Analys

SEB Jordbruksprodukter, 22 april 2013

Efter två år av avvaktande lugn på råvarumarknaden, vaknade den till liv, om man får säga så när det handlar om prisfall, i veckan som gick. BNP-tillväxten under första kvartalet i Kina kom in på +7.7%, betydligt svagare än de 8% som marknaden väntat sig. IMF reviderade ner sin prognos för global BNP-tillväxt till +3.3%. Det är den svagaste tillväxten sedan åtminstone 1980, bortsett från katastrofåret 2008. Den svaga tillväxten i världen, som nu även märks i tillväxtländer, ledde till stora prisfall på råvarumarknaden i veckan som gick.

Efter två år av avvaktande lugn på råvarumarknaden, vaknade den till liv, om man får säga så när det handlar om prisfall, i veckan som gick. BNP-tillväxten under första kvartalet i Kina kom in på +7.7%, betydligt svagare än de 8% som marknaden väntat sig. IMF reviderade ner sin prognos för global BNP-tillväxt till +3.3%. Det är den svagaste tillväxten sedan åtminstone 1980, bortsett från katastrofåret 2008. Den svaga tillväxten i världen, som nu även märks i tillväxtländer, ledde till stora prisfall på råvarumarknaden i veckan som gick.

Vädret i USA har fördröjt majssådden, vilket fått majspriset att hålla sig stabilt, men i gengäld påverkat sojabönorna negativt, eftersom denna gröda då tenderar att vinna areal. Kinas svagare ekonomi tyngde också sojabönorna. Handeln är annars mest väderstyrd nu och vi går igenom detta lite djupare än vanligt.

Vädret i USA har fördröjt majssådden, vilket fått majspriset att hålla sig stabilt, men i gengäld påverkat sojabönorna negativt, eftersom denna gröda då tenderar att vinna areal. Kinas svagare ekonomi tyngde också sojabönorna. Handeln är annars mest väderstyrd nu och vi går igenom detta lite djupare än vanligt.

Odlingsväder

USA och Kanada är kallt, vått och snörikt. Australiens odlingsområden är torra och norr om Svarta-havet byggs ett högtryck upp. Norra Kina är torrt, där man odlar vete. I lördags (förrgår) föll temperaturen i Oklahoma ner till minus 4 grader och i New Mexico till minus fem grader. Samtidigt har över hälften av vetet börjat gå i ax, vilket gör plantan känslig för frost. Mer om detta nedan.

Vete

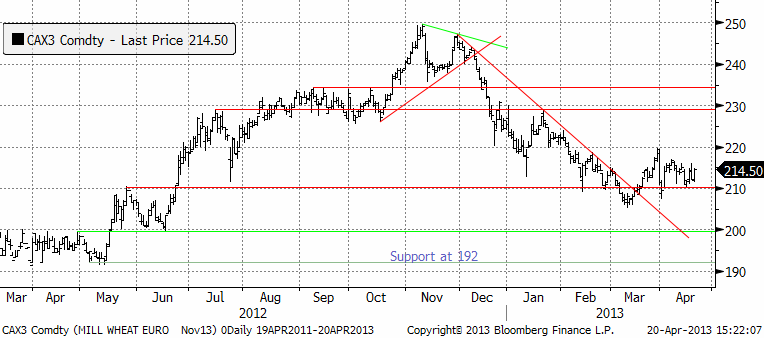

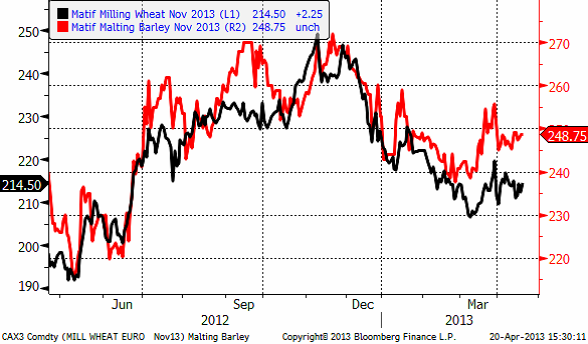

Priset på november (2013) har hållit sig över 210 euro, som nu återigen fungerar som ett tekniskt stöd. Frågan är om priset ska bryta uppåt och testa 230.

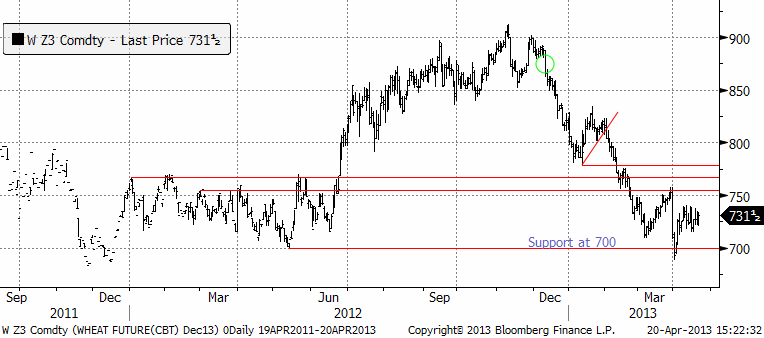

Decemberkontraktet på CBOT ser mindre ”bullish” ut än grafen för Matif-vetet. Så som Chicagovetet handlats förefaller ett test av 700 cent på nedsidan vara troligare.

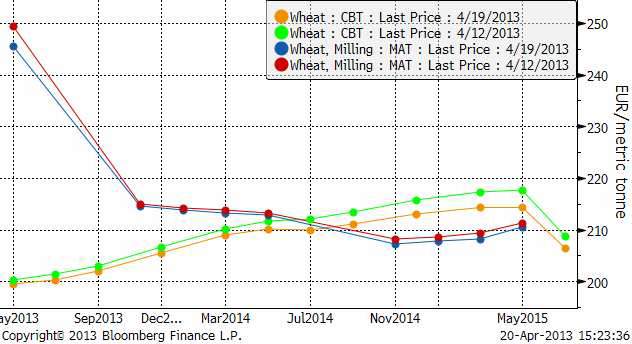

Ser vi på den senaste veckan förändring av terminskurvorna, ser vi att framförallt gammal skörd på Matif handlats ner. Det kan bero på att Tunisien faktiskt köpt ryskt vete i veckan. Det verkar alltså som om Ryssland kommit ut på exportmarknaden igen, efter att ha varit borta i nästan sex månader. I USA föll framförallt de tidsmässigt mest avlägsna leveransdatumen.

