Nyheter

David Hargreaves on Precious Metals, week 26 2014

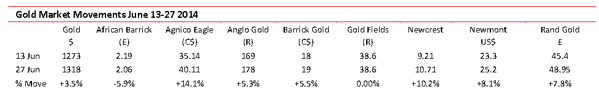

Gold continues to nudge ahead as the Iraq conflict intensifies; we can expect little else. America has its finger on the trigger even as it and the UK dither over increases in interest rates. So lots of incentives to stay with the metal right now. Platinum saw the end of the RSA miners’ strike, after 24 weeks, so an inevitable price drift follows.

Silver, as ever, is hostage to the two whilst the short-lived palladium bubble will surely pop. We are into politico-economic land.

Gold goes down when interest rates rise, normally. Gold goes up when people start throwing things at each other, usually. That is how we see it now. Both features are behind the metal but this can quickly change.

The stock market has not bought into it fully yet:

We are not alone in believing this rally cannot last. Bloomberg thinks so too. Begging the question as to whether Fed. Chair Janet Yellen and Bank of England governor Mark Carney are having an affair, we witness that they are certainly holding hands on interest rates at least. They will stay low. So Bloomberg says its consensus pull goes for a gold price of $1240 in Q4 and $1300 in Q1 2015. Then it opts for a shilly-shally of $1225-1270. It also notes that daily London trading volumes were down, 16% in the 4 months through to April to c. 18.3Moz per day and the least since 2010. US domestic gold buying is also down. The sale of one-ounce Eagle coins was 252.500 in the 6 months to June, 60% on like 2013. Holdings in global ETFs are at their lowest since 2009. Clearly America believes in economic growth, not gold.

ETFs and all that (Exchange Traded Funds) were a good idea. Have a stake in a physical metal without having to pay VAT, store and insure the stuff, but not take a risk on share prices. So they became popular. Dangerous, too. These funds hold thousands of tonnes and the managers can decide on when to sell. Not like an individual rattling a few Krugerrand. They became popular in China and India where locals pay a premium on the gold price. The migration of gold and silver from West to East has been notable. But now, in China at least, the music may have stopped awhile so decreasing premiums attach. What it all points to is an increase in volatility on a short term basis.

Peru and gold. In fact, Peru and what else? That large South American country is major to copper (8% of world output), silver (16%), zinc (12%) and lead (6%). Its importance rests in the fact that most of its output is exported, much to China. But it is troubled politically. A largely peasant population is easily swayed to the communist persuasion and this has been behind Newmont Mining (NYSE) the world’s No 2 producer, halting the major Conga project there. It sits in the mineral-rich Cajamarca region where political tensions run high. Now the regional president, one G Santos, has just been jailed for 14 months whilst a corruption enquiry takes place. G.S. did not think the Conga miner would do the peasants any good.

WIM says: We presently pre-occupy with Africa, but South America simmers, too. Little wonder the safety of North America, Europe and Australia looks attractive.

Silver is on a charm offensive. It has breached $21/oz on the upside but to remind, in late 2012, it bettered $30. The ratio to gold rests at c.62:1, where as it has seen 55:1. The metal’s rampers are coming out of the woodwork but we ask, why? We conservatively believe there to be about 9,000,000 tonnes of silver on surface, being added to at 20,000 tonnes annually. It has industrial uses, all capable of substitution if the price is right. The only silver corner of recent years, the Bunker-Hunt endeavour of 1980-81, was carefully orchestrated but short-lived. Little chance of a replay now.

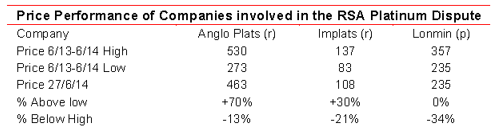

Platinum celebrated the end of the longest and costliest strike in South Africa’s history with militant union AMCU declaring “a victory”. Well, they would, wouldn’t they? Over the week, the price edged up a notch, $23 or 1.6% to $1479/oz. What now? To the immediate we have the share prices of the three involved companies:

Not bad when you have suffered a six-months outage of production. There were threats of cash calls, but none materialised. Surface stocks, including recycled material, held out. Now for the aftermath. We discuss it more broadly in this week’s leader and warn it will be a telling one (the aftermath, not the leader). This strike has done the country lasting damage and we suspect that both Angloplats and Lonmin are looking for a new home. What will need close examination is the true supply-demand position on the metal’s availability. Mine production will flow again so we can only see the price being under pressure.

