Analys

Still upside to crude oil spot prices into Q2-17 but softer again in H2-17

We expect front month Brent crude to head higher in Q2-17 to average $57.5/b but to toutch above $60/b at times.

We expect front month Brent crude to head higher in Q2-17 to average $57.5/b but to toutch above $60/b at times.

Refineries will move back into operation consuming more oil. OPEC is delivering on cuts and inventories will decline.

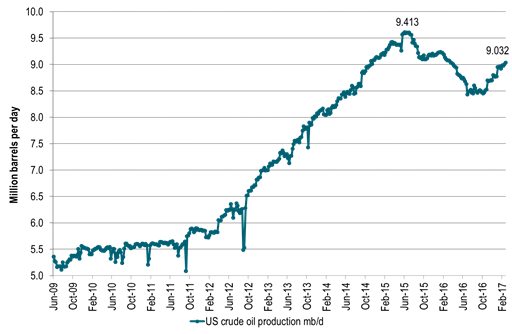

US crude production is now growing (marginally, annualized) as fast as it did between 2012 and May 2015.

We expect OPEC to end cuts after H1-17 as mission is accomplished: Inventories are steady or declining and spot crude oil prices are equal to or higher than longer dated contracts. Not much more OPEC can do.

We expect the front month Brent crude oil price to fall back in H2-17 in the face of strongly rising US shale oil production and reviving OPEC production.

Brent crude front month price to average $52.5/b in Q4-17 toutching $50/b at times.

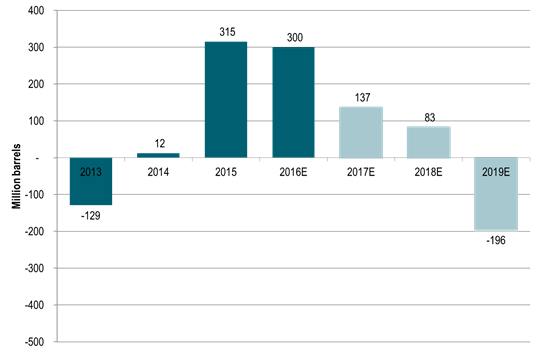

Higher than expected US shale oil rig additions since the start of the year has softening our projected deficit in 2019. However, we still see a substantial inventory draw below normal in 2019.

From the news flow:

Exxon will use 50% of its drilling budget for 2017 on US onshore drilling with its production there growing 20% pa to 2025

Libya’s crude oil production falls back again as clashes re-erupt

IEA: OPEC will increase its production capacity by 2 mb/d from 2016 to 2022 with Iraq lifting production to 5.4 mb/d in 2022

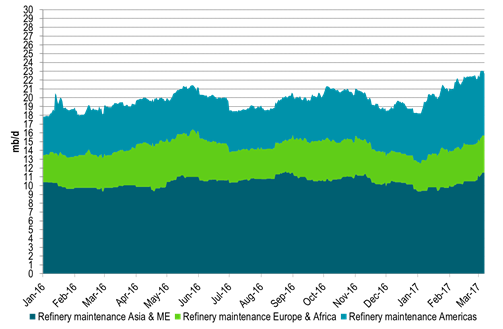

Ch1: Global refinery maintenance increased strongly in Q1-17 – Refineries soon to resume activity

A large increase in global refinery maintenance in Q1-17 left a comparble volume to be stored rather than processed

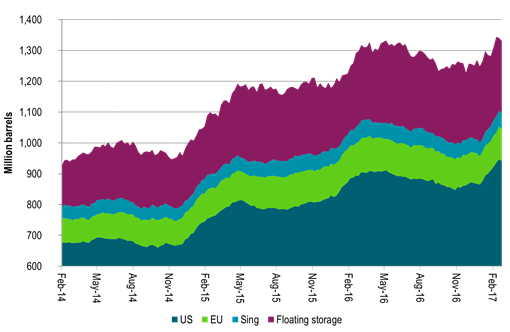

Ch2: Weekly inventories have rissen strongly in Q1-17 – Soon to decline.

