Analys

A tight July counters OPEC+ efforts to calm the market

Brent crude fell back 1.1% yesterday to $74.73/bl while it intraday was down as much as 2.4% to $73.74/bl following the forceful message from Russia and Saudi Arabia on Saturday that they have already geared up production and will deliver whatever is needed by the market. The simple story is that OPEC+ cut production through 2017 till today, drew down inventories to “normal levels” and lifted the oil price to a satisfactory level of $70-80/bl and now they are done. In other words the orchestrated steady draw down of inventories is over as well as the continuous rise in the oil price. At least until OPEC+ has exhausted its spare capacity. Oil market conditions in July however look like they might be quite strained anyhow.

Brent crude fell back 1.1% yesterday to $74.73/bl while it intraday was down as much as 2.4% to $73.74/bl following the forceful message from Russia and Saudi Arabia on Saturday that they have already geared up production and will deliver whatever is needed by the market. The simple story is that OPEC+ cut production through 2017 till today, drew down inventories to “normal levels” and lifted the oil price to a satisfactory level of $70-80/bl and now they are done. In other words the orchestrated steady draw down of inventories is over as well as the continuous rise in the oil price. At least until OPEC+ has exhausted its spare capacity. Oil market conditions in July however look like they might be quite strained anyhow.

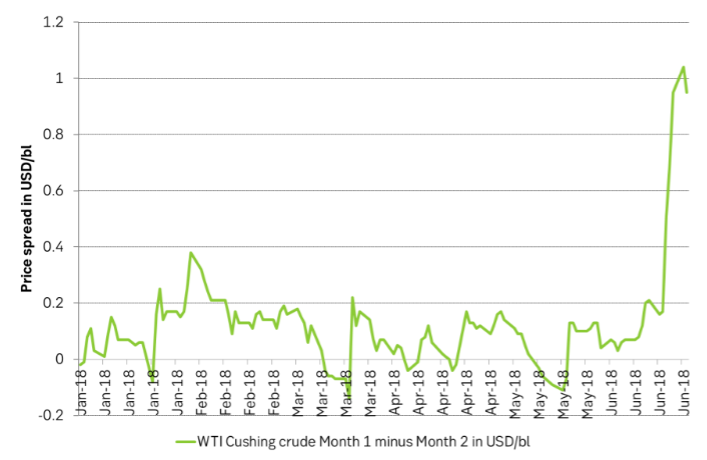

The oil market conditions in July do however look like they are going to be tight. Russia, Saudi Arabia and some of the other OPEC+ members are likely going to increase production by some 0.7 to 1.0 m bl/d. Saudi Arabia looks like it is going to produce some 10.5 to 10.6 m bl/d in July vs. 10.0 m bl/d in May. This will however to a large degree be eaten up by increased domestic summer heating demand. On the supply side we have however lost 350 k bl/d in Canada and 400 k bl/d in Libya while Venezuela continues to decline. The WTI August contract has jumped to a one dollar premium to the September contract reflecting the tight situation. US Cushing crude stocks where WTI is priced has declined five weeks in a row to low levels and will likely continue to decline through July and August as US refineries are running close to flat out. Thus at least for July the market looks like it is going to be tight and that is why oil prices are bid and take little notice of elevated risk aversion in equities and bonds.

Saudi Arabia increased its production by 0.3 m bl/d to 10.3 m bl/d in June according to Energy Aspects and is set to lift it to 10.5 or 10.6 m bl/d in July. The June production lift is however already in the market and thus most likely reflected in the oil price. Russia is likely to lift its production by some 02 m bl/d to 11.2 m bl/d and UAE, Kuwait and Iraq are likely to add some more as well. So all in all versus May there will be internal production increases by some 0.7 to 1 m bl/d. A significant amount of the increase from Saudi Arabia is however eaten up by higher domestic consumption due oil fired power production for air conditioning through the hot summer.

