Analys

SEB – Råvarukommentarer vecka 11 2012

Sammanfattning: Föregående vecka

Brett råvaruindex: -0,96 %

Brett råvaruindex: -0,96 %

UBS Bloomberg CMCI TR Index- Energi: +1,05 %

UBS Bloomberg CMCI Energy TR Index - Ädelmetaller: -0,09 %

UBS Bloomberg CMCI Precious Metals TR Index - Industrimetaller: -2,02 %

UBS Bloomberg CMCI Industrial Metals TR Index - Jordbruk: -2,24 %

UBS Bloomberg CMCI Agriculture TR Index

Kortsiktig marknadssyn:

- Guld: Neutral

- Olja: Neutral/sälj

- Koppar: Neutral/sälj

- Majs: Neutral/köp

- Vete: Köp

Guld

- Guldpriset föll efter fredagens arbetsstatistik, vilken var något bättre än förväntat. Den amerikanska sysselsättningen utanför jordbrukssektorn ökade med 227 000 personer, totalt sett åtta procent över förväntan. Arbetslösheten låg kvar på 8,3 procent. Totalt var 12,8 miljoner människor arbetslösa i februari.

- Dollarn sjönk på beskedet och eventuellt kan siffrorna leda till att marknaden förväntar sig att FED kommer att höja räntan snabbare än den tidigare utannonserad räntebanan vill göra gällande.

- Guldet reagerade även negativt på att Kina, som av många ses som den globala ekonomins motor, sänkte sitt tillväxtmål för 2012. Detta skulle kunna indikera en minskning i landets stimulansåtgärder, något som i praktiken talar mot ett högre guldpris.

- Enligt National Bureau of Statistics har även den kinesiska guldproduktionen ökat kraftigt, men det ökade utbudet kommer till stor del att fångas upp av en stark inhemsk efterfrågan.

- ECB lämnade räntan oförändrad. Detta var helt i linje med marknadens förväntningar och innebär en fortsatt låg alternativkostnad till att hålla guld.

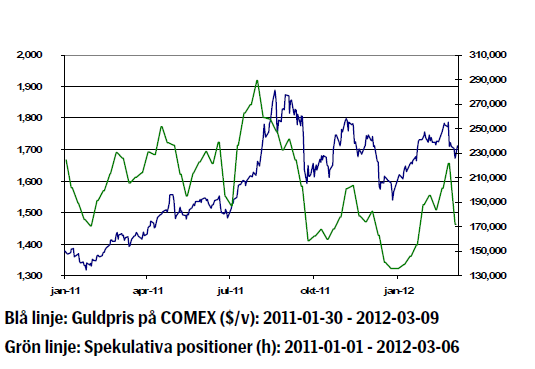

- Många taktiska investerare minskar nu sina innehav i guld, detta delvis som en funktion av den starka dollarn. Vi förhåller oss fortsatt neutrala till guldpriset.

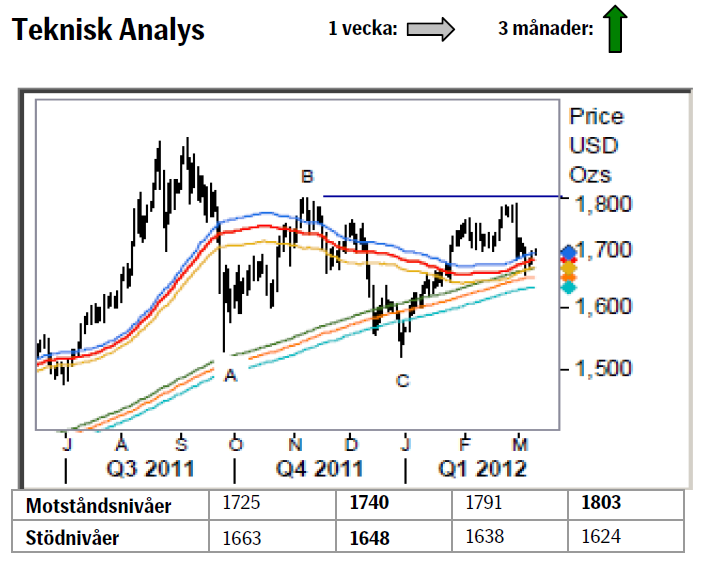

- Teknisk Analys: I och med att vi hållit oss under 1740 befinner vi oss fortfarande i korrektionsfasen. Ett först försök ned i 55/233d medelvärdesbanden har avvisats något som mycket väl kan vara slutet på korrektionen och en uppgång över 1725/40 bekräftar att så är fallet. Fram till dess kvarstår dock en viss osäkerhet.

