Analys

SEB – Råvarukommentarer, 16 september 2013

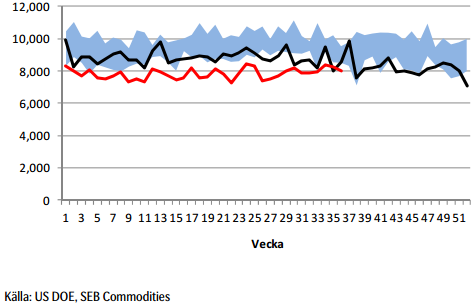

Rekommendationer

*) Avkastningen anges för 1:1 certifikaten där både BULL och 1:1 certifikat är angivna.

Inledning

Elmarknaden går kanske ner i veckan eftersom det ostadiga vädret har anlänt. Eftersom trenden är så tydligt positiv på marknaderna för kol och utsläppsrätter bör man ta ett sådant tillfälle i akt och köpa certifikat på el. Det kan bli en mycket bra affär.

De höga priserna på olja har fått oljeproducenter att sälja sin produkt på termin. Detta gör att avkastningen för dem som investerar i oljemarknaden via terminer erbjuds bra avkastning. Den rekyl nedåt som USA:s inställda angrepp på Syrien föranlett, är ett bra tillfälle att placera i oljemarknaden via certifikatet OLJA S.

USA:s jordbruksdepartement USDA publicerade sin månadsvisa uppdatering av utbud och efterfrågan på världsmarknaden. Den var negativ för priset på vete och majs, men neutral på soja. Sojapriset steg och det tror vi beror på att vissa aktörer lider av en psykologisk anspänning, snarare än något med grund i fakta. Vi upprepar vår säljrekommendation på soja och raps.

Två rapporter kom, i polemik med Czarnikows prognos om ett mindre överskott än väntat i sockermarknaden. Men kontentan var ändå att överskottet blir mindre än tidigare prognostiserats.

Råolja – Brent

Oljepriset föll tillbaka när det gick upp för alla – även de som inte läst det här veckobrevet – att USA inte skulle eskalera konflikten med Syrien. Som vi skrev för redan två veckor sedan var det uppenbart att USA:s president inte skulle fullfölja sitt hot. Syrienkonflikten skulle kunna ha påverkat producerande länder, så att oljepriset påverkats, men det finns även andra faktorer som faktiskt har en påverkan på oljepriset och som fått verka i det tysta. Libyens produktion har haft problem och efterfrågan har fått skjuts av den ekonomiska återhämtningen som sker i hela världen. Oljepriset befinner sig i en positiv trend rent tekniskt. Priset har gott stöd vid 110 dollar per fat, men motstånd vid 118 dollar ungefär. Fortfarande handlas oljepriset inom det prisintervall som varit rådande sedan tre år tillbaka.

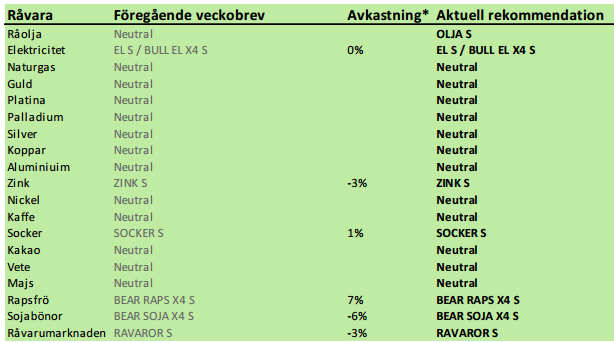

Terminskurvorna för Brent (den översta) och den av lager- och transportkapacitet strypta marknaden för West Texas Intermediate ligger lite lägre.

Tidningen Energy Risk skrev i fredags en artikel om att de höga priserna lockat fram en våg av prissäkring från amerikanska oljebolag. Dessa säljer framtida produktion på termin och lyckas på så sätt minska risken i sin verksamhet. De gör detta trots att terminspriserna är lägre än spotpriserna därför att de vinner i minskad osäkerhet. De är med andra ord villiga att betala försäkringspremien till dem som köper terminerna – och bär risken i deras ställe.

För råvaruinvesterare är den här rabatten nu väldigt attraktiv. Man kan tjäna ca 7 – 10% extra på att äga råoljeterminer.

