Analys

SEB – Råvarukommentarer, 4 november 2013

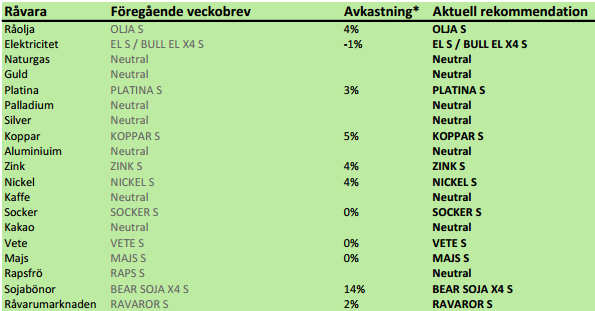

Rekommendationer

*) Avkastningen anges för 1:1 certifikaten där både BULL och 1:1 certifikat är angivna.

Inledning

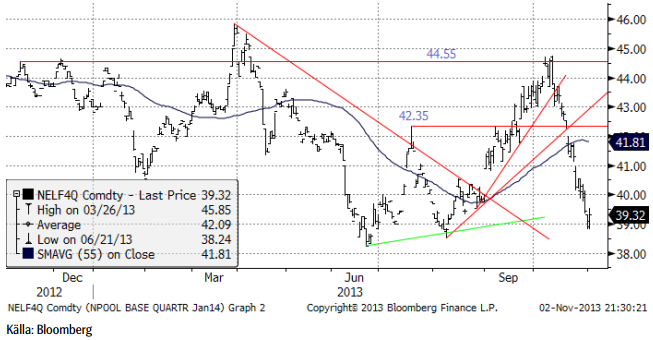

Vi har haft fel i att rekommendera köp efter bara en liten rekyl nedåt på elpriset för två veckor sedan. Rekylen från uppgången till 44.75 trodde vi skulle stanna på över 42, men priset fortsatte falla ner till 39. Fredagens stängningspris på 39.32 ligger faktiskt bara en hårsmån över den absoluta bottennoteringen på 38.24 euro som noterades den 21 juni. Rimligtvis måste det vara ett bra pris att köpa på. Trots att vi haft fel, måste vi återigen rekommendera köp av el på kort sikt. På en sikt av ett par år tror vi att konjunkturuppgången i världen har bidragit till att höja elpriset betydligt.

Priset på socker har fallit tillbaka till den tekniska utbrottsnivån och vi anser att detta är ett tillfälle att köpa SOCKER S eller BULL SOCKER X4 S (för den som vill ta mer risk).

Vi gör inga rekommendationsförändringar i raps förutom att vi går tillbaka till neutral rekommendation efter att i förra veckobrevet gjort en försiktig höjning till köp.

På fredag publicerar USDA sin första WASDE-rapport på två månader. Den väntas innehålla en stor uppjustering av hektarskörden för amerikansk majs. Förväntningarna om det har fått majspriset att gå ner den senaste tiden.

Råolja – Brent

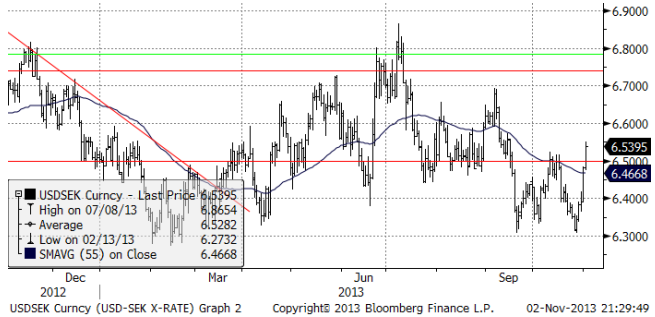

Oljepriset backade med 1% i veckan, det mesta i fredags, som vi ser i diagrammet nedan. En viktig bidragande orsak bakom prisfallet på oljan var att dollarn stärktes mot europeiska valutor. Kursuppgången mot kronan är 3% sedan förra veckan. Tillsammans med andra faktorer som t ex intjänad rabatt på terminer, steg SEB:s certfikat på olja (OLJA S) med 4% i veckan.

Nedanför ser vi kursutvecklingen på dollar mot kronor. Notera att hela kursfallet efter budgetbråket i USA är återhämtat. Orsakerna bakom dollarns styrka (och de europeiska valutornas svaghet) är att inköpschefsindex för USA kom in på 56.4 för oktober. Månaden innan låg indexet på 56.2, men analytiker hade väntat sig ett ISM på 55. Det skapades också förväntningar på att ECB ska sänka sin styrränta i veckan som kommer, då en rapport visade att EU närmast har deflation.

Onsdagens lagerstatistik från DOE i USA visade att råoljelagren i Cushing ökat med 2.18 miljoner fat till 35.5 miljoner. USA:s totala lager ökade med 4.09 miljoner fat till 383.9. Det är den högsta nivån sedan i juni.

Det finns flera tecken på ökat utbud av råolja. Alla känner till den ökade produktionen av olja med hjälp av horisontell borrning och hydraulisk sprängning, kallad ”fracking”. Vi har skrivit om Mexikos betydelsefulla kursändring vad gäller det nationella oljebolaget PEMEX. Nyheter om liberalisering av den Mexikanska marknaden fortsätter att komma.

Libyens produktion låg i slutet av veckan på 400,000 fat, rapporterade OPEC. Det är ca 100,000 fat mer än förra veckan och detta är ett tecken på att landet börjar få igång sin kapacitet, som före inbördeskriget var 1.5 – 2 miljoner fat.

Även Irak exporterar nu över 2 miljoner fat om dagen. Landet bör kunna fördubbla den volymen.

En majoritet av analytikerkåren tror på ett fallande oljepris i veckan som kommer, enligt en frågeundersökning gjord av Bloomberg.

Då rabatten på terminer alltjämt fortsätter att erbjuda en hög riskpremie på att äga oljeterminer via SEB:s certifikat OLJA S, är det en placering vi gillar, men den som är intresserad kanske bör avvakta med köp ifall priset faller i veckan.

Elektricitet

Elpriset lämnade tillbaka hela uppgången från botten. Vi hade inte väntat oss en så pass grundlig rekyl och beklagar att vi haft fel om djupet på rekylen. Eftersom vi anser att elpriset på en sikt av ett till två år bör vara betydligt högre därför att priset på kol är nedtryckt under en nivå där gruvbolagen långsiktigt kan täcka kostnaderna (95 dollar / ton) och priset på utsläppsrätter bör kunna återhämta sig väsentligt.

