Analys

Crude oil comment – Surplus stored here or there?

Crude oil comment – Surplus stored here or there?

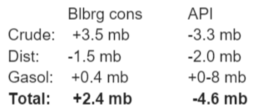

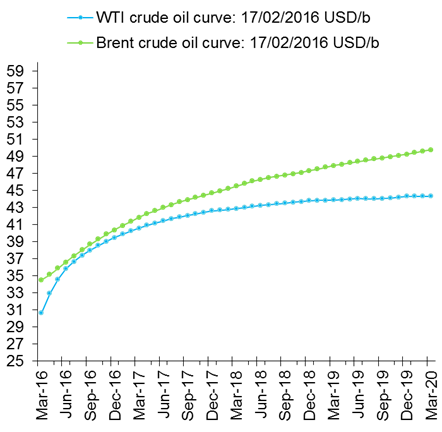

Crude oil comment – Surplus stored here or there?- Graph 1: Deep WTI contango – Costly or impractical to store oil in the US mid-continent

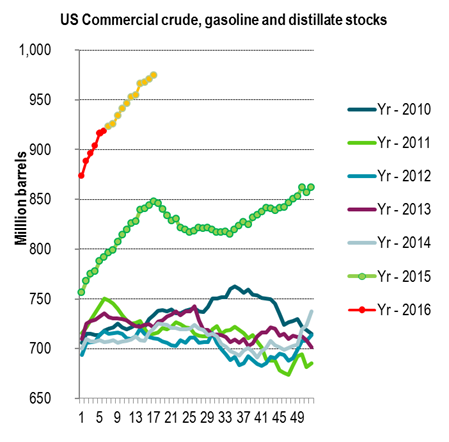

- Graph 2: US crude, gasoline and distillate stocks

Crude oil comment – Surplus stored here or there?

Today we will have the publishing of US oil inventory data at 17.00 CET. Since the start of August last year total commercial US crude and product stocks have increased by 102 million barrels. During that period we have only seen 5 weeks with declines in the net change in stocks constituted by crude + gasoline + distillates. The general take has been that the US holds a substantial capacity of the yet remaining free storage capacity for oil globally. Thus not surprisingly that has also been where we have seen the solid accumulation in oil inventories. The US is a huge net importer of oil, still the second biggest oil importer in the world. Thus when we see consistently increasing oil inventories in the US it basically means that the US is importing more oil than it needs. This has of course been impacted by logistical issues within the US regarding location of production versus consumption and crude qualities and refinery specs in combination with the earlier crude oil export ban.

In last week’s data release we saw that the net increase of crude, gasoline and distillates only came in at a +1.8 mb gain. That was the lowest gain since late December since which the average weekly gain has been running at about +10 mb per week. The Bloomberg consensus for today’s US oil inventory data released points to a total rise of 2.4 mb. The partial data set aggregated by API from its members in the US oil space did however point to a solid total decline of 4.6 mb with a significant decline in US crude stocks as well as distillates:

So what is driving this change in pattern? No more stock building in the US? On paper it looks like the US Pad II should still hold a substantial amount of free, available storage capacity for both crude and products. However, what the deep contango in the WTI curve is telling us is that it is becoming very expensive to store oil in the US mid-continent. Yes, crude stocks in Cushing Oklahoma are close to full. As such the contango in the WTI crude oil curve should be deep. However, if there was a substantial amount of storage capacity which was low cost to use, easy logistics and easily operational readily available in the vicinity of Cushing and in the Pad II region, then the close to capacity and deep contango in the WTI curve should drive oil away from Cushing and into other storage facilities in Pad II. Thus again, the deep WTI contango probably tells the market that the remaining available storage capacity in Pad II in the US may not be very cheap to utilize. This could be thus be due to several issues like cumbersome logistics or old age or that storage space is there but it is not really operationally available.

Looking at the WTI forward curve in comparison with the Brent curve the WTI curve’s accelerating, deepening contango this year is basically shouting out: It is becoming increasingly expensive to store oil in the US mid-continent. Go and store oil somewhere else.