Kortsiktig marknadssyn: Neutral

Olja

- Hoppet om minskade spänningar i Mellanöstern har ökat i och med beskedet att USA, Ryssland, Kina, Storbritannien, Frankrike och Tyskland ska träffa Irans chefsförhandlare. Samtalen kommer då att röra kärnenergiprogrammet och osäkerheten är stor inför dessa möten. President Barack Obama har i sin tur sagt att det fortfarande finns utrymme för en diplomatisk lösning.

- Även de bilaterala spänningarna mellan Israel och Iran består. Israels premiärminister Netanyahu sade efter ett möte med president Obama att han inte kommer tillåta att Israel blir hotat av ett iranskt kärnvapen. I Iran svarade en ledamot i försvarsutskottet att Irans militära kapacitet har växt och att landet skulle hämnas en eventuell attack från israeliskt håll.

- Ovan nämnda situation fortsätter att prägla oljemarknaden. Skulle man mot all förmodan nå en överenskommelse skulle det minska spänningarna avsevärt.

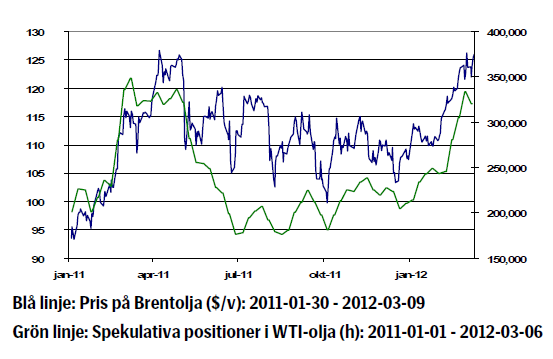

- Den ökade andelen spekulativa köpare av olja skulle kunna förstärka rörelsen rejält vid en eventuell nedgång. Detta då ett unisont säljande skulle aktivera en mängd stoploss-nivåer.

- Vi förhåller oss svagt negativa till oljepriset denna vecka.

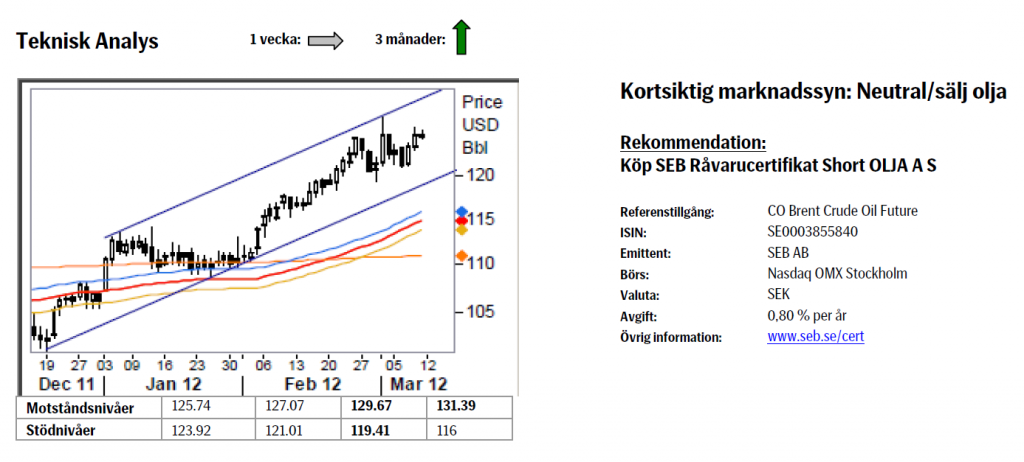

- Teknisk Analys: Förra veckas misslyckade försök att ta sig upp ur den stigande parallell-kanalen har vare sig lockat till något aggressivare säljande (vilket man kanske kunde ha väntat sig) eller något förnyat köpande av betydelse. Därav att vi går in i nästa vecka med en neutral vy dock med en viss faiblesse för ytterligare nedgång. Ett brott under 121 skulle utlösa en huvud skuldra topp formation och en nedgång till antingen 119 eller 116.