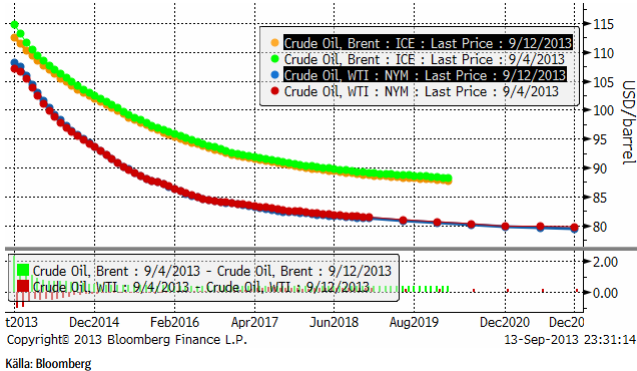

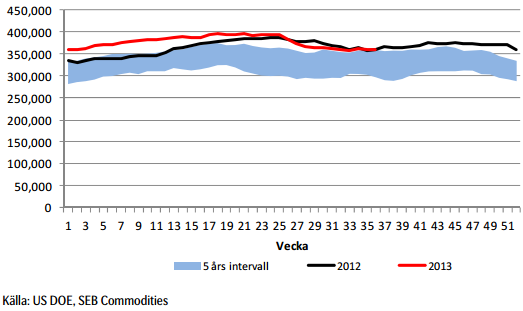

Råoljelagren fortsätter att minska i USA.

Importen år 2013 (röd) minskade i den senaste rapporten från DOE.

När nu priset fallit tillbaka och rabatten på terminer är så attraktiv, tycker vi att det är ett bra tillfälle att komma in i den lönsamma oljemarknaden och rekommenderar köp av OLJA S. Det är framförallt rabatten på terminerna vi vill komma åt och därför föredrar vi OLJA S framför t ex BULL OLJA X4 S.

Elektricitet

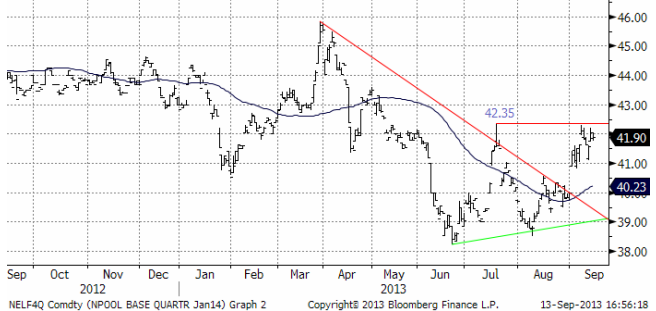

Nedan ser vi prisdiagrammet på det första kvartalets 2014 kontrakt. Det är det kontrakt som är underliggande för certifikaten sedan början på månaden.

Man har gjort försök att få igång O3:an i veckan, utan att lyckas. Finnarna har inte heller fått igång sin. Kärnkraften går just nu på halva sin installerade kapacitet.

Väderleksprognoserna visar fortsatt blött. Det ostadiga vädret väntas komma nu.

Tekniskt har motståndet vid 41.35 hållit stånd. Det är inte otänkbart att blötare väder och kärnkraftverk som kommer igång, kan få priset att rekylera ner från fredagens stängningspris på 41.90 euro per MWh. En sådan rekyl betraktar vi som ett utmärkt köptillfälle.

Som nämnt ovan, har den nordiska kärnkraften fortsätta problem. I fredags producerades endast 51% av den installerade kapaciteten. OKG kommer att starta om Oskarshamn 3 klockan 15:00 på tisdag. Reaktorn har varit avstängd sedan den 1 september och tre försök att återstarta den har misslyckats. OKG har skjutit upp starten av Orskarshamn 1 från i torsdags till måndagen. Reaktorn har varit avstängd sedan den 9 juli pga ventilproblem. PVO kommer att återstarta Olkiluoto 2 på tisdag. Reaktorn stängdes i måndags förra veckan pga en överhettad generator. Ringhals 2, Ringhals 3, Orskarshamn 2 och Loviisa 2 var avstängda för det årliga underhållet.

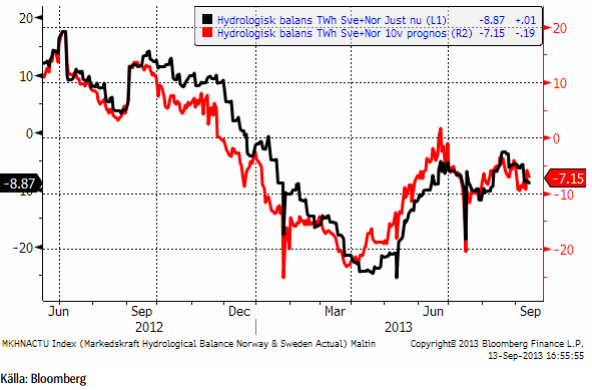

Hydrologisk balans har fortsatt att försämras, särskilt prognosen.

Marginalkostnaden för att producera el bestäms av priset på kol och priset på utsläppsrätter. Nedan ser vi priset på utsläppsrätter i euro / ton. Notera den fortsatta prisuppgången.

