Nyheter

David Hargreaves on Precious Metals, week 10 2014

Here we go again. Says a ‘usually authoritative” source, gold will nudge $1900 by August on its way to five figures sometime. Now our inveterate readers know WIM is for $40,000, but only on remonetisation, which is not even a distant prospect. The fact is that in the two weeks which have straddled the before-during-after-Vladimir’s threat to invade the Ukraine, February 23-March 7th, our favourite friend has nudged up from $1322 to $1335, about 1%. Now commenting on all this keeps us hacks in business. Where lies reality? We think it is this: The true price of a commodity, in a balanced market, is its cost of production plus a reasonable margin of profit.

Here we go again. Says a ‘usually authoritative” source, gold will nudge $1900 by August on its way to five figures sometime. Now our inveterate readers know WIM is for $40,000, but only on remonetisation, which is not even a distant prospect. The fact is that in the two weeks which have straddled the before-during-after-Vladimir’s threat to invade the Ukraine, February 23-March 7th, our favourite friend has nudged up from $1322 to $1335, about 1%. Now commenting on all this keeps us hacks in business. Where lies reality? We think it is this: The true price of a commodity, in a balanced market, is its cost of production plus a reasonable margin of profit.

Thus gold. The shake-out of the past two years has shown that the sustainable cost of mining c.3000tpa is about $1000/oz. Add 10% and you have $1100/oz in a perfect world. So, where does the current $250 froth come from?

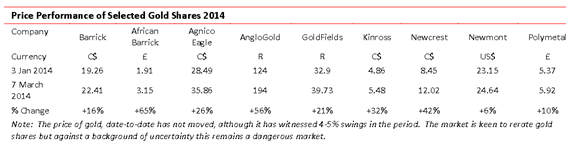

Well, Vladimir, Syria, Egypt, selected bits of Africa and the EU currency crises. Then demand. That 3000 new tonnes are produced and consumed is not in doubt, but there are c.150,000t of surface stocks readily identifiable. At the right price they will come out as that keeps a lid on the casserole. Yet patterns are changing. China and India have a taste for about 1000tpa each, even as the West is slackening. The paper and pseudo markets come into play. ETFs, forwards all chip-in. But they are transient. So it brings in the thorny one, how to value an equity when its underlying commodity is a hot potato. They have for the most part been seriously re-rated since the 2012-13 crash and the wakeup signal.

India. Do we clutch at straws? The world’s largest importer of gold does two things with its +1000tpa imports. Some is re-exported in jewellery form which helps the balance of payments, but much goes under the bed, which damages the federal account. So the government hiked import duties, which had a telling effect. The current account deficit narrowed to a four-year low, of $4.2bn, Oct-Dec, compared with $5.2bn in the prior quarter. It has helped the rupee up 11% from its all-time low of October 26th. But China’s appetite shows no sign of slowing. Yet.

The London Gold Fix is entrenched, if archaic. Now Deutsche Bank has withdrawn as a member we hear South Africa’s Standard Bank, in conjunction with Commercial Bank of China (ICBC) may replace it. To put this market into context, at current prices, the value of newly-mined gold in the world is about $125 billions. The daily London turnover, says the London Bullion Market Association, is c. $240 billions. More will be heard of ICBC, we are sure.

Silver is seeing strong investment demand, particularly for coins. The US Mint saw sales up 26% in 2013, at 42.6Moz the highest since it started marketing in 1986. Canada registered an increase of 60% and Australia 62%.

Platinum nudged its premium to gold ahead, from 1.08 to 1.12 as the unions and mine owners continue their stand-off on wage increases. So far no strain on physical supplies, but one is bound to show if this continues.

WIM says: our view is well recorded. The unions will lose this one and it could turn bloody. The government, facing an election, is impotent

[hr]

About David Hargreaves

David Hargreaves is a mining engineer with over forty years of senior experience in the industry. After qualifying in coal mining he worked in the iron ore mines of Quebec and Northwest Ontario before diversifying into other bulk minerals including bauxite. He was Head of Research for stockbrokers James Capel in London from 1974 to 1977 and voted Mining Analyst of the year on three successive occasions.

Since forming his own metals broking and research company in 1977, he has successfully promoted and been a director of several public companies. He currently writes “The Week in Mining”, an incisive review of world mining events, for stockbrokers WH Ireland. David’s research pays particular attention to steel via the iron ore and coal supply industries. He is a Chartered Mining Engineer, Fellow of the Geological Society and the Institute of Mining, Minerals and Materials, and a Member of the Royal Institution. His textbook, “The World Index of Resources and Population” accurately predicted the exponential rise in demand for steel industry products.

Nyheter

Uppgången i oljepriset planade ut under helgen

Oljepriset gick upp direkt när Israel attackerade Iran förra veckan, men under helgen har prisutvecklingen planat ut trots att konflikten tilltagit. Thina Saltvedt, energianalytiker på Nordea, kommenterar utvecklingen och vad som kan hända framåt.

Nyheter

Låga elpriser i sommar – men mellersta Sverige får en ökning

Snittpriset på el väntas landa på cirka 30 öre per kilowattimme i sommar – i nivå med fjolåret. Men i elområde SE3, där bland annat Stockholm ingår, väntas priserna stiga med 70 procent till följd av att kärnkraftreaktorn Oskarshamn 3 står still. Samtidigt pressar höga vattennivåer ner priserna i norra Sverige. Det visar Bixias elprisprognos för sommaren.