Vädret har varit onormalt blött i hela Europa, men nu på måndagsmorgonen kunde vi läsa om torrare prognoser. Det bör ge stöd för elmarknaden.

Nedan ser vi prisdiagrammet för det första kvartalet 2014:s kontrakt, uppdaterat till i fredags.

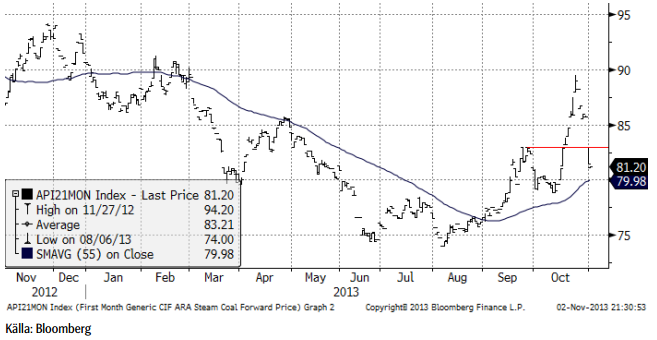

Nedan ser vi priset på energikol, den närmaste månadens leveranstermin. Priset föll kraftigt med fem dollar per ton i slutet av förra veckan. Trenden är dock fortfarande uppåtgående och då måste man betrakta nedgången som en rekyl. 55-dagars glidande medelvärde pekar uppåt och marknaden har senast noterat en ny topp och en ny högre botten. 80 dollar per ton är ett tekniskt stöd, bevisat både i mars och i oktober.

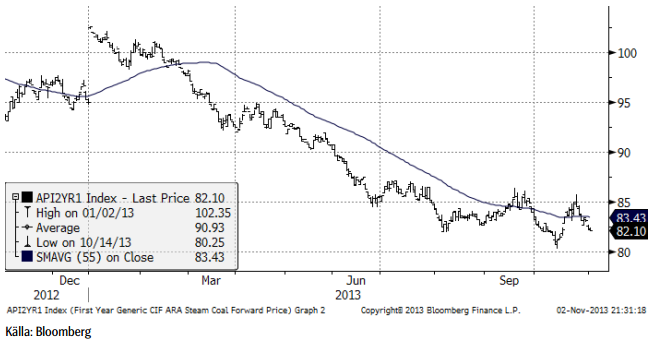

Även årskontraktet på kol har stigit från 80 dollar till 83.70, som vi ser i diagrammet nedan.

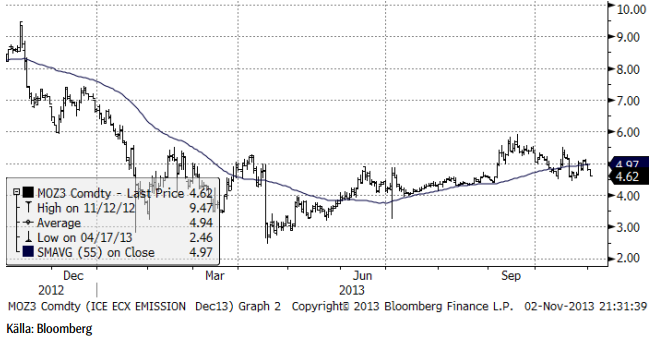

Priset på utsläppsrätter föll tillbaka förra veckan. Trenden, given av 55-dagars glidande medelvärde, är dock fortfarande uppåtriktad. Köpintressen vid 4.50 euro har tidigare hejdat prisnedgångar under den nivån.

Vi rekommenderar alltså köp av EL S eller BULL EL X4 S.

Naturgas

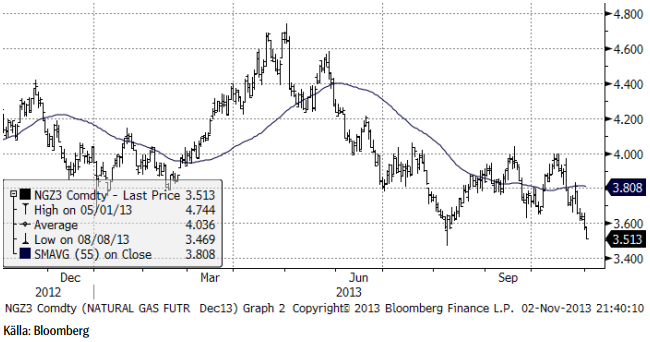

Naturgaspriset föll kraftigt i veckan som gick, minus 5%. Det gör amerikansk naturgas till förloraren bland de råvaror som man kan placera i. BEAR NATGAS X4 S steg med 30% förra veckan och blev därmed det certifikat som ökade mest i värde förra veckan.

Vi har ingen insyn i den amerikanska marknaden för naturgas, en marknad som är strikt lokal till sin natur, men noterar att priset nu ligger nära bottennoteringen från augusti. En tidigare bottennotering brukar kunna utgöra en teknisk stödnivå, en prisnivå där en rekyl uppåt eventuellt kan ta sin utgångspunkt.

Guld & Silver

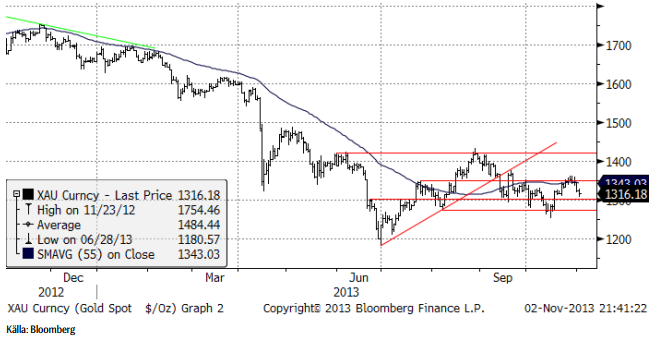

Guldpriset (i dollar) orkade inte över motståndet vid 1350 dollar.

Våra vänner på Guldcentralen säger att det är stark efterfrågan på fysiskt investeringsguld och att leveranstiderna från grossisterna i utlandet har blivit längre – ett tecken på att det är allmänt stark efterfrågan. Samtidigt kan vi läsa att efterfrågan i Kina och Indien visar tecken på mättnad vid den här prisnivån efter att priset legat under 1400 dollar sedan i våras. När folk köper fysiskt guld gör man det med en lång eller mycket lång tidshorisont.

Tekniskt har priset som ovan nämnt vänt ner efter motståndet vid 1350 dollar. Sedan slutet av juni har den fallande trenden övergått i en konsolideringsfas. I det här läget går inte att säga om denna kommer att följas av en fortsättning på prisfallet eller om trenden kommer att vändas uppåt.