If we today see that total US oil stocks are actually declined in the US last week as indicated by the API numbers then it is likely to have a bullish impact on oil prices. Especially if it is combined with for example a further decline in US crude oil production (data to be published together with inventory data today) in combination with the current ongoing oil price rebound on the back of the OPEC + Russia talks on production freeze. It is going to be perceived as bullish partly because it may be interpreted as if the global oil market is less in surplus now than 3-4 weeks ago. This we think is the wrong interpretation. The market is still running a surplus of some 1.5 mbpd which needs to be stored somewhere. If stocks don’t continue to rise in the US it basically means that stocks will need to rise outside of the US. It does mean that the deep contango in the WTI curve may ease a bit while the contango in the Brent curve will deepen. As such it is on the margin supportive for the WTI front month prices versus a bearish impact for the Brent front month price.

Thus do not jump on the conclusion that declining stocks in the US means that there is no global surplus. It basically means that surplus is stored somewhere else.

Graph 1: Deep WTI contango – Costly or impractical to store oil in the US mid-continent

Graph 2: US crude, gasoline and distillate stocks

Yellow line is if further inventory rise follows last year’s trende from here.

Normally total US crude, gasoline and distillate stocks don’t increase much.

Thus the increase last year and so far this year is a reflection of the global surplus

Thus if it is becoming increasingly costly to store oil in the US then the stock building has to take plase somewhere else.

Kind regards

Bjarne Schieldrop

Chief analyst, Commodities

SEB Markets

Merchant Banking

Analys

Brent slips to USD 64.5: sanction doubts and OPEC focus reduce gains

After reaching USD 66.78 per barrel on Friday afternoon, Brent crude has since traded mostly sideways, yet dipping lower this morning. The market appears to be consolidating last week’s sharp gains, with Brent now easing back to around USD 64.5 per barrel, roughly USD 2.3 below Friday’s peak but still well above last Monday’s USD 60.07 low.

The rebound last week was initially driven by Washington’s decision to blacklist Russia’s two largest oil producers, Rosneft and Lukoil, which together account for nearly half of the country’s crude exports. The move sparked a wave of risk repricing and short covering, with Brent rallying almost 10% from Monday’s trough. Yet, the market is now questioning the actual effectiveness of the sanctions. While a full blacklisting sounds dramatic, the mechanisms for enforcement remain unclear, and so far, there are no signs of disrupted Russian flows.

In practice, these measures are unlikely to materially affect Russian supply or revenues in the near term, yet we have now seen Indian refiners reportedly paused new orders for Russian barrels pending government guidance. BPCL is expected to issue a replacement spot tender within 7–10 days, potentially sourcing crude from non-sanctioned entities instead. Meanwhile, Lukoil is exploring the sale of overseas assets, and Germany has requested extra time for Rosneft to reorganize its refining interests in the country.

The broader market focus is now shifting toward this week’s Fed decision and Sunday’s OPEC+ meeting, both seen as potential short-term price drivers. Renewed U.S.-China trade dialogue ahead of Trump’s meeting with President Xi Jinping in South Korea is also lending some macro support.

In short, while the White House’s latest move adds to geopolitical noise, it does not yet represent a true supply disruption. If Washington had intended to apply real pressure, it could have advanced the long-standing Senate bill enforcing secondary sanctions on buyers of Russian oil, legislation with overwhelming backing, or delivered more direct military assistance to Ukraine. Instead, the latest action looks more like political theatre than policy shift, projecting toughness without imposing material economic pain.

Still, while the immediate supply impact appears limited, the episode has refocused attention on Russia’s export vulnerability and underscored the ongoing geopolitical risk premium in the oil market. Combined with counter-seasonal draws in U.S. crude inventories, record-high barrels at sea, and ongoing uncertainty ahead of the OPEC+ meeting, short-term fundamentals remain somewhat tighter than the broader surplus story suggests.

i.e., the sanctions may prove mostly symbolic, but the combination of geopolitics and uneven inventory draws is likely to keep Brent volatile around the low to mid-USD 60s in the days ahead.