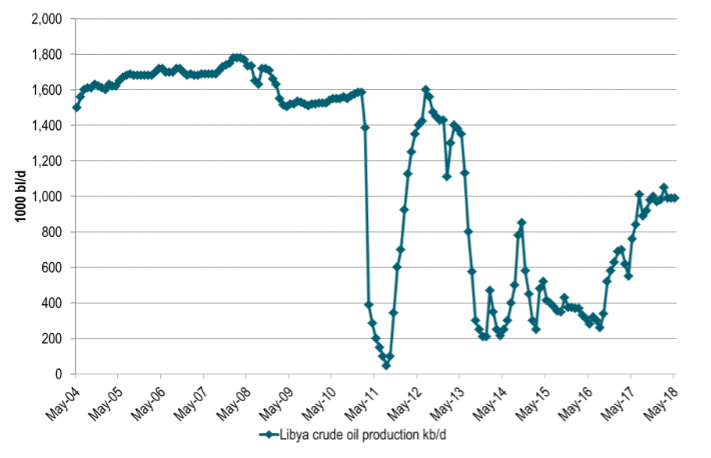

These additions are however countered by declines of 400 k bl/d in Libya (don’t know how long) and 350 k bl/d in Canada (through July) as well as further likely declines in Venezuela.

An oil transformer/upgrader with a 350 k bl/d capacity in Fort McMurray, Alberta, Canada blew up on Wednesday 20th. This will halt supply of 350 k bl/d of high quality low sulphur crude normally flowing to the US and Cushing Oklahoma.

In Libya, General Haftar who is controlling the eastern side of the country has now handed all oil assets in that region to the National Oil Company (NOC) in Benghazi (east) thus defying the internationally recognized NOC in Tripoli (west). The recent loss of 400 k bl/d of supply in Libya may thus be a more permanent situation. The NOC in Benghazi has earlier tried in vain to export oil out of Libya without channelling the proceeds to the NOC in Tripoli. And now it looks like they are trying again. The effect is likely going to be a production in Libya of around 0.5 m bl/d rather than 1.0 m bl/d which it has produced a while now.

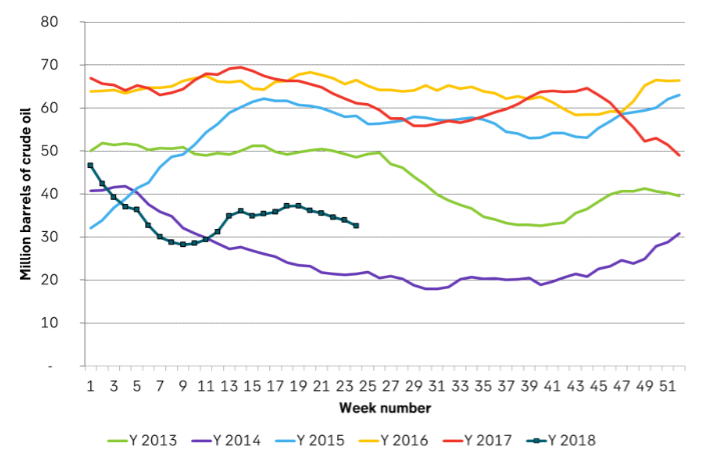

US refineries will now run close to max capacity all through July and August which will help to draw down US crude oil inventories. US Cushing Oklahoma crude stocks have already been drawing down for five weeks in a row and this trend now seems likely to continue through July and August.

Ch1: US Cushing crude oil stocks are ticking lower

Ch2: WTI crude price premium for front month contract over the second month jumping

Ch3. Libya’s crude oil production may move down to around 0.5 m bl/d as General Haftar has handed the oil assets in the east to the authorities in Benghazi which are not recognized by the international community