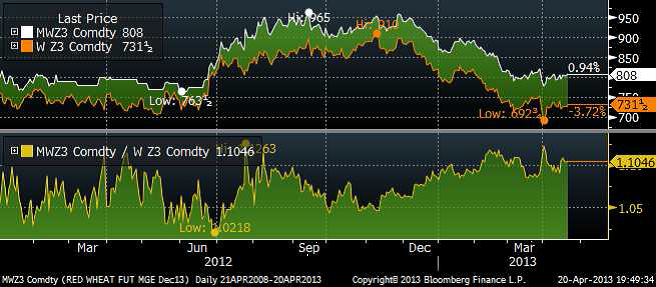

Den kalla och sena våren i USA har gjort att vårvetet på Minneapolis Grain Exchange handlats upp. I diagrammet nedan ser vi kvoten mellan priset på vårvete och chicagovete. Premien för kvalitet ökade som vi ser redan under vintern, och har legat högt – och kommer kanske att gå högre på helgens köldknäpp.

Vi ser ju faktiskt något av samma sak vad gäller maltkornet på Matif, som drar ifrån höstvetet. Strategie Grains fortsätter att justera ned sitt estimat för EU:s veteproduktion 2013/14 med ca 500 000 ton till 130 mt, vilket är den fjärde nedjusteringen i rad. Revideringen beror främst på en minskning av produktionen i Storbritannien med 330 000 ton efter förra årets katastrofala höstsådd samt lägre areal i Danmark och Spanien som resulterar i en minskning med 200 000 ton. Det blöta och kalla vädret i år har dessutom försenat höstgrödornas utveckling samtidigt som det har hämmat sådden av vårgrödor.

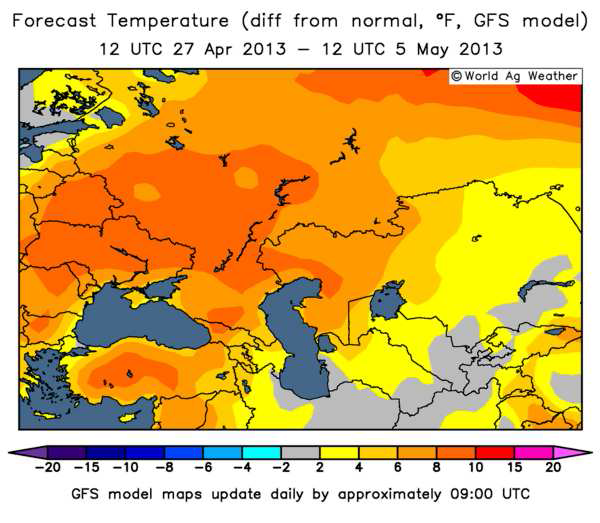

Estimatet för EU:s produktion plus Kroatiens, som ansluter sig och blir EU:s 28:e medlem i juli, uppgår till 131.1 mt, vilket är en nedjustering från 131.6 mt förra månaden. Men temperaturen i norra Europa, med centrum i Tyskland, har den senaste veckan legat över det normala.

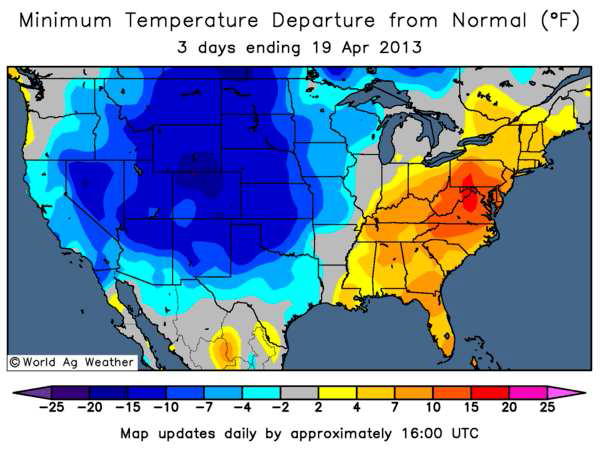

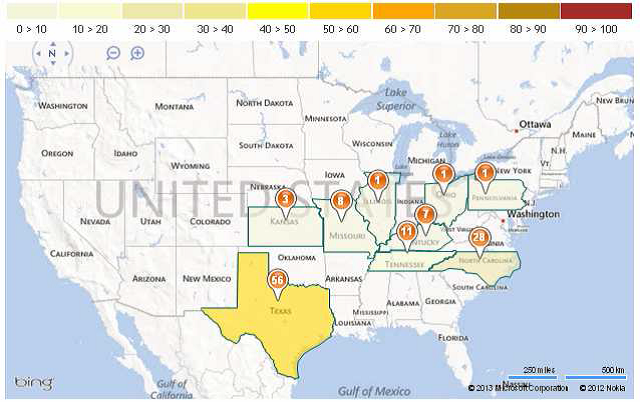

Prognosen för de närmaste två veckorna visar att värmen håller i sig. Nederbörden har också varit god och väntas vara fortsatt god. I USA har det däremot varit alarm. I Kansas, den delstat som producerar mest vete, föll temperaturen i lördags till minus 4 grader. I Texas föll temperaturen till minus 5 grader. Även Oklahoma och New Mexico berördes av frosten. Kansas, Oklahoma och Texas star för 28% av den amerikanska veteproduktionen. 68% av Oklahomas vete och 49% av Texas vete hade satt ax den 14 april enligt USDA-data. I Kansas var det bara 17% som gått i ax. Nedan ser vi de tre senaste dagarnas temperaturavvikelse från det normala. Nedan ser vi de tre senaste dagarnas temperaturavvikelse för USA.

Under tiden håller ett ordentligt högtryck på att stärkas över Svartahavsområdet (Ryssland och Ukraina) med temperaturer upp till 8 grader över det normal. Det är redan ovanligt torrt i området nord – till nordost om Svarta havet.

