Analys

SEB – Råvarukommentarer vecka 30

Sammanfattning av rekommendationer

Råvara – Rekommendation

Råolja – Köp OLJA S

Guld – Köp BULL GULD X4 S

Silver – Ingen rekommendation

Koppar – Köp KOPPAR S

Zink – Ingen rekommendation

Kaffe – Köp KAFFE S

Socker – Möjligen köp av SHORT SOCKE A S

Vete – Köp VETE S

Majs – Köp MAJS S

Sojabönor – Köp SOJABO S

Inledning

Den senaste månaden har majspriset stigit med 26%. Chicagovetet har gått upp med 25% och kostar nu återigen, för alla löptider, mer än Matif:s kvarnvete. Matif-vetet har ”bara” stigit med 18%. Sojabönorna med 14%. Vi fortsätter att ha en vy om högre priser på vete, maltkorn, majs, och sojabönor.

Vi har i princip köprekommendation på alla metaller, med tanke på stimulanser i Kina och att investeringar som vanligt sker under andra halvåret. Ett eventuellt QE3 kan också hjälpa till.

Europas problem är hotet mot väntade prisuppgångar.

Tekniskt börjar metallerna förlora momentum nedåt och ser ut att bottna ur från nedåtgående trender till sidledes. Produktionskostnaden ligger på de här nivåerna på metaller, utom för koppar. Det gör att det finns ett ”fundamentalt golv” för metallpriserna på nuvarande nivåer.

Brent tycker vi att man bör köpa på ”dippar” under 100 dollar.

Råolja – Brent

Den senaste månaden har priset på brentolja stigit upp från 90 dollar. Nu ligger priset över 100 dollar per fat. Orosmolnet är krisen i EU. Vad skulle hända om krisen förvärrades? Det är trots allt tämligen troligt, trots att ECB-chefen Mario Draghi idag drog i med brösttoner och försäkrade att ECB har oändligt stöd bland EU:s ledande politiker att lösa vilket problem som helst. Frågan är om en akut kris skulle leda till samma tvärnit i oljeefterfrågan som Lehman-krisen gjorde. Sedan 2005 producerade då OPEC så mycket de kunde, men när oljepriset i spåren efter Lehmankrisen fallit ner till 40 dollar lyckades Saudierna begränsa produktionen så att utbudet kunde dämpas och åstadkomma en effekt på priset.

Idag är beredskapen större än då. OPEC och saudierna har 2008 i gott minne. ECB likaså, liksom alla vi andra. Vi tror därför inte att ett prisfall på olja kan bli lika allvarligt, om en kris liknande Lehman-konkursen skulle inträffa. I och för sig är ett konkursande land inte lika stort som när en bank går omkull. Det är naturligtvis mycket större. Så det återstår att se vad som händer.

Just nu ligger priset på Brent för spotleverans över 100 dollar per fat och snittet hittills i år är 112.2 dollar per fat. Detta trots en svag tillväxt i USA och i Kina och i eurozonen. Samtidigt producerar Saudiarabien i närheten av det mesta de gjort på 30 år. Balansen i den globala oljemarknaden är stram med begränsad reservkapacitet. Risken kvarstår för produktionsbortfall i mellanöstern och vi går nu in i säsongsmässigt högre konsumtion. Detta borde tala för ett högre oljepris. Och oljepriset hade naturligtvis varit högre om inte EU hade så massiva problem. När vi fick positiva nyheter idag i form av Draghis kommentarer, reagerade oljepriset med att stiga. På nedsidan har vi Saudiarabiens prismål om 100 dollar per fat.

Ytterligare positiva faktorer är, som nämnt i inledningen, möjligheten för en kommande QE3 i USA, att Kinas stimulansåtgärder biter på den reala ekonomin och tillväxten, att jobless claims i USA igår förvånade på den positiva sidan.

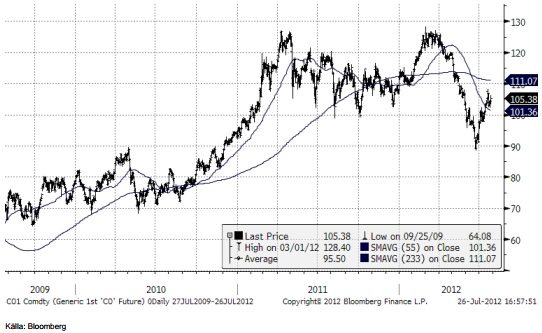

Nedan ser vi kursdiagrammet på spotkontraktet på Brent. 90 – 100 dollar tycks Brent vara köpvärt. Samtidigt finns ett kortsiktigt tekniskt motstånd på ca 110 dollar.