Analys

Crude stocks fall again – diesel tightness persists

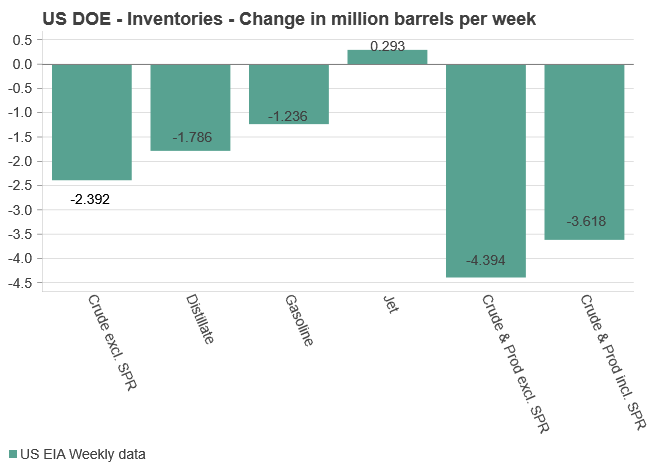

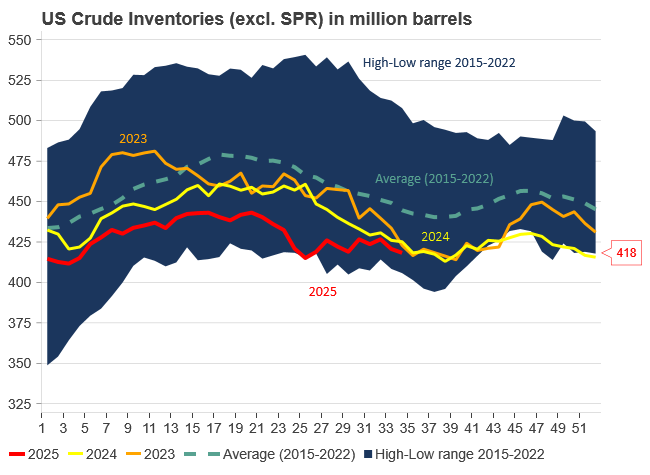

U.S. commercial crude inventories posted another draw last week, falling by 2.4 million barrels to 418.3 million barrels, according to the latest DOE report. Inventories are now 6% below the five-year seasonal average, underlining a persistently tight supply picture as we move into the post-peak demand season.

While the draw was smaller than last week’s 6 million barrel decline, the trend remains consistent with seasonal patterns. Current inventories are still well below the 2015–2022 average of around 449 million barrels.

Gasoline inventories dropped by 1.2 million barrels and are now close to the five-year average. The breakdown showed a modest increase in finished gasoline offset by a decline in blending components – hinting at steady end-user demand.

Diesel inventories saw yet another sharp move, falling by 1.8 million barrels. Stocks are now 15% below the five-year average, pointing to sustained tightness in middle distillates. In fact, diesel remains the most undersupplied segment, with current inventory levels at the very low end of the historical range (see page 3 attached).

Total commercial petroleum inventories – including crude and products but excluding the SPR – fell by 4.4 million barrels on the week, bringing total inventories to approximately 1,259 million barrels. Despite rising refinery utilization at 94.6%, the broader inventory complex remains structurally tight.

On the demand side, the DOE’s ‘products supplied’ metric – a proxy for implied consumption – stayed strong. Total product demand averaged 21.2 million barrels per day over the last four weeks, up 2.5% YoY. Diesel and jet fuel were the standouts, up 7.7% and 1.7%, respectively, while gasoline demand softened slightly, down 1.1% YoY. The figures reflect a still-solid late-summer demand environment, particularly in industrial and freight-related sectors.

Analys

Increasing risk that OPEC+ will unwind the last 1.65 mb/d of cuts when they meet on 7 September

Pushed higher by falling US inventories and positive Jackson Hall signals. Brent crude traded up 2.9% last week to a close of $67.73/b. It traded between $65.3/b and $68.0/b with the low early in the week and the high on Friday. US oil inventory draws together with positive signals from Powel at Jackson Hall signaling that rate cuts are highly likely helped to drive both oil and equities higher.

Ticking higher for a fourth day in a row. Bank holiday in the UK calls for muted European session. Brent crude is inching 0.2% higher this morning to $67.9/b which if it holds will be the fourth trading day in a row with gains. Price action in the European session will likely be quite muted due to bank holiday in the UK today.

OPEC+ is lifting production but we keep waiting for the surplus to show up. The rapid unwinding of voluntary cuts by OPEC+ has placed the market in a waiting position. Waiting for the surplus to emerge and materialize. Waiting for OECD stocks to rise rapidly and visibly. Waiting for US crude and product stocks to rise. Waiting for crude oil forward curves to bend into proper contango. Waiting for increasing supply of medium sour crude from OPEC+ to push sour cracks lower and to push Mid-East sour crudes to increasing discounts to light sweet Brent crude. In anticipation of this the market has traded Brent and WTI crude benchmarks up to $10/b lower than what solely looking at present OECD inventories, US inventories and front-end backwardation would have warranted.