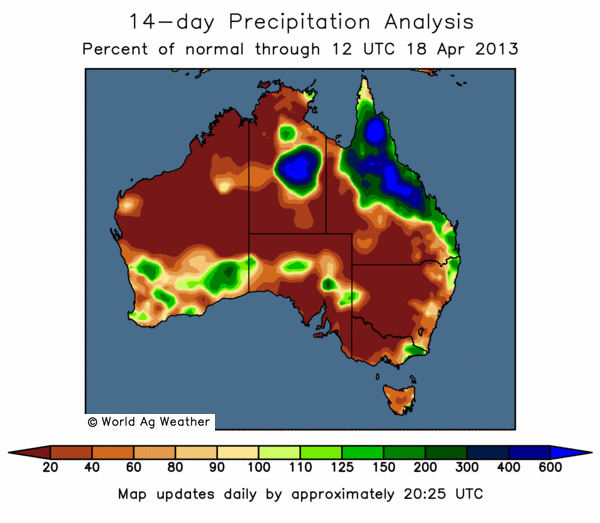

På andra sidan klotet, där vårbruket snart ska starta, är det ovanligt torrt, som vi ser av nederbördskartan nedan.

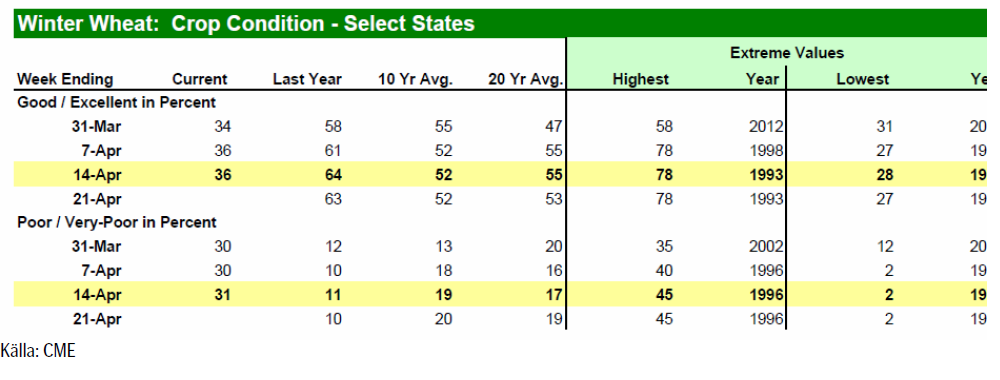

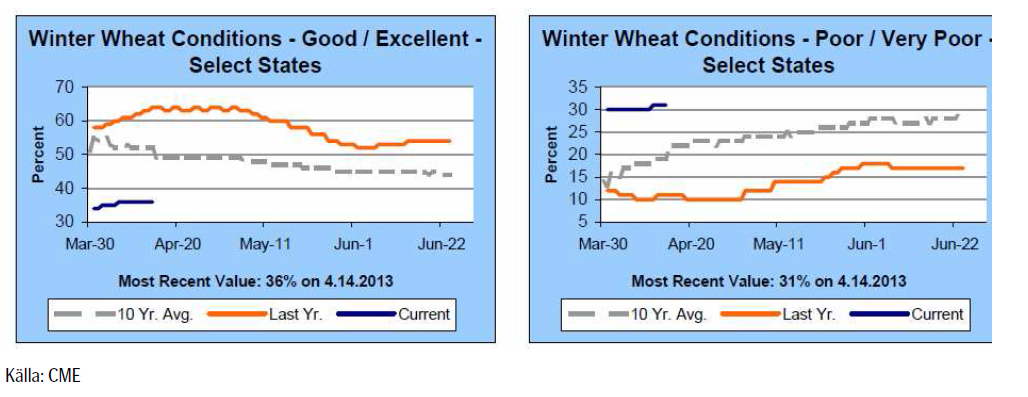

Crop progress för en vecka sedan visade oförändrat 36% i good/excellent condition.

USDA bekräftar att frost har skadat somliga höstgrödor som har kommit ur vintervilan, och som då är mer utsatta för kyla. Bl.a i Kansas, oroar sig lantbrukarna över de låga temperaturernas påverkan på grödorna, men det är fortfarande för tidigt att avgöra skadornas omfattning. I måndagens Crop Progress rapport från USDA så klassas dock fortfarande 36% av det amerikanska höstvetet som ”good/excellent” vilket är oförändrat från förra veckan, men givetvis mycket lägre än förra årets 64% vid samma tid, men samtidigt bättre än vad marknaden hade förväntat sig. Andelen grödor klassade som ”poor/very poor” har dock ökat med 1% till 31%.

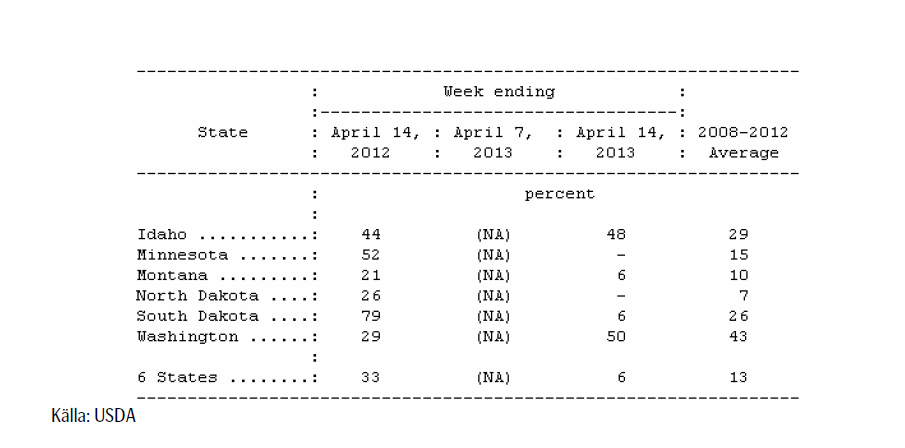

Crop Progress-rapporten visar också att sådden av vårvete i USA har fått en långsam start. 6% är i marken, vilket är att jämföra med det femåriga genomsnittet på 13% och 33% förra året, som en följd av snöfall i de norra staterna som producerar vårvete. Snön, som inte bara försenar sådden, leder också till en viss oro för översvämningar vid en snabb snösmältning framöver.

Vi fortsätter tro på sidledes prisrörelse tills vidare. Vi har sett de högsta priserna för året – om det inte blir en rejäl torka i år igen. Allt annat lika bör man passa på att sälja på uppgångar tycker jag.

Maltkorn

Priset på maltkorn med leverans i november har fortsatt att visa mer styrka än höstvetet / kvarnvetet på Matif.