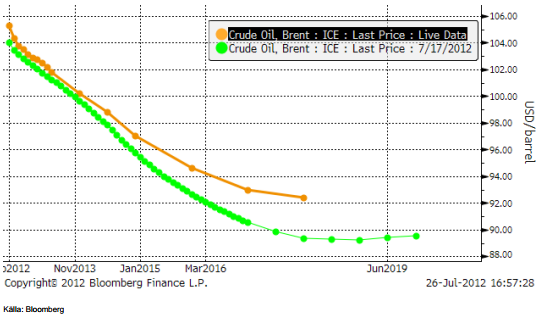

Råvarucertifikat får sin avkastning inte endast från stigande priser, utan också på att över tiden tillgodogöra sig rabatter på terminer i förhållande till spot. Vi ser i diagrammet nedan att terminer är billigare än spot på Brent. Genom att över tiden köpa billigt och sälja till spot (dyrt), samlar man på sig vinster. Råvarucertifikat gör just detta genom sin konstruktion. De hämtar sin avkastning från terminskontrakt, som ”rullas” in i längre kontrakt när tiden gjort att det gamla kontraktet är nära förfall. Att köpa t ex OLJA S, ochsitta på det, kan därför ge ganska hög avkastning, även om priset på råolja väntar med att stiga.

Guld

Att priset på guld rört sig sidledes och något nedåt i ett år, har varit en prövning för många guldinvesterare. Tekniska analytiker har också noterat att glidande medelvärden signalerar ”sälj”, som vi ser i diagrammet nedan. Det börjar dra ihop sig för guldpriset att lämna sin sidledes rörelse. Tekniskt stöd finns strax under dagens nivåer. Jag har markerat nivån med en linje som binder ihop bottennoteringarna det senaste året. Vi har också sjunkande motståndsnivåer.

Men vi kan faktiskt se en liten positiv signal. De senaste dagarna har priset brutit ett litet motstånd. Priset i dollar ligger i skrivande stund i 1616 dollar och det är över ett kortsiktigt motstånd. Detta kan vara början på ett mer betydande brott uppåt.

Den som är lite modig kan försöka sig på att köpa ett certifikat med hög hävstång och hög förlustrisk om priset vänder ner. Ett sådant är BULL GULD X4 S. Det ger 4 gångers utväxling på prisuppgångar (och till nackdel om priset istället faller).

Silver

Liksom guld uppvisar silver samma konsolideringsmönster det senaste året. Sin vana trogen är detta mycket häftigare för silver än för guld. Stödet på ca 26 dollar per uns är tydligt i silvermarknaden. Jag har ritat in nivån i diagrammet nedan. Motståndet från toppen under våren 2011 är också tydligt. När marknaden når en sådan här punkt, där priset trängs mellan stöd och motstånd brukar endera köpare eller säljare vinna, vilket då avgör om priset ska upp eller ner. Det återstår att se – och då vara snabb att ta position i LONG eller SHORT SILVER S, vilket det nu än visar sig bli.

Koppar

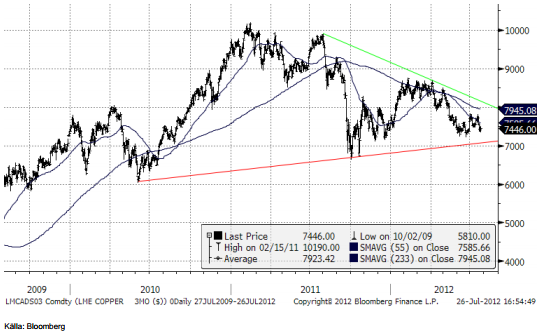

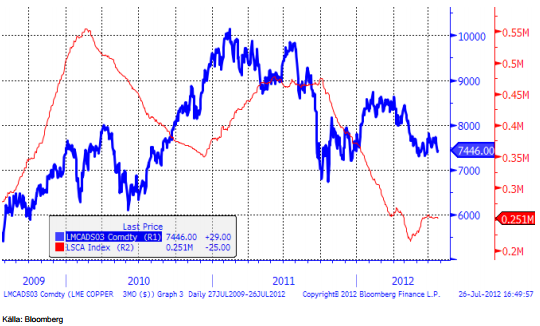

Prisfallet på koppar har förlorat momentum och tycks bottna ut när nedåttrenden försvagas. Tekniskt finns det stöd strax under dagens nivåer. Det bör finnas potential för högre pris på koppar.

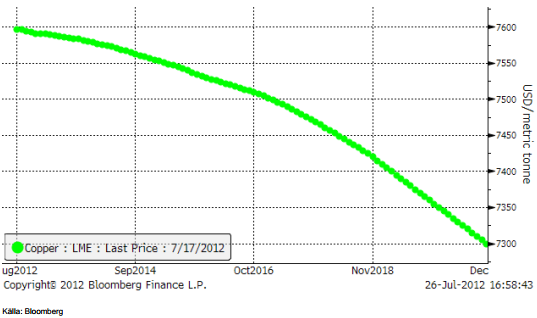

Bara att äga råvarucertifikat på koppar gör att man tjänar pengar, även om priset på koppar står still. Anledningen till detta är att kopparmarknaden är i backwardation, som vi ser i nedanstående diagram. När det är backwardation köper man terminer billigare än spot. Den rabatten blir en vinst över tiden. Koppar är en råvara som konsekvent över tiden ofta för att inte säga, nästan alltid, handlats med rabatt på terminerna. Trots att prisuppgången på t ex guld har varit så stor, har ändå en råvarucertifikatinvestering i koppar gett imponerande avkastning.

