Analys

Market does not care about US shale, but it should. It is now growing as it did in 2014

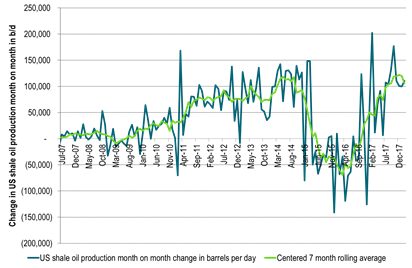

Yesterday’s US EIA Drilling Productivity Report (DPR) showed that US crude oil production is now growing at a marginal rate of 1.3 mb/d/yr and as strongly as it did in 2014. If we adjust for increased well productivity then completions of wells in December stood 27% above the 2014 average. We estimate that volume drilling productivity rose 23% from 4Q16 to 4Q17. Drilling is still running well ahead of completions and we estimate that the number of rigs could decline by 200 rigs without hurting the current marginal production growth. Unless there is a significant set-back in global oil markets or sentiment or in the US shale space with a drop in completions per month we should see US crude production averaging close to 10.7 mb/d in 2018 thus growing 1.38 mb/d y/y average 2017 to average 2018. In addition comes US NGL’s growth of 0.5 mb/d y/y which will bring total US liquids growth to 1.88 mb/d for average 2017 to average 2018.

Yesterday’s US EIA Drilling Productivity Report (DPR) showed that US crude oil production is now growing at a marginal rate of 1.3 mb/d/yr and as strongly as it did in 2014. If we adjust for increased well productivity then completions of wells in December stood 27% above the 2014 average. We estimate that volume drilling productivity rose 23% from 4Q16 to 4Q17. Drilling is still running well ahead of completions and we estimate that the number of rigs could decline by 200 rigs without hurting the current marginal production growth. Unless there is a significant set-back in global oil markets or sentiment or in the US shale space with a drop in completions per month we should see US crude production averaging close to 10.7 mb/d in 2018 thus growing 1.38 mb/d y/y average 2017 to average 2018. In addition comes US NGL’s growth of 0.5 mb/d y/y which will bring total US liquids growth to 1.88 mb/d for average 2017 to average 2018.

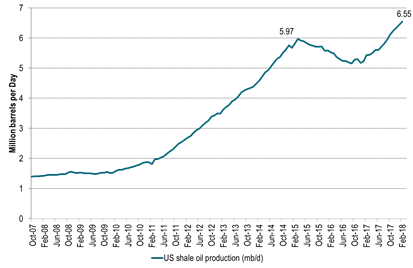

Yesterday’s US DPR report showed that shale oil production is growing as strongly now as it did in 2014 when it grew at a monthly rate of 114 k bl/d/mth (1.4 mb/d rate).

The EIA estimates that US shale oil production will grow by 110 k bl/d from Jan to Feb which is a marginal rate of 1.3 mb/d. This is in stark contrast to EIA’s latest monthly oil report which predicted crude oil production from US lower 48 states (ex Gulf of Mexico) would only grow at a rate of 33 k bl/d in 1Q18 and on average only 42 k bl/d through 2018.

Yesterday’s DPR report shows that US shale oil production is growing 160% faster than what the US EIA uses in its STEO report assumptions for 2018 forecast. It shows that the US EIA will have to revise its US crude oil production forecast for 2018 significantly higher. It has revised it upwards in its last four reports. It is far from done doing so in our view.

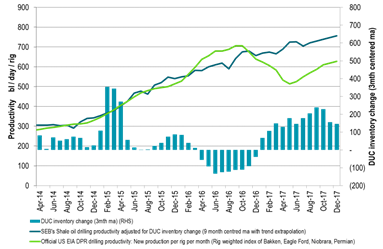

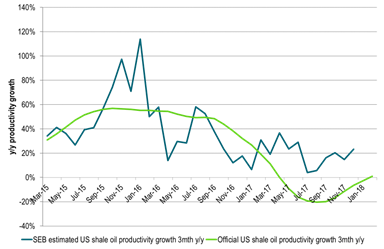

US shale oil volume productivity growth (new oil per rig in operation) is in our calculations up 23% y/y 4Q17 to 4Q16. This is in strong contrast to EIA’s official productivity measure of zero growth which is not taking account of the huge build-up of DUCs.

