Analys

SEB – Råvarukommentarer vecka 26 2012

Sammanfattning: Denna vecka

- Brett råvaruindex: +2,74%

UBS Bloomberg CMCI TR Index - Energi: +1,05%

UBS Bloomberg CMCI Energy TR Index - Ädelmetaller: +0,18%

UBS Bloomberg CMCI Precious Metals TR Index - Industrimetaller: +1,44%

UBS Bloomberg CMCI Industrial Metals TR Index - Jordbruk: +6,44%

UBS Bloomberg CMCI Agriculture TR Index

Kortsiktig marknadsvy:

- Guld: Neutral/köp

- Olja: Neutral/köp

- Koppar: Neutral

- Majs: Köp

- Vete: Köp

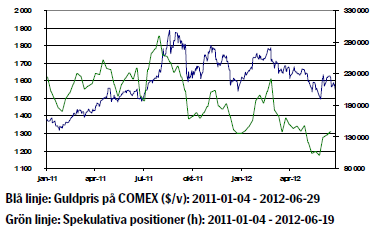

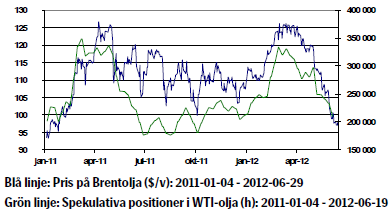

Guld

Fokus i veckan har riktats mot gårdagens och dagens EU-toppmöte. Tongångarna mellan ledarna har varit skarpa och den rådande oenigheten är stor, framförallt vad gäller möjligheten till en framtida fiskal integration, något som skulle inskränka ländernas nationella självbestämmande. Möjligheterna att EU-ledarna ska komma fram till några tydliga beslut måste betraktas som små. Idag på morgon är det övervägande positiv stämning som överväger det negativa sentiment som rådde igår. Natten till idag enades ledarna att några nödvändiga punkter som börjar likna en krisplan.

Oron för Spanien fortsätter och i veckan kom dessutom formella ansökningar om stöd från både Cypern och Spanien.

I Grekland är en ny regering på plats och det finns förmodligen ett visst utrymme för att man ska komma överens med sina långivare om smärre lättnader i villkoren för stödlånen.

Guldet har backat 0,10 procent under veckan. Vi anser inte att guldrally är troligt men att vi kommer se högre priser på kort sikt.

Teknisk analys: Tillbaka under 55d bandet.

Något förvånande, i.a.f. för undertecknad, föll den gula metallen tillbaka under 55dagars bandet, något som gör att vi måste vara lite försiktigare. Fortfarande gäller att så länge vi inte bryter under decembers botten, 1521, så kvarstår den generellt positiva vyn. Förnyad styrka utlöses vid uppgång över 1634.