I nedanstående diagram ser vi kopparpriset och lagren i antal ton i LME:s lagerhus. Vi ser att lagrene har fallit sedan mitten av 2011. Konsumtionen är alltså större än produktionen. Det är ingen mekanisk sanning, men allt annat lika ”borde” sjunkande lager i vart fall ge stöd åt priset.

Vi rekommenderar köp av koppar, via ett råvarucertifikat utan hävstång och då är KOPPAR S ett sådant som skulle kunna placeras i.

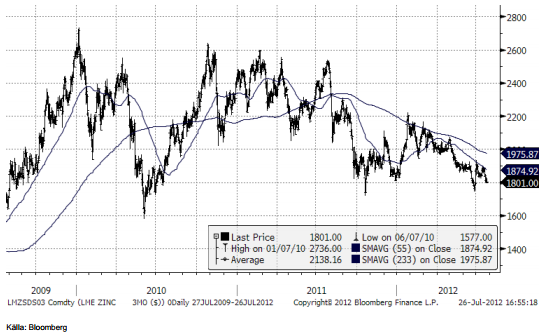

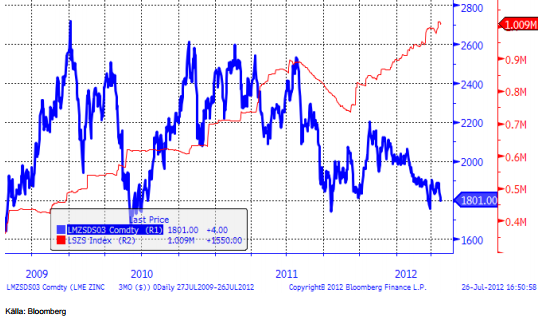

Zink

Zinkpriset ligger på bottennivåer i det prisintervall som etablerats sedan 2009. Produktionskostnaden för zink ligger på dessa nivåer. I råvarumarknaden brukar man kalla detta för råvarans ”fundamentala golv”. Vi ser därför inte några stora kursfallsrisker i zink.

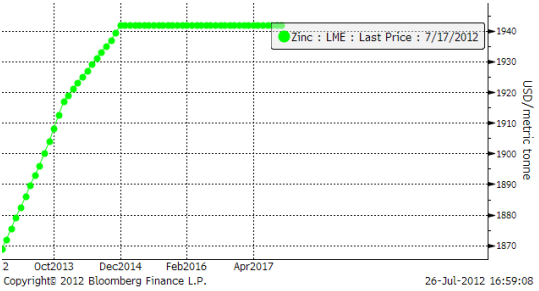

Zinkterminer handlas till skillnad från koppar och råolja i contango, dvs terminer är dyrare än spot. Det innebär att den som placerar i råvarucertifikat förlorar pengar, även om priset står still. Man skulle kunna se det som priset för att kursfallsrisken är begränsad av produktionskostnaden.

Lagren på LME har stigande på zink. Zink används mycket i byggindustrin (i stället för målarfärg på stål). När det är något av fastighetskris i stora delar av Europa är det inte förvånande att zinkmarknaden är under press.

Vi är positiva till zink, men inte lika mycket så som för koppar.

Kaffe

Priset på Arabica, som handlas i New York, har brutit sin nedåtgående trend, efter att ha varit nere på 150 cent per pund. 150 cent var toppnoteringen från slutet av 2009 och var därför för många en naturlig nivå att lägga in köpordrar på.

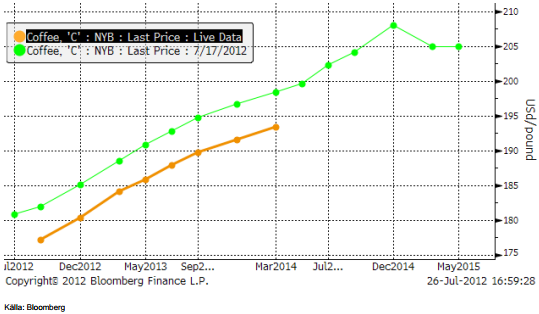

Det råder contango i terminsmarknaden för arabica-kaffe, som ser i nedanstående diagram.

Vi tycker att man kan börja köpa på sig certifikat på kaffe, på rekyler. Den rekyl vi har haft de senaste dagarna kan t ex vara ett sådant tillfälle. Om man inte önskar ta så hög risk kan råvarucertifikatet KAFFE S vara ett bra val.

