Analys

Crude oil comment – The dissconnect and the reconnect

Brent crude sold off 4.7% ydy to a close of $48.38/b (1 mth contract) while in the longer dated contracts we saw the December 2020 contract lose 2.1% to trade down to $51.15/b which was the lowest level since April 2016. Early this morning the Dec 2020 contract traded as low as $50.5/b. At the time of writing the 1 mth Brent contract is up 0.5% to $48.6/b after having traded as low as $46.64/b in the early hours of the day.

Brent crude sold off 4.7% ydy to a close of $48.38/b (1 mth contract) while in the longer dated contracts we saw the December 2020 contract lose 2.1% to trade down to $51.15/b which was the lowest level since April 2016. Early this morning the Dec 2020 contract traded as low as $50.5/b. At the time of writing the 1 mth Brent contract is up 0.5% to $48.6/b after having traded as low as $46.64/b in the early hours of the day.

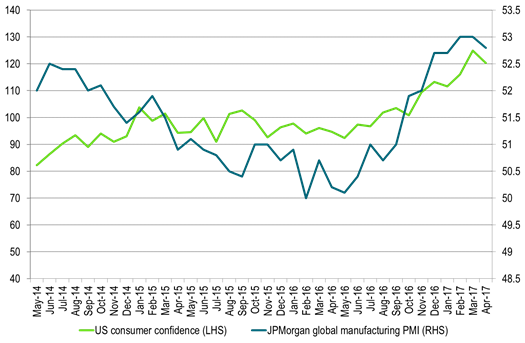

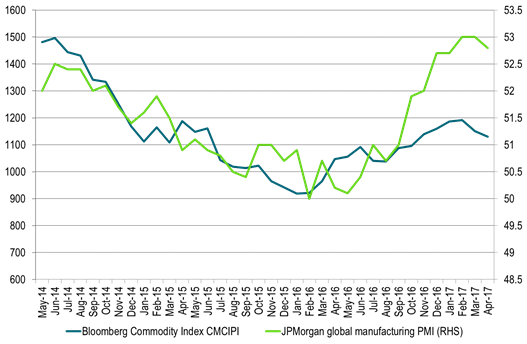

The discussion is going left, right and centre for explanations of why we have such a sharp sell-off in commodities in general and oil specifically. Is the macro backdrop deteriorating? The decline in US consumer confidence by 5 points from March to April as well as a topping over of the global manufacturing PMI at the same time might have been a queue to macro driven investors to take profits on commodities in general. The general view is however that the macro backdrop is fine. That US Q1 growth weakness is transitory and that Chinese infrastructure contractor order intake was strong in Q1-17. Chinese tightening liquidity settings aiming to prevent overheating and too much speculative activity is probably a part of the reason for the sell-off in metals. As such it seems like there is a disconnect between the general macro-view which looks overall positive and the current commodity sell-off which is blood red. Graphing global PMI to commodities does however paint a picture of a fairly good relationship. Is the commodity sell-off an indicator that the somewhat rosy macro view is wrong? Probably not seems to be the main view so far.

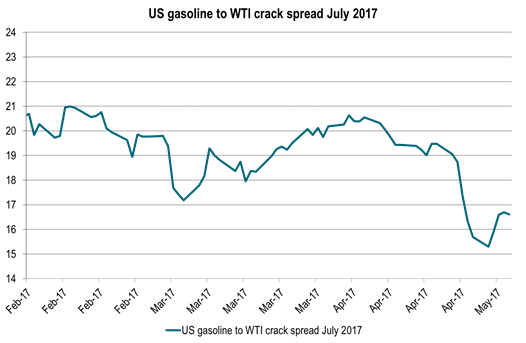

Another angel for the sell-off in crude oil is US gasoline. Looking at the sell-off in crude oil we can see that the sell-off has been preceded by a sell-off in gasoline. Gasoline and the driving season is normally a bullish element this time of year. Counter to normal we have instead had a sell-off in gasoline which has been feeding into a bearish pressure on crude oil as well. So weakening US gasoline prices clearly are partly to blame for the latest crude sell-off.