Kortsiktig marknadssyn: Neutral/sälj olja

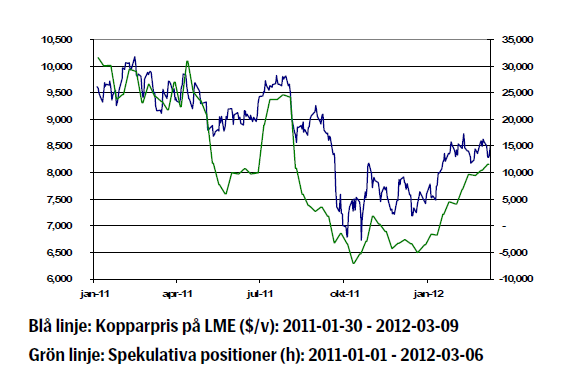

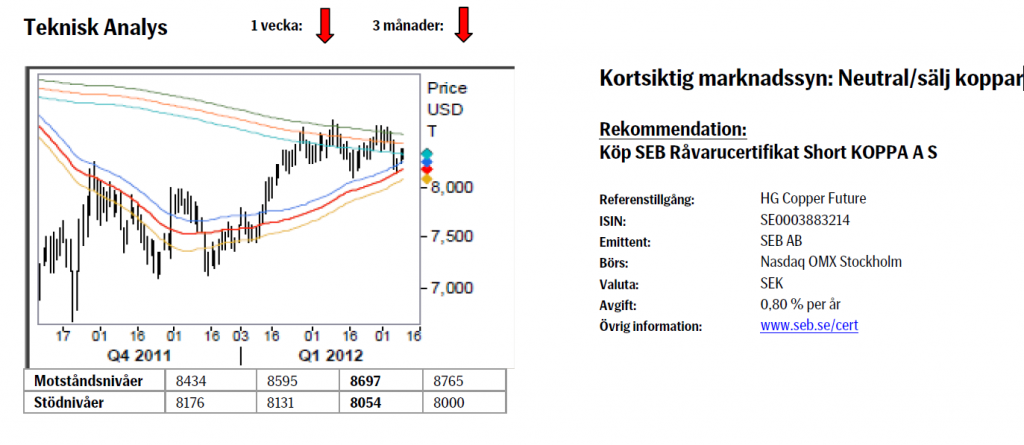

Koppar

- Enligt en rådgivare till den Kinesiska centralbanken kommer fastighetspriserna att fortsätta sjunka under året, men detta innebär inte att vi får se ett stort prisfall. Regeringen kommer att fortsätta strama åt fastighetsmarknaden, men målet med åtstramningarna är en kontrollerad prisutveckling.

- Lagernivån hos London Metal Exchange är för närvarande 289 000 ton, vilken är den lägsta nivån sedan augusti 2009. Samtidigt uppvisar Shanghai både höga lagernivåer och en god kopparproduktion.

- Kinesisk statistik visar att inflationen för februari var 3,2 % vilket är 20-månaderslägsta. Detta innebär att den nu är under målet på 4 procent, något som väcker förhoppningar om kommande monetär stimulans. Enligt Kinas premiärminister förväntas Kina uppvisa en tillväxt på 7,5 procent, vilket är mindre än den åttaprocentiga tillväxt som landet alltid haft som målsättning. Enligt premiärministern kommer landet att föra en försiktig monetär politik vilket gör att marknaden kan förvänta sig ytterligare stimulans.

- Enligt CFTC ökar andelen spekulativa positioner och uppmäter nu 155 000 kontrakt, vilket är den högsta nivån sedan augusti 2011. Detta öppnar för en förstärkning av eventuella negativa prisrörelser.

- Teknisk Analys: Vi noterar, med en viss tillfredsställelse, att vi nu fått både en lägre topp samt, vilket är viktigare, en andra bortstötning från 233dagars bandet. Vi tror att detta torde vara nog för att attrahera ett tilltagande säljtryck varför vi håller en försiktig negativ vy inför nästa vecka.

