Nyheter

Mining in Mexico – Producers report record results

MERIT AND POTENTIAL DESERVE HIGHER VALUES

NEW GENERATION OF EXPLORATION COMPANIES VISIBLE

Sometimes it looks as if investors take the very favourable results that the gold and silver producers in Mexico report, for granted. The production figures are generally higher and the earnings look pretty solid and healthy. It really is a growth industry and if we apply our confidence in the future price performances of gold and silver, shareholders in the Mexican producers have a warm and rosy future to look forward to.

It all seems normal. But is it? No, not really. It is quite extraordinary. Which other country is so dominated by the exploitation of and exploration for its natural resources, in this case silver and gold but also lead, zinc, copper and several other minerals? In the MINING IN MEXICO issue of January last year, I included a map of Mexico with the principal mining project locations clearly spread over almost the full length of the country, all along the three major resource belts. That natural gift and the glorious history that goes back for so long make it easy to understand that mining is such a significant part of life for many Mexicans.

And for many investors in the rest of the world too! For Mexico has built a reputation of being a very safe place to invest their capital. Some months ago, Nomura Securities’ analyst Benito Berber wrote “In the next decade Mexico is likely to become Latam’s largest economy and one of the most dynamic among emerging markets”. The mining industry remains one of Mexico’s most important drivers for economic development. Not in the least through the participation of foreign investment capital of which Canada has emerged as the largest contributor with an estimated 75% of the total of foreign investment in the Mexican mining sector.

And for many investors in the rest of the world too! For Mexico has built a reputation of being a very safe place to invest their capital. Some months ago, Nomura Securities’ analyst Benito Berber wrote “In the next decade Mexico is likely to become Latam’s largest economy and one of the most dynamic among emerging markets”. The mining industry remains one of Mexico’s most important drivers for economic development. Not in the least through the participation of foreign investment capital of which Canada has emerged as the largest contributor with an estimated 75% of the total of foreign investment in the Mexican mining sector.

According to Camimex, the Chamber of Mines of Mexico, the influx of new capital in the country’s mining industry was estimated to have been US$7.6 billion in 2012, up from US$5.6 billion in 2011 and US$3.3 billion in 2010. This year, 2013, a further increase of up to 40% is expected.

When you are looking at Mexico and the development of its flourishing and still expanding mining industry, it is outright striking how many success stories can be found about companies emerging from just an exploration company into a successful and still growing producer. Let me give you some representative examples:

Alamos Gold (TSX:AGI) developed over the last 10 years after acquiring the Mulatos Mine in 2003 for about $10 million. It started initial production in 2005, over 2012 it produced 200,000 ounces of gold (up 32% over 2011) at a cash operating cost of $355 per ounce, now expanding into Turkey, making an effort to acquire Aurizon Mines in Canada and having a market cap of C$1.9 billion;

AuRico Gold (TSX, NYSE:AUQ) made its history as Gammon Gold bringing its Ocampo Mine to commercial production in 2007 and expanding it into the largest operating gold/silver mine in Chihuahua. In Q4 2012, the Ocampo Mine was sold to Minera Frisco (BMV: MFRISCO), a Mexican resource group, for an amount of $750 million. With a market cap of $1.6 billion, it continues its operations in Canada and the El Chanate project in Mexico;

Endeavour Silver (NYSE:EXK, TSX:EDR) progressed from its start-up in 2004 to producing 4.5 million ounces of silver and 38,600 ounces of gold from its Guanaceví, Bolañitos and El Cubo silver mines. With 5 district-scale exploration properties in Mexico and Chile, Endeavour has ambitions to become a premier senior silver producer of +10 million ounces per year;

Excellon Resources (TSX:EXN), an old friend for my long-term readers, operates the Platosa silver, lead, zinc mine, the highest-grade silver mine in Durango, Mexico. It started production in 2005 and has set its targets for 2013 at producing 1,5 million ounces of silver (2012: 1,08 million ounces), 9,5 million lb lead (2012: 5,7 million lb) and 13,0 million lb zinc (2012: 10,4 million lb);

