Analys

From surge to slump for natural gas: Navigating the new normal in Europe

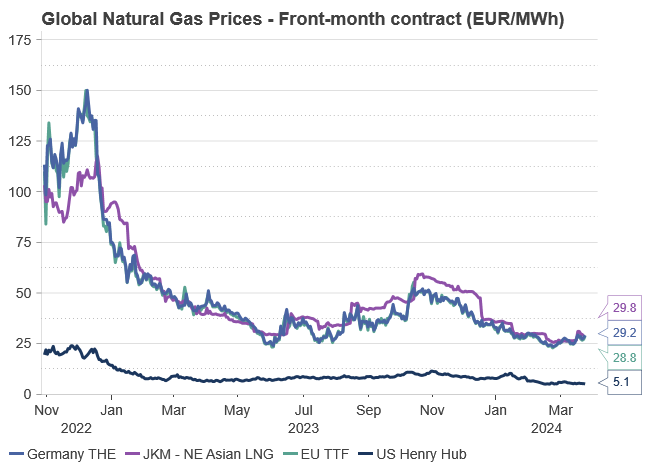

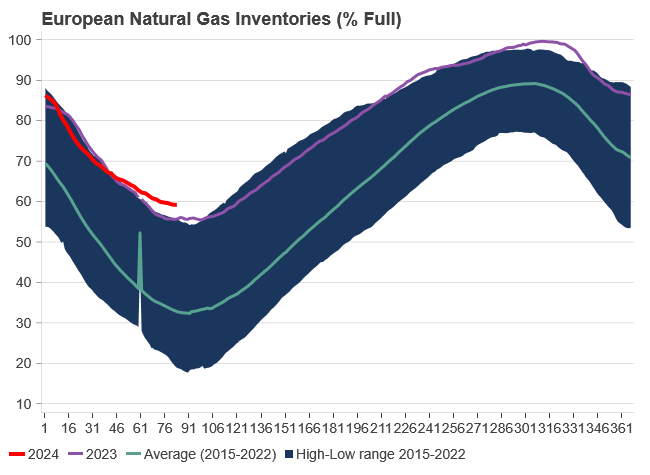

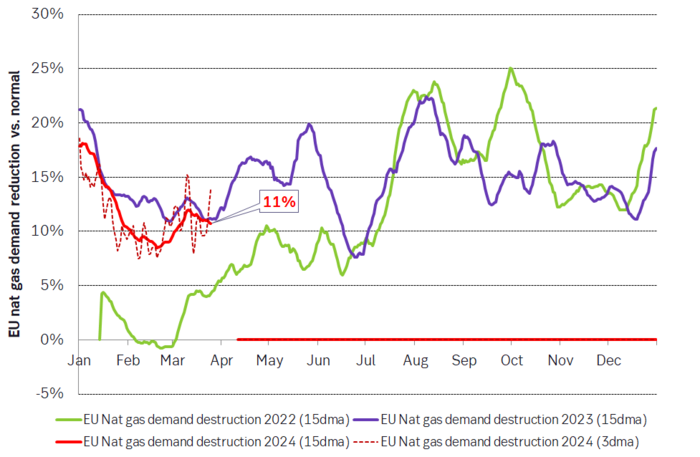

Over the past 4-5 months, EU natural gas prices, indicated by the TTF benchmark, have plummeted by 50% from an October high of EUR 56/MWh to the current EUR 28/MWh for the front-month contract, defying expectations of seasonal price increases. This downturn can be attributed to robust EU inventories at 59% capacity and persistently subdued natural gas demand, down by 11% compared to historical norms. Mild weather in Northwest Europe and a prolonged industrial recession have suppressed consumption, resulting in a significant gas surplus despite nearing the end of the winter heating season (90% complete). These factors collectively exert downward pressure on prices.

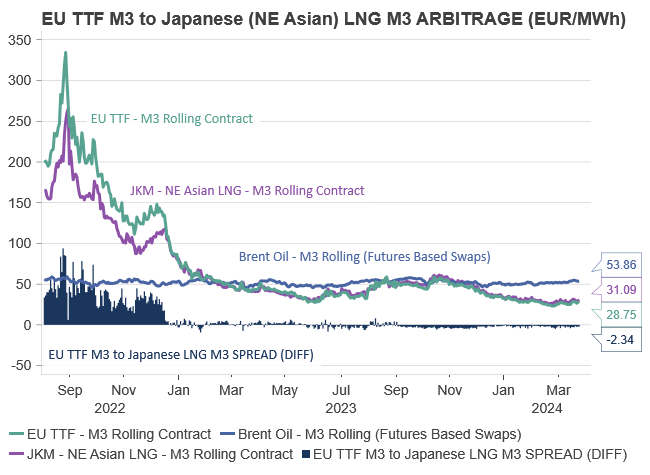

The correlation between Brent and TTF prices remains from times partly “fluid”. In our December 2023 natural gas price update, we predicted a constrained global natural gas market, anticipating a swift resurgence in demand following a decline in gas prices. Our projections were underpinned by a robust Brent Crude price outlook, set at USD 85/bl, USD 87.5/bl, and USD 90/bl for 2024, 2025, and 2026 respectively, with a Crude-to-gas rate of 80%. However, this scenario has yet to materialize as the anticipated demand recovery has been notably delayed, requiring even lower prices than initially predicted for its realization—a phenomenon unique in recent memory.

Achieving a global natural gas price convergence towards levels more aligned with Brent Crude appears plausible, signaling a return to a measure of normalcy. The absence of a winter premium during the 2023/24 winter season suggests a healthier outlook for Q2-24, mitigating the risk of substantial short-term price spikes in European gas markets. The sporadic spikes witnessed in 2022 and partially in 2023 are now a thing of the past, indicating a change from the volatility experienced in recent years.

Short-term EU gas prices hinge heavily on immediate weather patterns and industrial gas demand, both exerting considerable influence on inventory levels, which serve as a critical gauge of supply and demand dynamics. Looking further ahead, the trajectory of prices is linked with the global LNG balance, particularly contingent upon factors such as projected US natural gas production and the capacity of US LNG exports to the global market.

Moreover, the declining influence of Russia on the European gas market is notable, with sporadic gas export halts from the former energy powerhouse carrying reduced impact. Global market recalibrations indicate a sustained elevation in price levels, with EUR 30/MWh emerging as a feasible benchmark for the foreseeable future. We also call “the end of the energy crisis”, as the worst is history. Reflecting on the current year, EU TTF prices hit the lowest point in late February, with expectations of a potential slide/climb from current prices at EUR 28/MWh.