OPEC also produced at record high level in Nov and Dec which has hit the market in Q1-17 along with several months of natural lag in the supply chain between production and consumption. Both helping to drive weekly inventory data up strongly in Q1-17

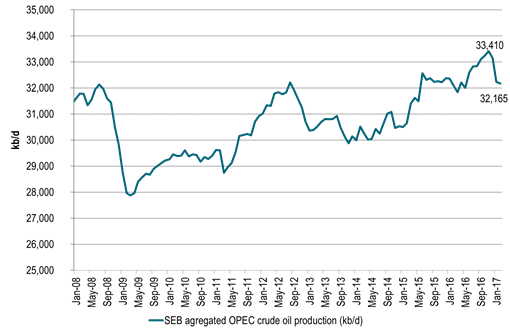

Ch3: OPEC delivers on cuts.

OPEC is delivering on its promises to cut. So when refineries move back on-line after maintenance and we also have the Nov and Dec OPEC production blob cleared out the the market we will see inventories starting to decline in Q2-17.

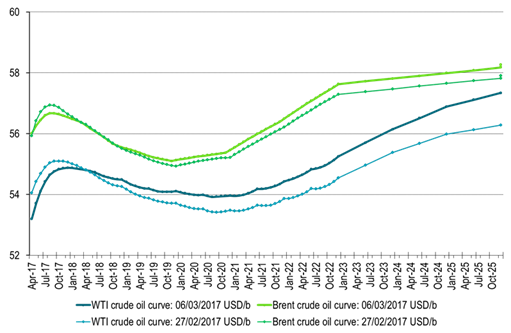

Ch4: Crude oil forward curve soon to move fully into backwardation

The forward crude curves will then move fully into backwardation with also the very front end of the curve (which is still in contango) moving into backwardation.

This is likely to lead front end Brent crude oil price up towards the $60/b mark with our expectation for an average Brent 1mth price of $57.5/b during Q2-17 touching $60/b at times.

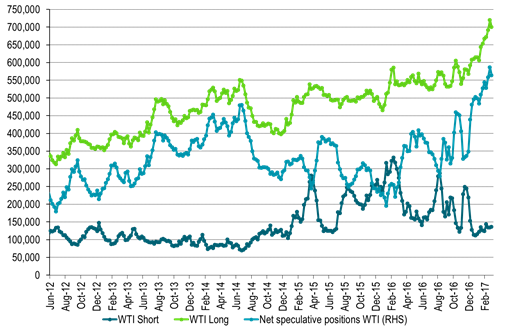

Ch5: Speculators are bullish awaiting that last move into full backwardation

And speculators are bullish accordingly – close to record high net long speculative position in WTI

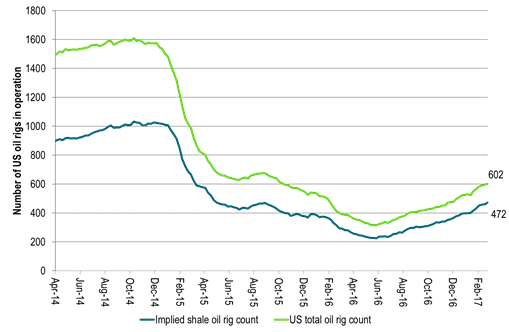

Ch6: US oil rig count moves higher and higher and higher

But US oil rigs are constantly added to the market and at a higher rate than we had expected.