First Majestic Silver (TSX:FR, NYSE:AG, FSE:FMV), branding itself as The World’s Purest Silver Producer, operates 5 producing silver mines with a 8.3 million ounces of silver production in 2012. For 2013, the production target is set at 11.1-11.7 million ounces of silver. Talking about ambition, its company goal is to achieve annualized production of 16 million ounces of silver by the end of 2014;

McEwen Mining (NYSE,TSX:MUX) is active in Mexico, Nevada and Argentina, in total aiming to increase its production from 105,000 ounces of gold eq via 130,000 ounces in 2013, 180,000 ounces in 2014 and 290,000 ounces in 2015. A significant portion of that growth will be derived from Mexico, the already producing El Gallo 1 mine and the El Gallo 2 mine starting construction in 2013 and contributing to production in 2014;

and, two companies that started their upswing from a one project base in Mexico to true multinational and multi-project enterprises, i.e. Pan American Silver (NASDAQ,TSX:PAAS) with Ross Beaty as the main key driver and Silver Standard (NASDAQ:SSRI, TSX:SSO), the brain child of Robert Quatermain. Both companies operate major mines in Mexico but have really spread out into the world by adding mines in several other parts of the world.

Talking about mining in Mexico, I would not do justice to the industry if I would omit to mention that Mexico also has its own mining companies. There are many, ranging from very small mining operations to the few real mining giants that we know:

Fresnillo (LSE:FRES) is probably the best internationally known, in part also due to the listing of its shares at the London Stock Exchange in 2008, which came after a successful, profitable and decades-long track record as a mining company with proven expertise in the mining value chain, from exploration through to mine development and operation. It is the world’s largest primary silver producer and the 2nd largest gold producer in Mexico. It has 7 operating mines, 2 development projects and 5 advanced exploration prospects, not counting a number of other long term exploration targets. Total attributable production in 2012 amounted to 473,034 ounces of gold and 41 million ounces of silver. Its long term target is to produce 500,000 ounces of gold and 65 million ounces of silver by 2018. Fresnillo is 77% owned by

Industrias Peñoles (BMV:PENOLES), the 2nd largest Mexican mining company, 100% Mexican and part of the private Grupo Bal. Current consolidated annual production stands at about 80,5 million ounces of silver and 756,000 ounces of gold. Founded in 1887, its operations include 9 underground mines, 2 open pit mines and a world class refining complex;

Grupo Mexico (BMV:GMEXICOB) is more than a mining company. But besides the sectors Transportation and Infrastructure, the Mining sector is the most important with the Buenavista del Cobre mine in Sonora as flagship. It has the largest copper reserves worldwide. In 2012, a record production of 826,209 tons of copper content, which led to sales of over US$10 billion for the second year in a row, despite a significant drop in metal prices. As a result of a continuing and expansive capital expenditures program, production of copper is expected to increase by 70% to 1.4 million tons, with 40% growth and 100% growth foreseen in respectively molybdenum and zinc.

Mexico’s own mining companies symbolize very well what I mean with the subheading of the MINING IN MEXICO report:

“mining and exploration in Mexico, the world’s largest silver producer and more than that“

In my GOLDVIEW issues and in the social media, I have been reporting the quite impressive results from Argonaut Gold, Aurcana, Avino Mines, Canasil, Great Panther Silver, Paramount Gold & Silver, SilverCrest Mines and Timmins Gold, companies that I have been writing about for quite some time and without which I would not be able to do what I do. Let me kind of restate what I wrote earlier in last month’ GOLDVIEW issue because it still is so appropriate.

My overall comment on these Supporting Companies and their projects is that they are confirming that the outlook for the industry is generally quite promising. Other than most current share prices of mining and exploration companies may suggest, many companies make excellent progress. In particular, the emerging producers Argonaut Gold, Aurcana, Great Panther Silver, SilverCrest Mines and Timmins Gold are perfect examples.

