Analys

Trade war and Nopec-shake, but market looks like tightening

Brent crude sold off 1.7% yesterday with a close of $61.63/bl but has rebounded 0.4% today trading at $61.8/bl. The sell-off came on the back of a 0.9% decline in S&P 500 and a marginally stronger dollar with DXY now just 0.9% below the highs from late 2018. The clear driver for the sell-off in both crude and equities was the signal from Donald Trump that there will be no trade deal between China and the US before the March 1 deadline runs out. The consequence of this is that tariffs on about $200bn worth of goods from China will increase from 10% to 25% from March 1. It definitely took the air out of growth hopes both for economics and for oil.

Brent crude sold off 1.7% yesterday with a close of $61.63/bl but has rebounded 0.4% today trading at $61.8/bl. The sell-off came on the back of a 0.9% decline in S&P 500 and a marginally stronger dollar with DXY now just 0.9% below the highs from late 2018. The clear driver for the sell-off in both crude and equities was the signal from Donald Trump that there will be no trade deal between China and the US before the March 1 deadline runs out. The consequence of this is that tariffs on about $200bn worth of goods from China will increase from 10% to 25% from March 1. It definitely took the air out of growth hopes both for economics and for oil.

US Nopec legislation (“No Oil Producing and Exporting Cartels Act 2019”) moved forward in the US. The bill was approved by the House judiciary committee on Thursday and is now ready for a full House vote. It will also need to be approved by the US Senate. Given Donald Trump’s known hostile stance towards OPEC it now looks like a very good chance that the bill will actually be voted through without being vetoed down by the President (George W Bush did that last time the bill was promoted). The prospect of a passage of Nopec legislation has added bearish pressure to Brent crude.

We don’t think that OPEC intervention matters all that much in the medium to longer term. After all, it is not low cost OPEC oil which sets the marginal cost of oil in the global market. It is the higher non-OPEC marginal cost which sets the global oil price over time. OPEC can never escape from this fact.

OPEC intervention is however a very important short term oil price driver. It is no doubt that the boost in production by OPEC+ from May to November last year helped to drown the global market in oil and crash the oil price from October to December. It is likewise just as clear that the revival in oil prices since December low of just below $50/bl to a recent high of $63.63/bl has the fingerprint of production cuts agreed by OPEC+ in December all over it.

So if the US Nopec legislation is voted through and becomes law it could definitely be bearish for oil prices right here and now given that OPEC+ is in the midst of tactical production cuts right this moment. The Nopec law will enable the US to prosecute OPEC members for price manipulation and potentially confiscate oil assets in the US belonging to such OPEC members. Whether OPEC members in general and Saudi Arabia specifically would cave in if Nopec becomes law remains to be seen. Qatar however left OPEC in December after 57 years in the group presumably due to the risk of Nopec becoming law.

It is Saudi Arabia which really is the captain of the OPEC ship. It is also Saudi Arabia who really moves supply up and down and moves the market with the other members just pitching in a little. The Nopec legislation could end tactical, cooperative production cuts and increases orchestrated by OPEC. It should probably not hinder Saudi Arabia to move production up and down on its own in order to address tactical turns and imbalances in the global oil market.

The Nopec legislation is however right in the face of Saudi Arabia. If Nopec becomes law it must be very damaging to the long lasting relationship between the US and Saudi Arabia. How can they go on being best palls if the US kills off OPEC as an organisation we wonder? This may be the next step in the geopolitical changes taking place in the Middle East. The US needs the Middle East less due to close to self-sufficiency of oil. China and India needs it more and more along with their rapidly rising oil imports and Russia is eager to get closer ties and influence in the region. Thus geopolitical changes could be the biggest fall-out.

OPEC’s true value strategy is not primarily about holding back supply tactically from existing production capacity from time to time even though this is primarily what the oil market is focusing on. The true strategy for OPEC is to make sure that they do not over-invest in their own low cost oil assets over time. It is about making sure that the global oil price balances on the higher non-OPEC marginal cost and not through over-investments within OPEC ends up balancing on low cost OPEC oil.

Thus OPEC needs to make sure that if global oil demand grows with some 1.4 m bl/d per year, then production growth from OPEC should be materially less than that. Achieving that is not about holding back production in existing capacity. It is about making sure that upstream investments in OPEC are not too high. The true OPEC strategy is thus about investment discipline over time and not about production discipline from existing capacity. On this more strategic issue it is not so clear that Nopec legislation will have all that much impact.

