Analys

SEB – Råvarukommentarer, 7 september 2012

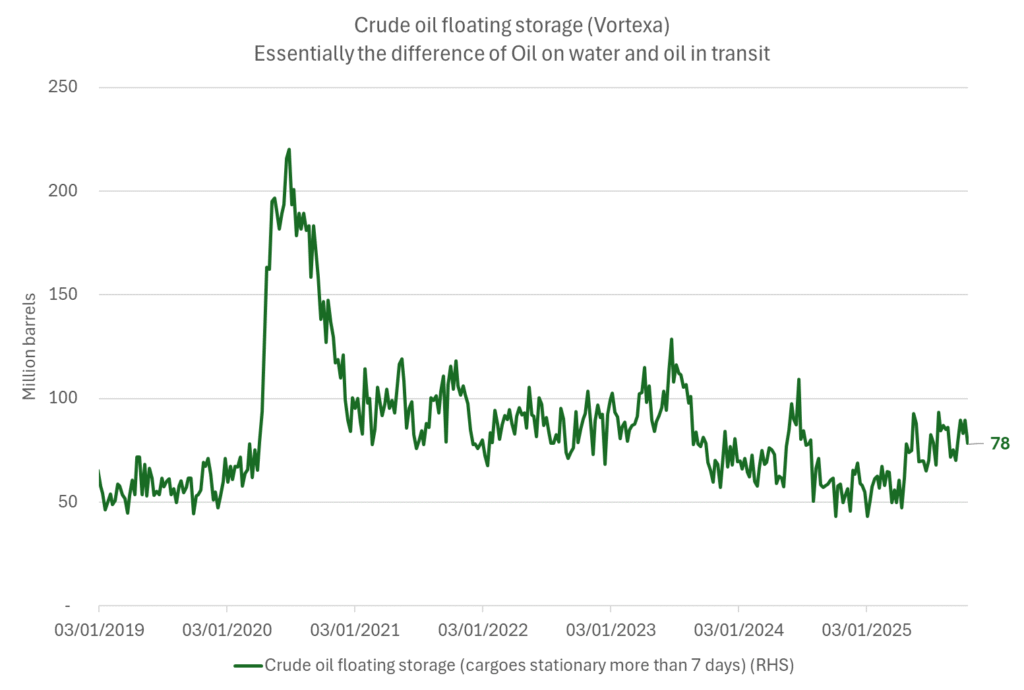

Sammanfattning av rekommendationer

Även den här veckan har rekommendationerna varit vinstgivande.

Råolja – Brent

Uppgången in i motståndsområdet verkar ha kommit av sig, dock noteras även stöd i ett glidande 233-dagars genomsnittsband ($113.30 / 110.00), men skulle utbudet vara så stort att efterfrågan i detta området mättas så räknar vi med fall ner in i ett bredare ~$108 / 101 område. Nya toppar krävs nu för att minska den kortsiktiga nedåtrisken.

Vi tycker att oljeprisuppgången som inleddes i början av juli gick väl snabbt och kanske även väl högt men noterar att så länge utbudsstörningarna kvarstår, så är utbuds- och efterfrågebalansen tight, varför det är rimligt med ett brentpris i rangen 100-115 usd/fat. Vid nuvarande prisnivå kring 113 usd rekommendera vi en kort position. Även vår tekniska analys stöder en kort position. Man väljer t ex BEAR OLJA X2 S eller BEAR OLJA X4 S – om man vill ha hög hävstång.

Elektricitet

Elterminerna på elbörsen har sedan förra veckans kortrekommendation fallit 2.8% . I allt väsentligt kvarstår argumenten för nedsidan och i vissa delar har de även stärkts.

Priset befinner sig en bit från tidigare bottnar, vilka med den nuvarande fundamentala situationen, bör vara inom räckhåll.

Höstvädret blir avgörande för elpriset framöver då fyllnadsgraden i vattenmagasinen fortsatt är på 5-års högsta. Den gångna veckans nederbördsutfall har varit rikligt och prognoserna, vilka nu är starkt influerade av resterna av de stormsystem som tidigare svept in över USA:s syd- och östkust, visar på mycket stora mängder regn. Produktion i de svenska kärnkraftverken är på uppgång och på sina håll i södra Norge är det troligt att vattenkraftproducenter den närmaste tiden t o m tvingas ”spilla” vatten förbi turbinerna.

