Nyheter

Molybdenum’s dramatic price response

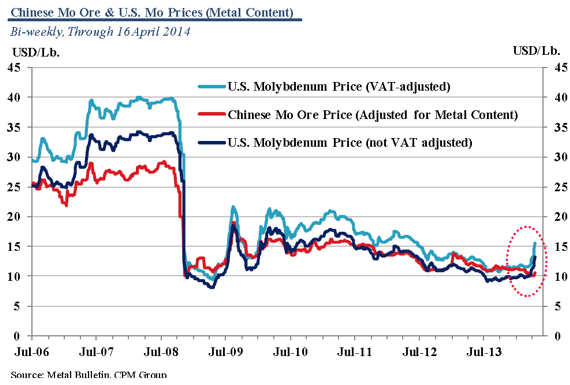

Molybdenum prices in Europe have risen rapidly following the World Trade Organization’s confirmation that the export duties and quotas imposed by China on molybdenum are incompatible with its WTO obligations. This report concludes a dispute initiated in March 2012 when the European Union, Japan, and the United States filed a formal request with the WTO for consultation with China over its restrictions on exports of rare earths, tungsten, and molybdenum. As of 16 April molybdenum prices have jumped nearly 31% to $13.20 (basis Metal Bulletin, US$ per pound Mo contained) since the 26 March report. Prices in China meanwhile are up just 4.2% over this same period.

Molybdenum prices in Europe have risen rapidly following the World Trade Organization’s confirmation that the export duties and quotas imposed by China on molybdenum are incompatible with its WTO obligations. This report concludes a dispute initiated in March 2012 when the European Union, Japan, and the United States filed a formal request with the WTO for consultation with China over its restrictions on exports of rare earths, tungsten, and molybdenum. As of 16 April molybdenum prices have jumped nearly 31% to $13.20 (basis Metal Bulletin, US$ per pound Mo contained) since the 26 March report. Prices in China meanwhile are up just 4.2% over this same period.

China has yet to announce a formal response to the WTO’s ruling. There is a possibility that China may remove the export duties on some molybdenum products as a concession in order to keep duties and quotas on tungsten and rare earths. As part of a January 2013 response to a WTO ruling on a separate case regarding export taxes on silicon metal, silicon carbide, manganese, magnesium, zinc, bauxite, coking coal, fluorspar and yellow phosphorus, the Chinese government removed the 20% duty on the export of EMM as well as some of the duties of other metals.

China may be pushed to reduce or remove the current duties on molybdenum product exports, as had been the case with the electrolytic manganese (EMM) export duty. EMM exports rose strongly in response, possibly due to exporters officially reporting their goods at customs rather than smuggling them out of the country. Official EMM prices also fell.

The case for molybdenum differs from EMM, however, as it is a metal under consideration for a national resource classification. Official regulations for the molybdenum industry could be shifted to the Ministry of Land and Resources, which also manages tungsten and rare earths. There also are government concerns with regard to the price stability of these specialty metal markets. In the past, the Chinese government has adamantly opposed lowering prices for its raw material exports, particularly in instances related to price competition by a large number of domestic exporters. That said, there have been major producers voicing support for lowering trade barriers as they seek to expand sales internationally in response to the lack of orders for the surplus metal in the domestic market.

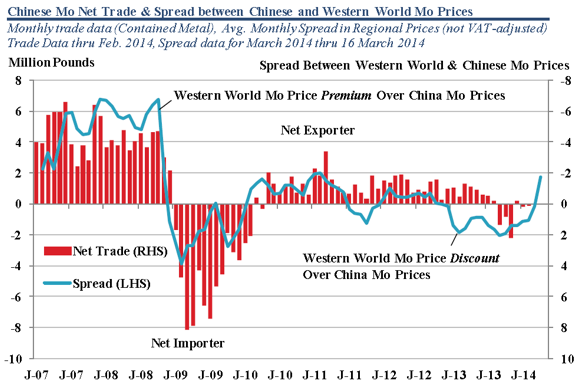

In 2013 China’s domestic molybdenum prices traded at premium (~14.3%) to western world prices so there was no incentive to export molybdenum. This trend remained in place until the run up in western world prices in the first two weeks in April. According to Metal Bulletin, Chinese prices held on average a $0.91 or 9.2% premium over western world price between 1 January and 21 March. Since the ruling, however, western world prices are at a premium to China. As of 16 April, Metal Bulletin reported western world molybdenum at $13.20 and Chinese molybdenum at roughly $10.55, a premium of $2.65 or 20%. Obviously both markets need time to process the news. However, western world prices have risen to levels that will likely encourage exports from China in the near term. Even with current duties in place on various molybdenum products, some of which are as high as 20%, arbitrage opportunities still exist for Chinese exporters. The current sizable price differential may act as an incentive for the Chinese government to keep present taxes in place to help disincentivize exports of their national molybdenum resource.

Furthermore molybdenum prices in the western world are being bolstered by robust demand, which has been strengthening in regions outside of China. This is most notable in Europe and South Korea, which have seen a strong rebound in steel production during first two months of 2014 growing 6.5% and 3.9% year-on-year, respectively, compared to -2.2% and -4.8% in all of 2013. Crude steel production is also strengthening in Japan, with output rising 3.8% in the first two months of 2014 from year ago levels.

[box]Denna analys är producerad av CPM Group och publiceras med tillstånd på Råvarumarknaden.se.[/box]

Disclaimer

Copyright CPM Group 2012. Not for reproduction or retransmission without written consent of CPM Group. Market Commentary is published by CPM Group and is distributed via e-mail. The views expressed within are solely those of CPM Group. Such information has not been verified, nor does CPM make any representation as to its accuracy or completeness.