Nedan ser vi kursdiagrammet för silver i dollar per troy ounce. Vi noterar att den fallande trendlinjen / motståndet från toppen för ett år sedan, inte har brutits ännu, även om det var nära förra veckan. Priset föll tillbaka till 22 dollar. I det här läget skulle en uppgång över 23 dollar signalera att den fallande trenden är bruten. I annat fall är den intakt.

Vi fortsätter att vara neutrala guld och silver. Silverprisets utveckling är särskilt intressant att följa nu, med tanke på att det är så nära till ett trendbrott uppåt.

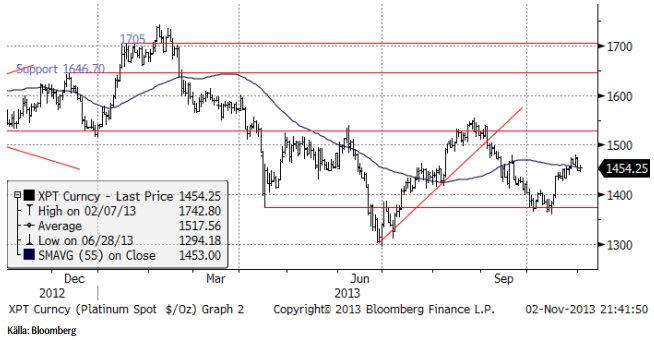

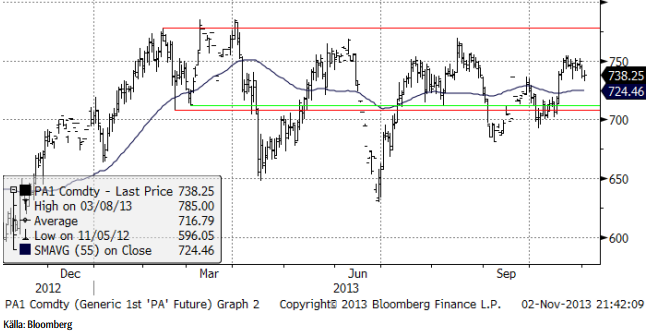

Platina & Palladium

SEB:s certifikat PLATINA S steg med 3% den senaste veckan och PALLADIUM S med 2%. I dollartermer föll priset något, men eftersom dollarn stärktes, blev slutresultatet en uppgång.

Man kan se av CFTC:statistiken av non-commercials positioner att, dessa (hedgefonder) köper platina-terminer vid priser under 1500 dollar per troy uns. Smyckesefterfrågan anses avta vid priser över 1500 dollar.

Det är gruvarbetarkonflikt i luften i Sydafrika. Det finns två betydelsefulla fackföreningar: ACMU (Association of Miners and Construction Workers Union) och National Union of Mineworkers (NUM).

ACMU hotar att börja strejka vid Implats gruvor, vilket skulle kunna sprida sig till Amplats. Förhandlingar pågår med Lonmin.

NUM leder just nu kampviljan. I veckan som gick varslades om strejk vid Northam-Platinum i Limpopo. Från Johannesburg rapporterades på söndagskvällen att förhandlingar inte kommit igång. NUM:s chefsförhandlare Ecliff Tantsi sade på söndagseftermiddagen att gruvarbetarna inte kommer att gå på när nattskiftet börjar klockan 20:00 på söndagskvällen och att ingen kommer att komma till gruvan när dagskiftet börjar klockan 05:00 på måndagsmorgonen. Tantsi sade att de 7000 NUM-medlemmarna utgjorde 80% av arbetsstyrkan vid gruvan. Lönekravet är en höjning på mellan 22 och 43%, beroende på kategori. Bolaget meddelade förra månaden, i samband med samtal med ”the Commission for Conciliation Mediation and Arbitration” att man planerar för en lönehöjning med 7 – 8% för år 2014

Analytiker som studerat leveranserna från Sydafrika till Schweiz hävdar att gruvbolagen har lager motsvarande en månads efterfrågan, som en buffert för eventuella strejker. Det krävs därför en långvarig konflikt för att påverka utbudet. Ju längre konflikten pågår, desto större effekt kan den alltså få på priset, i synnerhet om ACMU förverkligar sitt hot om strejk vid Implats gruvor.

Ingen av gruvorna går med vinst vid dagens lönenivå och prisnivå på platina.

Nedan ser vi frontmånadskontraktet på palladium. Palladium ligger fortfarande i en slags sidledes rörelse, utan trend.

Platina är vår favorit, inte minst med tanke på att strejksäsongen har börjat i Sydafrika. Vi rekommenderar köp av PLATINA S. Vi går också över till köp för palladium, som vi tycker att man kan försöka köpa vid nivåer vid 725 dollar per uns.

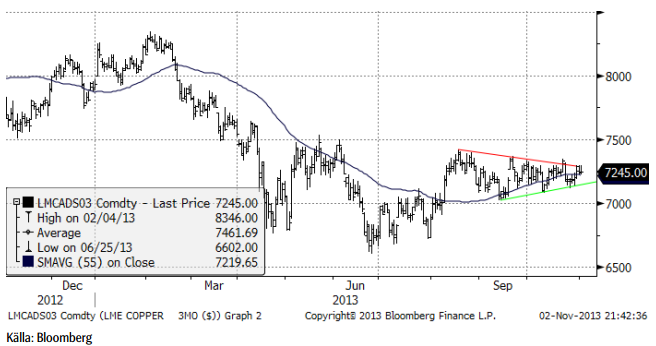

Koppar

Koppar har fortfarande inte brutit sig ur den triangelformation, som syns tydligt i kursdiagrammet. Kanske händer ingenting innan november månads prompt-dag, den tredje onsdagen i månaden. Med fallande lagernivåer och stigande ekonomisk aktivitet tror vi att brottet blir på uppsidan. Tekniskt motstånd finns vid 7500 dollar per ton. Vi fortsätter därför att rekommendera en köpt position i KOPPAR S.

