Analys

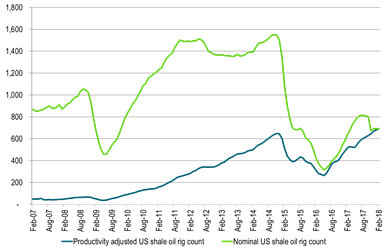

Market does not care about US shale, but it should. It is now growing as it did in 2014

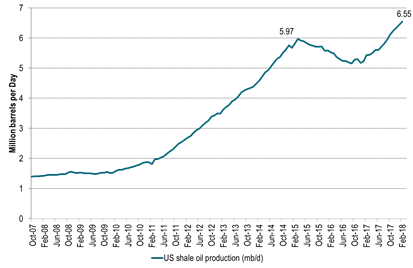

Yesterday’s US EIA Drilling Productivity Report (DPR) showed that US crude oil production is now growing at a marginal rate of 1.3 mb/d/yr and as strongly as it did in 2014. If we adjust for increased well productivity then completions of wells in December stood 27% above the 2014 average. We estimate that volume drilling productivity rose 23% from 4Q16 to 4Q17. Drilling is still running well ahead of completions and we estimate that the number of rigs could decline by 200 rigs without hurting the current marginal production growth. Unless there is a significant set-back in global oil markets or sentiment or in the US shale space with a drop in completions per month we should see US crude production averaging close to 10.7 mb/d in 2018 thus growing 1.38 mb/d y/y average 2017 to average 2018. In addition comes US NGL’s growth of 0.5 mb/d y/y which will bring total US liquids growth to 1.88 mb/d for average 2017 to average 2018.

Yesterday’s US EIA Drilling Productivity Report (DPR) showed that US crude oil production is now growing at a marginal rate of 1.3 mb/d/yr and as strongly as it did in 2014. If we adjust for increased well productivity then completions of wells in December stood 27% above the 2014 average. We estimate that volume drilling productivity rose 23% from 4Q16 to 4Q17. Drilling is still running well ahead of completions and we estimate that the number of rigs could decline by 200 rigs without hurting the current marginal production growth. Unless there is a significant set-back in global oil markets or sentiment or in the US shale space with a drop in completions per month we should see US crude production averaging close to 10.7 mb/d in 2018 thus growing 1.38 mb/d y/y average 2017 to average 2018. In addition comes US NGL’s growth of 0.5 mb/d y/y which will bring total US liquids growth to 1.88 mb/d for average 2017 to average 2018.

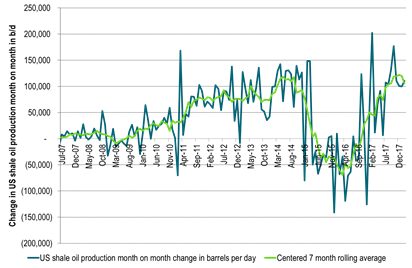

Yesterday’s US DPR report showed that shale oil production is growing as strongly now as it did in 2014 when it grew at a monthly rate of 114 k bl/d/mth (1.4 mb/d rate).

The EIA estimates that US shale oil production will grow by 110 k bl/d from Jan to Feb which is a marginal rate of 1.3 mb/d. This is in stark contrast to EIA’s latest monthly oil report which predicted crude oil production from US lower 48 states (ex Gulf of Mexico) would only grow at a rate of 33 k bl/d in 1Q18 and on average only 42 k bl/d through 2018.

Yesterday’s DPR report shows that US shale oil production is growing 160% faster than what the US EIA uses in its STEO report assumptions for 2018 forecast. It shows that the US EIA will have to revise its US crude oil production forecast for 2018 significantly higher. It has revised it upwards in its last four reports. It is far from done doing so in our view.

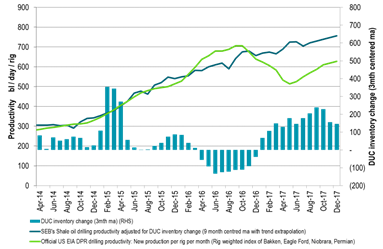

US shale oil volume productivity growth (new oil per rig in operation) is in our calculations up 23% y/y 4Q17 to 4Q16. This is in strong contrast to EIA’s official productivity measure of zero growth which is not taking account of the huge build-up of DUCs.

