Analys

Shale oil denial once again?

Price action – Dollar headwinds driving speculators to take money off the table

Price action – Dollar headwinds driving speculators to take money off the table

Equities across the board rebounded 0.7% ydy following the recent North Korea driven sell-off. The USD Index however gained 0.4% on the day which helped to drive all commodity indices lower with the overall Blbrg commodity index down 0.7% with energy losing the most. Brent crude sold down 2.6% closing at $50.73/b while the longer dated Brent Dec 2020 contract only lost 1% closing at $52.62/b.

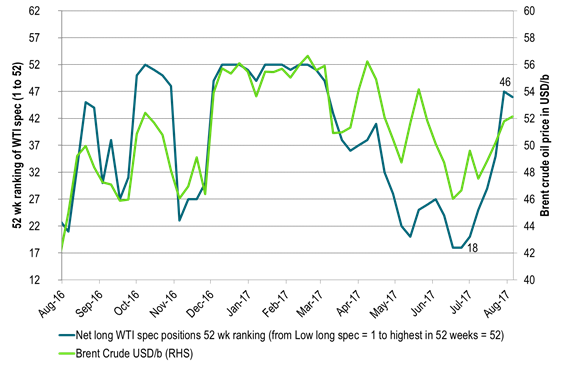

Since a Brent crude oil price low of $44.35/b in June 21st net long speculative WTI positions have moved in only one direction – up. Since then the number of net long speculative WTI contracts have increased by 156,000 contracts (+42%) or 156 mb. As of Tuesday last week the number of net long speculative WTI contracts stood at 532,000 contracts which was the 7th highest speculative position over the past 52 weeks. Except for the release of the US EIA’s monthly Drilling Productivity report there was little in the news that warranted the 2.6% sell-off in Brent crude oil prices other than speculators taking money off the table following 7 consecutive weeks of rising long bets.

Crude oil comment – Shale oil denial once again?

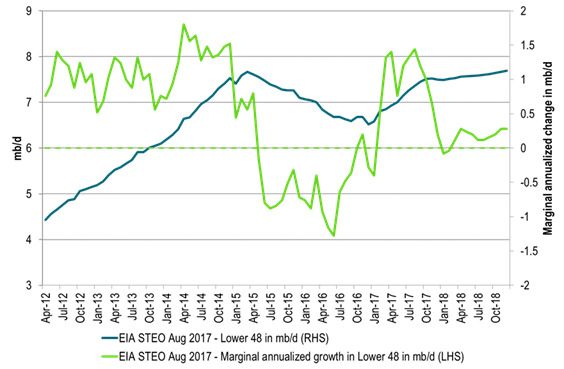

What puzzles us a lot is graph 2 below. It shows the US EIA’s projection of US crude oil production coming out of Lower 48 states (i.e. ex Gulf of Mexico and Alaska). Thus it basically constitutes US shale oil production even though it includes a million or two of US crude production which is not shale oil as well.

What the the US EIA STEO August report projects is that from January to September the marginal, annualized Lower 48 crude oil production growth has averaged 1.25 mb/d. That we buy into. Then however, from October 2017 onwards their projected growth rate then suddenly collapse to a marginal annualized growth rate of only +0.2 mb/d all to the end of 2018 (on average).

When the US shale oil production was booming from 2011 to 2015 the story was always that yes, production is growing strongly now, but next year it will taper off. The tapering off never happened before the oil price collapsed and all breaks were on. During 2012, 2013 and 2014 the US shale oil production grew relentlessly at an annual pace of 1 mb/d.

Thus even if the market is fully aware of US shale oil these days. Fully aware that rigs are rising and productivity is rising. The story still looks a bit the same in terms of what the US EIA currently is projecting in its August STEO report. Yes, shale oil is growing at a strong marginal, annual pace now, but from October onwards it is all going to slow sharply. Thus shale oil awareness is definitely there but is it again too pesimistic in terms of volumes delivered down the road just as was the case consistently from 2012 to 2014/15. Still some kind of shale oil denial in a way in terms of production down the road.