Här väljer vi att klippa veckans utgåva SEBs nyhetsbrev Veckans Råvarukommentarer, då återstående innehåll även fanns i gårdagens SEB Jordbruksprodukter.

[box]SEB Veckobrev Veckans råvarukommentar är producerat av SEB Merchant Banking och publiceras i samarbete och med tillstånd på Råvarumarknaden.se[/box]

Disclaimer

The information in this document has been compiled by SEB Merchant Banking, a division within Skandinaviska Enskilda Banken AB (publ) (“SEB”).

Opinions contained in this report represent the bank’s present opinion only and are subject to change without notice. All information contained in this report has been compiled in good faith from sources believed to be reliable. However, no representation or warranty, expressed or implied, is made with respect to the completeness or accuracy of its contents and the information is not to be relied upon as authoritative. Anyone considering taking actions based upon the content of this document is urged to base his or her investment decisions upon such investigations as he or she deems necessary. This document is being provided as information only, and no specific actions are being solicited as a result of it; to the extent permitted by law, no liability whatsoever is accepted for any direct or consequential loss arising from use of this document or its contents.

About SEB

SEB is a public company incorporated in Stockholm, Sweden, with limited liability. It is a participant at major Nordic and other European Regulated Markets and Multilateral Trading Facilities (as well as some non-European equivalent markets) for trading in financial instruments, such as markets operated by NASDAQ OMX, NYSE Euronext, London Stock Exchange, Deutsche Börse, Swiss Exchanges, Turquoise and Chi-X. SEB is authorized and regulated by Finansinspektionen in Sweden; it is authorized and subject to limited regulation by the Financial Services Authority for the conduct of designated investment business in the UK, and is subject to the provisions of relevant regulators in all other jurisdictions where SEB conducts operations. SEB Merchant Banking. All rights reserved.

Analys

Sell the rally. Trump has become predictable in his unpredictability

Hesitant today. Brent jumped to an intraday high of $66.36/b yesterday after having touched an intraday low of $60.07/b on Monday as Indian and Chinese buyers cancelled some Russian oil purchases and instead redirected their purchases towards the Middle East due to the news US sanctions. Brent is falling back 0.4% this morning to $65.8/b.

It’s our strong view that the only sensible thing is to sell this rally. In all Trump’s unpredictability he has become increasingly predictable. Again and again he has rumbled about how he is going to be tough on Putin. Punish Putin if he won’t agree to peace in Ukraine. Recent rumbling was about the Tomahawk rockets which Trump threatened on 10 October and 12 October to sell/send to Ukraine. Then on 17 October he said that ”the U.S. didn’t want to give away weapons (Tomahawks) it needs”.

All of Trump’s threats towards Putin have been hot air. So far Trump’s threats have been all hot air and threats which later have evaporated after ”great talks with Putin”. After all these repetitions it is very hard to believe that this time will be any different. The new sanctions won’t take effect before 21. November. Trump has already said that: ”he was hoping that these new sanctions would be very short-lived in any case”. Come 21. November these new sanctions will either evaporate like all the other threats Trump has thrown at Putin before fading them. Or the sanctions will be postponed by another 4 weeks or 8 weeks with the appearance that Trump is even more angry with Putin. But so far Trump has done nothing that hurt Putin/Russia. We can’t imagine that this will be different. The only way forward in our view for a propre lasting peace in Ukraine is to turn Ukraine into defensive porcupine equipped with a stinging tail if need be.

China will likely stand up to Trump if new sanctions really materialize on 21 Nov. Just one country has really stood up to Trump in his tariff trade war this year: China. China has come of age and strength. I will no longer be bullied. Trump upped tariffs. China responded in kind. Trump cut China off from high-end computer chips. China put on the breaks on rare earth metals. China won’t be bullied any more and it has the power to stand up. Some Chinese state-owned companies like Sinopec have cancelled some of their Russian purchases. But China’s Foreign Ministry spokesperson Guo Jiakun has stated that China “oppose unilateral sanctions which lack a basis in international law and authorization of the UN Security Council”. Thus no one, not even the US shall unilaterally dictate China from whom they can buy oil or not. This is yet another opportunity for China to show its new strength and stand up to Trump in a show of force. Exactly how China choses to play this remains to be seen. But China won’t be bullied by over something as important as its oil purchases. So best guess here is that China will defy Trump on this. But probably China won’t need to make a bid deal over this. Firstly because these new sanctions will either evaporate as all the other threats or be postponed once we get to 21 November. Secondly because the sanctions are explicit towards US persons and companies but only ”may” be enforced versus non-US entities.

Sanctions is not a reduction in global supply of oil. Just some added layer of friction. Anyhow, the new sanctions won’t reduce the supply of Russian crude oil to the market. It will only increase the friction in the market with yet more need for the shadow fleet and ship to ship transfer of Russian oil to dodge the sanctions. If they materialize at all.