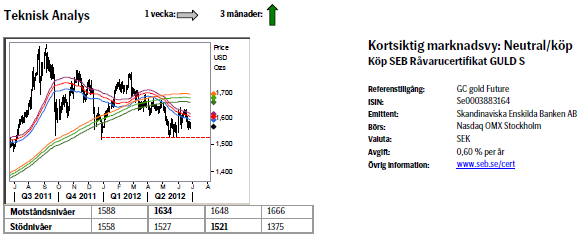

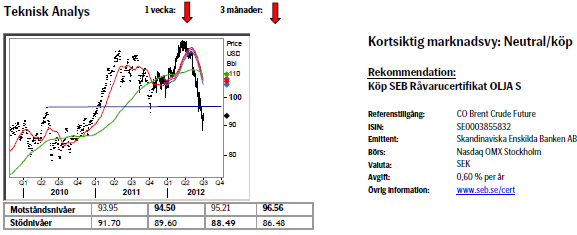

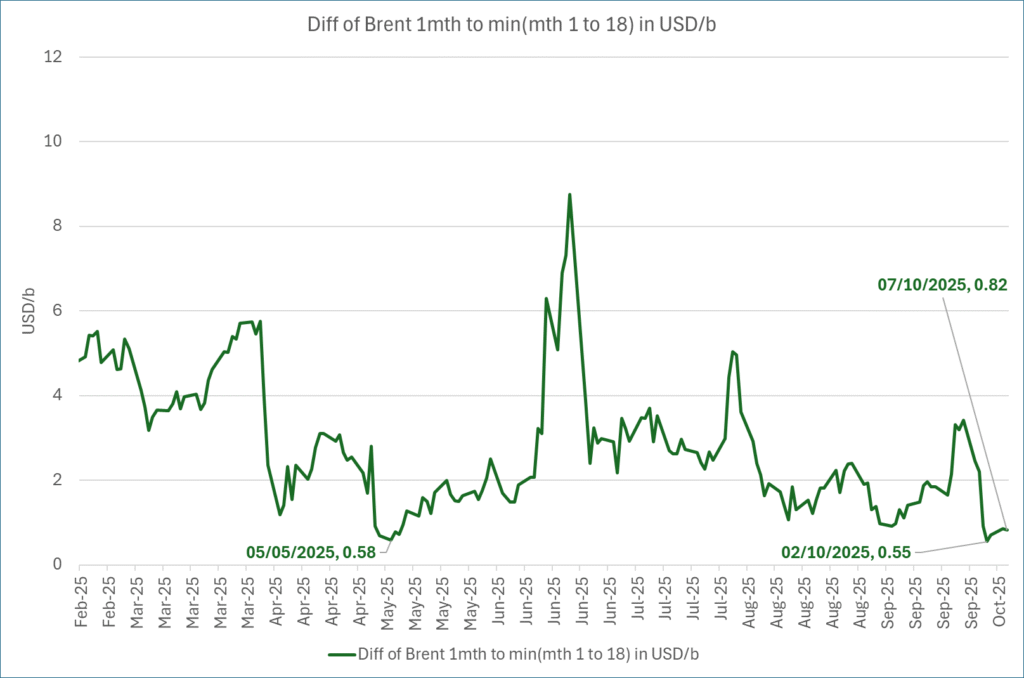

Olja

Priset på Brentolja steg 2,3 procent under veckan och handlade vid fler tillfällen under 90 dollar nivån. En av orsakerna till det fallande oljepriset är det utbudsöverskott som vi ser för tillfället.

Den pågående strejken bland norska oljearbetare minskar oljeproduktionen med cirka 200 000 fat per dag vilket ger stöd åt priset.

EU-ländernas embargo mot Iran träder i kraft nästa vecka. Försäkringsbolag i Europa är förbjudna att försäkra oljefrakt från Iran. Effekterna av sanktionerna mot Iran börjar bli kännbara för landets invånare och dess regim. En mycket försvårande omständighet för landet är kraftigt ökade spannmålspriser på världsmarknaden vilka bidrar till att hålla inflationen hög.

American Petroleum Institute publicerade i tisdags den inofficiella statistiken över amerikanska oljelager vilken visade att lagren av råolja steg med 0,5 miljoner fat förra veckan. Statistiken från USA:s energidepartement, DOE, inkom i onsdags och visade att lagren av råolja sjönk med ringa 0,1 miljoner fat under förra veckan.

Positiva nyheter från EU-toppmötet och en fortsatt försvagning av dollarn kan snabbt ge ett Brentpris över hundra dollar. På kort sikt ser det fortsatt osäkert ut.

Teknisk analys: Ramlade ned i falluckan.

En ny stark säljsignal utlöstes i och med förra veckans stängning. Då vi nu fallit igenom huvudstödet sätter vi ett nytt medelsiktigt mål runt $78. Uppgångar förväntas bli temporära och inte orka mycket mer än 96.50 området samt om de inträffar utnyttjas till att sälja.

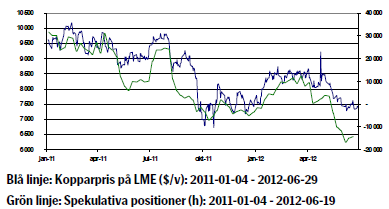

Koppar

Kopparpriset steg 3,2 procent under veckan.

I onsdags publicerades kontrakterade hus affärer i USA vilka överraskade positivt och kopparpriset steg på siffrorna. Antalet nya kontrakt om köp av befintliga bostäder i USA steg med 5,9 procent i maj jämfört med föregående månad. Det framgår av National Association of Realtors, NAR, index över kontrakterade husaffärer.

På grund av risken för inflation i Kina om matpriser fortsätter att stiga kan kinesiska myndigheter som följd avvakta med de stimulanser man tidigare annonserat vilket skulle påverka kopparpriset negativt.

Med en europeisk skuldkris som fortsätter skapa stor osäkerhet och allmänt sett svag makrostatistik med en långsam återhämtning i USA och en inbromsning i Kina är risken stor att kopparpriset ligger kvar på nuvarande nivåer på kort sikt.

