Nyheter

David Hargreaves on Precious Metals, week 28 2014

What to make of precious metal prices is starting to perplex. Gold made a further advance, 1.2% to $1335/oz, whilst platinum tailed it with just 0.7% to $1508. Each trails its late 2012 peak but has pulled ahead in the past year. It is contrary to the economic news. The focus remains more on economic than political; oil is taking care of the latter.

What to make of precious metal prices is starting to perplex. Gold made a further advance, 1.2% to $1335/oz, whilst platinum tailed it with just 0.7% to $1508. Each trails its late 2012 peak but has pulled ahead in the past year. It is contrary to the economic news. The focus remains more on economic than political; oil is taking care of the latter.

As ever, the US holds the purse strings. QE will end in October, they tell us, with interest rate increases likely in Q3-Q4 2015. That is a long time in commodities, so gold maintains its head of steam. As we further report, India is keeping the lid – at least officially – on gold and silver imports and China appears to have slowed down. Yet the miners are busy getting their houses back in order, so newly mined supplies are tempered. Russia’s gold production rose 29% to 87t in January-May but is set for an overall year-on-year decrease of 5% in 2014 because of the postponement of large projects.

The World Gold Council counts most of the major producers as members and performs a long standing watchdog role. Members pay a fee based on ounces produced and the cost of these has persuaded two RSA – based miners, AngloGold Ashanti (NYSE AU) and Gold Fields (NYSE: GFI) not to renew. This comes as the London Gold Fix comes under scrutiny.

Dubai forges ahead in gold, silver and diamonds. We are told that when it introduces a spot gold contract in Q3 it will consider a silver contract too. The spot gold contract will be for one kilo (32.15 troy oz). The exchange, DGCX already trades gold futures. It has its eye too on softs. These could compliment the established Citi oil, Brent Crude and currencies.

India stays firm on gold. Two nations dominate the import and image of gold, India and China. Now whilst its annual mined output, c. 3000t, is dwarfed by its surface stocks, c. 150,000t, this matters. India is the larger importer, c. 1200t, since it has little domestic supply. This hurts its balance of payments, since some is re-exported in finished jewellery, but much goes under the bed. Now the new government has demanded in its state-budget to keep import duty on gold and silver unchanged at a record 10%.

The gold fix. Will, it, won’t it? Much speculation as to whether the venerable, twice daily, London god price fix will be scrapped. If so, what will replace it? The silver fix goes next month, so why not its big brother? A criticism of the fix is not just that it is archaic, perhaps unrepresentative, but open to manipulation. Right now five major banks meet AM and PM to set the daily price accordingly to their order books. The direct and indirect business that flows as a result is huge. It trickles down to the sale of a humble Krugerrand across a shop counter, which is normally basis the last fix.

The call is for more groups to be involved. As we write the World Gold Council has been in session, most of the week, at its London offices in a round table debate on reform and modernisation.

WIM says: We are still at a formative stage in determining if in total, some or any change will carry. Thinks if it ain’t broke don’t fix it?

The silver fix, long the property of the London Bullion Market Association, LBMA, is due to end next month. To be replaced by? Rumour is that the LBMA members have chosen CME/Thompson Reuters to replace it when it formally ends on August 15th. This bid war chose from a short list of seven that included the LME, Bloomberg, ETF Securities and Platts. Big hitters. We should hear on Monday.

Gold hedging, oh dear. When you are a miner of a commodity whose value has almost doubled in few years, only to slump by 30% meantime then recover about 80% of that, you have to ask, should I hedge? Should I sell my production forward? It is a tempting strategy. If you can lock in a potential profit of up to 50% on your cost of production you could be smiling. That does of course require you to produce. Suppose you fail and the price goes even higher? You have to buy-in and take a thumping loss. Even if you keep up your output but the price rises, your investors will note you could have made more. Hedging peaked at over 3000t – total world annual production – in 1999. This was the last year of a net position before 2011. At end March 2014 it stood at 87t. now Russia’s largest producer, Polyus Gold has forward sold 310,000oz (10t) over the next two years. Only a trickle, but an indicator.

[hr]

About David Hargreaves

David Hargreaves is a mining engineer with over forty years of senior experience in the industry. After qualifying in coal mining he worked in the iron ore mines of Quebec and Northwest Ontario before diversifying into other bulk minerals including bauxite. He was Head of Research for stockbrokers James Capel in London from 1974 to 1977 and voted Mining Analyst of the year on three successive occasions.

Since forming his own metals broking and research company in 1977, he has successfully promoted and been a director of several public companies. He currently writes “The Week in Mining”, an incisive review of world mining events, for stockbrokers WH Ireland. David’s research pays particular attention to steel via the iron ore and coal supply industries. He is a Chartered Mining Engineer, Fellow of the Geological Society and the Institute of Mining, Minerals and Materials, and a Member of the Royal Institution. His textbook, “The World Index of Resources and Population” accurately predicted the exponential rise in demand for steel industry products.

Nyheter

Vad guldets uppgång egentligen betyder för världen

Guldpriset har nyligen nått rekordnivåer, över 4 000 dollar per uns. Denna uppgång är inte bara ett resultat av spekulation, utan speglar djupare förändringar i den globala ekonomin. Bloomberg analyserar hur detta hänger samman med minskad tillit till dollarn, geopolitisk oro och förändrade investeringsmönster.