They finished 2012 with very satisfactory production and earnings figures and it was remarkable how strong their Q4 results were. A very good way to begin the new year and if we look at what these companies do expect to achieve in 2013 and the 2 or 3 years beyond that, we have every reason to be very confident about the future prospects. I feel pretty sure that these companies will not only sustain their recent business performance but that they will continue to surprise us in a very positive way.

As to Avino, I am quite optimistic that they are well on their way to their former status as a significant silver producer and if they continue as they are doing now, they will be joining the group of emerging producers this year. Right next in line in phase of development comes Paramount Gold & Silver which is not only proceeding with bringing its Sleeper Mine in Nevada back into production but also is marching ahead with its San Miguel project in Chihuahua State in Mexico. As to Canasil, the company continues to charm me with its steady progress and CEO Bahman Yamini’s quality management style. If one company deserves to be recognized for what it has built in its property portfolio, it is Canasil. All three have proven to have what it takes to get ahead in the Mexico resource scene and see the seeds they have been planting grow into beautiful and fruit producing plants, or more appropriate, into shiny and gold and silver from their projects.

LATEST DEVELOPMENTS SUPPORTING COMPANIES IN MEXICO

Argonaut Gold Inc.

TSX:AR – price Mar 8: C$8.20

shares outstanding: 149 million, fully diluted: 151 million, market cap C$ 1.2 billion

Argonaut Gold has given its new guidance for its 2013 production. Management is looking to produce between 120,000 and 140,000 ounces of gold, up from 108,000 ounces in 2012. Cash cost of production is also expected to increase slightly to $630-$660 per ounce. This year, a $57-$75 million capital expansion program is undertaken to prepare further production increases in 2014 and beyond, in particular at the El Castillo ($32 million) and the La Colorada ($14 million); the balance will be spent at the San Antonio, general exploration and the recently acquired Magino. A new pre-feasibility report is expected to be issued by mid-year. Management has set a production of 300,000-500,000 ounces per year as its longer-term target and I am confident they will make it happen. Shafter ramping up, La Negra reporting good results and share consolidation proposed

Aurcana Corporation

TSXV: AUN – price Mar 8: C$0.75

shares outstanding: 467 million, fully diluted: 568.0 million, market cap C$ 350 million

Aurcana continues to progress with realizing its great production upside potential. At the Shafter Mine in Texas, production is ramping up towards the anticipated 3.8 million ounces of silver at a US$10/oz cash cost. At the La Negra in Mexico, the mill expansion to 3,000 tpd will be completed in this Q1. This should result in a substantially increasing production in 2013 in comparison with the 2.5 million ounces of silver equivalent which was produced at a negative cash cost of -$0.29 after compensation of the zinc-lead-copper proceeds. Exploration results reported last month, included significant intersections, new discoveries and the presence of gold. Aurcana is proposing a 1:8 share consolidation in order to make its capitalization structure more accessible for potential new investors. A most interesting company.

Avino Silver & Gold Mines Ltd.

NYSE MKT, TSXV:ASM – price Mar 8: C$1.69

shares outstanding: 27.1 million, fully diluted: 34.9 million, market cap C$46 million.

The expansion program of Avino is continuing and progressing: increasing production at the San Gonzalo, expanding total capacity from 250tpd (San Gonzalo) to 1,250tpd (San Gonzalo+Avino Mine), re-processing the oxide tailings from previous operations, exploring regional targets and adding mineable resources. Management has made some interesting calculations as to the production totals from 2010 to the 2013 anticipations: concentrates 399-1,101-1,171-2,200E tonnes, silver 25,966-133,064-191,635-600,000E ounces, gold 184-686-925-2,200 ounces. Certainly ambitious but with further potential in 2014-2015. Avino had a great past as a significant silver producer with the Avino Mine, it has a future with it too.

Canasil Resources Inc.