Rapidly rising US crude oil production in combination with elevated net long speculative positions in WTI has of course been important foundation for the current sell-off. Speculators have been taking cover as the price moved into technically bearish territory. On Tuesday next week the US EIA will publish its last monthly energy report before OPEC’s meeting on May 25th. It is likely to lift its projected US crude oil production for 2018 yet another 150 – 200 kb/d as it accounts for the 35 oil rigs which were added to the market in April.

Hardly anyone seems to doubt that OPEC will roll over its cuts from H1 to H2 and Russia also seems to be positive for such a decision. This is probably the biggest disconnect in the oil sell-off. OPEC seems positive for cuts, Russia seems positive and the general market expectation is for a roll-over of cuts into H2. A decision to roll over cuts into H2-17 when OPEC meets on May 25th in Vienna will clearly lift Brent crude oil prices back up towards $55/b. As such the current sell-off to $46-47-48/b is clearly a disconnect to the consensus that OPEC will cut in H2-17. Cutting in H2-17 will however stimulate more US oil rigs to enter the market thus leading to higher production in 2018 and 2019. As such a decision to cut on May 25th will be a sacrifice of the balance and oil prices for 2018 and 2019 as it will shift both of those years into strict surplus.

But for now the sell-off is a disconnect to the view that OPEC will cut. As such it is a good buy ahead of the OPEC meeting which is now less than three weeks ahead. Unless of course OPEC totally caves in and instead lets oil production flow unhindered. That would be a vindication of prior Saudi oil minister Ali al-Naimi’s earlier aired view that cutting production is not a good idea as it would only lead to lower volume but not necessarily a higher price. Saudi Arabia may however have too much at stake with its planned Saudi Aramco IPO planned for early 2018 to let the oil flow loose quite yet. Thus betting on the consensus for a cut and buying the current sell-off may not be such a bad idea and strattegy. Rather we think it is a good strattegy to buy into the current sell-off at the moment ahead of the upcoming OPEC meeting.

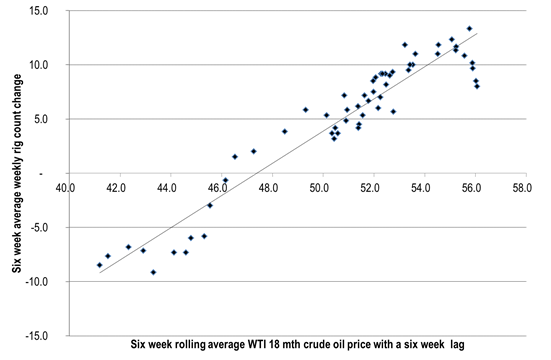

On the one hand there is now a dissconnect between a strong belief in an OPEC cut versus a current weak oil prices. On the other hand though one might also say that the oil price finally has reconnected with shale oil fundamentals. If the oil market is in no need for yet more oil in 2018 then there is no need to activate yet more oil rigs in the US right now. At the moment we forecast 2018 to be close to balanced. As such the mid-term WTI crude price curve should traded at about $47/b (empirical rig count inflection point versus prices). The 1-2 year WTI forward curve at the time of writing trades at $47.8/b. But that reconnect looks likely to be foreced apart again if/when OPEC decides to roll cuts over into H2-17. In that case the reconnect is postponed to 2018. Post the Saudi Aramco IPO.

Ch1: Global growth momentum topping out?

Graphically yes, but general view is that global growth is fine and that US Q1-17 weakness is transitory

Ch2: Commodity prices are softening anyhow

Ch3: Gasoline prices usually a bullish factor into the US driving seasson – But this time it has been a bearish factor dragging crude prices lower

Ch4: Relationship between US mid-term WTI forward prices and weekly US oil rig additions

The inflection point is from April/May/June last year

Kind regards

Bjarne Schieldrop

Chief analyst, Commodities

SEB Markets

Merchant Banking

Analys

A sharp weakening at the core of the oil market: The Dubai curve

Down to the lowest since early May. Brent crude has fallen sharply the latest four days. It closed at USD 64.11/b yesterday which is the lowest since early May. It is staging a 1.3% rebound this morning along with gains in both equities and industrial metals with an added touch of support from a softer USD on top.