Majs

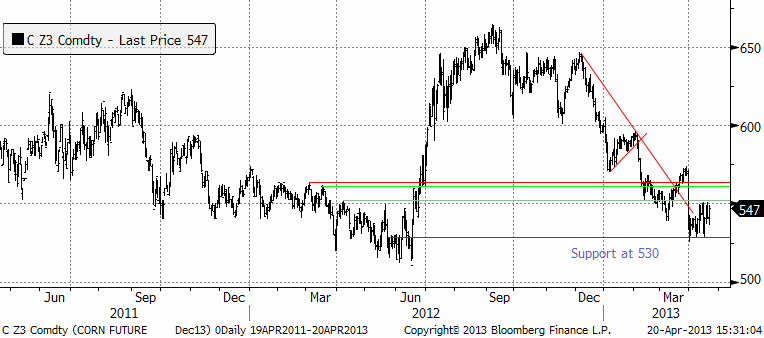

Majspriset (december 2013) har trotsat prisfallen på resten av råvarumarknaden och ligger på toppnivåer för månaden. I fredags stängde handeln i decemberkontraktet på 547 cent per bushel. Det är den låga takten i sådden som ligger bakom. I veckan var endast 2% av arealen sådd i USA, pga kallt och ogynnsamt väder. Från Argentina rapporterar BAGE att 32% är skördat.

Råoljepriset har fortsatt falla, men etanolpriset har stigit i veckan, vilket gett stöd för majspriset. I veckans energistatistik var etanollagren mindre, men så var även produktionen.

Strategie Grains höjer sitt estimat för EU:s majsproduktion 2013/14 med 500 000 ton till 64.6 mt som en följd av ett skifte i areal från vårkorn till majs i Frankrike, Polen och Tyskland. Estimatet för EU:s produktion plus Kroatiens uppgår till 66.5 mt, vilket är en ökning från förra månadens 66 mt. Kroatien ansluter sig till EU:s framgångsrika union och blir dess 28:e medlem från och med juli månad. Kroatien är ett land som är har ”credit rating” ”B”, har en frisk banksektor, statskulden är 60% av BNP, och livnär sig huvudsakligen på varvsindustri och säsongsturism.

Det kalla och blöta vädret i USA har också lett till att sådden av majs har fått en riktigt långsam start. USDA:s Crop Progress-rapport från den 14 april visar att amerikanska lantbrukare endast hade sått 2%, vilket är 5% lägre än det femåriga genomsnittet på 7%.

Det är också en enorm kontrast jämfört med förra året då det varma och torra vädret gjorde att 15% av sådden var avklarad vid denna tidpunkt på året.

Framförallt har vädret varit en bidragande faktor till begränsat fältarbete i Iowa och Illinois, de största producenterna av majs. I Illinois uppgick sådden till 1%, att jämföra med det femåriga genomsnittet på 12%, medan sådden i Iowa ännu inte har påbörjats.

Prisfallet har stannat av därför att sådden går långsamt. Det är vädret som styr. Om vädret förbättras och takten i sådden ökar, kan ett test av 530 cent bli aktuellt i veckan. Minns den stora arealen från prospective plantings-rapporten för ett par veckor sedan. Marknaden väntar bara på varmare och torrare väder i ”Corn belt” i USA för att sälja terminer.

Sojabönor

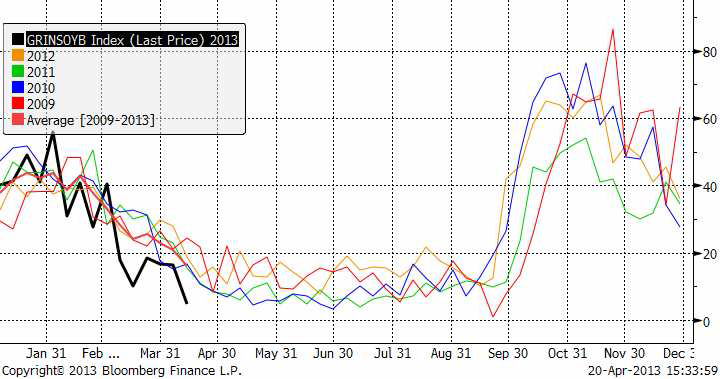

Sojabönorna (november 2013) har tagit nästa trappsteg nedåt och studsade på 1200 cent, med 1225 som övre motstånd. Chansen är stor att 1200 bryts i veckan som kommer. Det rapporterades bland annat i veckan att efterfrågan på griskött i USA utvecklas svagt och fågelinfluensan i Kina kan påverka importbehovet av sojabönor i Kina något sämre, allt annat lika. Det kalla och ogynnsamma vädret för sådden av majs i USA, där endast 2% var i backen i förra måndagens statistik, gör att mer areal kan flyttas över till soja istället. Soja sås senare än majs. På samma sätt som det amerikanska vädret ger stöd för majspriset, verkar det alltså negativt på sojapriset.

Det kommer naturligtvis vanlig veckostatistik också. Nedan ser vi export inspections enligt USDA.

BAGE rapporterade att skörden var klar till 39% och behöll skördeestimatet på 48.5 mt. USDA låg förra veckan på 51.5 mt. Brasiliens skörd är till 82% färdig. Det är lite snabbare än vanligt. Abiove sänkte skördeestimatet till 82.1 mt.

USDA låg i april månadads WASDE-rapport på 83.5 mt. Conab ligger högre. Vi tror att priset kommer att fortsätta falla och rekommenderar en såld position i sojabönor.

Raps

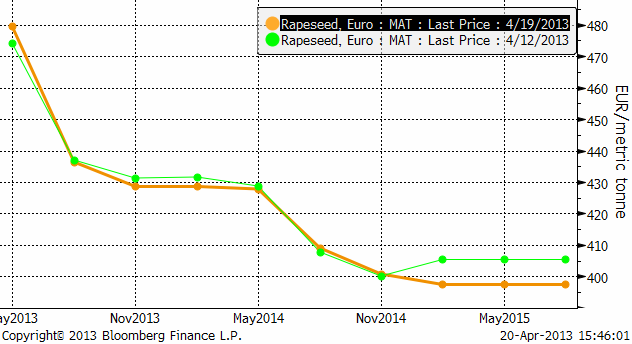

Rapspriset (november 2013) ligger kvar på någorlunda hög nivå. En anledning är att skörden i Europa väntas bli ca 1 månad senare än normalt.