Drilling of wells is still running significantly ahead of completions with the inventory of uncompleted wells rising by 156 wells in December. Completions are struggling to catch up. Either drilling will have to fall or completions will have to speed up in order to prevent a further build-up of DUCs. Players should kick out 100 drilling rigs in order to get drilling in line with completions. In order to draw down the DUC inventory they should kick out another 100 rigs more and thus a total 200 rigs while keeping completions at current level. The market should thus not be optimistic on prices due to a decline in US drilling rig count.

Completions of wells rose to (1091) the highest level since April 2015. However, if the number of completions is adjusted for increasing well productivity then well completions in December 2017 came in at the highest level since these data started in Jan 2014 and 27% higher than well completions on average in 2014.

In our view it seems reasonable to assume that US shale oil production will grow at its current speed through 2018 which means a total growth of 1.32 mb/d from Dec-17 to Dec-18. In addition comes a growth of 180 k bl/d from non-shale bringing the total US crude oil growth in 2018 to 1.5 mb/d. This will place US crude oil production at 10.68 mb/d on average for 2018 which is up 1.38 mb/d from 2017 average of 9.3 mb/d. In addition comes a 0.5 mb/d growth in US NGLs bringing total US liquids growth to 1.88 mb/d y/y average 2017 to average 2018.

Chart 1: US shale oil production to a new all-time-high in February

Growing like it did in 2014.

Chart 2: US shale oil production growing as strongly as it did in 2014

Chart 3: The number of drilled but uncompleted wells is still growing briskly

Thus drilling is running ahead of completions. Completions trying to catch up.

Players should kick out 200 drilling rigs in order to draw down the DUCs

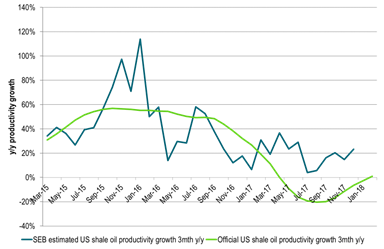

Chart 4: US volume drilling productivity is up 23% from 4Q16 to 4Q17 in our calculations

That is very different from the official US EIA drilling productivity measure which does not take account of the shifts in the DUC inventory

Chart 5: Thus US shale oil volume drilling productivity per rig never really declined y/y

Instead it has stayed at a pretty solid level of around +-20% y/y

Chart 6: Today’s drilling rig count is 21% above the average 2014 count in real terms

Adjusting historical rig count with today’s official US EIA drilling productivity

Official US drilling productivity is today 2.6 times as high as it was on average in 2014

Kind regards

Bjarne Schieldrop

Chief analyst, Commodities

SEB Markets

Merchant Banking

Analys

The Mid-East anchor dragging crude oil lower

When it starts to move lower it moves rather quickly. Gaza, China, IEA. Brent crude is down 2.1% today to $62/b after having traded as high as $66.58/b last Thursday and above $70/b in late September. The sell-off follows the truce/peace in Gaze, a flareup in US-China trade and yet another bearish oil outlook from the IEA.

A lasting peace in Gaze could drive crude oil at sea to onshore stocks. A lasting peace in Gaza would probably calm down the Houthis and thus allow more normal shipments of crude oil to sail through the Suez Canal, the Red Sea and out through the Bab-el-Mandeb Strait. Crude oil at sea has risen from 48 mb in April to now 91 mb versus a pre-Covid normal of about 50-60 mb. The rise to 91 mb is probably the result of crude sailing around Africa to be shot to pieces by the Houthis. If sailings were to normalize through the Suez Canal, then it could free up some 40 mb in transit at sea moving onshore into stocks.

The US-China trade conflict is of course bearish for demand if it continues.

Bearish IEA yet again. Getting closer to 2026. Credibility rises. We expect OPEC to cut end of 2025. The bearish monthly report from the IEA is what it is, but the closer we get to 2026, the more likely the IEA is of being ball-park right in its outlook. In its monthly report today the IEA estimates that the need for crude oil from OPEC in 2026 will be 25.4 mb/d versus production by the group in September of 29.1 mb/d. The group thus needs to do some serious cutting at the end of 2025 if it wants to keep the market balanced and avoid inventories from skyrocketing. Given that IEA is correct that is. We do however expect OPEC to implement cuts to avoid a large increase in inventories in Q1-26. The group will probably revert to cuts either at its early December meeting when they discuss production for January or in early January when they discuss production for February. The oil price will likely head yet lower until the group reverts to cuts.