Vår syn på priset (lägre) på fossila bränslen som kol och naturgas är också oförändrad. Såvida inte vädersituationen ändras väsentligt inom den närmaste tiden tror vi därför att kontraktet som är underliggande för våra certifikat på el har fortsatt nedsida, varför kortrekommendationen kvarstår.

Guld, Silver och Platina

Ädelmetallerna går väldigt starkt och är tydligaste indikationen på marknadens förväntningar om stimulanspaket under hösten. Silver är vinnaren med en uppgång med 7 % sedan förra fredagen. Guld har stigit 3% medan Platina är upp 5 %. Trenderna är starka och stöds både av stimulansförväntningar och positiva tekniska signaler. Vi tror att komplexet har mer att ge. Ur ett kortsiktigt tekniskt perspektiv finns utrymme upp till $1800 (nu 1705) för guld, $ 35 (nu 32,60) för silver och $1700 (nu 1582) för Platina.

Vår favorit är Platina (t ex genom certifikatet PLATINA S, eller för den som vill ha lite mer hävstång, BULL PLATIN X4 S). Nedan ser vi platinaprisets utveckling, där brottet av den långsiktiga motståndslinjen, signalerar att den långa konsolideringsperioden är bruten, på uppsidan!

Nedan ser vi silverprisets kursutveckling. Det är samma starka tekniska köpsignal i den här metallen.

Koppar

Bernanke’s tal förra veckan gav inte några nya indikationer. De penningpolitiska stimulanserna kanske dröjer någon månad till. Blickarna vändes istället mot ECB:s räntebesked idag torsdag. Draghi bekräftade obligationsköp. Det var det som marknaden ville höra och priserna steg. Basmetaller har gått starkt i veckan och är upp mellan 2 och 3 %. Veckan inleddes annars med Kinas index är nu under den psykologiska 50-nivån. Negativa siffror således och basmetaller brukar följa ISM, men inte nu paradoxalt nog. Aktörerna väljer att se dem som en bekräftelse att Kina måste göra någonting. Frågan är bara vad och hur mycket.

Kopparpriset är nu tillbaka i den övre delen av trading-intervallet. Antalet utestående terminskontrakt på LME är fortfarande ovanligt lågt, den lägsta nivå sen i början av 2009. Det visar hur osäkra aktörerna är. De vill inte ta några stora positioner just nu. Så länge vi är kvar i intervallet erbjuds intressanta tradingmöjligheter, mellan $7300 och $7700, men med viss försiktighet när marknaden når brytpunkterna.

Vi väljer att fortsätta rekommendera köp av KOPPAR S.

Kaffe

Priset på Arabica, som handlas i New York, har fortsatt att falla i pris och vi undrar om inte utbrottet från trendlinjen var falskt. Skörden av Robusta i Vietnam har drabbats av torka. Det huvudsakliga odlingsområdet Dak Lak har fått 4.6 mm regn de senaste tio dagarna mot 22 normalt och förra året. Robusta-lagren i London har fallit med 65% sedan toppen i juli. Enligt en survey gjord av Bloomberg kan skörden minska med 10% från förra året. Coffee Network, en del av FC Stone, råvaruhandlaren, förutspår att utbudet bara överträffar efterfrågan med 500,000 säckar nästa år. En säck grönt kaffe väger 60 kilo.

Det är möjligt att kaffepriset håller på att etablera en botten med 1.50 dollar som stödnivå. Man bör kunna bottenfiska KAFFE S på de här nivåerna och sedan vänta in prisuppgångar i framtiden.

Socker

Priset på socker har studsat upp från strax under 20 cent och ligger nu på nästan exakt 20 cent. Trenden är ner, men trenden är också gammal.

