Nyheter

Beowulf Mining sets the drill rigs turning once again at Kallak North

“Drilling has gone well”, says Clive Sinclair-Poulton of Beowulf Mining. “We started drilling in May and put a second rig in place in June.”. The subject of Beowulf’s attentions is the Kallak North iron ore project in Norrbotten County, northern Sweden.

Drilling at Kallak

So far the company has been able to identify a resource of 131.6 million tonnes of ore grading 28% iron. But there should be plenty more to come.

Already the signs from the ongoing drilling are beginning to come in, and they’ve been highly encouraging. “Our JORC resource was based on drilling to 250 metres”, says Clive, “but the latest intersections show 350 vertical metres of iron ore.”

Already the signs from the ongoing drilling are beginning to come in, and they’ve been highly encouraging. “Our JORC resource was based on drilling to 250 metres”, says Clive, “but the latest intersections show 350 vertical metres of iron ore.”

The full assay results won’t be out until next month, but, local conditions allowing, progress after that ought to be pretty rapid. “We’ll do a JORC upgrade at Kallak as soon as possible”, says Clive. At the same time, the company also plans to start work again on the contiguous ground at Kallak South, where a previous drilling produced mixed results because, says Clive, “we weren’t drilling in the correct areas”.

This time round, he’s hopeful the drilling will be more effectual, and that a maiden JORC resource for Kallak South can be put together early next year. “I want to be in a situation where we have tonnage on both North and South Kallak”, says Clive. By that time a scoping study should be underway, and the company will be thinking about test production.

Precisely what that will show remains to be seen, but Clive is optimistic. “If we get the tonnage we have a 60 year life. It’s 40 clicks to get to the rail network of northern Sweden.” The rail network can then provide access either to Narvik on the Norwegian coast or Luleå on the Baltic coast, depending on what sort of deal Beowulg eventually strikes in regard to the final destination for the ore.

Clive has long been in dialogue with potential customers in the Far East, although he won’t be drawn into a deal quite yet. He’s waiting for two things. One, for more progress on Kallak. And two, for further improvement in the iron ore market, which he remains firmly bullish about.

In fact, iron ore hasn’t been doing too badly of late, as the Chinese are beginning to realise that some projects that had been likely to add to global supply are now not likely to come on stream. The Brazilian champion Vale is a case in point. Vale recently outlined its iron ore plans for the next five years, and these show a significantly lower production increase than had been expected. What’s more, says Clive, fairly soon India will become an importer. It’s currently the third largest exporter.

It all makes for relative strength in the iron ore space, at a time when other sectors are looking distinctly shaky, including equities markets. Beowulf has not been immune to this, as its shares have dropped by around 80 per cent since they hit a 12 month high of 50p back in October last year. But although the wider negative market sentiment hasn’t’ helped, the company has also face some quite specific issues which have rubbed off the value.

First off it was sanctioned by the authorities for drilling without a permit. Clive is blunt about this. “Mea culpa”, he says. “As Dan Maskell would have said, it was an ‘unforced error’.” Procedures are now in place to ensure such a mistake doesn’t happen again. More significant has been the deterioration of relations with the local indigenous group, the Saami community The Saami are worried about their ability to drive reindeer across the land, and the impact Beowulf’s operations are likely to have on their migratory patterns.

“Dialogue is very difficult”, says Clive, “although in all of Sweden there are only 20,000 Saami.” The Beowulf plan is to set up a fund for the benefit of all residents of the Jokkmokk region in which it operates, not just the Saami. In the meantime Clive is confident that the Mines Inspectorate will broker a compromise when disagreements arise, as it has done in the past.

In the meantime, the drill rigs continue to turn, and funding, at least for the moment, is not a worry. “We are in a strong position”, says Clive. “We have the funds in place to do the drilling. On our current drilling campaign the money won’t run out.” It’ll be interesting to see what sort of the results the campaign comes up with, and how much closer they take Beowulf to its eventual target of 500 million tonnes.

Nyheter

Samtal om sällsynta jordartsmetaller, guld och silver

Samtal om sällsynta jordartsmetaller, guld och silver, samt gruvbolag. Clara My Lernborg på EFN ger sin syn på sällsynta jordartsmetaller som blivit centrala i den globala geopolitiken. Sarah Tomlinson på Metals Focus ger sin syn på guld. Eric Strand på AuAg Fonder ger sin syn på guld, silver och relaterade gruvbolagsaktier.