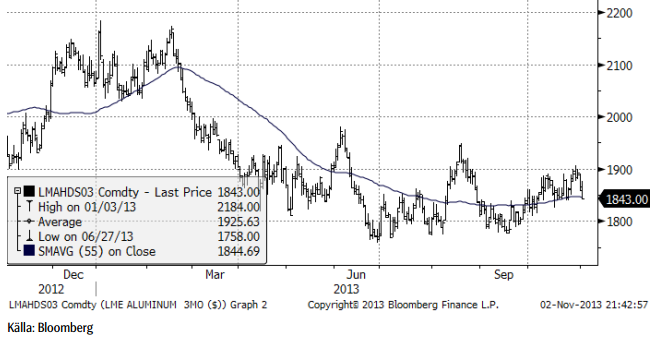

Aluminium

Aluminiummarknaden tog sig upp till 1900 dollar per ton. Det är den övre delen av det intervall om 1800 – 1900 dollar, som vi tror att priset kommer att ligga inom. Mot slutet av förra veckan föll priset ner till 1843 dollar. Fundamentalt har inget hänt den senaste tiden. Vi tror att marknaden kommer att fortsätta handla inom intervallet 1800 – 1900 dollar.

Vi har neutral rekommendation.

Zink

Zink gick upp till motstånden vid 1975 och föll därefter tillbaka mot slutet av förra veckan. Marknaden befinner sig fortfarande i konsolidering inför vad vi tror är en prisuppgång. Sedan i våras har zink handlats inom ett konsolideringsintervall på mellan 1825 – 2000 dollar per ton. Kan man komma in i ZINK S när zinkpriset är i den nedre halvan av det intervallet tror vi att man har goda chanser att göra en bra affär. Vi fortsätter att rekommendera köp av ZINK S (med det förbehållet).

Nickel

Nickelmarknaden sätter sitt hopp till att Indonesien genomför sitt exportstopp av nickelmalm. Konsultfirman Wood MacKenzie estimerar att 40% av nickelindustrin går med förlust vid dagens priser. Priset passerade marginalkostnaden på uppskattningsvis 17000 dollar per ton under 2012. Det är av den här anledningen som Glencore Xstrata stängde sin Focandogruva i Dominikanska Republiken och det brasilianska bolaget Votoratim stängde sin gruva utanför Fortaleza. Samtidigt expanderar Vale sin produktion med sina nya projekt VNC, Koniambo, Abatovy, Ramu och Ravensthorpe. Alla utom Ravensthorpe är flera år försenade, men kommer nu alltså igång, vilket är oturligt med tanke på priset. De totalt sju projekt som nu successivt kommer igång tillför 275,000 ton nickel till marknaden per år med fullt genomslag 2017 – 2018. Det ska jämföras med överskottet i marknaden under 2008 – 2012 som uppgick till 319,000 ton.

Indonesien antog redan år 2009 en lag om att sluta exportera laterit nickel-malm, som försett Kinas verk med råvaran för att tillverka Nickel Pig Iron (NPI). Indonesien vill att malmen förädlas inom landet. Om Indonesien inte exporterat sin malm (och inte gjort något annat med den heller), skulle marknaden istället för ett överskott av nickel på 319,000 ton ha haft ett underskott på 221,000 ton. Priset på nickel hade då utvecklat sig helt annorlunda än det gjort. Ett dussintal kinesiska företag håller på att bygga fabriker i Indonesien för att på plats förädla malmen. Nickeljärn kommer sedan troligtvis att exporteras till Kina. Man kan därför inte bara hoppas att utbudet ska försvinna i och med Indonesiens exportförbud mot malm. Metallen kommer att komma ut ändå, givet att den inhemska produktionen kommer igång. Just nu ser det ut att det kommer att ta ett tag innan full kapacitet är på plats inom landet.

Till saken hör att Indonesien har ett stort underskott i bytesbalansen och verkligen behöver exportinkomsterna från malmen. Om den inhemska förädlingsindustrin inte finns på plats, ska man inte utesluta att exportstoppets startdatum (början på 2014) kan skjutas upp. Det kan knappast vara i landets intressen att få själva gruvorna att gå i konkurs.

Vi avråder bestämt från att köpa nickel med förhoppningen om att Indonesiens nickelkälla ska försvinna från marknaden. Det är rent önsketänkande. Samtidigt har vi en gruvindustri som går med förlust pga det låga priset. Man kan kanske tro att det är en situation som nickelmarknaden inte kan tolerera. En stor del av 1980-talet rådde emellertid just den situationen. Producenter drog sig för att stänga nya och moderna gruvor, trots att de gjorde förlust, med vissheten att nickel är en lyxprodukt, som allt rikare befolkningar gärna konsumerar mer av. Förr eller senare kommer efterfrågan ikapp. Dagens situation är snarlik, men miljökraven vid stängning av nickelgruvor är ännu mer kostsam. Någon återgång till 50,000 dollar per ton tror vi är helt uteslutet och vi tror att risken för besvikelser pga grund av Indonesiens aviserade exportstopp av malm är uppenbar.

Med det sagt, tror vi ändå, att nickelpriset har en botten etablerad vid 13,500 dollar per ton. En övre gräns är just nu 15,000 dollar per ton. Det krävs ytterligare drag i den globala ekonomin för att få priset att gå över den nivån. Det tror vi kommer att ske, men kanske inte just nu, när risken för besvikelse pga att Indonesiens regering kompromissar om exportstoppet till dess den inhemska produktionen är på plats, får priset att rekylera ner igen. Men den som köper nickel (NICKEL S) vid ett pris vid eller under 14,000 dollar per ton, gör sannolikt en god affär på sikt.

Med varning för att priset just nu är högt, är vår grundsyn att man bör försöka köpa nickel och rekommenderar köp av NICKEL S mot ovanstående bakgrund.

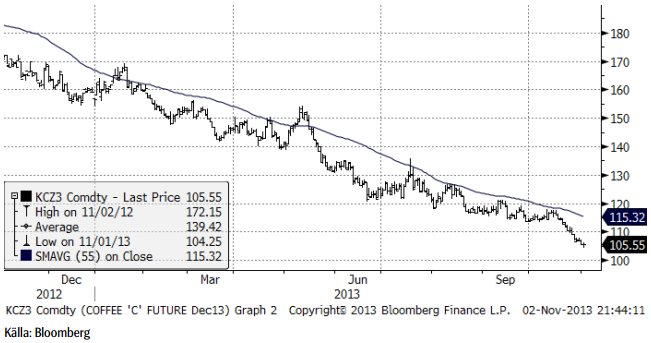

Kaffe

Kaffepriset föll 10% från drygt 115 cent till 105 cent sedan det förra veckobrevet. I Vietnam skördar kaffebönderna sin robusta just nu. Skörden väntas uppgå till rekordhöga 28 miljoner säckar (60 Kg), 10% mer än förra året.