Guldets roll som säker tillgång har stärkts i takt med att förtroendet för den amerikanska centralbanken minskat. Osäkerhet kring Federal Reserves oberoende, inflationens utveckling och USA:s ekonomiska stabilitet har fått investerare att söka alternativ till fiatvalutor. Donald Trumps handelskrig har också bidragit till att underminera dollarns status som global reservvaluta.

Samtidigt ökar den geopolitiska spänningen, särskilt mellan USA och Kina. Kapitalflykt från Kina, driven av oro för övertryckta valutor och instabilitet i det finansiella systemet, har lett till ökad efterfrågan på guld. Även kryptovalutor som bitcoin stiger i värde, vilket tyder på ett bredare skifte mot hårda tillgångar.

Bloomberg lyfter fram att derivatmarknaden för guld visar tecken på spekulativ överhettning. Positioneringsdata och avvikelser i terminskurvor tyder på att investerare roterar bort från aktier och obligationer till guld. ETF-flöden och CFTC-statistik bekräftar denna trend.

En annan aspekt är att de superrika nu köper upp alla tillgångsslag – aktier, fastigheter, statsobligationer och guld – vilket bryter mot traditionella investeringslogiker där vissa tillgångar fungerar som motvikt till andra. Detta tyder på att marknaden är ur balans och att kapitalfördelningen är skev.

Sammanfattningsvis är guldets prisrally ett tecken på en värld i ekonomisk omkalibrering. Det signalerar misstro mot fiatvalutor, oro för geopolitisk instabilitet och ett skifte i hur investerare ser på risk och trygghet.

Nyheter

Spotpriset på guld över 4300 USD och silver över 54 USD

Guldpriset stiger i ett spektakulärt tempo, nya rekord sätts nu på löpande band. Terminspriset ligger oftast före i utvecklingen, men ikväll passerade även spotpriset på guld 4300 USD per uns. Guldet är just nu som ett ångande tåg som det hela tiden skyfflas in mer kol i. En praktisk fördel med ett högre pris är att det totala värdet på guld även blir högre, vilket gör att centralbanker och privatpersoner kan placera mer pengar i guld.

Även spotpriset på silver har nu passerat 54 USD vilket innebär att alla pristoppar från Hunt-brödernas klassiska squeeze på silver har passerats med marginal. Ett högt pris på guld påverkar främst köpare av smycken, men konsekvensen av ett högt pris på silver är betydligt mer kännbar. Silver är en metall som används inom många olika industrier, i allt från solceller till medicinsk utrustning.

Nyheter

Guld och silver stiger hela tiden mot nya höjder

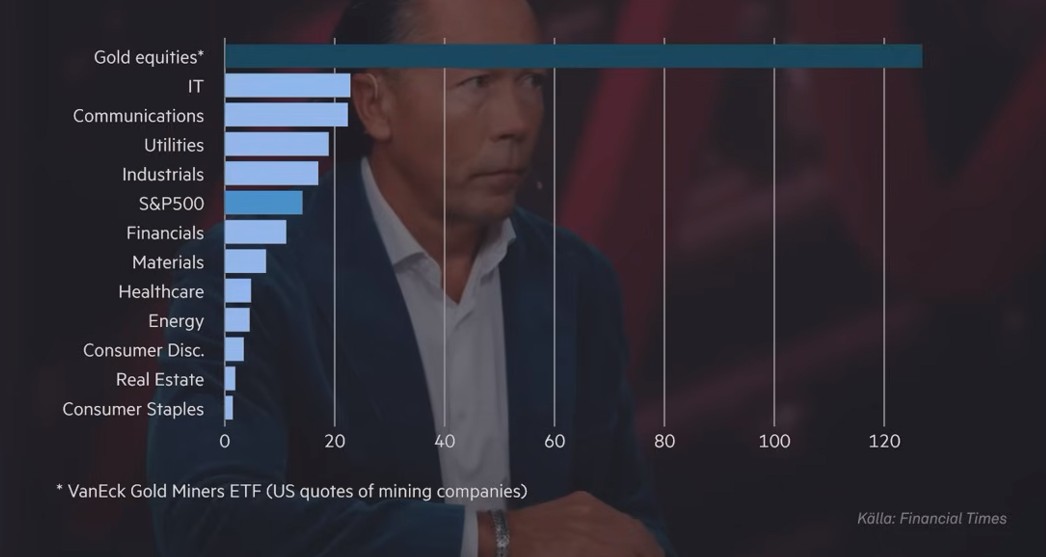

Priserna på guld och silver stiger hela tiden mot nya höjder. Eric Strand går här igenom vilka faktorerna som ligger bakom uppgångarna och vad som kan hända framöver. Han får även kommentera aktier inom guldgruvbolag som har haft en bättre utveckling än nästan allt annat. Han säger bland annat att uppgången kommer från låga nivåer och att det i genomsnitt är en mycket högre kvalitet på ledningarna för bolagen idag.

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanOPEC+ missar produktionsmål, stöder oljepriserna

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanEtt samtal om guld, olja, fjärrvärme och förnybar energi

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanGoldman Sachs höjer prognosen för guld, tror priset når 4900 USD

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanGuld nära 4000 USD och silver 50 USD, därför kan de fortsätta stiga

-

Analys3 veckor sedan

Analys3 veckor sedanAre Ukraine’s attacks on Russian energy infrastructure working?

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanBlykalla och amerikanska Oklo inleder ett samarbete

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanGuldpriset uppe på nya höjder, nu 3750 USD

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanEtt samtal om guld, olja, koppar och stål