In essence, our current natural gas price forecast hinges on a delicate equilibrium among three pivotal factors. Firstly, the TTF price must strike a balance, remaining sufficiently low to stimulate a resurgence in demand. For context, the historical average real price hovers around EUR 27/MWh, with EUR 30/MWh anticipated to gradually encourage demand recovery, thereby mitigating the effects of demand destruction. Secondly, the TTF price should maintain a relatively ”normal” relationship with Crude prices, as historical trends indicate a natural correlation between the two. A notably low rate would invariably attract heightened interest from Asian markets, as LNG emerges as a cost-effective alternative to oil in terms of energy content. Lastly, the TTF price must also exhibit a level of elevation to cover the expenses associated with producing and transporting US natural gas to the European market. This entails factoring in costs related to Henry Hub, tolling fees, liquefaction, transportation, and regasification, among other associated expenses. Achieving a delicate equilibrium among these factors is vital for ensuring the stability and sustainability of natural gas pricing dynamics in the European market.

Consequently, our current stance reflects a delicate balancing act among these three critical factors. Settling on EUR 30/MWh, we predict that prices lower than this threshold would catalyze a swifter demand resurgence, while simultaneously enhancing the appeal of natural gas against oil as the spread widens. Moreover, importation from the USA would encounter mounting challenges as prices decline, particularly approaching the EUR 25/MWh mark when landed in ARA.

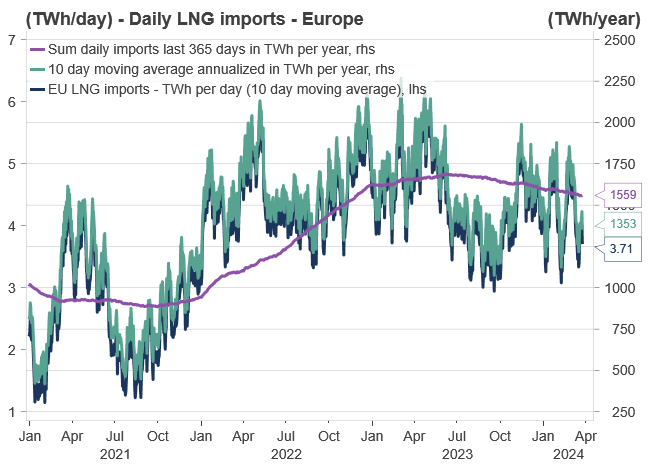

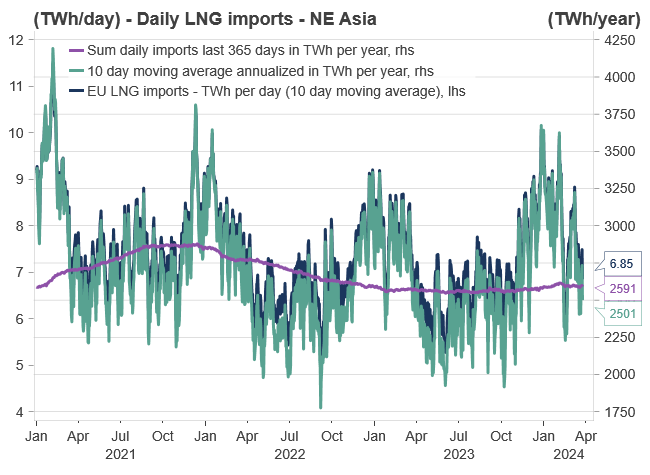

The TTF market has been complexly interlinked with the global LNG market at the margins since 2015, many years before the energy crisis. While the proportion of LNG consumed in Europe has surged significantly, the concept of LNG prices influencing TTF prices at the margin is not new. However, in terms of volume, the current situation declares us notably more vulnerable than in previous years.

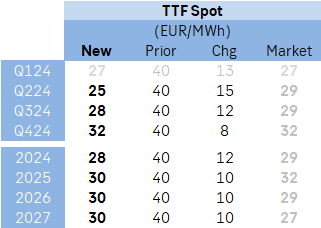

In our updated projections, we have revised our price forecasts downward, particularly notable at the front end, encompassing Q2-24, Q3-24, and the Full-year (FY) 2024. Other adjustments, though marginally smaller, remain for FY 2025, 2026, and 2027. Despite these reductions, we anticipate a trajectory of increasing European natural gas prices from their current levels. Notably, Q1-24 is now expected to average EUR 27/MWh, followed by predictions of EUR 25/MWh, EUR 28/MWh, and EUR 32/MWh for Q2-24, Q3-24, and Q4-24 respectively. Consequently, the average for FY 2024 is forecasted at EUR 28/MWh, marking a notable decline from the previous estimate of EUR 40/MWh.

In our outlook for longer-term pricing, we anticipate an average of EUR 30/MWh for the years 2025, 2026, and 2027—a reduction of EUR 10/MWh compared to our previous update in December 2023, which projected EUR 40/MWh. This long-term forecast only sits marginally higher, by EUR 3-4/MWh, than the historical average real price of approximately EUR 27/MWh. Such pricing aligns intending to stimulate further demand recovery and maintain consumer affordability within the European economy. Reflecting on historical trends, previous price levels in the European market might be seen as reliant on potentially risky agreements with Russia. Consequently, the era of exceptionally low-cost energy is drawing to a close, indicating a new paradigm where European gas and power are priced slightly higher, establishing a ”new normal” for the foreseeable future.

PRICE ACTION

The absence of a winter premium for global natural gas is notable. Our longer-term natural gas price projection, set at EUR 30/MWh, demonstrates resilience compared to historical market norms. Last quarter (Q4-23) closed at EUR 43/MWh for the front-month contract, a figure approximately EUR 10/MWh lower than our recent expectations. Noteworthy market adjustments have transpired not only within the European gas market but also on a global scale. This ongoing adaptation is expected to continue influencing the gas market into 2024, resulting in fewer severe price spikes and a return to more normal price differentials.

Maintaining our gas price forecast at EUR 30/MWh for 2025 suggests an expectation for European natural gas prices to stabilize at current market rates. This projection extends to 2026 and 2027, which stand roughly 30% higher than historical norms – a contrast to the previous era of favorable deals with Russia flooding European consumers with low-cost piped natural gas.

Considerable attention is drawn to the relationship between gas and oil prices. With our oil market outlook projecting USD 85/bl, USD 87.5/bl, and USD 90/bl for 2024, 2025, and 2026 respectively, the convergence of gas prices to more normal circumstances implies a corresponding alignment with oil prices. Historically, EU natural gas prices have traded at 0.55-0.6 times Brent crude prices, a figure that is expected to converge closer to historical norms. However, our forecasts for 2024, 2025, and 2026 slightly exceed historical norms, at 0.62 x Brent, 0.65 x Brent, and 0.62 x Brent respectively, reflecting a tighter natural gas balance in the coming years.

