Analys

OPEC meeting: Holding back is easy as Iran and Venezuela takes all the pain

Brent crude jumps 2.8% this morning to $66.6/bl following news that Saudi Arabia and Russia are in agreement of an extension of current cuts for another 6 to 9 months and that this plan is also endorsed by Iran’s oil minister Zanganeh. A trade truce between US and China also adds strength to the oil price this morning.

OPEC being “between a rock and a hard place” has been the description of OPEC’s situation in the run-up to this OPEC meeting. Losing market share to booming US shale oil production on the one hand while facing weakening oil demand growth along with slowing global growth on the other hand. It is true that OPEC as a whole is losing market share. But this burden is not evenly distributed as it is Venezuela and Iran who are taking almost all the pain. The other OPEC members (and OPEC+ members) are basically not taking any heat at all.

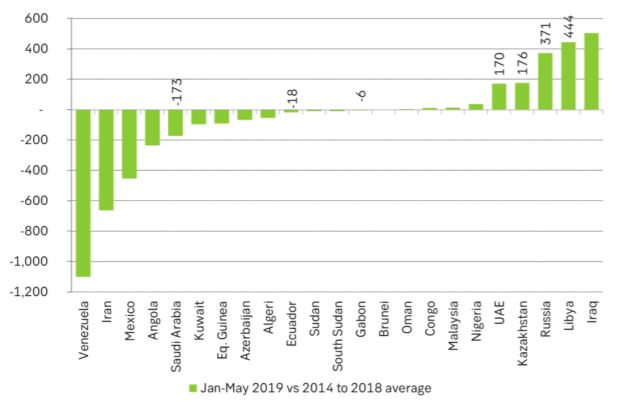

From Jan to May Saudi Arabia produced only 173 k bl/d below its 2014-2018 average while Russia produced 371 k bl/d above that average.

It is thus easy for the main producers to decide to roll cuts forward as they do not really cost them anything, or very little to do so. The only price they have to pay is to hold back supply slightly and refrain from growing their production along with global oil demand growth while harvesting an oil price of $60-70/bl.

It will of course be problematic when Iran and Venezuela eventually returns to the market. And that could indeed be a very bearish moment in the oil market. Given the large range of uncertainties in the oil market OPEC has learned to act reactively rather than trying to act pre-emptively. Thus OPEC will have to deal with the return of Venezuela and Iran at some point in the future but then it will deal with that rainy day when it comes. Right now things are as they are and it is easy for OPEC’s key members and Russia to roll the cuts forward into H2-19 and also likely into Q1-20.

It is clear that the global economy is still in a slow-down mode and so is global oil demand growth. Global oil demand growth is however rarely below +1% y/y unless the global economy is in a recession and as far as we can see we are not there yet at all.

Global oil demand seasonally jumps roughly 1 m bl/d from Q2 to H2. US shale oil production is currently growing at a marginal annualized rate of about 0.8 m bl/d YoY and in addition comes US NGL growth. US crude production will thus probably be 0.4 m bl/d higher at year end but on average just 0.2 m bl/d higher in H2 than in June. So OPEC+ will probably have to produce more in H2 than they did in H1 in order to satisfy seasonally higher demand unless the global economy tanks completely. Thus if Russia, Saudi Arabia and the other key OPEC members keeps production at the levels they produced in H1-19 they will ensure that the global oil market is not flowing over. They will only have to pay a small restraint while reaping a nice oil price of $60-70/bl

Two factors are coming into play in H2-19 in addition to global oil demand growth. The first is a large ramp-up of oil pipelines coming online from the Permian basin and out to the US Gulf. Cactus, EPIC and Grey Oak will add a total capacity of between 2.2 and 2.5 m bl/d from Permian to the USGC which effectively (80%) will amount to 1.7 to 2.0 m bl/d. This will help to release surplus oil inventories in the US into the global market place, tighten up the US market while easing the global situation. It will help to tighten up the WTI crude price curve while helping to ease the Brent crude price curve in relative terms. The oil market has a tendency to trade the global oil price on the back of US oil data due to lacking availability of high quality global data. Thus a draining of US oil inventories could be interpreted bullishly even though it is only shifting inventories from the US to non-US.