Drilling of wells is still running significantly ahead of completions with the inventory of uncompleted wells rising by 156 wells in December. Completions are struggling to catch up. Either drilling will have to fall or completions will have to speed up in order to prevent a further build-up of DUCs. Players should kick out 100 drilling rigs in order to get drilling in line with completions. In order to draw down the DUC inventory they should kick out another 100 rigs more and thus a total 200 rigs while keeping completions at current level. The market should thus not be optimistic on prices due to a decline in US drilling rig count.

Completions of wells rose to (1091) the highest level since April 2015. However, if the number of completions is adjusted for increasing well productivity then well completions in December 2017 came in at the highest level since these data started in Jan 2014 and 27% higher than well completions on average in 2014.

In our view it seems reasonable to assume that US shale oil production will grow at its current speed through 2018 which means a total growth of 1.32 mb/d from Dec-17 to Dec-18. In addition comes a growth of 180 k bl/d from non-shale bringing the total US crude oil growth in 2018 to 1.5 mb/d. This will place US crude oil production at 10.68 mb/d on average for 2018 which is up 1.38 mb/d from 2017 average of 9.3 mb/d. In addition comes a 0.5 mb/d growth in US NGLs bringing total US liquids growth to 1.88 mb/d y/y average 2017 to average 2018.

Chart 1: US shale oil production to a new all-time-high in February

Growing like it did in 2014.

Chart 2: US shale oil production growing as strongly as it did in 2014

Chart 3: The number of drilled but uncompleted wells is still growing briskly

Thus drilling is running ahead of completions. Completions trying to catch up.

Players should kick out 200 drilling rigs in order to draw down the DUCs

Chart 4: US volume drilling productivity is up 23% from 4Q16 to 4Q17 in our calculations

That is very different from the official US EIA drilling productivity measure which does not take account of the shifts in the DUC inventory

Chart 5: Thus US shale oil volume drilling productivity per rig never really declined y/y

Instead it has stayed at a pretty solid level of around +-20% y/y

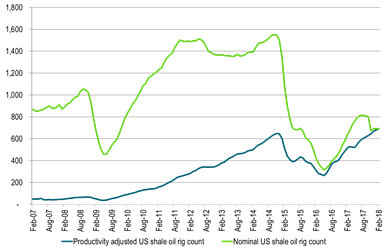

Chart 6: Today’s drilling rig count is 21% above the average 2014 count in real terms

Adjusting historical rig count with today’s official US EIA drilling productivity

Official US drilling productivity is today 2.6 times as high as it was on average in 2014

Kind regards

Bjarne Schieldrop

Chief analyst, Commodities

SEB Markets

Merchant Banking

Analys

Brent needs to fall to USD 58/b to make cheating unprofitable for Kazakhstan

Brent jumping 2.4% as OPEC+ lifts quota by ”only” 411 kb/d in July. Brent crude is jumping 2.4% this morning to USD 64.3/b following the decision by OPEC+ this weekend to lift the production cap of ”Voluntary 8” (V8) by 411 kb/d in July and not more as was feared going into the weekend. The motivation for the triple hikes of 411 kb/d in May and June and now also in July has been a bit unclear: 1) Cheating by Kazakhstan and Iraq, 2) Muhammed bin Salman listening to Donald Trump for more oil and a lower oil price in exchange for weapons deals and political alignments in the Middle East and lastly 3) Higher supply to meet higher demand for oil this summer. The argument that they are taking back market share was already decided in the original plan of unwinding the 2.2 mb/d of V8 voluntary cuts by the end of 2026. The surprise has been the unexpected speed with monthly increases of 3×137 kb/d/mth rather than just 137 kb/d monthly steps.