Kakao

Vi skrev förra veckan att vi skulle vilja vara långa kakao om nivån 2500 dollar bröts. Den bröts i veckan och vi är därför långa KAKAO S. Västafrika har drabbats av torka. De kommande 30 dagarnas väder blir avgörande för skörden i Elfenbenskusten, som tävlar med Ghana om att vara världens största producenter.

För spannmål och övriga jordbruksprodukter hänvisas till gårdagens nyhetsbrev.

[box]SEB Veckobrev Veckans råvarukommentar är producerat av SEB Merchant Banking och publiceras i samarbete och med tillstånd på Råvarumarknaden.se[/box]

Disclaimer

The information in this document has been compiled by SEB Merchant Banking, a division within Skandinaviska Enskilda Banken AB (publ) (“SEB”).

Opinions contained in this report represent the bank’s present opinion only and are subject to change without notice. All information contained in this report has been compiled in good faith from sources believed to be reliable. However, no representation or warranty, expressed or implied, is made with respect to the completeness or accuracy of its contents and the information is not to be relied upon as authoritative. Anyone considering taking actions based upon the content of this document is urged to base his or her investment decisions upon such investigations as he or she deems necessary. This document is being provided as information only, and no specific actions are being solicited as a result of it; to the extent permitted by law, no liability whatsoever is accepted for any direct or consequential loss arising from use of this document or its contents.

About SEB

SEB is a public company incorporated in Stockholm, Sweden, with limited liability. It is a participant at major Nordic and other European Regulated Markets and Multilateral Trading Facilities (as well as some non-European equivalent markets) for trading in financial instruments, such as markets operated by NASDAQ OMX, NYSE Euronext, London Stock Exchange, Deutsche Börse, Swiss Exchanges, Turquoise and Chi-X. SEB is authorized and regulated by Finansinspektionen in Sweden; it is authorized and subject to limited regulation by the Financial Services Authority for the conduct of designated investment business in the UK, and is subject to the provisions of relevant regulators in all other jurisdictions where SEB conducts operations. SEB Merchant Banking. All rights reserved.

Analys

Brent crude set to dip its feet into the high $50ies/b this week

Parts of the Brent crude curve dipping into the high $50ies/b. Brent crude fell 2.3% over the week to Friday. It closed the week at $61.29/b, a slight gain on the day, but also traded to a low of $60.14/b that same day and just barely avoided trading into the $50ies/b. This morning it is risk-on in equities which seems to help industrial metals a little higher. But no such luck for oil. It is down 0.8% at $60.8/b. This week looks set for Brent crude to dip its feet in the $50ies/b. The Brent 3mth contract actually traded into the high $50ies/b on Friday.

