Analys

Prices pull back as market awaits OPEC+ and demand signals

The Brent crude oil August contract traded briefly above the $40/bl line yesterday but has now pulled back again as the market is awaiting a decision by OPEC+ whether to roll current cuts of 9.7 m bl/d beyond June. We think that there is a better than even chance for this happening but a final decision is probably not available before mid-June as the group struggles with how to whip cheaters into line. Current demand signals from the US are also weak but will most definitely strengthen again at some point in time in the coming months. Crude oil prices are pulling back awaiting OPEC+ and demand signals. Use the opportunity to buy 2021.

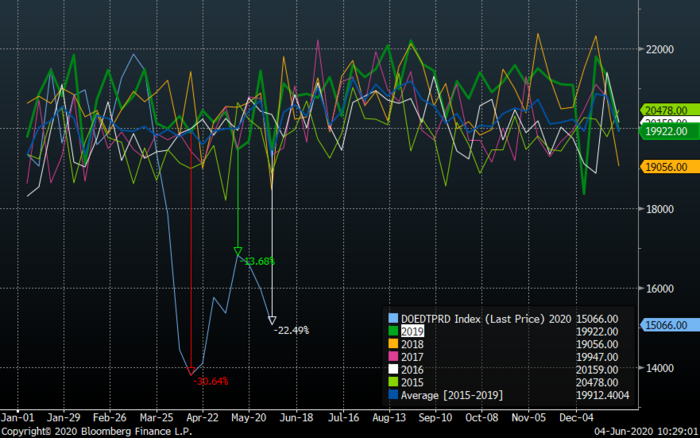

The Brent crude August contract has had a great run from its lowest quote in late April of $22.45/bl to a close yesterday of $39.79/bl which is just below the 38.2% Fibonacci retracement level. The rally has been supported by both a revival in demand as well as a sharp reduction in supply. Both of these two forces are now being placed into question. US shale oil players are contemplating a reopening of shale oil wells which were closed when demand and prices crashed. OPEC+ is scheduled to bring back supply from July unless current discord can be overcome while recent demand indications in the US published this week were weakening for a third week in a row with total products delivered down 22.5% YoY. There is thus quite a bit of headwind right now to propel the Brent crude oil price above and beyond the $40/bl line for now.

All eyes are now naturally focused on OPEC+ and their deliberations over what to do in July. Reduce cuts from 9.7 m bl/d in May and June to 7.7 m bl/d in July and H2 overall as planned or roll current cuts of 9.7 m bl/d forward for an additional 1-3 months’ time. Saudi Arabia, Kuwait and UAE have also had an additional 1.2 m bl/d of above target cuts in June which might be cancelled in July.

Saudi Arabia and Russia indicatively seems to be willing to roll current cuts forward for another 1-3 months’ time but limited compliance to the agreement in April has become a significant stumbling block with Nigeria and Iraq the two biggest offenders. Unless these offenders can be reined in there is not going to be any forward rolling of current cuts of 9.7 m bl/d.

The proposed early OPEC meeting on the 4th of June has been ditched and now the originally planned meeting on June 9 to 10 is probably being shifted out in time to mid-June. This to review more data on compliance as Saudi Arabia is getting ready for hard-ball negotiations with OPEC-cheats. Without guarantees of full compliance Russia is unlikely to come along rolling cuts of 9.7 m bl/d forward into July. Not only are cheaters being pushed to fully comply with the deal going forward but they are also asked to make up for what they did not deliver in May and June by additional deeper cuts in July and August. That sounds like a very tall order. Our first instinctive reaction: this will never happen.

We don’t hold a strong view over whether current cuts of 9.7 m bl/d will be rolled forward for another 1-3 months or not. Maybe, maybe not. What we shouldn’t forget here is what happened on the 6th of March when Russia and Saudi Arabia fell apart as Saudi wanted to chase prices higher through further cuts while Russia was getting sick of cutting and just wanted to get back to business as usual. This underlying conflict is still there between the two parties in OPEC+ as it originates from the fact that Saudi Arabia has a presumed social break-even oil price of $80-85/bl while Russia’s is closer to $40/bl. As such they naturally get different goals and strategies with Russia favouring volume growth at an oil price in the range of $45-55/bl (if that is the oil price in a shale oil world) while Saudi Arabia unavoidably wants to chase prices to $60-70-80/bl through production cuts.