TSXV:CLZ – price Mar 8: C$0.11

shares outstanding: 73.4 million, fully diluted: 83.8 million, market cap C$8 million

Canasil has 10 fully-owned projects in the Durango, Zacatecas and Sinaloa States in Mexico (and 4 projects in BC, Canada) of which 7 projects are drill ready. The La Esperanza project is under option to MAG Silver (TSXV:MAG) which reported satisfactory results from its Phase 2 drilling program last January. Compared with some of its peers in Mexico and expressed in its market valuation, the potential of Canasil is largely undiscovered. Last week, Canasil received drill permits for its Sandra-Escobar (expanded) and Salamandra projects in Durango which may attract additional joint-venture partners. Or as I have said before, I would not be surprised if a larger company will come with a good proposal.

Great Panther Silver Limited

TSX:GPR, NYSE MKT:GPL – price Mar 8: C$1.43

shares outstanding: 137.8 million, fully diluted: 144.1 million, market cap C$197 million

Production in 2012 from its 100% owned mines in Mexico, the Guanajuato and the Topia, increased by 8% to 2.37 million silver equivalent ounces, silver production by 4% to 1.56 million ounces and gold by 36% To 10,923 ounces. The strong Q4 finished the year with several quarterly and annual production records at both operations. Management has set its target to grow into the mid-tier level of primary silver producers by attaining a >5 million silver equivalent ounces per year production from a >40 million ounce resource through organic growth of existing projects and some strategic acquisitions. I am confident that Robert Archer and his team will be taking another good step forward in 2013.

Paramount Gold & Silver Corp.

TSX, NYSE:PZG – price Mar 8: C$2.06

shares outstanding: 147.5 million, fully diluted: 158.1 million, market cap C$303 million

While progressing with reviving its Sleeper Mine in Nevada back to production, an important stage was reached at its 100% owned San Miguel Project in the Palmarejo Mining District of Chihuahua. The San Miguel project is ideally situated near established, low cost production where the infrastructure already exists for early, cost-effective exploitation. Just a week ago, Paramount announced the results of a Preliminary Economic Assessment which confirmed that the San Miguel project represents an unusually robust economic opportunity to develop a low cost mine in this prolific Sierra Madre belt. The study indicates that low initial capital of $232 million and low operating costs would generate exceptional economics from an estimated average annual production of 57,300 ounces of gold and 3.1 million ounces of silver for 14 years. Management is now in the process of determining to proceed with development options or continue to expand and enhance the project.

SilverCrest Mines Inc.

TSXV:SVL, NYSE MKT:SVLC – price Mar 8: C$2.46

shares outstanding: 107.6 million, fully diluted: 114.5 million, market cap C$264 million

After the remarkable 2012 production results, reported at 2.37 million ounces silver equivalent, SilverCrest is realizing further steps of its expansion plans. The next production target is set 3.5 to 4.5 million ounces silver equivalent by 2014. Recent drill results have expanded the Santa Elena deposit, resulted in new mineralized zones and more bonanza grade intercepts while the underground decline has progressed beyond 1.2km. The awaited new underground resources and reserve estimates should considerable extent the mine life. At the La Joya property, an updated resource estimate was reported last month. A PEA will be in progress soon, and include addressing the possibility to mark the 60gpt silver equivalent portion of the deposit with an estimated tonnage of 27.9 million tonnes as a possible “Starter Pit” for initial operations. The built-in growth potential of SilverCrest keeps surprising me as it is unveiled.

Timmins Gold Corp.

TSX:TMM, NYSE MKT:TGD – price Mar 8: C$2.71

shares outstanding: 143.9 million, fully diluted: 153.0 million, market cap C$390 million

After having produced a record 94,444 ounces of gold in 2012 from the 100% owned San Francisco and La Chicharra open pit heap leaching operations, this year’s target for production is set at 125,000-130,000 ounces of gold. The increased capacity of the crushing facilities, completed in Q4 2012, and the more efficient production process will contribute to achieving the set objective. In addition, installation of additional crushing capacity for expansion to over 30,000tpd is planned to be completed in Q2 2013. In the meantime, the exploration activities continue at an impressive level. For 2013, an extensive 200,000m drilling program is underway to expand the deposit in all directions around and beneath the main pit with significant regional exploration. Expanding the existing gold reserve of 1.33 million ounces (72.3 million tonnes @ 0.572g/t gold) is one of the objectives for 2013. I am very positive about the quality growth that this quality gold producer will continue to realize.