The transformation of global LNG trade, from roughly 5% spot and short-term LNG trade in 2000 to roughly 30% in 2023, underscores a higher degree of flexibility in negotiating spot and short-term LNG contracts. This evolution suggests a shift towards contracts potentially decoupled from Brent indexations, challenging the conventional reliance on oil prices as a benchmarking tool for global natural gas prices.

US LNG

A significant surge in global liquefaction (export) capacity is anticipated from the US and Qatar starting in 2026 and beyond. These large-scale liquefaction projects typically entail long-term contracts with predefined off-takers or demand centers, primarily serving power plants or industrial applications. The transportation of substantial LNG volumes from the US to Europe underscores strategic economic and energy considerations. The US, propelled by abundant shale gas resources and extensive LNG liquefaction infrastructure, has emerged as a major LNG exporter. Europe, seeking to diversify energy sources and reduce dependence on Russia, offers an attractive market for American LNG. Additionally, LNG’s flexibility as a cleaner-burning fuel aligns with Europe’s environmental sustainability objectives and transition away from coal.

The transatlantic LNG trade between the US and Europe capitalizes on arbitrage opportunities driven by regional gas price variations and demand-supply imbalances. This flow not only enhances energy security for European nations but also aids NE Asia in meeting environmental obligations.

The US-Europe netback for LNG cargo depends on various economic factors, including global natural gas prices, US regional supply and demand dynamics, and fluctuations in shipping costs.

The competitiveness of US LNG in the European market is influenced by several factors, including the US benchmark price for domestic natural gas (Henry Hub), source gas costs, voyage costs, shipping costs, and regasification costs at the destination.

In more detail the competitiveness of US LNG in the European market is influenced by factors such as the US benchmark price for domestic natural gas (Henry Hub); Source gas cost (Henry Hub + Tolling fee and liquefaction fee); voyage cost (Insurance, port, canal, boil-off, and fuel cost); shipping cost at day rate; and regasification cost in the other end.

A simplified calculation demonstrates the US-EU arbitrage opportunity. At current market figures, the total cost of delivering LNG from the US to Europe is roughly USD 7.05/MMBtu or approximately EUR 22/MWh. Comparatively, the EU TTF front-month contract trades at EUR 28/MWh, indicating an average EUR 6/MWh arbitrage opportunity and an equal profit margin for traders. However, with state-of-the-art LNG vessels, the total cost could decrease significantly, resulting in a substantial profit margin for traders.

The calculation (with current market figures all in USD per MMBtu as a standard unit):

Front-month Henry Hub (1.65) + 15% tolling fee (0.25) and liquefaction fee for conventional LNG ships (2.5) + Insurance, port, and canal (on average 0.33) + boil-off and fuel cost (on average 1.2) + regasification (0.5) + shipping cost at current day rate (0.62).

i.e., for total cost from the US to Europe we get 1.65 + 0.25 + 2.5 + 0.33 + 1.2 + 0.5 + 0.62 = USD 7.05/MMBtu – or roughly EUR 22/MWh. At the time of writing, the EU TTF front-month contract is trading at EUR 28/MWh. Hence, in the current spot market, the US-EU arbitrage is at roughly on average EUR 6/MWh and equally EUR 6/MWh profit to trader. However, this is a conservative estimate. In a situation with a state-of-the-art MEGI / X-DF LNG vessel, we would have a lower liquefaction fee and per unit insurance, boil-off, and fuel cost, which would imply a total cost of USD 6.0/MMBtu (EUR 18.5/MWh) – consequently, a massive EUR 9.5/MWh profit to the trader. Understating the massive economic argument in shipping LNG from the US to the EU (at current market rates).

But even though a substantial arrival of LNG export capacity in the US is approaching, it is not like the US has unlimited natural gas production, or unlimited LNG capacity to feed the global thirst for LNG. Hence, it is not like the EU TTF will plunge to levels comparable to the US Henry Hub + all associated costs for delivering to the EU.

A substantial surge in LNG export capacity is imminent, fueled by significant investments totaling USD 235 billion directed towards upcoming super-chilled fuel projects since 2019. The majority of these projects are slated to come online from the second half of 2025 onward, with an additional USD 55 billion investment expected by 2025, driving a remarkable 45% surge in LNG liquefaction capacity by the end of the decade.

Currently, the global LNG export market boasts a total capacity of approximately 420 million tonnes, projected to expand significantly to 610 million tonnes by 2030. The bulk of this expansion will stem from Qatar, Russia, and the US, with capacities increasing by roughly 23, 26, and 117 million tonnes respectively from 2024 to 2030.

However, it’s worth noting that on January 26, 2024, the Biden Administration paused LNG exports to non-FTA countries, awaiting updated analyses by the DOE. This affects 4 major projects and risks WTO challenges. The DOE cites outdated assessments, signaling a policy shift and raising market uncertainties.

This pause could have significant geopolitical and trade implications, as it also becomes an election issue. Stakeholders, including exporters and developers, now face uncertainties and must review agreements. Overall, the pause prompts a broader review of LNG export policies, impacting domestic and international markets. However, it’s too early to fully assess its impact, so the aforementioned capacity forecast remains firm for now.

The industry’s confidence is underpinned by the anticipation of rising LNG demand, driven by Europe’s efforts to reduce reliance on Russian gas and Asia’s shift away from coal, particularly in China. Yet, this expansion is not merely speculative; it represents a long-term commitment between suppliers and off-takers. These projects typically entail long-term contracts of 20+ years, often supplying power plants or industrial applications. Consequently, the new LNG export capacity is expected to match a similar scale of demand.

The significant export ventures from the United States to Qatar will further cement LNG’s role in the global energy landscape, with contracts extending well into the 2050s, even surpassing some carbon-neutral targets.

Moreover, there remains ample room for natural gas in the long run. The COP28 acknowledged that transitional fuels like LNG can facilitate the energy transition, signaling implicit support for LNG over dirtier fossil fuels.

Critics argue that natural gas isn’t the most environmentally friendly fossil fuel due to potential methane leakage along the supply chain. However, such concerns arise belatedly as the wave of new facilities is already underway. With oil demand reaching its peak and coal declining gradually, gas is expected to maintain its prominence in the energy mix.

SUPPLY & DEMAND

In the short term, the winter wildcard/premium is gone, pointing to a healthier Q2 2024. We have, a while back, pinpointed that the European natural gas market is in a limbo state between supply uncertainties and demand uncertainties. With a consequence of a winter wildcard largely being balanced by the short/medium-term weather and withdrawal rate of European natural gas inventories.