Saudi Arabia can and probably must at some point in time shift its social break-even oil price from current $80-85/bl and down towards $50/bl by increasing exports by 30-40% while cutting budget spending by 20-30%. This is also the messages that Muhammed bin Salman gave to Saudi Aramco and state departments following the break-down with Russia on the 6th of March this year. Though Covid-19, demand collapse and Donald Trump’s political pressure later forced Russia and Saudi to cooperate again.

Saudi Arabia and Russia’s interests are probably aligned as long as the oil price is below $40-45/bl, shale oil production is deteriorating while global oil demand is significantly below normal. But once we get to $50/bl, US shale oil wells are re-started, drilling rig count is ticking higher and global demand is moving closer to normal then we think that the dividing line between Russia and Saudi Arabia again is likely to re-emerge.

Russia is happy with an oil price around the $50/bl mark and wants to get its volumes back into the market again at such a price level rather than to see that US shale again starts to eat away at its market share.

It is very difficult for us to understand why OPEC+ agreed in late April to hold production cuts all to the end of April 2022. By doing so the group will give US shale oil producers all the time in the world to shape up, get bankruptcies out of the way and rebound production to the extent that oil prices allow it to do. This is the same recipe and the same mistake that OPEC+ did through 2017,18,19 when it held medium cuts for a long time. This gave US shale oil producers all the runway in the world to ramp up production. Getting its production cuts back into the market became forever impossible without crashing the oil price and Russia was caught in forever lasting cut agreement.

A much better solution would be to cut hard, deep and fast. As such we support a solution where current cuts of 9.7 m bl/d are rolled forward for another 3-6 months. But it should be coupled with the message that cuts will thereafter rapidly be placed back into the market through Q1/Q2 2021.

In this way US shale oil players will not have time to revive production other than to place closed wells back into operation. There won’t be a good reason to ramp up shale oil drilling and fracking either because OPEC+’ volumes will be placed back into the market again already in H1-2021.

As such we are inclined to believe that there is probably a better than even chance that OPEC+ will roll its current cuts of 9.7 m bl/d forward to July, August,.. rather than to reduce cuts down to the originally planned 7.7 m bl/d cuts.

For now oil prices are pulling back awaiting a decision by OPEC+. The Brent crude August contract could easily pull back towards the $35-36/bl level but would definitely rebound up and above the $40/bl line again if OPEC+ decides to roll the 9.7 m bl/d cuts forward beyond June. Stronger demand revival signals would also be welcome. They will come for sure. Peak oil demand? Not at all yet. We will move back up to 100 m bl/d again and above. Just a matter of time.

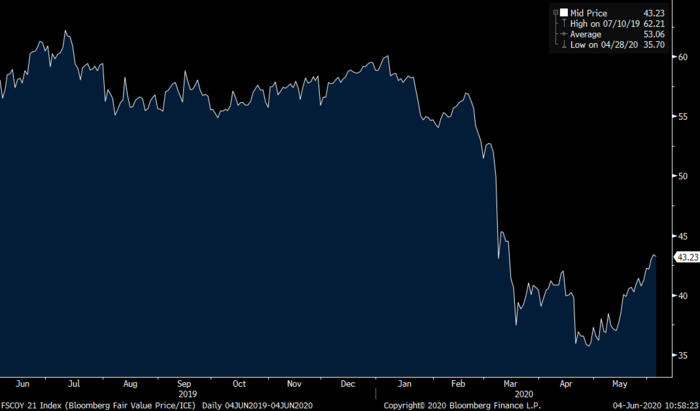

The Brent crude oil August contract closed just a fraction below the 38.2% Fibonacci retracement level yesterday. Now pulling back on weakness in US demand signals as well as awaiting a decision by OPEC+

Total US products delivered has dissapointed now three weeks in a row. It all looked good in terms of demand revival until mid-May but since then it has been a sad story

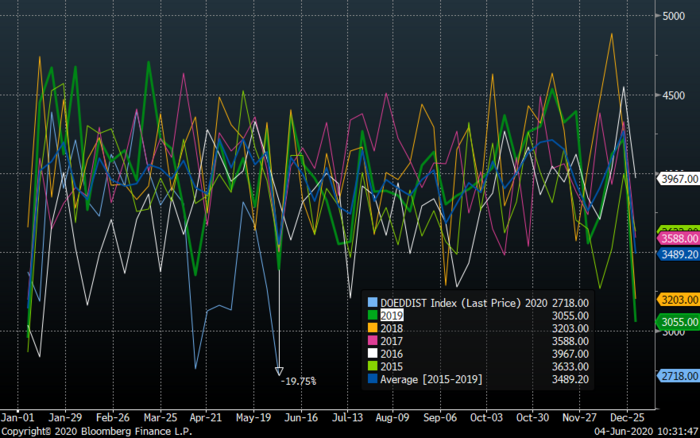

It is deliveries of US mid-dist products which is the weakness here. That is typically diesel and jet fuel.