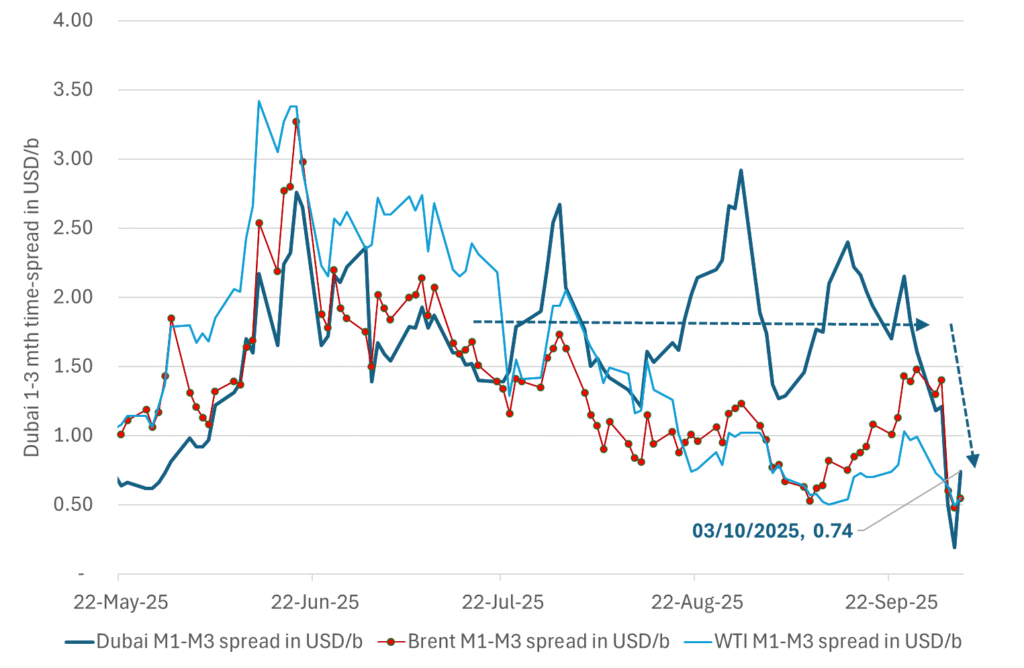

What stands out the most to us this week is the collapse in the Dubai one to three months time-spread.

Dubai is medium sour crude. OPEC+ is in general medium sour crude production. Asian refineries are predominantly designed to process medium sour crude. So Dubai is the real measure of the balance between OPEC+ holding back or not versus Asian oil demand for consumption and stock building.

A sharp weakening of the front-end of the Dubai curve. The front-end of the Dubai crude curve has been holding out very solidly throughout this summer while the front-end of the Brent and WTI curves have been steadily softening. But the strength in the Dubai curve in our view was carrying the crude oil market in general. A source of strength in the crude oil market. The core of the strength.

The now finally sharp decline of the front-end of the Dubai crude curve is thus a strong shift. Weakness in the Dubai crude marker is weakness in the core of the oil market. The core which has helped to hold the oil market elevated.