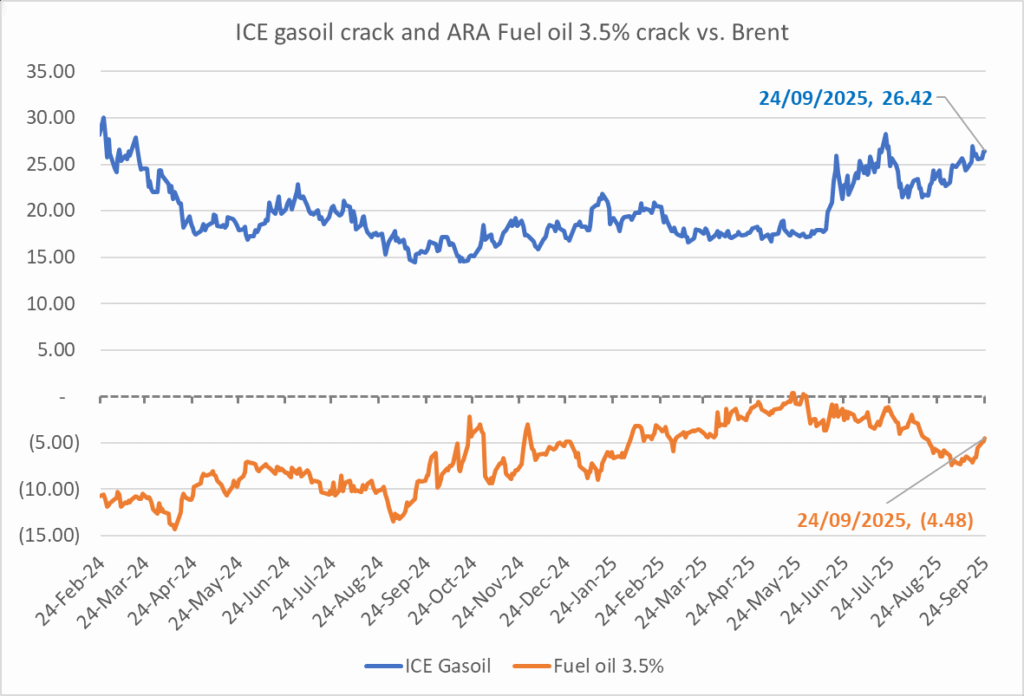

The other factor is the IMO – 2020 shift of fuel quality in global shipping from maximum 3.5% sulphur to only 0.5% sulphur in January 2020. In general this will add a lot of Marine Gasoil (MGO) demand from global shipping and especially so in Q4-19 and H1-2020. Global refineries will need to run hard to satisfy elevated stock building and demand already in Q4-19. This will be bullish for global crude oil demand already in H2-19. Ballpark figures are that shipping will need an additional 2 m bl/d of MGO in this period. Global refineries will probably have to process another 4-5 m bl/d of crude in order to satisfy this added MGO demand.

Ch1: Supply from OPEC+ declined 3.0 m bl/d from a peak in November last year. It looks like a decisive cut. To a large degree it is the misfortune of Iran and Venezuela. OPEC+ also boosted production from May to Nov last year and then cut from a peak.

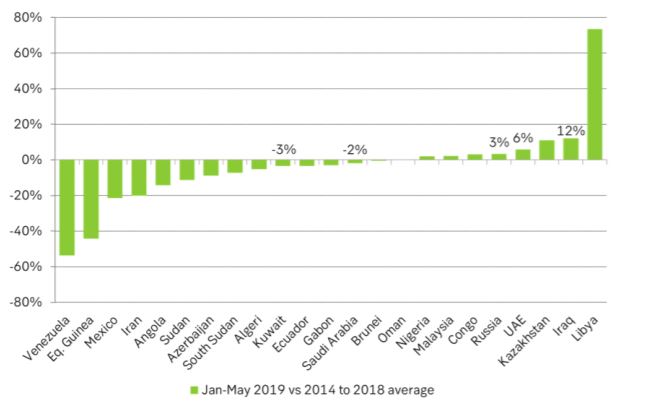

Ch2: Production in OPEC+ during Jan to May this year versus average levels from 2014 to 2018 in %. Russia, Iraq and UAE are well above while Saudi Arabia and Kuwait are just marginally below. Not a high price for these countries to hold production unchanged through H2-19 and Q1-20. Venezuela and Iran are taking the pain