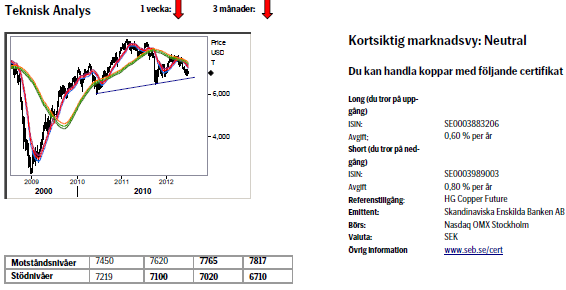

Teknisk analys: Nacklinjen nästa.

Den mindre uppgång som vi såg som ytterst korrektiv har nu avslutats och marknaden följaktligen vänt nedåt. Nästa viktiga steg kommer att bli ett test av nacklinjen (av den stora huvud-skuldra formation som nu befinner sig i sitt slutskede (nickel o alu har redan brutit ned från liknande toppformationer) och ett brott (troligt) bör få långtgående implikationer för kopparpriset.

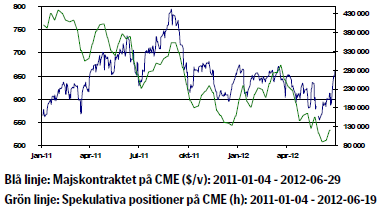

Majs

Amerikansk majs har handlats upp kraftigt p.g.a. av den allvarliga torka som råder i USA och majsen fortsätter att handla på höga nivåer. Bristen på fukt kan komma påverka kvalitén negativt. Majspriset steg 15 procent under veckan och det är en helt väderrelaterad prisökning.

Spreaden mellan juliterminskontraktet och decemberterminskontraktet har minskat till 20-månaders lägsta eftersom priset på närliggande terminskontrakt stigit kraftigt p.g.a. ökad oro för den kommande skörden.

I Europa är däremot vädret betydligt mera gynnsamt.

Enligt USDA crop report för den amerikanska majsen är andelen good/excellent 56 procent, jämfört med 63 procent föregående vecka. Samma period föregående år låg nivåerna på 70 procent.

Andelen poor/very poor låg på 14 procent, förra veckan 9 procent jämfört med samma period förra året då nivån låg på 9 procent.

Ser man till hedgefonder och spekulanter är de enligt US Commodity Futures Trading Commission fortsatt försiktigt positionerade för högre priser med 70 715 utstående terminer och optioner i juni jämfört med ett två års genomsnitt på 257 000 kontrakt per månad.

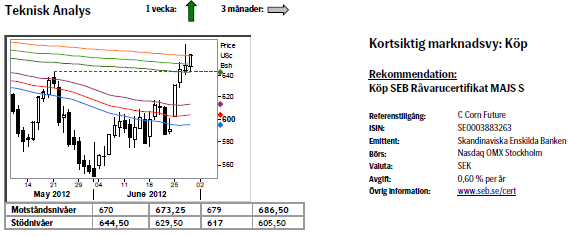

Teknisk analys: Fortsatt rally.

Rallyt har fortsatt sedan förra veckan och därigenom ökat på den positiva bilden pga 1) att vi nu passerat 55dagars bandet samt 2) att vi passerat föregående rekyltopp. Sammantaget finner vi att sannolikheten för ytterligare uppgång ser bra ut varför vi rekommenderar att köpa ett återtest av brottet av majtoppen.

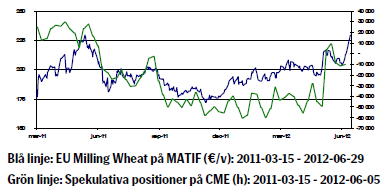

Vete

Jordbrukssektorn har fortsatt högre under veckan. Förhållandena i de viktiga amerikanska odlingsområdena är fortsatt mycket torra och heta.

De senaste väderprognoserna håller fast vid hett och torrt väder och risken ökar för ytterligare skada/sämre skördar.

Enligt USDA crop report för vintervetet är andelen good/excellent 54 procent, samma siffra som föregående vecka. Samma period föregående år låg nivåerna på 25 procent.

För vårvetet är andelen good/excellent 77 procent jämfört med föregående vecka då det var 76 procent. Samma period föregående år var andelen 69 procent. I Europa gynnar regnet i de norra regionerna det planterade vetet medan det torra och varma vädret fortsätter i de södra delarna där skörden alltså kan fortgå utan problem.

I USA finns det på grund av torkan risker för skador men några större skador har ännu inte skett i praktiken. Situationen kan alltså förbättras snabbt om man får lite mer regn.

Teknisk analys: Upp i överljudsfart.

