Analys

An age of unprecedented oil volatility

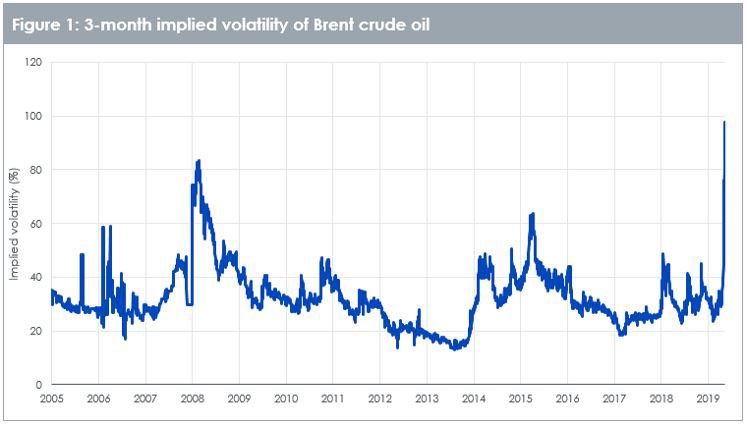

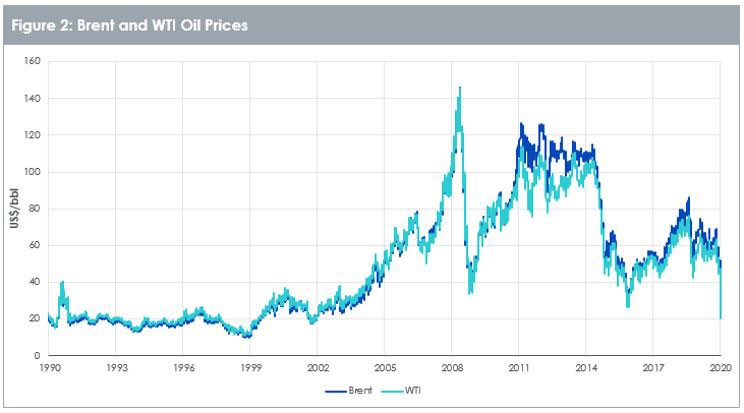

We are living in a time of unprecedented volatility in oil. That is the consequence of a twin shock: both demand is collapsing and supply is rising. Oil prices are now more volatile than they were in the Great Financial Crisis (that started in 2008) or the oil price war of 2014-2016.

The sheer drop in prices over a short timespan has rarely been seen before. Neither in 2008 nor 2014 did we see such a sharp decline. If we were to annualise the price decline we have seen in the past two weeks, it will outpace the price declines of 2008 and 2014.

The protagonist seeks vengeance

As we discussed in Post OPEC meeting note -OPEC’s Greek Tragedy, the events of 5th and 6th March profoundly changed the oil markets. The Organization of the Petroleum Exporting Countries (OPEC) and its partner countries (collectively known as OPEC+) failed to reach an agreement on policy. We believe that OPEC is functionally dead as a result. Since 2017, OPEC has been reliant on Russia to endorse OPEC’s policy and even though Russia has habitually failed to follow through with implementation of quotas in full, the unity has been symbolically important as Saudi Arabia has been willing to cut more than its fair share to compensate. With Russia’s betrayal to this alliance, Saudi Arabia is now slashing prices and raising production. The chart below shows the Saudi official selling price of Arab light crude oil to Asia as a spread over the average cash Dubai price and Oman crude oil future price. Saudi Arabia is selling oil at close to a US$3/bbl discount to its peers. After Saudi Arabia refused to participate in the Joint Technical Committee originally scheduled for March 18th, the meeting was cancelled.

To be clear, Saudi Arabia now has its own agenda: to inflict maximum pain on Russia and it doesn’t seem to care which casualties it will take with it. Saudi Arabia intends to expand capacity to 13 million barrels per day from 12 million barrels per day currently. Saudi Arabia was producing 9.6 million barrels per day in February 2020. If Saudi Arabia produces at capacity, the world will be awash with oil.