Yesterday the US EIA released its drilling productivity report (DPR) and its DUC’s report (Drilled wells and uncompleted wells). First out the reports stated a projection that US shale oil production will increase by 117 kb/d mth/mth to September. That equals a marginal, annualized pace of 1.4 mb/d per year. The puzzle is that the EIA projects that this strong growth rate is going to suddenly fall back in October onwards.

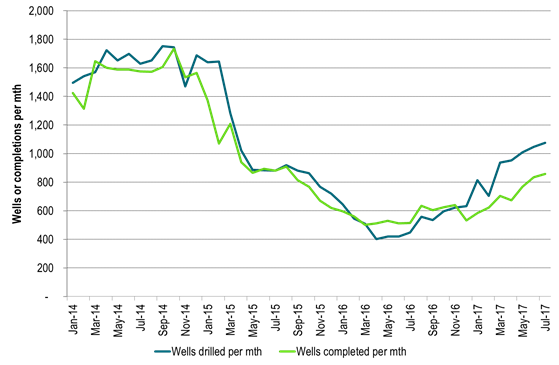

What was further revealed was that the number of completed wells per month continued to rise by 25 wells mth/mth to 859 wells in July. Completions were however still trailing way behind the number of wells drilled by more than 200 wells. Wells drilled reached 1075 wells in July which also was an increase mth/mth by 28 wells. Thus completions are rising but are still solidly trailing behind drilling of wells.

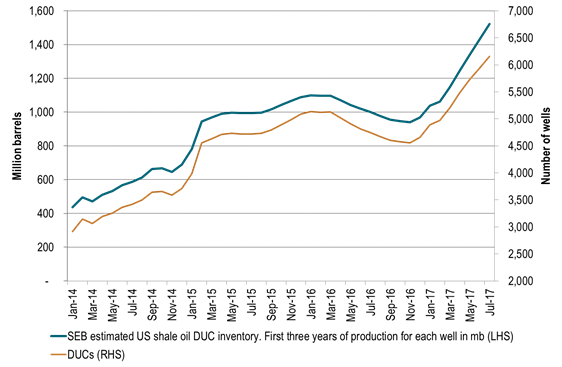

For US shale oil production to slow down we first need to see a halt in the number of drilling rigs being added into operation. Only 2 implied shale oil rigs were added last week, but the number is still rising marginally rather than falling. But yes, that part is slowing down. The next step then is to see that completions manage to catch up with drilling. I.e. completions needs to move from a July level of 859 wells completed to at least 1075 wells drilled. Then the last step is that completions start to draw down the now very high DUC inventory which has seen an increase of 1595 wells since November 2016 now standing at 6154 wells.

So during the unavoidable (some time in the future) draw down period of DUCs we need to see that completions move above drilled wells per month in order to draw down the DUC inventory. I.e. the number of wells completed should move above 1075 wells per month unless of course the number of drilling rigs declines. A lower oil price or reduced access to capital is typically the driving forces which would lead to a reduction in drilling rigs. Captial spending and profitability is definitely at the top end of the agenda these days in the shale oil space.

In terms of the DUC inventory build up. In perspective the 1595 wells added since November last year equates to some 5-600 million barrels of additional producible oil within a three year time frame. That is if we assume 350,000 barrels of oil from each well during the first three years of production on average for all wells.

In this perspective it is difficult to understand the US EIA’s projection that US L48 crude oil production growth is going to slow sharply from October onwards. Drilling rigs are still rising (although slowly) and completions still has a lot of catching up to do just to get up to speed with drilling and then some to draw down the DUC inventory.

Not surprisingly we are bullish for US crude oil production for 2018 where we expect US crude oil production to increase y/y by 1.5 mb/d rather than the US EIA’s y/y projecting that US crude oil will only increase 0.6 mb/d y/y to 2018.

OPEC will have a lont on its hands in 2018 and will likely need to manage supply all through to the end of 2018 rather than to end of Q1-17.

(Data for drilling and completions etc in this report were for the regions Anadarko, Bakken, Eagle Ford, Niobrara and Permian and are from the US EIA.)

Ch1 – Net long specs in WTI reached the 7th highest in a year last Tuesday

A strong, long rise in net long spec since the price low in late June

Sideways price action during most of August with no success to the upside when Brent hit $53.64/b.

