Nyheter

David Hargraves on Precious Metals week 8 2012

At the backend of 2011 we were not quite a lone voice in warning that gold – and therefore its siblings platinum and silver – might come off a bit, but it was lonely out there. The $2,500 and $5,000 bulls were pawing the ground and snorting hot gases from most orifices. We sounded the first note of caution on Dec. 10th when gold was $1717/oz. It obliged by falling to $1,578/oz by year end. As we write it sits at $1,717, hardly a bull run considering what the Euro, Iran, Syria, Bahrain et al have thrown at it. Now the bulls are in the pen and others see downside pressure, too. Amongst its anti-friends is one Warren Buffett who believes in assets that work for a living. He gets comfort from Charles Gibson of Edison Investment Management who feels the upward-only trend is coming to an end. No we are not performing bears, but $1,400-$1,500 would still be a high historic price. Yet it take two to contango and the CEO of Anglo Gold, the world No 3 miner thinks we could easily breach $2,000 this year. We are all staying on the tramlines, are we not? Mark you, Mark Cutifani, he of Anglo, says Mr. Buffett does not understand gold or gold investors. Presumably therefore neither does US asset manager John Paulson who keeps trimming his exposure to the shares. It is a brave man who calls W.B. to account, let alone Paulson.

Gold ended the week as it started. It seems only a definitive move by Iran in the Strait of Hormuz or with its nuclear toys or both will provide a nearby stimulus. Noteworthy on the week: Goldfields CEO Nick Holland qualifies for the SOTBO award this week. He tells us South Africa is one of the most expensive places for gold mining. Nick, old friend, when you get down to 16,000 feet life ain’t cheap anymore. His cost per ounce is $968 in RSA compared with $590 in Peru and $841 in Australia. He also notes above-inflation-average wage increases. These things happen if you are not careful.

India has more gold under the bed than anyone else. They use it as collateral for loans, would you believe, a practice which is growing apace. The Reserve Bank is getting itchy about this as the sums involved approach $10bn, which is 180 tonnes of metal. It is a shark-infested business, where they speak of 12-24% as a rate of interest. Given India’s long history with gold, they might regulate but they won’t stop it.

Gold demand hit a 14-year high in 2011, at 4067 tonnes, compared with newly mined supply of c. 2800 tonnes. Figures from the WGC show: Global demand 4067.1t, investment 1640.7t, Chinese demand 769.8t (up 20%), Indian demand 933.4t (down 7%), European demand 374.8t (+25%), world mined output 2809.5t (+4%), recycling 1611.9t (down 2%). GoldCorp (G.TO C$46.81; Hi-Lo CR55.93-43.08) the world’s No 5 producer of gold at a rated 79 tpy and silver at 715 tpy achieved record 2011 earnings despite a sharp Q4 drop. EPS was up to $2.22 per share on output of 78 t gold, from $1.43 per share in 2010. Reserves grew for the 8th consecutive year. Amplats, the world’s largest platinum producer is at the reins of the bandwagon. Its CEO says producers need $1,900/oz to have a variable longterm future. So how were you faring only three years ago when it was $826/oz? The company also warns that demand for its products will be down c. 200,000oz in 2012 to 2.5-2.6 Moz.

[hr]

About David Hargreaves

David Hargreaves is a mining engineer with over forty years of senior experience in the industry. After qualifying in coal mining he worked in the iron ore mines of Quebec and Northwest Ontario before diversifying into other bulk minerals including bauxite. He was Head of Research for stockbrokers James Capel in London from 1974 to 1977 and voted Mining Analyst of the year on three successive occasions.

Since forming his own metals broking and research company in 1977, he has successfully promoted and been a director of several public companies. He currently writes “The Week in Mining”, an incisive review of world mining events, for stockbrokers WH Ireland. David’s research pays particular attention to steel via the iron ore and coal supply industries. He is a Chartered Mining Engineer, Fellow of the Geological Society and the Institute of Mining, Minerals and Materials, and a Member of the Royal Institution. His textbook, “The World Index of Resources and Population” accurately predicted the exponential rise in demand for steel industry products.

Nyheter

Nickelmarknaden under fortsatt press – överskott väntas bestå till 2026

Nickelpriserna har fallit kraftigt de senaste åren, och enligt investmentbanken UBS ser återhämtningen ut att dröja. Trots en viss dämpning i produktionstakten och fördröjda projekt, kvarstår ett globalt överskott som väntas hålla i sig åtminstone till 2026.