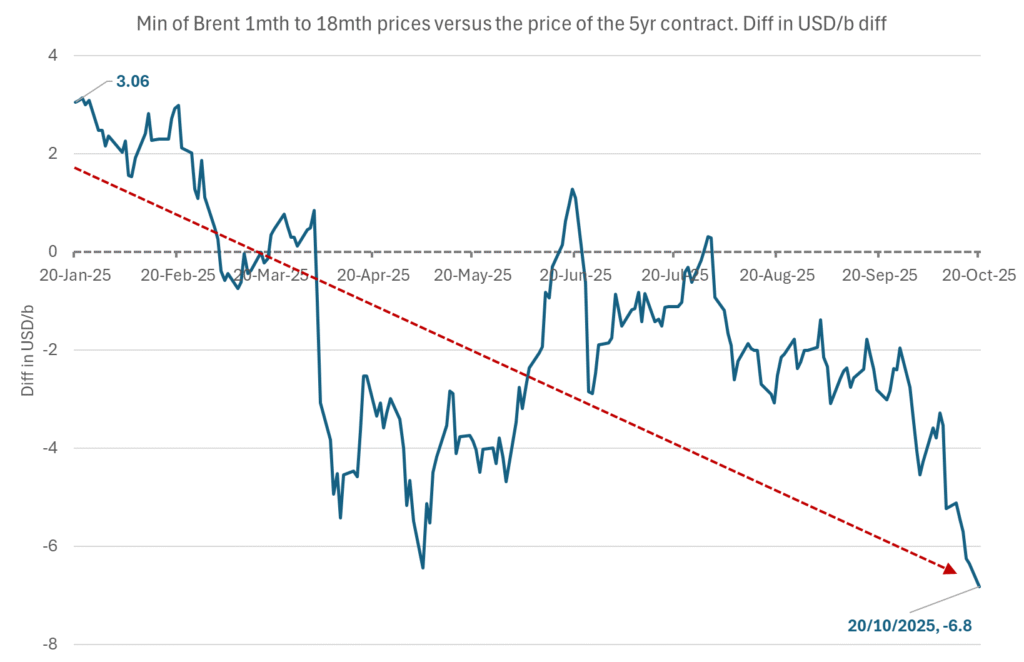

The front-end backwardation has been on a weakening foot and is now about to fully disappear. The lowest point of the crude oil curve has also moved steadily lower and lower and its discount to the 5yr contract is now $6.8/b. A solid contango. The Brent 3mth contract did actually dip into the $50ies/b intraday on Friday when it traded to a low point of $59.93/b.