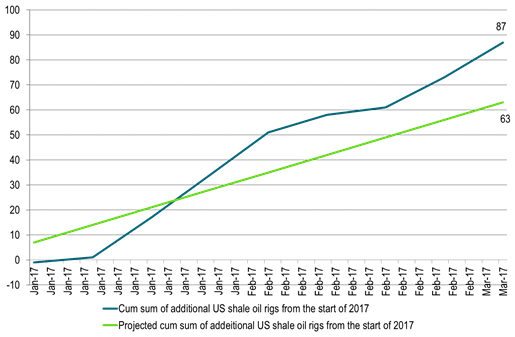

Ch7: More US shale oil rigs have been activated versus what we had expected

More shale oil rigs have been added into activity in the US shale oil space versus what we had expected

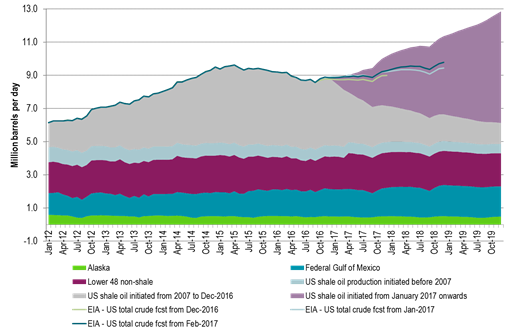

Ch8: Helping to shift US crude oil production growth back into full pre-2015 growth level again

US crude oil production is now on rising trend again adding on average 30 kb/d w/w since the start of the year.

That is equal to a marginal, annualized growth rate of 30 kb/d/week * 52 week = 1560 kb/d/year (1.5 mb/d marginal, annualized growth rate).

That is back to the growth rate seen between 2012 to June 2015.

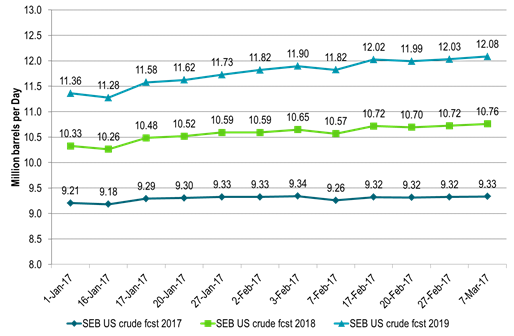

Ch9: More shale oil rigs than expected means higher forecasted US crude oil production than expected

This impacts our projected US crude oil production for 2017, 2018 and 2019 lifting it higher

Ch10: With US crude oil production now expected to lift to close to 13 mb/d at the end of 2019

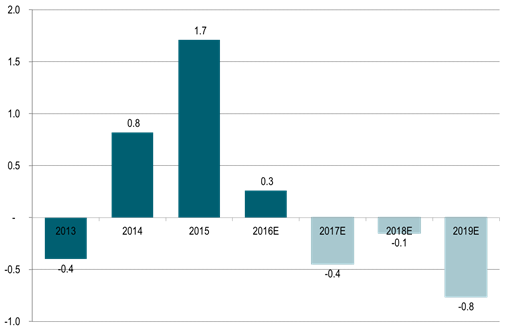

Ch11: Global supply/demand balance still in deficit next three years but not much deficit in 2018 any more

Almost constantly weakening and softening our projected supply/demand balance for the nearest three years.

With our view now that there will be almost no deficit in 2018.

But still a solid deficit and inventory draw coming in 2019 as cuts in investments in conventional supply since 2014 starts to hit the market.

Little conventional legacy investments to add additional supply in 2019 and thus little to counter natural declines in existing conventional production in 2019.

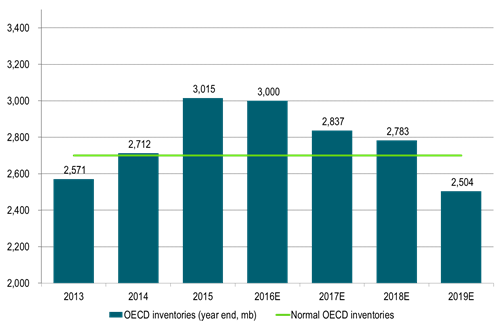

Ch12: End of year OECD inventories to draw substantially below normal in 2019

End of year OECD stocks still to draw substantially below a normal of 2700 million barrels in 2019.

But stocks are likely to end the year above normal for both 2017 and 2018.

Thus few pressure points in the global supply/demand balance during 2017 and 2018 as current elevated oil inventories provides a nice cushion

Ch13: End of year OECD inventories to stand some 200 mb below normal in December 2019

The year 2019 still looks like the year when things could happen to the oil price on the upside.