Analys

Sell the rally. Trump has become predictable in his unpredictability

Hesitant today. Brent jumped to an intraday high of $66.36/b yesterday after having touched an intraday low of $60.07/b on Monday as Indian and Chinese buyers cancelled some Russian oil purchases and instead redirected their purchases towards the Middle East due to the news US sanctions. Brent is falling back 0.4% this morning to $65.8/b.

It’s our strong view that the only sensible thing is to sell this rally. In all Trump’s unpredictability he has become increasingly predictable. Again and again he has rumbled about how he is going to be tough on Putin. Punish Putin if he won’t agree to peace in Ukraine. Recent rumbling was about the Tomahawk rockets which Trump threatened on 10 October and 12 October to sell/send to Ukraine. Then on 17 October he said that ”the U.S. didn’t want to give away weapons (Tomahawks) it needs”.

All of Trump’s threats towards Putin have been hot air. So far Trump’s threats have been all hot air and threats which later have evaporated after ”great talks with Putin”. After all these repetitions it is very hard to believe that this time will be any different. The new sanctions won’t take effect before 21. November. Trump has already said that: ”he was hoping that these new sanctions would be very short-lived in any case”. Come 21. November these new sanctions will either evaporate like all the other threats Trump has thrown at Putin before fading them. Or the sanctions will be postponed by another 4 weeks or 8 weeks with the appearance that Trump is even more angry with Putin. But so far Trump has done nothing that hurt Putin/Russia. We can’t imagine that this will be different. The only way forward in our view for a propre lasting peace in Ukraine is to turn Ukraine into defensive porcupine equipped with a stinging tail if need be.

China will likely stand up to Trump if new sanctions really materialize on 21 Nov. Just one country has really stood up to Trump in his tariff trade war this year: China. China has come of age and strength. I will no longer be bullied. Trump upped tariffs. China responded in kind. Trump cut China off from high-end computer chips. China put on the breaks on rare earth metals. China won’t be bullied any more and it has the power to stand up. Some Chinese state-owned companies like Sinopec have cancelled some of their Russian purchases. But China’s Foreign Ministry spokesperson Guo Jiakun has stated that China “oppose unilateral sanctions which lack a basis in international law and authorization of the UN Security Council”. Thus no one, not even the US shall unilaterally dictate China from whom they can buy oil or not. This is yet another opportunity for China to show its new strength and stand up to Trump in a show of force. Exactly how China choses to play this remains to be seen. But China won’t be bullied by over something as important as its oil purchases. So best guess here is that China will defy Trump on this. But probably China won’t need to make a bid deal over this. Firstly because these new sanctions will either evaporate as all the other threats or be postponed once we get to 21 November. Secondly because the sanctions are explicit towards US persons and companies but only ”may” be enforced versus non-US entities.

Sanctions is not a reduction in global supply of oil. Just some added layer of friction. Anyhow, the new sanctions won’t reduce the supply of Russian crude oil to the market. It will only increase the friction in the market with yet more need for the shadow fleet and ship to ship transfer of Russian oil to dodge the sanctions. If they materialize at all.

The jump in crude oil prices is probably due to redirections of crude purchases to the Mid-East and not because all speculators are now turned bullish. Has oil rallied because all speculators now suddenly have turned bullish? We don’t think so. Brent crude has probably jumped because some Indian and Chinese oil purchasers of have redirected their purchases from Russia towards the Mid-East just in case the sanctions really materializes on 21 November.