Efter en period av kraftig utbyggnad och stora förväntningar kopplade till batterimarknaden har efterfrågan inte levt upp till hypen. Visserligen har nickel klarat sig bättre än många andra basmetaller, men efterfrågan räcker inte till för att absorbera det fortsatta utbudet.

Indonesien, världens största producent, förändrar också spelplanen. Tillväxten av låggradigt nickel (NPI) bromsar in, medan nya projekt för höggradigt nickel med HPAL-teknik nu tas i drift – mer lämpade för batteritillverkning, men som ändå ökar utbudet.

Stålindustrin, som är nicklets största kund, minskar sina inköp i både USA och Europa. Samtidigt växer batterisegmentet långsammare än väntat, utan att bidra med någon betydande uppsida.

Indonesiens regering har börjat strama åt exportkvoterna, vilket driver upp råvarukostnaderna och sätter press på producenter med lägre marginaler. Trots att cirka 250 000 ton i produktionsneddragningar har annonserats, räcker det inte för att återställa balansen.

UBS räknar med en global efterfrågetillväxt på 4-5 % per år fram till 2028, men med fortsatt stigande lager och priser nära produktionskostnaden, förblir marknaden överutbudspräglad.

För investerare innebär detta att nickelpriserna sannolikt kommer att förbli pressade under överskådlig tid. De dagar då batteriboomen drev priserna uppåt ser ut att vara över – nu väntar en långsam och kostnadsdriven väg tillbaka mot balans.

Nyheter

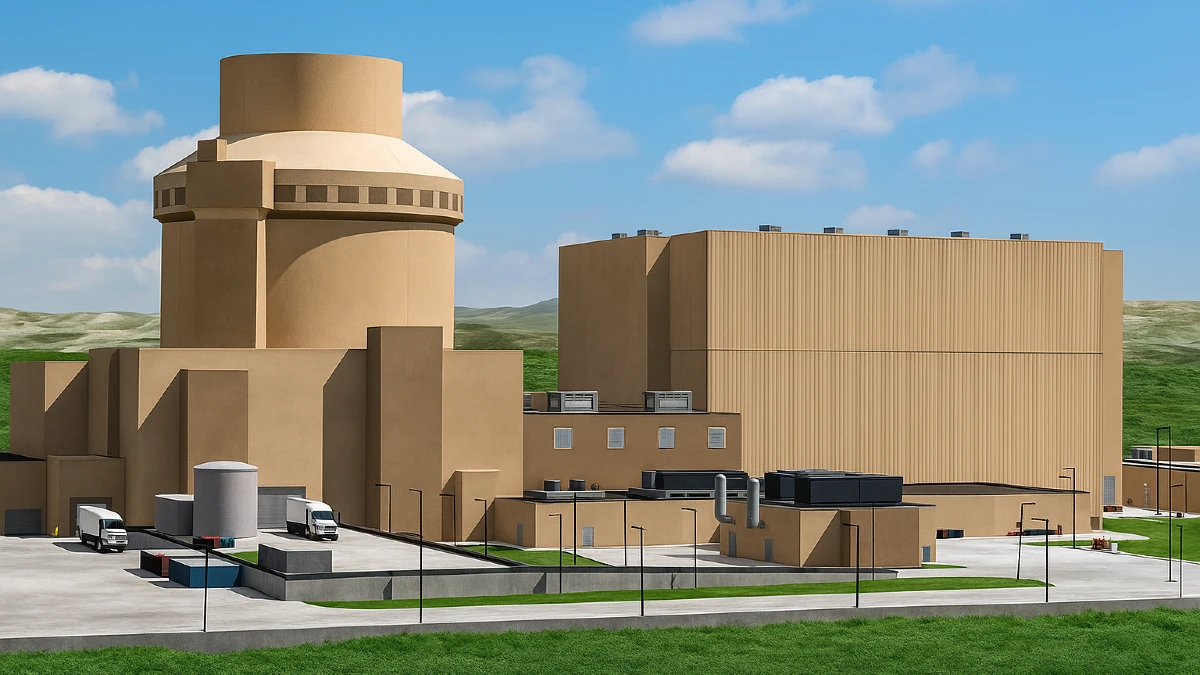

Westinghouse planerar tio nya stora kärnreaktorer i USA – byggstart senast 2030

Det amerikanska kärnkraftsbolaget Westinghouse meddelar planer på att bygga tio nya stora kärnreaktorer i USA, med byggstart planerad till senast 2030. Beskedet kom under en energikonferens med fokus på AI vid Carnegie Mellon University i Pittsburgh, där tillförordnade vd:n Dan Sumner presenterade satsningen direkt för president Donald Trump.