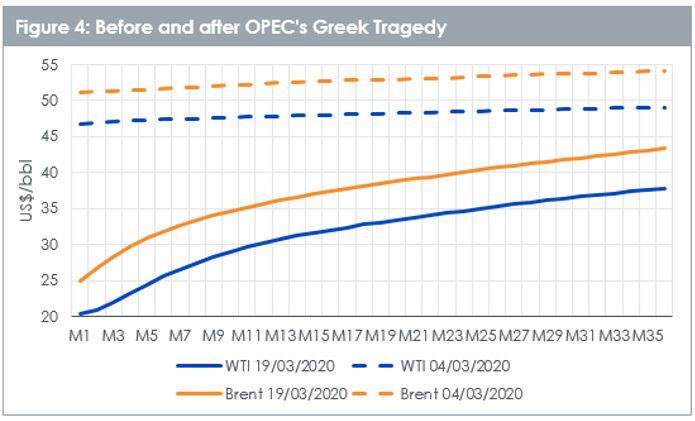

Twin shocks drive extreme contango

This supply shock is coming at a time when demand is severely hampered by COVID19. This double-whammy has caused extreme contango in the oil markets. The day before the OPEC meetings, oil was in mild contango, with the difference between 1st and 36th contract only between US$2bbl and US$3bbl (WTI and Brent). On 19th March 2020, the contango has become extreme, with the difference between 1st and 36th contract between US$17/bbl and US$18/bbl (WTI and Brent). Only in the depths of the 2008 Great Financial Crisis had we seen contango this deep.

Where will this end?

The pain from the 2014-2016 oil price war is still raw in OPEC countries’ memories, yet it failed to deter Saudi Arabia from engaging in a fresh price war with Russia. We don’t think that the group will change course anytime soon. We don’t think the rest of OPEC can operate without Saudi Arabia. Saudi has been responsible for most of the group’s swing-production – i.e. building spare production capacity that can be used in times of demand surges or supply outages.

We doubt that the rest of the world will be able to adjust to this new reality quickly. Most global oil companies do not use the Saudi Aramco (state oil company in Saudi Arabia) model of keeping redundant capacity. Shuttering production for most oil companies is slow and costly to the point of putting the company’s finances under fatal strain.

There have been discussions, confirmed by US Energy Secretary Dan Brouillette of the possibility of a joint US-Saudi oil alliance. It was only one of many strategies discussed by policy makers in the US and we doubt that the US will partake in a cartel that it has been criticizing for decades. But desperate times may call for desperate measures. After all, the OPEC cartel was designed on the Texan oil practices from the 1930s to 1970s2.

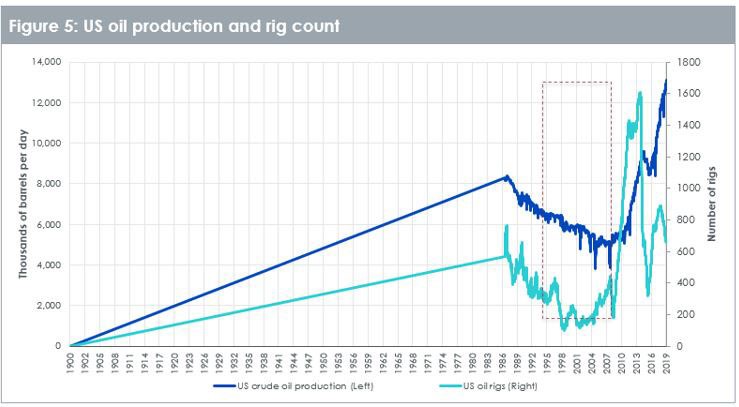

More likely, we believe that the US will allow market economics to trim back on production. Our working assumption is that the breakeven price for oil production in the US is US$50/bbl. With WTI prices at US$25/bbl at the time of writing, US oil producers are going to suffer and we expect bankruptcies to soar. In the 2014-2016 oil price war, rigs in operation in the US fell by two-thirds. The US is dominated by shale oil production, which does not have the same lengthy lead times for switching on and off production as traditional oil production. But the decline in rigs came at a time when technological improvements to production techniques were rising fast. So, the ultimate decline in production was not that steep. This time, rigs in operation which have already been declining for a year could be matched by commensurate declines in production. The US could in effect become the world’s new swing producer.

Analys

What OPEC+ is doing, what it is saying and what we are hearing

Down 4.4% last week with more from OPEC+, a possible truce in Ukraine and weak US data. Brent crude fell 4.4% last week with a close of the week of USD 66.59/b and a range of USD 65.53-69.98/b. Three bearish drivers were at work. One was the decision by OPEC+ V8 to lift its quotas by 547 kb/d in September and thus a full unwind of the 2.2 mb/d of voluntary cuts. The second was the announcement that Trump and Putin will meet on Friday 15 August to discuss the potential for cease fire in Ukraine (without Ukraine). I.e. no immediate new sanctions towards Russia and no secondary sanctions on buyers of Russian oil to any degree that matters for the oil price. The third was the latest disappointing US macro data which indicates that Trump’s tariffs are starting to bite. Brent is down another 1% this morning trading close to USD 66/b. Hopes for a truce on the horizon in Ukraine as Putin meets with Trump in Alaska in Friday 15, is inching oil lower this morning.