Analys

Brent crude set to dip its feet into the high $50ies/b this week

Parts of the Brent crude curve dipping into the high $50ies/b. Brent crude fell 2.3% over the week to Friday. It closed the week at $61.29/b, a slight gain on the day, but also traded to a low of $60.14/b that same day and just barely avoided trading into the $50ies/b. This morning it is risk-on in equities which seems to help industrial metals a little higher. But no such luck for oil. It is down 0.8% at $60.8/b. This week looks set for Brent crude to dip its feet in the $50ies/b. The Brent 3mth contract actually traded into the high $50ies/b on Friday.

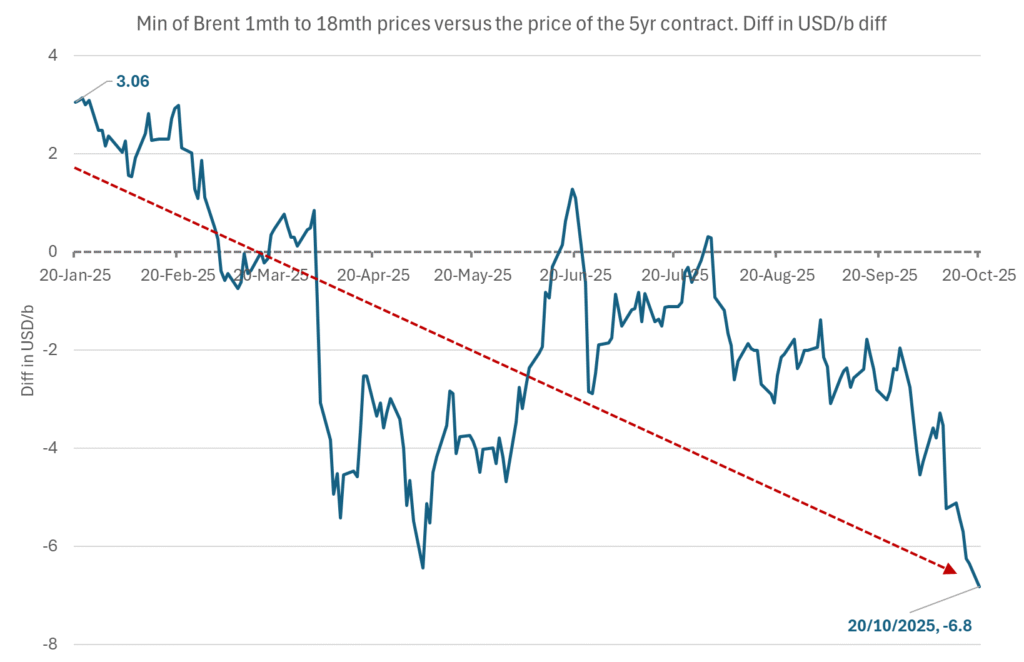

The front-end backwardation has been on a weakening foot and is now about to fully disappear. The lowest point of the crude oil curve has also moved steadily lower and lower and its discount to the 5yr contract is now $6.8/b. A solid contango. The Brent 3mth contract did actually dip into the $50ies/b intraday on Friday when it traded to a low point of $59.93/b.