It is just a pleasure to be connected with these Supporting Companies and to be able to bring their news to you, my audience, on a continuing basis. Every time I see more good news coming, I feel confirmed in my belief in them. And do I see them as examples of a flourishing industry and absolutely not as members of an industry in distress. As said, I do realize that also these companies could not escape from the disappointing markets of resource stocks. Resource stocks performed mainly on the general expectations of and the distinct influences on the gold price. Strangely enough, the actual results of the underlying companies did hardly seem to matter, even in the cases of companies that can look forward to more years of obvious further growth and prosperity. If you are, like me, not seeing any reasons for the gold price, the silver price and the copper price to really collapse to (close to) uneconomic levels, you should look at the future with confidence. The market will come to recognize the true merit and potential of these companies, sooner or later.

I continue to believe firmly that the patient and confident investors who own these shares will be amply awarded. For new investors, the current prices are offering great opportunities. I have written and in my frequent meetings with European investors I have said, as I also did in my recent interview with THE GOLD REPORT, that I consider the shares of these companies as belonging to the best values that you can find these days……

In my recent GOLDVIEW and MINING IN AFRICA reports and some of my personal presentations and interviews, I have signalled a further shift in the ranks of the companies as to their status of operations. The major producers have reached production levels at which further significant increases are hard to attain and remain manageable. Moreover, it is clear that ever higher production does not automatically lead to comparably higher earnings. At the two levels below the majors, the mid-tier and in particular the emerging producers, you see the same flexibility and growth performance as they had to get there, and in some cases you see even an advanced development. The same is visible among the resource companies with advanced exploration. There are a nice number of those companies that are obviously proceeding towards pre-feasibility, feasibility and production decision stage. As my regular and attentive readers could have noticed, I like to find and associate with especially those companies in the categories from successful exploration up to and including the emerging producers. Of course, I also would like to be able to write about some of the mid-tier producers, the group includes some truly great companies, but when they reach that stage, apparently something changes in their mentality and come to think they should take their elevator one or more flights up when it comes to communicating with the investment public. A fact of life……

Also in Mexico, I see the shifting in and between the ranks of resource companies happening. As covered earlier in this issue, the producing Supporting Companies all perfectly fit in the category emerging producers. Avino is on its way to join them and next-in-line Paramount is nearing the moment that vital decisions to move upward can be taken. For those vital decisions, Canasil is more dependant on other companies. But I am also following many other companies like the ones that I mentioned on pages 2 and 3. In addition to those some companies that already are in production such as Gold Resource (NYSE MKT:GORO), Scorpio Mining (TSX:SPM), Sierra Metals (TSXV:SMT), formerly called Diabras, and Golden Minerals (NYSE MKT:AUMN, TSX:AUM) several other ones with the specific purpose to see which ones are making above average progress and seem to get ready for a major step forward in their development. Some of those companies I know pretty well because I have been covering in their early years, such as International Northair (TSXV:INM) and Kimber Resources (TSX:KBR, NYSE MKT:KBX) that both have been working for years to bring their projects closer to a possible production decision within a foreseeable future. Other companies that I find very worthwhile to follow because of their consistent reporting of interesting exploration results are Arian Silver (TSXV,AIM:AGQ), Caza Gold (TSXV:CZY), Cerro Resources (ASX,TSX:CJO), Chesapeake Gold (TSXV:CKG), El Tigre Silver (TSXV:ELS), Garibaldi Resources (TSXV:GGI), GoGold Resources (TSXV:GGD), MAG Silver (TSX:MAG, NYSE MKT:MVG), Minaurum Gold (TSXV:MGG), NSX Silver (TSXV:NXY), NWM Mining (TSXV:NWM), Revolution Resources (TSX:RV), Riverside Resources (TSXV:RRI), Silver Bull Resources (NYSE MKT:SVBL, TSX:SVB) and Santa Cruz Silver (TSXV:SCZ). For those of you that like to do exploration of their own, this section is giving a good and helpful travel guide.