USA:s jordbruksattaché i Bogota höjde skördeestimatet i landet med 1.5 miljoner säckar till 10.5 miljoner för 2013-14. Landets kaffeproduktion återhämtar sig alltså i snabbare takt än räknat med efter bladmögelangreppen.

Det finns alltså mycket gott om kaffe i världen, även om lagren av robusta är låga.

Priset är dock så lågt att det inte täcker kostnaderna. Vad som måste till, är att priset påverkar produktionen. Tvyärr har nu även Vietnam bestämt sig för att låta staten köpa upp kaffe till interventionslager. Detta kaffe utbud är dock bara lagrat och kommer ut på marknaden förr eller senare. Det är en kortsiktig lösning på ett långsiktigt problem – att det produceras för mycket kaffe i världen för att det ska vara en långsiktigt lönsam verksamhet. Kaffepriset är för lågt i ett långsiktigt perspektiv, men vändpunkten skjuts fram på grund av att marknadskrafterna sätts ur spel av stödprogram. I och för sig innebär detta att priset på världsmarknaden har potential att fall ännu längre ner från det långsiktiga jämviktspriset (där producenter långsiktigt får en rimlig vinst på produktionen.)

Vi behåller tills vidare neutral rekommendation, tills vi ser tecken på ett trendbrott.

[box]SEB Veckobrev Veckans råvarukommentar är producerat av SEB Merchant Banking och publiceras i samarbete och med tillstånd på Råvarumarknaden.se[/box]

Disclaimer

The information in this document has been compiled by SEB Merchant Banking, a division within Skandinaviska Enskilda Banken AB (publ) (“SEB”).

Opinions contained in this report represent the bank’s present opinion only and are subject to change without notice. All information contained in this report has been compiled in good faith from sources believed to be reliable. However, no representation or warranty, expressed or implied, is made with respect to the completeness or accuracy of its contents and the information is not to be relied upon as authoritative. Anyone considering taking actions based upon the content of this document is urged to base his or her investment decisions upon such investigations as he or she deems necessary. This document is being provided as information only, and no specific actions are being solicited as a result of it; to the extent permitted by law, no liability whatsoever is accepted for any direct or consequential loss arising from use of this document or its contents.

About SEB

SEB is a public company incorporated in Stockholm, Sweden, with limited liability. It is a participant at major Nordic and other European Regulated Markets and Multilateral Trading Facilities (as well as some non-European equivalent markets) for trading in financial instruments, such as markets operated by NASDAQ OMX, NYSE Euronext, London Stock Exchange, Deutsche Börse, Swiss Exchanges, Turquoise and Chi-X. SEB is authorized and regulated by Finansinspektionen in Sweden; it is authorized and subject to limited regulation by the Financial Services Authority for the conduct of designated investment business in the UK, and is subject to the provisions of relevant regulators in all other jurisdictions where SEB conducts operations. SEB Merchant Banking. All rights reserved.

Analys

Brent crude set to dip its feet into the high $50ies/b this week

Parts of the Brent crude curve dipping into the high $50ies/b. Brent crude fell 2.3% over the week to Friday. It closed the week at $61.29/b, a slight gain on the day, but also traded to a low of $60.14/b that same day and just barely avoided trading into the $50ies/b. This morning it is risk-on in equities which seems to help industrial metals a little higher. But no such luck for oil. It is down 0.8% at $60.8/b. This week looks set for Brent crude to dip its feet in the $50ies/b. The Brent 3mth contract actually traded into the high $50ies/b on Friday.

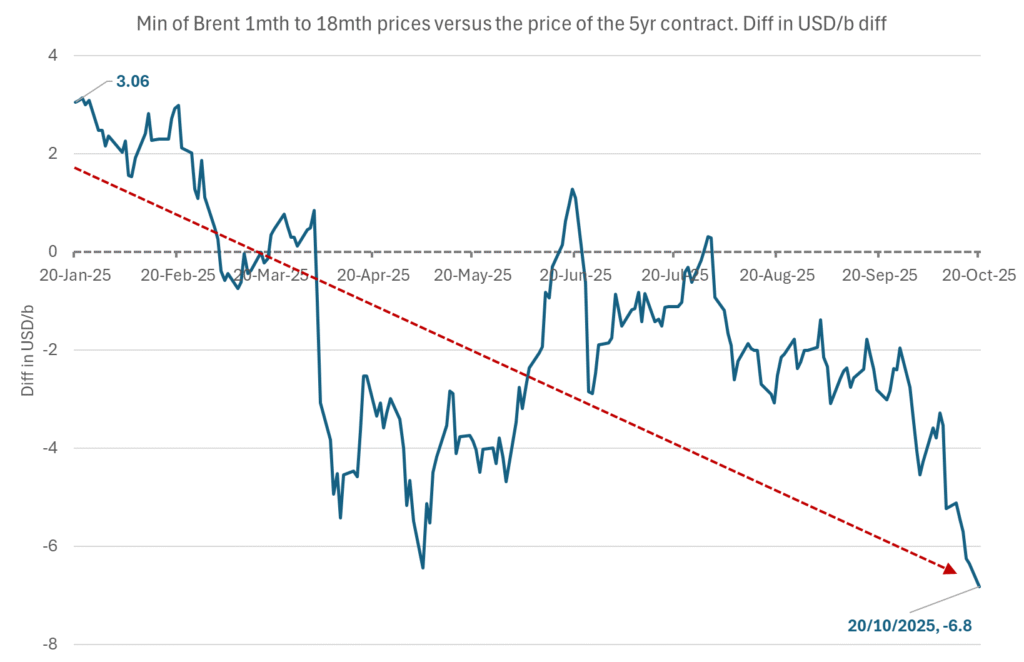

The front-end backwardation has been on a weakening foot and is now about to fully disappear. The lowest point of the crude oil curve has also moved steadily lower and lower and its discount to the 5yr contract is now $6.8/b. A solid contango. The Brent 3mth contract did actually dip into the $50ies/b intraday on Friday when it traded to a low point of $59.93/b.