Then dollar headwinds and North Korea risk aversion. Both pushing specs to take money off the table

Oil prices in graph are averaged over weeks ending Tuesday. Same as specs reporting

Ch2 – US EIA STEO August report projects a sharp slowdown in marginal growth in US L48 crude oil production from October onwards

How is that possible when drilling rig count is still rising and completions are still working hard catching up rising as well.

Ch3 – Completions of shale wells rising as they try to catch up to drilled wells per month which is also rising (US EIA August DUC report)

Today’s level looks unimpressive versus 2014 levels. But they need to be adjusted with productivity improvements

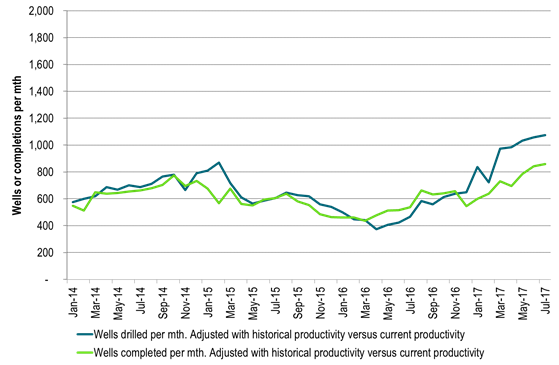

Ch3 – Productivity adjusted – Completions of shale wells rising as they try to catch up to drilled wells per month which is also rising (US EIA August DUC report)

If we productivity adjust the historical data of number of wells drilled and completed with productivity then:

a) Number of drilled wells today per month is 40% higher then the previous peak in September 2014

b) Number of completed wells is 11% higher than the previous peak in October 2014

If completions catches up to current drilling then completions will run 40% higher than the previous peak in October 2014 in productivity adjusted terms.

Ch 4 – Strong rise in DUC (uncompleted wells) inventory since November last year

Equating it to oil it has increased close to 600 mb since Nov last year in terms of oil from first three years of production each well

Kind regards

Bjarne Schieldrop

Chief analyst, Commodities

SEB Markets

Merchant Banking

Analys

’wait and see’ mode

So far this week, Brent Crude prices have strengthened by USD 1.3 per barrel since Monday’s opening. While macroeconomic concerns persist, they have somewhat abated, resulting in muted price reactions. Fundamentals predominantly influence global oil price developments at present. This week, we’ve observed highs of USD 89 per barrel yesterday morning and lows of USD 85.7 per barrel on Monday morning. Currently, Brent Crude is trading at a stable USD 88.3 per barrel, maintaining this level for the past 24 hours.

Additionally, there has been no significant price reaction to Crude following yesterday’s US inventory report (see page 11 attached):

- US commercial crude inventories (excluding SPR) decreased by 6.4 million barrels from the previous week, standing at 453.6 million barrels, roughly 3% below the five-year average for this time of year.

- Total motor gasoline inventories decreased by 0.6 million barrels, approximately 4% below the five-year average.

- Distillate (diesel) inventories increased by 1.6 million barrels but remain weak historically, about 7% below the five-year average.

- Total commercial petroleum inventories (crude + products) decreased by 3.8 million barrels last week.

Regarding petroleum products, the overall build/withdrawal aligns with seasonal patterns, theoretically exerting limited effect on prices. However, the significant draw in commercial crude inventories counters the seasonality, surpassing market expectations and API figures released on Tuesday, indicating a draw of 3.2 million barrels (compared to Bloomberg consensus of +1.3 million). API numbers for products were more in line with the US DOE.

Against this backdrop, yesterday’s inventory report is bullish, theoretically exerting upward pressure on crude prices.

Yet, the current stability in prices may be attributed to reduced geopolitical risks, balanced against demand concerns. Markets are adopting a wait-and-see approach ahead of Q1 US GDP (today at 14:30) and the Fed’s preferred inflation measure, “core PCE prices” (tomorrow at 14:30). A stronger print could potentially dampen crude prices as market participants worry over the demand outlook.

Geopolitical “risk premiums” have decreased from last week, although concerns persist, highlighted by Ukraine’s strikes on two Russian oil depots in western Russia and Houthis’ claims of targeting shipping off the Yemeni coast yesterday.