No surplus yet. Time-spreads tightened last week. US inventories fell the week before last. In support of point 3) above it is worth noting that the Brent crude oil front-end backwardation strengthened last week (sign of tightness) even when the market was fearing for a production hike of more than 411 kb/d for July. US crude, diesel and gasoline stocks fell the week before last with overall commercial stocks falling 0.7 mb versus a normal rise this time of year of 3-6 mb per week. So surplus is not here yet. And more oil from OPEC+ is welcomed by consumers.

Saudi Arabia calling the shots with Russia objecting. This weekend however we got to know a little bit more. Saudi Arabia was predominantly calling the shots and decided the outcome. Russia together with Oman and Algeria opposed the hike in July and instead argued for zero increase. What this alures to in our view is that it is probably the cheating by Kazakhstan and Iraq which is at the heart of the unexpectedly fast monthly increases. Saudi Arabia cannot allow it to be profitable for the individual members to cheat. And especially so when Kazakhstan explicitly and blatantly rejects its quota obligation stating that they have no plans of cutting production from 1.77 mb/d to 1.47 mb/d. And when not even Russia is able to whip Kazakhstan into line, then the whole V8 project is kind of over.

Is it simply a decision by Saudi Arabia to unwind faster altogether? What is still puzzling though is that despite the three monthly hikes of 411 kb/d, the revival of the 2.2 mb/d of voluntary production cuts is still kind of orderly. Saudi Arabia could have just abandoned the whole V8 project from one month to the next. But we have seen no explicit communication that the plan of reviving the cuts by the end of 2026 has been abandoned. It may be that it is simply a general change of mind by Saudi Arabia where the new view is that production cuts altogether needs to be unwinded sooner rather than later. For Saudi Arabia it means getting its production back up to 10 mb/d. That implies first unwinding the 2.2 mb/d and then the next 1.6 mb/d.

Brent would likely crash with a fast unwind of 2.2 + 1.6 mb/d by year end. If Saudi Arabia has decided on a fast unwind it would meant that the group would lift the quotas by 411 kb/d both in August and in September. It would then basically be done with the 2.2 mb/d revival. Thereafter directly embark on reviving the remaining 1.6 mb/d. That would imply a very sad end of the year for the oil price. It would then probably crash in Q4-25. But it is far from clear that this is where we are heading.

Brent needs to fall to USD 58/b or lower to make it unprofitable for Kazakhstan to cheat. To make it unprofitable for Kazakhstan to cheat. Kazakhstan is currently producing 1.77 mb/d versus its quota which before the hikes stood at 1.47 kb/d. If they had cut back to the quota level they might have gotten USD 70/b or USD 103/day. Instead they choose to keep production at 1.77 mb/d. For Saudi Arabia to make it a loss-making business for Kazakhstan to cheat the oil price needs to fall below USD 58/b ( 103/1.77).

Analys

All eyes on OPEC V8 and their July quota decision on Saturday

Tariffs or no tariffs played ping pong with Brent crude yesterday. Brent crude traded to a joyous high of USD 66.13/b yesterday as a US court rejected Trump’s tariffs. Though that ruling was later overturned again with Brent closing down 1.2% on the day to USD 64.15/b.

US commercial oil inventories fell 0.7 mb last week versus a seasonal normal rise of 3-6 mb. US commercial crude and product stocks fell 0.7 mb last week which is fairly bullish since the seasonal normal is for a rise of 4.3 mb. US crude stocks fell 2.8 mb, Distillates fell 0.7 mb and Gasoline stocks fell 2.4 mb.

All eyes are now on OPEC V8 (Saudi Arabia, Iraq, Kuwait, UAE, Algeria, Russia, Oman, Kazakhstan) which will make a decision tomorrow on what to do with production for July. Overall they are in a process of placing 2.2 mb/d of cuts back into the market over a period stretching out to December 2026. Following an expected hike of 137 kb/d in April they surprised the market by lifting production targets by 411 kb/d for May and then an additional 411 kb/d again for June. It is widely expected that the group will decide to lift production targets by another 411 kb/d also for July. That is probably mostly priced in the market. As such it will probably not have all that much of a bearish bearish price impact on Monday if they do.