Vi ser förhållandevis små förändringar i terminskurvan från förra veckan (fredag till fredag).

Om vi däremot tänker att skörden blir senare än normalt, kan det påverka utbudet för augustikontraktet på Matif. Leveranser på det kontraktet kan ske hela augusti och det är normalt sett inga problem att leverera ny skörd på det. Men i år ligger skörden kanske en månad senare än normalt. I diagrammet nedan ser vi priset på novemberkontraktet dividerat med priset på augustikontraktet. Vi ser att marknaden har börjat prisa in en försening av skörden (och utbudet). Med väsentligt bättre väder i Europa i prognosen för de kommande 14 dagarna tror vi att det kan vara värt att sälja augusti och köpa november.

Generellt sett alltså, tror vi att en såld position i raps är bra. Vi tror också att augusti är mer säljvärd än november. Att sälja augusti och köpa november är en affär som direkt spelar på att vädret förbättras fram till skörd.

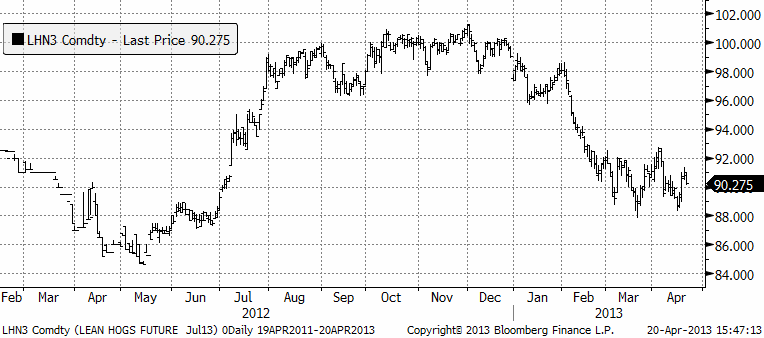

Gris

Grispriset (September 13) som har fortsatt att röra sig sidledes. Det rapporterades i veckan att efterfrågan på griskött i USA utvecklar sig svagare än väntat, vilket fick priset att falla tillbaka mot slutet av förra veckan.

Mjölk

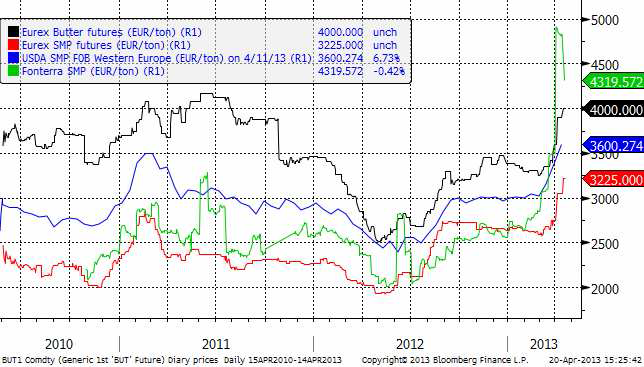

Fonterras pris på SMP tvärvände ner i veckan. Priset ligger fortfarande högt. Ser vi till tidigare tillfällen när Fonterra-priset rusat, ser vi att då har nedgången varit lika kraftig som uppgången och hela den abnorma uppgången tagits ut av nedgången.

I kursdiagrammet nedan ser vi priserna på Fonterras SMP, USDA:s prisnotering på SMP i Europa och Eurex-börsens pris, samt Eurex pris på smör. Alla priser är angivna i euro per ton.

Priserna på smör och skummjölkspulver har fortsatt att stiga på Eurex. Sedan förra veckan har det implicita priset på mjölk, som man får genom att ta rätt andelar smör och SMP, stigit med 10% för leverans i maj och med 9% för leverans i juni. För leverans längre fram i tiden har det varit betydligt mindre prisrörelser.

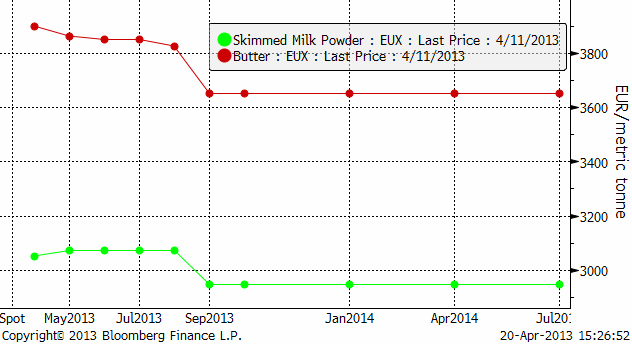

Nedan ser vi terminskurvorna för smör och skummjölkspulver på Eurex.

SEB Commodities erbjuder ett litet ”prova-på” kontrakt som består av 0.5 ton Eurex-smör och 0.9 ton Eurex SMP. Ett paket som motsvarar 10 ton flytande mjölkråvara. Just nu är det underliggande värdet på ett sådant kontrakt drygt 33 000 kronor. Vi garanterar börspris eller bättre.

Den som vill följa priset på SMP på Eurex gör det via länken:

www.eurexchange.com/exchange-en/products/com/agr/14016/

Vi tycker att den här haussen på världsmarknaden skapar ett bra tillfälle att säkra via terminer.

[box]SEB Veckobrev Jordbruksprodukter är producerat av SEB Merchant Banking och publiceras i samarbete och med tillstånd på Råvarumarknaden.se[/box]

Disclaimer

The information in this document has been compiled by SEB Merchant Banking, a division within Skandinaviska Enskilda Banken AB (publ) (“SEB”).

Opinions contained in this report represent the bank’s present opinion only and are subject to change without notice. All information contained in this report has been compiled in good faith from sources believed to be reliable. However, no representation or warranty, expressed or implied, is made with respect to the completeness or accuracy of its contents and the information is not to be relied upon as authoritative. Anyone considering taking actions based upon the content of this document is urged to base his or her investment decisions upon such investigations as he or she deems necessary. This document is being provided as information only, and no specific actions are being solicited as a result of it; to the extent permitted by law, no liability whatsoever is accepted for any direct or consequential loss arising from use of this document or its contents.