The jump in crude oil prices is probably due to redirections of crude purchases to the Mid-East and not because all speculators are now turned bullish. Has oil rallied because all speculators now suddenly have turned bullish? We don’t think so. Brent crude has probably jumped because some Indian and Chinese oil purchasers of have redirected their purchases from Russia towards the Mid-East just in case the sanctions really materializes on 21 November.

Analys

Brent crude set to dip its feet into the high $50ies/b this week

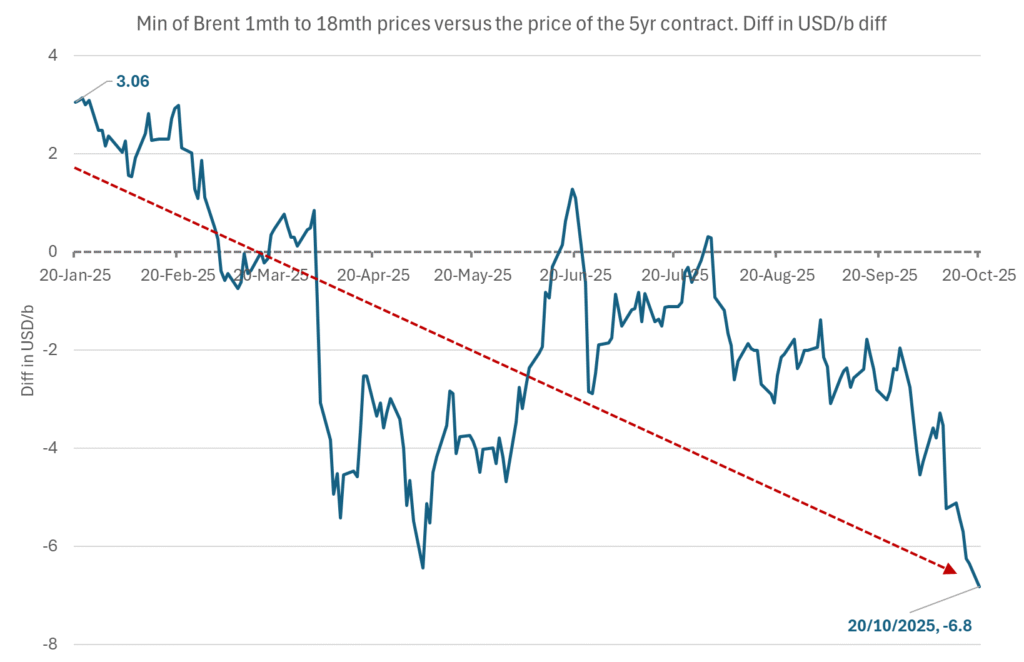

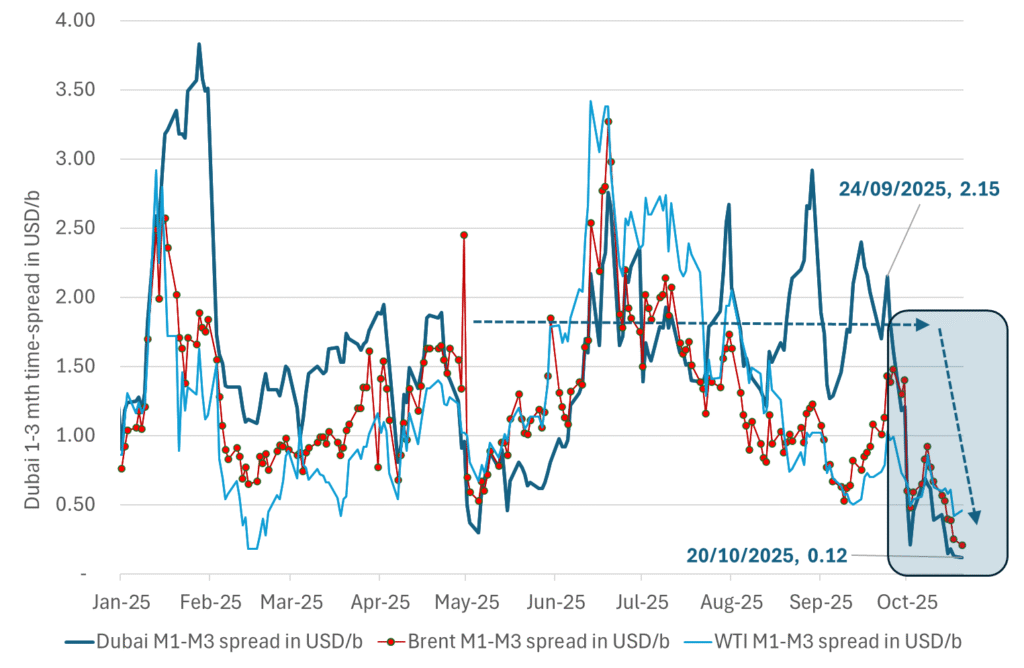

Parts of the Brent crude curve dipping into the high $50ies/b. Brent crude fell 2.3% over the week to Friday. It closed the week at $61.29/b, a slight gain on the day, but also traded to a low of $60.14/b that same day and just barely avoided trading into the $50ies/b. This morning it is risk-on in equities which seems to help industrial metals a little higher. But no such luck for oil. It is down 0.8% at $60.8/b. This week looks set for Brent crude to dip its feet in the $50ies/b. The Brent 3mth contract actually traded into the high $50ies/b on Friday.

