Nyheter

David Hargreaves on Iron Ore Week 19 2012

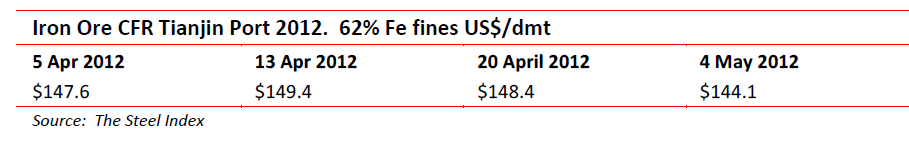

Iron ore, as ever, grabs the news. The increasingly important spot price fell this week, to $144/t down $4 in two weeks. Fears are of lower offtake from China as it enters a less steel-intensive growth phase. The World Steel Association is forecasting consumption growth in 2012 of “only” 3.6%, from 5.6% in 2011. That is still an extra 90Mt of iron ore, or the combined outputs of Canada and South Africa. Yet this must be matched against growth ambitions of the miners. Long term expansion plans, all of them highly CAPEX demanding, are underway in well rooted homes Brazil, Australia and South Africa. China dominates imports with 59% of world demand at c. 650Mt/yr despite being the largest producer. So it is looking abroad. West Africa – Sierra Leone, Liberia, Guinea – are hotspots but Canada is again rising.

Iron ore, as ever, grabs the news. The increasingly important spot price fell this week, to $144/t down $4 in two weeks. Fears are of lower offtake from China as it enters a less steel-intensive growth phase. The World Steel Association is forecasting consumption growth in 2012 of “only” 3.6%, from 5.6% in 2011. That is still an extra 90Mt of iron ore, or the combined outputs of Canada and South Africa. Yet this must be matched against growth ambitions of the miners. Long term expansion plans, all of them highly CAPEX demanding, are underway in well rooted homes Brazil, Australia and South Africa. China dominates imports with 59% of world demand at c. 650Mt/yr despite being the largest producer. So it is looking abroad. West Africa – Sierra Leone, Liberia, Guinea – are hotspots but Canada is again rising.

Its major concentration is in the Labrador Trough. An unforgiving tract of land stretching to the Arctic Circle. It first produced iron ore in the 1950’s and is making a comeback, using much of the remaining infrastructure including the vital rail links from the deepwater port of Sept-lles to the mines. The Chinese have found out where it is. Their initial foray is via steel giant Hebei Iron and Steel and a Canadian junior Alderan Iron Ore (TSX: ADV), in which Hebei has taken a 19.9% interest. Already well established in Labrador is Labrador Iron Mines: (TSX: LIM) in which the UK’s Anglesey Mining has a 28% stake. Analysts speak of Canada’s iron ore production rising from 41Mt in 2011 to 72Mt in 2012. Health warning: in Labrador and northern Quebec you get 9 months winter when 70 below is not uncommon. So you pray for summer. In that short window you get 90° above and if the mosquitoes don’t get you, the black flies will.

[hr]

About David Hargreaves

David Hargreaves is a mining engineer with over forty years of senior experience in the industry. After qualifying in coal mining he worked in the iron ore mines of Quebec and Northwest Ontario before diversifying into other bulk minerals including bauxite. He was Head of Research for stockbrokers James Capel in London from 1974 to 1977 and voted Mining Analyst of the year on three successive occasions.

Since forming his own metals broking and research company in 1977, he has successfully promoted and been a director of several public companies. He currently writes “The Week in Mining”, an incisive review of world mining events, for stockbrokers WH Ireland. David’s research pays particular attention to steel via the iron ore and coal supply industries. He is a Chartered Mining Engineer, Fellow of the Geological Society and the Institute of Mining, Minerals and Materials, and a Member of the Royal Institution. His textbook, “The World Index of Resources and Population” accurately predicted the exponential rise in demand for steel industry products.

Nyheter

Samtal om sällsynta jordartsmetaller, guld och silver

Samtal om sällsynta jordartsmetaller, guld och silver, samt gruvbolag. Clara My Lernborg på EFN ger sin syn på sällsynta jordartsmetaller som blivit centrala i den globala geopolitiken. Sarah Tomlinson på Metals Focus ger sin syn på guld. Eric Strand på AuAg Fonder ger sin syn på guld, silver och relaterade gruvbolagsaktier.

Nyheter

Brookfield köper bränsleceller för 5 miljarder USD av Bloom Energy för att driva AI-datacenter

Brookfield och Bloom Energy inleder ett partnerskap där Brookfield i den första fasen köper bränsleceller för 5 miljarder USD av Bloom Energy för att driva AI-datacenter. Bränslecellerna kommer att installeras bakom elmätarna och AI-datacentren kommer således inte att belasta eller vara beroende av elnätet.

Partnerskapet markerar den första fasen i en gemensam vision om att bygga AI-datacenter som kan möta den snabbt växande efterfrågan på beräkningskapacitet och energi inom artificiell intelligens.

