Analys

Oil price is mostly fundamentals, not geopolitical risk premium

Brent crude has recovered to above USD 90/b again. Risk premium due to Israel/Gaza? Maybe not so much at all. Latest data from the IEA indicates that the global oil market ran an implied deficit of 2.1 m b/d in August, a deficit of 0.7 m b/d in September and a likely deficit of 1.2 m b/d in Q4-23. Inventory draws have mostly taken place in floating stocks and in non-OECD. Inventories which are typically harder to track. Demand growth of 2.3 m b/d this year has more or less entirely taken place in non-OECD. As such it is not so strange that inventory draws have first taken place just there as well. But if we continue to run a deficit of 1.2 m b/d in Q4-23 then we should eventually see OECD stocks starting to draw down as well. This should keep oil prices well supported in Q4-23. The US EIA last week lifted its outlook for Brent crude for 2024 to USD 95/b (+7) on the back of slowing US shale oil growth leaving OPEC in good control of the market.

Brent crude sold off sharply at the end of September as longer dated bond yields rallied and markets feared that central banks would keep rates high for longer leading to a recession in the end with associated weak oil demand and falling oil price. One can of course question if that is the right interpretation. If market had really turned bearish on the economic outlook (recession, crash,..), then longer dated bond yields should have gone down and not up as they did. Hm, well, maybe oil was just ripe for a bearish correction following a long upturn in prices since late June and only needed some kind of bearish catalyst story to set off that correction in late September. The sell-off was short-lived as the attack on Israel by Hamas on 7 October made oil jump back up above USD 90/b again. The low-point in the recent sell-off was a close of USD 84/b on 6 October. With Brent crude now at USD 90/b the most immediate interpretation is that we now have a USD 6/b risk premium in the oil price due to Israel/Hamas/Gaza. The fear is that the conflict might spiral out and eventually lead to real loss of supply with Iran being most at risk there. But such geopolitical risk premiums are usually short-lived unless actual supply disruptions occur. The most immediate fear is that the US would impose harsher sanctions towards Iran which is Hamas’ biggest backer. But US Treasury Secretary Jannet Yellen stated on 11 Oct that the US has no plans to impose new sanctions on Iran.

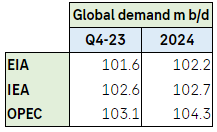

So let’s leave possible recession fears as well as geopolitical risk premiums aside and instead just look at the current state and the outlook for the oil market. The three main monthly oil market reports from IEA, US EIA and OPEC were out last week. One thing that stands out is a continued disagreement of what oil demand is today and what it will be tomorrow. On 2024 the IEA and the EIA partially agrees while OPEC is in a camp of its own. But one thing is to have strongly diverging outlooks for demand in 2024. Another is to have extremely wide estimates for what demand is here and now in Q4-23. This shows that there is still a very high uncertainty of what is actually the current state of the oil market. Deficit, balanced, surplus?