The front-end backwardation has been on a weakening foot and is now about to fully disappear. The lowest point of the crude oil curve has also moved steadily lower and lower and its discount to the 5yr contract is now $6.8/b. A solid contango. The Brent 3mth contract did actually dip into the $50ies/b intraday on Friday when it traded to a low point of $59.93/b.

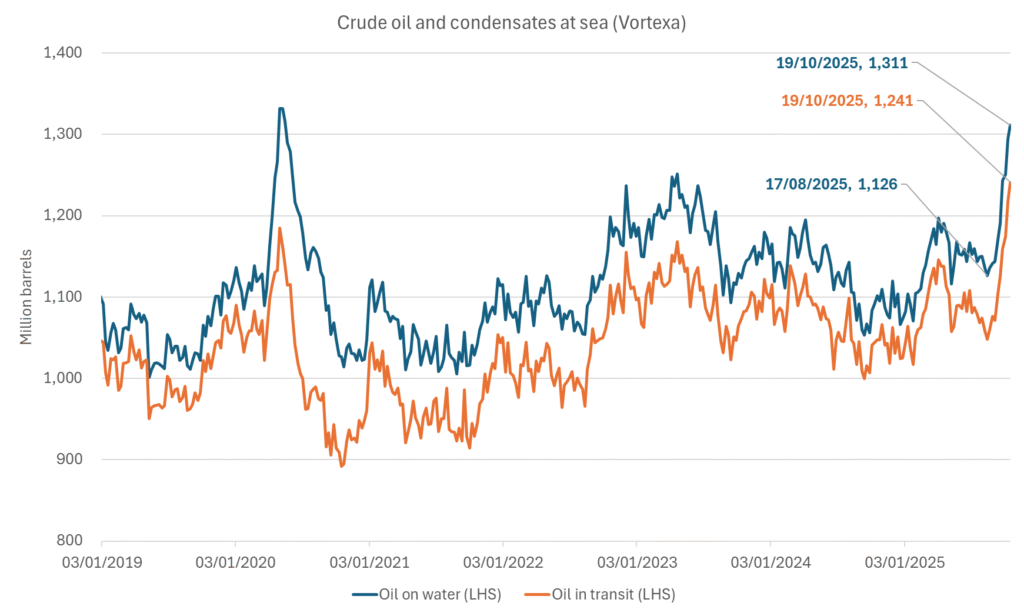

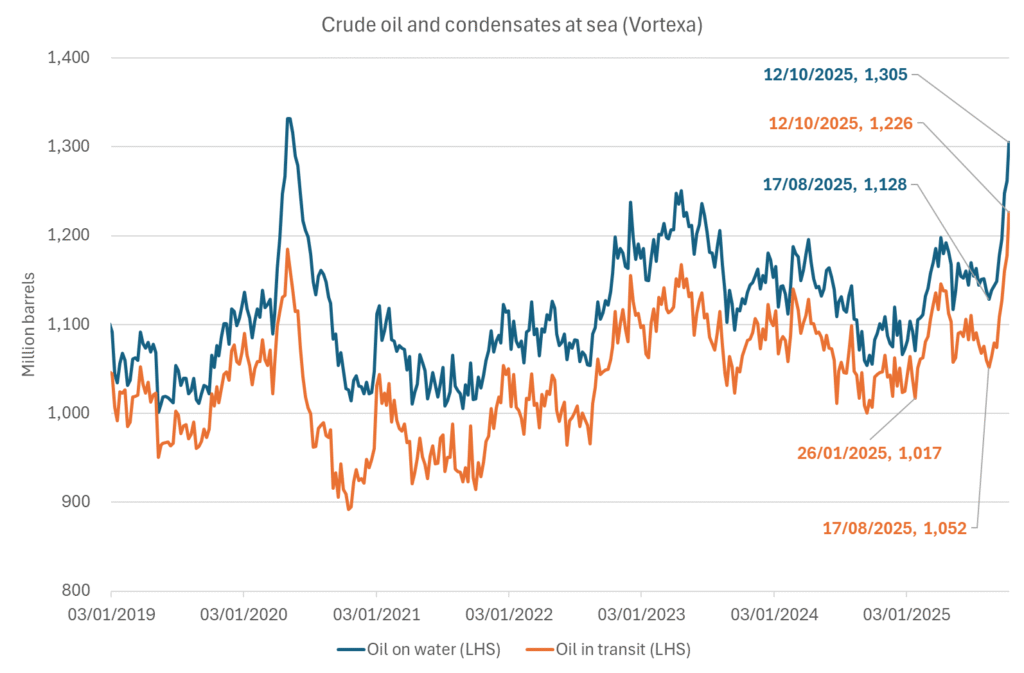

More weakness to come as lots of oil at sea comes to ports. Mid-East OPEC countries have boosted exports along with lower post summer consumption and higher production. The result is highly visibly in oil at sea which increased by 17 mb to 1,311 mb over the week to Sunday. Up 185 mb since mid-August. On its way to discharge at a port somewhere over the coming month or two.