Recent weather forecasts predict slightly colder temperatures in early April across Northwest Europe, but the preceding winter months saw normal to milder conditions, resulting in lower-than-expected inventory drawdowns and weak price trends.

Looking ahead, forecasts for April to June 2024 suggest above-normal temperatures in Northwest Europe, reducing heating and power demand and maintaining subdued gas consumption. Prices in Q2-24 are forecasted to average around EUR 25/MWh.

Furthermore, it is easy to think of the faded energy crisis as a European crisis. But the adaptation for global gas markets has been equally/more important. Very high global gas prices have resulted in adaption in all corners of the globe, consequently, easing the global natural gas balance and freeing more gas volumes to the highest bidder at more “reasonable” prices. During the peak of the crisis, the highest bidder was naturally Europe which was sucking up all excess global LNG volumes. However, at the current price levels, the “three importing giants”, namely China, South Korea, and Japan have finally woken up, and are no longer “re-routing” their LNG cargos, while also actively participating in the short-term/spot market.

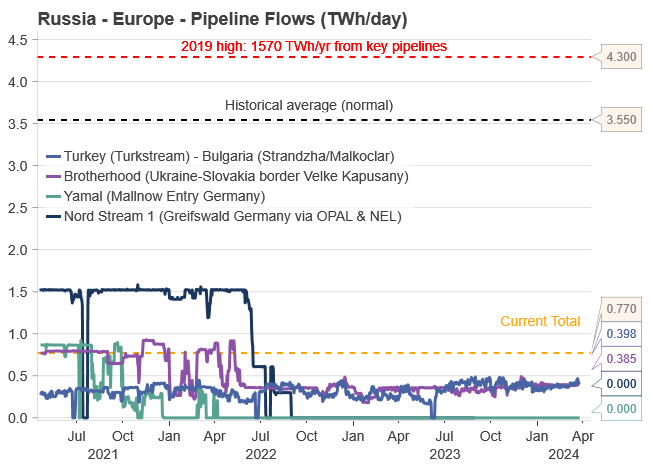

Russia’s grip over the EU is expected to weaken in the spring/summer of 2024. Since February/March 2022, President Putin sought to balance revenue generation and geopolitical pressure by controlling the energy supply to the EU. This strategy faced challenges: reducing exports to zero would jeopardize revenue, while high exports would alleviate the EU’s energy crisis, as seen in winter 2022/23. Despite efforts, Putin’s goal of using natural gas as a strategic tool faltered in winter 2023/24.

Market adaptation ensued. Since December 2022, Russian piped gas supply to Europe has fluctuated between 10-25% of historical averages, currently nearing 20%. To intensify geopolitical pressure, Russia may need to further reduce flows, possibly to around 10% in winter 2024/25. Despite the distant outlook, the market has already factored in potential price increases for next winter.

Two main pipelines deliver Russian gas to Europe: ”Turkstream,” to Turkey, and the ”Brotherhood,” through Ukraine to Slovakia. These pipelines each contribute roughly 50% of the 0.75 TWh per day flow. The pipeline via Ukraine faces physical risks, and a supply halt is likely next winter as the transit agreement between Gazprom and Naftogaz expires in December 2024, with little chance of renewal.

EU INVENTORIES

The trajectory of EU natural gas inventories for the upcoming summer is primarily influenced by both the global LNG market and European natural gas demand. In Q2-23 (one year ago), inventories commenced the injection season at an all-time high, leading to the current record-high inventory status. These comfortable inventories suggest the EU has the situation under control as it emerges from the winter season. Currently, inventories stand at 59%, a substantial 25% above the 2015-2022 average.

Despite missing out on over 1,000 TWh of natural gas imports from Russia compared to historical levels, the mild winter of 2022/23, reduced demand due to high prices, and increased LNG imports compensated with an additional 1,400 TWh. This over-compensation of 400 TWh in Q1-23 facilitated an unprecedented injection rate into European inventories during Q1 and Q2 2023. As a result, European inventories shifted from a deficit of 180 TWh in January 2022 to a surplus of 259 TWh in April 2023, leading to the current record-high levels.

However, if NE Asia, predominantly led by China, continues to outbid the EU for LNG cargo and industrial gas demand increases due to favorable long-term hedging levels, current comfortable inventory levels will gradually return to normal. This suggests EU TTF prices will slowly climb towards over EUR 30/MWh by the next heating season, a trend partly factored into current pricing.

While the crisis urgency has faded, market adjustments now activate at lower price thresholds. Nonetheless, we anticipate slightly higher long-term price levels (EUR 30/MWh) due to increasing LNG bids from China (+NE Asia), a rebound in EU demand, and reduced LNG imports influenced by lower prices. This will result in a slower inventory build during Q2-24 and Q3-24 compared to last year. Despite diminishing supply from Russia, the EU remains focused on maintaining preparedness for future winters, leading to a new normal in natural gas inventory levels throughout the year.

The European energy crisis has significantly eased during 2023 and Q1-24. Softened front-end prices influence longer-dated prices, with the winter premium/seasonality fully washed out during the ongoing heating season. Healthy EU natural gas inventories, currently at 59% capacity (675 TWh) and surpassing the European Commission’s target of reaching 90% storage fullness by 1 November, contribute to this subsiding crisis. Continued subdued European consumption (11% below historical averages) and robust LNG imports set a ceiling on short-term prices, although increased EU demand could quickly alter this scenario, as EU demand has proven stickier than anticipated.

DEMAND RECOVERY

Reduced uncertainty and lower prices are expected to lead to more long-term hedging. Since the start of Q1 2024 (year-to-date), the TTF spot has averaged EUR 27/MWh, approximately USD 50/boe, only marginally below the ’historical norm’ when adjusted for inflation. Despite these price levels, a resurgence in European industrial gas consumption during the winter is not straightforward.

Industrial gas demand remains subdued, sitting 11% below historical averages. While this marks an improvement from the 25-30% drop experienced in mid-summer 2022 – a period characterized as the ”peak of the crisis” – when spot prices consistently traded at EUR 150/MWh (USD 255/boe).

The slower-than-expected recovery is largely attributed to industries hesitating to commit to longer-term prices. For example, during Q4 2023, despite tumbling spot prices, futures prices remained strong. In mid-October, gas for delivery in January 2024 was priced at EUR 55/MWh (USD 103/boe). Thus, during Q4 2023, peak-winter prices maintained a considerable premium over spot prices to a large extent.

However, the current landscape has changed. The winter premium has diminished as we exit the heating season, and weak spot prices predominantly drive forward. This reflects a market that is more certain and willing to forecast futures during a less turbulent phase. The convergence and narrowing gap between spot and long-term prices signify that ”peak natural gas has passed.” Major consumers in Europe are expected to adopt more long-term hedging for longer-term prices, ideally hedging these futures close to current spot prices. This suggests that current market prices will likely trigger increased consumption compared to Q3 and Q4 2023, although a full-scale comeback will take time.