With a relatively calmer geopolitical landscape, the market carefully evaluates data and fundamentals. While the supply picture appears clear, demand remains the predominant uncertainty that the market attempts to decode.

Analys

Also OPEC+ wants to get compensation for inflation

Brent crude has fallen USD 3/b since the peak of Iran-Israel concerns last week. Still lots of talk about significant Mid-East risk premium in the current oil price. But OPEC+ is in no way anywhere close to loosing control of the oil market. Thus what will really matter is what OPEC+ decides to do in June with respect to production in Q3-24 and the market knows this very well. Saudi Arabia’s social cost-break-even is estimated at USD 100/b today. Also Saudi Arabia’s purse is hurt by 21% US inflation since Jan 2020. Saudi needs more money to make ends meet. Why shouldn’t they get a higher nominal pay as everyone else. Saudi will ask for it

Brent is down USD 3/b vs. last week as the immediate risk for Iran-Israel has faded. But risk is far from over says experts. The Brent crude oil price has fallen 3% to now USD 87.3/b since it became clear that Israel was willing to restrain itself with only a muted counter attack versus Israel while Iran at the same time totally played down the counterattack by Israel. The hope now is of course that that was the end of it. The real fear has now receded for the scenario where Israeli and Iranian exchanges of rockets and drones would escalate to a point where also the US is dragged into it with Mid East oil supply being hurt in the end. Not everyone are as optimistic. Professor Meir Javedanfar who teaches Iranian-Israeli studies in Israel instead judges that ”this is just the beginning” and that they sooner or later will confront each other again according to NYT. While the the tension between Iran and Israel has faded significantly, the pain and anger spiraling out of destruction of Gaza will however close to guarantee that bombs and military strifes will take place left, right and center in the Middle East going forward.

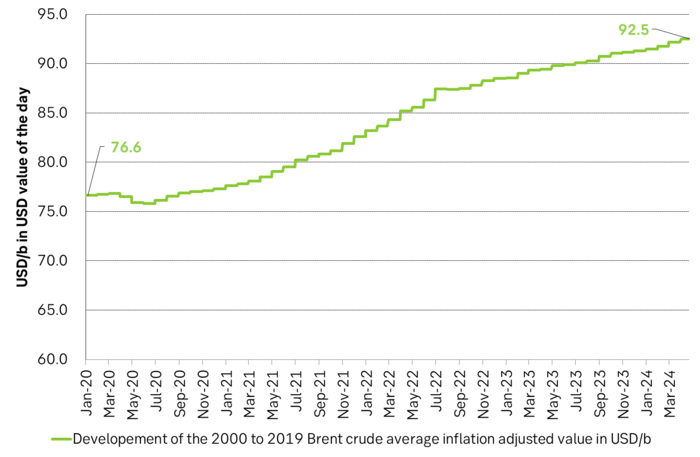

Also OPEC+ wants to get paid. At the start of 2020 the 20 year inflation adjusted average Brent crude price stood at USD 76.6/b. If we keep the averaging period fixed and move forward till today that inflation adjusted average has risen to USD 92.5/b. So when OPEC looks in its purse and income stream it today needs a 21% higher oil price than in January 2020 in order to make ends meet and OPEC(+) is working hard to get it.