Don’t forget that the oil market path ahead is all down to OPEC+. Remember that what is playing out in the oil market now is all by design by OPEC+. The group has decided that the unwind of the voluntary cuts is what it wants to do. In a combination of meeting demand from consumers as well as taking back market share. But we need to remember that how this plays out going forward is all at the mercy of what OPEC+ decides to do. It will halt the unwinding at some point. It will revert to cuts instead of unwind at some point.

A few months with Brent at $55/b and 40-50 US shale oil rigs kicked out may be what is needed. We think OPEC+ needs to see the exit of another 40-50 drilling rigs in the US shale oil patches to set US shale oil production on a path to of a 1 mb/d year on year decline Dec-25 to Dec-26. We are not there yet. But a 2-3 months period with Brent crude averaging $55/b would probably do it.

Oil on water increased 17 mb over the week to Sunday while oil in transit increased by 23 mb. So less oil was standing still. More was moving.

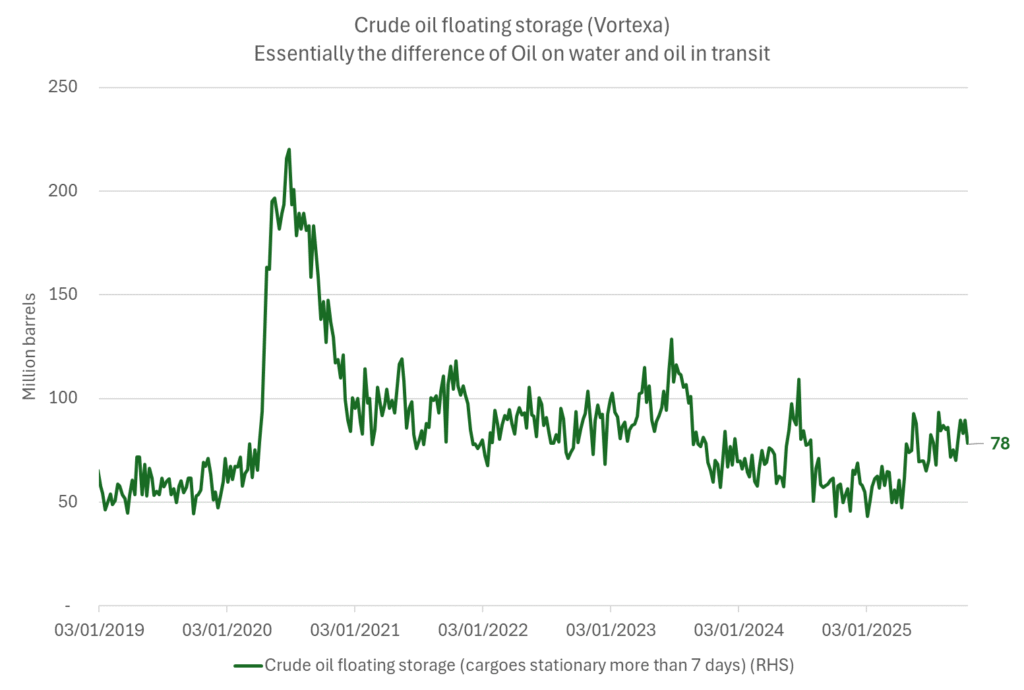

Crude oil floating storage (stationary more than 7 days). Down 11 mb over week to Sunday

The lowest point of the Brent crude oil curve versus the 5yr contract. Weakest so far this year.

Crude oil 1mth to 3mth time-spreads. Dubai held out strongly through summer, but then that center of strength fell apart in late September and has been leading weakness in crude curves lower since then.

Analys

Crude oil soon coming to a port near you

Rebounding along with most markets. But concerns over solidity of Gaza peace may also contribute. Brent crude fell 0.8% yesterday to $61.91/b and its lowest close since May this year. This morning it is bouncing up 0.9% to $62.5/b along with a softer USD amid positive sentiment with both equities and industrial metals moving higher. Concerns that the peace in Gaza may be less solid than what one might hope for also yields some support to Brent. Bets on tech stocks are rebounding, defying fears of trade war. Money moving back into markets. Gold continues upwards its strong trend and a softer dollar helps it higher today as well.

