Nyheter

David Hargreaves on Iron ore, week 14 2012

Iron Ore continues to dominate news in the bulk trade, as befits a mineral whose output is measured at over one billion tonnes per year and growing at over 6% annually. That alone is the combined exports of Canada and South Africa.

Iron Ore continues to dominate news in the bulk trade, as befits a mineral whose output is measured at over one billion tonnes per year and growing at over 6% annually. That alone is the combined exports of Canada and South Africa.

Of greatest importance is that as an export-driven trade, critical to producers such as Australia, Brazil, India and the CIS. Further, almost 60% of all is destined for China and 20% for Japan and South Korea. The market is effectively polarised.

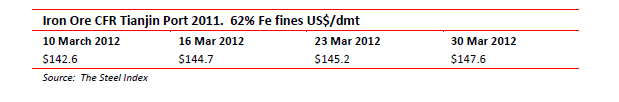

Contract pricing ruled for many years in annual bargains driven by the above importers and the major producing companies Vale SA (24% world production), Rio Tinto (14%) and BHPB (10%). Now it has all but broken down and been replaced by reference to the spot market. The growth of that mechanism owes much to the development of diversified production bases in West Africa and continued growth in the established mining locations. Much has been made of the possible economic slowdown in China. In context, this means that last year’s 9.3% increase may only be 8% this year. That is still another 80Mtpy. There are warnings of the spot price softening but this has not been borne out. It further nudged up to $145.2/t thisweek even as new investment and output news flows in. Increasingly, users are investing in mines to secure supplies.

- Japanese trader Marubeni is teaming up with South Korea’s steel maker Posco and ship builder STX to buy 30% of the Roy Hill project in Australia, whose plan is to hit 55Mtpy by 2014. That works out at about $220/t of output or 1.50 x the sales price.

- AIM listed but with loftier ambitions, London Mining (285p; Hi-Lo 438p-256p) is now fully funded to boost capacity at its Marampa, Sierra Leone mine to 5Mtpy. It has an offtake agreement with trading company Vitol. It also has an offtake contract with Glencore. Both have prepayment clauses. There is a further target of 9Mtpy.

Iron ore pricing. Wood MacKenzie sees iron ore supply and demand coming into balance over the next few years and the price slowly to decline. Their range is $157/t in 2012, $155/t in 2013 and $140/t in 2014. They warn of projects in the riskier and less developed regions suffering. Demand growth in China is pitched at 5% per year. They look for coking coal, essential to steel making, to average $200-215/t in the next few years.

Chrome Ore. A much misunderstood metal, its major end use is as ferro-chrome for use in steel making, particularly the stainless variety. This is achieved by mixing the ore with iron and coke, a relatively expensive process but with a resultant price enhancement. Resources are not a problem, measuring over 300 years at present rates of usage. However they lie selectively in RSA (70%) Russia and CIS (10%) and Zimbabwe (10%). South Africa has long been the dominant producer, but its share of supply as ferro-chrome (as opposed to chrome ore) has slipped from 50% in 2001 to 42% now, with China’s share up in the same period from 5% to 25%. Much of China’s output arises from raw ore shipped from RSA. This has been noticed in high places. They tell us the industry employs 200,000 people and its exports are worth R42bn to GDP. So there is a call to slap a duty of $100/t on raw chrome exports, to encourage local beneficiation. Problem: it is energy intensive and to show the comic-tragic nature of the situation, even as the call went out for the export tax, at least one ferrochrome producer was cutting back on its electricity usage at the behest of power generator Eskom. You can’t have your pasties and eat them, chaps

[hr]

About David Hargreaves

David Hargreaves is a mining engineer with over forty years of senior experience in the industry. After qualifying in coal mining he worked in the iron ore mines of Quebec and Northwest Ontario before diversifying into other bulk minerals including bauxite. He was Head of Research for stockbrokers James Capel in London from 1974 to 1977 and voted Mining Analyst of the year on three successive occasions.

Since forming his own metals broking and research company in 1977, he has successfully promoted and been a director of several public companies. He currently writes “The Week in Mining”, an incisive review of world mining events, for stockbrokers WH Ireland. David’s research pays particular attention to steel via the iron ore and coal supply industries. He is a Chartered Mining Engineer, Fellow of the Geological Society and the Institute of Mining, Minerals and Materials, and a Member of the Royal Institution. His textbook, “The World Index of Resources and Population” accurately predicted the exponential rise in demand for steel industry products.

Nyheter

Hur säkrar vi Sveriges tillgång till kritiska metaller och mineral i en ny geopolitisk verklighet?

