Analys

Crude oil – It’s a (hybrid) market share war

Rebound after a very bearish day as US inventories declines further. Last week Brent crude broke down below USD 75/b. And it didn’t take long before the heralded production increase was shifted out two months to instead start in December. This however, was far from enough to halt the oil price sell-off where Brent crude traded down to USD 68.68/b (-4.4%) before closing the day at USD 69.19/b (-3.7%). The market was gripped with bearish demand fears and there were hardly any bullish voices to be heard. This morning Brent is rebounding 1.5% to USD 70.25/b. US inventories likely continued to decline last week by around 3 mb according to indics by API in an extension of steady declines since mid-June. Russia and other OPEC+ members complied better to quota targets in August.

A (hybrid) market share war. A fight over market share between OPEC+ and non-OPEC+ is indeed a key element of the latest turmoil in the oil market. And not the least unclarity over how exactly the group is going to execute its long heralded production increase. But the group partially showed its cards last week when it modified its plan to hike production almost immediately after Brent crude fell below USD 75/b last week.

This is very different from 2014/15. OPEC+ is clearly set to return volumes to the market. But this looks very different from 2014/15 when OPEC simply flooded the market with oil and crashed the price. This time around the group is behaving more like a central bank. In June they laid out and communicated to the market their plan to return 2.2 m b/d of voluntary cuts to the market. Gradually lifting production from Q4-2024 to Q3-2025. They communicated this long time in advance of when the actual production increase is supposed to take place. At first it shocked the market and Saudi Arabia was forced to soften the message with ifs and buts. Saying that the plan will be adaptable to market circumstances once we actually get to Q4-2024. Though without being too specific about it. And now we are very, very close to Q4. The market is hit by China weakness as well as a bit of unclarity over the ”new” strategy of OPEC+. The oil price tanks.

They will lift production by 2.2 mb/d but it will take longer time. We do believe that OPEC+ will indeed lift production by 2.2 m b/d as stated but that they will spend more time doing it and also that they will have to accept a somewhat lower price to get it done. If nothing else they need to lift production back towards more normal levels in order to be in a position to cut again when the next crisis occur. Just like central banks needs to lift interest rates in order to be positioned to cut the yet again.

Not all bearish. Here are some bullish elements. Amid all the bearish concerns which is gripping the market currently here is a list of supportive elements.

1) OPEC+ modified its production increase plan the moment Brent fell below USD 75/b. More modifications to come if needed in our view.

2) Better compliance by OPEC+ members in August with Russia now very close to production quota-target.

3) US oil inventories have fallen steadily and counter seasonally since mid-June and likely fell another 3 mb last week (crude and products) according to indic. by API. Global floating crude oil stocks have declined by close to 50 mb since a peak in mid-June.

4) VLCC freight rates from the Middle East to China are ticking higher. Probably a sign of increased appetite for oil imports.

5) US EIA yesterday reduced its US crude oil production forecast marginally lower along with a slightly lower price forecast.

Deep rooted market concerns at the moment are about fear for coming surplus with predictions that the market will flip to surplus some time in November and December. Thus no surplus as of yet. Though Chinese weakness is apparent to be seen.

An oil price of USD 75/b in 2025 will likely give OPEC+ what it wants. A somewhat lower oil price (SEB 2024 Brent average forecast is USD 75/b) will be very positive for the global economy, lower inflation, lower interest rates, higher oil demand growth down the road and also further dampening of US shale oil production growth. A WTI crude oil price of around USD 70/b will likely also stimulated the US government to buy more oil to refill its Strategic Petroleum Reserves (SPR) which were heavily depleted in 2022/23. All good things for OPEC+ and its ability to place 2.2 mb/d of oil back into the market.

Analys

Physical easing. Iran risk easing. But Persian Gulf risk cannot fully fade before US war ships are pulled away

Traded down 3.7% last week as Iranian risk faded a bit. Brent crude traded in a range of $65.19 – 69.76/b last week. In the end it traded down 3.7% with a close of $68.05/b. It was unable to challenge the peak of $71.89/b from the previous week when the market got its first nervous shake as Trump threatened Iran with an armada of US war ships.