Trump – Putin meets in Alaska. The potential start of a process. No disruption of Russian oil in sight. Trump has invited Putin to Alaska on 15 August to discuss Ukraine. The first such invitation since 2007. Ukraine not being present is bad news for Ukraine. Trump has already suggested ”swapping of territory”. This is not a deal which will be closed on Friday. But rather a start of a process. But Trump is very, very unlikely to slap sanctions on Russian oil while this process is ongoing. I.e. no disruption of Russian oil in sight.

What OPEC+ is doing, what it is saying and what we are hearing. OPEC+ V8 is done unwinding its 2.2 mb/d in September. It doesn’t mean production will increase equally much. Since it started the unwind and up to July (to when we have production data), the increase in quotas has gone up by 1.4 mb/d, while actual production has gone up by less than 0.7 mb/d. Some in the V8 group are unable to increase while others, like Russia and Iraq are paying down previous excess production debt. Russia and Iraq shouldn’t increase production before Jan and Mar next year respectively.

We know that OPEC+ has spare capacity which it will deploy back into the market at some point in time. And with the accelerated time-line for the redeployment of the 2.2 mb/d voluntary cuts it looks like it is happening fast. Faster than we had expected and faster than OPEC+ V8 previously announced.

As bystanders and watchers of the oil market we naturally combine our knowledge of their surplus spare capacity with their accelerated quota unwind and the combination of that is naturally bearish. Amid this we are not really able to hear or believe OPEC+ when they say that they are ready to cut again if needed. Instead we are kind of drowning our selves out in a combo of ”surplus spare capacity” and ”rapid unwind” to conclude that we are now on a highway to a bear market where OPEC+ closes its eyes to price and blindly takes back market share whatever it costs. But that is not what the group is saying. Maybe we should listen a little.

That doesn’t mean we are bullish for oil in 2026. But we may not be on a ”highway to bear market” either where OPEC+ is blind to the price.

Saudi OSPs to Asia in September at third highest since Feb 2024. Saudi Arabia lifted its official selling prices to Asia for September to the third highest since February 2024. That is not a sign that Saudi Arabia is pushing oil out the door at any cost.

Saudi Arabia OSPs to Asia in September at third highest since Feb 2024

Analys

Breaking some eggs in US shale

Lower as OPEC+ keeps fast-tracking redeployment of previous cuts. Brent closed down 1.3% yesterday to USD 68.76/b on the back of the news over the weekend that OPEC+ (V8) lifted its quota by 547 kb/d for September. Intraday it traded to a low of USD 68.0/b but then pushed higher as Trump threatened to slap sanctions on India if it continues to buy loads of Russian oil. An effort by Donald Trump to force Putin to a truce in Ukraine. This morning it is trading down 0.6% at USD 68.3/b which is just USD 1.3/b below its July average.

Only US shale can hand back the market share which OPEC+ is after. The overall picture in the oil market today and the coming 18 months is that OPEC+ is in the process of taking back market share which it lost over the past years in exchange for higher prices. There is only one source of oil supply which has sufficient reactivity and that is US shale. Average liquids production in the US is set to average 23.1 mb/d in 2025 which is up a whooping 3.4 mb/d since 2021 while it is only up 280 kb/d versus 2024.

Taking back market share is usually a messy business involving a deep trough in prices and significant economic pain for the involved parties. The original plan of OPEC+ (V8) was to tip-toe the 2.2 mb/d cuts gradually back into the market over the course to December 2026. Hoping that robust demand growth and slower non-OPEC+ supply growth would make room for the re-deployment without pushing oil prices down too much.

From tip-toing to fast-tracking. Though still not full aggression. US trade war, weaker global growth outlook and Trump insisting on a lower oil price, and persistent robust non-OPEC+ supply growth changed their minds. Now it is much more fast-track with the re-deployment of the 2.2 mb/d done already by September this year. Though with some adjustments. Lifting quotas is not immediately the same as lifting production as Russia and Iraq first have to pay down their production debt. The OPEC+ organization is also holding the door open for production cuts if need be. And the group is not blasting the market with oil. So far it has all been very orderly with limited impact on prices. Despite the fast-tracking.

The overall process is nonetheless still to take back market share. And that won’t be without pain. The good news for OPEC+ is of course that US shale now is cooling down when WTI is south of USD 65/b rather than heating up when WTI is north of USD 45/b as was the case before.

