Nyheter

David Hargreaves on Exchange Traded Metals, week 48 2013

By and large, large and by, both warehouse stocks and prices dipped down this week; not a lot, but down. Tin, ever one to watch, was off a sharp 5% on stock levels. It remains a close one on the screen, for reasons explained below.

By and large, large and by, both warehouse stocks and prices dipped down this week; not a lot, but down. Tin, ever one to watch, was off a sharp 5% on stock levels. It remains a close one on the screen, for reasons explained below.

We note also US copper production up, Rio playing games on its base metals across the board and Abu Dhabi sniffing at Guinea’s bauxite.

Tin, as ever, continues to intrigue. After years at c. $5000/t it spiked in the 1976-81 period as its cartel-like operator, the International Tin Council, unwound. It then shot to almost $35,000/t in 2010-11 before subsiding to its current, but not-too-shabby ±$22,000/tn. Its control has changed hands several times both in respect of mined supply and end uses. Presently China does over 40% of mined supply, but uses all of that plus 10% more domestically. Indonesia is the frame; it mines c.30% but exports c. 40% of world demand. It is presently calling the shots. End uses, too, have changed over time and electrical and electronics (little soldered contract points) have overtaken tinplate as the major end use. The list of quoted companies is scarce and they are mostly quoted on unpronounceable stock exchanges.

The hunt is on for non-Indonesian or non-Chinese tin deposits as long as the fever spreads. Here is a brief update:

Indonesia wants higher tin prices, beneficiation at source and the price and supply to be controlled locally. It wants to take on the LME’s monopoly which has been there since Captain Cook was in short trousers.

Total output of the metal worldwide is not large, about 325,000tpa. Some comes from suspect origins, like the DRC and Rwanda. An initiative promoted via the US Frank-Dodd Act and its cohorts, seeks to put a stamp of approval – or otherwise – on supplies, so this is adding to the fun. We read (via the USA, so it must be right), that certified parcels of ore achieve twice the price of dodgy ones. We will continue to report but meanwhile do not be surprised if you wake up and find the price has bounded. Quoted companies include PT Timah, Malaysia Smelting Corporation, Minswur (Peru) and EM Vinto (Bolivia).

Copper still remains on most wish lists and a couple of snippets are worth the pen.

When Glencore was treading the tortuous path to its merger with Xstrata, the Chinese weighed in with concerns of monopolies so insisted that for Beijing’s rubber stamp, Glencore had to divest itself of the giant, prospective Las Bambas Copper Mine in Chile. Glencore duly obliged by putting it on the auction block and professional cynics such as ourselves asked, “So, which Chinese company is going to pick it up cheap?” Front runner was Chinalco, but has surprisingly dropped out. Still in there is China Minmetals, however. The $6 bn project could be doing over 300,000tpa copper plus gold, once developed.

OZ Minerals (OZL.AX A$3.07; Hi-Lo A$7.73-3.03) says its Carrapateena project in Australia now has a resource estimate of 760-800Mt of copper at 0.8oz/t plus 8.4Moz contained gold. That smacks of a 250,000tpa metal producer.

WIM says: All this confirms our view that there are no shortages, just a choice of where to mine them. Will governments listen?

[hr]

About David Hargreaves

David Hargreaves is a mining engineer with over forty years of senior experience in the industry. After qualifying in coal mining he worked in the iron ore mines of Quebec and Northwest Ontario before diversifying into other bulk minerals including bauxite. He was Head of Research for stockbrokers James Capel in London from 1974 to 1977 and voted Mining Analyst of the year on three successive occasions.

Since forming his own metals broking and research company in 1977, he has successfully promoted and been a director of several public companies. He currently writes “The Week in Mining”, an incisive review of world mining events, for stockbrokers WH Ireland. David’s research pays particular attention to steel via the iron ore and coal supply industries. He is a Chartered Mining Engineer, Fellow of the Geological Society and the Institute of Mining, Minerals and Materials, and a Member of the Royal Institution. His textbook, “The World Index of Resources and Population” accurately predicted the exponential rise in demand for steel industry products.