The amount of fossil fuels in the world is in a human perspective more or less infinite. It is all over the place. We are not running out. The price of oil is about how much oil we have above ground and not about how much is in the ground. Thus discipline on investments is OPEC’s true strategy.

As of right now OPEC+ continues to firm up the global market with its tactical tightening agreed upon in December. In addition we are losing volumes in Venezuela and Iran while general Haftar is fighting over the Sharara oil field in Libya.

Our view is that the situation in Venezuela will get worse before it gets better. US sanctions are biting and a visible reflection of that could be the softer shipping rates for Caribbean to the US Gulf trades since early January. I.e. it looks like shipments of oil out of Venezuela are declining further due to US sanctions. There may be a regime shift from Maduro to Guaido sometime in the future but we find it hard to imagine that Maduro will give up easily as he is backed by China and Russia. Even after a potential shift it will take time to revive confidence to international investors (debt holders) and oil service companies as well as all the oil service personnel which has fled the country. Money, people, competence and companies needs to move back to the country and then the oil industry needs to be revived. It is hard to see a strong revival in oil production in Venezuela this year.

Iran is definitely a sad, sad story and US shale oil production boom is bad, bad news for the Iran. Donald Trump handed out handsome oil import waivers to international buyers in Q4-18 in order to avoid a spike in the oil price. However, every additional barrel of oil produced in the US enables the US to reduce the Iran waivers just as much. Thus the more you are bullish US crude production, the more you should expect to see further declines in Iran oil exports along with smaller and smaller US waivers being handed out. Thus more US oil probably means comparably less oil out of Iran. Unfortunately for Iran.

The global economy is of great concern with continued US-China trade war (no resolution by March 1) and weakening outlook in general driving the outlook for global oil demand growth in 2019 lower. Global refining margins have moved down to very weak and painful levels at which refineries becomes increasingly likely to reduce their refining utilization. We are also moving towards the spring (March, April) refinery turnarounds where refineries are taken off-line for maintenance and summer tuning. This should lead to a temporary softer crude market with somewhat weaker crude spot dynamics over the next couple of months which might weight bearishly on crude prices. I.e. crude prices could be more bearishly sensitive to ingredients like a stronger dollar and/or equity sell-offs.

In total and on balance, it still looks like the crude oil market is on a tightening path due to both voluntary and involuntary cuts by OPEC+. Set-backs in the oil price rally since late December is however clearly a risk with Nopec, US-China trade war, global growth concerns, weak refinery margins, US dollar strength and potential sell-offs in the S&P 500 as the main concerns.

Analys

OPEC+ in a process of retaking market share

Oil prices are likely to fall for a fourth straight year as OPEC+ unwinds cuts and retakes market share. We expect Brent crude to average USD 55/b in Q4/25 before OPEC+ steps in to stabilise the market into 2026. Surplus, stock building, oil prices are under pressure with OPEC+ calling the shots as to how rough it wants to play it. We see natural gas prices following parity with oil (except for seasonality) until LNG surplus arrives in late 2026/early 2027.

Oil market: Q4/25 and 2026 will be all about how OPEC+ chooses to play it

OPEC+ is in a process of unwinding voluntary cuts by a sub-group of the members and taking back market share. But the process looks set to be different from 2014-16, as the group doesn’t look likely to blindly lift production to take back market share. The group has stated very explicitly that it can just as well cut production as increase it ahead. While the oil price is unlikely to drop as violently and lasting as in 2014-16, it will likely fall further before the group steps in with fresh cuts to stabilise the price. We expect Brent to fall to USD 55/b in Q4/25 before the group steps in with fresh cuts at the end of the year.

Natural gas market: Winter risk ahead, yet LNG balance to loosen from 2026

The global gas market entered 2025 in a fragile state of balance. European reliance on LNG remains high, with Russian pipeline flows limited to Turkey and Russian LNG constrained by sanctions. Planned NCS maintenance in late summer could trim exports by up to 1.3 TWh/day, pressuring EU storage ahead of winter. Meanwhile, NE Asia accounts for more than 50% of global LNG demand, with China alone nearing a 20% share (~80 mt in 2024). US shale gas production has likely peaked after reaching 104.8 bcf/d, even as LNG export capacity expands rapidly, tightening the US balance. Global supply additions are limited until late 2026, when major US, Qatari and Canadian projects are due to start up. Until then, we expect TTF to average EUR 38/MWh through 2025, before easing as the new supply wave likely arrives in late 2026 and then in 2027.