The market has started to cool down a bit with US and Iran in talks in Oman on Friday and Brent crude is easing 0.9% this morning to $67.4/b in an extension of that. As we have stated before we think the probability is very low for a scenario where the US attacks Iran in such a way that it risks an uncontrollable escalation with possible large scale disruption of oil out of the Strait of Hormuz and thus a massive spike in the oil price. That would endanger Trump’s mid-term election which is already challenged with unhappy US voters complaining about affordability and that Trump is spending too much time on foreign issues.

A statement by Trump last week that India had agreed not to buy Russian crude turns out to have little substance as India has agreed to no such thing on paper. The statement last week naturally supported oil prices as the market is already struggling with a two tire market with legal versus illegal barrels. There is a lot of friction in the market for sanctioned crude oil barrels from Iran and Russia. If India had agreed not to buy Russian crude oil then the market for legal barrels would have been tighter.

The physical market has been tighter than expected. And the recent concerns over Iranian risk has come on top of that. The market is probably starting calm down regarding the Iranian risk. But the physical tightness is also going to ease gradually over the coming couple of weeks. CPC blend exports averaged 1.5 mb/d last year, but were down to less than 1 mb/d in January due to a combination of factors. Drone attacks by Ukraine in late November. The Tengiz field has been disrupted by fires. Adverse winter weather has also been a problem. US crude oil production has also been disrupted by a fierce winter storm. But these issues are fading with supply reviving over the next couple of weeks.

The physical tightness is likely going to ease over the next couple of weeks. The market may also have started to get used to the Iranian situation. But the Iranian risk premium cannot be fully defused as long as US warships are located where they are with their guns and rockets pointing towards Iran.

Analys

Brent crude will pull back if the US climbs down its threats towards Iran

Brent crude rose 2.7% last week to $65.88/b with a gain on Friday of 2.8%. Unusually cold US winter weather with higher heating oil demand and likely US oil supply outages was probably part of the bullish drive at the end of last week. But US threats towards Iran with USS Abraham Lincoln being deployed to the Middle East was probably more important.

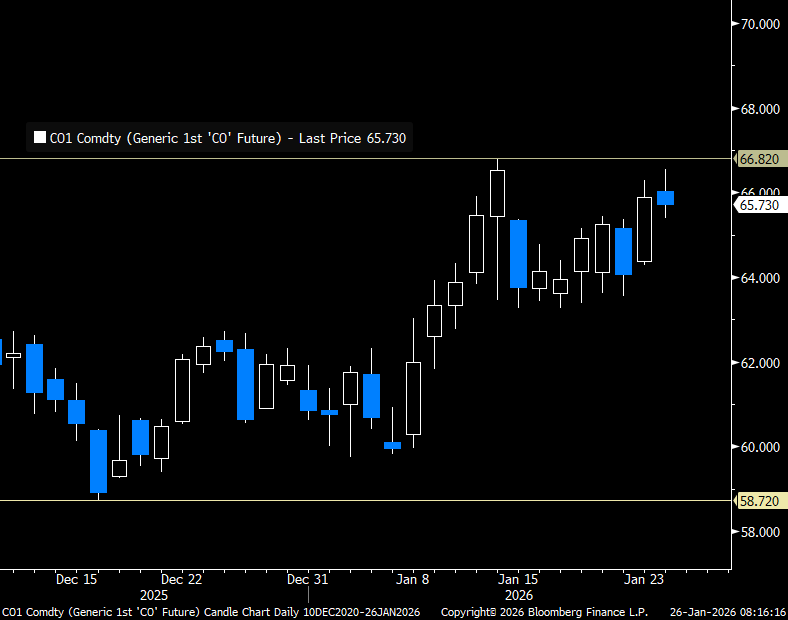

Brent crude has maintained the gains it got from 8 January onwards when it rose from the $60/b-line and up to around $65/b on the back of Iranian riots where the US added fuel to the fire by threatening to attack Iran in support of the rioters. This morning Brent has tested the upside to $66.54/b. That is short of the $66.82/b from 14 January and Brent has given back part of the early gains this morning and is currently trading close to unchanged versus Friday’s close with a dollar decline of 0.4% not enough to add much boost to the price yet at least.