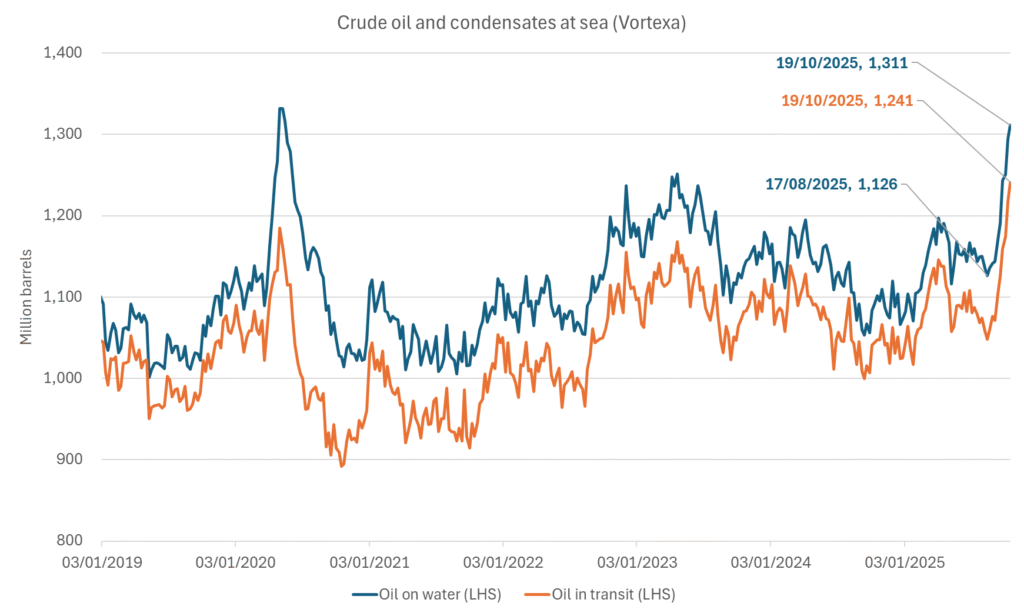

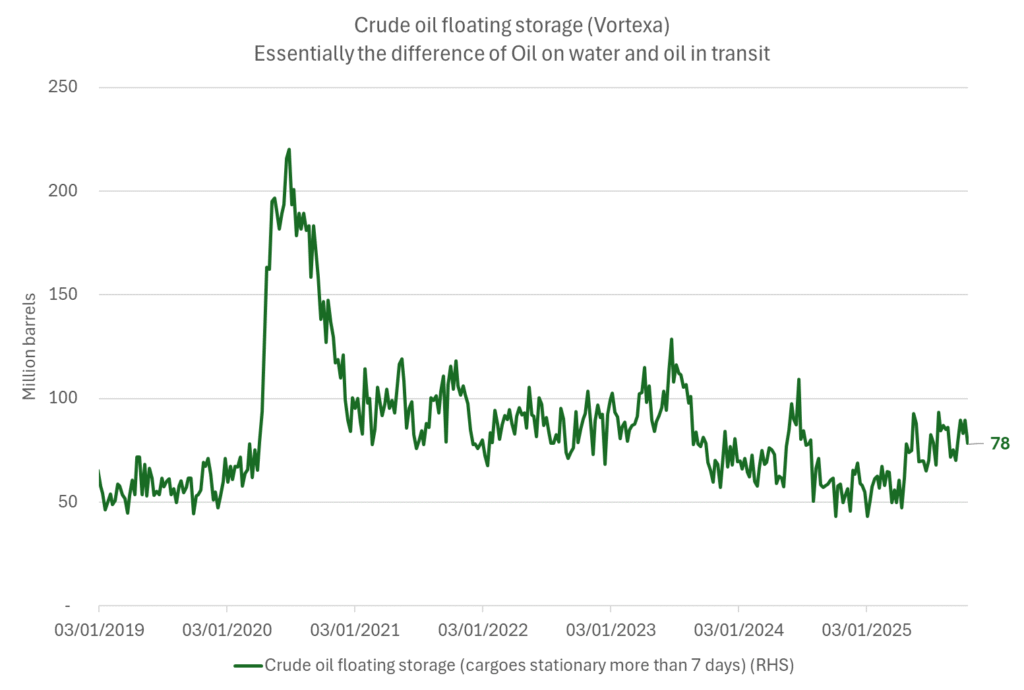

More weakness to come as lots of oil at sea comes to ports. Mid-East OPEC countries have boosted exports along with lower post summer consumption and higher production. The result is highly visibly in oil at sea which increased by 17 mb to 1,311 mb over the week to Sunday. Up 185 mb since mid-August. On its way to discharge at a port somewhere over the coming month or two.

Don’t forget that the oil market path ahead is all down to OPEC+. Remember that what is playing out in the oil market now is all by design by OPEC+. The group has decided that the unwind of the voluntary cuts is what it wants to do. In a combination of meeting demand from consumers as well as taking back market share. But we need to remember that how this plays out going forward is all at the mercy of what OPEC+ decides to do. It will halt the unwinding at some point. It will revert to cuts instead of unwind at some point.