I en enastående hastighet har marknaden stigit sedan det senaste besöket i 55dagars bandet, vilket ligger helt i plan med vår vy, denna pekade som sagt var inte bara på ett återtest av 218.75 utan också att 2011 års topp, 231, ska passeras. Ligg lång men passopp om vi återvänder ned under den tidigare topplinjen.

[box]SEB Veckobrev Veckans råvarukommentar är producerat av SEB Merchant Banking och publiceras i samarbete och med tillstånd på Råvarumarknaden.se[/box]

Disclaimer

The information in this document has been compiled by SEB Merchant Banking, a division within Skandinaviska Enskilda Banken AB (publ) (“SEB”).

Opinions contained in this report represent the bank’s present opinion only and are subject to change without notice. All information contained in this report has been compiled in good faith from sources believed to be reliable. However, no representation or warranty, expressed or implied, is made with respect to the completeness or accuracy of its contents and the information is not to be relied upon as authoritative. Anyone considering taking actions based upon the content of this document is urged to base his or her investment decisions upon such investigations as he or she deems necessary. This document is being provided as information only, and no specific actions are being solicited as a result of it; to the extent permitted by law, no liability whatsoever is accepted for any direct or consequential loss arising from use of this document or its contents.

About SEB

SEB is a public company incorporated in Stockholm, Sweden, with limited liability. It is a participant at major Nordic and other European Regulated Markets and Multilateral Trading Facilities (as well as some non-European equivalent markets) for trading in financial instruments, such as markets operated by NASDAQ OMX, NYSE Euronext, London Stock Exchange, Deutsche Börse, Swiss Exchanges, Turquoise and Chi-X. SEB is authorized and regulated by Finansinspektionen in Sweden; it is authorized and subject to limited regulation by the Financial Services Authority for the conduct of designated investment business in the UK, and is subject to the provisions of relevant regulators in all other jurisdictions where SEB conducts operations. SEB Merchant Banking. All rights reserved.

Analys

The Mid-East anchor dragging crude oil lower

When it starts to move lower it moves rather quickly. Gaza, China, IEA. Brent crude is down 2.1% today to $62/b after having traded as high as $66.58/b last Thursday and above $70/b in late September. The sell-off follows the truce/peace in Gaze, a flareup in US-China trade and yet another bearish oil outlook from the IEA.

A lasting peace in Gaze could drive crude oil at sea to onshore stocks. A lasting peace in Gaza would probably calm down the Houthis and thus allow more normal shipments of crude oil to sail through the Suez Canal, the Red Sea and out through the Bab-el-Mandeb Strait. Crude oil at sea has risen from 48 mb in April to now 91 mb versus a pre-Covid normal of about 50-60 mb. The rise to 91 mb is probably the result of crude sailing around Africa to be shot to pieces by the Houthis. If sailings were to normalize through the Suez Canal, then it could free up some 40 mb in transit at sea moving onshore into stocks.

The US-China trade conflict is of course bearish for demand if it continues.

Bearish IEA yet again. Getting closer to 2026. Credibility rises. We expect OPEC to cut end of 2025. The bearish monthly report from the IEA is what it is, but the closer we get to 2026, the more likely the IEA is of being ball-park right in its outlook. In its monthly report today the IEA estimates that the need for crude oil from OPEC in 2026 will be 25.4 mb/d versus production by the group in September of 29.1 mb/d. The group thus needs to do some serious cutting at the end of 2025 if it wants to keep the market balanced and avoid inventories from skyrocketing. Given that IEA is correct that is. We do however expect OPEC to implement cuts to avoid a large increase in inventories in Q1-26. The group will probably revert to cuts either at its early December meeting when they discuss production for January or in early January when they discuss production for February. The oil price will likely head yet lower until the group reverts to cuts.