It is still a bit unclear what is going on and why they are lifting production so rapidly rather than at a very gradual pace towards the end of 2026. One argument is that the oil is needed in the market as Middle East demand rises sharply in summertime. Another is that the group is partially listening to Donald Trump which has called for more oil and a lower price. The last is that Saudi Arabia is angry with Kazakhstan which has produced 300 kb/d more than its quota with no indications that they will adhere to their quota.

So far we have heard no explicit signal from the group that they have abandoned the plan of measured increases with monthly assessments so that the 2.2 mb/d is fully back in the market by the end of 2026. If the V8 group continues to lift quotas by 411 kb/d every month they will have revived the production by the full 2.2 mb/d already in September this year. There are clearly some expectations in the market that this is indeed what they actually will do. But this is far from given. Thus any verbal wrapping around the decision for July quotas on Saturday will be very important and can have a significant impact on the oil price. So far they have been tightlipped beyond what they will do beyond the month in question and have said nothing about abandoning the ”gradually towards the end of 2026” plan. It is thus a good chance that they will ease back on the hikes come August, maybe do no changes for a couple of months or even cut the quotas back a little if needed.

Significant OPEC+ spare capacity will be placed back into the market over the coming 1-2 years. What we do know though is that OPEC+ as a whole as well as the V8 subgroup specifically have significant spare capacity at hand which will be placed back into the market over the coming year or two or three. Probably an increase of around 3.0 – 3.5 mb/d. There is only two ways to get it back into the market. The oil price must be sufficiently low so that 1) Demand growth is stronger and 2) US shale oil backs off. In combo allowing the spare capacity back into the market.

Low global inventories stands ready to soak up 200-300 mb of oil. What will cushion the downside for the oil price for a while over the coming year is that current, global oil inventories are low and stand ready to soak up surplus production to the tune of 200-300 mb.

Analys

Brent steady at $65 ahead of OPEC+ and Iran outcomes

Following the rebound on Wednesday last week – when Brent reached an intra-week high of USD 66.6 per barrel – crude oil prices have since trended lower. Since opening at USD 65.4 per barrel on Monday this week, prices have softened slightly and are currently trading around USD 64.7 per barrel.

This morning, oil prices are trading sideways to slightly positive, supported by signs of easing trade tensions between the U.S. and the EU. European equities climbed while long-term government bond yields declined after President Trump announced a pause in new tariffs yesterday, encouraging hopes of a transatlantic trade agreement.

The optimisms were further supported by reports indicating that the EU has agreed to fast-track trade negotiations with the U.S.

More significantly, crude prices appear to be consolidating around the USD 65 level as markets await the upcoming OPEC+ meeting. We expect the group to finalize its July output plans – driven by the eight key producers known as the “Voluntary Eight” – on May 31st, one day ahead of the original schedule.

We assign a high probability to another sizeable output increase of 411,000 barrels per day. However, this potential hike seems largely priced in already. While a minor price dip may occur on opening next week (Monday morning), we expect market reactions to remain relatively muted.

Meanwhile, the U.S. president expressed optimism following the latest round of nuclear talks with Iran in Rome, describing them as “very good.” Although such statements should be taken with caution, a positive outcome now appears more plausible. A successful agreement could eventually lead to the return of more Iranian barrels to the global market.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanFörenade Arabemiraten siktar på att bygga ett datacenter på 5 GW, motsvarande fem stora kärnkraftsreaktorer

-

Analys4 veckor sedan

Analys4 veckor sedanA lower oil price AND a softer USD will lift global appetite for oil

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanSamtal om när oljepriserna vänder och gruvindustrins största frågor

-

Analys3 veckor sedan

Analys3 veckor sedanAn Israeli attack on Iran moves closer as Trump’s bully-diplomacy has reach a dead end

-

Analys3 veckor sedan

Analys3 veckor sedanBrent steady at $65 ahead of OPEC+ and Iran outcomes

-

Analys3 veckor sedan

Analys3 veckor sedanA shift to surplus will likely drive Brent towards the 60-line and the high 50ies

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanUSA slår nytt produktionsrekord av naturgas

-

Analys2 veckor sedan

Analys2 veckor sedanAll eyes on OPEC V8 and their July quota decision on Saturday