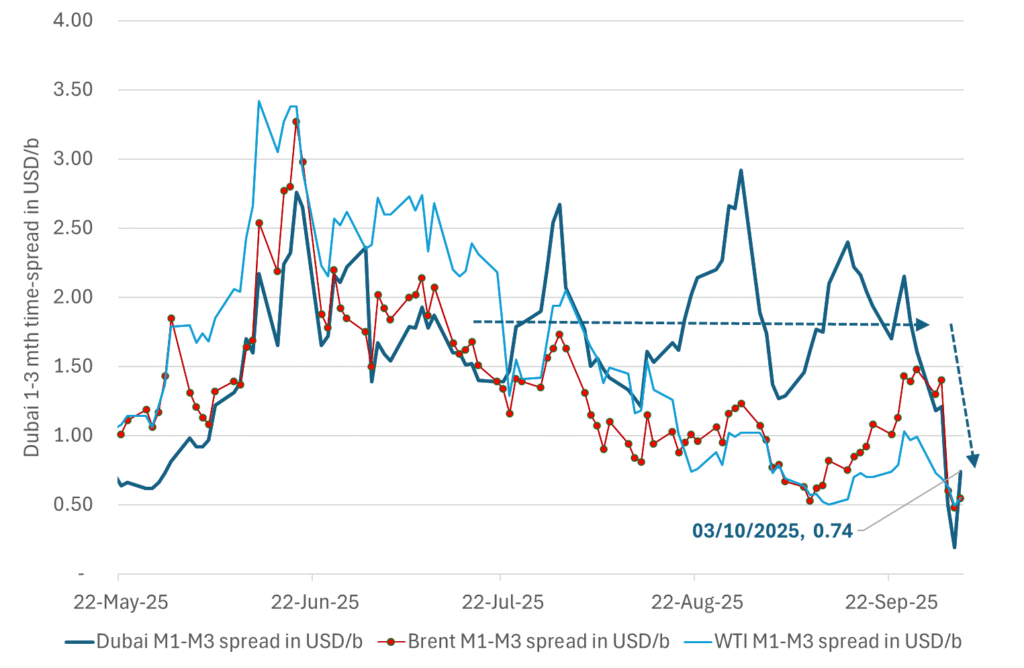

Dubai: The Mid-East anchor dragging crude oil lower. Surplus emerging in Mid-East pricing. Crude oil prices held surprisingly strong all through the summer. A sign and a key source of that strength came from the strength in the front-end backwardation of the Dubai crude oil curve. It held out strong from mid-June and all until late September with an average 1-3mth time-spread premium of $1.8/b from mid-June to end of September. The 1-3mth time-spreads for Brent and WTI however were in steady deterioration from late June while their flat prices probably were held up by the strength coming from the Persian Gulf. Then in late September the strength in the Dubai curve suddenly collapsed. Since the start of October it has been weaker than both the Brent and the WTI curves. The Dubai 1-3mth time-spread now only stands at $0.25/b. The Middle East is now exporting more as it is producing more and also consuming less following elevated summer crude burn for power (Aircon) etc.

The only bear-element missing is a sudden and solid rise in OECD stocks. The only thing that is missing for the bear-case everyone have been waiting for is a solid, visible rise in OECD stocks in general and US oil stocks specifically. So watch out for US API indications tomorrow and official US oil inventories on Thursday.

No sign of any kind of fire-sale of oil from Saudi Arabia yet. To what we can see, Saudi Arabia is not at all struggling to sell its oil. It only lowered its Official Selling Prices (OSPs) to Asia marginally for November. A surplus market + Saudi determination to sell its oil to the market would normally lead to a sharp lowering of Saudi OSPs to Asia. Not yet at least and not for November.