About SEB

SEB is a public company incorporated in Stockholm, Sweden, with limited liability. It is a participant at major Nordic and other European Regulated Markets and Multilateral Trading Facilities (as well as some non-European equivalent markets) for trading in financial instruments, such as markets operated by NASDAQ OMX, NYSE Euronext, London Stock Exchange, Deutsche Börse, Swiss Exchanges, Turquoise and Chi-X. SEB is authorized and regulated by Finansinspektionen in Sweden; it is authorized and subject to limited regulation by the Financial Services Authority for the conduct of designated investment business in the UK, and is subject to the provisions of relevant regulators in all other jurisdictions where SEB conducts operations. SEB Merchant Banking. All rights reserved.

Analys

Crude oil soon coming to a port near you

Rebounding along with most markets. But concerns over solidity of Gaza peace may also contribute. Brent crude fell 0.8% yesterday to $61.91/b and its lowest close since May this year. This morning it is bouncing up 0.9% to $62.5/b along with a softer USD amid positive sentiment with both equities and industrial metals moving higher. Concerns that the peace in Gaza may be less solid than what one might hope for also yields some support to Brent. Bets on tech stocks are rebounding, defying fears of trade war. Money moving back into markets. Gold continues upwards its strong trend and a softer dollar helps it higher today as well.

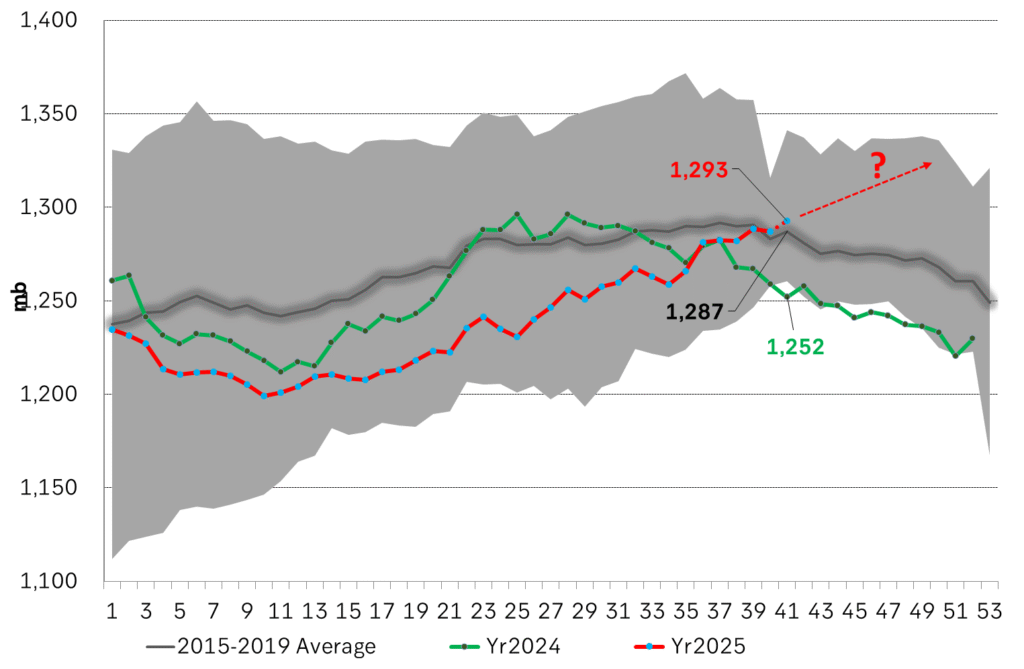

US crude & products probably rose 5.6 mb last week (API) versus a normal seasonal decline of 2.4 mb. The US API last night partial and thus indicative data for US oil inventories. Their data indicates that US crude stocks rose 7.4 mb last week, gasoline stocks rose 3.0 mb while Distillate stocks fell 4.8 mb. Altogether an increase in commercial crude and product stocks of 5.6 mb. Commercial US crude and product stocks normally decline by 2.4 mb this time of year. So seasonally adjusted the US inventories rose 8 mb last week according to the indicative numbers by the API. That is a lot. Also, the counter seasonal trend of rising stocks versus normally declining stocks this time of year looks on a solid pace of continuation. If the API is correct then total US crude and product stocks would stand 41 mb higher than one year ago and 6 mb higher than the 2015-19 average. And if we combine this with our knowledge of a sharp increase in production and exports by OPEC(+) and a large increase in oil at sea, then the current trend in US oil inventories looks set to continue. So higher stocks and lower crude oil prices until OPEC(+) switch to cuts. Actual US oil inventory data today at 18:00 CET.

US commercial crude and product stocks rising to 1293 mb in week 41 if last nights indicative numbers from API are correct.