OPEC+ will have to break some eggs in the US shale oil patches to take back lost market share. The process is already in play. Global oil inventories have been building and they will build more and the oil price will be pushed lower.

A Brent average of USD 60/b in 2026 implies a low of the year of USD 45-47.5/b. Assume that an average Brent crude oil price of USD 60/b and an average WTI price of USD 57.5/b in 2026 is sufficient to drive US oil rig count down by another 100 rigs and US crude production down by 1.5 mb/d from Dec-25 to Dec-26. A Brent crude average of USD 60/b sounds like a nice price. Do remember though that over the course of a year Brent crude fluctuates +/- USD 10-15/b around the average. So if USD 60/b is the average price, then the low of the year is in the mid to the high USD 40ies/b.

US shale oil producers are likely bracing themselves for what’s in store. US shale oil producers are aware of what is in store. They can see that inventories are rising and they have been cutting rigs and drilling activity since mid-April. But significantly more is needed over the coming 18 months or so. The faster they cut the better off they will be. Cutting 5 drilling rigs per week to the end of the year, an additional total of 100 rigs, will likely drive US crude oil production down by 1.5 mb/d from Dec-25 to Dec-26 and come a long way of handing back the market share OPEC+ is after.

Analys

More from OPEC+ means US shale has to gradually back off further

The OPEC+ subgroup V8 this weekend decided to fully unwind their voluntary cut of 2.2 mb/d. The September quota hike was set at 547 kb/d thereby unwinding the full 2.2 mb/d. This still leaves another layer of voluntary cuts of 1.6 mb/d which is likely to be unwind at some point.

Higher quotas however do not immediately translate to equally higher production. This because Russia and Iraq have ”production debts” of cumulative over-production which they need to pay back by holding production below the agreed quotas. I.e. they cannot (should not) lift production before Jan (Russia) and March (Iraq) next year.

Argus estimates that global oil stocks have increased by 180 mb so far this year but with large skews. Strong build in Asia while Europe and the US still have low inventories. US Gulf stocks are at the lowest level in 35 years. This strong skew is likely due to political sanctions towards Russian and Iranian oil exports and the shadow fleet used to export their oil. These sanctions naturally drive their oil exports to Asia and non-OECD countries. That is where the surplus over the past half year has been going and where inventories have been building. An area which has a much more opaque oil market. Relatively low visibility with respect to oil inventories and thus weaker price signals from inventory dynamics there.

This has helped shield Brent and WTI crude oil price benchmarks to some degree from the running, global surplus over the past half year. Brent crude averaged USD 73/b in December 2024 and at current USD 69.7/b it is not all that much lower today despite an estimated global stock build of 180 mb since the end of last year and a highly anticipated equally large stock build for the rest of the year.

What helps to blur the message from OPEC+ in its current process of unwinding cuts and taking back market share, is that, while lifting quotas, it is at the same time also quite explicit that this is not a one way street. That it may turn around make new cuts if need be.

This is very different from its previous efforts to take back market share from US shale oil producers. In its previous efforts it typically tried to shock US shale oil producers out of the market. But they came back very, very quickly.

When OPEC+ now is taking back market share from US shale oil it is more like it is exerting a continuous, gradually increasing pressure towards US shale oil rather than trying to shock it out of the market which it tried before. OPEC+ is now forcing US shale oil producers to gradually back off. US oil drilling rig count is down from 480 in Q1-25 to now 410 last week and it is typically falling by some 4-5 rigs per week currently. This has happened at an average WTI price of about USD 65/b. This is very different from earlier when US shale oil activity exploded when WTI went north of USD 45/b. This helps to give OPEC+ a lot of confidence.

Global oil inventories are set to rise further in H2-25 and crude oil prices will likely be forced lower though the global skew in terms of where inventories are building is muddying the picture. US shale oil activity will likely decline further in H2-25 as well with rig count down maybe another 100 rigs. Thus making room for more oil from OPEC+.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanUSA inför 93,5 % tull på kinesisk grafit

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanFusionsföretag visar hur guld kan produceras av kvicksilver i stor skala – alkemidrömmen ska bli verklighet

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanWestinghouse planerar tio nya stora kärnreaktorer i USA – byggstart senast 2030

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanKopparpriset i fritt fall i USA efter att tullregler presenterats

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanRyska militären har skjutit ihjäl minst 11 guldletare vid sin gruva i Centralafrikanska republiken

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanEurobattery Minerals förvärvar majoritet i spansk volframgruva

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanLundin Gold rapporterar enastående borrresultat vid Fruta del Norte

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanKina skärper kontrollen av sällsynta jordartsmetaller, vill stoppa olaglig export