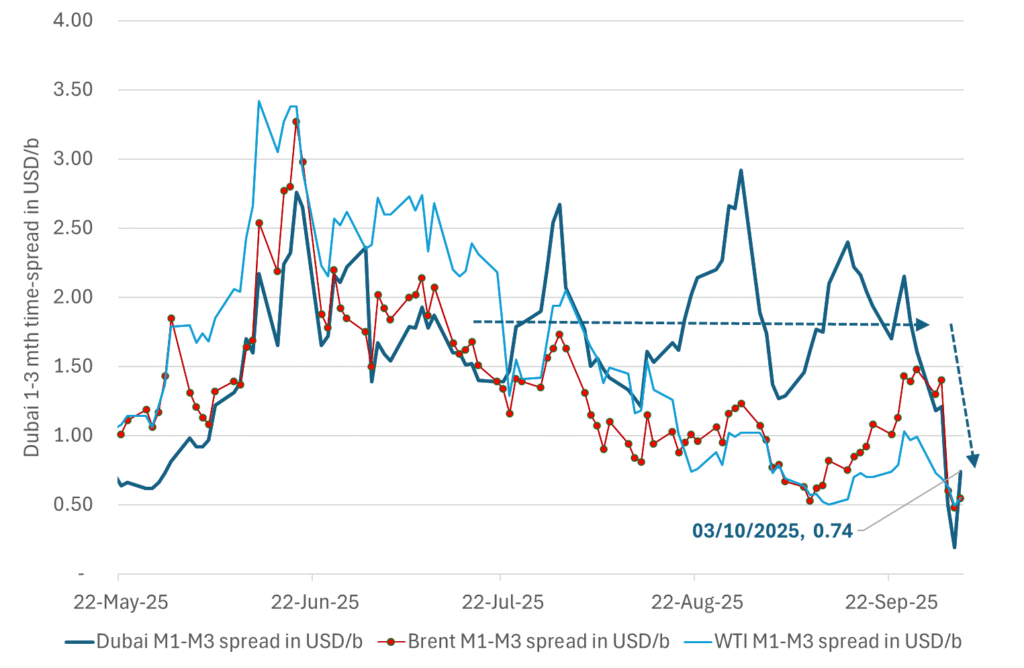

Dubai: The Mid-East anchor dragging crude oil lower. Surplus emerging in Mid-East pricing. Crude oil prices held surprisingly strong all through the summer. A sign and a key source of that strength came from the strength in the front-end backwardation of the Dubai crude oil curve. It held out strong from mid-June and all until late September with an average 1-3mth time-spread premium of $1.8/b from mid-June to end of September. The 1-3mth time-spreads for Brent and WTI however were in steady deterioration from late June while their flat prices probably were held up by the strength coming from the Persian Gulf. Then in late September the strength in the Dubai curve suddenly collapsed. Since the start of October it has been weaker than both the Brent and the WTI curves. The Dubai 1-3mth time-spread now only stands at $0.25/b. The Middle East is now exporting more as it is producing more and also consuming less following elevated summer crude burn for power (Aircon) etc.

The only bear-element missing is a sudden and solid rise in OECD stocks. The only thing that is missing for the bear-case everyone have been waiting for is a solid, visible rise in OECD stocks in general and US oil stocks specifically. So watch out for US API indications tomorrow and official US oil inventories on Thursday.

No sign of any kind of fire-sale of oil from Saudi Arabia yet. To what we can see, Saudi Arabia is not at all struggling to sell its oil. It only lowered its Official Selling Prices (OSPs) to Asia marginally for November. A surplus market + Saudi determination to sell its oil to the market would normally lead to a sharp lowering of Saudi OSPs to Asia. Not yet at least and not for November.