As end of year OECD inventories could draw down some 200 million barrels below normal

Unless of course demand growth weakens, US shale oil production accelerates even more or oil companies accelerate in-field drilling thus countering conventional declines.

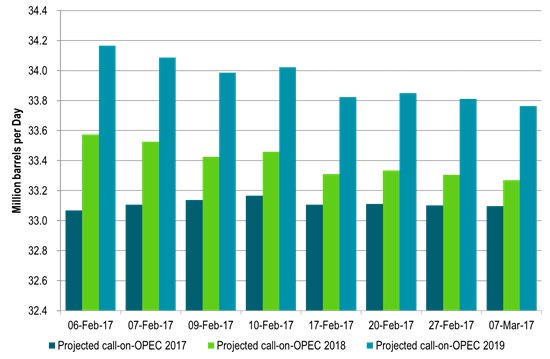

Ch14: Projected call on OPEC has declined since the start of February along with higher US crude oil production projections

As we steadily adjust our US crude oil production higher for 2017, 2018 and 2019 along with higher than expected additions of US shale oil rigs

The need for oil from OPEC declines comparably for the years to come

How far down is OPEC willing to let it slide? Probably not below 33 mb/d for 2018.

Ch15: Softer supply/demand balance naturally means softer prices

In a dynamic crude oil price forecasting frame the forecasted crude oil price declines along with with a softening forward looking supply/demand balance

(Prices in graph are mathematically extended from the $80/b forecasted at the start of February and are not new price forecast assessments)

Ch16: Longer dated market prices have deteriorated since the start of the year

Longer dated contracts like Brent crude December 2020 have deteriorated since the start of the year

Probably reflecting the acceleration in US shale oil rig additions in Q1-17

In late February the contract traded at its lowest level since April 2016.

Kind regards

Bjarne Schieldrop

Chief analyst, Commodities

SEB Markets

Merchant Banking

Analys

Breaking some eggs in US shale

Lower as OPEC+ keeps fast-tracking redeployment of previous cuts. Brent closed down 1.3% yesterday to USD 68.76/b on the back of the news over the weekend that OPEC+ (V8) lifted its quota by 547 kb/d for September. Intraday it traded to a low of USD 68.0/b but then pushed higher as Trump threatened to slap sanctions on India if it continues to buy loads of Russian oil. An effort by Donald Trump to force Putin to a truce in Ukraine. This morning it is trading down 0.6% at USD 68.3/b which is just USD 1.3/b below its July average.

Only US shale can hand back the market share which OPEC+ is after. The overall picture in the oil market today and the coming 18 months is that OPEC+ is in the process of taking back market share which it lost over the past years in exchange for higher prices. There is only one source of oil supply which has sufficient reactivity and that is US shale. Average liquids production in the US is set to average 23.1 mb/d in 2025 which is up a whooping 3.4 mb/d since 2021 while it is only up 280 kb/d versus 2024.

Taking back market share is usually a messy business involving a deep trough in prices and significant economic pain for the involved parties. The original plan of OPEC+ (V8) was to tip-toe the 2.2 mb/d cuts gradually back into the market over the course to December 2026. Hoping that robust demand growth and slower non-OPEC+ supply growth would make room for the re-deployment without pushing oil prices down too much.

From tip-toing to fast-tracking. Though still not full aggression. US trade war, weaker global growth outlook and Trump insisting on a lower oil price, and persistent robust non-OPEC+ supply growth changed their minds. Now it is much more fast-track with the re-deployment of the 2.2 mb/d done already by September this year. Though with some adjustments. Lifting quotas is not immediately the same as lifting production as Russia and Iraq first have to pay down their production debt. The OPEC+ organization is also holding the door open for production cuts if need be. And the group is not blasting the market with oil. So far it has all been very orderly with limited impact on prices. Despite the fast-tracking.