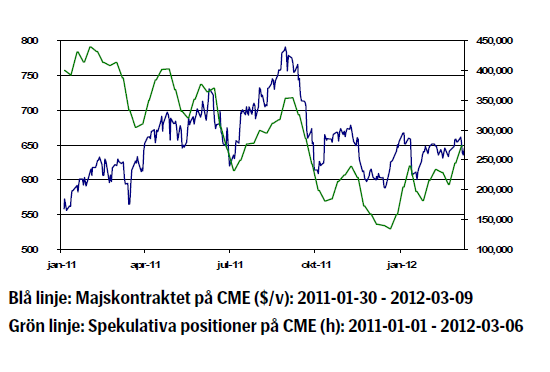

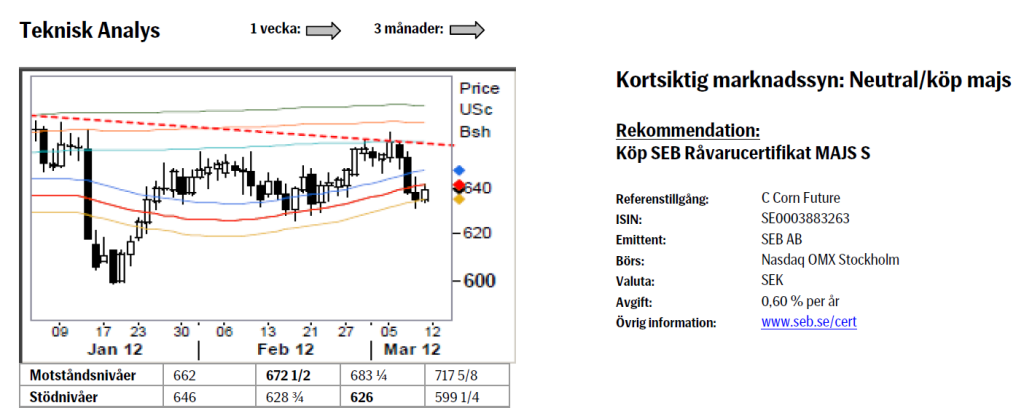

Majs

- I mars månads WASDE-rapport, vilken kom ut i fredags eftermiddag, justerade det amerikanska jordbruksdepartementet (USDA) ned sin prognos något avseende de globala majslagren.

- Marknaden hade dock förväntat sig ännu svagare siffror, detta efter de senaste månadernas köldvåg runt Svarta havet samt torkan i Sydamerika.

- Totalt sett var majspriset ned under förra veckan, men fredagens rapport fick priset att komma upp en del igen innan veckan kunde summeras. Enligt ett marknadsbrev från CME hade en hel del spekulanter positionerat sig mot en nedgång i samband med rapporten, dessa aktörer hjälpte majspriset uppåt då de var tvungna att stänga ut sina positioner.

- Bortsett från den förhållandevis intetsägande rapporten för majs var det stora samtalsämnet den ökade importen från Kina under 2012. Även detta tryckte upp priserna.

- Fundamentalt sett bedömer vi att efterdyningarna efter fredagens rapport kan få priset att ligga kvar, eller till och med gå upp något denna vecka. Vi väljer att särskilt hålla ögonen på den sydamerikanska utvecklingen.

- Teknisk Analys: Försöket att bryta dödläget genom ett brott upp ur innevarande intervall misslyckades då det enda resultatet av testet blev en s.k. spik, dvs. rakt upp och rakt ned samma dag. Misslyckandet muntrade i sin tur upp säljarna som därefter lyckats pressa ned priset till 55dagars medelvärdesbandet, det primära stödet. Veckans utveckling gör att vi bibehåller en neutral vy.

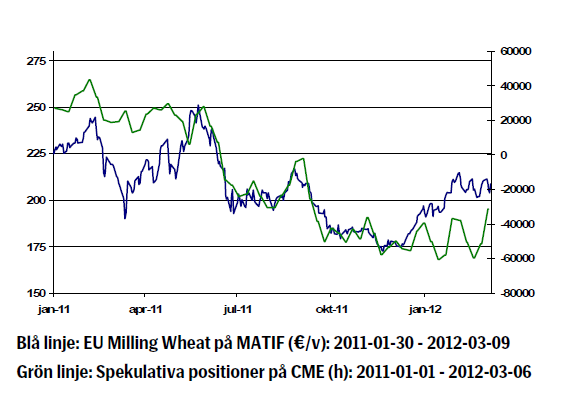

Vete

- Efter att ha fallit under hela veckan kom vetepriset i Paris tillbaka ordentligt under fredagen, detta trots att prognosen på lagernivåerna i Euroland justerades upp något jämfört med förra månadens WASDE-rapport.

- På global basis reviderade USDA ned sin syn på vetelagren. Detta fick enligt ovan priset i Paris, men även i Chicago, att på fredagen återhämta sig något jämfört med föregående dagar.

- En nation vars vetebehov diskuterats flitigt i dagarna är Iran, där importen väntas bli förhållandevis stor under 2012. Faktum är att USDA:s största uppjustering av importbehovet är för Iran.