A few months with Brent at $55/b and 40-50 US shale oil rigs kicked out may be what is needed. We think OPEC+ needs to see the exit of another 40-50 drilling rigs in the US shale oil patches to set US shale oil production on a path to of a 1 mb/d year on year decline Dec-25 to Dec-26. We are not there yet. But a 2-3 months period with Brent crude averaging $55/b would probably do it.

Oil on water increased 17 mb over the week to Sunday while oil in transit increased by 23 mb. So less oil was standing still. More was moving.

Crude oil floating storage (stationary more than 7 days). Down 11 mb over week to Sunday

The lowest point of the Brent crude oil curve versus the 5yr contract. Weakest so far this year.

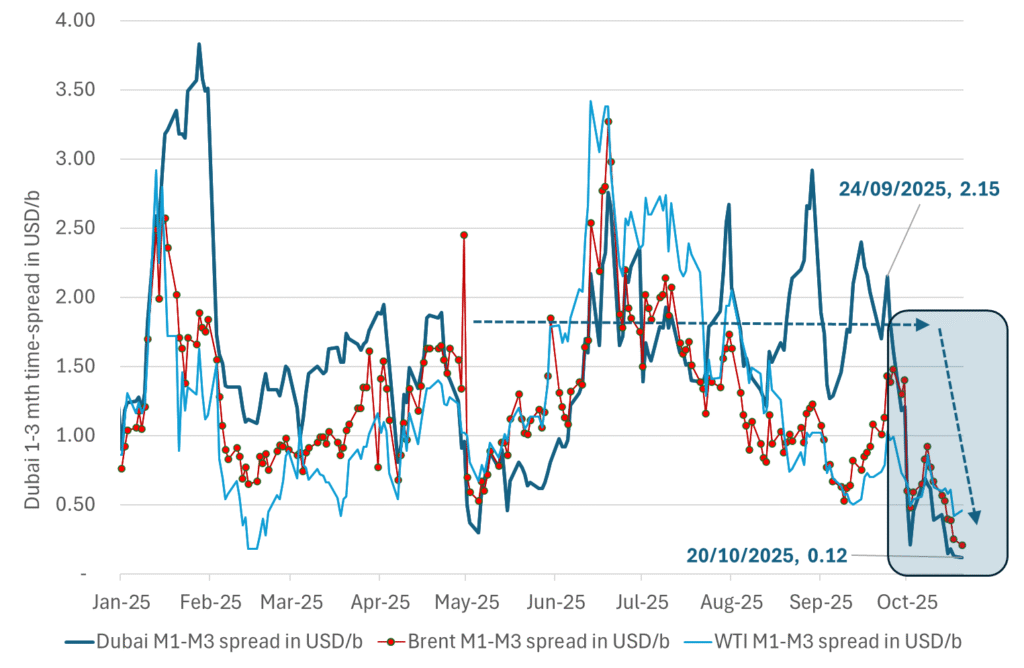

Crude oil 1mth to 3mth time-spreads. Dubai held out strongly through summer, but then that center of strength fell apart in late September and has been leading weakness in crude curves lower since then.

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanGoldman Sachs höjer prognosen för guld, tror priset når 4900 USD

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanBlykalla och amerikanska Oklo inleder ett samarbete

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanGuld nära 4000 USD och silver 50 USD, därför kan de fortsätta stiga

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanLeading Edge Materials är på rätt plats i rätt tid

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanNytt prisrekord, guld stiger över 4000 USD

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanEtt samtal om guld, olja, koppar och stål

-

Analys4 veckor sedan

Analys4 veckor sedanOPEC+ will likely unwind 500 kb/d of voluntary quotas in October. But a full unwind of 1.5 mb/d in one go could be in the cards

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanNeptune Energy bekräftar enorma litiumfyndigheter i Tyskland