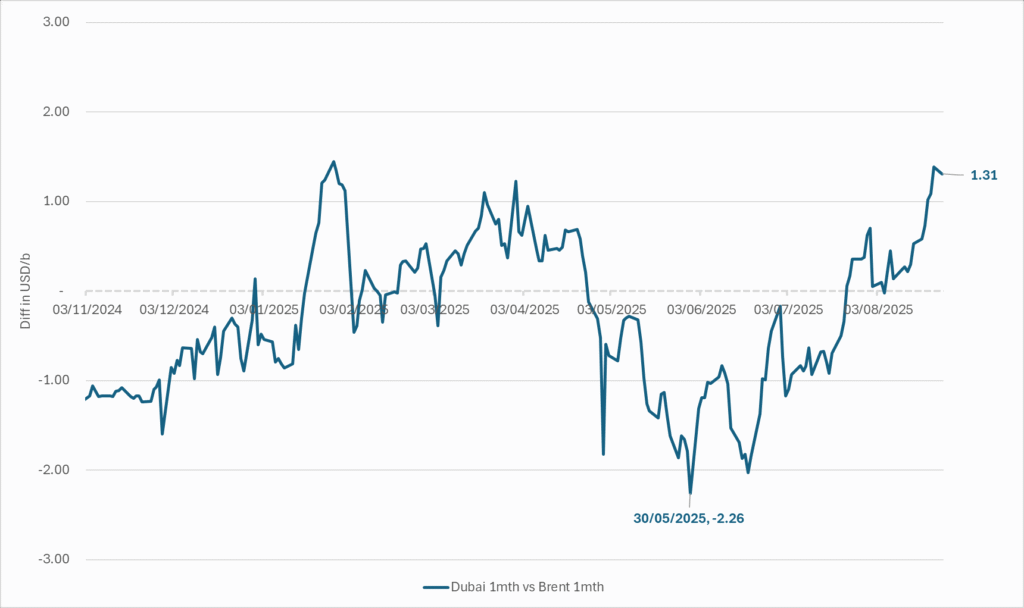

Quite a few pockets of strength. Dubai sour crude is trading at a premium to Brent crude! The front-end of the crude oil curves are still in backwardation. High sulfur fuel oil in ARA has weakened from parity with Brent crude in May, but is still only trading at a discount of $5.6/b to Brent versus a more normal discount of $10/b. ARA middle distillates are trading at a premium of $25/b versus Brent crude versus a more normal $15-20/b. US crude stocks are at the lowest seasonal level since 2018. And lastly, the Dubai sour crude marker is trading a premium to Brent crude (light sweet crude in Europe) as highlighted by Bloomberg this morning. Dubai is normally at a discount to Brent. With more medium sour crude from OPEC+ in general and the Middle East specifically, the widespread and natural expectation has been that Dubai should trade at an increasing discount to Brent. the opposite has happened. Dubai traded at a discount of $2.3/b to Brent in early June. Dubai has since then been on a steady strengthening path versus Brent crude and Dubai is today trading at a premium of $1.3/b. Quite unusual in general but especially so now that OPEC+ is supposed to produce more.

This makes the upcoming OPEC+ meeting on 7 September even more of a thrill. At stake is the next and last layer of 1.65 mb/d of voluntary cuts to unwind. The market described above shows pockets of strength blinking here and there. This clearly increases the chance that OPEC+ decides to unwind the remaining 1.65 mb/d of voluntary cuts when they meet on 7 September to discuss production in October. Though maybe they split it over two or three months of unwind. After that the group can start again with a clean slate and discuss OPEC+ wide cuts rather than voluntary cuts by a sub-group. That paves the way for OPEC+ wide cuts into Q1-26 where a large surplus is projected unless the group kicks in with cuts.

The Dubai medium sour crude oil marker usually trades at a discount to Brent crude. More oil from the Middle East as they unwind cuts should make that discount to Brent crude even more pronounced. Dubai has instead traded steadily stronger versus Brent since late May.