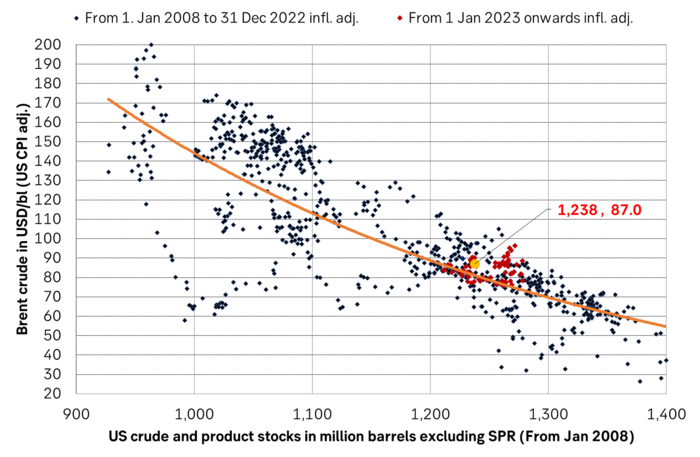

Much talk about Mid-East risk premium of USD 5-10-25/b. But OPEC+ is in control so why does it matter. There is much talk these days that there is a significant risk premium in Brent crude these days and that it could evaporate if the erratic state of the Middle East as well as Ukraine/Russia settles down. With the latest gains in US oil inventories one could maybe argue that there is a USD 5/b risk premium versus total US commercial crude and product inventories in the Brent crude oil price today. But what really matters for the oil price is what OPEC+ decides to do in June with respect to Q3-24 production. We are in no doubt that the group will steer this market to where they want it also in Q3-24. If there is a little bit too much oil in the market versus demand then they will trim supply accordingly.

Also OPEC+ wants to make ends meet. The 20-year real average Brent price from 2000 to 2019 stood at USD 76.6/b in Jan 2020. That same averaging period is today at USD 92.5/b in today’s money value. OPEC+ needs a higher nominal price to make ends meet and they will work hard to get it.

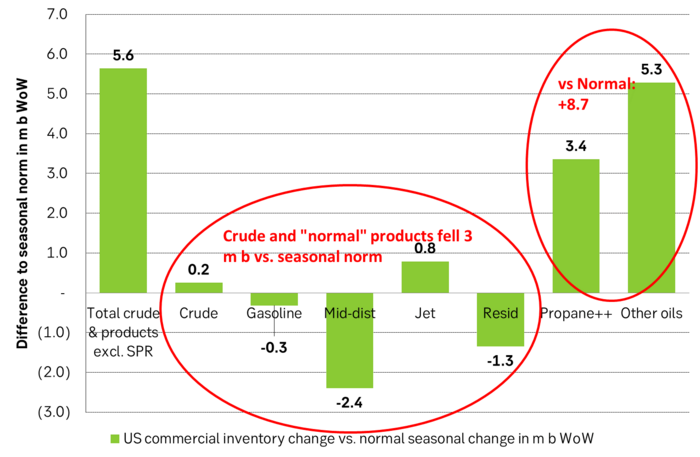

Inflation adjusted Brent crude price versus total US commercial crude and product stocks. A bit above the regression line. Maybe USD 5/b risk premium. But type of inventories matter. Latest big gains were in Propane and Other oils and not so much in crude and products

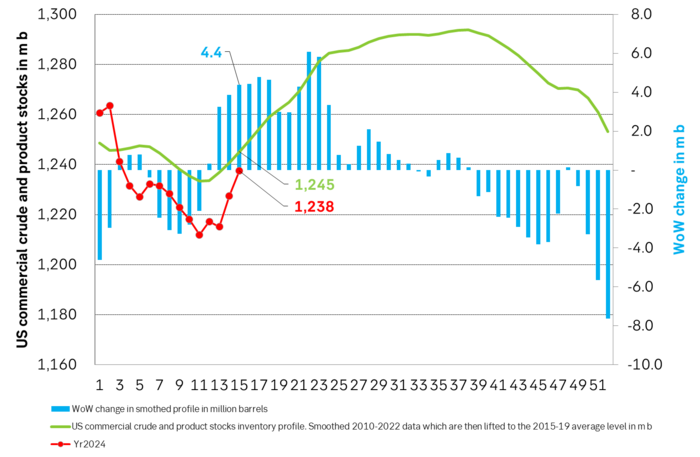

Total US commercial crude and product stocks usually rise by 4-5 m b per week this time of year. Gains have been very strong lately, but mostly in Propane and Other oils

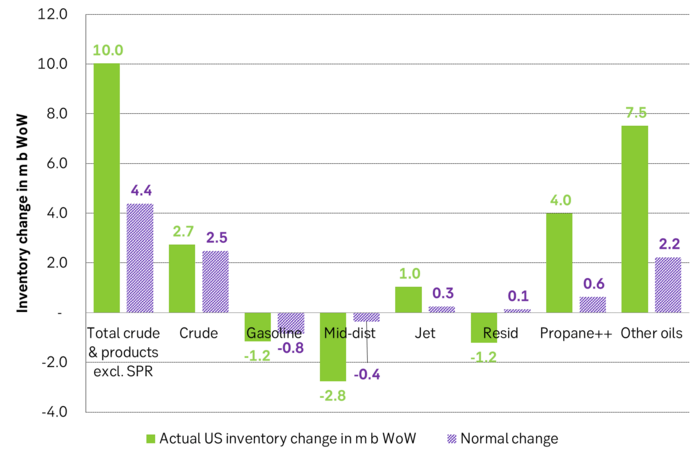

Last week’s US inventory data. Big rise of 10 m b in commercial inventories. What really stands out is the big gains in Propane and Other oils