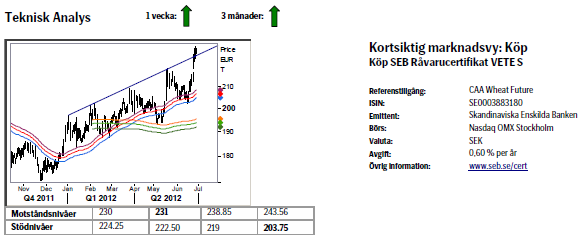

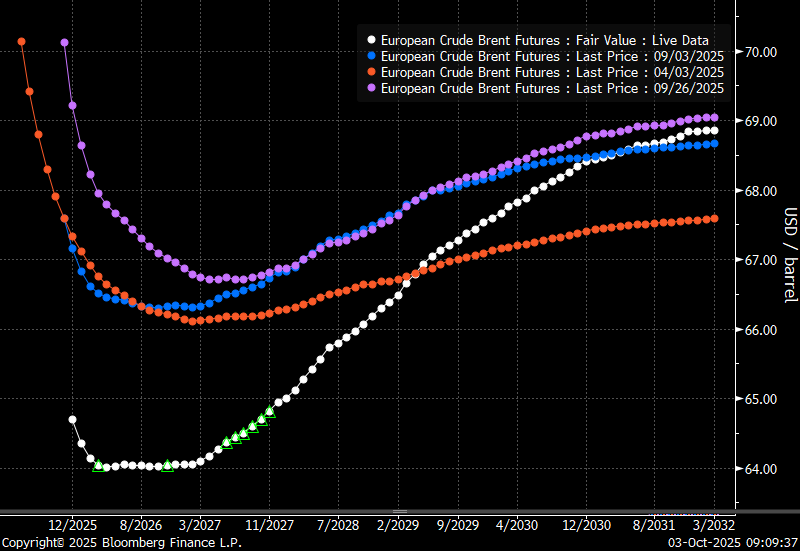

The 5yr contract close to fixed at $68/b. Of importance with respect to how far down oil can/will go. When the oil market moves into a surplus then the spot price starts to trade in a large discount to the 5yr contract. Typically $10-15/b below the 5yr contract on average in bear-years (2009, 2015, 2016, 2020). But the 5yr contract is usually pulled lower as well thus making this approach a moving target. But the 5yr contract price has now been rock solidly been pegged to $68/b since 2022. And in the 2022 bull-year (Brent spot average $99/b), the 5yr contract only went to $72/b on average. If we assume that the same goes for the downside and that 2026 is a bear-year then the 5yr goes to $64/b while the spot is trading at a $10-15/b discount to that. That would imply an average spot price next year of $49-54/b. But that is if OPEC doesn’t revert to cuts and instead keeps production flowing. We think OPEC(+) will trim/cut production as needed into 2026 to prevent a huge build-up in global oil stocks and a crash in prices. But for now we are still heading lower. Into the $50ies/b.

Analys

More weakness and lower price levels ahead, but the world won’t drown in oil in 2026

Some rebound but not much. Brent crude rebounded 1.5% yesterday to $65.47/b. This morning it is inching 0.2% up to $65.6/b. The lowest close last week was on Thursday at $64.11/b.

The curve structure is almost as week as it was before the weekend. The rebound we now have gotten post the message from OPEC+ over the weekend is to a large degree a rebound along the curve rather than much strengthening at the front-end of the curve. That part of the curve structure is almost as weak as it was last Thursday.

We are still on a weakening path. The message from OPEC+ over the weekend was we are still on a weakening path with rising supply from the group. It is just not as rapidly weakening as was feared ahead of the weekend when a quota hike of 500 kb/d/mth for November was discussed.

The Brent curve is on its way to full contango with Brent dipping into the $50ies/b. Thus the ongoing weakening we have had in the crude curve since the start of the year, and especially since early June, will continue until the Brent crude oil forward curve is in full contango along with visibly rising US and OECD oil inventories. The front-month Brent contract will then flip down towards the $60/b-line and below into the $50ies/b.

At what point will OPEC+ turn to cuts? The big question then becomes: When will OPEC+ turn around to make some cuts? At what (price) point will they choose to stabilize the market? Because for sure they will. Higher oil inventories, some more shedding of drilling rigs in US shale and Brent into the 50ies somewhere is probably where the group will step in.

There is nothing we have seen from the group so far which indicates that they will close their eyes, let the world drown in oil and the oil price crash to $40/b or below.

The message from OPEC+ is also about balance and stability. The world won’t drown in oil in 2026. The message from the group as far as we manage to interpret it is twofold: 1) Taking back market share which requires a lower price for non-OPEC+ to back off a bit, and 2) Oil market stability and balance. It is not just about 1. Thus fretting about how we are all going to drown in oil in 2026 is totally off the mark by just focusing on point 1.

When to buy cal 2026? Before Christmas when Brent hits $55/b and before OPEC+ holds its last meeting of the year which is likely to be in early December.