As previously noted, substantial demand destruction occurred not only in Europe but also globally, particularly in Asia. Over the last couple of years, demand destruction amounted to approximately 800 TWh per year, while the normal growth rate in the global LNG market is 200 TWh per annum. This indicates that most of the demand will eventually return, although the timing remains uncertain.

NE ASIAN LNG

EUR 25/MWh presents a favorable ”buy opportunity,” and prices are expected to either slide or climb from this point. The decline in prices can be attributed to sustained low demand and high inventories. We anticipate prices to either slide or increase from here, with minimal downside, as prices are likely to find support around EUR 25/MWh.

Forward prices for both JKM and TTF indicate that the NE Asian LNG market will remain a preferred destination for marginal LNG cargo in the near term. While the EU previously heavily relied on NE Asia, the European market can no longer solely depend on the economic vulnerabilities of NE Asia or China.

A long-awaited pent-up demand for energy in China would lead to increased demand for goods and services, consequently boosting energy consumption, particularly natural gas, primarily in the form of LNG. In such a scenario, the JKM may command a larger premium over the TTF than the existing EUR 2.5/MWh (3-month rolling contract). This would divert LNG spot cargoes away from Europe, further reducing the EU’s natural gas surplus. Thus, the ongoing recovery in China’s economy is likely to stimulate Asia’s demand for natural gas, potentially resulting in EU LNG purchasers paying a premium to secure essential LNG imports in the future.

With current prices, we anticipate an increase in EU demand coupled with a decrease in EU LNG imports. This trend may persist until we observe a slight shortfall in compensation relative to the natural gas deficit from Russia, which could drive prices upward during the summer.

KEY TAKEAWAYS

The ongoing transition from coal to natural gas signifies a significant shift in the global energy landscape. Natural gas emerges as a crucial bridging technology, offering a cleaner alternative to coal and facilitating the transition toward widespread adoption of renewable energy sources. This transition underscores the environmental benefits of natural gas, positioning it as a pivotal component in mitigating climate change and reducing greenhouse gas emissions.

Despite challenges such as the reduction in Russian gas supply, the natural gas market is adapting rapidly. Europe, in particular, faces competition for global LNG volumes, primarily sourced from the US and Qatar. The market’s ability to swiftly adjust reflects its adaptability and resilience on a global scale, highlighting the importance of diversifying energy sources and supply routes.

Our current natural gas price forecast relies on achieving a delicate equilibrium among key factors. This includes stimulating demand, maintaining a correlation with crude prices, and ensuring cost coverage for US natural gas transportation. Striking this balance is essential for maintaining stability and sustainability in European gas pricing dynamics, ensuring energy security.

In response to changing market conditions, we have revised our price outlook downward for the short term, notably for Q2-24, Q3-24, and FY 2024. Specifically, Q1-24 is forecasted to average EUR 27/MWh, followed by predictions of EUR 25/MWh for Q2-24, EUR 28/MWh for Q3-24, and EUR 32/MWh for Q4-24. However, prices are expected to gradually increase over the longer term, with an average forecast of EUR 30/MWh for the years 2025, 2026, and 2027, slightly higher than historical averages.

This revised outlook reflects the evolving nature of the natural gas market and the need for flexibility in response to changing geopolitical landscapes and supply dynamics. Looking ahead, natural gas remains a crucial bridge over coal, facilitating the transition towards cleaner energy sources.

Analys

Brent crude set to dip its feet into the high $50ies/b this week

Parts of the Brent crude curve dipping into the high $50ies/b. Brent crude fell 2.3% over the week to Friday. It closed the week at $61.29/b, a slight gain on the day, but also traded to a low of $60.14/b that same day and just barely avoided trading into the $50ies/b. This morning it is risk-on in equities which seems to help industrial metals a little higher. But no such luck for oil. It is down 0.8% at $60.8/b. This week looks set for Brent crude to dip its feet in the $50ies/b. The Brent 3mth contract actually traded into the high $50ies/b on Friday.

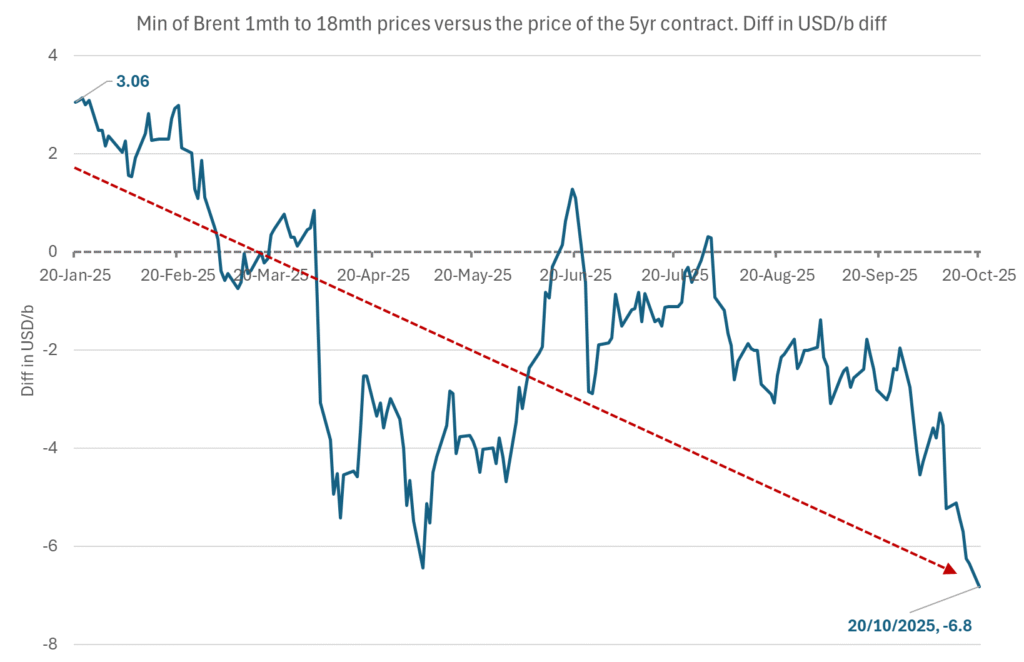

The front-end backwardation has been on a weakening foot and is now about to fully disappear. The lowest point of the crude oil curve has also moved steadily lower and lower and its discount to the 5yr contract is now $6.8/b. A solid contango. The Brent 3mth contract did actually dip into the $50ies/b intraday on Friday when it traded to a low point of $59.93/b.