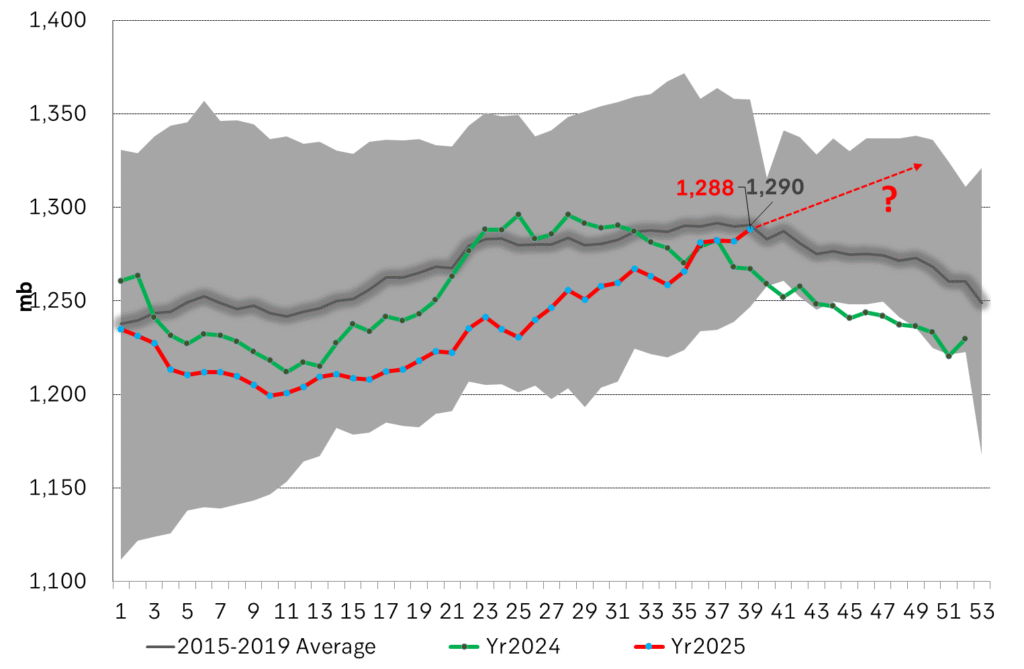

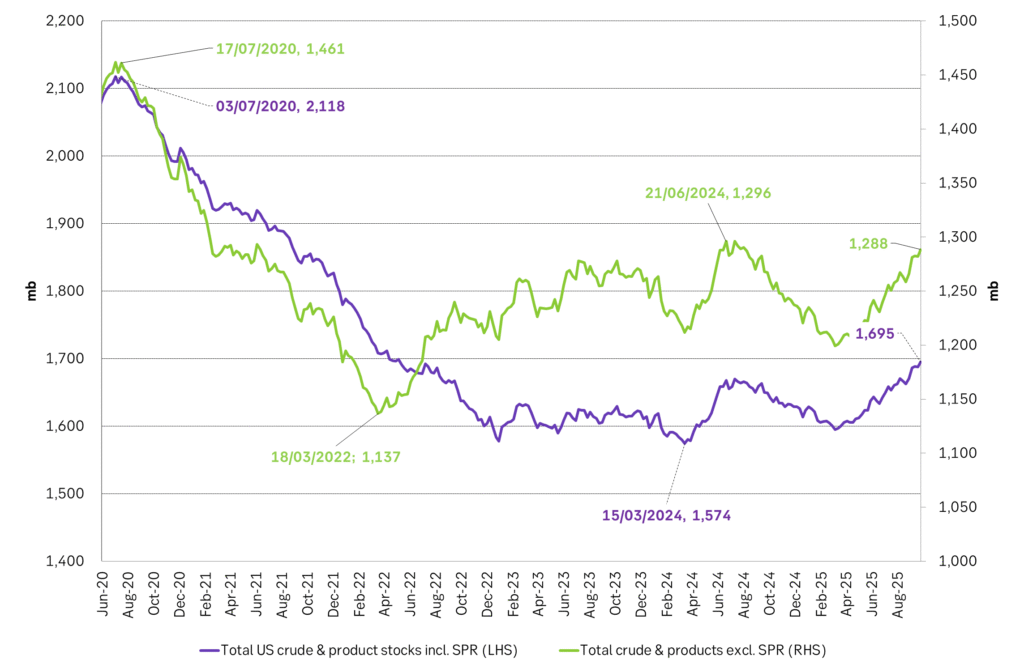

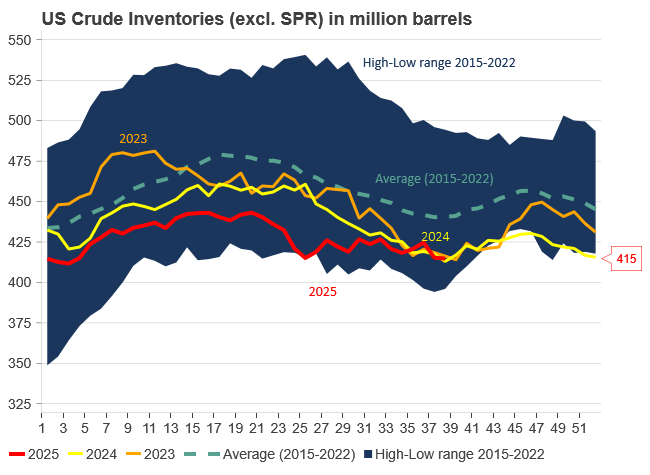

Facts supports the weakening. Add in facts of Iraq lifting production from Kurdistan through Turkey. Saudi Arabia lifting production to 10 mb/d in September (normal production level) and lifting exports as well as domestic demand for oil for power for air con is fading along with summer heat. Add also in counter seasonal rise in US crude and product stocks last week. US oil stocks usually decline by 1.3 mb/week this time of year. Last week they instead rose 6.4 mb/week (+7.2 mb if including SPR). Total US commercial oil stocks are now only 2.1 mb below the 2015-19 seasonal average. US oil stocks normally decline from now to Christmas. If they instead continue to rise, then it will be strongly counter seasonal rise and will create a very strong bearish pressure on oil prices.