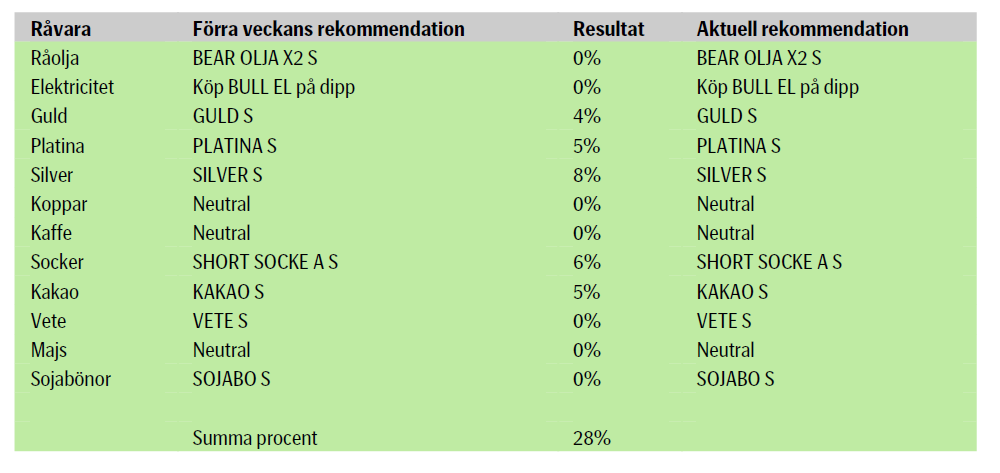

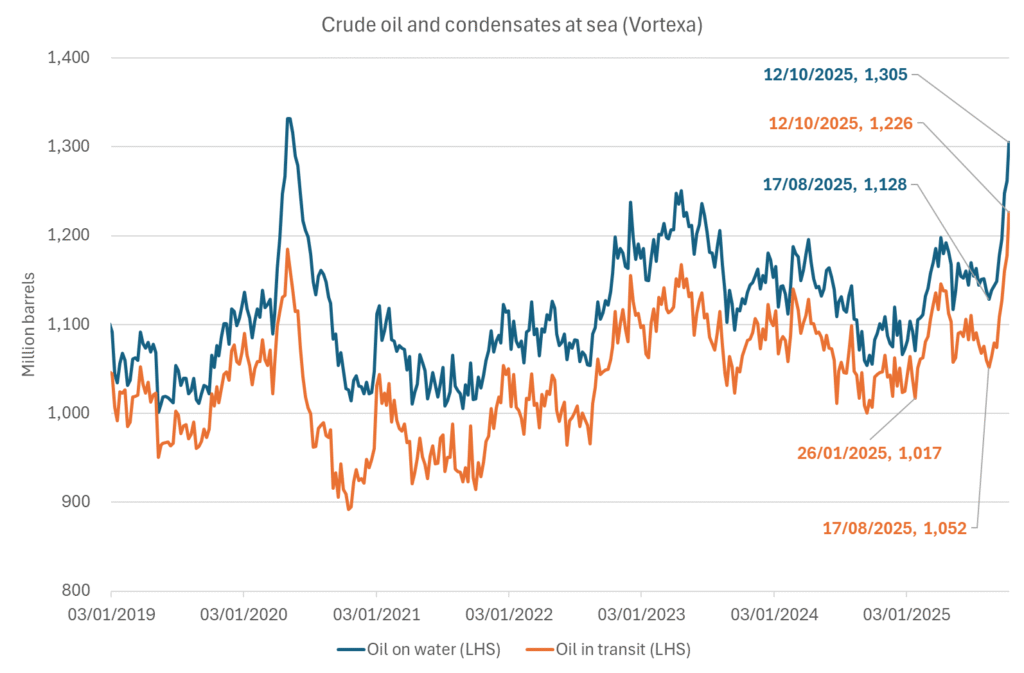

More weakness to come as lots of oil at sea comes to ports. Mid-East OPEC countries have boosted exports along with lower post summer consumption and higher production. The result is highly visibly in oil at sea which increased by 17 mb to 1,311 mb over the week to Sunday. Up 185 mb since mid-August. On its way to discharge at a port somewhere over the coming month or two.

Don’t forget that the oil market path ahead is all down to OPEC+. Remember that what is playing out in the oil market now is all by design by OPEC+. The group has decided that the unwind of the voluntary cuts is what it wants to do. In a combination of meeting demand from consumers as well as taking back market share. But we need to remember that how this plays out going forward is all at the mercy of what OPEC+ decides to do. It will halt the unwinding at some point. It will revert to cuts instead of unwind at some point.

A few months with Brent at $55/b and 40-50 US shale oil rigs kicked out may be what is needed. We think OPEC+ needs to see the exit of another 40-50 drilling rigs in the US shale oil patches to set US shale oil production on a path to of a 1 mb/d year on year decline Dec-25 to Dec-26. We are not there yet. But a 2-3 months period with Brent crude averaging $55/b would probably do it.

Oil on water increased 17 mb over the week to Sunday while oil in transit increased by 23 mb. So less oil was standing still. More was moving.

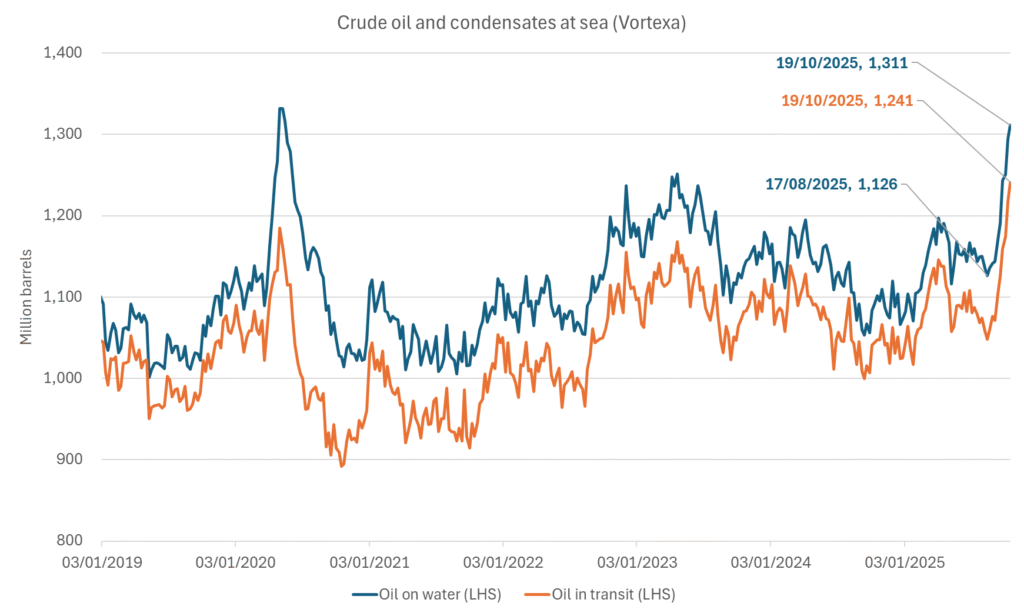

Crude oil floating storage (stationary more than 7 days). Down 11 mb over week to Sunday

The lowest point of the Brent crude oil curve versus the 5yr contract. Weakest so far this year.