Take actual changes minus normal seasonal changes we find that US commercial crude and regular products like diesel, gasoline, jet and bunker oil actually fell 3 m b versus normal change.

Analys

Nat gas to EUA correlation will likely switch to negative in 2026/27 onward

Historically positive Nat gas to EUA correlation will likely switch to negative in 2026/27 onward

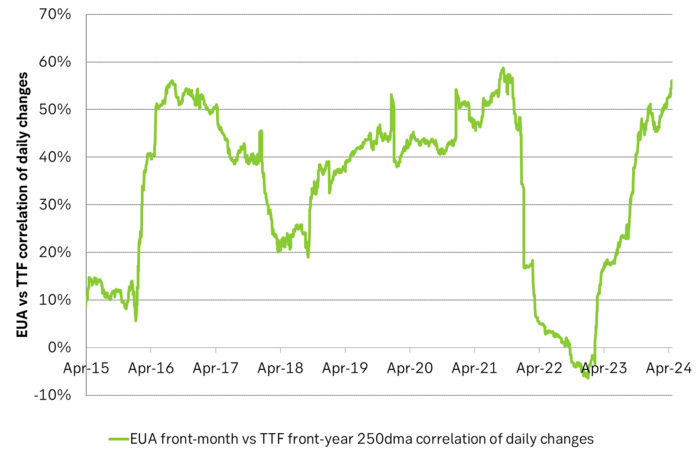

Historically there has been a strong, positive correlation between EUAs and nat gas prices. That correlation is still fully intact and possibly even stronger than ever as traders increasingly takes this correlation as a given with possible amplification through trading action.

The correlation broke down in 2022 as nat gas prices went ballistic but overall the relationship has been very strong for quite a few years.

The correlation between nat gas and EUAs should be positive as long as there is a dynamical mix of coal and gas in EU power sector and the EUA market is neither too tight nor too weak:

Nat gas price UP => ”you go black” by using more coal => higher emissions => EUA price UP

But in the future we’ll go beyond the dynamically capacity to flex between nat gas and coal. As the EUA price moves yet higher along with a tightening carbon market the dynamical coal to gas flex will max out. The EUA price will then trade significantly above where this flex technically will occur. There will still be quite a few coal fired power plants running since they are needed for grid stability and supply amid constrained local grids.

As it looks now we still have such overall coal to gas flex in 2024 and partially in 2025, but come 2026 it could be all maxed out. At least if we look at implied pricing on the forward curves where the forward EUA price for 2026 and 2027 are trading way above technical coal to gas differentials. The current forward pricing implications matches well with what we theoretically expect to see as the EUA market gets tighter and marginal abatement moves from the power sector to the industrial sector. The EUA price should then trade up and way above the technical coal to gas differentials. That is also what we see in current forward prices for 2026 and 2027.

The correlation between nat gas and EUAs should then (2026/27 onward) switch from positive to negative. What is left of coal in the power mix will then no longer be dynamically involved versus nat gas and EUAs. The overall power price will then be ruled by EUA prices, nat gas prices and renewable penetration. There will be pockets with high cost power in the geographical points where there are no other alternatives than coal.

The EUA price is an added cost of energy as long as we consume fossil energy. Thus both today and in future years we’ll have the following as long as we consume fossil energy:

EUA price UP => Pain for consumers of energy => lower energy consumption, faster implementation of energy efficiency and renewable energy => lower emissions

The whole idea with the EUA price is after all that emissions goes down when the EUA price goes up. Either due to reduced energy consumption directly, accelerated energy efficiency measures or faster switch to renewable energy etc.