Nyheter

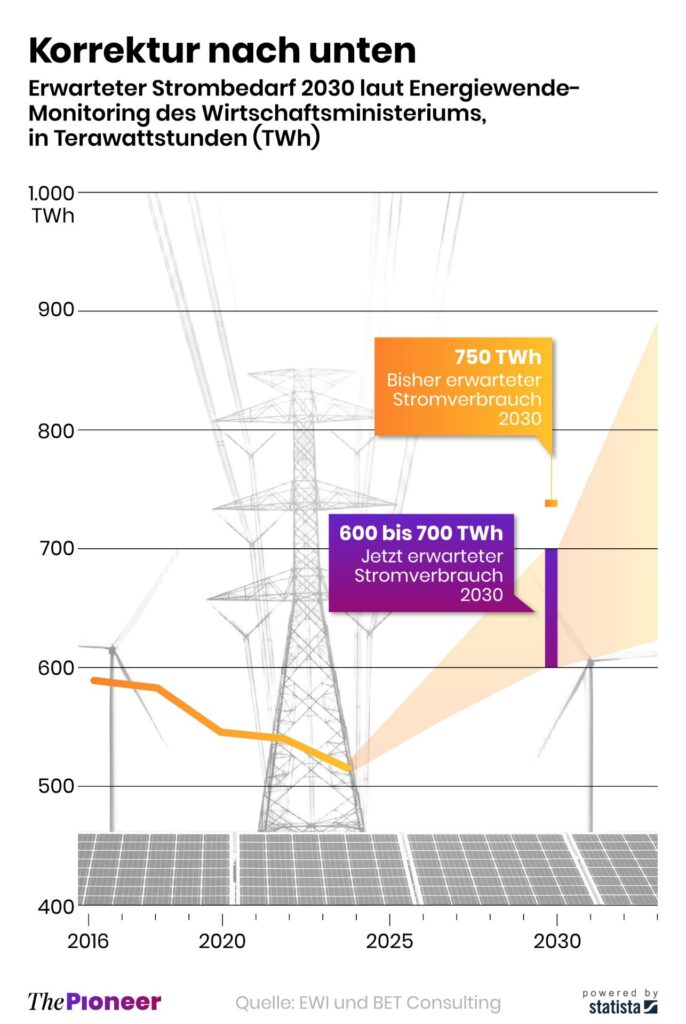

Tyskland har så höga elpriser att företag inte har råd att använda elektricitet

Tyskland har skrivit ner prognosen på hur mycket elektricitet landet kommer att behöva 2030. Hittills har prognosen varit 750 TWh, vilken nu har skrivits ner till 600-700 TWh,

Det kan vid en första anblick låta positivt. Men orsaken är inte att effektiviseringar. Utan priserna är så pass höga att företag inte har råd att använda elektriciteten. Elintensiv industri flyttar sin verksamhet till andra länder och få företag satsar på att etablera energikrävande verksamhet i landet.

Tyskland har inte heller någon plan för att förändra sin havererade energipolitik. Eller rättare sagt, planen är att uppfinna fusionskraft och använda det som energikälla. Något som dock inte löser problemet på några årtionden.

Nyheter

Kinas elproduktion slog nytt rekord i augusti, vilket även kolkraft gjorde

Kinas officiella statistik för elproduktion har släppts för augusti och den visar att landet slog ett nytt rekord. Under augusti producerades 936 TWh elektricitet.

Stephen Stapczynski på Bloomberg lyfter fram att det är ungefär lika mycket som Japan producerar per år, vilket innebär är de producerar ungefär lika mycket elektricitet per invånare.

Kinas elproduktion kom i augusti från:

| Fossil energi | 67 % |

| Vattenkraft | 16 % |

| Vind och Sol | 13 % |

| Kärnkraft | 5 % |

Stapczynskis kollega Javier Blas uppmärksammar även att det totala rekordet inkluderade ett nytt rekord för kolkraft. Termisk energi (där nästan allting är kol) producerade 627,4 TWh under augusti. Vi rapporterade tidigare i år att Kina under första kvartalet slog ett nytt rekord i kolproduktion.

Nyheter

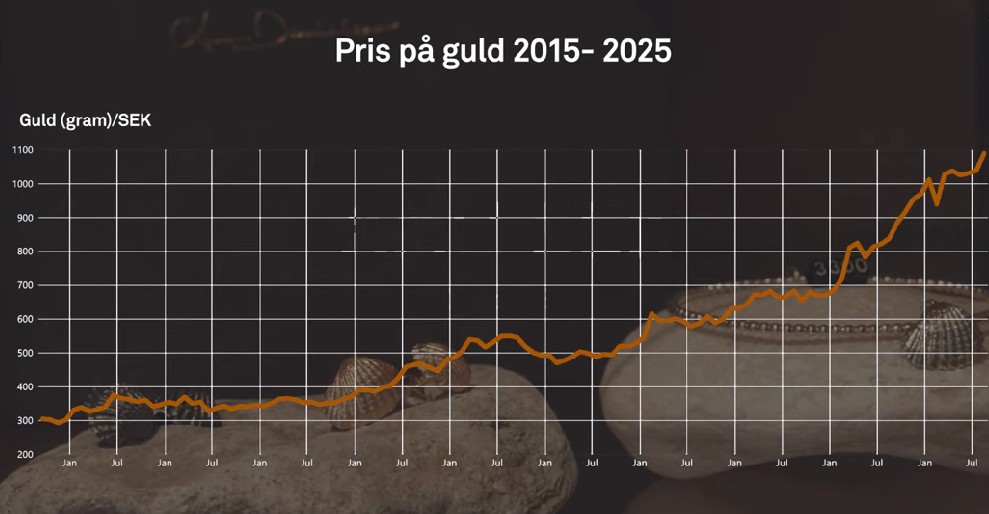

Det stigande guldpriset en utmaning för smyckesköpare

Guldpriset når hela tiden nya höjder och det märks för folk när de ska köpa smycken. Det gör att butikerna måste justera upp sina priser löpande och kunder funderar på om det går att välja något med lägre karat eller mindre diamant. Anna Danielsson, vd på Smyckevalvet, säger att det samtidigt gör att kunderna får upp ögonen för värdet av att äga guld. Det högre guldpriset har även gjort att gamla smycken som ligger hemma i folks byrålådor kan ha fått ett överraskande högt värde.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanMeta bygger ett AI-datacenter på 5 GW och 2,25 GW gaskraftverk

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanAker BP gör ett av Norges största oljefynd på ett decennium, stärker resurserna i Yggdrasilområdet

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanSommarens torka kan ge högre elpriser i höst

-

Analys4 veckor sedan

Analys4 veckor sedanBrent edges higher as India–Russia oil trade draws U.S. ire and Powell takes the stage at Jackson Hole

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanMahvie Minerals är verksamt i guldrikt område i Finland

-

Analys3 veckor sedan

Analys3 veckor sedanIncreasing risk that OPEC+ will unwind the last 1.65 mb/d of cuts when they meet on 7 September

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanNeil Atkinson spår att priset på olja kommer att stiga till 70 USD

-

Analys2 veckor sedan

Analys2 veckor sedanOPEC+ in a process of retaking market share