Nyheter

Brookfield köper bränsleceller för 5 miljarder USD av Bloom Energy för att driva AI-datacenter

Brookfield och Bloom Energy inleder ett partnerskap där Brookfield i den första fasen köper bränsleceller för 5 miljarder USD av Bloom Energy för att driva AI-datacenter. Bränslecellerna kommer att installeras bakom elmätarna och AI-datacentren kommer således inte att belasta eller vara beroende av elnätet.

Partnerskapet markerar den första fasen i en gemensam vision om att bygga AI-datacenter som kan möta den snabbt växande efterfrågan på beräkningskapacitet och energi inom artificiell intelligens.

AI-datacenter kräver infrastruktur som integrerar beräkningskraft, energi, datacenterarkitektur och kapital på ett tätt och effektivt sätt. Bloom Energys bränsleceller levererar pålitlig, skalbar och lokal energi som snabbt kan tas i drift utan beroende av traditionella elnät. Brookfield tillför världsledande kompetens inom infrastrukturutveckling och finansiering.

I kärnan av det nya partnerskapet kommer Brookfield att investera upp till 5 miljarder dollar för att införa Blooms avancerade bränslecellsteknik. Bolagen samarbetar aktivt kring utformning och leverans av AI-datacenter globalt – inklusive en europeisk anläggning som kommer att offentliggöras innan årets slut.

”AI-infrastruktur måste byggas som en fabrik – med syfte, hastighet och skala,” säger KR Sridhar, grundare, ordförande och vd för Bloom Energy. ”Till skillnad från traditionella fabriker kräver AI-fabriker enorm energitillgång, snabb etablering och realtidsanpassning till belastning – något som gamla elnät inte klarar av. Den effektiva AI-fabriken uppnås genom att energi, infrastruktur och beräkningskraft designas i harmoni från dag ett. Det är den principen som styr vårt samarbete med Brookfield när vi omformar framtidens datacenter. Tillsammans skapar vi en ny ritning för hur AI skalas upp med kraft.”

”Energilösningar bakom mätaren är avgörande för att överbrygga elnätsgapet för AI-fabriker,” säger Sikander Rashid, global chef för AI-infrastruktur på Brookfield. ”Blooms avancerade bränslecellsteknik ger oss en unik möjlighet att designa och bygga moderna AI-fabriker med ett helhetsperspektiv på energibehov. Som världens största investerare inom AI-infrastruktur tillför detta partnerskap ett kraftfullt nytt verktyg till vår globala tillväxtstrategi – särskilt i en marknad där tillgången till elnät är begränsad.”

AI-datacenter i USA förväntas använda 100 gigawatt vid 2035

Enligt prognosoer väntas elförbrukningen från AI-datacenter i USA växa exponentiellt och överstiga 100 gigawatt till 2035. Bränsleceller har blivit en nyckellösning för att möta detta problem, och partnerskapet mellan Bloom Energy och Brookfield är utformat för att hantera just detta energigap.

Bloom Energy har erfarenhet

Bloom Energy har redan installerat hundratals megawatt av sin bränslecellsteknik i datacenter och levererar el till några av världens mest kritiska digitala infrastrukturer genom partnerskap med American Electric Power (AEP), Equinix och Oracle.

Brookfield är en jätte inom digital infrastruktur

Detta partnerskap utgör Brookfields första investering inom sin dedikerade AI-infrastruktur-strategi, som fokuserar på investeringar i stora AI-datacenter, energilösningar, beräkningsinfrastruktur och strategiska kapitalpartnerskap. Strategin bygger vidare på Brookfields erfarenhet av att ha investerat över 100 miljarder dollar i digital infrastruktur globalt.

