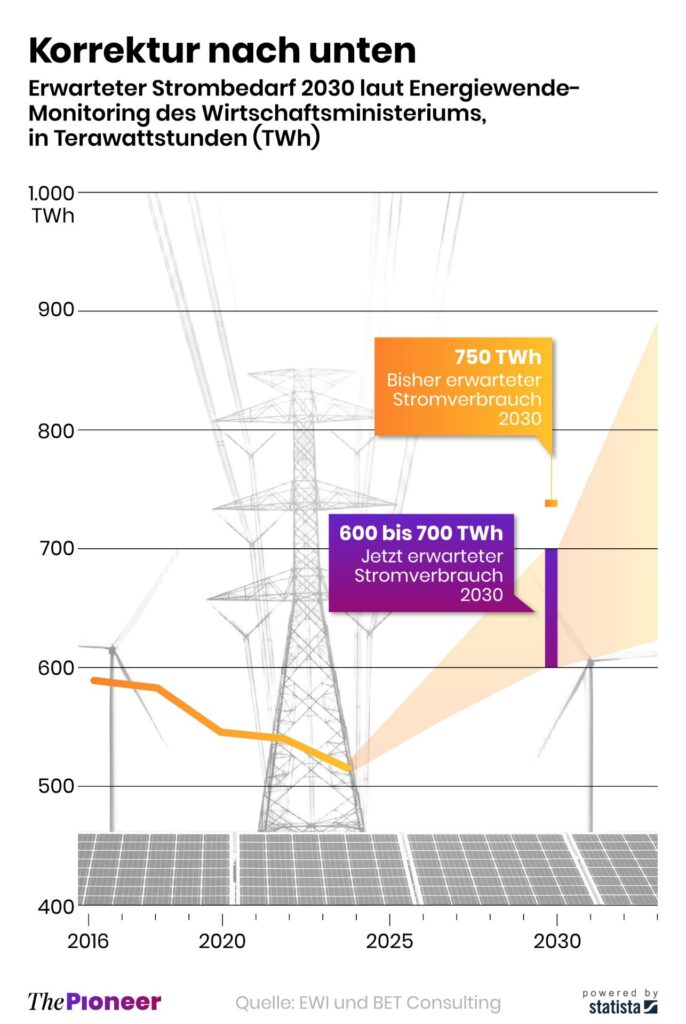

Tyskland har så höga elpriser att företag inte har råd att använda elektricitet

Tyskland har skrivit ner prognosen på hur mycket elektricitet landet kommer att behöva 2030. Hittills har prognosen varit 750 TWh, vilken nu har skrivits ner till 600-700 TWh,

Det kan vid en första anblick låta positivt. Men orsaken är inte att effektiviseringar. Utan priserna är så pass höga att företag inte har råd att använda elektriciteten. Elintensiv industri flyttar sin verksamhet till andra länder och få företag satsar på att etablera energikrävande verksamhet i landet.

Tyskland har inte heller någon plan för att förändra sin havererade energipolitik. Eller rättare sagt, planen är att uppfinna fusionskraft och använda det som energikälla. Något som dock inte löser problemet på några årtionden.

Nyheter

Kinas elproduktion slog nytt rekord i augusti, vilket även kolkraft gjorde

Kinas officiella statistik för elproduktion har släppts för augusti och den visar att landet slog ett nytt rekord. Under augusti producerades 936 TWh elektricitet.

Stephen Stapczynski på Bloomberg lyfter fram att det är ungefär lika mycket som Japan producerar per år, vilket innebär är de producerar ungefär lika mycket elektricitet per invånare.

Kinas elproduktion kom i augusti från:

| Fossil energi | 67 % |

| Vattenkraft | 16 % |

| Vind och Sol | 13 % |

| Kärnkraft | 5 % |

Stapczynskis kollega Javier Blas uppmärksammar även att det totala rekordet inkluderade ett nytt rekord för kolkraft. Termisk energi (där nästan allting är kol) producerade 627,4 TWh under augusti. Vi rapporterade tidigare i år att Kina under första kvartalet slog ett nytt rekord i kolproduktion.

Nyheter

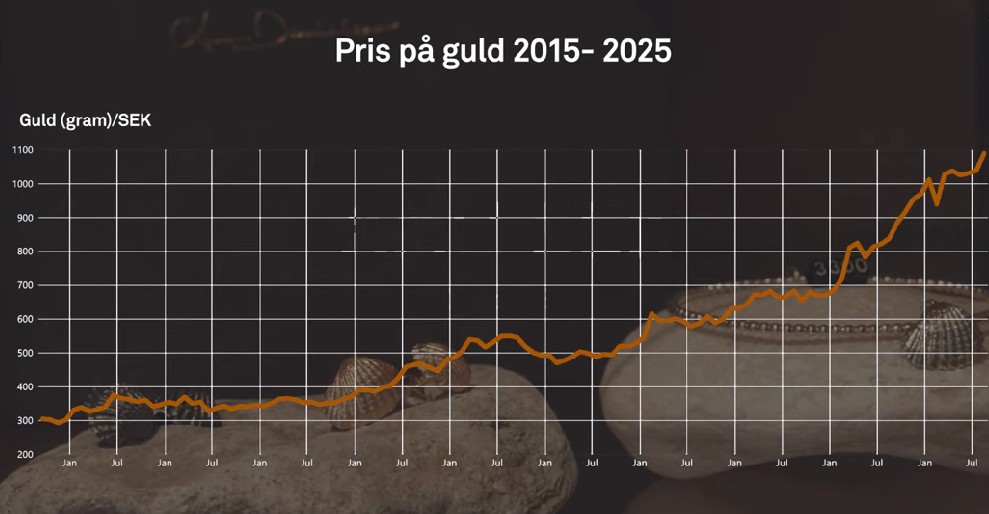

Det stigande guldpriset en utmaning för smyckesköpare

Guldpriset når hela tiden nya höjder och det märks för folk när de ska köpa smycken. Det gör att butikerna måste justera upp sina priser löpande och kunder funderar på om det går att välja något med lägre karat eller mindre diamant. Anna Danielsson, vd på Smyckevalvet, säger att det samtidigt gör att kunderna får upp ögonen för värdet av att äga guld. Det högre guldpriset har även gjort att gamla smycken som ligger hemma i folks byrålådor kan ha fått ett överraskande högt värde.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanMeta bygger ett AI-datacenter på 5 GW och 2,25 GW gaskraftverk

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanAker BP gör ett av Norges största oljefynd på ett decennium, stärker resurserna i Yggdrasilområdet

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanEtt samtal om koppar, kaffe och spannmål

-

Analys4 veckor sedan

Analys4 veckor sedanBrent sideways on sanctions and peace talks

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanSommarens torka kan ge högre elpriser i höst

-

Analys4 veckor sedan

Analys4 veckor sedanBrent edges higher as India–Russia oil trade draws U.S. ire and Powell takes the stage at Jackson Hole

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanMahvie Minerals är verksamt i guldrikt område i Finland

-

Analys3 veckor sedan

Analys3 veckor sedanIncreasing risk that OPEC+ will unwind the last 1.65 mb/d of cuts when they meet on 7 September