Will OPEC+ lift its voluntary quotas by zero, 137 kb/d, 500 kb/d or 1.5 mb/d? On Sunday of course OPEC+ will decide on how much to unwind of the remaining 1.5 mb/d of voluntary quotas for November. Will it be 137 kb/d yet again as for October? Will it be 500 kb/d as was talked about earlier this week? Or will it be a full unwind in one go of 1.5 mb/d? We think most likely now it will be at least 500 kb/d and possibly a full unwind. We discussed this in a not earlier this week: ”500 kb/d of voluntary quotas in October. But a full unwind of 1.5 mb/d”

The strength in the front-end of the Dubai curve held out through summer while Brent and WTI curve structures weakened steadily. That core strength helped to keep flat crude oil prices elevated close to the 70-line. Now also the Dubai curve has given in.

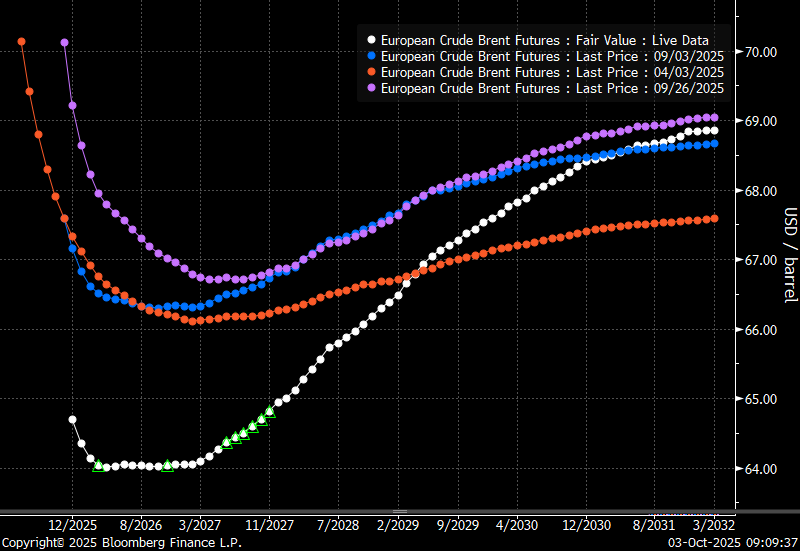

Brent crude oil forward curves

Total US commercial stocks now close to normal. Counter seasonal rise last week. Rest of year?

Total US crude and product stocks on a steady trend higher.

Analys

OPEC+ will likely unwind 500 kb/d of voluntary quotas in October. But a full unwind of 1.5 mb/d in one go could be in the cards

Down to mid-60ies as Iraq lifts production while Saudi may be tired of voluntary cut frugality. The Brent December contract dropped 1.6% yesterday to USD 66.03/b. This morning it is down another 0.3% to USD 65.8/b. The drop in the price came on the back of the combined news that Iraq has resumed 190 kb/d of production in Kurdistan with exports through Turkey while OPEC+ delegates send signals that the group will unwind the remaining 1.65 mb/d (less the 137 kb/d in October) of voluntary cuts at a pace of 500 kb/d per month pace.

Signals of accelerated unwind and Iraqi increase may be connected. Russia, Kazakhstan and Iraq were main offenders versus the voluntary quotas they had agreed to follow. Russia had a production ’debt’ (cumulative overproduction versus quota) of close to 90 mb in March this year while Kazakhstan had a ’debt’ of about 60 mb and the same for Iraq. This apparently made Saudi Arabia angry this spring. Why should Saudi Arabia hold back if the other voluntary cutters were just freeriding? Thus the sudden rapid unwinding of voluntary cuts. That is at least one angle of explanations for the accelerated unwinding.

If the offenders with production debts then refrained from lifting production as the voluntary cuts were rapidly unwinded, then they could ’pay back’ their ’debts’ as they would under-produce versus the new and steadily higher quotas.