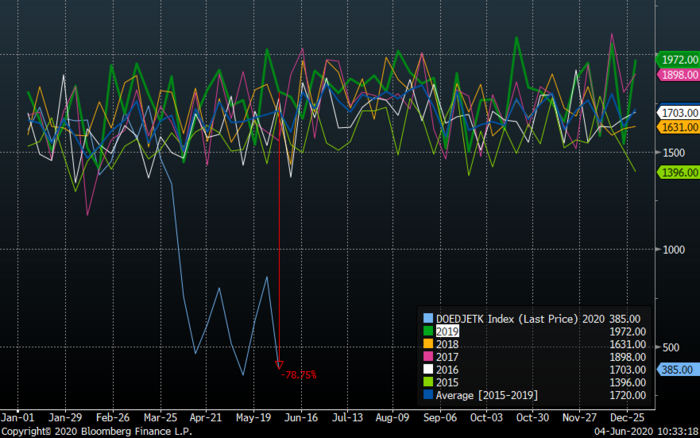

Deliveries of jet fuel in the US is still down 79% YoY. No solid signal of rebound yet there.

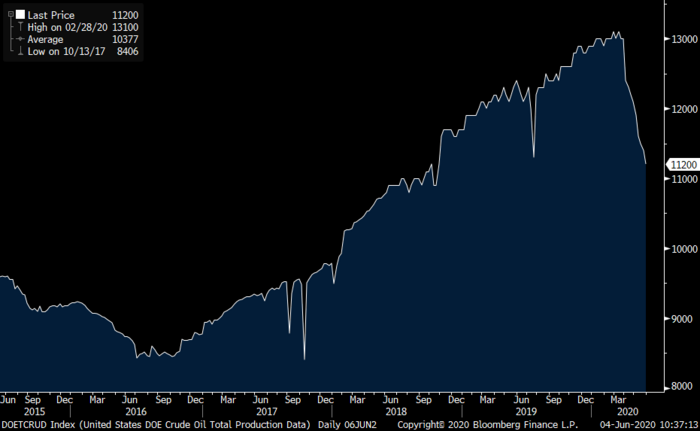

US crude oil continues to fall sharply in a combination of structural decline and deliberate shutting of wells. The underlying losses in US shale oil crude and NGL production in the US is in the range of 600 – 800 k bl/d per month. Currently there are only 222 active oil rigs in the US. These have an implied productive effect of about 165 k bl/d per month of new supply if all the wells they produce are placed into production (probably not done now). There is thus a significant ongoing structural decline in the US of up to 400 – 600 k bl/d per month today.

The Brent crude oil time spread of the 1 month minus the 6 month contract. The contango moved deeper than in 2009 but has come back faster. The front-month Brent contract has actually been in backwardation vs the second contract briefly in intraday trading lately. If cuts of 9.7 m bl/d are rolled forward beyond June then market is likely to move into deficit, inventories drawing down and poff we are back in backwardation.

The current set back in crude oil prices can provide yet another chance to purchase forward Brent crude for 2021 average delivery at very low, favorable price levels. We strongly advised our clients to purchase crude and oil products when the forward Brent 2021 contract traded in the range of $35-40/bl. We still view low-40ies as a very favorable level.

Analys

OPEC+ will likely unwind 500 kb/d of voluntary quotas in October. But a full unwind of 1.5 mb/d in one go could be in the cards

Down to mid-60ies as Iraq lifts production while Saudi may be tired of voluntary cut frugality. The Brent December contract dropped 1.6% yesterday to USD 66.03/b. This morning it is down another 0.3% to USD 65.8/b. The drop in the price came on the back of the combined news that Iraq has resumed 190 kb/d of production in Kurdistan with exports through Turkey while OPEC+ delegates send signals that the group will unwind the remaining 1.65 mb/d (less the 137 kb/d in October) of voluntary cuts at a pace of 500 kb/d per month pace.