Väderprognoserna pekar på normala förhållanden i Skandinavien. Men det blöta vädret under förra hösten och vintern har fyllt vattenmagasinen rejält, vilket bidrar till låga och stabila elpriser under juni till augusti.

– Att vi går in i sommaren med välfyllda vattenmagasin borgar för riktigt låga elpriser, särskilt i norr. I kombination med låg elförbrukning minimeras risken för några större prischocker i sommar, säger Johan Sigvardsson, analytiker på Bixia.

Ner i norr, upp i syd

Det ovanligt stora vattenöverskottet både i Sverige och Norge fortsätter att pressa priserna norra Sverige. I SE1 och SE2 väntas elpriserna landa på 13–14 öre per kilowattimme, jämfört med 18 öre i fjol.

I mellersta Sverige, elområde SE3, väntas elpriset i stället stiga till cirka 32 öre per kilowattimme, vilket är 70 procent högre än förra sommaren. Orsaken är att underhållet av kärnkraftsreaktorn Oskarshamn 3 förlängts till den 15 augusti, vilket minskar den planerbara elproduktionen.

Även SE4, längst i söder, påverkas av den reducerade kärnkraftsproduktionen, då kopplingen till kontinentens högre elpriser blir större. Här väntas elpriset landa på cirka 50 öre per kilowattimme vilket är i linje med fjolåret.

– Om inte underhållet i Oskarshamn förlängts hade vi för ovanlighetens skull haft full kärnkraftsproduktion i både Sverige och Finland i sommar. Nu får vi istället ett underskott som höjer priserna i mellersta och södra Sverige, säger Johan Sigvardsson.

Under sommaren väntas också många så kallade minustimmar – timmar med negativt elpris – framför allt mitt på dagen när solkraften är som mest effektiv.

– En riktigt het sommardag kan solkraften stå för 80-90 procent av det tyska elbehovet under dagtid. Då blir ankkurvan djup och vi får negativa priser, vilket såklart pressar ner dygnsmedelpriset och gör att vi i Norden kan importera billigt, säger Johan Sigvardsson.

Europa kan pressa upp priserna till hösten

Samtidigt visar prognoser att södra Europa går mot en varm och torr sommar, vilket kan påverka elmarknaden längre fram.

– Hetare väder ökar behovet av luftkonditionering och elförbrukningen stiger. Det innebär att gaslagren inte fylls på i samma takt under påfyllnadssäsongen och efterfrågan i höst lär öka, vilket kan driva upp elpriserna i Europa till hösten och påverka även oss i Sverige, säger Johan Sigvardsson.

Elpriset juni-augusti 2025 jämfört med 2024

| Elområde | 2024 (utfall) | 2025 (prognos) |

| Systempris | 27 öre | 29 öre |

| SE1 | 18 öre | 14 öre |

| SE2 | 18 öre | 13 öre |

| SE3 | 19 öre | 32 öre |

| SE4 | 51 öre | 50 öre |

Nyheter

Stor uppsida i Lappland Guldprospekterings aktie enligt analys

Impala Nordic har gjort en uppdragsanalys på Lappland Guldprospektering, som noterades på Spotlight förra hösten, där man ser en rejält uppsida i aktien.

Lappland Guldprospektering är ett svenskt bolag verksamt inom guldprospektering med fokus på att utveckla och bedriva guldbrytning i större skala i Sverige och övriga Norden. Bolaget har som målsättning att bli en betydande guldproducent, där bolagets nyckelpersoner besitter en mångårig erfarenhet av utveckling och drift av gruvor över hela världen.

Bolaget drivs med väldigt slimmad kostnadsbas, som understiger 1 miljon kronor per kvartal. Således har bolaget en betydande runway med nuvarande kassa, som uppgick till cirka 18 miljoner kronor i utgången av Q1 2025.

”Vi ser det som möjligt att Bolaget kan etablera en gruvverksamhet i huvudprojektet Stortjärnhobben inom 3–4 år, vilket skulle innebära kassaflöden under många år framöver. Om Bolaget lyckas med sitt mål att klassificera en mineralresurs på 500 000 troy ounce (uns) ser vi potential till betydande uppvärdering baserat på värderingen av bolag som varit i liknande skede. Vi bedömer att uppsidan motsvarar ett börsvärde på minst 500 MSEK, drygt 400 % över dagens värdering.”

-

Analys4 veckor sedan

Analys4 veckor sedanBrent steady at $65 ahead of OPEC+ and Iran outcomes

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanUSA slår nytt produktionsrekord av naturgas

-

Analys3 veckor sedan

Analys3 veckor sedanAll eyes on OPEC V8 and their July quota decision on Saturday

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanBrookfield ska bygga ett AI-datacenter på hela 750 MW i Strängnäs

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanStor uppsida i Lappland Guldprospekterings aktie enligt analys

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanSommaren inleds med sol och varierande elpriser

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanOPEC+ ökar oljeproduktionen trots fallande priser

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanSilverpriset släpar efter guldets utveckling, har mer uppsida