Let’s say that the coal to gas flex is maxed out with an EUA price way above the technical coal to gas differentials in 2026/27 and later. If the nat gas price then goes up it will no longer be an option to ”go black” and use more coal as the distance to that is too far away price vise due to a tight carbon market and a high EUA price. We’ll then instead have that:

Nat gas higher => higher energy costs with pain for consumers => weaker nat gas / energy demand & stronger drive for energy efficiency implementation & stronger drive for more non-fossil energy => lower emissions => EUA price lower

And if nat gas prices goes down it will give an incentive to consume more nat gas and thus emit more CO2:

Cheaper nat gas => Cheaper energy costs altogether, higher energy and nat gas consumption, less energy efficiency implementations in the broader economy => emissions either goes up or falls slower than before => EUA price UP

Historical and current positive correlation between nat gas and EUA prices should thus not at all be taken for granted for ever and we do expect this correlation to switch to negative some time in 2026/27.

In the UK there is hardly any coal left at all in the power mix. There is thus no option to ”go black” and burn more coal if the nat gas price goes up. A higher nat gas price will instead inflict pain on consumers of energy and lead to lower energy consumption, lower nat gas consumption and lower emissions on the margin. There is still some positive correlation left between nat gas and UKAs but it is very weak and it could relate to correlations between power prices in the UK and the continent as well as some correlations between UKAs and EUAs.

Correlation of daily changes in front month EUA prices and front-year TTF nat gas prices, 250dma correlation.

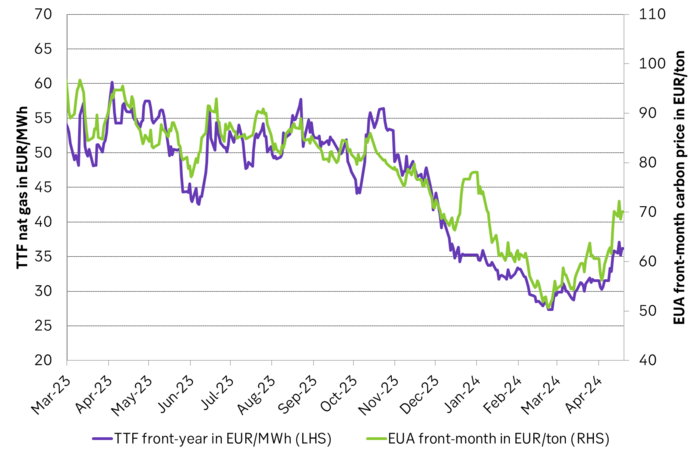

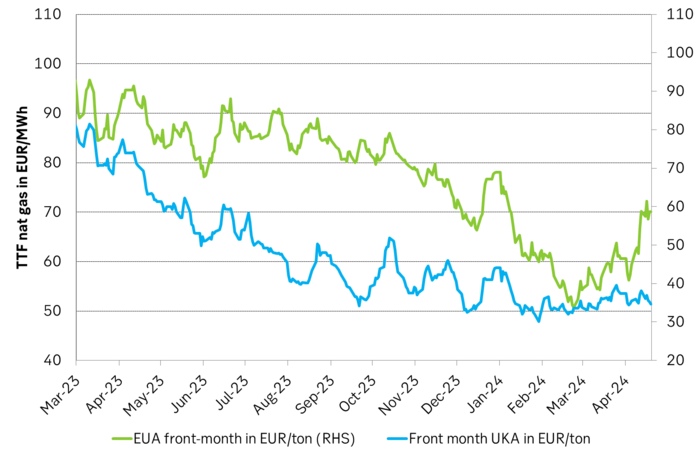

EUA price vs front-year TTF nat gas price since March 2023

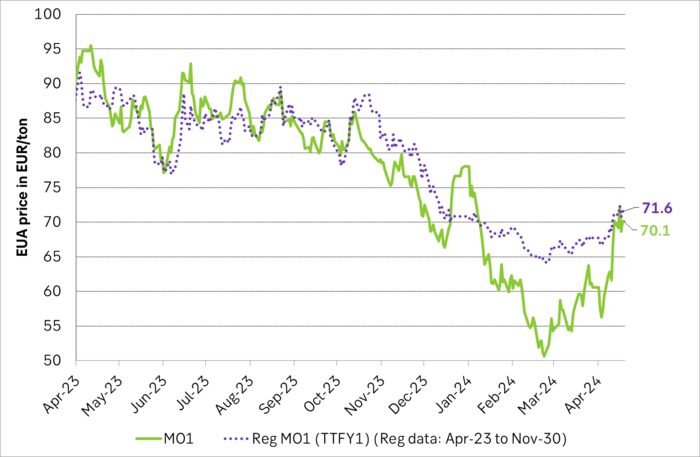

Front-month EUA price vs regression function of EUA price vs. nat gas derived from data from Apr to Nov last year.