Coming to the end of this issue, I like to mention that I am aware of some other issues that come to mind when we are talking about mining and exploration in Mexico. There are interesting discussions of the aftermath of the last Presidential elections, and the influence the results can have on national issues as general safety, the war against the drug lords and some upcoming new tax levies and royalties on mining. I have chosen to concentrate on the bright side of mining life in Mexico as the positives far outweigh the negatives. Yet, in a next issue of MINING IN MEXICO, I will not shy away from touching those sensitive subjects. For now, I chose to agree with what Mining Journal said in its latest Supplement on Mexico:

”still a land of opportunity”

Henk J. Krasenberg

[hr]

European Gold Centre

European Gold Centre analyzes and comments on gold, other metals & minerals and international mining and exploration companies in perspective to the rapidly changing world of economics, finance and investments. Through its publications, The Centre informs international investors, both institutional and private, primarily in Europe but also worldwide, who have an interest in natural resources and investing in resource companies.

The Centre also provides assistance to international mining and exploration companies in building and expanding their European investor following and shareholdership.

Henk J. Krasenberg

After my professional career in security analysis, investment advisory, porfolio management and investment banking, I made the decision to concentrate on and specialize in the world of metals, minerals and mining finance. From 1983 to 1992, I have been writing and consulting about gold, other metals and minerals and resource companies.

The depressed metal markets of the early 1990’s led me to a temporary shift. I pursued one of my other hobbies and started an art gallery in contemporary abstracts, awaiting a new cycle in metals and mining. That started to come in the early 2000’s and I returned to metals and mining in 2002 with the European Gold Centre.

With my GOLDVIEW reports, I have built an extensive institutional investor following in Europe and more of a private investor following in the rest of the world. In 2007, I introduced my MINING IN AFRICA publication, to be followed by MINING IN EUROPE in 2010 and MINING IN MEXICO in 2012.

For more information: www.europeangoldcentre.com

Nyheter

Vad guldets uppgång egentligen betyder för världen

Guldpriset har nyligen nått rekordnivåer, över 4 000 dollar per uns. Denna uppgång är inte bara ett resultat av spekulation, utan speglar djupare förändringar i den globala ekonomin. Bloomberg analyserar hur detta hänger samman med minskad tillit till dollarn, geopolitisk oro och förändrade investeringsmönster.

Guldets roll som säker tillgång har stärkts i takt med att förtroendet för den amerikanska centralbanken minskat. Osäkerhet kring Federal Reserves oberoende, inflationens utveckling och USA:s ekonomiska stabilitet har fått investerare att söka alternativ till fiatvalutor. Donald Trumps handelskrig har också bidragit till att underminera dollarns status som global reservvaluta.

Samtidigt ökar den geopolitiska spänningen, särskilt mellan USA och Kina. Kapitalflykt från Kina, driven av oro för övertryckta valutor och instabilitet i det finansiella systemet, har lett till ökad efterfrågan på guld. Även kryptovalutor som bitcoin stiger i värde, vilket tyder på ett bredare skifte mot hårda tillgångar.

Bloomberg lyfter fram att derivatmarknaden för guld visar tecken på spekulativ överhettning. Positioneringsdata och avvikelser i terminskurvor tyder på att investerare roterar bort från aktier och obligationer till guld. ETF-flöden och CFTC-statistik bekräftar denna trend.

En annan aspekt är att de superrika nu köper upp alla tillgångsslag – aktier, fastigheter, statsobligationer och guld – vilket bryter mot traditionella investeringslogiker där vissa tillgångar fungerar som motvikt till andra. Detta tyder på att marknaden är ur balans och att kapitalfördelningen är skev.

Sammanfattningsvis är guldets prisrally ett tecken på en värld i ekonomisk omkalibrering. Det signalerar misstro mot fiatvalutor, oro för geopolitisk instabilitet och ett skifte i hur investerare ser på risk och trygghet.