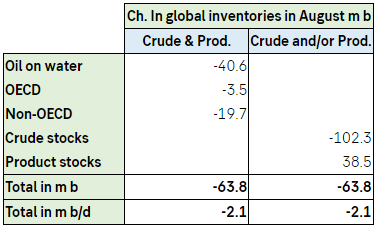

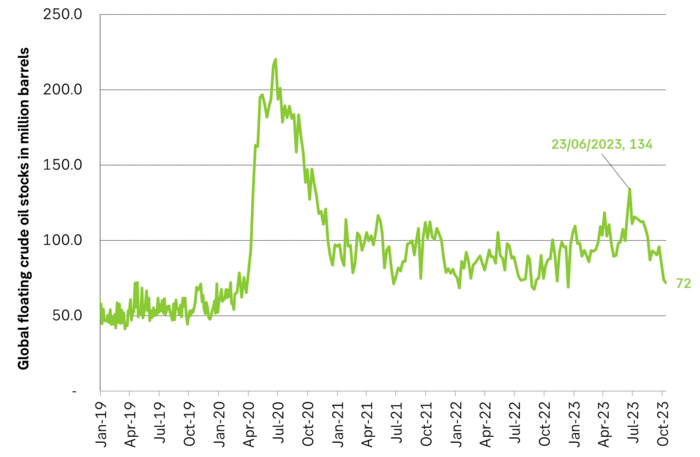

The most prominent of the three reports, the IEA, made few changes to its overall projects vs. its September report. Changes were typically +/- 100 k b/d or less for most items. The reports was however still very interesting with respect to clues to what is the actual state of the market balance. The proof of the pudding is always the change in oil inventories and as such always in hindsight. IEA data showed that global oil inventories declined by 63.8 m b in August which equals a deficit of 2.1 m b/d. Preliminary inventory data for September indicates an implied deficit of 0.7 m b/d.

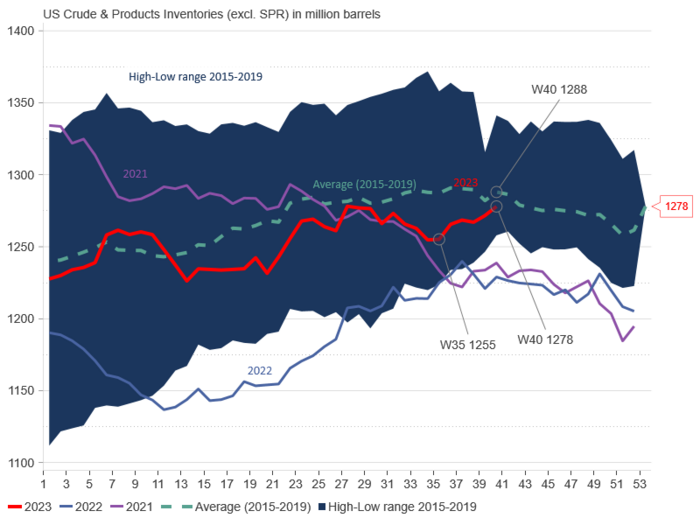

Important here is that the stock draws in August mostly took place in oil on water and in non-OECD. These stocks are typically less easily observable. Oil markets are often highly focused on more easily observable data like the weekly US oil inventories as well as EU and Japan. The US commercial crude and product stocks have moved upwards since week 35 (late August) so that in the last data point the US commercial stocks are only 10 m b below the 2015-19 seasonal average. This has undoubtedly been a bearish factor for oil prices lately and probably contributed to the sell-off in late September, early October.

US crude and product stocks (excl. SPR)

1) The global August and September (indic.) inventory data from IEA gives credibility to its current assessment of the global oil market. For Q4-23 it estimates Call-on-OPEC at 29.3 m b/d. Russia and Saudi Arabia last week held a joint statement heralding that they would keep production at current level to the end of year. With OPEC production steady at 28 m b/d it implies a global oil market deficit of 1.2 m b/d. For H1-24 its estimates a call-on-OPEC of 27.7 m b/d. This means that Saudi Arabia and Russia will likely stick to their current production levels also in H1-24. But then the market will likely be balanced rather than in deficit like it has been in Q3-23 and Q4-23.

2) The global oil market is very large with significant dynamical time lags. IEA estimates a global consumption growth this year of 2.3 m b/d. China accounts for 77% of this and non-OECD accounts for 97%. So oil demand growth this year is all taking place in non-OECD. As such it is not so surprising that inventory draws have been taking place there and on-water rather than in the OECD. But a global deficit will eventually involve also the OECD inventories. The demand-pull this year has been all about non-OECD. First you draw down non-OECD supply chains, inventories and on-water oil. Then you start to pull more oil from the wider market which eventually involve a draw-down also in OECD inventories. IEA’s estimate of an implied deficit of about 1.2 m b/d in Q4-23. So if we have already drawn down non-OECD supply chains and oil on water we might start to see a significant draw in OECD stocks in Q4-23 if the market runs an estimated 1.2 m b/d as estimated by the IEA.