Ch3: Production in OPEC+ during Jan to May this year versus average levels from 2014 to 2018 in k bl/d. Saudi Arabia produced only 173 k bl/d below the 5 year average while Russia produced 371 k bl/d above that level. They are producing at very good volumes and not really paying a high price.

Analys

OPEC+ will likely unwind 500 kb/d of voluntary quotas in October. But a full unwind of 1.5 mb/d in one go could be in the cards

Down to mid-60ies as Iraq lifts production while Saudi may be tired of voluntary cut frugality. The Brent December contract dropped 1.6% yesterday to USD 66.03/b. This morning it is down another 0.3% to USD 65.8/b. The drop in the price came on the back of the combined news that Iraq has resumed 190 kb/d of production in Kurdistan with exports through Turkey while OPEC+ delegates send signals that the group will unwind the remaining 1.65 mb/d (less the 137 kb/d in October) of voluntary cuts at a pace of 500 kb/d per month pace.

Signals of accelerated unwind and Iraqi increase may be connected. Russia, Kazakhstan and Iraq were main offenders versus the voluntary quotas they had agreed to follow. Russia had a production ’debt’ (cumulative overproduction versus quota) of close to 90 mb in March this year while Kazakhstan had a ’debt’ of about 60 mb and the same for Iraq. This apparently made Saudi Arabia angry this spring. Why should Saudi Arabia hold back if the other voluntary cutters were just freeriding? Thus the sudden rapid unwinding of voluntary cuts. That is at least one angle of explanations for the accelerated unwinding.

If the offenders with production debts then refrained from lifting production as the voluntary cuts were rapidly unwinded, then they could ’pay back’ their ’debts’ as they would under-produce versus the new and steadily higher quotas.

Forget about Kazakhstan. Its production was just too far above the quotas with no hope that the country would hold back production due to cross-ownership of oil assets by international oil companies. But Russia and Iraq should be able to do it.