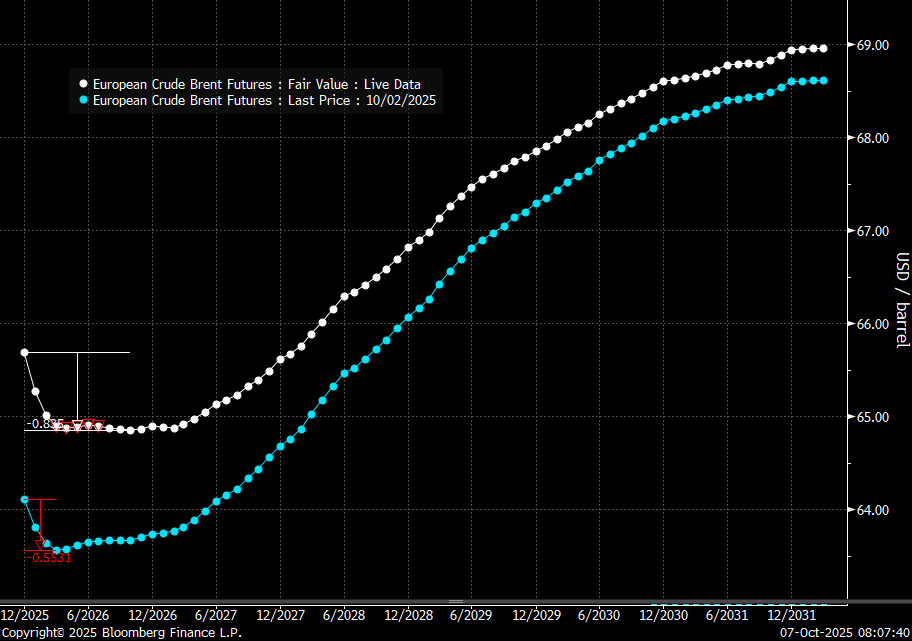

Brent crude oil prices have rebounded a bit along the forward curve. Not much strengthening in the structure of the curve. The front-end backwardation is not much stronger today than on its weakest level so far this year which was on Thursday last week.

The front-end backwardation fell to its weakest level so far this year on Thursday last week. A slight pickup yesterday and today, but still very close to the weakest year to date. More oil from OPEC+ in the coming months and softer demand and rising inventories. We are heading for yet softer levels.

Analys

A sharp weakening at the core of the oil market: The Dubai curve

Down to the lowest since early May. Brent crude has fallen sharply the latest four days. It closed at USD 64.11/b yesterday which is the lowest since early May. It is staging a 1.3% rebound this morning along with gains in both equities and industrial metals with an added touch of support from a softer USD on top.

What stands out the most to us this week is the collapse in the Dubai one to three months time-spread.

Dubai is medium sour crude. OPEC+ is in general medium sour crude production. Asian refineries are predominantly designed to process medium sour crude. So Dubai is the real measure of the balance between OPEC+ holding back or not versus Asian oil demand for consumption and stock building.

A sharp weakening of the front-end of the Dubai curve. The front-end of the Dubai crude curve has been holding out very solidly throughout this summer while the front-end of the Brent and WTI curves have been steadily softening. But the strength in the Dubai curve in our view was carrying the crude oil market in general. A source of strength in the crude oil market. The core of the strength.

The now finally sharp decline of the front-end of the Dubai crude curve is thus a strong shift. Weakness in the Dubai crude marker is weakness in the core of the oil market. The core which has helped to hold the oil market elevated.