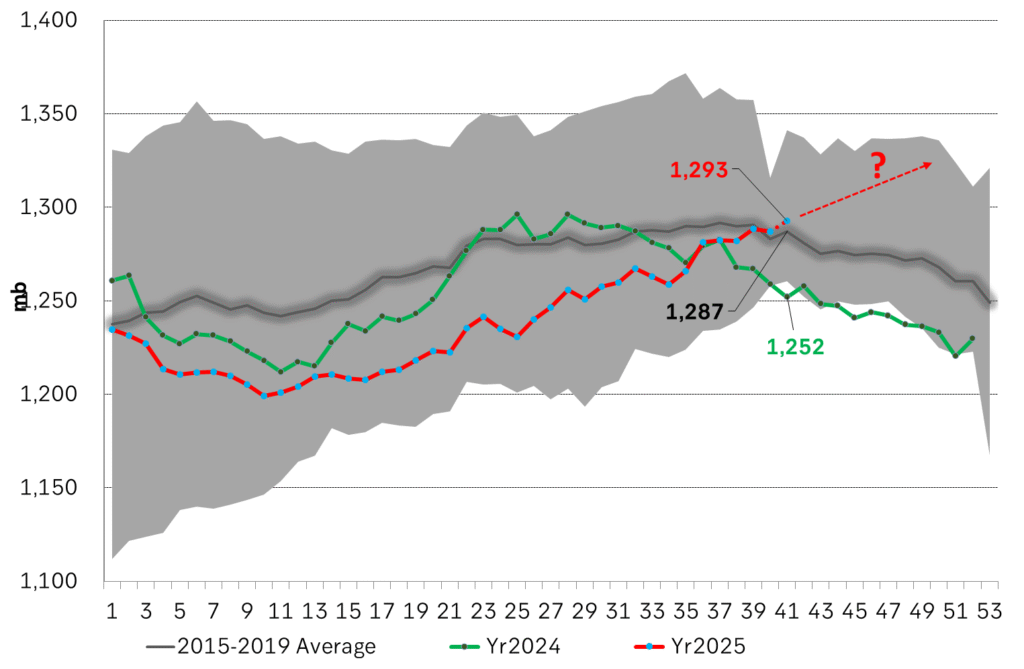

US crude & products probably rose 5.6 mb last week (API) versus a normal seasonal decline of 2.4 mb. The US API last night partial and thus indicative data for US oil inventories. Their data indicates that US crude stocks rose 7.4 mb last week, gasoline stocks rose 3.0 mb while Distillate stocks fell 4.8 mb. Altogether an increase in commercial crude and product stocks of 5.6 mb. Commercial US crude and product stocks normally decline by 2.4 mb this time of year. So seasonally adjusted the US inventories rose 8 mb last week according to the indicative numbers by the API. That is a lot. Also, the counter seasonal trend of rising stocks versus normally declining stocks this time of year looks on a solid pace of continuation. If the API is correct then total US crude and product stocks would stand 41 mb higher than one year ago and 6 mb higher than the 2015-19 average. And if we combine this with our knowledge of a sharp increase in production and exports by OPEC(+) and a large increase in oil at sea, then the current trend in US oil inventories looks set to continue. So higher stocks and lower crude oil prices until OPEC(+) switch to cuts. Actual US oil inventory data today at 18:00 CET.

US commercial crude and product stocks rising to 1293 mb in week 41 if last nights indicative numbers from API are correct.

Crude oil soon coming to a port near you. OPEC has lifted production sharply higher this autumn. At the same time demand for oil in the Middle-East has fallen as we have moved out of summer heat and crude oil burn for power for air-conditioning. The Middle-East oil producers have thus been able to lift exports higher on both accounts. Crude oil and condensates on water has shot up by 177 mb since mid-August. This oil is now on its way to ports around the world. And when they arrive, it will likely help to lift stocks onshore higher. That is probably when we will lose the last bit of front-end backwardation the the crude oil curves. That will help to drive the front-month Brent crude oil price down to the $60/b line and revisit the high $50ies/b. Then the eyes will be all back on OPEC+ when they meet in early November and then again in early December.

Crude oil and condensates at sea have moved straight up by 177 mb since mid-August as OPEC(+) has produced more, consumed less and exported more.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanOPEC+ missar produktionsmål, stöder oljepriserna

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanGoldman Sachs höjer prognosen för guld, tror priset når 4900 USD

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanBlykalla och amerikanska Oklo inleder ett samarbete

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanGuld nära 4000 USD och silver 50 USD, därför kan de fortsätta stiga

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanLeading Edge Materials är på rätt plats i rätt tid

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanNytt prisrekord, guld stiger över 4000 USD

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanEtt samtal om guld, olja, koppar och stål

-

Analys3 veckor sedan

Analys3 veckor sedanOPEC+ will likely unwind 500 kb/d of voluntary quotas in October. But a full unwind of 1.5 mb/d in one go could be in the cards