Analys

Manufacturing PMIs ticking higher lends support to both copper and oil

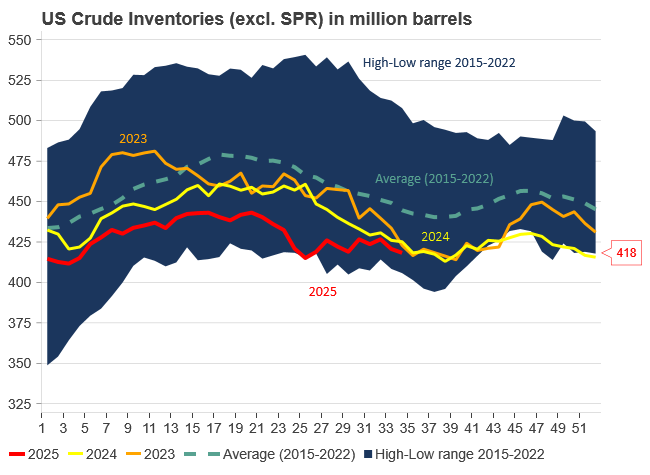

Price action contained withing USD 2/b last week. Likely muted today as well with US closed. The Brent November contract is the new front-month contract as of today. It traded in a range of USD 66.37-68.49/b and closed the week up a mere 0.4% at USD 67.48/b. US oil inventory data didn’t make much of an impact on the Brent price last week as it is totally normal for US crude stocks to decline 2.4 mb/d this time of year as data showed. This morning Brent is up a meager 0.5% to USD 67.8/b. It is US Labor day today with US markets closed. Today’s price action is likely going to be muted due to that.

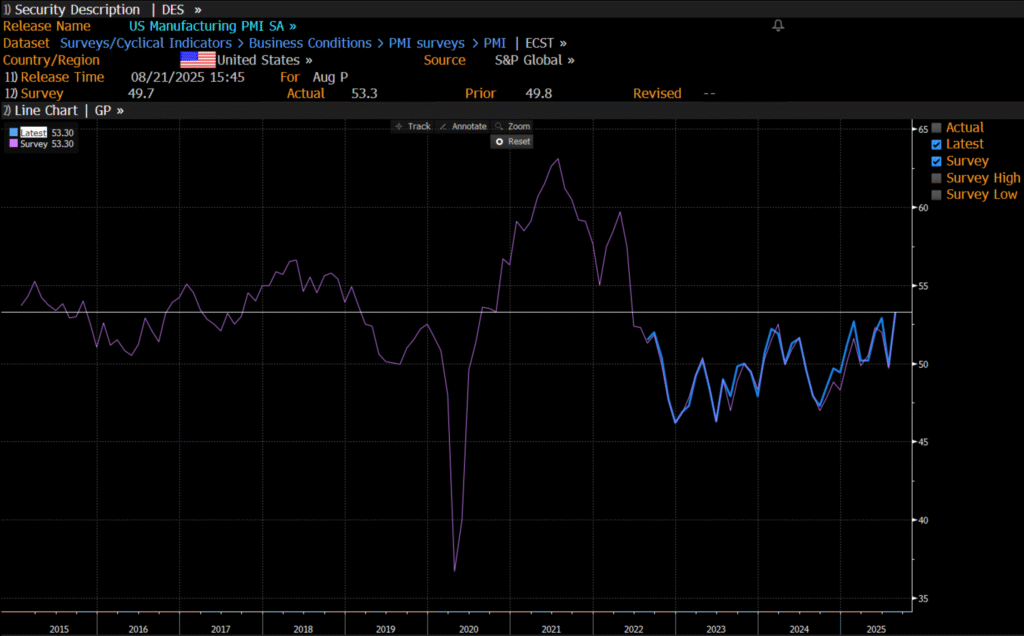

Improving manufacturing readings. China’s manufacturing PMI for August came in at 49.4 versus 49.3 for July. A marginal improvement. The total PMI index ticked up to 50.5 from 50.2 with non-manufacturing also helping it higher. The HCOB Eurozone manufacturing PMI was a disastrous 45.1 last December, but has since then been on a one-way street upwards to its current 50.5 for August. The S&P US manufacturing index jumped to 53.3 in August which was the highest since 2022 (US ISM manufacturing tomorrow). India manufacturing PMI rose further and to 59.3 for August which is the highest since at least 2022.