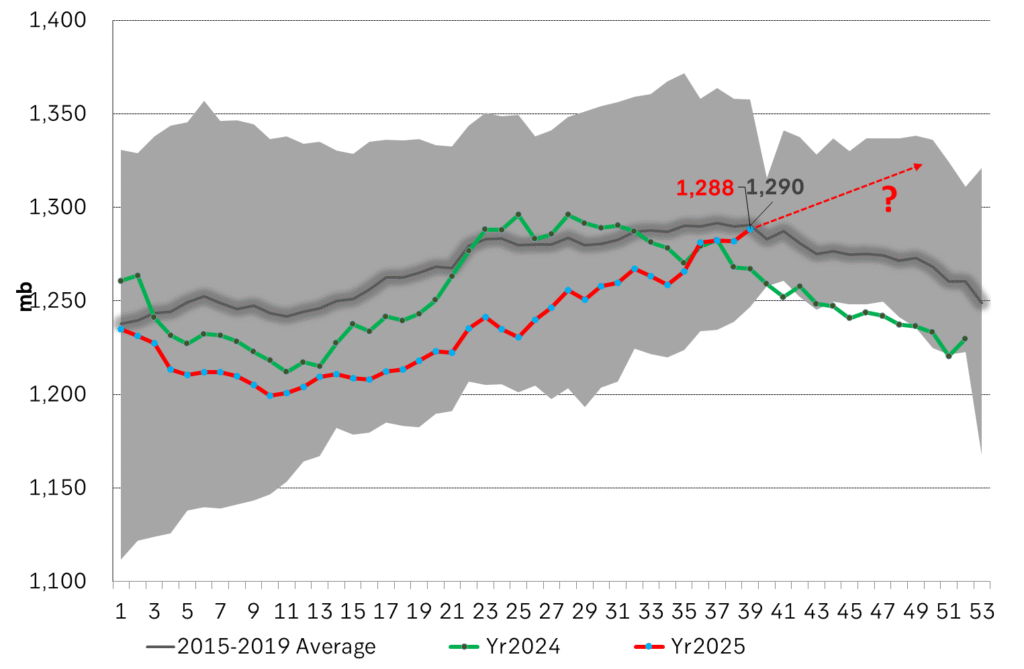

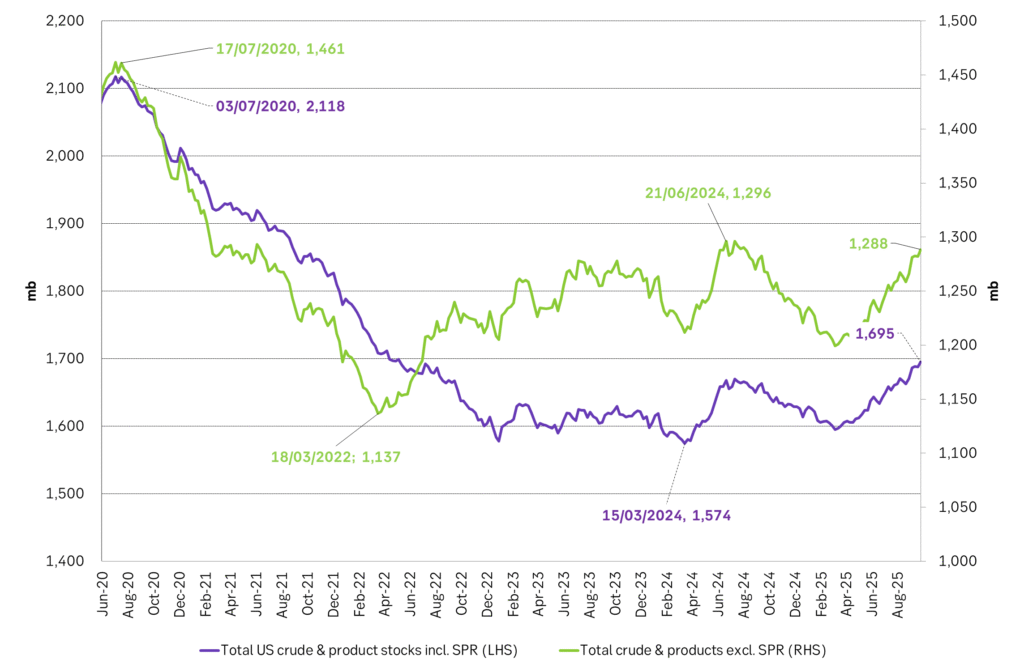

Facts supports the weakening. Add in facts of Iraq lifting production from Kurdistan through Turkey. Saudi Arabia lifting production to 10 mb/d in September (normal production level) and lifting exports as well as domestic demand for oil for power for air con is fading along with summer heat. Add also in counter seasonal rise in US crude and product stocks last week. US oil stocks usually decline by 1.3 mb/week this time of year. Last week they instead rose 6.4 mb/week (+7.2 mb if including SPR). Total US commercial oil stocks are now only 2.1 mb below the 2015-19 seasonal average. US oil stocks normally decline from now to Christmas. If they instead continue to rise, then it will be strongly counter seasonal rise and will create a very strong bearish pressure on oil prices.

Will OPEC+ lift its voluntary quotas by zero, 137 kb/d, 500 kb/d or 1.5 mb/d? On Sunday of course OPEC+ will decide on how much to unwind of the remaining 1.5 mb/d of voluntary quotas for November. Will it be 137 kb/d yet again as for October? Will it be 500 kb/d as was talked about earlier this week? Or will it be a full unwind in one go of 1.5 mb/d? We think most likely now it will be at least 500 kb/d and possibly a full unwind. We discussed this in a not earlier this week: ”500 kb/d of voluntary quotas in October. But a full unwind of 1.5 mb/d”

The strength in the front-end of the Dubai curve held out through summer while Brent and WTI curve structures weakened steadily. That core strength helped to keep flat crude oil prices elevated close to the 70-line. Now also the Dubai curve has given in.

Brent crude oil forward curves

Total US commercial stocks now close to normal. Counter seasonal rise last week. Rest of year?

Total US crude and product stocks on a steady trend higher.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanTyskland har så höga elpriser att företag inte har råd att använda elektricitet

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanOPEC+ missar produktionsmål, stöder oljepriserna

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanEtt samtal om guld, olja, fjärrvärme och förnybar energi

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanGuld nära 4000 USD och silver 50 USD, därför kan de fortsätta stiga

-

Analys3 veckor sedan

Analys3 veckor sedanAre Ukraine’s attacks on Russian energy infrastructure working?

-

Nyheter1 vecka sedan

Nyheter1 vecka sedanGoldman Sachs höjer prognosen för guld, tror priset når 4900 USD

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanBlykalla och amerikanska Oklo inleder ett samarbete

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanGuldpriset uppe på nya höjder, nu 3750 USD