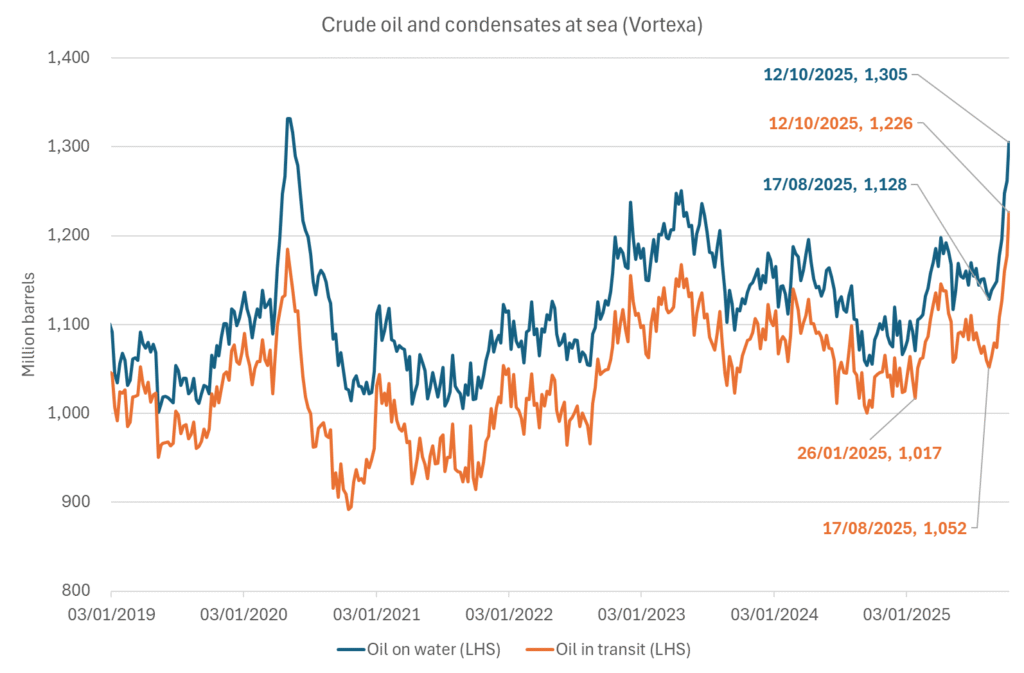

Crude oil soon coming to a port near you. OPEC has lifted production sharply higher this autumn. At the same time demand for oil in the Middle-East has fallen as we have moved out of summer heat and crude oil burn for power for air-conditioning. The Middle-East oil producers have thus been able to lift exports higher on both accounts. Crude oil and condensates on water has shot up by 177 mb since mid-August. This oil is now on its way to ports around the world. And when they arrive, it will likely help to lift stocks onshore higher. That is probably when we will lose the last bit of front-end backwardation the the crude oil curves. That will help to drive the front-month Brent crude oil price down to the $60/b line and revisit the high $50ies/b. Then the eyes will be all back on OPEC+ when they meet in early November and then again in early December.

Crude oil and condensates at sea have moved straight up by 177 mb since mid-August as OPEC(+) has produced more, consumed less and exported more.

Analys

The Mid-East anchor dragging crude oil lower

When it starts to move lower it moves rather quickly. Gaza, China, IEA. Brent crude is down 2.1% today to $62/b after having traded as high as $66.58/b last Thursday and above $70/b in late September. The sell-off follows the truce/peace in Gaze, a flareup in US-China trade and yet another bearish oil outlook from the IEA.

A lasting peace in Gaze could drive crude oil at sea to onshore stocks. A lasting peace in Gaza would probably calm down the Houthis and thus allow more normal shipments of crude oil to sail through the Suez Canal, the Red Sea and out through the Bab-el-Mandeb Strait. Crude oil at sea has risen from 48 mb in April to now 91 mb versus a pre-Covid normal of about 50-60 mb. The rise to 91 mb is probably the result of crude sailing around Africa to be shot to pieces by the Houthis. If sailings were to normalize through the Suez Canal, then it could free up some 40 mb in transit at sea moving onshore into stocks.

The US-China trade conflict is of course bearish for demand if it continues.

Bearish IEA yet again. Getting closer to 2026. Credibility rises. We expect OPEC to cut end of 2025. The bearish monthly report from the IEA is what it is, but the closer we get to 2026, the more likely the IEA is of being ball-park right in its outlook. In its monthly report today the IEA estimates that the need for crude oil from OPEC in 2026 will be 25.4 mb/d versus production by the group in September of 29.1 mb/d. The group thus needs to do some serious cutting at the end of 2025 if it wants to keep the market balanced and avoid inventories from skyrocketing. Given that IEA is correct that is. We do however expect OPEC to implement cuts to avoid a large increase in inventories in Q1-26. The group will probably revert to cuts either at its early December meeting when they discuss production for January or in early January when they discuss production for February. The oil price will likely head yet lower until the group reverts to cuts.

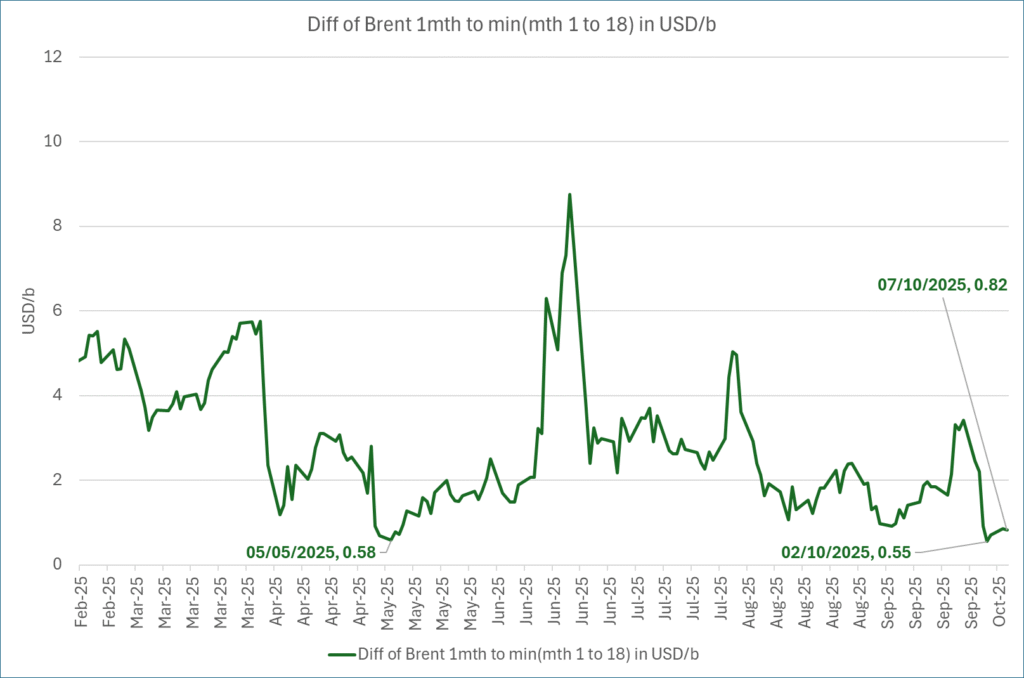

Dubai: The Mid-East anchor dragging crude oil lower. Surplus emerging in Mid-East pricing. Crude oil prices held surprisingly strong all through the summer. A sign and a key source of that strength came from the strength in the front-end backwardation of the Dubai crude oil curve. It held out strong from mid-June and all until late September with an average 1-3mth time-spread premium of $1.8/b from mid-June to end of September. The 1-3mth time-spreads for Brent and WTI however were in steady deterioration from late June while their flat prices probably were held up by the strength coming from the Persian Gulf. Then in late September the strength in the Dubai curve suddenly collapsed. Since the start of October it has been weaker than both the Brent and the WTI curves. The Dubai 1-3mth time-spread now only stands at $0.25/b. The Middle East is now exporting more as it is producing more and also consuming less following elevated summer crude burn for power (Aircon) etc.

The only bear-element missing is a sudden and solid rise in OECD stocks. The only thing that is missing for the bear-case everyone have been waiting for is a solid, visible rise in OECD stocks in general and US oil stocks specifically. So watch out for US API indications tomorrow and official US oil inventories on Thursday.