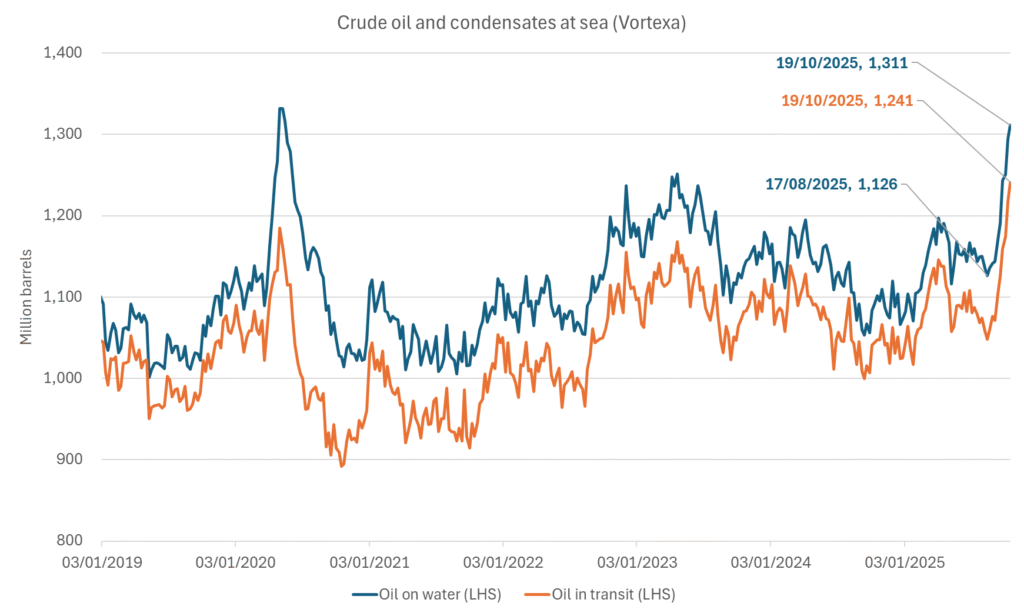

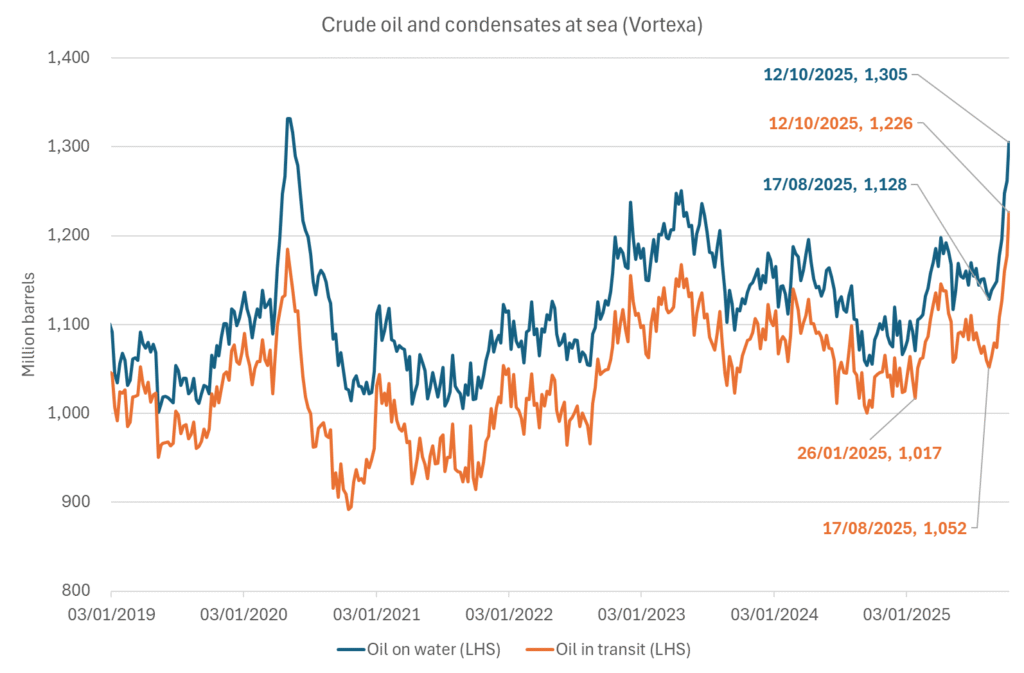

More weakness to come as lots of oil at sea comes to ports. Mid-East OPEC countries have boosted exports along with lower post summer consumption and higher production. The result is highly visibly in oil at sea which increased by 17 mb to 1,311 mb over the week to Sunday. Up 185 mb since mid-August. On its way to discharge at a port somewhere over the coming month or two.

Don’t forget that the oil market path ahead is all down to OPEC+. Remember that what is playing out in the oil market now is all by design by OPEC+. The group has decided that the unwind of the voluntary cuts is what it wants to do. In a combination of meeting demand from consumers as well as taking back market share. But we need to remember that how this plays out going forward is all at the mercy of what OPEC+ decides to do. It will halt the unwinding at some point. It will revert to cuts instead of unwind at some point.

A few months with Brent at $55/b and 40-50 US shale oil rigs kicked out may be what is needed. We think OPEC+ needs to see the exit of another 40-50 drilling rigs in the US shale oil patches to set US shale oil production on a path to of a 1 mb/d year on year decline Dec-25 to Dec-26. We are not there yet. But a 2-3 months period with Brent crude averaging $55/b would probably do it.

Oil on water increased 17 mb over the week to Sunday while oil in transit increased by 23 mb. So less oil was standing still. More was moving.