The EUA price vs the UKA price. Correlations previously, but not much any more.

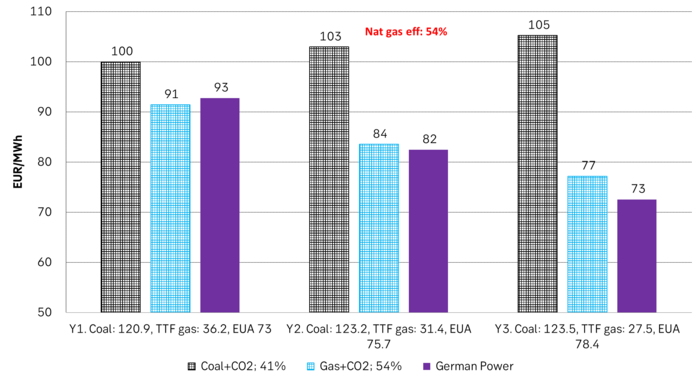

Forward German power prices versus clean cost of coal and clean cost of gas power. Coal is totally priced out vs power and nat gas on a forward 2026/27 basis.

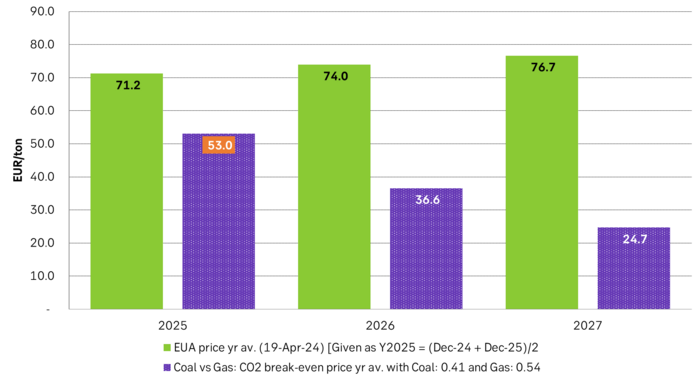

Forward price of EUAs versus technical level where dynamical coal to gas flex typically takes place. EUA price for 2026/27 is at a level where there is no longer any price dynamical interaction or flex between coal and nat gas. The EUA price should/could then start to be negatively correlated to nat gas.

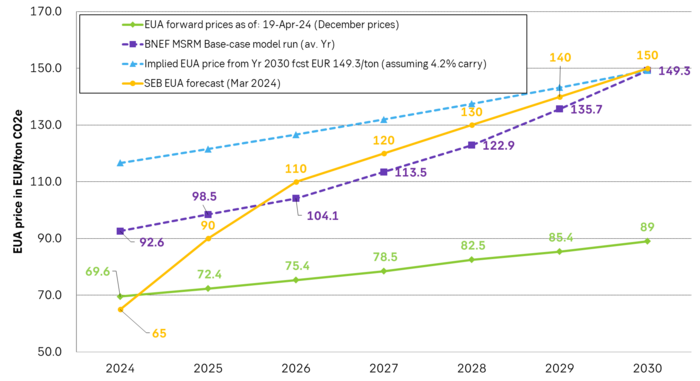

Forward EAU price vs. BNEF base model run (look for new update will come in late April), SEB’s EUA price forecast.

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanGuldpriset når nytt all time high och bryter igenom 2300 USD

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanUSAs stigande konsumtion av naturgas

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanCentralbanker fortsatte att köpa guld under februari

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanKakaomarknaden är extrem för tillfället

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanHur mår den svenska skogsbraschen? Två favoritaktier

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanBoliden på 20 minuter

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanBetydande underskott i utbudet av olja kan få priset att blossa upp

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanMyten om guld – Den magiska metallen född från stjärnstoft