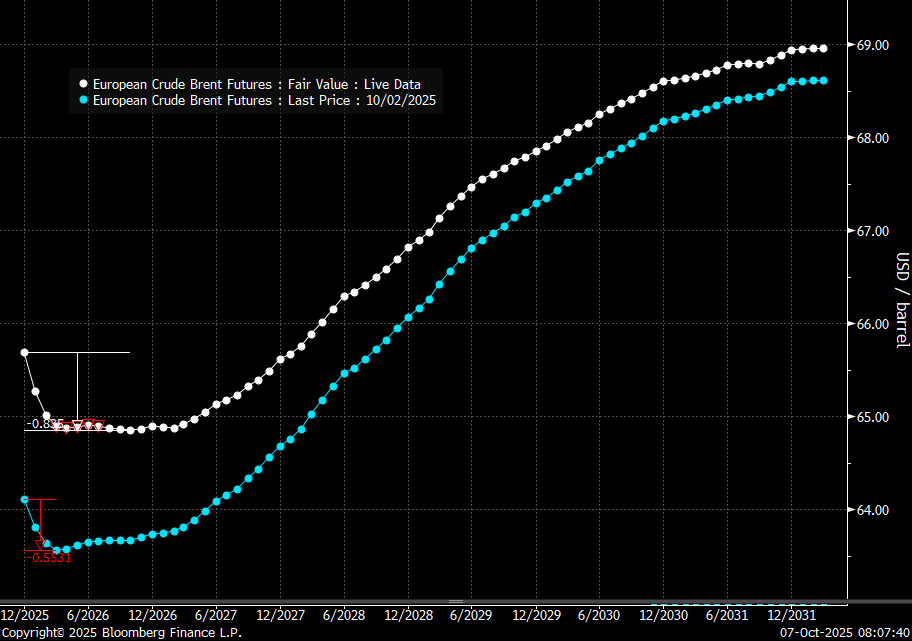

The 5yr contract close to fixed at $68/b. Of importance with respect to how far down oil can/will go. When the oil market moves into a surplus then the spot price starts to trade in a large discount to the 5yr contract. Typically $10-15/b below the 5yr contract on average in bear-years (2009, 2015, 2016, 2020). But the 5yr contract is usually pulled lower as well thus making this approach a moving target. But the 5yr contract price has now been rock solidly been pegged to $68/b since 2022. And in the 2022 bull-year (Brent spot average $99/b), the 5yr contract only went to $72/b on average. If we assume that the same goes for the downside and that 2026 is a bear-year then the 5yr goes to $64/b while the spot is trading at a $10-15/b discount to that. That would imply an average spot price next year of $49-54/b. But that is if OPEC doesn’t revert to cuts and instead keeps production flowing. We think OPEC(+) will trim/cut production as needed into 2026 to prevent a huge build-up in global oil stocks and a crash in prices. But for now we are still heading lower. Into the $50ies/b.

Analys

More weakness and lower price levels ahead, but the world won’t drown in oil in 2026

Some rebound but not much. Brent crude rebounded 1.5% yesterday to $65.47/b. This morning it is inching 0.2% up to $65.6/b. The lowest close last week was on Thursday at $64.11/b.