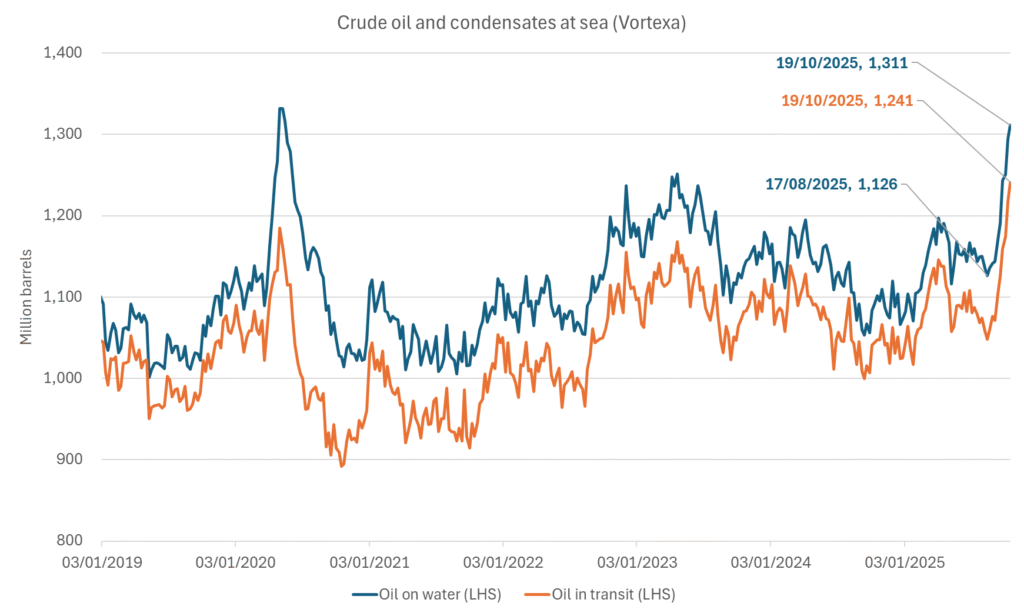

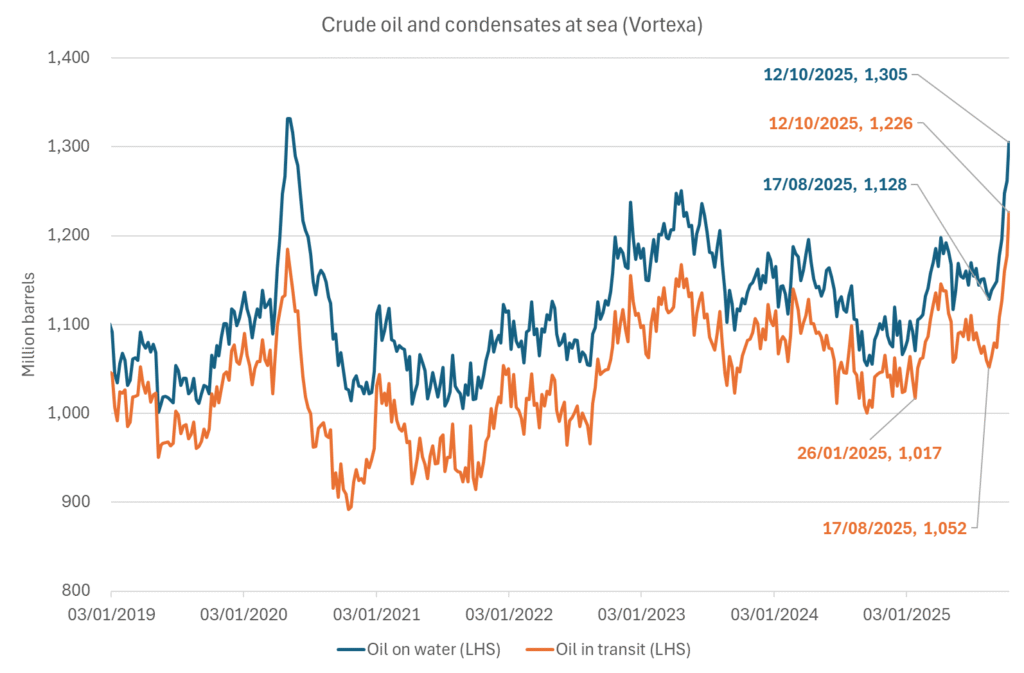

More weakness to come as lots of oil at sea comes to ports. Mid-East OPEC countries have boosted exports along with lower post summer consumption and higher production. The result is highly visibly in oil at sea which increased by 17 mb to 1,311 mb over the week to Sunday. Up 185 mb since mid-August. On its way to discharge at a port somewhere over the coming month or two.

Don’t forget that the oil market path ahead is all down to OPEC+. Remember that what is playing out in the oil market now is all by design by OPEC+. The group has decided that the unwind of the voluntary cuts is what it wants to do. In a combination of meeting demand from consumers as well as taking back market share. But we need to remember that how this plays out going forward is all at the mercy of what OPEC+ decides to do. It will halt the unwinding at some point. It will revert to cuts instead of unwind at some point.

A few months with Brent at $55/b and 40-50 US shale oil rigs kicked out may be what is needed. We think OPEC+ needs to see the exit of another 40-50 drilling rigs in the US shale oil patches to set US shale oil production on a path to of a 1 mb/d year on year decline Dec-25 to Dec-26. We are not there yet. But a 2-3 months period with Brent crude averaging $55/b would probably do it.

Oil on water increased 17 mb over the week to Sunday while oil in transit increased by 23 mb. So less oil was standing still. More was moving.

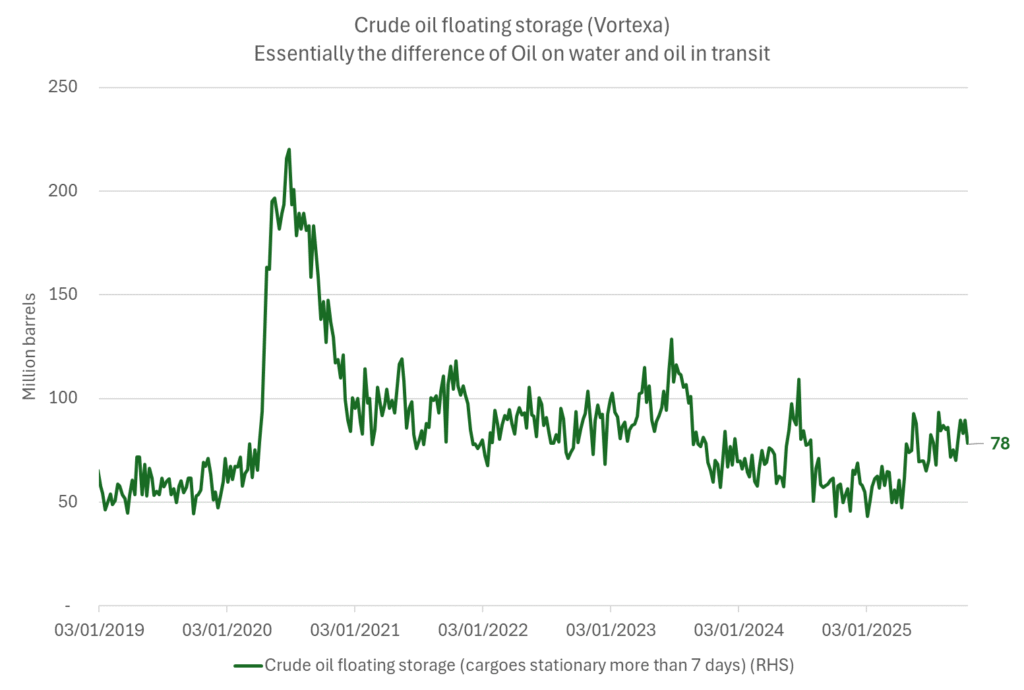

Crude oil floating storage (stationary more than 7 days). Down 11 mb over week to Sunday