Nyheter

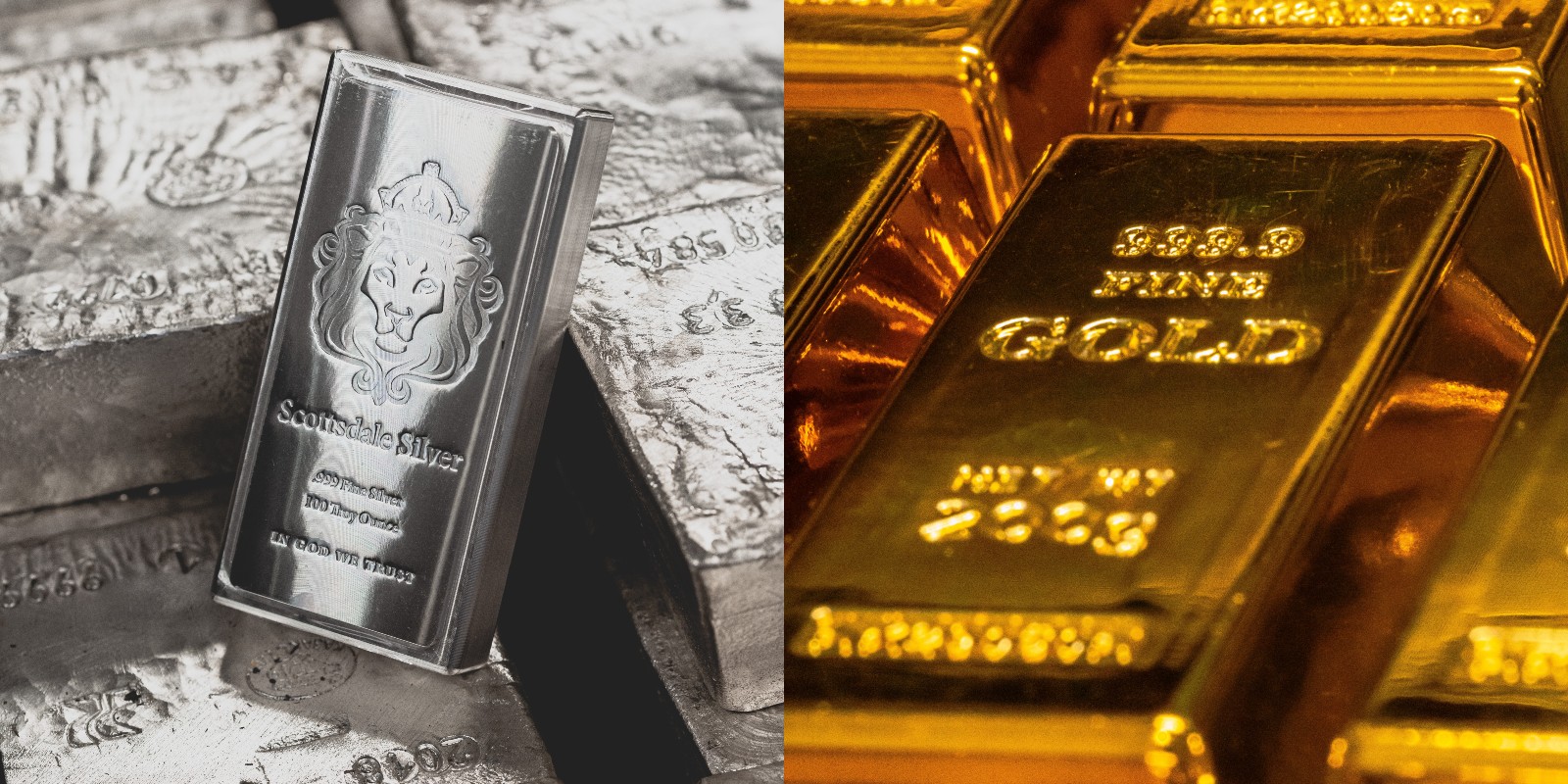

Spotpriset på guld över 4300 USD och silver över 54 USD

Guldpriset stiger i ett spektakulärt tempo, nya rekord sätts nu på löpande band. Terminspriset ligger oftast före i utvecklingen, men ikväll passerade även spotpriset på guld 4300 USD per uns. Guldet är just nu som ett ångande tåg som det hela tiden skyfflas in mer kol i. En praktisk fördel med ett högre pris är att det totala värdet på guld även blir högre, vilket gör att centralbanker och privatpersoner kan placera mer pengar i guld.