[hr]

About David Hargreaves

David Hargreaves is a mining engineer with over forty years of senior experience in the industry. After qualifying in coal mining he worked in the iron ore mines of Quebec and Northwest Ontario before diversifying into other bulk minerals including bauxite. He was Head of Research for stockbrokers James Capel in London from 1974 to 1977 and voted Mining Analyst of the year on three successive occasions.

Since forming his own metals broking and research company in 1977, he has successfully promoted and been a director of several public companies. He currently writes “The Week in Mining”, an incisive review of world mining events, for stockbrokers WH Ireland. David’s research pays particular attention to steel via the iron ore and coal supply industries. He is a Chartered Mining Engineer, Fellow of the Geological Society and the Institute of Mining, Minerals and Materials, and a Member of the Royal Institution. His textbook, “The World Index of Resources and Population” accurately predicted the exponential rise in demand for steel industry products.

Nyheter

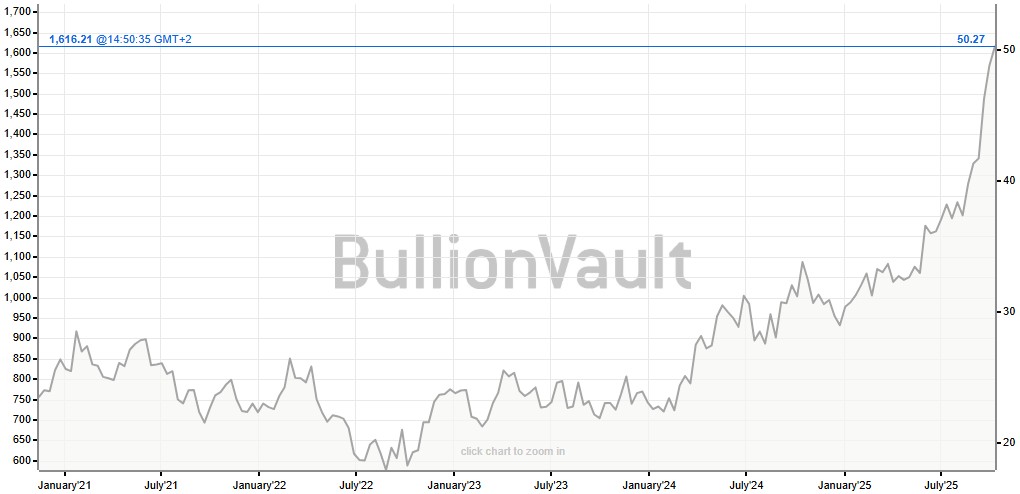

Silver spränger den magiska gränsen, kostar nu över 50 USD per uns

Ädelmetallen silver spränger en smått magisk gräns och handlas nu över 50 USD per uns. Priset har verkligen exploderat. Silver följer med i ett bredare rally där fult nyligen sprängde 4000 USD per uns-nivån. Priset för att låna silver har också skjutit i höjden på senare tid vilket indikerar att tillgången på silver på den fysiska marknaden har börjat bli lågt. Samtidig är efterfrågan från industrin bra och räntorna låga. Och på toppen av det kan vi lägga geopolitisk oro som gör att fler letar sig till fysiska tillgångar som silver.

Nyheter

Blykalla, Evroc och Studsvik vill bygga kärnkraftsdrivna datacenter i Sverige

Blykalla, Evroc och Studsvik har undertecknat ett samförståndsavtal för att undersöka möjligheten att utveckla Sveriges första kärnkraftsdrivna datacenter vid Studsviks licensierade kärnkraftsanläggning i Nyköping.

Blykalla utvecklar avancerade blykylda kärnreaktorer för att leverera säker, kostnadseffektiv och hållbar basenergi. Evroc bygger hyperscale-moln- och AI-infrastruktur för att driva Europas digitala framtid. Studsvik driver en licensierad kärnkraftsanläggning i Nyköping och tillhandahåller livscykeltjänster för kärnkraftssektorn, inklusive bränsle, material och avfallshantering. Tillsammans kombinerar de teknik, infrastruktur och anläggningsexpertis för att påskynda utbyggnaden av kärnkraftsdrivna datacenter.

Det finns en växande internationell efterfrågan på kärnkraftsdrivna datacenter, driven av parallella krav från AI och elektrifiering. Med sin kapacitet att leverera ren, pålitlig baskraft och inbyggd redundans är små modulära reaktorer särskilt väl lämpade för att möta detta behov.