Are we in for global manufacturing expansion? Would help to explain copper at 10k and resilient oil. JPMorgan global manufacturing index for August is due tomorrow. It was 49.7 in July and has been below the 50-line since February. Looking at the above it looks like a good chance for moving into positive territory for global manufacturing. A copper price of USD 9935/ton, sniffing at the 10k line could be a reflection of that. An oil price holding up fairly well at close to USD 68/b despite the fact that oil balances for Q4-25 and 2026 looks bloated could be another reflection that global manufacturing may be accelerating.

US manufacturing PMI by S&P rose to 53.3 in August. It was published on 21 August, so not at all newly released. But the US ISM manufacturing PMI is due tomorrow and has the potential to follow suite with a strong manufacturing reading.

Analys

Crude stocks fall again – diesel tightness persists

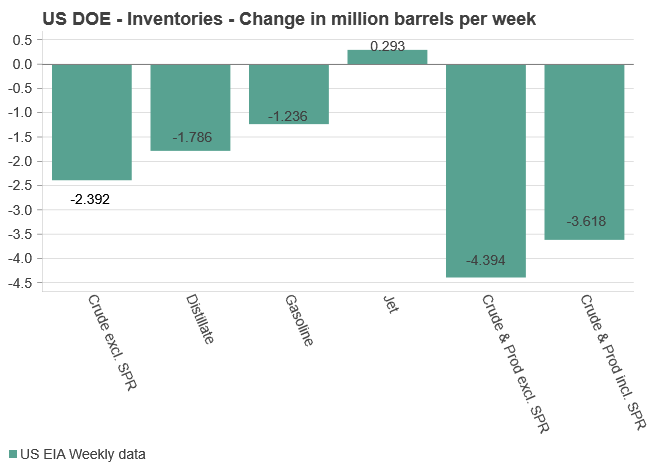

U.S. commercial crude inventories posted another draw last week, falling by 2.4 million barrels to 418.3 million barrels, according to the latest DOE report. Inventories are now 6% below the five-year seasonal average, underlining a persistently tight supply picture as we move into the post-peak demand season.

While the draw was smaller than last week’s 6 million barrel decline, the trend remains consistent with seasonal patterns. Current inventories are still well below the 2015–2022 average of around 449 million barrels.

Gasoline inventories dropped by 1.2 million barrels and are now close to the five-year average. The breakdown showed a modest increase in finished gasoline offset by a decline in blending components – hinting at steady end-user demand.

Diesel inventories saw yet another sharp move, falling by 1.8 million barrels. Stocks are now 15% below the five-year average, pointing to sustained tightness in middle distillates. In fact, diesel remains the most undersupplied segment, with current inventory levels at the very low end of the historical range (see page 3 attached).

Total commercial petroleum inventories – including crude and products but excluding the SPR – fell by 4.4 million barrels on the week, bringing total inventories to approximately 1,259 million barrels. Despite rising refinery utilization at 94.6%, the broader inventory complex remains structurally tight.

On the demand side, the DOE’s ‘products supplied’ metric – a proxy for implied consumption – stayed strong. Total product demand averaged 21.2 million barrels per day over the last four weeks, up 2.5% YoY. Diesel and jet fuel were the standouts, up 7.7% and 1.7%, respectively, while gasoline demand softened slightly, down 1.1% YoY. The figures reflect a still-solid late-summer demand environment, particularly in industrial and freight-related sectors.

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanOmgående mångmiljardfiasko för Equinors satsning på Ørsted och vindkraft

-

Nyheter4 veckor sedan

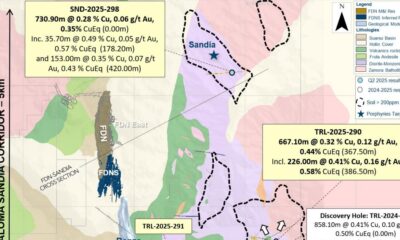

Nyheter4 veckor sedanLundin Gold hittar ny koppar-guld-fyndighet vid Fruta del Norte-gruvan

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanMeta bygger ett AI-datacenter på 5 GW och 2,25 GW gaskraftverk

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanGuld stiger till över 3500 USD på osäkerhet i världen

-

Analys3 veckor sedan

Analys3 veckor sedanWhat OPEC+ is doing, what it is saying and what we are hearing

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanAlkane Resources och Mandalay Resources har gått samman, aktör inom guld och antimon

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanAker BP gör ett av Norges största oljefynd på ett decennium, stärker resurserna i Yggdrasilområdet

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanLyten, tillverkare av litium-svavelbatterier, tar över Northvolts tillgångar i Sverige och Tyskland