Any statements non-factual in nature constitute only current opinions, which are subject to change. While every effort has been made to ensure that the accuracy of the material contained in the reports is correct, CPM Group cannot be held liable for errors or omissions. CPM Group is not soliciting any action based on it. Visit www.cpmgroup.com for more information.

Nyheter

Sommarvädret styr elpriset i Sverige

Många verksamheter tar nu ett sommaruppehåll och ute värmer solen, det är gott om vatten och vinden blåser. Lägre efterfrågan på el och goda förutsättningar för kraftproduktionen höll ner elpriserna under juni.

Elpriset på den nordiska elbörsen Nord Pool (utan påslag och exklusive moms) i elområde 1 och 2 (Norra Sverige) blev för juni 3,05 respektive 4,99 öre/kWh, vilket är rekordlågt och de lägsta på minst 25 år.

– Elpriset påverkas av en rad faktorer men vädret väger tyngst. På sommaren minskar efterfrågan på el och många verksamheter har ett uppehåll. Detta tillsammans med goda förutsättningar inom kraftproduktionen påverkar elpriset nedåt, säger Jonas Stenbeck, privatkundschef Vattenfall Försäljning Norden.

Den hydrologiska balansen, måttet för att uppskatta hur mycket vatten som finns lagrat ovanför kraftstationerna, ligger över normal nivå, särskilt i norra Skandinavien. Tillgängligheten för kärnkraften i Norden är just nu 82 procent av installerad effekt.

– De goda nordiska produktionsförutsättningarna gör elpriserna mindre känsliga för förändringar i omvärlden, säger Jonas Stenbeck.

Priserna på olja och gas kan dock ändras snabbt med anledning av en turbulent omvärld. På kontinenten har efterfrågan på gas sjunkit och nytt solkraftsrekord för Tyskland sattes på midsommarafton med en produktion på 52,5 GW.

– Många av de goda elvanor vi skaffade oss under elpriskrisen verkar leva kvar och gör nytta även på sommaren. De svenska hushållens elförbrukning under 2024 var faktiskt den lägsta detta millenium, säger Jonas Stenbeck.

| Medelspotpris | Juni 2024 | Juni 2025 |

| Elområde 1, Norra Sverige | 24,04 öre/kWh | 3,05 öre/kWh |

| Elområde 2, Norra Mellansverige | 24,04 öre/kWh | 4,99 öre/kWh |

| Elområde 3, Södra Mellansverige | 27,27 öre/kWh | 22,79 öre/kWh |

| Elområde 4, Södra Sverige | 62,70 öre/kWh | 40,70 öre/kWh |

Nyheter

Samtal om flera delar av råvarumarknaden

Ett samtal som sammanfattar ett relativt stabilt halvår på råvarumarknaden trots volatilitet och geopolitiska spänningar som sannolikt fortsätter in i andra halvan av året. Vi bjuds även på kommentarer från Carlos Mera, Rabobanks analyschef för jordbrukssektorn och Kari Kangas, skogsanalytiker.

Nyheter

Jonas Lindvall är tillbaka med ett nytt oljebolag, Perthro, som ska börsnoteras

Jonas Lindvall, ett välkänt namn i den svenska olje- och gasindustrin, är tillbaka med ett nytt företag – Perthro AB – som nu förbereds för notering i Stockholm. Med över 35 års erfarenhet från bolag som Lundin Oil, Shell och Talisman Energy, och som medgrundare till energibolag som Tethys Oil och Maha Energy, är Lindvall redo att än en gång bygga ett bolag från grunden.

Tillsammans med Andres Modarelli har han startat Perthro med ambitionen att bli en långsiktigt hållbar och kostnadseffektiv producent inom upstream-sektorn – alltså själva oljeutvinningen. Deras timing är strategisk. Med ett inflationsjusterat oljepris som enligt Lindvall är lägre än på 1970-talet, men med fortsatt växande efterfrågan globalt, ser de stora möjligheter att förvärva tillgångar till attraktiva priser.

Perthro har redan säkrat bevisade oljereserver i Alberta, Kanada – en region med rik oljehistoria. Bolaget tittar även på ytterligare projekt i Oman och Brasilien, där Lindvall har tidigare erfarenhet. Enligt honom är marknadsförutsättningarna idealiska: världens efterfrågan på olja ökar, medan utbudet inte hänger med. Produktionen från befintliga oljefält minskar med cirka fem procent per år, samtidigt som de största oljebolagen har svårt att ersätta de reserver som produceras.

”Det här skapar en öppning för nya aktörer som kan agera snabbare, tänka långsiktigt och agera med kapitaldisciplin”, säger Lindvall.

Perthro vill fylla det växande gapet på marknaden – med fokus på hållbar tillväxt, hög avkastning och effektiv produktion. Med Lindvalls meritlista och branschkunskap hoppas bolaget nu kunna bli nästa svenska oljebolag att sätta avtryck på världskartan – och på börsen.

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanStor uppsida i Lappland Guldprospekterings aktie enligt analys

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanBrookfield ska bygga ett AI-datacenter på hela 750 MW i Strängnäs

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanSilverpriset släpar efter guldets utveckling, har mer uppsida

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanTradingfirman XTX Markets bygger datacenter i finska Kajana för 1 miljard euro

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanUppgången i oljepriset planade ut under helgen

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanLåga elpriser i sommar – men mellersta Sverige får en ökning

-

Analys2 veckor sedan

Analys2 veckor sedanVery relaxed at USD 75/b. Risk barometer will likely fluctuate to higher levels with Brent into the 80ies or higher coming 2-3 weeks

-

Nyheter1 vecka sedan

Nyheter1 vecka sedanMahvie Minerals växlar spår – satsar fullt ut på guld