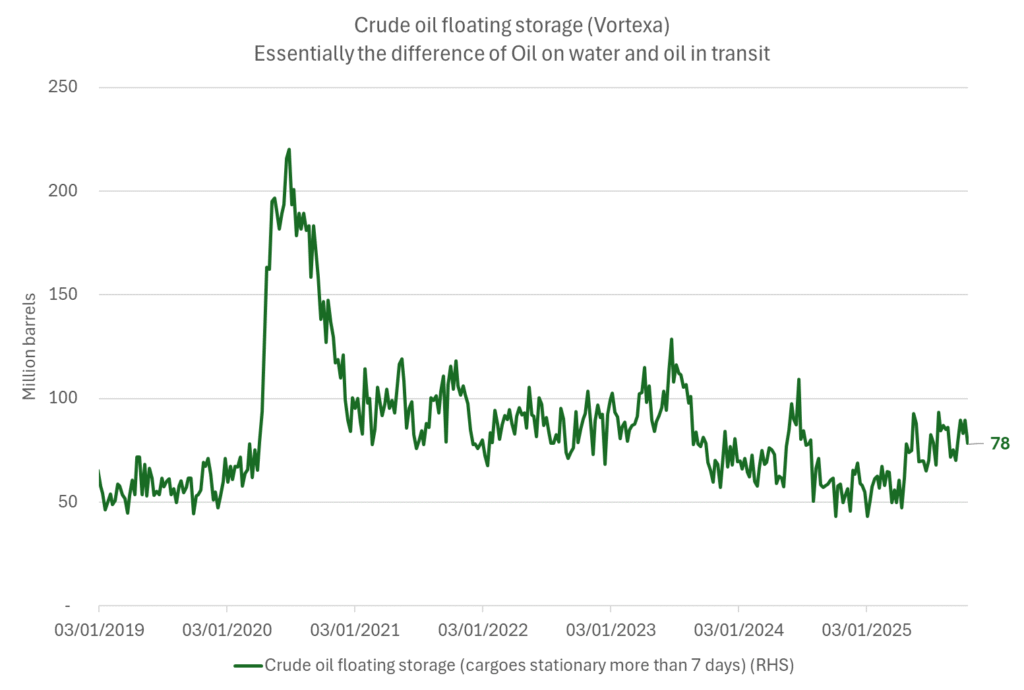

Crude oil floating storage (stationary more than 7 days). Down 11 mb over week to Sunday

The lowest point of the Brent crude oil curve versus the 5yr contract. Weakest so far this year.

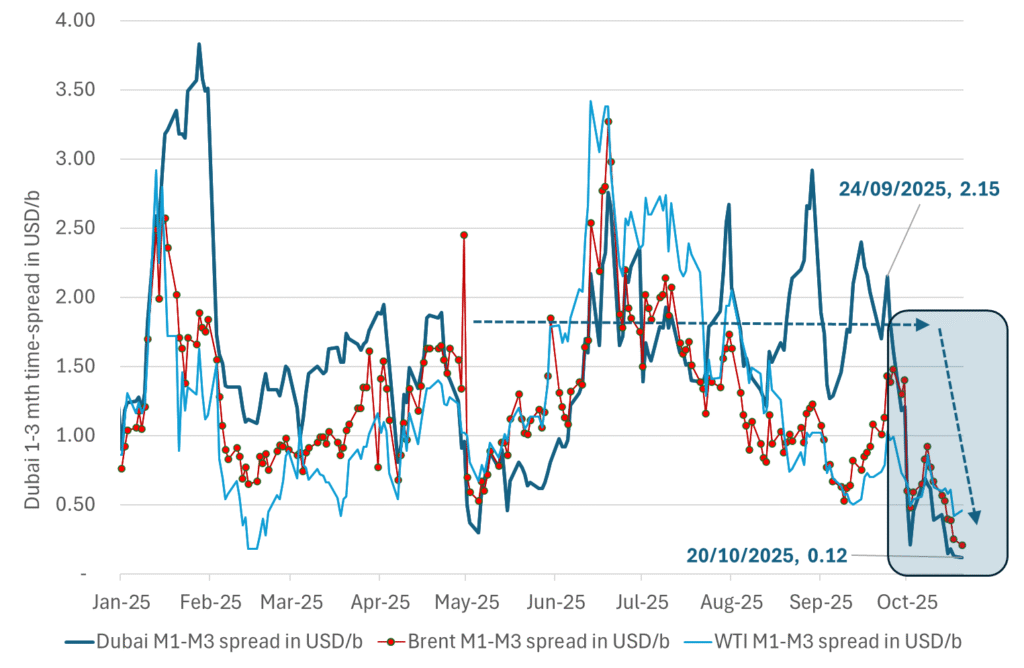

Crude oil 1mth to 3mth time-spreads. Dubai held out strongly through summer, but then that center of strength fell apart in late September and has been leading weakness in crude curves lower since then.

Analys

Crude oil soon coming to a port near you

Rebounding along with most markets. But concerns over solidity of Gaza peace may also contribute. Brent crude fell 0.8% yesterday to $61.91/b and its lowest close since May this year. This morning it is bouncing up 0.9% to $62.5/b along with a softer USD amid positive sentiment with both equities and industrial metals moving higher. Concerns that the peace in Gaza may be less solid than what one might hope for also yields some support to Brent. Bets on tech stocks are rebounding, defying fears of trade war. Money moving back into markets. Gold continues upwards its strong trend and a softer dollar helps it higher today as well.

US crude & products probably rose 5.6 mb last week (API) versus a normal seasonal decline of 2.4 mb. The US API last night partial and thus indicative data for US oil inventories. Their data indicates that US crude stocks rose 7.4 mb last week, gasoline stocks rose 3.0 mb while Distillate stocks fell 4.8 mb. Altogether an increase in commercial crude and product stocks of 5.6 mb. Commercial US crude and product stocks normally decline by 2.4 mb this time of year. So seasonally adjusted the US inventories rose 8 mb last week according to the indicative numbers by the API. That is a lot. Also, the counter seasonal trend of rising stocks versus normally declining stocks this time of year looks on a solid pace of continuation. If the API is correct then total US crude and product stocks would stand 41 mb higher than one year ago and 6 mb higher than the 2015-19 average. And if we combine this with our knowledge of a sharp increase in production and exports by OPEC(+) and a large increase in oil at sea, then the current trend in US oil inventories looks set to continue. So higher stocks and lower crude oil prices until OPEC(+) switch to cuts. Actual US oil inventory data today at 18:00 CET.