Brent crude front-month prices in USD/b

The rally in Brent crude from the $60/b-line to its current level of $65-66/b seems to be tightly linked to an elevated risk of the US attacking Iran in support of the rioters. Bloomberg reported on Saturday that the US has dispatched the USS Abraham Lincoln aircraft carrier and its associated strike group to the Middle East. It is a similar force which the US deployed to the Caribbean Sea just weeks before the 3 January operation where Maduro was captured. The probability of a US/Israeli attack on Iran is pegged at 65-70% by geopolitical risk assessment firms Eurasia Group and Rapidan Energy Group. Such a high probability explains much of the recent rally in Brent crude.

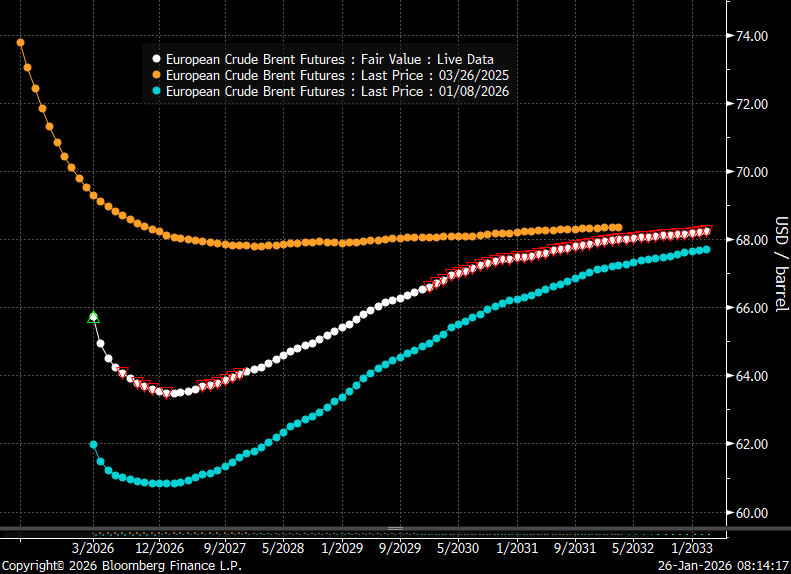

The recent rally in Brent crude is not a signal from the oil market that the much discussed global surplus has been called off. If we look at the shape of the Brent crude oil curve it is currently heavily front-end backwardated with the curve sloping upwards in contango thereafter. It signals front-end tightness or near term geopolitical risk premium followed by surplus. If the market had called off the views of a surplus, then the whole Brent forward curve would have been much flatter and without the intermediate deep dip in the curve. The shape of the Brent curve is telling us that the market is concerned right now for what might happen in Iran, but it still maintains and overall view of surplus and stock building unless OPEC+ cuts back on supply.

It also implies that Brent crude will fall back if the US pulls back from its threats of attacking Iran.

Brent crude forward curves in USD/b.

Analys

Oil market assigns limited risks to Iranian induced supply disruptions

Falling back this morning. Brent crude traded from an intraday low of $59.75/b last Monday to an intraday high of $63.92/b on Friday and a close that day of $63.34/b. Driven higher by the rising riots in Iran. Brent is trading slightly lower this morning at $63.0/b.

Iranian riots and risk of supply disruption in the Middle East takes center stage. The Iranian public is rioting in response to rapidly falling living conditions. The current oppressive regime has been ruling the country for 46 years. The Iranian economy has rapidly deteriorated the latest years along with the mismanagement of the economy, a water crisis, encompassing corruption with the Iranian Revolutionary Guard Corps at the center and with US sanctions on top. The public has had enough and is now rioting. SEB’s EM Strategist Erik Meyersson wrote the following on the Iranian situation yesterday: ”Iran is on the brink – but of what?” with one statement being ”…the regime seems to lack a comprehensive set of solutions to solve the socioeconomic problems”. That is of course bad news for the regime. What can it do? Erik’s takeaway is that it is an open question what this will lead to while also drawing up different possible scenarios.