- Enligt en del analytiker börjar en mängd industriella spannmålskonsumenter nu byta från majs till vete som djurfoder, detta då vetepriset än en gång kommit ned strax under majspriset. Som referens kan nämnas att vetepriset i Chicago de senaste 10 åren i snitt varit drygt 40 procent högre än majspriset.

- Med indikationer om ett förväntat ökat behov av vete bedömer vi fundamentalt att risken för vetepriset i Paris denna vecka ligger på uppsidan. Trots att ryska källor idag har gått ut med uppgifter om goda markförhållanden för den kommande skörden tror vi inte att det kommer att kunna trycka priset nedåt denna vecka.

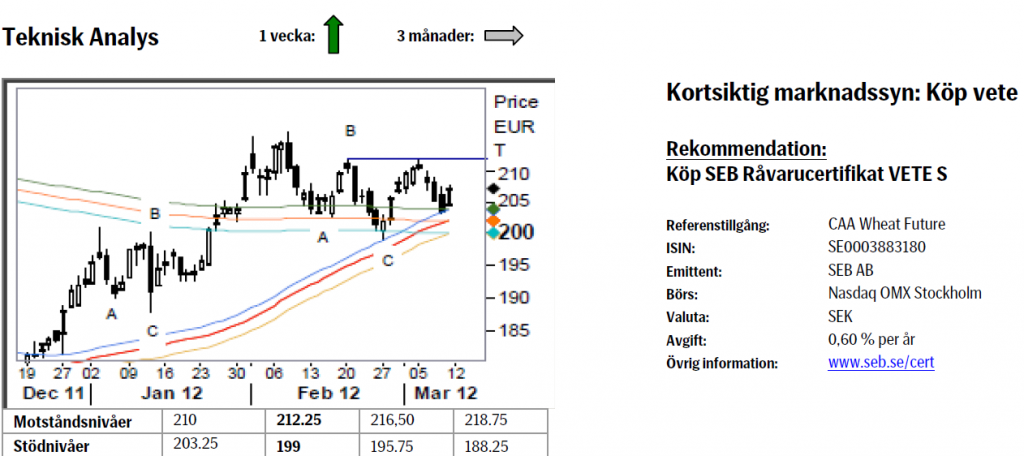

- Teknisk Analys: Med fortsatt bra stöd i medelvärdesbanden (samt de tidigare pekade på upprepade trevågs nedgångarna (A-B-C = korrektiva rörelser) fortsätter vi att peka på bra potential för ytterligare uppgång. Ett brott över 212.25 bör att vara den utlösande faktorn och ett brott ger vid handen ett mål uppemot 245.

[box]SEB Veckobrev Veckans råvarukommentar är producerat av SEB Merchant Banking och publiceras i samarbete och med tillstånd på Råvarumarknaden.se[/box]

Disclaimer

The information in this document has been compiled by SEB Merchant Banking, a division within Skandinaviska Enskilda Banken AB (publ) (“SEB”).

Opinions contained in this report represent the bank’s present opinion only and are subject to change without notice. All information contained in this report has been compiled in good faith from sources believed to be reliable. However, no representation or warranty, expressed or implied, is made with respect to the completeness or accuracy of its contents and the information is not to be relied upon as authoritative. Anyone considering taking actions based upon the content of this document is urged to base his or her investment decisions upon such investigations as he or she deems necessary. This document is being provided as information only, and no specific actions are being solicited as a result of it; to the extent permitted by law, no liability whatsoever is accepted for any direct or consequential loss arising from use of this document or its contents.

About SEB

SEB is a public company incorporated in Stockholm, Sweden, with limited liability. It is a participant at major Nordic and other European Regulated Markets and Multilateral Trading Facilities (as well as some non-European equivalent markets) for trading in financial instruments, such as markets operated by NASDAQ OMX, NYSE Euronext, London Stock Exchange, Deutsche Börse, Swiss Exchanges, Turquoise and Chi-X. SEB is authorized and regulated by Finansinspektionen in Sweden; it is authorized and subject to limited regulation by the Financial Services Authority for the conduct of designated investment business in the UK, and is subject to the provisions of relevant regulators in all other jurisdictions where SEB conducts operations. SEB Merchant Banking. All rights reserved.

Analys

Brent crude ticks higher on tension, but market structure stays soft

Brent crude has climbed roughly USD 1.5-2 per barrel since Friday, yet falling USD 0.3 per barrel this mornig and currently trading near USD 67.25/bbl after yesterday’s climb. While the rally reflects short-term geopolitical tension, price action has been choppy, and crude remains locked in a broader range – caught between supply-side pressure and spot resilience.