The overall process is nonetheless still to take back market share. And that won’t be without pain. The good news for OPEC+ is of course that US shale now is cooling down when WTI is south of USD 65/b rather than heating up when WTI is north of USD 45/b as was the case before.

OPEC+ will have to break some eggs in the US shale oil patches to take back lost market share. The process is already in play. Global oil inventories have been building and they will build more and the oil price will be pushed lower.

A Brent average of USD 60/b in 2026 implies a low of the year of USD 45-47.5/b. Assume that an average Brent crude oil price of USD 60/b and an average WTI price of USD 57.5/b in 2026 is sufficient to drive US oil rig count down by another 100 rigs and US crude production down by 1.5 mb/d from Dec-25 to Dec-26. A Brent crude average of USD 60/b sounds like a nice price. Do remember though that over the course of a year Brent crude fluctuates +/- USD 10-15/b around the average. So if USD 60/b is the average price, then the low of the year is in the mid to the high USD 40ies/b.

US shale oil producers are likely bracing themselves for what’s in store. US shale oil producers are aware of what is in store. They can see that inventories are rising and they have been cutting rigs and drilling activity since mid-April. But significantly more is needed over the coming 18 months or so. The faster they cut the better off they will be. Cutting 5 drilling rigs per week to the end of the year, an additional total of 100 rigs, will likely drive US crude oil production down by 1.5 mb/d from Dec-25 to Dec-26 and come a long way of handing back the market share OPEC+ is after.

Analys

More from OPEC+ means US shale has to gradually back off further

The OPEC+ subgroup V8 this weekend decided to fully unwind their voluntary cut of 2.2 mb/d. The September quota hike was set at 547 kb/d thereby unwinding the full 2.2 mb/d. This still leaves another layer of voluntary cuts of 1.6 mb/d which is likely to be unwind at some point.

Higher quotas however do not immediately translate to equally higher production. This because Russia and Iraq have ”production debts” of cumulative over-production which they need to pay back by holding production below the agreed quotas. I.e. they cannot (should not) lift production before Jan (Russia) and March (Iraq) next year.

Argus estimates that global oil stocks have increased by 180 mb so far this year but with large skews. Strong build in Asia while Europe and the US still have low inventories. US Gulf stocks are at the lowest level in 35 years. This strong skew is likely due to political sanctions towards Russian and Iranian oil exports and the shadow fleet used to export their oil. These sanctions naturally drive their oil exports to Asia and non-OECD countries. That is where the surplus over the past half year has been going and where inventories have been building. An area which has a much more opaque oil market. Relatively low visibility with respect to oil inventories and thus weaker price signals from inventory dynamics there.

This has helped shield Brent and WTI crude oil price benchmarks to some degree from the running, global surplus over the past half year. Brent crude averaged USD 73/b in December 2024 and at current USD 69.7/b it is not all that much lower today despite an estimated global stock build of 180 mb since the end of last year and a highly anticipated equally large stock build for the rest of the year.

What helps to blur the message from OPEC+ in its current process of unwinding cuts and taking back market share, is that, while lifting quotas, it is at the same time also quite explicit that this is not a one way street. That it may turn around make new cuts if need be.

This is very different from its previous efforts to take back market share from US shale oil producers. In its previous efforts it typically tried to shock US shale oil producers out of the market. But they came back very, very quickly.

When OPEC+ now is taking back market share from US shale oil it is more like it is exerting a continuous, gradually increasing pressure towards US shale oil rather than trying to shock it out of the market which it tried before. OPEC+ is now forcing US shale oil producers to gradually back off. US oil drilling rig count is down from 480 in Q1-25 to now 410 last week and it is typically falling by some 4-5 rigs per week currently. This has happened at an average WTI price of about USD 65/b. This is very different from earlier when US shale oil activity exploded when WTI went north of USD 45/b. This helps to give OPEC+ a lot of confidence.

Global oil inventories are set to rise further in H2-25 and crude oil prices will likely be forced lower though the global skew in terms of where inventories are building is muddying the picture. US shale oil activity will likely decline further in H2-25 as well with rig count down maybe another 100 rigs. Thus making room for more oil from OPEC+.