Forget about Kazakhstan. Its production was just too far above the quotas with no hope that the country would hold back production due to cross-ownership of oil assets by international oil companies. But Russia and Iraq should be able to do it.

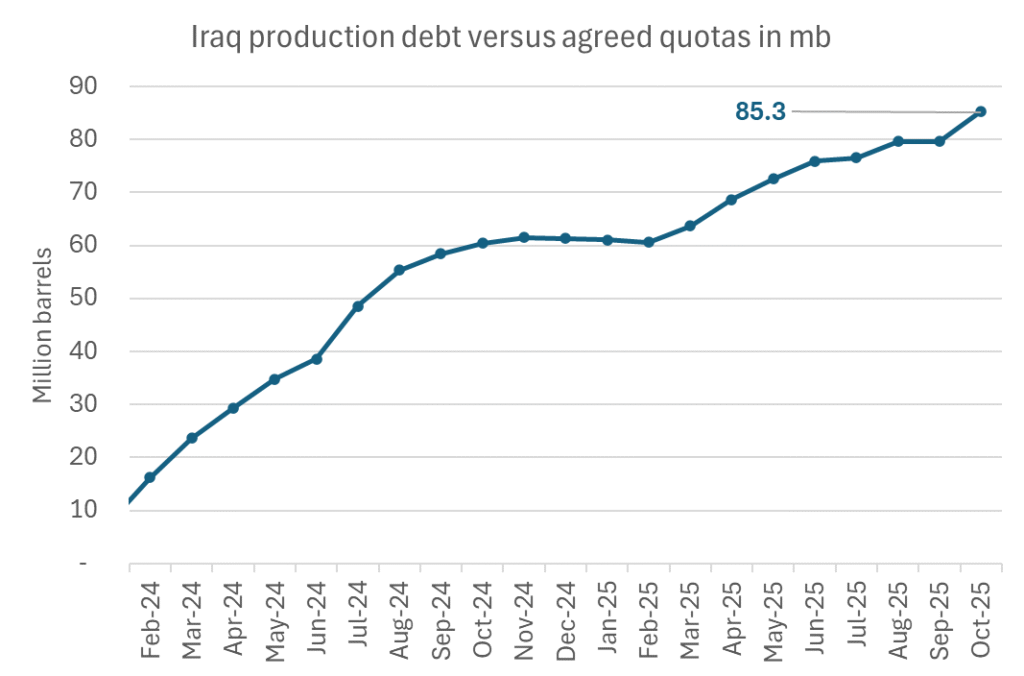

Iraqi cumulative overproduction versus quotas could reach 85-90 mb in October. Iraq has however steadily continued to overproduce by 3-5 mb per month. In July its new and gradually higher quota came close to equal with a cumulative overproduction of only 0.6 mb that month. In August again however its production had an overshoot of 100 kb/d or 3.1 mb for the month. Its cumulative production debt had then risen to close to 80 mb. We don’t know for September yet. But looking at October we now know that its production will likely average close to 4.5 mb/d due to the revival of 190 kb/d of production in Kurdistan. Its quota however will only be 4.24 mb/d. Its overproduction in October will thus likely be around 250 kb/d above its quota with its production debt rising another 7-8 mb to a total of close to 90 mb.

Again, why should Saudi Arabia be frugal while Iraq is freeriding. Better to get rid of the voluntary quotas as quickly as possible and then start all over with clean sheets.

Unwinding the remaining 1.513 mb/d in one go in October? If OPEC+ unwinds the remaining 1.513 mb/d of voluntary cuts in one big go in October, then Iraq’s quota will be around 4.4 mb/d for October versus its likely production of close to 4.5 mb/d for the coming month..

OPEC+ should thus unwind the remaining 1.513 mb/d (1.65 – 0.137 mb/d) in one go for October in order for the quota of Iraq to be able to keep track with Iraq’s actual production increase.

October 5 will show how it plays out. But a quota unwind of at least 500 kb/d for Oct seems likely. An overall increase of at least 500 kb/d in the voluntary quota for October looks likely. But it could be the whole 1.513 mb/d in one go. If the increase in the quota is ’only’ 500 kb/d then Iraqi cumulative production will still rise by 5.7 mb to a total of 85 mb in October.