Personally I fear that this may end very badly for the rioters. That the regime will use absolute force to quash the riots. Kill many, many more and arrest and torture anyone who still dare to protest. I do not have high hopes for a transition to another regime. I bet that Iranian’s telephone lines to its diverse group of autocratic friends currently are running red-hot with ”friendly” recommendations of how to quash the riots. This could easily become the ”Tiananmen Square” moment (1989) for the current Iranian regime.

The risks to the oil market are:

1) The current regime applies absolute force. The riots die out and oil production and exports continue as before. Continued US and EU sanctions with Iranian oil mostly going to China. No major loss of supply to the global market in total. Limited impact on oil prices. Current risk premium fades. Economically the Iranian regime continues to limp forward at a deteriorating path.

2) The regime applies absolute force as in 1), but the US intervenes kinetically. Escalation ensues in the Middle East to the point that oil exports out of the Strait of Hormuz are curbed. The price of oil shots above $150/b.

3) Riots spreads to affect Iranian oil production/exports. The current regime does not apply sufficient absolute force. Riots spreads further to affect oil production and export facilities with the result that the oil market loses some 1.5 mb/d to 2.0 mb/d of exports from Iran. Thereafter a messy aftermath regime wise.

Looking at the oil market today the Brent crude oil price is falling back 0.6% to $63/b. As such the oil market is assigning very low risk for scenario 2) and probably a very high probability for scenario 1).