Analys

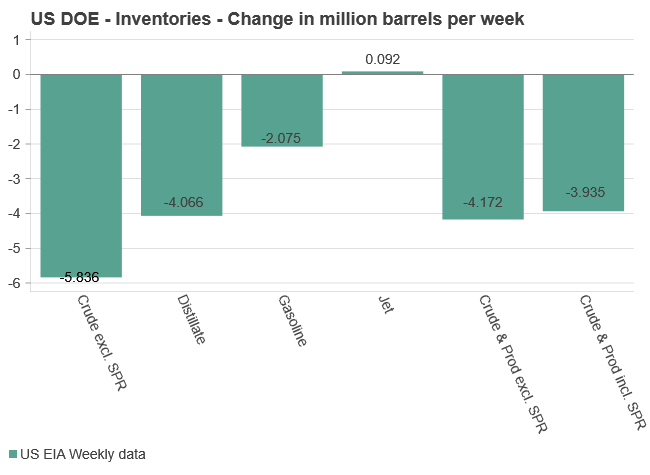

Tightening fundamentals – bullish inventories from DOE

The latest weekly report from the US DOE showed a substantial drawdown across key petroleum categories, adding more upside potential to the fundamental picture.

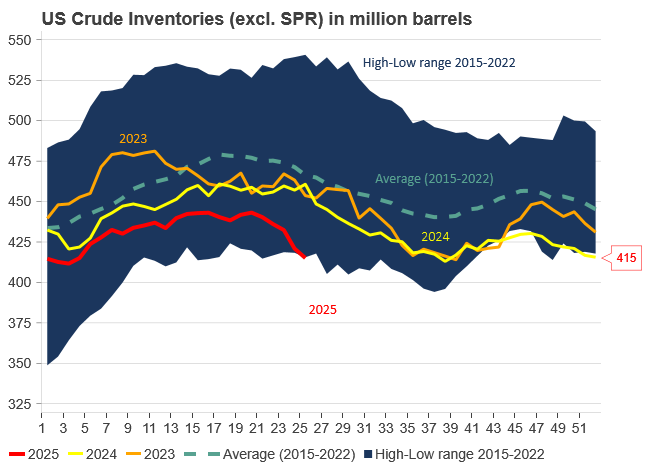

Commercial crude inventories (excl. SPR) fell by 5.8 million barrels, bringing total inventories down to 415.1 million barrels. Now sitting 11% below the five-year seasonal norm and placed in the lowest 2015-2022 range (see picture below).

Product inventories also tightened further last week. Gasoline inventories declined by 2.1 million barrels, with reductions seen in both finished gasoline and blending components. Current gasoline levels are about 3% below the five-year average for this time of year.

Among products, the most notable move came in diesel, where inventories dropped by almost 4.1 million barrels, deepening the deficit to around 20% below seasonal norms – continuing to underscore the persistent supply tightness in diesel markets.

The only area of inventory growth was in propane/propylene, which posted a significant 5.1-million-barrel build and now stands 9% above the five-year average.

Total commercial petroleum inventories (crude plus refined products) declined by 4.2 million barrels on the week, reinforcing the overall tightening of US crude and products.

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanUSA inför 93,5 % tull på kinesisk grafit

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanFusionsföretag visar hur guld kan produceras av kvicksilver i stor skala – alkemidrömmen ska bli verklighet

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanWestinghouse planerar tio nya stora kärnreaktorer i USA – byggstart senast 2030

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanRyska militären har skjutit ihjäl minst 11 guldletare vid sin gruva i Centralafrikanska republiken

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanKopparpriset i fritt fall i USA efter att tullregler presenterats

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanEurobattery Minerals förvärvar majoritet i spansk volframgruva

-

Nyheter1 vecka sedan

Nyheter1 vecka sedanLundin Gold rapporterar enastående borrresultat vid Fruta del Norte

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanKina skärper kontrollen av sällsynta jordartsmetaller, vill stoppa olaglig export