Signals of accelerated unwind and Iraqi increase may be connected. Russia, Kazakhstan and Iraq were main offenders versus the voluntary quotas they had agreed to follow. Russia had a production ’debt’ (cumulative overproduction versus quota) of close to 90 mb in March this year while Kazakhstan had a ’debt’ of about 60 mb and the same for Iraq. This apparently made Saudi Arabia angry this spring. Why should Saudi Arabia hold back if the other voluntary cutters were just freeriding? Thus the sudden rapid unwinding of voluntary cuts. That is at least one angle of explanations for the accelerated unwinding.

If the offenders with production debts then refrained from lifting production as the voluntary cuts were rapidly unwinded, then they could ’pay back’ their ’debts’ as they would under-produce versus the new and steadily higher quotas.

Forget about Kazakhstan. Its production was just too far above the quotas with no hope that the country would hold back production due to cross-ownership of oil assets by international oil companies. But Russia and Iraq should be able to do it.

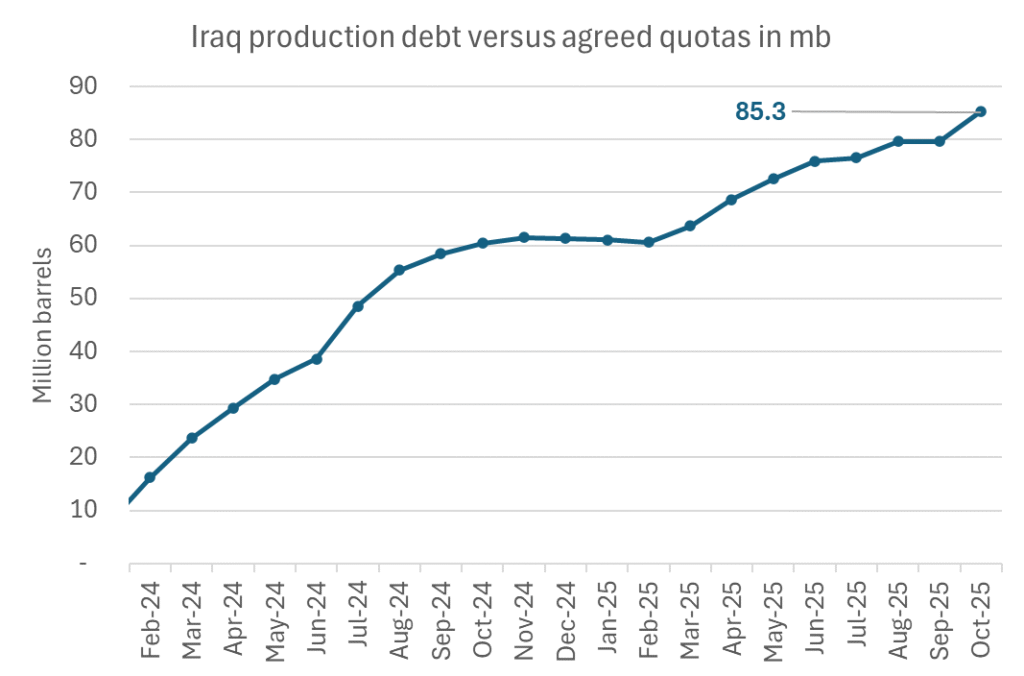

Iraqi cumulative overproduction versus quotas could reach 85-90 mb in October. Iraq has however steadily continued to overproduce by 3-5 mb per month. In July its new and gradually higher quota came close to equal with a cumulative overproduction of only 0.6 mb that month. In August again however its production had an overshoot of 100 kb/d or 3.1 mb for the month. Its cumulative production debt had then risen to close to 80 mb. We don’t know for September yet. But looking at October we now know that its production will likely average close to 4.5 mb/d due to the revival of 190 kb/d of production in Kurdistan. Its quota however will only be 4.24 mb/d. Its overproduction in October will thus likely be around 250 kb/d above its quota with its production debt rising another 7-8 mb to a total of close to 90 mb.

Again, why should Saudi Arabia be frugal while Iraq is freeriding. Better to get rid of the voluntary quotas as quickly as possible and then start all over with clean sheets.