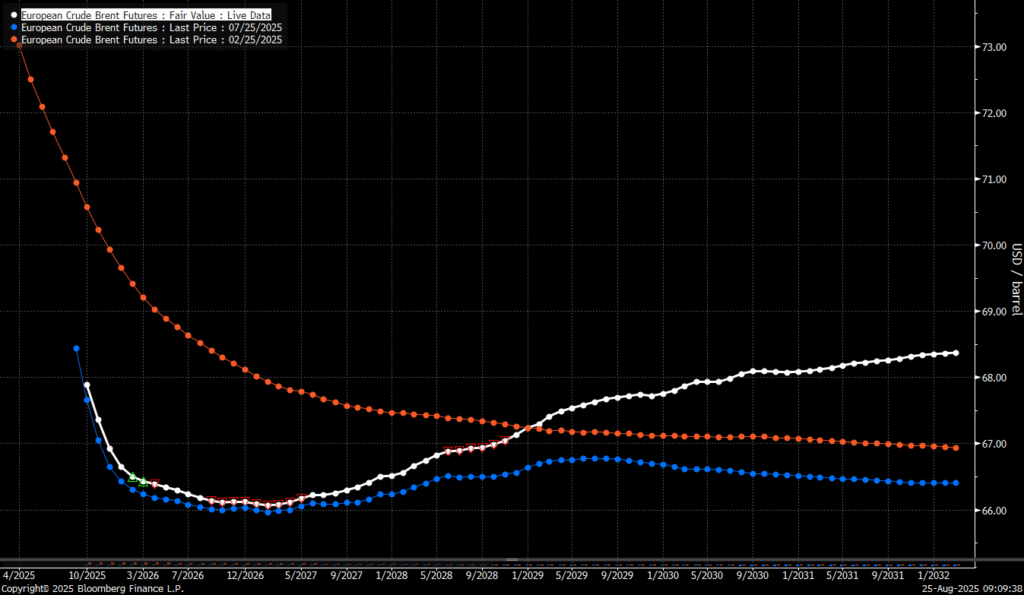

The Brent crude oil forward curve (latest in white) keeps stuck in backwardation at the front end of the curve. I.e. it is still a tight crude oil market at present. The smile-effect is the market anticipation of surplus down the road.

Analys

Brent edges higher as India–Russia oil trade draws U.S. ire and Powell takes the stage at Jackson Hole

Best price since early August. Brent crude gained 1.2% yesterday to settle at USD 67.67/b, the highest close since early August and the second day of gains. Prices traded to an intraday low of USD 66.74/b before closing up on the day. This morning Brent is ticking slightly higher at USD 67.76/b as the market steadies ahead of Fed Chair Jerome Powell’s Jackson Hole speech later today.

No Russia/Ukraine peace in sight and India getting heat from US over imports of Russian oil. Yesterday’s price action was driven by renewed geopolitical tension and steady underlying demand. Stalled ceasefire talks between Russia and Ukraine helped maintain a modest risk premium, while the spotlight turned to India’s continued imports of Russian crude. Trump sharply criticized New Delhi’s purchases, threatening higher tariffs and possible sanctions. His administration has already announced tariff hikes on Indian goods from 25% to 50% later this month. India has pushed back, defending its right to diversify crude sourcing and highlighting that it also buys oil from the U.S. Moscow meanwhile reaffirmed its commitment to supply India, deepening the impression that global energy flows are becoming increasingly politicized.

Holding steady this morning awaiting Powell’s address at Jackson Hall. This morning the main market focus is Powell’s address at Jackson Hole. It is set to be the key event for markets today, with traders parsing every word for signals on the Fed’s policy path. A September rate cut is still the base case but the odds have slipped from almost certainty earlier this month to around three-quarters. Sticky inflation data have tempered expectations, raising the stakes for Powell to strike the right balance between growth concerns and inflation risks. His tone will shape global risk sentiment into the weekend and will be closely watched for implications on the oil demand outlook.

For now, oil is holding steady with geopolitical frictions lending support and macro uncertainty keeping gains in check.

Oil market is starting to think and worry about next OPEC+ meeting on 7 September. While still a good two weeks to go, the next OPEC+ meeting on 7 September will be crucial for the oil market. After approving hefty production hikes in August and September, the question is now whether the group will also unwind the remaining 1.65 million bpd of voluntary cuts. Thereby completing the full phase-out of voluntary reductions well ahead of schedule. The decision will test OPEC+’s balancing act between volume-driven influence and price stability. The gathering on 7 September may give the clearest signal yet of whether the group will pause, pivot, or press ahead.

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanOmgående mångmiljardfiasko för Equinors satsning på Ørsted och vindkraft

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanLundin Gold hittar ny koppar-guld-fyndighet vid Fruta del Norte-gruvan

-

Nyheter1 vecka sedan

Nyheter1 vecka sedanMeta bygger ett AI-datacenter på 5 GW och 2,25 GW gaskraftverk

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanGuld stiger till över 3500 USD på osäkerhet i världen

-

Analys3 veckor sedan

Analys3 veckor sedanWhat OPEC+ is doing, what it is saying and what we are hearing

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanAlkane Resources och Mandalay Resources har gått samman, aktör inom guld och antimon

-

Nyheter1 vecka sedan

Nyheter1 vecka sedanAker BP gör ett av Norges största oljefynd på ett decennium, stärker resurserna i Yggdrasilområdet

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanLyten, tillverkare av litium-svavelbatterier, tar över Northvolts tillgångar i Sverige och Tyskland