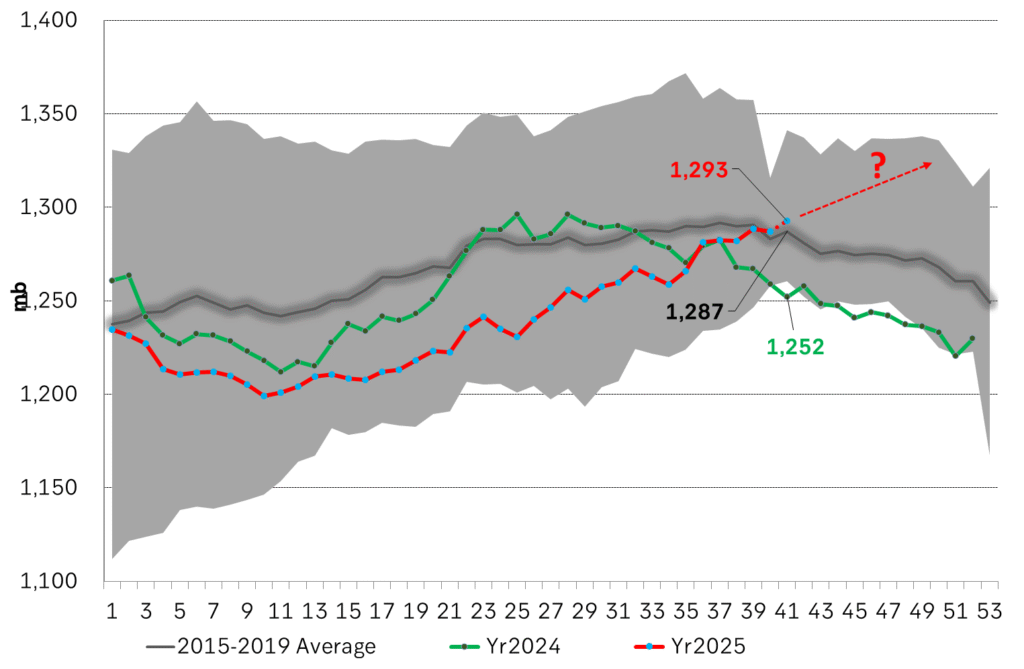

US commercial crude and product stocks rising to 1293 mb in week 41 if last nights indicative numbers from API are correct.

Crude oil soon coming to a port near you. OPEC has lifted production sharply higher this autumn. At the same time demand for oil in the Middle-East has fallen as we have moved out of summer heat and crude oil burn for power for air-conditioning. The Middle-East oil producers have thus been able to lift exports higher on both accounts. Crude oil and condensates on water has shot up by 177 mb since mid-August. This oil is now on its way to ports around the world. And when they arrive, it will likely help to lift stocks onshore higher. That is probably when we will lose the last bit of front-end backwardation the the crude oil curves. That will help to drive the front-month Brent crude oil price down to the $60/b line and revisit the high $50ies/b. Then the eyes will be all back on OPEC+ when they meet in early November and then again in early December.

Crude oil and condensates at sea have moved straight up by 177 mb since mid-August as OPEC(+) has produced more, consumed less and exported more.

Analys

The Mid-East anchor dragging crude oil lower

When it starts to move lower it moves rather quickly. Gaza, China, IEA. Brent crude is down 2.1% today to $62/b after having traded as high as $66.58/b last Thursday and above $70/b in late September. The sell-off follows the truce/peace in Gaze, a flareup in US-China trade and yet another bearish oil outlook from the IEA.

A lasting peace in Gaze could drive crude oil at sea to onshore stocks. A lasting peace in Gaza would probably calm down the Houthis and thus allow more normal shipments of crude oil to sail through the Suez Canal, the Red Sea and out through the Bab-el-Mandeb Strait. Crude oil at sea has risen from 48 mb in April to now 91 mb versus a pre-Covid normal of about 50-60 mb. The rise to 91 mb is probably the result of crude sailing around Africa to be shot to pieces by the Houthis. If sailings were to normalize through the Suez Canal, then it could free up some 40 mb in transit at sea moving onshore into stocks.

The US-China trade conflict is of course bearish for demand if it continues.

Bearish IEA yet again. Getting closer to 2026. Credibility rises. We expect OPEC to cut end of 2025. The bearish monthly report from the IEA is what it is, but the closer we get to 2026, the more likely the IEA is of being ball-park right in its outlook. In its monthly report today the IEA estimates that the need for crude oil from OPEC in 2026 will be 25.4 mb/d versus production by the group in September of 29.1 mb/d. The group thus needs to do some serious cutting at the end of 2025 if it wants to keep the market balanced and avoid inventories from skyrocketing. Given that IEA is correct that is. We do however expect OPEC to implement cuts to avoid a large increase in inventories in Q1-26. The group will probably revert to cuts either at its early December meeting when they discuss production for January or in early January when they discuss production for February. The oil price will likely head yet lower until the group reverts to cuts.

Dubai: The Mid-East anchor dragging crude oil lower. Surplus emerging in Mid-East pricing. Crude oil prices held surprisingly strong all through the summer. A sign and a key source of that strength came from the strength in the front-end backwardation of the Dubai crude oil curve. It held out strong from mid-June and all until late September with an average 1-3mth time-spread premium of $1.8/b from mid-June to end of September. The 1-3mth time-spreads for Brent and WTI however were in steady deterioration from late June while their flat prices probably were held up by the strength coming from the Persian Gulf. Then in late September the strength in the Dubai curve suddenly collapsed. Since the start of October it has been weaker than both the Brent and the WTI curves. The Dubai 1-3mth time-spread now only stands at $0.25/b. The Middle East is now exporting more as it is producing more and also consuming less following elevated summer crude burn for power (Aircon) etc.

The only bear-element missing is a sudden and solid rise in OECD stocks. The only thing that is missing for the bear-case everyone have been waiting for is a solid, visible rise in OECD stocks in general and US oil stocks specifically. So watch out for US API indications tomorrow and official US oil inventories on Thursday.

No sign of any kind of fire-sale of oil from Saudi Arabia yet. To what we can see, Saudi Arabia is not at all struggling to sell its oil. It only lowered its Official Selling Prices (OSPs) to Asia marginally for November. A surplus market + Saudi determination to sell its oil to the market would normally lead to a sharp lowering of Saudi OSPs to Asia. Not yet at least and not for November.

The 5yr contract close to fixed at $68/b. Of importance with respect to how far down oil can/will go. When the oil market moves into a surplus then the spot price starts to trade in a large discount to the 5yr contract. Typically $10-15/b below the 5yr contract on average in bear-years (2009, 2015, 2016, 2020). But the 5yr contract is usually pulled lower as well thus making this approach a moving target. But the 5yr contract price has now been rock solidly been pegged to $68/b since 2022. And in the 2022 bull-year (Brent spot average $99/b), the 5yr contract only went to $72/b on average. If we assume that the same goes for the downside and that 2026 is a bear-year then the 5yr goes to $64/b while the spot is trading at a $10-15/b discount to that. That would imply an average spot price next year of $49-54/b. But that is if OPEC doesn’t revert to cuts and instead keeps production flowing. We think OPEC(+) will trim/cut production as needed into 2026 to prevent a huge build-up in global oil stocks and a crash in prices. But for now we are still heading lower. Into the $50ies/b.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanOPEC+ missar produktionsmål, stöder oljepriserna

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanGoldman Sachs höjer prognosen för guld, tror priset når 4900 USD

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanEtt samtal om guld, olja, fjärrvärme och förnybar energi

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanBlykalla och amerikanska Oklo inleder ett samarbete

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanGuld nära 4000 USD och silver 50 USD, därför kan de fortsätta stiga

-

Analys4 veckor sedan

Analys4 veckor sedanAre Ukraine’s attacks on Russian energy infrastructure working?

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanGuldpriset uppe på nya höjder, nu 3750 USD

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanEtt samtal om guld, olja, koppar och stål