Unwinding the remaining 1.513 mb/d in one go in October? If OPEC+ unwinds the remaining 1.513 mb/d of voluntary cuts in one big go in October, then Iraq’s quota will be around 4.4 mb/d for October versus its likely production of close to 4.5 mb/d for the coming month..

OPEC+ should thus unwind the remaining 1.513 mb/d (1.65 – 0.137 mb/d) in one go for October in order for the quota of Iraq to be able to keep track with Iraq’s actual production increase.

October 5 will show how it plays out. But a quota unwind of at least 500 kb/d for Oct seems likely. An overall increase of at least 500 kb/d in the voluntary quota for October looks likely. But it could be the whole 1.513 mb/d in one go. If the increase in the quota is ’only’ 500 kb/d then Iraqi cumulative production will still rise by 5.7 mb to a total of 85 mb in October.

Iraqi production debt versus quotas will likely rise by 5.7 mb in October if OPEC+ only lifts the overall quota by 500 kb/d in October. Here assuming historical production debt did not rise in September. That Iraq lifts its production by 190 kb/d in October to 4.47 mb/d (August level + 190 kb/d) and that OPEC+ unwinds 500 kb/d of the remining quotas in October when they decide on this on 5 October.

Analys

Modest draws, flat demand, and diesel back in focus

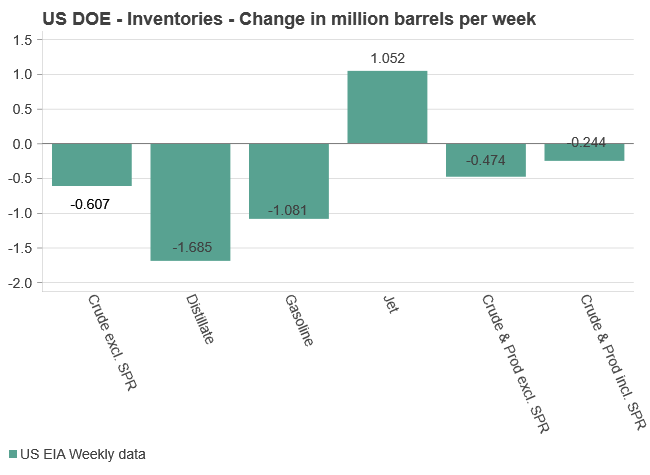

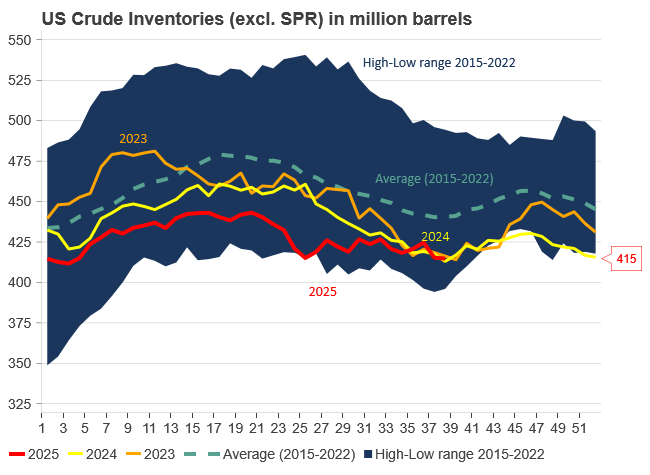

U.S. commercial crude inventories posted a marginal draw last week, falling by 0.6 million barrels to 414.8 million barrels. Inventories remain 4% below the five-year seasonal average, but the draw is far smaller than last week’s massive 9.3-million-barrel decline. Higher crude imports (+803,000 bl d WoW) and steady refinery runs (93% utilization) helped keep the crude balance relatively neutral.

Yet another drawdown indicates commercial crude inventories continue to trend below the 2015–2022 seasonal norm (~440 million barrels), though at 414.8 million barrels, levels are now almost exactly in line with both the 2023 and 2024 trajectory, suggesting stable YoY conditions (see page 3 attached).

Gasoline inventories dropped by 1.1 million barrels and are now 2% below the five-year average. The decline was broad-based, with both finished gasoline and blending components falling, indicating lower output and resilient end-user demand as we enter the shoulder season post-summer (see page 6 attached).

On the diesel side, distillate inventories declined by 1.7 million barrels, snapping a two-week streak of strong builds. At 125 million barrels, diesel inventories are once again 8% below the five-year average and trending near the low end of the historical range.