AI-datacenter kräver infrastruktur som integrerar beräkningskraft, energi, datacenterarkitektur och kapital på ett tätt och effektivt sätt. Bloom Energys bränsleceller levererar pålitlig, skalbar och lokal energi som snabbt kan tas i drift utan beroende av traditionella elnät. Brookfield tillför världsledande kompetens inom infrastrukturutveckling och finansiering.

I kärnan av det nya partnerskapet kommer Brookfield att investera upp till 5 miljarder dollar för att införa Blooms avancerade bränslecellsteknik. Bolagen samarbetar aktivt kring utformning och leverans av AI-datacenter globalt – inklusive en europeisk anläggning som kommer att offentliggöras innan årets slut.

”AI-infrastruktur måste byggas som en fabrik – med syfte, hastighet och skala,” säger KR Sridhar, grundare, ordförande och vd för Bloom Energy. ”Till skillnad från traditionella fabriker kräver AI-fabriker enorm energitillgång, snabb etablering och realtidsanpassning till belastning – något som gamla elnät inte klarar av. Den effektiva AI-fabriken uppnås genom att energi, infrastruktur och beräkningskraft designas i harmoni från dag ett. Det är den principen som styr vårt samarbete med Brookfield när vi omformar framtidens datacenter. Tillsammans skapar vi en ny ritning för hur AI skalas upp med kraft.”

”Energilösningar bakom mätaren är avgörande för att överbrygga elnätsgapet för AI-fabriker,” säger Sikander Rashid, global chef för AI-infrastruktur på Brookfield. ”Blooms avancerade bränslecellsteknik ger oss en unik möjlighet att designa och bygga moderna AI-fabriker med ett helhetsperspektiv på energibehov. Som världens största investerare inom AI-infrastruktur tillför detta partnerskap ett kraftfullt nytt verktyg till vår globala tillväxtstrategi – särskilt i en marknad där tillgången till elnät är begränsad.”

AI-datacenter i USA förväntas använda 100 gigawatt vid 2035

Enligt prognosoer väntas elförbrukningen från AI-datacenter i USA växa exponentiellt och överstiga 100 gigawatt till 2035. Bränsleceller har blivit en nyckellösning för att möta detta problem, och partnerskapet mellan Bloom Energy och Brookfield är utformat för att hantera just detta energigap.

Bloom Energy har erfarenhet

Bloom Energy har redan installerat hundratals megawatt av sin bränslecellsteknik i datacenter och levererar el till några av världens mest kritiska digitala infrastrukturer genom partnerskap med American Electric Power (AEP), Equinix och Oracle.

Brookfield är en jätte inom digital infrastruktur

Detta partnerskap utgör Brookfields första investering inom sin dedikerade AI-infrastruktur-strategi, som fokuserar på investeringar i stora AI-datacenter, energilösningar, beräkningsinfrastruktur och strategiska kapitalpartnerskap. Strategin bygger vidare på Brookfields erfarenhet av att ha investerat över 100 miljarder dollar i digital infrastruktur globalt.

Nyheter

Teck Resources kan förse Nordamerika och kanske hela G7 med all germanium som behövs

Kanadensiska gruvbolaget Teck Resources för samtal med både USA och Kanada om att leverera kritiska mineraler till de båda ländernas försvarsindustrier – bara en dag efter att Kina skärpt sina exportregler för sällsynta jordartsmetaller.

Enligt Financial Times diskuterar bolaget möjligheterna att leverera germanium, antimon och gallium, under förutsättning att det kan få garantier för minimipriser och köpvolymer.

Kinas senaste besked innebär en utvidgning och förtydligande av de omfattande exportkontroller som infördes redan i april. De tidigare restriktionerna ledde till stora bristsituationer globalt innan nya avtal med Europa och USA gjorde det möjligt att återuppta leveranser. Den nya regeln klargör dock att exportlicenser sannolikt kommer att nekas till vapenproducenter och vissa halvledarföretag.

Vid FT Metals and Mining Summit uppgav Teck Resources vd att bolaget kan producera tillräckligt med germanium för att täcka hela Nordamerikas behov – och möjligen även G7-ländernas.

Teck Resources och Anglo American går samman

Teck Resources och Anglo American är mitt uppe i en fusion, vilket beskrivs som ett samgående av två jämbördiga parter.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanKinas elproduktion slog nytt rekord i augusti, vilket även kolkraft gjorde

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanTyskland har så höga elpriser att företag inte har råd att använda elektricitet

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanOPEC+ missar produktionsmål, stöder oljepriserna

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanEtt samtal om guld, olja, fjärrvärme och förnybar energi

-

Analys4 veckor sedan

Analys4 veckor sedanBrent crude ticks higher on tension, but market structure stays soft

-

Analys3 veckor sedan

Analys3 veckor sedanAre Ukraine’s attacks on Russian energy infrastructure working?

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanGuld nära 4000 USD och silver 50 USD, därför kan de fortsätta stiga

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanGuldpriset uppe på nya höjder, nu 3750 USD