The lowest point of the Brent crude oil curve versus the 5yr contract. Weakest so far this year.

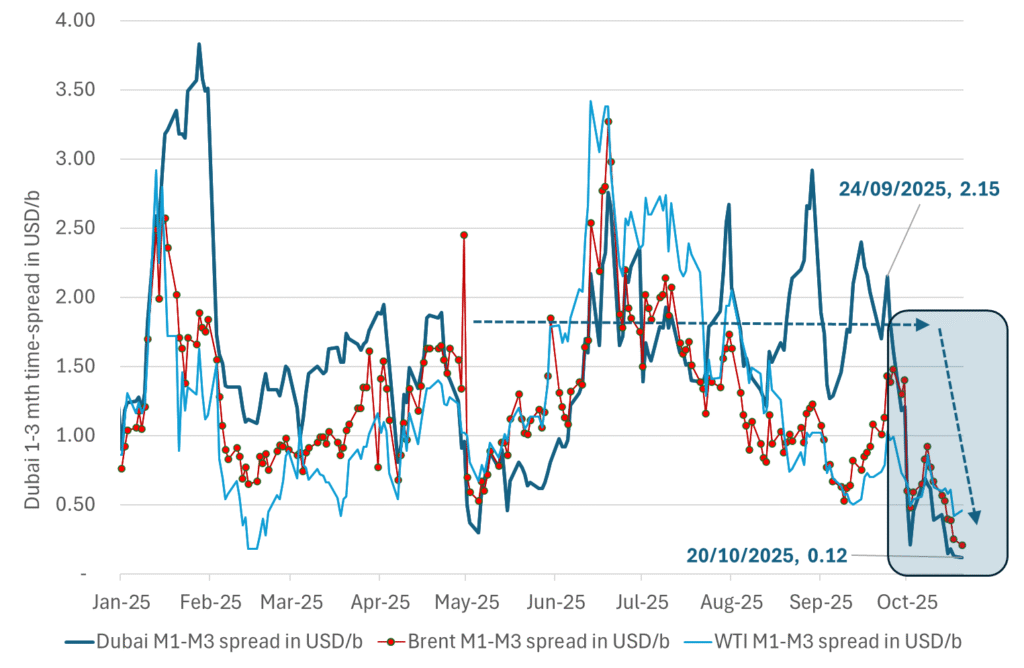

Crude oil 1mth to 3mth time-spreads. Dubai held out strongly through summer, but then that center of strength fell apart in late September and has been leading weakness in crude curves lower since then.

Analys

Crude oil soon coming to a port near you

Rebounding along with most markets. But concerns over solidity of Gaza peace may also contribute. Brent crude fell 0.8% yesterday to $61.91/b and its lowest close since May this year. This morning it is bouncing up 0.9% to $62.5/b along with a softer USD amid positive sentiment with both equities and industrial metals moving higher. Concerns that the peace in Gaza may be less solid than what one might hope for also yields some support to Brent. Bets on tech stocks are rebounding, defying fears of trade war. Money moving back into markets. Gold continues upwards its strong trend and a softer dollar helps it higher today as well.

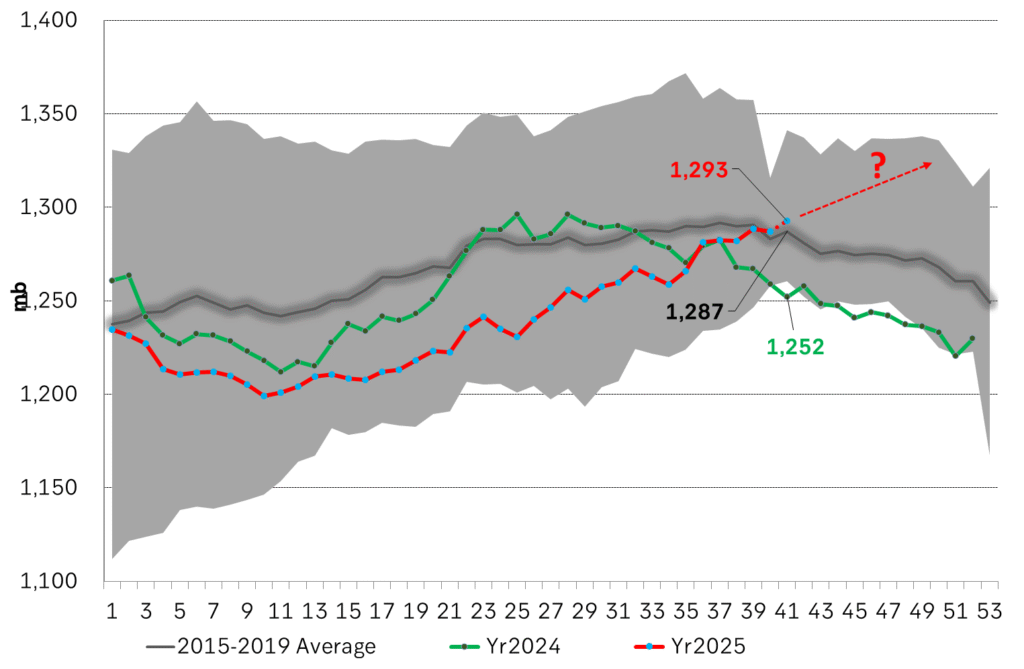

US crude & products probably rose 5.6 mb last week (API) versus a normal seasonal decline of 2.4 mb. The US API last night partial and thus indicative data for US oil inventories. Their data indicates that US crude stocks rose 7.4 mb last week, gasoline stocks rose 3.0 mb while Distillate stocks fell 4.8 mb. Altogether an increase in commercial crude and product stocks of 5.6 mb. Commercial US crude and product stocks normally decline by 2.4 mb this time of year. So seasonally adjusted the US inventories rose 8 mb last week according to the indicative numbers by the API. That is a lot. Also, the counter seasonal trend of rising stocks versus normally declining stocks this time of year looks on a solid pace of continuation. If the API is correct then total US crude and product stocks would stand 41 mb higher than one year ago and 6 mb higher than the 2015-19 average. And if we combine this with our knowledge of a sharp increase in production and exports by OPEC(+) and a large increase in oil at sea, then the current trend in US oil inventories looks set to continue. So higher stocks and lower crude oil prices until OPEC(+) switch to cuts. Actual US oil inventory data today at 18:00 CET.