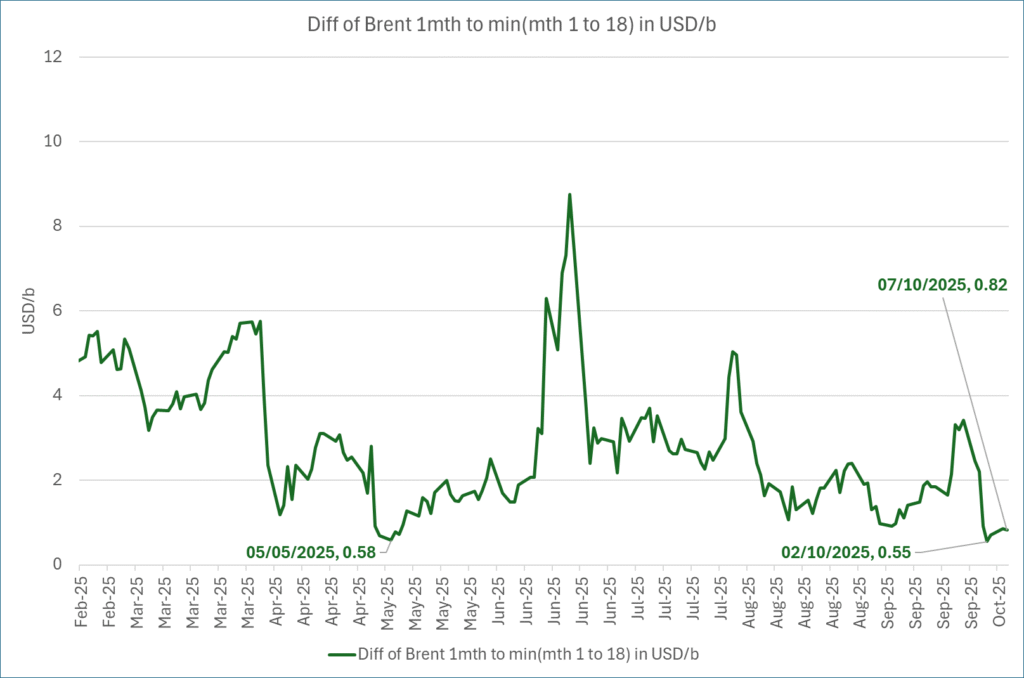

The curve structure is almost as week as it was before the weekend. The rebound we now have gotten post the message from OPEC+ over the weekend is to a large degree a rebound along the curve rather than much strengthening at the front-end of the curve. That part of the curve structure is almost as weak as it was last Thursday.

We are still on a weakening path. The message from OPEC+ over the weekend was we are still on a weakening path with rising supply from the group. It is just not as rapidly weakening as was feared ahead of the weekend when a quota hike of 500 kb/d/mth for November was discussed.

The Brent curve is on its way to full contango with Brent dipping into the $50ies/b. Thus the ongoing weakening we have had in the crude curve since the start of the year, and especially since early June, will continue until the Brent crude oil forward curve is in full contango along with visibly rising US and OECD oil inventories. The front-month Brent contract will then flip down towards the $60/b-line and below into the $50ies/b.

At what point will OPEC+ turn to cuts? The big question then becomes: When will OPEC+ turn around to make some cuts? At what (price) point will they choose to stabilize the market? Because for sure they will. Higher oil inventories, some more shedding of drilling rigs in US shale and Brent into the 50ies somewhere is probably where the group will step in.

There is nothing we have seen from the group so far which indicates that they will close their eyes, let the world drown in oil and the oil price crash to $40/b or below.

The message from OPEC+ is also about balance and stability. The world won’t drown in oil in 2026. The message from the group as far as we manage to interpret it is twofold: 1) Taking back market share which requires a lower price for non-OPEC+ to back off a bit, and 2) Oil market stability and balance. It is not just about 1. Thus fretting about how we are all going to drown in oil in 2026 is totally off the mark by just focusing on point 1.

When to buy cal 2026? Before Christmas when Brent hits $55/b and before OPEC+ holds its last meeting of the year which is likely to be in early December.

Brent crude oil prices have rebounded a bit along the forward curve. Not much strengthening in the structure of the curve. The front-end backwardation is not much stronger today than on its weakest level so far this year which was on Thursday last week.

The front-end backwardation fell to its weakest level so far this year on Thursday last week. A slight pickup yesterday and today, but still very close to the weakest year to date. More oil from OPEC+ in the coming months and softer demand and rising inventories. We are heading for yet softer levels.

Analys

A sharp weakening at the core of the oil market: The Dubai curve

Down to the lowest since early May. Brent crude has fallen sharply the latest four days. It closed at USD 64.11/b yesterday which is the lowest since early May. It is staging a 1.3% rebound this morning along with gains in both equities and industrial metals with an added touch of support from a softer USD on top.

What stands out the most to us this week is the collapse in the Dubai one to three months time-spread.

Dubai is medium sour crude. OPEC+ is in general medium sour crude production. Asian refineries are predominantly designed to process medium sour crude. So Dubai is the real measure of the balance between OPEC+ holding back or not versus Asian oil demand for consumption and stock building.

A sharp weakening of the front-end of the Dubai curve. The front-end of the Dubai crude curve has been holding out very solidly throughout this summer while the front-end of the Brent and WTI curves have been steadily softening. But the strength in the Dubai curve in our view was carrying the crude oil market in general. A source of strength in the crude oil market. The core of the strength.