Nyheter

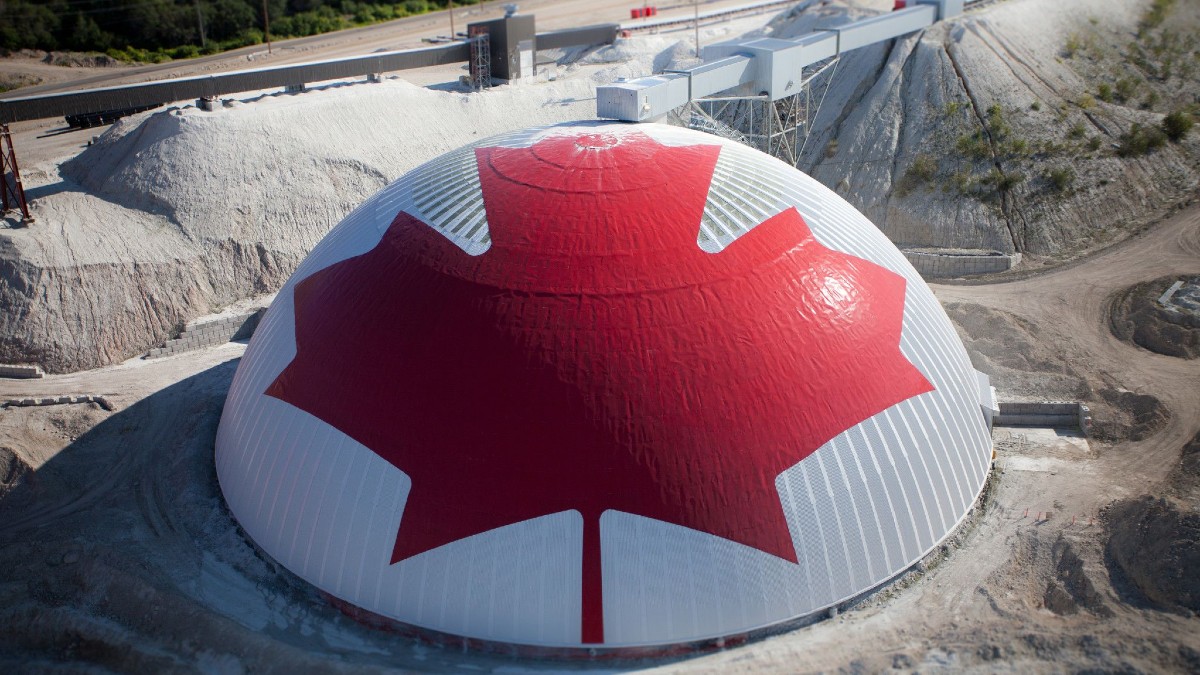

Teck Resources kan förse Nordamerika och kanske hela G7 med all germanium som behövs

Kanadensiska gruvbolaget Teck Resources för samtal med både USA och Kanada om att leverera kritiska mineraler till de båda ländernas försvarsindustrier – bara en dag efter att Kina skärpt sina exportregler för sällsynta jordartsmetaller.

Enligt Financial Times diskuterar bolaget möjligheterna att leverera germanium, antimon och gallium, under förutsättning att det kan få garantier för minimipriser och köpvolymer.

Kinas senaste besked innebär en utvidgning och förtydligande av de omfattande exportkontroller som infördes redan i april. De tidigare restriktionerna ledde till stora bristsituationer globalt innan nya avtal med Europa och USA gjorde det möjligt att återuppta leveranser. Den nya regeln klargör dock att exportlicenser sannolikt kommer att nekas till vapenproducenter och vissa halvledarföretag.

Vid FT Metals and Mining Summit uppgav Teck Resources vd att bolaget kan producera tillräckligt med germanium för att täcka hela Nordamerikas behov – och möjligen även G7-ländernas.

Teck Resources och Anglo American går samman

Teck Resources och Anglo American är mitt uppe i en fusion, vilket beskrivs som ett samgående av två jämbördiga parter.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanKinas elproduktion slog nytt rekord i augusti, vilket även kolkraft gjorde

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanTyskland har så höga elpriser att företag inte har råd att använda elektricitet

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanOPEC+ missar produktionsmål, stöder oljepriserna

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanEtt samtal om guld, olja, fjärrvärme och förnybar energi

-

Analys4 veckor sedan

Analys4 veckor sedanBrent crude ticks higher on tension, but market structure stays soft

-

Analys3 veckor sedan

Analys3 veckor sedanAre Ukraine’s attacks on Russian energy infrastructure working?

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanGuld nära 4000 USD och silver 50 USD, därför kan de fortsätta stiga

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanGuldpriset uppe på nya höjder, nu 3750 USD