Även spotpriset på silver har nu passerat 54 USD vilket innebär att alla pristoppar från Hunt-brödernas klassiska squeeze på silver har passerats med marginal. Ett högt pris på guld påverkar främst köpare av smycken, men konsekvensen av ett högt pris på silver är betydligt mer kännbar. Silver är en metall som används inom många olika industrier, i allt från solceller till medicinsk utrustning.

Nyheter

Guld och silver stiger hela tiden mot nya höjder

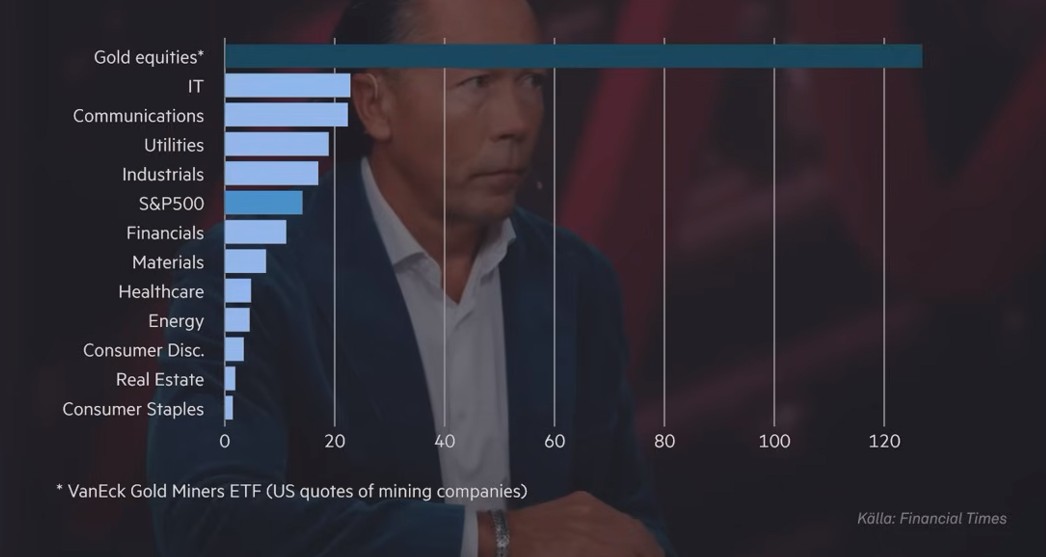

Priserna på guld och silver stiger hela tiden mot nya höjder. Eric Strand går här igenom vilka faktorerna som ligger bakom uppgångarna och vad som kan hända framöver. Han får även kommentera aktier inom guldgruvbolag som har haft en bättre utveckling än nästan allt annat. Han säger bland annat att uppgången kommer från låga nivåer och att det i genomsnitt är en mycket högre kvalitet på ledningarna för bolagen idag.

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanOPEC+ missar produktionsmål, stöder oljepriserna

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanEtt samtal om guld, olja, fjärrvärme och förnybar energi

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanGoldman Sachs höjer prognosen för guld, tror priset når 4900 USD

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanGuld nära 4000 USD och silver 50 USD, därför kan de fortsätta stiga

-

Analys3 veckor sedan

Analys3 veckor sedanAre Ukraine’s attacks on Russian energy infrastructure working?

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanBlykalla och amerikanska Oklo inleder ett samarbete

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanGuldpriset uppe på nya höjder, nu 3750 USD

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanEtt samtal om guld, olja, koppar och stål