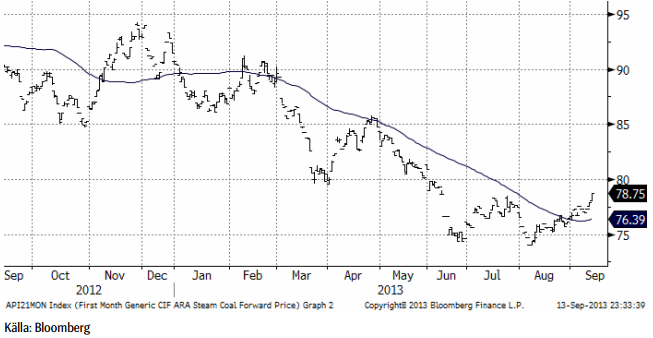

Nedan ser vi terminspriset för månaden, på energikol i Rotterdam. Vi ser att marknaden har vänt uppåt. Trenden är bruten. Detta har indirekt, men helt säkert, en påverkan på prisnivån på nordisk elektricitet. Vi väntar oss en fortsatt återhämtning i kolpriset åtminstone upp till 95 dollar per ton. Och därmed motsvarande prisuppgång på nordisk elektricitet. Dessutom tror vi på en procentuellt sett väsentligt högre prisuppgång på utsläppsrätter.

Vi rekommenderar alltså köp av el, t ex EL S eller BULL EL X4 S.

Naturgas

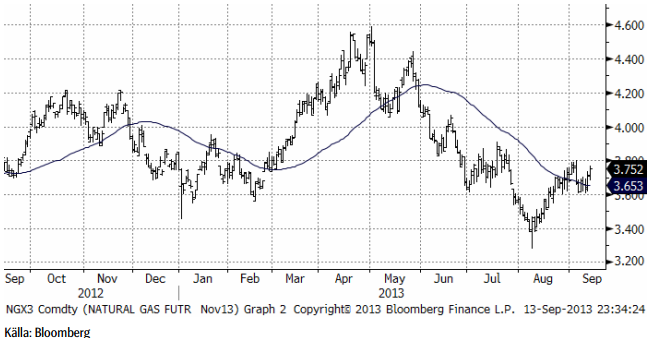

Naturgaspriset studsade på 3.60 i veckan och stängde i fredags på 3.75. Tekniskt motstånd ligger på 3.80.

Vi har neutral rekommendation.

Guld & Silver

Guldpriset föll ned till stödet på 1300 dollar per troy uns, efter att ha brutit stödet för uppgången från juni / juli. Vi har tidigare sagt att vi betraktar hela uppgången från juni / juli som en rekyl mot den fallande trenden. Goldman Sachs publicerade en rapport i fredags, där de säger att priset på guld kan falla så långt som till 1000 dollar per troy uns. Goldman Sachs har emellertid en tendens att göra prognoser som påminner om rena extrapoleringar av trender. Det går sällan så långt som Goldman Sachs analytiker har förutspått. Vi delar dock vyn att priset på guld förmodligen kommer att falla vidare. I det riktigt korta perspektivet noterar vi dock att 1300 dollar är ett starkt tekniskt stöd, varifrån marknaden kan samla kraft och göra ett nytt försök uppåt.

Nedan ser vi kursdiagrammet för silver i dollar per troy ounce. Då och då ser man att handlare hänger upp sig på 55-dagars glidande medelvärde och priset studsade i fredags precis på den nivå som det ligger på, som vi ser i diagrammet nedan. Går priset under den nivån, kan priset gå till 20 dollar, annars kan det gå pp mot 24 dollar. Notera att toppen i slutat av augusti inte lyckades bryta motståndet för den fallande pristrenden. Vi är alltså fortfarande i en bear market för silver.

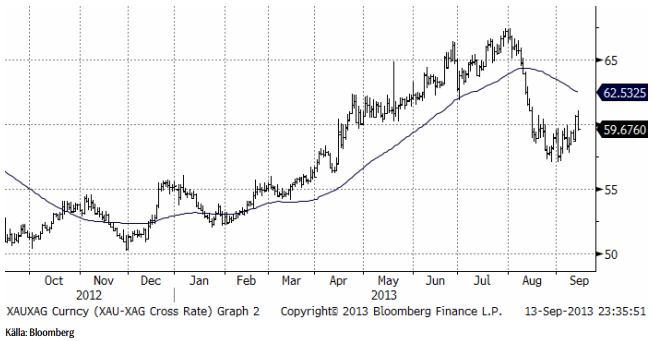

Nedan ser vi kvoten mellan guldpriset och silverpriset.

Silverpriset har i den allmänna prisnedgången, i vanlig ordning, fallit mer än guld.

Vi fortsätter att vara neutrala guld och silver och skulle inte vilja köpa någon av dem idag.