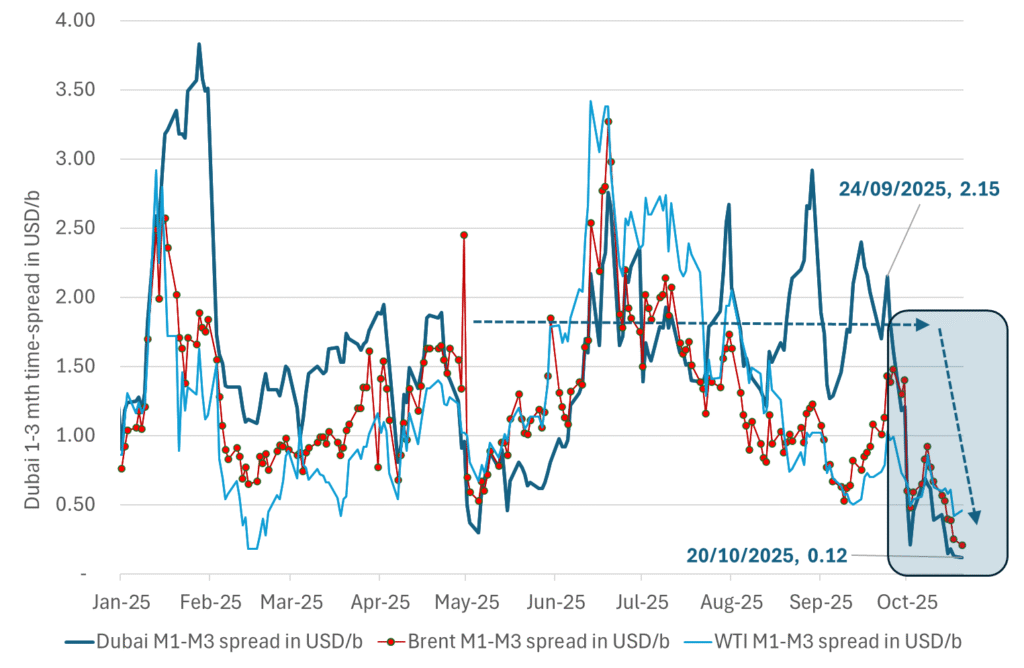

Crude oil 1mth to 3mth time-spreads. Dubai held out strongly through summer, but then that center of strength fell apart in late September and has been leading weakness in crude curves lower since then.

Analys

Crude oil soon coming to a port near you

Rebounding along with most markets. But concerns over solidity of Gaza peace may also contribute. Brent crude fell 0.8% yesterday to $61.91/b and its lowest close since May this year. This morning it is bouncing up 0.9% to $62.5/b along with a softer USD amid positive sentiment with both equities and industrial metals moving higher. Concerns that the peace in Gaza may be less solid than what one might hope for also yields some support to Brent. Bets on tech stocks are rebounding, defying fears of trade war. Money moving back into markets. Gold continues upwards its strong trend and a softer dollar helps it higher today as well.