US commercial crude and product stocks rising to 1293 mb in week 41 if last nights indicative numbers from API are correct.

Crude oil soon coming to a port near you. OPEC has lifted production sharply higher this autumn. At the same time demand for oil in the Middle-East has fallen as we have moved out of summer heat and crude oil burn for power for air-conditioning. The Middle-East oil producers have thus been able to lift exports higher on both accounts. Crude oil and condensates on water has shot up by 177 mb since mid-August. This oil is now on its way to ports around the world. And when they arrive, it will likely help to lift stocks onshore higher. That is probably when we will lose the last bit of front-end backwardation the the crude oil curves. That will help to drive the front-month Brent crude oil price down to the $60/b line and revisit the high $50ies/b. Then the eyes will be all back on OPEC+ when they meet in early November and then again in early December.

Crude oil and condensates at sea have moved straight up by 177 mb since mid-August as OPEC(+) has produced more, consumed less and exported more.

Analys

The Mid-East anchor dragging crude oil lower

When it starts to move lower it moves rather quickly. Gaza, China, IEA. Brent crude is down 2.1% today to $62/b after having traded as high as $66.58/b last Thursday and above $70/b in late September. The sell-off follows the truce/peace in Gaze, a flareup in US-China trade and yet another bearish oil outlook from the IEA.

A lasting peace in Gaze could drive crude oil at sea to onshore stocks. A lasting peace in Gaza would probably calm down the Houthis and thus allow more normal shipments of crude oil to sail through the Suez Canal, the Red Sea and out through the Bab-el-Mandeb Strait. Crude oil at sea has risen from 48 mb in April to now 91 mb versus a pre-Covid normal of about 50-60 mb. The rise to 91 mb is probably the result of crude sailing around Africa to be shot to pieces by the Houthis. If sailings were to normalize through the Suez Canal, then it could free up some 40 mb in transit at sea moving onshore into stocks.

The US-China trade conflict is of course bearish for demand if it continues.

Bearish IEA yet again. Getting closer to 2026. Credibility rises. We expect OPEC to cut end of 2025. The bearish monthly report from the IEA is what it is, but the closer we get to 2026, the more likely the IEA is of being ball-park right in its outlook. In its monthly report today the IEA estimates that the need for crude oil from OPEC in 2026 will be 25.4 mb/d versus production by the group in September of 29.1 mb/d. The group thus needs to do some serious cutting at the end of 2025 if it wants to keep the market balanced and avoid inventories from skyrocketing. Given that IEA is correct that is. We do however expect OPEC to implement cuts to avoid a large increase in inventories in Q1-26. The group will probably revert to cuts either at its early December meeting when they discuss production for January or in early January when they discuss production for February. The oil price will likely head yet lower until the group reverts to cuts.

Dubai: The Mid-East anchor dragging crude oil lower. Surplus emerging in Mid-East pricing. Crude oil prices held surprisingly strong all through the summer. A sign and a key source of that strength came from the strength in the front-end backwardation of the Dubai crude oil curve. It held out strong from mid-June and all until late September with an average 1-3mth time-spread premium of $1.8/b from mid-June to end of September. The 1-3mth time-spreads for Brent and WTI however were in steady deterioration from late June while their flat prices probably were held up by the strength coming from the Persian Gulf. Then in late September the strength in the Dubai curve suddenly collapsed. Since the start of October it has been weaker than both the Brent and the WTI curves. The Dubai 1-3mth time-spread now only stands at $0.25/b. The Middle East is now exporting more as it is producing more and also consuming less following elevated summer crude burn for power (Aircon) etc.

The only bear-element missing is a sudden and solid rise in OECD stocks. The only thing that is missing for the bear-case everyone have been waiting for is a solid, visible rise in OECD stocks in general and US oil stocks specifically. So watch out for US API indications tomorrow and official US oil inventories on Thursday.

No sign of any kind of fire-sale of oil from Saudi Arabia yet. To what we can see, Saudi Arabia is not at all struggling to sell its oil. It only lowered its Official Selling Prices (OSPs) to Asia marginally for November. A surplus market + Saudi determination to sell its oil to the market would normally lead to a sharp lowering of Saudi OSPs to Asia. Not yet at least and not for November.

The 5yr contract close to fixed at $68/b. Of importance with respect to how far down oil can/will go. When the oil market moves into a surplus then the spot price starts to trade in a large discount to the 5yr contract. Typically $10-15/b below the 5yr contract on average in bear-years (2009, 2015, 2016, 2020). But the 5yr contract is usually pulled lower as well thus making this approach a moving target. But the 5yr contract price has now been rock solidly been pegged to $68/b since 2022. And in the 2022 bull-year (Brent spot average $99/b), the 5yr contract only went to $72/b on average. If we assume that the same goes for the downside and that 2026 is a bear-year then the 5yr goes to $64/b while the spot is trading at a $10-15/b discount to that. That would imply an average spot price next year of $49-54/b. But that is if OPEC doesn’t revert to cuts and instead keeps production flowing. We think OPEC(+) will trim/cut production as needed into 2026 to prevent a huge build-up in global oil stocks and a crash in prices. But for now we are still heading lower. Into the $50ies/b.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanOPEC+ missar produktionsmål, stöder oljepriserna

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanGoldman Sachs höjer prognosen för guld, tror priset når 4900 USD

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanBlykalla och amerikanska Oklo inleder ett samarbete

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanGuld nära 4000 USD och silver 50 USD, därför kan de fortsätta stiga

-

Analys4 veckor sedan

Analys4 veckor sedanAre Ukraine’s attacks on Russian energy infrastructure working?

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanLeading Edge Materials är på rätt plats i rätt tid

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanNytt prisrekord, guld stiger över 4000 USD

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanEtt samtal om guld, olja, koppar och stål