Platina & Palladium

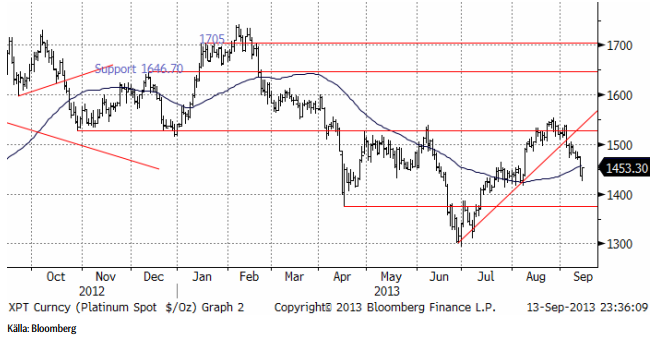

Förra veckan skrev vi att platina då brutit stödet för uppgången. Resultatet ser vi nu, där priset fallit ordentligt, ned till nivåer som utgjorde stöd under juli – augusti. Det vore inte otänktbart med en rekyl uppåt i det riktigt korta perspektivet, men vi ser inte detta som en trendvändning, utan som en rekyl i en fallande pristrend.

Nedan ser i kvoten mellan platina och guld. I slutet av förra veckan steg platina i förhållande till guld, men vi ser detta som en kortsiktig ”blip” och tror att platina kan falla tillbaka.

Palladiumpriset är håller på att bryta ner från den triangel vi skrivit om tidigare. Kursfallet kan bli stort.

Vi är för närvarande neutrala platina och palladium, men om palladium skulle falla bara något lite ytterligare, skulle vi vilja haka på och ta en kort position via BEAR PALLAD X4 S. Vi skulle absolut inte vilja köpa någon av dem.

Koppar

Priset på koppar var i princip oförändrat i veckan som gick. Trenden är nedåtriktad, men priset är förhållandevis lågt. Vi fortsätter med neutral vy.

Det är en svårtolkad bild och vi rekommenderar neutral position.

Aluminium

Förra veckan noterade en marginell prisnedgång som stannade på 1812 dollar per ton. Stöd finns vid 1800 dollar. Går priset under den nivån skulle vi vilja vara korta, dvs köpta BEAR ALU X4 S.

Vi har neutral rekommendation, tidigare köp.

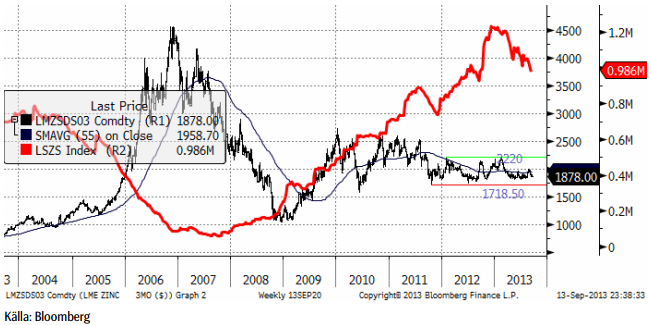

Zink

Priset på zink har i nästan två års tid legat inom ett intervall mellan 1718.50 dollar per ton och 2200 dollar per ton, som vi ser nedan. Den röda linjen visar lagren av zink vid LME. Vi ser att marknaden börjat komma mer i balans. Detta fortsatte i veckan som gick. De rekordstora lagren har börjat minska. Det finns en förväntan om en stor inleverans till tredje onsdagen i september, den 18 september, eftersom detta skett både i maj och i juli. Analytiker har noterat att detta kan hänga ihop med lagerfinansieringsaffärer utanför LME-systemet.

Den senaste ILZG-rapporten indikerar dock att det finns en starkare efterfrågan och att balansen förbättras, vilket gör ett aluminium-scenario mindre sannolikt. Stöd finns vid 1850 dollar per ton, som vi tror att marknaden håller sig över.

Vi fortsätter med en försiktig köprekommendation, av ZINK S.

Nickel

Nickelpriset följde den generella tendensen under veckan och stängde på veckans lägsta nivå, där priset balanserar på det tekniska stödet 13675 dollar per ton. Marknaden förväntar sig en återhämtning av fysisk efterfrågan under årets sista kvartal, huvudsakligen drivet av Kina. Produktionen av rostfritt stål steg med 11% i Kina under det första halvåret i år, huvudsakligen från 300-serien, som innehåller 8 – 10% nickel, enligt CRU. Efter en långsammare takt under det tredje kvartalet, tror CRU på en återhämtning under det fjärde. Det skulle innebära en ökning av efterfrågan på 13% i årstakt. Med det stora lager som finns skulle detta verkligen behövas för att få marknaden i balans. En faktor som skulle kunna leda till ökad efterfrågan är den premie för nickel i nickel pig iron vi nämnde i förra veckans brev. Att vi ser att cancellerade warrants (lagerbevis) vid LME nu uppgår till 20% av LME:s lager, kan vara ett tecken på ökad efterfrågan på primärnickel. Nya ”cancellations” rapporteras från Malaysia, där allt nickel i lager har levererats in från Kina. Det är nu möjligt att det här lagret går tillbaka till Kina. Det finns alltså några tecken på förbättringar i marknadsläget, men nickel har förmodligen en lång väg att gå innan vi ser en rejäl återhämtning.