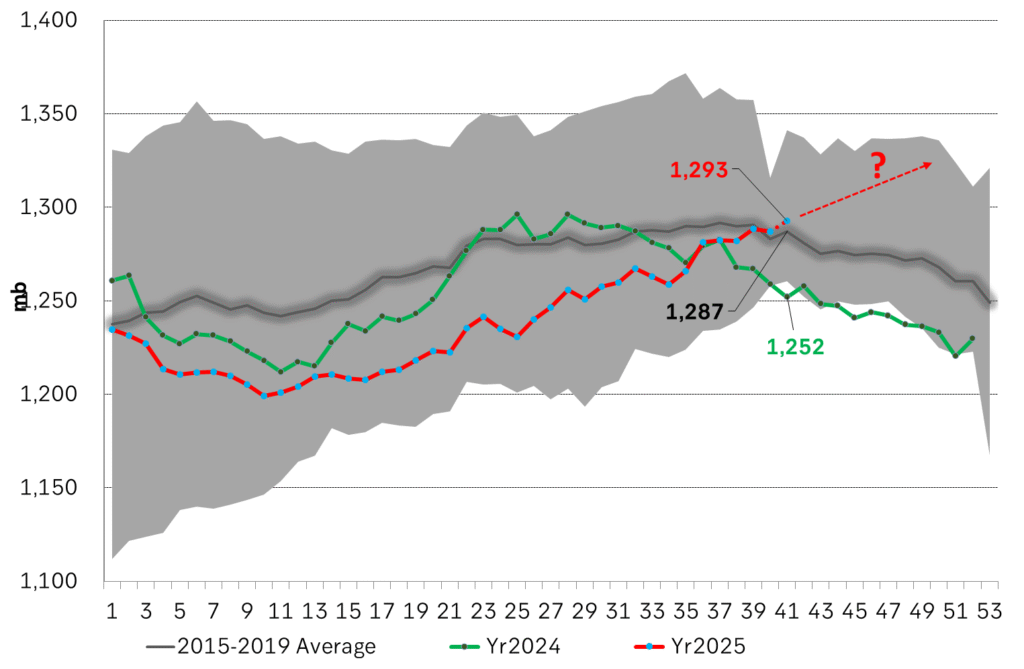

US crude & products probably rose 5.6 mb last week (API) versus a normal seasonal decline of 2.4 mb. The US API last night partial and thus indicative data for US oil inventories. Their data indicates that US crude stocks rose 7.4 mb last week, gasoline stocks rose 3.0 mb while Distillate stocks fell 4.8 mb. Altogether an increase in commercial crude and product stocks of 5.6 mb. Commercial US crude and product stocks normally decline by 2.4 mb this time of year. So seasonally adjusted the US inventories rose 8 mb last week according to the indicative numbers by the API. That is a lot. Also, the counter seasonal trend of rising stocks versus normally declining stocks this time of year looks on a solid pace of continuation. If the API is correct then total US crude and product stocks would stand 41 mb higher than one year ago and 6 mb higher than the 2015-19 average. And if we combine this with our knowledge of a sharp increase in production and exports by OPEC(+) and a large increase in oil at sea, then the current trend in US oil inventories looks set to continue. So higher stocks and lower crude oil prices until OPEC(+) switch to cuts. Actual US oil inventory data today at 18:00 CET.

US commercial crude and product stocks rising to 1293 mb in week 41 if last nights indicative numbers from API are correct.

Crude oil soon coming to a port near you. OPEC has lifted production sharply higher this autumn. At the same time demand for oil in the Middle-East has fallen as we have moved out of summer heat and crude oil burn for power for air-conditioning. The Middle-East oil producers have thus been able to lift exports higher on both accounts. Crude oil and condensates on water has shot up by 177 mb since mid-August. This oil is now on its way to ports around the world. And when they arrive, it will likely help to lift stocks onshore higher. That is probably when we will lose the last bit of front-end backwardation the the crude oil curves. That will help to drive the front-month Brent crude oil price down to the $60/b line and revisit the high $50ies/b. Then the eyes will be all back on OPEC+ when they meet in early November and then again in early December.

Crude oil and condensates at sea have moved straight up by 177 mb since mid-August as OPEC(+) has produced more, consumed less and exported more.

Analys

The Mid-East anchor dragging crude oil lower

When it starts to move lower it moves rather quickly. Gaza, China, IEA. Brent crude is down 2.1% today to $62/b after having traded as high as $66.58/b last Thursday and above $70/b in late September. The sell-off follows the truce/peace in Gaze, a flareup in US-China trade and yet another bearish oil outlook from the IEA.

A lasting peace in Gaze could drive crude oil at sea to onshore stocks. A lasting peace in Gaza would probably calm down the Houthis and thus allow more normal shipments of crude oil to sail through the Suez Canal, the Red Sea and out through the Bab-el-Mandeb Strait. Crude oil at sea has risen from 48 mb in April to now 91 mb versus a pre-Covid normal of about 50-60 mb. The rise to 91 mb is probably the result of crude sailing around Africa to be shot to pieces by the Houthis. If sailings were to normalize through the Suez Canal, then it could free up some 40 mb in transit at sea moving onshore into stocks.