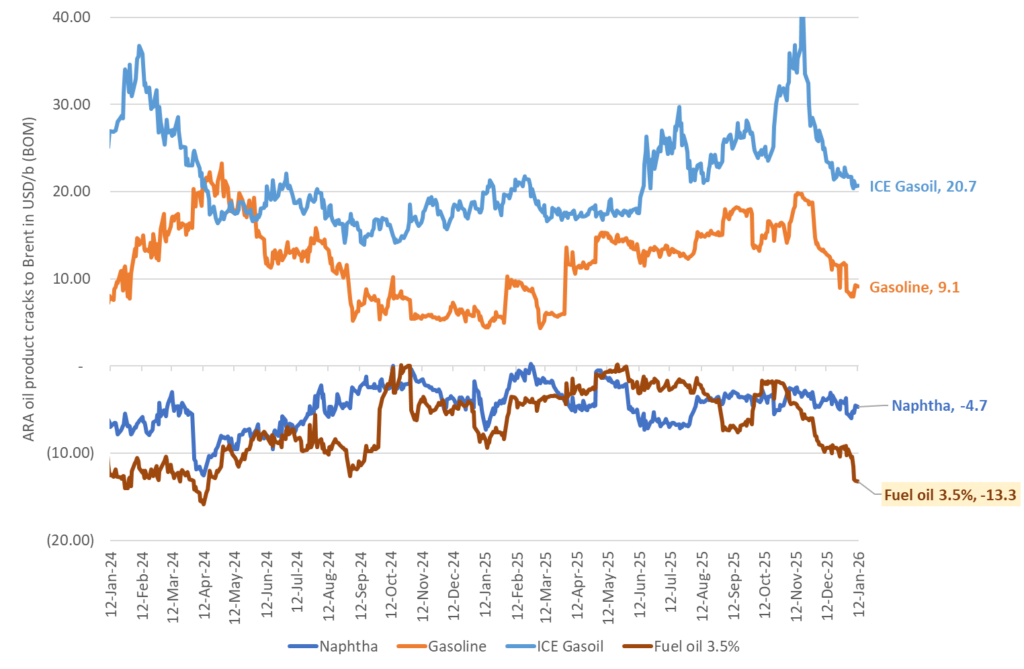

Venezuela: Heavy sour crude and product prices falls sharply on prospect of reduced US sanctions on Venezuelan oil exports. The oil market take on Venezuela has quickly shifted from fear of losing what was left of its production and exports to instead expecting more heavy oil from Venezuela to be released into the market. Not at least easier access to Venezuelan heavy crude for USGC refineries. The US has started to partially lift sanctions on Venezuelan crude oil exports with the aim of releasing 30mn-50mn bl of Venezuelan crude from onshore and offshore stocks according to the US energy secretary Chris Wright. But a significant increase in oil production and exports is far away. It is estimated that it will take $10bn in capex spending every year for 10 years to drive its production up by 1.5 mb/d to a total of 2.5 mb/d. That is not moving the needle a lot for the US which has a total hydrocarbon liquids production today of 23.6 mb/d (2025 average). At the same time US oil majors are not all that eager to invest in Venezuela as they still hold tens of billions of dollars in claims against the nation from when it confiscated their assets in 2007. Prices for heavy crude in the USGC have however fallen sharply over the prospect of getting easier access to more heavy crude from Venezuela. The relative price of heavy sour crude products in Western Europe versus Brent crude have also fallen sharply into the new year.

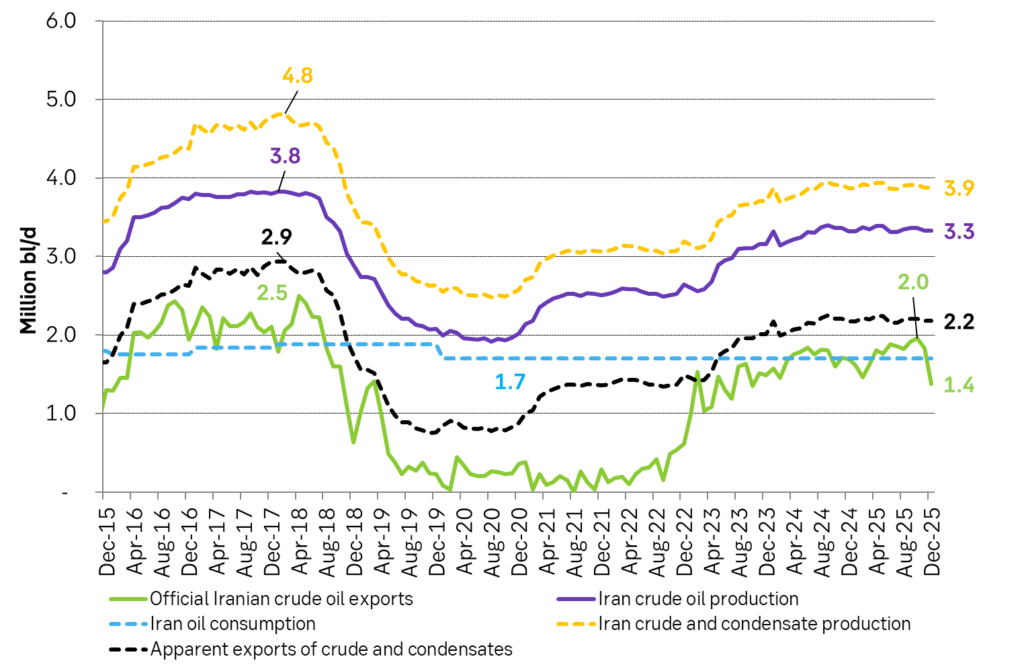

Iran officially exported 1.75 mb/d of crude on average in 2025 falling sharply to 1.4 mb/d in December. But it also produces condensates. Probably in the magnitude of 0.5-0.6 mb/d. Total production of crude and condensates probably close to 3.9 mb/d.

The price of heavy, sour fuel oil has fallen sharply versus Brent crude the latest days in response to the prospect of more heavy sour crude from Venezuela.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanSilverpriset stiger över 100 USD per uns

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanGuldpriset stiger till över 5000 USD per uns

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanSamtal om guld och andra råvaror när flera priser rusar i höjden

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanChristian Kopfer om marknadens olika råvaror

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanSilver utgör nu 30 procent av kostnaden för att producera solcellspaneler

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanKall och nederbördsfattig månad driver upp elpriset

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanIndien kommer inte att göra slut med kol

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanKylan lyfter elpriset i vinter, minst 40 procent högre än väntat