No sign of any kind of fire-sale of oil from Saudi Arabia yet. To what we can see, Saudi Arabia is not at all struggling to sell its oil. It only lowered its Official Selling Prices (OSPs) to Asia marginally for November. A surplus market + Saudi determination to sell its oil to the market would normally lead to a sharp lowering of Saudi OSPs to Asia. Not yet at least and not for November.

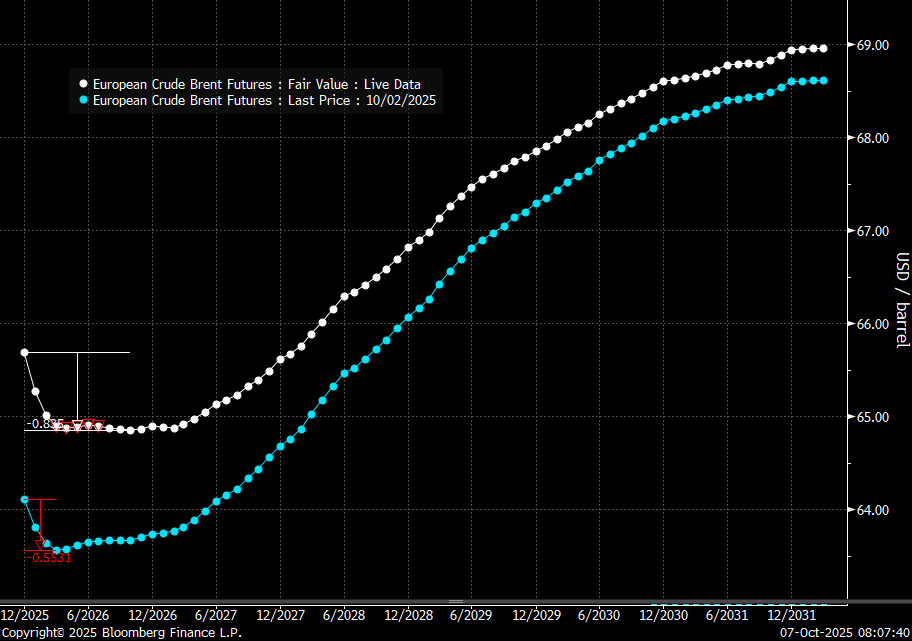

The 5yr contract close to fixed at $68/b. Of importance with respect to how far down oil can/will go. When the oil market moves into a surplus then the spot price starts to trade in a large discount to the 5yr contract. Typically $10-15/b below the 5yr contract on average in bear-years (2009, 2015, 2016, 2020). But the 5yr contract is usually pulled lower as well thus making this approach a moving target. But the 5yr contract price has now been rock solidly been pegged to $68/b since 2022. And in the 2022 bull-year (Brent spot average $99/b), the 5yr contract only went to $72/b on average. If we assume that the same goes for the downside and that 2026 is a bear-year then the 5yr goes to $64/b while the spot is trading at a $10-15/b discount to that. That would imply an average spot price next year of $49-54/b. But that is if OPEC doesn’t revert to cuts and instead keeps production flowing. We think OPEC(+) will trim/cut production as needed into 2026 to prevent a huge build-up in global oil stocks and a crash in prices. But for now we are still heading lower. Into the $50ies/b.

Analys

More weakness and lower price levels ahead, but the world won’t drown in oil in 2026

Some rebound but not much. Brent crude rebounded 1.5% yesterday to $65.47/b. This morning it is inching 0.2% up to $65.6/b. The lowest close last week was on Thursday at $64.11/b.

The curve structure is almost as week as it was before the weekend. The rebound we now have gotten post the message from OPEC+ over the weekend is to a large degree a rebound along the curve rather than much strengthening at the front-end of the curve. That part of the curve structure is almost as weak as it was last Thursday.

We are still on a weakening path. The message from OPEC+ over the weekend was we are still on a weakening path with rising supply from the group. It is just not as rapidly weakening as was feared ahead of the weekend when a quota hike of 500 kb/d/mth for November was discussed.

The Brent curve is on its way to full contango with Brent dipping into the $50ies/b. Thus the ongoing weakening we have had in the crude curve since the start of the year, and especially since early June, will continue until the Brent crude oil forward curve is in full contango along with visibly rising US and OECD oil inventories. The front-month Brent contract will then flip down towards the $60/b-line and below into the $50ies/b.

At what point will OPEC+ turn to cuts? The big question then becomes: When will OPEC+ turn around to make some cuts? At what (price) point will they choose to stabilize the market? Because for sure they will. Higher oil inventories, some more shedding of drilling rigs in US shale and Brent into the 50ies somewhere is probably where the group will step in.

There is nothing we have seen from the group so far which indicates that they will close their eyes, let the world drown in oil and the oil price crash to $40/b or below.

The message from OPEC+ is also about balance and stability. The world won’t drown in oil in 2026. The message from the group as far as we manage to interpret it is twofold: 1) Taking back market share which requires a lower price for non-OPEC+ to back off a bit, and 2) Oil market stability and balance. It is not just about 1. Thus fretting about how we are all going to drown in oil in 2026 is totally off the mark by just focusing on point 1.

When to buy cal 2026? Before Christmas when Brent hits $55/b and before OPEC+ holds its last meeting of the year which is likely to be in early December.

Brent crude oil prices have rebounded a bit along the forward curve. Not much strengthening in the structure of the curve. The front-end backwardation is not much stronger today than on its weakest level so far this year which was on Thursday last week.

The front-end backwardation fell to its weakest level so far this year on Thursday last week. A slight pickup yesterday and today, but still very close to the weakest year to date. More oil from OPEC+ in the coming months and softer demand and rising inventories. We are heading for yet softer levels.

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanOPEC+ missar produktionsmål, stöder oljepriserna

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanEtt samtal om guld, olja, fjärrvärme och förnybar energi

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanGoldman Sachs höjer prognosen för guld, tror priset når 4900 USD

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanGuld nära 4000 USD och silver 50 USD, därför kan de fortsätta stiga

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanBlykalla och amerikanska Oklo inleder ett samarbete

-

Analys4 veckor sedan

Analys4 veckor sedanAre Ukraine’s attacks on Russian energy infrastructure working?

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanGuldpriset uppe på nya höjder, nu 3750 USD

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanEtt samtal om guld, olja, koppar och stål