Belastar inte elnätet

En stor fördel med att bygga datacenter och kärnkraftverk bredvid varandra är att elnätet inte belastas. Det gör totalpriset för elektriciteten blir lägre, samtidigt som det inte tillkommer investeringskostnader för operatören av elnätet.

Vill etablera Sverige som en föregångare

Med detta avtal strävar parterna efter att etablera Sverige som en föregångare i denna globala omställning, genom att utnyttja Studsviks licensierade anläggning, Evrocs digitala infrastruktur och Blykallas avancerade SMR-teknik.

”Detta samarbete är en möjlighet för Sverige att bli ledande inom digital infrastruktur. Det ger oss möjlighet att visa hur små modulära reaktorer kan tillhandahålla den stabila, fossilfria energi som krävs för AI-revolutionen”, säger Jacob Stedman, vd för Blykalla. ”Studsviks anläggning och evrocs ambitioner erbjuder rätt förutsättningar för ett banbrytande projekt.”

Samförståndsavtalet fastställer en ram för samarbete mellan de tre parterna. Målet är att utvärdera den kommersiella och tekniska genomförbarheten av att samlokalisera datacenter och SMR på Studsviks licensierade anläggning, samarbeta med kommuner och markägare samt definiera hur en framtida kommersiell struktur för elköpsavtal skulle kunna se ut.

”Den ständigt växande efterfrågan på AI understryker det akuta behovet av att snabbt bygga ut en massiv hyperskalig AI-infrastruktur. Genom vårt samarbete med Blykalla och Studsvik utforskar vi en modell där Sverige kan ta ledningen i byggandet av en klimatneutral digital infrastruktur”, kommenterar Mattias Åström, grundare och VD för Evroc.

”Studsvik erbjuder en unik plattform med anläggningsinfrastruktur och unik kompetens för att kombinera avancerad kärnkraft med nästa generations industri. Detta samförståndsavtal är ett viktigt steg för att utvärdera hur sådana synergier kan realiseras i Sverige”, kommenterar Karl Thedéen, vd för Studsvik.

Parterna kommer nu att inrätta en gemensam styrgrupp för att utvärdera anläggningen och affärsmodellen, med målet att inleda formella partnerskapsförhandlingar senare i år. Deras fortsatta samarbete ska möjliggöra ren och säker energi för Europas AI-infrastruktur och digitala infrastruktur.

Nyheter

Toppmöte om framtidens kärnkraft runt Östersjön hölls idag

Sveriges regering arrangerade på tisdagen ett toppmöte om framtidens kärnkraft i Östersjöregionen tillsammans med Finland. Ministrar från Polen, Lettland och Estland deltog, liksom investerare, banker och kärnkraftsbolag. EFN:s reporter Thomas Arnroth rapporterar från mötet.

Energi- och näringsminister Ebba Busch betonade att målet är att göra Sverige till regionens ledande kärnkraftsnation och en hub för kärnkraft i Östersjöområdet.

Tanken är att länderna ska samarbeta och se regionen som en gemensam marknad, vilket kan påskynda och sänka kostnaderna för nya reaktorer. Kunskap kan användas gemensamt över hela regionen och en reaktortyp skulle bara behöva godkännas en gång.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanMahvie Minerals i en guldtrend

-

Analys4 veckor sedan

Analys4 veckor sedanVolatile but going nowhere. Brent crude circles USD 66 as market weighs surplus vs risk

-

Nyheter4 veckor sedan

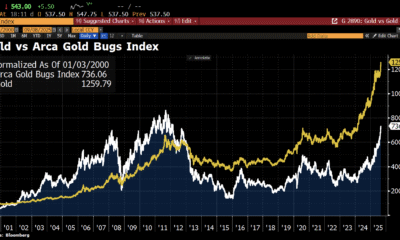

Nyheter4 veckor sedanAktier i guldbolag laggar priset på guld

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanKinas elproduktion slog nytt rekord i augusti, vilket även kolkraft gjorde

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanTyskland har så höga elpriser att företag inte har råd att använda elektricitet

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanGuld når sin högsta nivå någonsin, nu även justerat för inflation

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanDet stigande guldpriset en utmaning för smyckesköpare

-

Analys3 veckor sedan

Analys3 veckor sedanBrent crude ticks higher on tension, but market structure stays soft