In total, commercial petroleum inventories (excl. SPR) slipped by 0.5 million barrels on the week to ish 1,281.5 million barrels. While essentially flat, this ends a two-week streak of meaningful builds, reflecting a return to a slightly tighter situation.

On the demand side, the DOE’s ‘products supplied’ metric (see page 6 attached), a proxy for implied consumption, softened slightly. Total demand for crude oil over the past four weeks averaged 20.5 million barrels per day, up just 0.9% YoY.

Summing up: This week’s report shows a re-tightening in diesel supply and modest draws across the board, while demand growth is beginning to flatten. Inventories remain structurally low, but the tone is less bullish than in recent weeks.

Analys

Are Ukraine’s attacks on Russian energy infrastructure working?

Brent crude rose 1.6% yesterday. After trading in a range of USD 66.1 – 68.09/b it settled at USD 67.63/b. A level which we are well accustomed to see Brent crude flipping around since late August. This morning it is trading 0.5% higher at USD 68/b. The market was expecting an increase of 230 kb/d in Iraqi crude exports from Kurdistan through Turkey to the Cheyhan port but that has so far failed to materialize. This probably helped to drive Brent crude higher yesterday. Indications last evening that US crude oil inventories likely fell 3.8 mb last week (indicative numbers by API) probably also added some strength to Brent crude late in the session. The market continues to await the much heralded global surplus materializing as rising crude and product inventories in OECD countries in general and the US specifically.

The oil market is starting to focus increasingly on the successful Ukrainian attacks on Russian oil infrastructure. Especially the attacks on Russian refineries. Refineries are highly complex and much harder to repair than simple crude oil facilities like export pipelines, ports and hubs. It can take months and months to repair complex refineries. It is thus mainly Russian oil products which will be hurt by this. First oil product exports will go down, thereafter Russia will have to ration oil product consumption domestically. Russian crude exports may not be hurt as much. Its crude exports could actually go up as its capacity to process crude goes down. SEB’s Emerging Market strategist Erik Meyersson wrote about the Ukrainian campaign this morning: ”Are Ukraine’s attacks on Russian energy infrastructure working?”. Phillips P O’Brian published an interesting not on this as well yesterday: ”An Update On The Ukrainian Campaign Against Russian Refineries”. It is a pay-for article, but it is well worth reading. Amongst other things it highlights the strategic focus of Ukraine towards Russia’s energy infrastructure. A Ukrainian on the matter also put out a visual representation of the attacks on twitter. We have not verified the data representation. It needs to be interpreted with caution in terms of magnitude of impact and current outage.

Complex Russian oil refineries are sitting ducks in the new, modern long-range drone war. Ukraine is building a range of new weapons as well according to O’Brian. The problem with attacks on Russian refineries is thus on the rise. This will likely be an escalating problem for Russia. And oil products around the world may rise versus the crude oil price while the crude oil price itself may not rise all that much due to this.

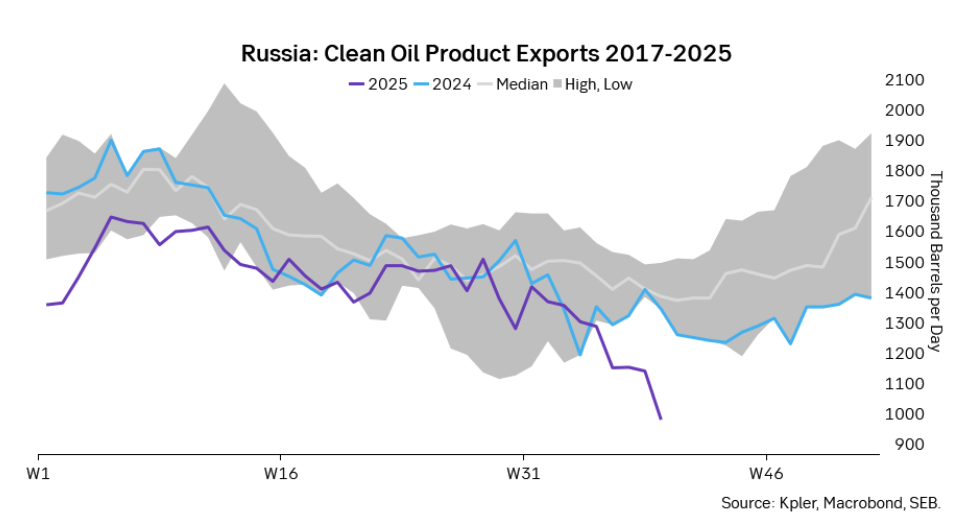

Russian clean oil product exports as presented by SEB’s Erik Meyersson in his note this morning.