The now finally sharp decline of the front-end of the Dubai crude curve is thus a strong shift. Weakness in the Dubai crude marker is weakness in the core of the oil market. The core which has helped to hold the oil market elevated.

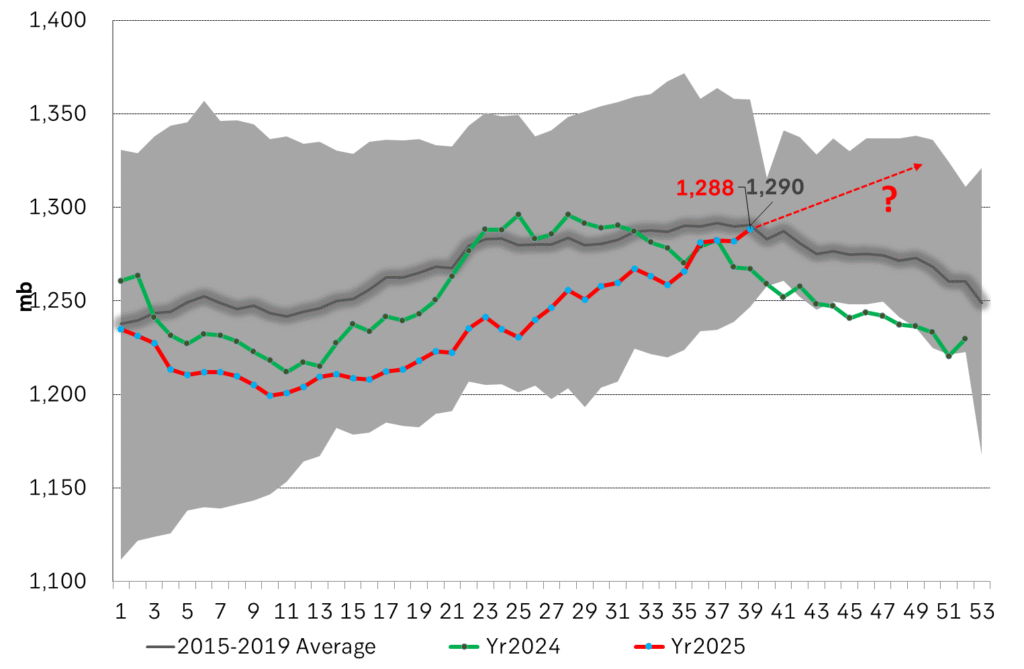

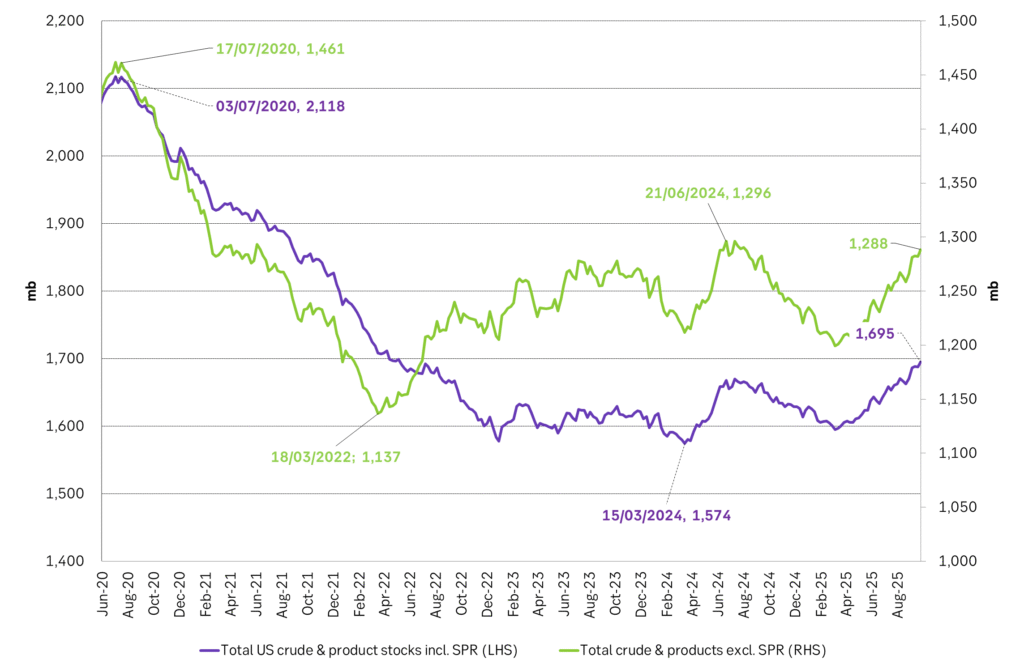

Facts supports the weakening. Add in facts of Iraq lifting production from Kurdistan through Turkey. Saudi Arabia lifting production to 10 mb/d in September (normal production level) and lifting exports as well as domestic demand for oil for power for air con is fading along with summer heat. Add also in counter seasonal rise in US crude and product stocks last week. US oil stocks usually decline by 1.3 mb/week this time of year. Last week they instead rose 6.4 mb/week (+7.2 mb if including SPR). Total US commercial oil stocks are now only 2.1 mb below the 2015-19 seasonal average. US oil stocks normally decline from now to Christmas. If they instead continue to rise, then it will be strongly counter seasonal rise and will create a very strong bearish pressure on oil prices.

Will OPEC+ lift its voluntary quotas by zero, 137 kb/d, 500 kb/d or 1.5 mb/d? On Sunday of course OPEC+ will decide on how much to unwind of the remaining 1.5 mb/d of voluntary quotas for November. Will it be 137 kb/d yet again as for October? Will it be 500 kb/d as was talked about earlier this week? Or will it be a full unwind in one go of 1.5 mb/d? We think most likely now it will be at least 500 kb/d and possibly a full unwind. We discussed this in a not earlier this week: ”500 kb/d of voluntary quotas in October. But a full unwind of 1.5 mb/d”