Prices have been supported by renewed Ukrainian drone strikes targeting Russian infrastructure. Over the weekend, falling debris triggered a fire at the 20mtpa Kirishi refinery, following last week’s attack on the key Primorsk terminal.

Argus estimates that these attacks have halted ish 300 kbl/d of Russian refining capacity in August and September. While the market impact is limited for now, the action signals Kyiv’s growing willingness to disrupt oil flows – supporting a soft geopolitical floor under prices.

The political environment is shifting: the EU is reportedly considering sanctions on Indian and Chinese firms facilitating Russian crude flows, while the U.S. has so far held back – despite Bessent warning that any action from Washington depends on broader European participation. Senator Graham has also publicly criticized NATO members like Slovakia and Hungary for continuing Russian oil imports.

It’s worth noting that China and India remain the two largest buyers of Russian barrels since the invasion of Ukraine. While New Delhi has been hit with 50% secondary tariffs, Beijing has been spared so far.

Still, the broader supply/demand balance leans bearish. Futures markets reflect this: Brent’s prompt spread (gauge of near-term tightness) has narrowed to the current USD 0.42/bl, down from USD 0.96/bl two months ago, pointing to weakening backwardation.

This aligns with expectations for a record surplus in 2026, largely driven by the faster-than-anticipated return of OPEC+ barrels to market. OPEC+ is gathering in Vienna this week to begin revising member production capacity estimates – setting the stage for new output baselines from 2027. The group aims to agree on how to define “maximum sustainable capacity,” with a proposal expected by year-end.

While the IEA pegs OPEC+ capacity at 47.9 million barrels per day, actual output in August was only 42.4 million barrels per day. Disagreements over data and quota fairness (especially from Iraq and Nigeria) have already delayed this process. Angola even quit the group last year after being assigned a lower target than expected. It also remains unclear whether Russia and Iraq can regain earlier output levels due to infrastructure constraints.

Also, macro remains another key driver this week. A 25bp Fed rate cut is widely expected tomorrow (Wednesday), and commodities in general could benefit a potential cut.

Summing up: Brent crude continues to drift sideways, finding near-term support from geopolitics and refining strength. But with surplus building and market structure softening, the upside may remain capped.

Analys

Volatile but going nowhere. Brent crude circles USD 66 as market weighs surplus vs risk

Brent crude is essentially flat on the week, but after a volatile ride. Prices started Monday near USD 65.5/bl, climbed steadily to a mid-week high of USD 67.8/bl on Wednesday evening, before falling sharply – losing about USD 2/bl during Thursday’s session.

Brent is currently trading around USD 65.8/bl, right back where it began. The volatility reflects the market’s ongoing struggle to balance growing surplus risks against persistent geopolitical uncertainty and resilient refined product margins. Thursday’s slide snapped a three-day rally and came largely in response to a string of bearish signals, most notably from the IEA’s updated short-term outlook.

The IEA now projects record global oversupply in 2026, reinforcing concerns flagged earlier by the U.S. EIA, which already sees inventories building this quarter. The forecast comes just days after OPEC+ confirmed it will continue returning idle barrels to the market in October – albeit at a slower pace of +137,000 bl/d. While modest, the move underscores a steady push to reclaim market share and adds to supply-side pressure into year-end.

Thursday’s price drop also followed geopolitical incidences: Israeli airstrikes reportedly targeted Hamas leadership in Doha, while Russian drones crossed into Polish airspace – events that initially sent crude higher as traders covered short positions.

Yet, sentiment remains broadly cautious. Strong refining margins and low inventories at key pricing hubs like Europe continue to support the downside. Chinese stockpiling of discounted Russian barrels and tightness in refined product markets – especially diesel – are also lending support.

On the demand side, the IEA revised up its 2025 global demand growth forecast by 60,000 bl/d to 740,000 bl/d YoY, while leaving 2026 unchanged at 698,000 bl/d. Interestingly, the agency also signaled that its next long-term report could show global oil demand rising through 2050.

Meanwhile, OPEC offered a contrasting view in its latest Monthly Oil Market Report, maintaining expectations for a supply deficit both this year and next, even as its members raise output. The group kept its demand growth estimates for 2025 and 2026 unchanged at 1.29 million bl/d and 1.38 million bl/d, respectively.