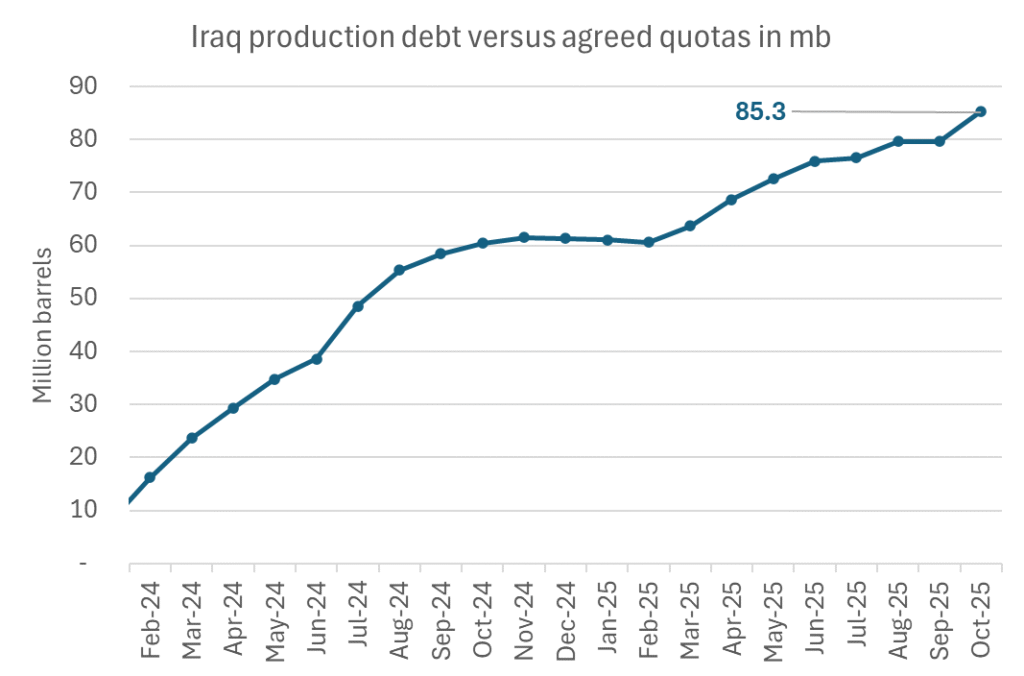

Iraqi cumulative overproduction versus quotas could reach 85-90 mb in October. Iraq has however steadily continued to overproduce by 3-5 mb per month. In July its new and gradually higher quota came close to equal with a cumulative overproduction of only 0.6 mb that month. In August again however its production had an overshoot of 100 kb/d or 3.1 mb for the month. Its cumulative production debt had then risen to close to 80 mb. We don’t know for September yet. But looking at October we now know that its production will likely average close to 4.5 mb/d due to the revival of 190 kb/d of production in Kurdistan. Its quota however will only be 4.24 mb/d. Its overproduction in October will thus likely be around 250 kb/d above its quota with its production debt rising another 7-8 mb to a total of close to 90 mb.

Again, why should Saudi Arabia be frugal while Iraq is freeriding. Better to get rid of the voluntary quotas as quickly as possible and then start all over with clean sheets.

Unwinding the remaining 1.513 mb/d in one go in October? If OPEC+ unwinds the remaining 1.513 mb/d of voluntary cuts in one big go in October, then Iraq’s quota will be around 4.4 mb/d for October versus its likely production of close to 4.5 mb/d for the coming month..

OPEC+ should thus unwind the remaining 1.513 mb/d (1.65 – 0.137 mb/d) in one go for October in order for the quota of Iraq to be able to keep track with Iraq’s actual production increase.

October 5 will show how it plays out. But a quota unwind of at least 500 kb/d for Oct seems likely. An overall increase of at least 500 kb/d in the voluntary quota for October looks likely. But it could be the whole 1.513 mb/d in one go. If the increase in the quota is ’only’ 500 kb/d then Iraqi cumulative production will still rise by 5.7 mb to a total of 85 mb in October.

Iraqi production debt versus quotas will likely rise by 5.7 mb in October if OPEC+ only lifts the overall quota by 500 kb/d in October. Here assuming historical production debt did not rise in September. That Iraq lifts its production by 190 kb/d in October to 4.47 mb/d (August level + 190 kb/d) and that OPEC+ unwinds 500 kb/d of the remining quotas in October when they decide on this on 5 October.