[box]SEB Veckobrev Veckans råvarukommentar är producerat av SEB Merchant Banking och publiceras i samarbete och med tillstånd på Råvarumarknaden.se[/box]

Disclaimer

The information in this document has been compiled by SEB Merchant Banking, a division within Skandinaviska Enskilda Banken AB (publ) (“SEB”).

Opinions contained in this report represent the bank’s present opinion only and are subject to change without notice. All information contained in this report has been compiled in good faith from sources believed to be reliable. However, no representation or warranty, expressed or implied, is made with respect to the completeness or accuracy of its contents and the information is not to be relied upon as authoritative. Anyone considering taking actions based upon the content of this document is urged to base his or her investment decisions upon such investigations as he or she deems necessary. This document is being provided as information only, and no specific actions are being solicited as a result of it; to the extent permitted by law, no liability whatsoever is accepted for any direct or consequential loss arising from use of this document or its contents.

About SEB

SEB is a public company incorporated in Stockholm, Sweden, with limited liability. It is a participant at major Nordic and other European Regulated Markets and Multilateral Trading Facilities (as well as some non-European equivalent markets) for trading in financial instruments, such as markets operated by NASDAQ OMX, NYSE Euronext, London Stock Exchange, Deutsche Börse, Swiss Exchanges, Turquoise and Chi-X. SEB is authorized and regulated by Finansinspektionen in Sweden; it is authorized and subject to limited regulation by the Financial Services Authority for the conduct of designated investment business in the UK, and is subject to the provisions of relevant regulators in all other jurisdictions where SEB conducts operations. SEB Merchant Banking. All rights reserved.

Analys

Brent slips to USD 64.5: sanction doubts and OPEC focus reduce gains

After reaching USD 66.78 per barrel on Friday afternoon, Brent crude has since traded mostly sideways, yet dipping lower this morning. The market appears to be consolidating last week’s sharp gains, with Brent now easing back to around USD 64.5 per barrel, roughly USD 2.3 below Friday’s peak but still well above last Monday’s USD 60.07 low.

The rebound last week was initially driven by Washington’s decision to blacklist Russia’s two largest oil producers, Rosneft and Lukoil, which together account for nearly half of the country’s crude exports. The move sparked a wave of risk repricing and short covering, with Brent rallying almost 10% from Monday’s trough. Yet, the market is now questioning the actual effectiveness of the sanctions. While a full blacklisting sounds dramatic, the mechanisms for enforcement remain unclear, and so far, there are no signs of disrupted Russian flows.

In practice, these measures are unlikely to materially affect Russian supply or revenues in the near term, yet we have now seen Indian refiners reportedly paused new orders for Russian barrels pending government guidance. BPCL is expected to issue a replacement spot tender within 7–10 days, potentially sourcing crude from non-sanctioned entities instead. Meanwhile, Lukoil is exploring the sale of overseas assets, and Germany has requested extra time for Rosneft to reorganize its refining interests in the country.

The broader market focus is now shifting toward this week’s Fed decision and Sunday’s OPEC+ meeting, both seen as potential short-term price drivers. Renewed U.S.-China trade dialogue ahead of Trump’s meeting with President Xi Jinping in South Korea is also lending some macro support.

In short, while the White House’s latest move adds to geopolitical noise, it does not yet represent a true supply disruption. If Washington had intended to apply real pressure, it could have advanced the long-standing Senate bill enforcing secondary sanctions on buyers of Russian oil, legislation with overwhelming backing, or delivered more direct military assistance to Ukraine. Instead, the latest action looks more like political theatre than policy shift, projecting toughness without imposing material economic pain.

Still, while the immediate supply impact appears limited, the episode has refocused attention on Russia’s export vulnerability and underscored the ongoing geopolitical risk premium in the oil market. Combined with counter-seasonal draws in U.S. crude inventories, record-high barrels at sea, and ongoing uncertainty ahead of the OPEC+ meeting, short-term fundamentals remain somewhat tighter than the broader surplus story suggests.

i.e., the sanctions may prove mostly symbolic, but the combination of geopolitics and uneven inventory draws is likely to keep Brent volatile around the low to mid-USD 60s in the days ahead.

Analys

Sell the rally. Trump has become predictable in his unpredictability

Hesitant today. Brent jumped to an intraday high of $66.36/b yesterday after having touched an intraday low of $60.07/b on Monday as Indian and Chinese buyers cancelled some Russian oil purchases and instead redirected their purchases towards the Middle East due to the news US sanctions. Brent is falling back 0.4% this morning to $65.8/b.

It’s our strong view that the only sensible thing is to sell this rally. In all Trump’s unpredictability he has become increasingly predictable. Again and again he has rumbled about how he is going to be tough on Putin. Punish Putin if he won’t agree to peace in Ukraine. Recent rumbling was about the Tomahawk rockets which Trump threatened on 10 October and 12 October to sell/send to Ukraine. Then on 17 October he said that ”the U.S. didn’t want to give away weapons (Tomahawks) it needs”.