The strength in the front-end of the Dubai curve held out through summer while Brent and WTI curve structures weakened steadily. That core strength helped to keep flat crude oil prices elevated close to the 70-line. Now also the Dubai curve has given in.

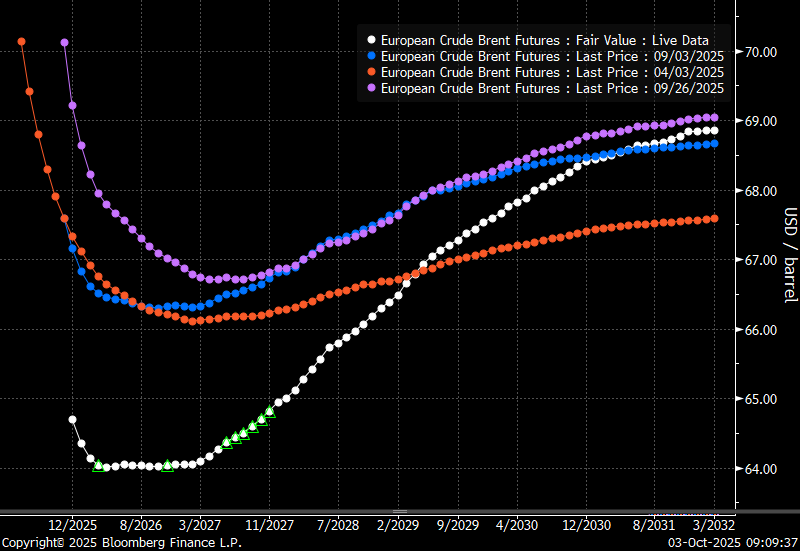

Brent crude oil forward curves

Total US commercial stocks now close to normal. Counter seasonal rise last week. Rest of year?

Total US crude and product stocks on a steady trend higher.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanKinas elproduktion slog nytt rekord i augusti, vilket även kolkraft gjorde

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanTyskland har så höga elpriser att företag inte har råd att använda elektricitet

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanOPEC+ missar produktionsmål, stöder oljepriserna

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanEtt samtal om guld, olja, fjärrvärme och förnybar energi

-

Analys4 veckor sedan

Analys4 veckor sedanBrent crude ticks higher on tension, but market structure stays soft

-

Analys3 veckor sedan

Analys3 veckor sedanAre Ukraine’s attacks on Russian energy infrastructure working?

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanGuld nära 4000 USD och silver 50 USD, därför kan de fortsätta stiga

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanGuldpriset uppe på nya höjder, nu 3750 USD