We continue to watch whether the bearish supply outlook will outweigh geopolitical risk, and if Brent can continue to find support above USD 65/bl – a level increasingly seen as a soft floor for OPEC+ policy.

Analys

Waiting for the surplus while we worry about Israel and Qatar

Brent crude makes some gains as Israel’s attack on Hamas in Qatar rattles markets. Brent crude spiked to a high of USD 67.38/b yesterday as Israel made a strike on Hamas in Qatar. But it wasn’t able to hold on to that level and only closed up 0.6% in the end at USD 66.39/b. This morning it is starting on the up with a gain of 0.9% at USD 67/b. Still rattled by Israel’s attack on Hamas in Qatar yesterday. Brent is getting some help on the margin this morning with Asian equities higher and copper gaining half a percent. But the dark cloud of surplus ahead is nonetheless hanging over the market with Brent trading two dollar lower than last Tuesday.

Geopolitical risk premiums in oil rarely lasts long unless actual supply disruption kicks in. While Israel’s attack on Hamas in Qatar is shocking, the geopolitical risk lifting crude oil yesterday and this morning is unlikely to last very long as such geopolitical risk premiums usually do not last long unless real disruption kicks in.

US API data yesterday indicated a US crude and product stock build last week of 3.1 mb. The US API last evening released partial US oil inventory data indicating that US crude stocks rose 1.3 mb and middle distillates rose 1.5 mb while gasoline rose 0.3 mb. In total a bit more than 3 mb increase. US crude and product stocks usually rise around 1 mb per week this time of year. So US commercial crude and product stock rose 2 mb over the past week adjusted for the seasonal norm. Official and complete data are due today at 16:30.

A 2 mb/week seasonally adj. US stock build implies a 1 – 1.4 mb/d global surplus if it is persistent. Assume that if the global oil market is running a surplus then some 20% to 30% of that surplus ends up in US commercial inventories. A 2 mb seasonally adjusted inventory build equals 286 kb/d. Divide by 0.2 to 0.3 and we get an implied global surplus of 950 kb/d to 1430 kb/d. A 2 mb/week seasonally adjusted build in US oil inventories is close to noise unless it is a persistent pattern every week.

US IEA STEO oil report: Robust surplus ahead and Brent averaging USD 51/b in 2026. The US EIA yesterday released its monthly STEO oil report. It projected a large and persistent surplus ahead. It estimates a global surplus of 2.2 m/d from September to December this year. A 2.4 mb/d surplus in Q1-26 and an average surplus for 2026 of 1.6 mb/d resulting in an average Brent crude oil price of USD 51/b next year. And that includes an assumption where OPEC crude oil production only averages 27.8 mb/d in 2026 versus 27.0 mb/d in 2024 and 28.6 mb/d in August.

Brent will feel the bear-pressure once US/OECD stocks starts visible build. In the meanwhile the oil market sits waiting for this projected surplus to materialize in US and OECD inventories. Once they visibly starts to build on a consistent basis, then Brent crude will likely quickly lose altitude. And unless some unforeseen supply disruption kicks in, it is bound to happen.