När världsläget förändras ställs Europas beroende av metaller och mineral på sin spets. Geopolitiska spänningar, handelskonflikter och ett mer oförutsägbart USA gör att vi inte längre kan ta gamla allianser för givna. Samtidigt kontrolleras en stor del av de kritiska råvarorna vi är beroende av av andra makter – inte minst Kina. Vad händer med Sveriges industriella förmåga i ett läge där importen stryps? Hur påverkas försvarsindustrin av Kinas exportrestriktioner? Är EU:s nya råvarupolitik tillräcklig för att minska sårbarheten – eller krävs ytterligare statliga insatser och beredskapslagring? Svemin anordnade den 25 juni ett seminarium som bestod av bestod av deltagare från myndigheter, politik och industri. Man diskuterar Sveriges och EU:s strategiska vägval i en ny global verklighet – och vad som krävs för att säkra tillgången till metaller när vi behöver dem som mest.

Nyheter

Lundin Mining ska bli en av de tio största kopparproducenterna i världen

Lundin Mining är bolaget i Lundin-sfären som satsar stort på Vicuña-projektet i Argentina. Det ska lyfta Lundin Mining till att bli en av de tio största kopparproducenterna i världen skriver Affärsvärlden och upprepar sin köprekommendation för aktien.

”Även om en framgång inte är på förhand given tror vi att Vicuña har goda chanser att bli bra. Vi förnyar vårt köpråd för Lundin Mining”

Enligt Lundin Minings ledning kommer man att klara att finansiera sin del av investeringarna i Vicuña genom det löpande kassaflödet som man förväntar sig ska bli omkring 5 miljarder dollar kommande fem år i kombination med lån.

Nyheter

Sommarvädret styr elpriset i Sverige

Många verksamheter tar nu ett sommaruppehåll och ute värmer solen, det är gott om vatten och vinden blåser. Lägre efterfrågan på el och goda förutsättningar för kraftproduktionen höll ner elpriserna under juni.

Elpriset på den nordiska elbörsen Nord Pool (utan påslag och exklusive moms) i elområde 1 och 2 (Norra Sverige) blev för juni 3,05 respektive 4,99 öre/kWh, vilket är rekordlågt och de lägsta på minst 25 år.

– Elpriset påverkas av en rad faktorer men vädret väger tyngst. På sommaren minskar efterfrågan på el och många verksamheter har ett uppehåll. Detta tillsammans med goda förutsättningar inom kraftproduktionen påverkar elpriset nedåt, säger Jonas Stenbeck, privatkundschef Vattenfall Försäljning Norden.

Den hydrologiska balansen, måttet för att uppskatta hur mycket vatten som finns lagrat ovanför kraftstationerna, ligger över normal nivå, särskilt i norra Skandinavien. Tillgängligheten för kärnkraften i Norden är just nu 82 procent av installerad effekt.

– De goda nordiska produktionsförutsättningarna gör elpriserna mindre känsliga för förändringar i omvärlden, säger Jonas Stenbeck.

Priserna på olja och gas kan dock ändras snabbt med anledning av en turbulent omvärld. På kontinenten har efterfrågan på gas sjunkit och nytt solkraftsrekord för Tyskland sattes på midsommarafton med en produktion på 52,5 GW.

– Många av de goda elvanor vi skaffade oss under elpriskrisen verkar leva kvar och gör nytta även på sommaren. De svenska hushållens elförbrukning under 2024 var faktiskt den lägsta detta millenium, säger Jonas Stenbeck.

| Medelspotpris | Juni 2024 | Juni 2025 |

| Elområde 1, Norra Sverige | 24,04 öre/kWh | 3,05 öre/kWh |

| Elområde 2, Norra Mellansverige | 24,04 öre/kWh | 4,99 öre/kWh |

| Elområde 3, Södra Mellansverige | 27,27 öre/kWh | 22,79 öre/kWh |

| Elområde 4, Södra Sverige | 62,70 öre/kWh | 40,70 öre/kWh |

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanStor uppsida i Lappland Guldprospekterings aktie enligt analys

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanSilverpriset släpar efter guldets utveckling, har mer uppsida

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanUppgången i oljepriset planade ut under helgen

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanLåga elpriser i sommar – men mellersta Sverige får en ökning

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanMahvie Minerals växlar spår – satsar fullt ut på guld

-

Analys3 veckor sedan

Analys3 veckor sedanVery relaxed at USD 75/b. Risk barometer will likely fluctuate to higher levels with Brent into the 80ies or higher coming 2-3 weeks

-

Nyheter1 vecka sedan

Nyheter1 vecka sedanOljan, guldet och marknadens oroande tystnad

-

Nyheter1 vecka sedan

Nyheter1 vecka sedanJonas Lindvall är tillbaka med ett nytt oljebolag, Perthro, som ska börsnoteras