Analys

Modest draws, flat demand, and diesel back in focus

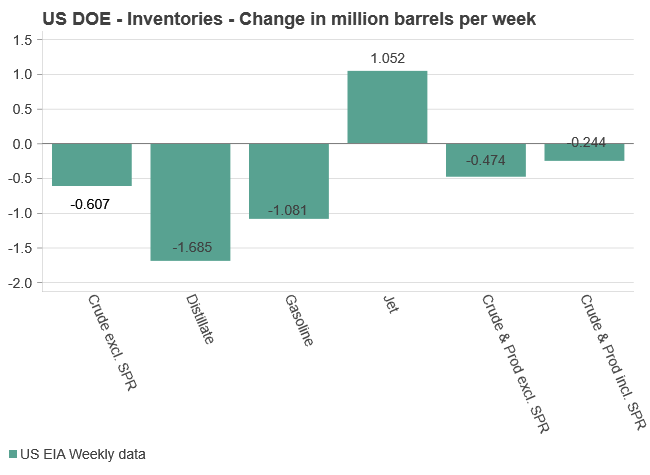

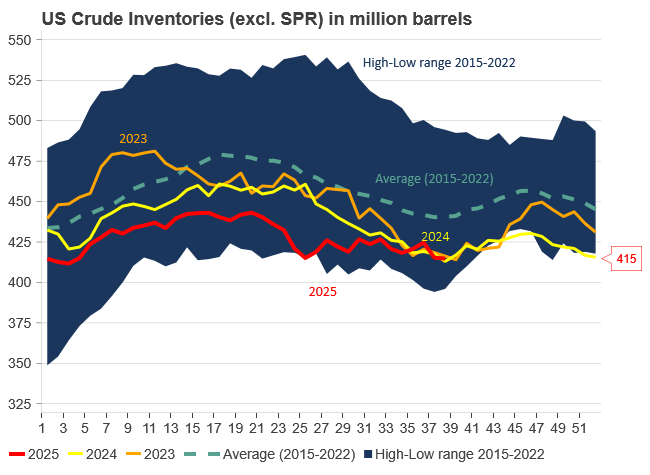

U.S. commercial crude inventories posted a marginal draw last week, falling by 0.6 million barrels to 414.8 million barrels. Inventories remain 4% below the five-year seasonal average, but the draw is far smaller than last week’s massive 9.3-million-barrel decline. Higher crude imports (+803,000 bl d WoW) and steady refinery runs (93% utilization) helped keep the crude balance relatively neutral.

Yet another drawdown indicates commercial crude inventories continue to trend below the 2015–2022 seasonal norm (~440 million barrels), though at 414.8 million barrels, levels are now almost exactly in line with both the 2023 and 2024 trajectory, suggesting stable YoY conditions (see page 3 attached).

Gasoline inventories dropped by 1.1 million barrels and are now 2% below the five-year average. The decline was broad-based, with both finished gasoline and blending components falling, indicating lower output and resilient end-user demand as we enter the shoulder season post-summer (see page 6 attached).

On the diesel side, distillate inventories declined by 1.7 million barrels, snapping a two-week streak of strong builds. At 125 million barrels, diesel inventories are once again 8% below the five-year average and trending near the low end of the historical range.

In total, commercial petroleum inventories (excl. SPR) slipped by 0.5 million barrels on the week to ish 1,281.5 million barrels. While essentially flat, this ends a two-week streak of meaningful builds, reflecting a return to a slightly tighter situation.

On the demand side, the DOE’s ‘products supplied’ metric (see page 6 attached), a proxy for implied consumption, softened slightly. Total demand for crude oil over the past four weeks averaged 20.5 million barrels per day, up just 0.9% YoY.

Summing up: This week’s report shows a re-tightening in diesel supply and modest draws across the board, while demand growth is beginning to flatten. Inventories remain structurally low, but the tone is less bullish than in recent weeks.

Analys

Are Ukraine’s attacks on Russian energy infrastructure working?

Brent crude rose 1.6% yesterday. After trading in a range of USD 66.1 – 68.09/b it settled at USD 67.63/b. A level which we are well accustomed to see Brent crude flipping around since late August. This morning it is trading 0.5% higher at USD 68/b. The market was expecting an increase of 230 kb/d in Iraqi crude exports from Kurdistan through Turkey to the Cheyhan port but that has so far failed to materialize. This probably helped to drive Brent crude higher yesterday. Indications last evening that US crude oil inventories likely fell 3.8 mb last week (indicative numbers by API) probably also added some strength to Brent crude late in the session. The market continues to await the much heralded global surplus materializing as rising crude and product inventories in OECD countries in general and the US specifically.