The US-China trade conflict is of course bearish for demand if it continues.

Bearish IEA yet again. Getting closer to 2026. Credibility rises. We expect OPEC to cut end of 2025. The bearish monthly report from the IEA is what it is, but the closer we get to 2026, the more likely the IEA is of being ball-park right in its outlook. In its monthly report today the IEA estimates that the need for crude oil from OPEC in 2026 will be 25.4 mb/d versus production by the group in September of 29.1 mb/d. The group thus needs to do some serious cutting at the end of 2025 if it wants to keep the market balanced and avoid inventories from skyrocketing. Given that IEA is correct that is. We do however expect OPEC to implement cuts to avoid a large increase in inventories in Q1-26. The group will probably revert to cuts either at its early December meeting when they discuss production for January or in early January when they discuss production for February. The oil price will likely head yet lower until the group reverts to cuts.

Dubai: The Mid-East anchor dragging crude oil lower. Surplus emerging in Mid-East pricing. Crude oil prices held surprisingly strong all through the summer. A sign and a key source of that strength came from the strength in the front-end backwardation of the Dubai crude oil curve. It held out strong from mid-June and all until late September with an average 1-3mth time-spread premium of $1.8/b from mid-June to end of September. The 1-3mth time-spreads for Brent and WTI however were in steady deterioration from late June while their flat prices probably were held up by the strength coming from the Persian Gulf. Then in late September the strength in the Dubai curve suddenly collapsed. Since the start of October it has been weaker than both the Brent and the WTI curves. The Dubai 1-3mth time-spread now only stands at $0.25/b. The Middle East is now exporting more as it is producing more and also consuming less following elevated summer crude burn for power (Aircon) etc.

The only bear-element missing is a sudden and solid rise in OECD stocks. The only thing that is missing for the bear-case everyone have been waiting for is a solid, visible rise in OECD stocks in general and US oil stocks specifically. So watch out for US API indications tomorrow and official US oil inventories on Thursday.

No sign of any kind of fire-sale of oil from Saudi Arabia yet. To what we can see, Saudi Arabia is not at all struggling to sell its oil. It only lowered its Official Selling Prices (OSPs) to Asia marginally for November. A surplus market + Saudi determination to sell its oil to the market would normally lead to a sharp lowering of Saudi OSPs to Asia. Not yet at least and not for November.

The 5yr contract close to fixed at $68/b. Of importance with respect to how far down oil can/will go. When the oil market moves into a surplus then the spot price starts to trade in a large discount to the 5yr contract. Typically $10-15/b below the 5yr contract on average in bear-years (2009, 2015, 2016, 2020). But the 5yr contract is usually pulled lower as well thus making this approach a moving target. But the 5yr contract price has now been rock solidly been pegged to $68/b since 2022. And in the 2022 bull-year (Brent spot average $99/b), the 5yr contract only went to $72/b on average. If we assume that the same goes for the downside and that 2026 is a bear-year then the 5yr goes to $64/b while the spot is trading at a $10-15/b discount to that. That would imply an average spot price next year of $49-54/b. But that is if OPEC doesn’t revert to cuts and instead keeps production flowing. We think OPEC(+) will trim/cut production as needed into 2026 to prevent a huge build-up in global oil stocks and a crash in prices. But for now we are still heading lower. Into the $50ies/b.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanOPEC+ missar produktionsmål, stöder oljepriserna

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanGoldman Sachs höjer prognosen för guld, tror priset når 4900 USD

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanBlykalla och amerikanska Oklo inleder ett samarbete

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanGuld nära 4000 USD och silver 50 USD, därför kan de fortsätta stiga

-

Analys4 veckor sedan

Analys4 veckor sedanAre Ukraine’s attacks on Russian energy infrastructure working?

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanLeading Edge Materials är på rätt plats i rätt tid

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanEtt samtal om guld, olja, koppar och stål

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanNytt prisrekord, guld stiger över 4000 USD