All of Trump’s threats towards Putin have been hot air. So far Trump’s threats have been all hot air and threats which later have evaporated after ”great talks with Putin”. After all these repetitions it is very hard to believe that this time will be any different. The new sanctions won’t take effect before 21. November. Trump has already said that: ”he was hoping that these new sanctions would be very short-lived in any case”. Come 21. November these new sanctions will either evaporate like all the other threats Trump has thrown at Putin before fading them. Or the sanctions will be postponed by another 4 weeks or 8 weeks with the appearance that Trump is even more angry with Putin. But so far Trump has done nothing that hurt Putin/Russia. We can’t imagine that this will be different. The only way forward in our view for a propre lasting peace in Ukraine is to turn Ukraine into defensive porcupine equipped with a stinging tail if need be.

China will likely stand up to Trump if new sanctions really materialize on 21 Nov. Just one country has really stood up to Trump in his tariff trade war this year: China. China has come of age and strength. I will no longer be bullied. Trump upped tariffs. China responded in kind. Trump cut China off from high-end computer chips. China put on the breaks on rare earth metals. China won’t be bullied any more and it has the power to stand up. Some Chinese state-owned companies like Sinopec have cancelled some of their Russian purchases. But China’s Foreign Ministry spokesperson Guo Jiakun has stated that China “oppose unilateral sanctions which lack a basis in international law and authorization of the UN Security Council”. Thus no one, not even the US shall unilaterally dictate China from whom they can buy oil or not. This is yet another opportunity for China to show its new strength and stand up to Trump in a show of force. Exactly how China choses to play this remains to be seen. But China won’t be bullied by over something as important as its oil purchases. So best guess here is that China will defy Trump on this. But probably China won’t need to make a bid deal over this. Firstly because these new sanctions will either evaporate as all the other threats or be postponed once we get to 21 November. Secondly because the sanctions are explicit towards US persons and companies but only ”may” be enforced versus non-US entities.

Sanctions is not a reduction in global supply of oil. Just some added layer of friction. Anyhow, the new sanctions won’t reduce the supply of Russian crude oil to the market. It will only increase the friction in the market with yet more need for the shadow fleet and ship to ship transfer of Russian oil to dodge the sanctions. If they materialize at all.

The jump in crude oil prices is probably due to redirections of crude purchases to the Mid-East and not because all speculators are now turned bullish. Has oil rallied because all speculators now suddenly have turned bullish? We don’t think so. Brent crude has probably jumped because some Indian and Chinese oil purchasers of have redirected their purchases from Russia towards the Mid-East just in case the sanctions really materializes on 21 November.

Analys

Brent crude set to dip its feet into the high $50ies/b this week

Parts of the Brent crude curve dipping into the high $50ies/b. Brent crude fell 2.3% over the week to Friday. It closed the week at $61.29/b, a slight gain on the day, but also traded to a low of $60.14/b that same day and just barely avoided trading into the $50ies/b. This morning it is risk-on in equities which seems to help industrial metals a little higher. But no such luck for oil. It is down 0.8% at $60.8/b. This week looks set for Brent crude to dip its feet in the $50ies/b. The Brent 3mth contract actually traded into the high $50ies/b on Friday.