3) Worth noting however is IEA’s warning that higher oil prices are starting to hurt demand. Demand in Nigeria, Pakistan and Egypt are all down 10% or more while US demand for gasoline also has shown significant demand weaknesses. For 2024 the IEA only projects a global demand growth of 0.9 m b/d YoY along with weaker global economic growth. Non-OPEC production continues to grow robustly at 1.3 m b/d with the result that call-on-OPEC falls from 28.8 m b/d this year to 28.3 m b/d next year. This is of course negative for OPEC and gives a bearish tint to the oil market next year. But it is still not so weak that OPEC will give up on holding the price where they (Saudi/Russia) want it to be. But implies that Saudi/Russia/OPEC will have to stick to current production levels through most of 2024.

Floating crude oil stocks in million barrels

Analys

Brent edges higher as India–Russia oil trade draws U.S. ire and Powell takes the stage at Jackson Hole

Best price since early August. Brent crude gained 1.2% yesterday to settle at USD 67.67/b, the highest close since early August and the second day of gains. Prices traded to an intraday low of USD 66.74/b before closing up on the day. This morning Brent is ticking slightly higher at USD 67.76/b as the market steadies ahead of Fed Chair Jerome Powell’s Jackson Hole speech later today.

No Russia/Ukraine peace in sight and India getting heat from US over imports of Russian oil. Yesterday’s price action was driven by renewed geopolitical tension and steady underlying demand. Stalled ceasefire talks between Russia and Ukraine helped maintain a modest risk premium, while the spotlight turned to India’s continued imports of Russian crude. Trump sharply criticized New Delhi’s purchases, threatening higher tariffs and possible sanctions. His administration has already announced tariff hikes on Indian goods from 25% to 50% later this month. India has pushed back, defending its right to diversify crude sourcing and highlighting that it also buys oil from the U.S. Moscow meanwhile reaffirmed its commitment to supply India, deepening the impression that global energy flows are becoming increasingly politicized.

Holding steady this morning awaiting Powell’s address at Jackson Hall. This morning the main market focus is Powell’s address at Jackson Hole. It is set to be the key event for markets today, with traders parsing every word for signals on the Fed’s policy path. A September rate cut is still the base case but the odds have slipped from almost certainty earlier this month to around three-quarters. Sticky inflation data have tempered expectations, raising the stakes for Powell to strike the right balance between growth concerns and inflation risks. His tone will shape global risk sentiment into the weekend and will be closely watched for implications on the oil demand outlook.

For now, oil is holding steady with geopolitical frictions lending support and macro uncertainty keeping gains in check.

Oil market is starting to think and worry about next OPEC+ meeting on 7 September. While still a good two weeks to go, the next OPEC+ meeting on 7 September will be crucial for the oil market. After approving hefty production hikes in August and September, the question is now whether the group will also unwind the remaining 1.65 million bpd of voluntary cuts. Thereby completing the full phase-out of voluntary reductions well ahead of schedule. The decision will test OPEC+’s balancing act between volume-driven influence and price stability. The gathering on 7 September may give the clearest signal yet of whether the group will pause, pivot, or press ahead.

Analys

Brent sideways on sanctions and peace talks

Brent crude is currently trading around USD 66.2 per barrel, following a relatively tight session on Monday, where prices ranged between USD 65.3 and USD 66.8. While expectations of higher OPEC+ supply continue to weigh on sentiment, recent headlines have been dominated by geopolitics – particularly developments in Washington.

At the center is the White House meeting between Trump, Zelenskyy, and several key European leaders. During the meeting, Trump reportedly placed a direct call to Putin to discuss a potential bilateral sit-down between Putin and Zelenskyy, which several European officials have said could take place within two weeks.

While the Kremlin’s response remains vague, markets have interpreted this as a modestly positive signal, with both equities and global oil prices holding steady. Brent is marginally lower since yesterday’s close, while U.S. and Asian equity markets remain broadly flat.

Still, the political undertone is shifting, and markets may be underestimating the longer-term implications. According to the NY times, Putin has proposed a peace plan under which Russia would claim full control of the Donbas in exchange for dropping demands over Kherson and Zaporizhzhia – territories it has not yet seized.