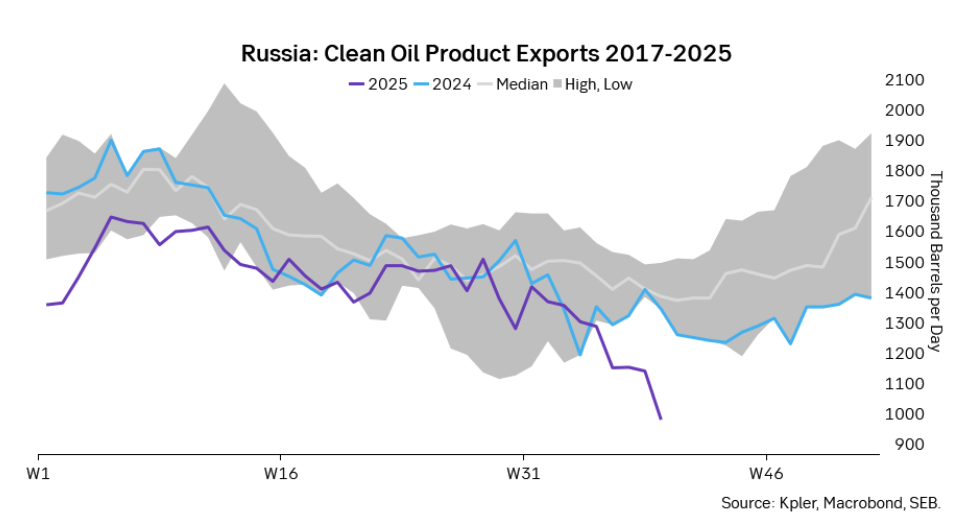

The oil market is starting to focus increasingly on the successful Ukrainian attacks on Russian oil infrastructure. Especially the attacks on Russian refineries. Refineries are highly complex and much harder to repair than simple crude oil facilities like export pipelines, ports and hubs. It can take months and months to repair complex refineries. It is thus mainly Russian oil products which will be hurt by this. First oil product exports will go down, thereafter Russia will have to ration oil product consumption domestically. Russian crude exports may not be hurt as much. Its crude exports could actually go up as its capacity to process crude goes down. SEB’s Emerging Market strategist Erik Meyersson wrote about the Ukrainian campaign this morning: ”Are Ukraine’s attacks on Russian energy infrastructure working?”. Phillips P O’Brian published an interesting not on this as well yesterday: ”An Update On The Ukrainian Campaign Against Russian Refineries”. It is a pay-for article, but it is well worth reading. Amongst other things it highlights the strategic focus of Ukraine towards Russia’s energy infrastructure. A Ukrainian on the matter also put out a visual representation of the attacks on twitter. We have not verified the data representation. It needs to be interpreted with caution in terms of magnitude of impact and current outage.

Complex Russian oil refineries are sitting ducks in the new, modern long-range drone war. Ukraine is building a range of new weapons as well according to O’Brian. The problem with attacks on Russian refineries is thus on the rise. This will likely be an escalating problem for Russia. And oil products around the world may rise versus the crude oil price while the crude oil price itself may not rise all that much due to this.

Russian clean oil product exports as presented by SEB’s Erik Meyersson in his note this morning.

The ICE Gasoil crack and the 3.5% fuel oil crack has been strengthening. The 3.5% crack should have weakened along with rising exports of sour crude from OPEC+, but it hasn’t. Rather it has moved higher instead. The higher cracks could in part be due to the Ukrainian attacks on Russian oil refineries.

Ukrainian inhabitants graphical representation of Ukrainian attacks on Russian oil refineries on Twitter. Highlighting date of attacks, size of refineries and distance from Ukraine. We have not verified the detailed information. And you cannot derive the amount of outage as a consequence of this.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanEurobattery Minerals satsar på kritiska metaller för Europas självförsörjning

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanMahvie Minerals i en guldtrend

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanGuldpriset kan närma sig 5000 USD om centralbankens oberoende skadas

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanOPEC signalerar att de inte bryr sig om oljepriset faller kommande månader

-

Analys3 veckor sedan

Analys3 veckor sedanVolatile but going nowhere. Brent crude circles USD 66 as market weighs surplus vs risk

-

Nyheter3 veckor sedan

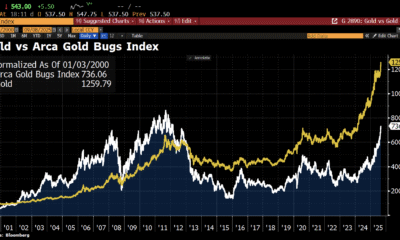

Nyheter3 veckor sedanAktier i guldbolag laggar priset på guld

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanKinas elproduktion slog nytt rekord i augusti, vilket även kolkraft gjorde

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanTyskland har så höga elpriser att företag inte har råd att använda elektricitet