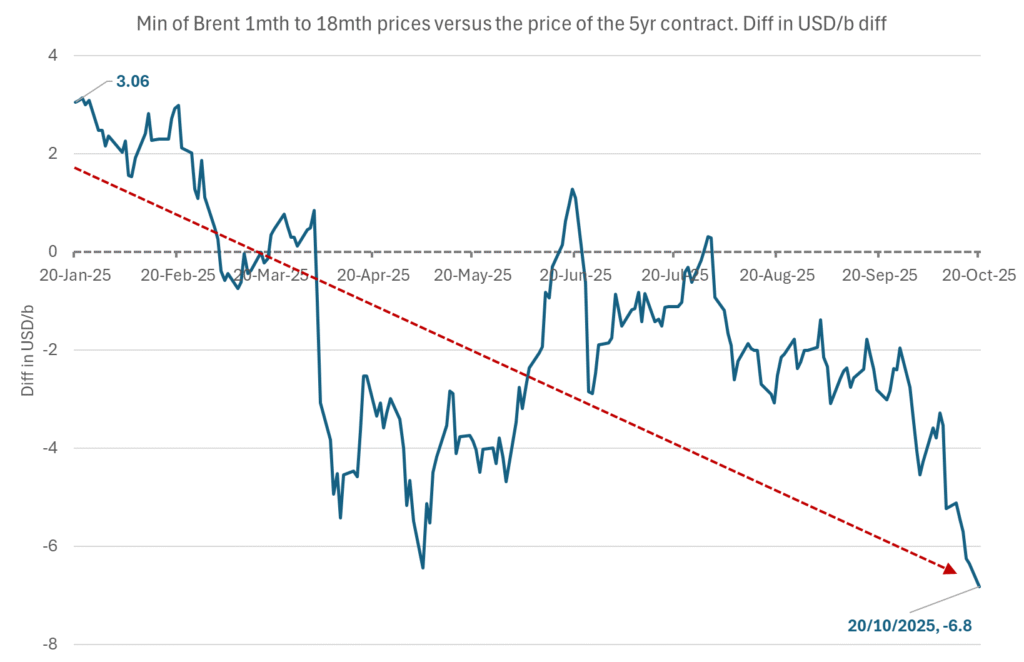

The front-end backwardation has been on a weakening foot and is now about to fully disappear. The lowest point of the crude oil curve has also moved steadily lower and lower and its discount to the 5yr contract is now $6.8/b. A solid contango. The Brent 3mth contract did actually dip into the $50ies/b intraday on Friday when it traded to a low point of $59.93/b.

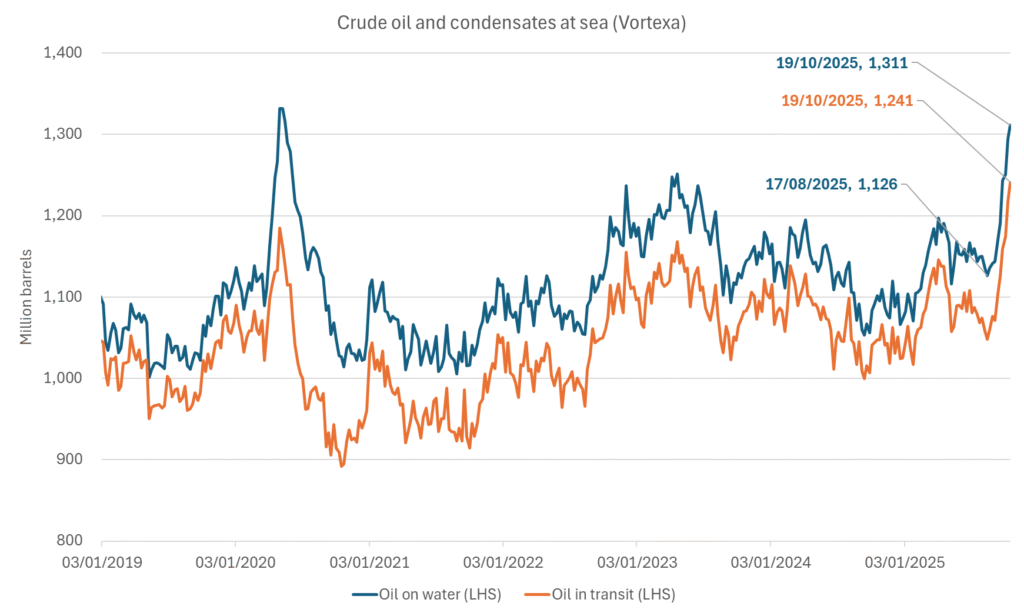

More weakness to come as lots of oil at sea comes to ports. Mid-East OPEC countries have boosted exports along with lower post summer consumption and higher production. The result is highly visibly in oil at sea which increased by 17 mb to 1,311 mb over the week to Sunday. Up 185 mb since mid-August. On its way to discharge at a port somewhere over the coming month or two.

Don’t forget that the oil market path ahead is all down to OPEC+. Remember that what is playing out in the oil market now is all by design by OPEC+. The group has decided that the unwind of the voluntary cuts is what it wants to do. In a combination of meeting demand from consumers as well as taking back market share. But we need to remember that how this plays out going forward is all at the mercy of what OPEC+ decides to do. It will halt the unwinding at some point. It will revert to cuts instead of unwind at some point.

A few months with Brent at $55/b and 40-50 US shale oil rigs kicked out may be what is needed. We think OPEC+ needs to see the exit of another 40-50 drilling rigs in the US shale oil patches to set US shale oil production on a path to of a 1 mb/d year on year decline Dec-25 to Dec-26. We are not there yet. But a 2-3 months period with Brent crude averaging $55/b would probably do it.