Meanwhile, discussions around Ukraine’s long-term security framework are starting to take shape. Zelenskyy appeared encouraged by Trump’s openness to supporting a post-war security guarantee for Ukraine. While the exact terms remain unclear, U.S. special envoy Steve Witkoff stated that Putin had signaled willingness to allow Washington and its allies to offer Kyiv a NATO-style collective defense guarantee – a move that would significantly reshape the regional security landscape.

As diplomatic efforts gain momentum, markets are also beginning to assess the potential consequences of a partial or full rollback of U.S. sanctions on Russian energy. Any unwind would likely be gradual and uneven, especially if European allies resist or delay alignment. The U.S. could act unilaterally by loosening financial restrictions, granting Russian firms greater access to Western capital and services, and effectively neutralizing the price cap mechanism. However, the EU embargo on Russian crude and products remains a more immediate constraint on flows – particularly as it continues to tighten.

Even if the U.S. were to ease restrictions, Moscow would remain heavily reliant on buyers like India and China to absorb the majority of its crude exports, as European countries are unlikely to quickly re-engage in energy trade. That shift is already playing out. As India pulls back amid newly doubled U.S. tariffs – a response to its ongoing Russian oil purchases – Chinese refiners have stepped in.

So far in August, Chinese imports of Russia’s Urals crude – typically shipped from Baltic and Black Sea ports – have nearly doubled from the YTD average, with at least two tankers idling off Zhoushan and more reportedly en route (Kpler data). The uptick is driven by attractive pricing and the absence of direct U.S. trade penalties on China, which remains in a delicate tariff truce with Washington.

Indian refiners, by contrast, are notably more cautious – receiving offers but accepting few. The takeaway is clear: China is acting as the buyer of last resort for surplus Russian barrels, likely directing them into strategic storage. While this may temporarily cushion the effects of sanctions relief, it cannot fully offset the constraints imposed by Europe’s ongoing absence.

As a result, any meaningful boost to global supply from a rollback of U.S. sanctions on Russia may take longer to materialize than headlines suggest.

Analys

Crude inventories builds, diesel remain low

U.S. commercial crude inventories posted a 3-million-barrel build last week, according to the DOE, bringing total stocks to 426.7 million barrels – now 6% below the five-year seasonal average. The official figure came in above Tuesday’s API estimate of a 1.5-million-barrel increase.

Gasoline inventories fell by 0.8 million barrels, bringing levels roughly in line with the five-year norm. The composition was mixed, with finished gasoline stocks rising, while blending components declined.

Diesel inventories rose by 0.7 million barrels, broadly in line with the API’s earlier reading of a 0.3-million-barrel increase. Despite the weekly build, distillate stocks remain 15% below the five-year average, highlighting continued tightness in diesel supply.

Total commercial petroleum inventories (crude and products combined, excluding SPR) rose by 7.5 million barrels on the week, bringing total stocks to 1,267 million barrels. While inventories are improving, they remain below historical norms – especially in distillates, where the market remains structurally tight.

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanKopparpriset i fritt fall i USA efter att tullregler presenterats

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanLundin Gold rapporterar enastående borrresultat vid Fruta del Norte

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanStargate Norway, AI-datacenter på upp till 520 MW etableras i Narvik

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanMängden M1-pengar ökar kraftigt

-

Nyheter2 veckor sedan

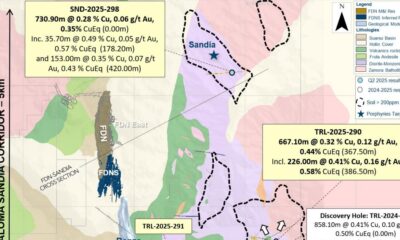

Nyheter2 veckor sedanLundin Gold hittar ny koppar-guld-fyndighet vid Fruta del Norte-gruvan

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanGuld stiger till över 3500 USD på osäkerhet i världen

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanOmgående mångmiljardfiasko för Equinors satsning på Ørsted och vindkraft

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanAlkane Resources och Mandalay Resources har gått samman, aktör inom guld och antimon