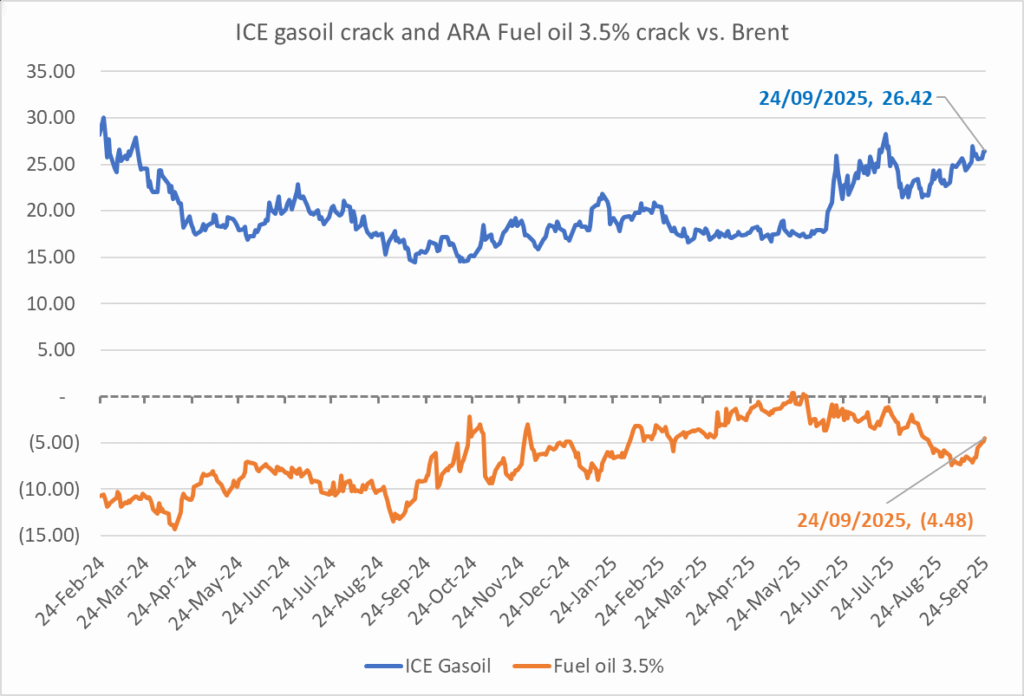

The ICE Gasoil crack and the 3.5% fuel oil crack has been strengthening. The 3.5% crack should have weakened along with rising exports of sour crude from OPEC+, but it hasn’t. Rather it has moved higher instead. The higher cracks could in part be due to the Ukrainian attacks on Russian oil refineries.

Ukrainian inhabitants graphical representation of Ukrainian attacks on Russian oil refineries on Twitter. Highlighting date of attacks, size of refineries and distance from Ukraine. We have not verified the detailed information. And you cannot derive the amount of outage as a consequence of this.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanEurobattery Minerals satsar på kritiska metaller för Europas självförsörjning

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanMahvie Minerals i en guldtrend

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanGuldpriset kan närma sig 5000 USD om centralbankens oberoende skadas

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanOPEC signalerar att de inte bryr sig om oljepriset faller kommande månader

-

Analys3 veckor sedan

Analys3 veckor sedanVolatile but going nowhere. Brent crude circles USD 66 as market weighs surplus vs risk

-

Nyheter3 veckor sedan

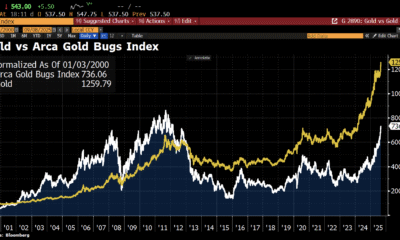

Nyheter3 veckor sedanAktier i guldbolag laggar priset på guld

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanKinas elproduktion slog nytt rekord i augusti, vilket även kolkraft gjorde

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanTyskland har så höga elpriser att företag inte har råd att använda elektricitet