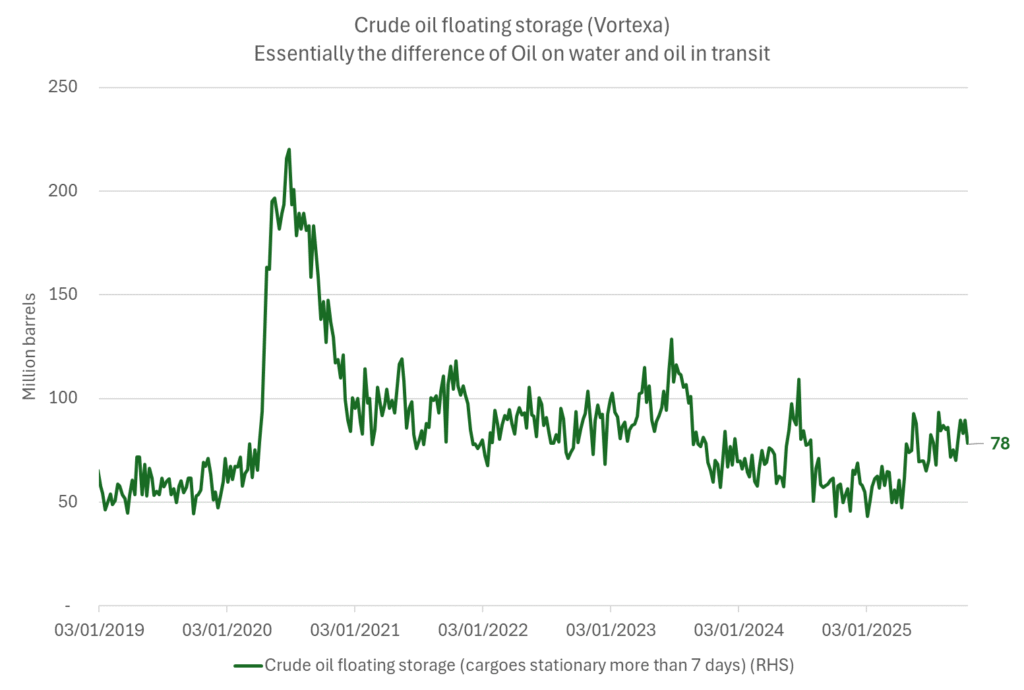

Oil on water increased 17 mb over the week to Sunday while oil in transit increased by 23 mb. So less oil was standing still. More was moving.

Crude oil floating storage (stationary more than 7 days). Down 11 mb over week to Sunday

The lowest point of the Brent crude oil curve versus the 5yr contract. Weakest so far this year.

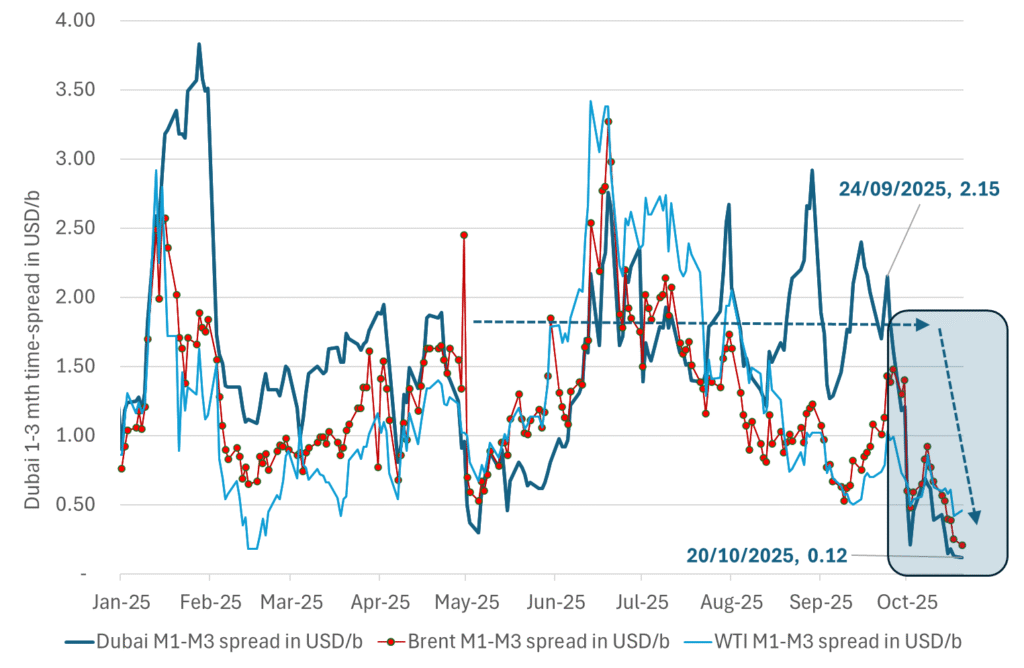

Crude oil 1mth to 3mth time-spreads. Dubai held out strongly through summer, but then that center of strength fell apart in late September and has been leading weakness in crude curves lower since then.

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanGoldman Sachs höjer prognosen för guld, tror priset når 4900 USD

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanBlykalla och amerikanska Oklo inleder ett samarbete

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanGuld nära 4000 USD och silver 50 USD, därför kan de fortsätta stiga

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanLeading Edge Materials är på rätt plats i rätt tid

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanNytt prisrekord, guld stiger över 4000 USD

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanEtt samtal om guld, olja, koppar och stål

-

Analys4 veckor sedan

Analys4 veckor sedanOPEC+ will likely unwind 500 kb/d of voluntary quotas in October. But a full unwind of 1.5 mb/d in one go could be in the cards

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanVad guldets uppgång egentligen betyder för världen