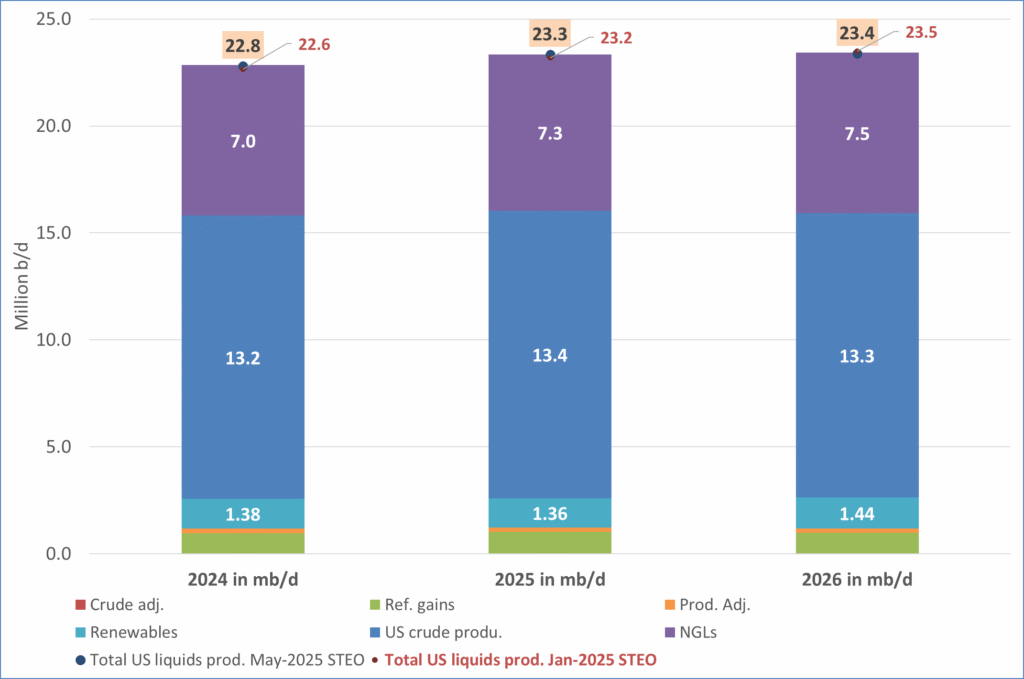

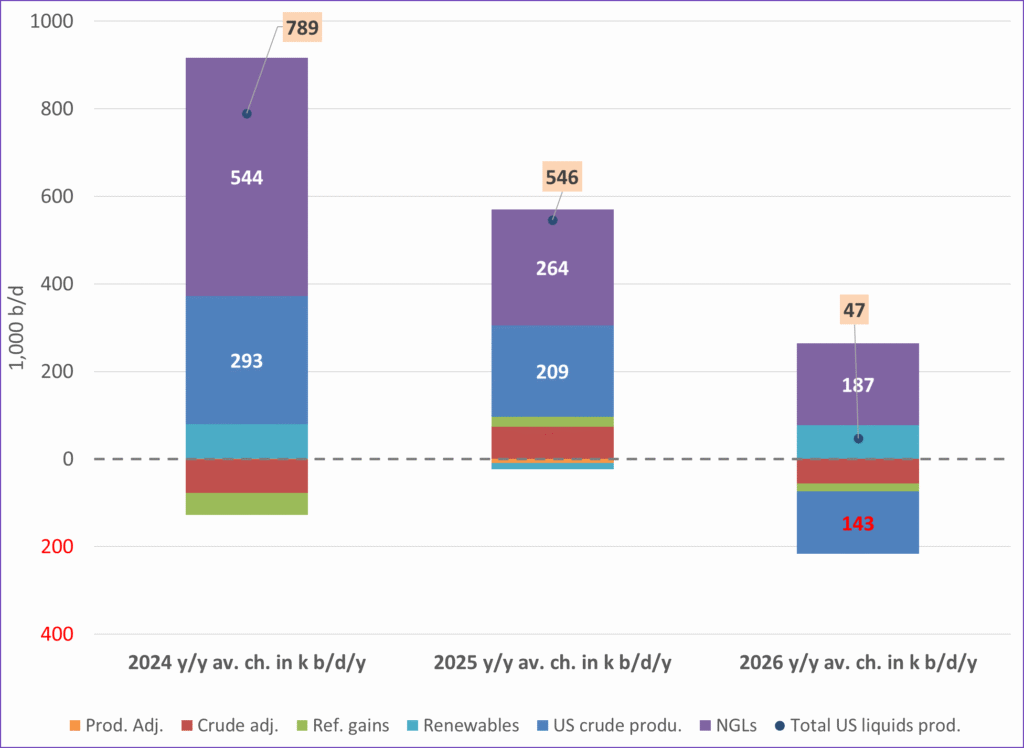

US IEA STEO September report. In total not much different than it was in January

US IEA STEO September report. US crude oil production contracting in 2026, but NGLs still growing. Close to zero net liquids growth in total.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanMeta bygger ett AI-datacenter på 5 GW och 2,25 GW gaskraftverk

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanAker BP gör ett av Norges största oljefynd på ett decennium, stärker resurserna i Yggdrasilområdet

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanEtt samtal om koppar, kaffe och spannmål

-

Analys4 veckor sedan

Analys4 veckor sedanBrent sideways on sanctions and peace talks

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanSommarens torka kan ge högre elpriser i höst

-

Analys4 veckor sedan

Analys4 veckor sedanBrent edges higher as India–Russia oil trade draws U.S. ire and Powell takes the stage at Jackson Hole

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanMahvie Minerals är verksamt i guldrikt område i Finland

-

Analys3 veckor sedan

Analys3 veckor sedanIncreasing risk that OPEC+ will unwind the last 1.65 mb/d of cuts when they meet on 7 September