Iraqi production debt versus quotas will likely rise by 5.7 mb in October if OPEC+ only lifts the overall quota by 500 kb/d in October. Here assuming historical production debt did not rise in September. That Iraq lifts its production by 190 kb/d in October to 4.47 mb/d (August level + 190 kb/d) and that OPEC+ unwinds 500 kb/d of the remining quotas in October when they decide on this on 5 October.

Analys

Modest draws, flat demand, and diesel back in focus

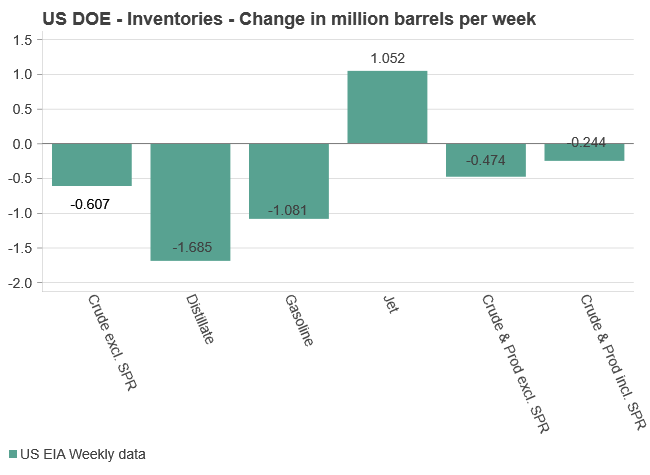

U.S. commercial crude inventories posted a marginal draw last week, falling by 0.6 million barrels to 414.8 million barrels. Inventories remain 4% below the five-year seasonal average, but the draw is far smaller than last week’s massive 9.3-million-barrel decline. Higher crude imports (+803,000 bl d WoW) and steady refinery runs (93% utilization) helped keep the crude balance relatively neutral.

Yet another drawdown indicates commercial crude inventories continue to trend below the 2015–2022 seasonal norm (~440 million barrels), though at 414.8 million barrels, levels are now almost exactly in line with both the 2023 and 2024 trajectory, suggesting stable YoY conditions (see page 3 attached).

Gasoline inventories dropped by 1.1 million barrels and are now 2% below the five-year average. The decline was broad-based, with both finished gasoline and blending components falling, indicating lower output and resilient end-user demand as we enter the shoulder season post-summer (see page 6 attached).

On the diesel side, distillate inventories declined by 1.7 million barrels, snapping a two-week streak of strong builds. At 125 million barrels, diesel inventories are once again 8% below the five-year average and trending near the low end of the historical range.

In total, commercial petroleum inventories (excl. SPR) slipped by 0.5 million barrels on the week to ish 1,281.5 million barrels. While essentially flat, this ends a two-week streak of meaningful builds, reflecting a return to a slightly tighter situation.

On the demand side, the DOE’s ‘products supplied’ metric (see page 6 attached), a proxy for implied consumption, softened slightly. Total demand for crude oil over the past four weeks averaged 20.5 million barrels per day, up just 0.9% YoY.

Summing up: This week’s report shows a re-tightening in diesel supply and modest draws across the board, while demand growth is beginning to flatten. Inventories remain structurally low, but the tone is less bullish than in recent weeks.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanEurobattery Minerals satsar på kritiska metaller för Europas självförsörjning

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanMahvie Minerals i en guldtrend

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanGuldpriset kan närma sig 5000 USD om centralbankens oberoende skadas

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanOPEC signalerar att de inte bryr sig om oljepriset faller kommande månader

-

Analys3 veckor sedan

Analys3 veckor sedanVolatile but going nowhere. Brent crude circles USD 66 as market weighs surplus vs risk

-

Nyheter3 veckor sedan

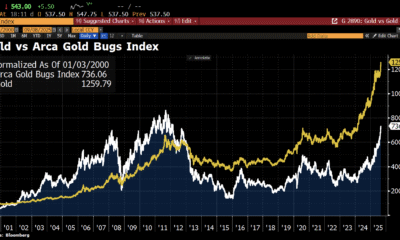

Nyheter3 veckor sedanAktier i guldbolag laggar priset på guld

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanKinas elproduktion slog nytt rekord i augusti, vilket även kolkraft gjorde

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanTyskland har så höga elpriser att företag inte har råd att använda elektricitet