De nya reaktorerna som planeras är av modellen AP1000 – en avancerad tryckvattenreaktor som enligt Westinghouse kan leverera el till över 750 000 hushåll vardera.

Satsningen på kärnkraften sker i skenet av president Trumps nyligen utfärdade fyra exekutiva order från maj månad, som syftar till att fyrdubbla USA:s kärnkraftsproduktion till år 2050. Bland annat vill han se minst tio kärnkraftverk under uppförande inom 25 år och har beordrat en omfattande översyn av regelverket för kärnkraftsindustrin.

Samtidigt som Westinghouse presenterade sina planer tillkännagavs även investeringar på över 90 miljarder dollar i datacenter och energiinfrastruktur från ett brett spektrum av teknik-, energi- och finansföretag. Konferensen anordnades av senator Dave McCormick.

Westinghouse har tidigare haft en turbulent resa inom ny kärnkraft. De senaste reaktorerna som byggts i USA – två AP1000-enheter vid Vogtle-anläggningen i Georgia – blev kraftigt försenade och budgeten överskreds med hela 18 miljarder dollar. Projektet bidrog starkt till att Westinghouse tvingades begära konkurs 2017. Bolaget återhämtade sig dock och ägs idag av det kanadensiska uranbolaget Cameco och investeringsjätten Brookfield Asset Management.

För att minska risken för framtida förseningar och kostnadsöverdrag inleder Westinghouse nu ett samarbete med Google. Med hjälp av AI-teknik ska man effektivisera och standardisera byggprocessen för AP1000-reaktorerna, enligt bolaget.

Med de nya planerna tar USA ett stort steg mot att åter bygga ut sin kärnkraftskapacitet – något som både energipolitiker och industrin ser som nödvändigt för att möta framtidens elbehov och klimatmål.

Nyheter

Eurobattery Minerals förvärvar majoritet i spansk volframgruva

Eurobattery Minerals har tagit ett stort steg i sin utveckling genom att underteckna ett avtal om att förvärva en majoritetsandel i volframgruvan San Juan i Galicien, Spanien. Genom en investering på totalt 1,5 miljoner euro i det spanska bolaget Tungsten San Juan S.L. (TSJ), säkrar Eurobattery Minerals en ägarandel på 51 procent – och kontroll över projektet redan efter första delbetalningen.

Investeringen syftar till att bygga en pilotanläggning för mineralbearbetning och starta gruvdriften, som redan har alla nödvändiga licenser och ett preliminärt leveransavtal med Wolfram Bergbau und Hütten AG – en ledande volframproducent inom Sandvik-koncernen. Första leveranserna till Europa väntas ske under andra halvåret 2026, då även positivt kassaflöde förväntas genereras.

”Detta är en game-changer för oss. För första gången går vi från ett prospekteringsbolag till ett bolag med faktiskt intäktspotential inom en snar framtid,” säger VD Roberto García Martínez.

San Juan-projektet har bekräftade malmreserver på cirka 60 000 ton med en volframoxidhalt på 1,3 %. Volfram är en kritisk råvara med ökande strategisk betydelse för industri och försvar, och priset har stigit med över 40 % under 2025.

Med detta förvärv stärker Eurobattery Minerals både sin finansiella ställning och sin position som en europeisk leverantör av kritiska råmaterial – ett viktigt steg mot en hållbar och självförsörjande batterivärdekedja i Europa.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanMahvie Minerals växlar spår – satsar fullt ut på guld

-

Analys4 veckor sedan

Analys4 veckor sedanA muted price reaction. Market looks relaxed, but it is still on edge waiting for what Iran will do

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanJonas Lindvall är tillbaka med ett nytt oljebolag, Perthro, som ska börsnoteras

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanOljan, guldet och marknadens oroande tystnad

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanDomstolen ger klartecken till Lappland Guldprospektering

-

Analys3 veckor sedan

Analys3 veckor sedanTightening fundamentals – bullish inventories from DOE

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanRyska staten siktar på att konfiskera en av landets största guldproducenter

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanLundin Mining ska bli en av de tio största kopparproducenterna i världen