Nyheter

David Hargreaves on Precious Metals, week 6 2014

Gold staggered ahead a full 0.7% this week, well 0.7394% actually, based on the London fix. Platinum was neither shaken nor stirred, whilst silver underperformed. Now it is rude to yawn whilst someone is talking, but the precious metals show is in limbo, is it not? Going no place. Its rally – of sorts – during the week was put down to US job figures not being as positive as analysts expected. Yet they were up. We have to conclude that should tinkering with numbers, like US unemployment falling 0.1% and thinking it matters to the gold price, we are doomed to die of boredom. Even wars are becoming unfashionable. Iraq and Iran went to rebuild their economies, Russia is hosting the Winter Olympics and deep down, who gives a flying dart about the Peruvian farmers right now? Nobody. So the great and good are still calling gold down. Standard & Poors has chopped its 2014-2016 forecast by nearly 10%, to $1250/oz for this year, then $1200. As a throwaway it says this could pressure some companies with persistently high costs. Not to be outdone, Bank of America looks for a ‘possible’ $1000. It uses continued selling by tactical investors and a lack of physical buying in China and India as its levers.

But what of platinum? Scarcely has a metal been so strongly in the grip of one source, have such an excellent demand profile and been in such a production muddle, yet failed to perform. The last time we recall a parallel was cobalt 80% coming from Zaire (now DRC) having its supply threatened. In six weeks the price went from $3.50 to $42.0 per pound. Platinum is unmoved. The RSA producers saw it coming. The irate unions have not even tried to elicit support from the non-RSA miners, Russia, Zim, Canada (would they know how?) and the price is moribund. They speak of a ‘fight to the death’ as strikes continue. Sadly, it may be just that. If you attend a meeting carrying a large sharp stick, you intend to use it, probably. Lonmin, the No 2 producer at 12% of total mined output, says it is looking at improving workers living conditions. This on the face of it, is laudable, but does not address long term advancement.

Workers should move towards owning their own houses and spending their (liveable) wages on what they see fit. Cradle-to-grave is one of the curses of African society. So they will ‘intensify’ industrial action. What a lovely prospect.

[hr]

About David Hargreaves

David Hargreaves is a mining engineer with over forty years of senior experience in the industry. After qualifying in coal mining he worked in the iron ore mines of Quebec and Northwest Ontario before diversifying into other bulk minerals including bauxite. He was Head of Research for stockbrokers James Capel in London from 1974 to 1977 and voted Mining Analyst of the year on three successive occasions.

Since forming his own metals broking and research company in 1977, he has successfully promoted and been a director of several public companies. He currently writes “The Week in Mining”, an incisive review of world mining events, for stockbrokers WH Ireland. David’s research pays particular attention to steel via the iron ore and coal supply industries. He is a Chartered Mining Engineer, Fellow of the Geological Society and the Institute of Mining, Minerals and Materials, and a Member of the Royal Institution. His textbook, “The World Index of Resources and Population” accurately predicted the exponential rise in demand for steel industry products.

Nyheter

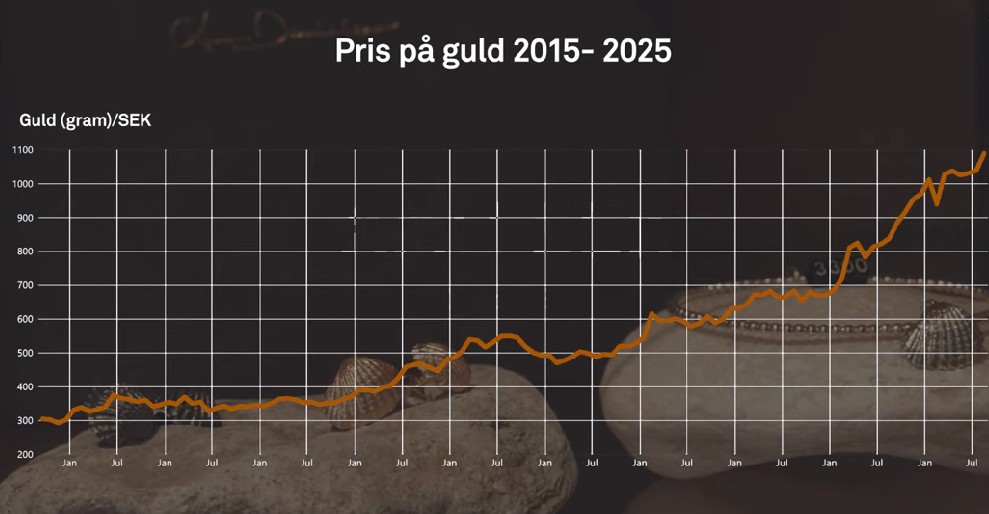

Det stigande guldpriset en utmaning för smyckesköpare

Guldpriset når hela tiden nya höjder och det märks för folk när de ska köpa smycken. Det gör att butikerna måste justera upp sina priser löpande och kunder funderar på om det går att välja något med lägre karat eller mindre diamant. Anna Danielsson, vd på Smyckevalvet, säger att det samtidigt gör att kunderna får upp ögonen för värdet av att äga guld. Det högre guldpriset har även gjort att gamla smycken som ligger hemma i folks byrålådor kan ha fått ett överraskande högt värde.

Nyheter

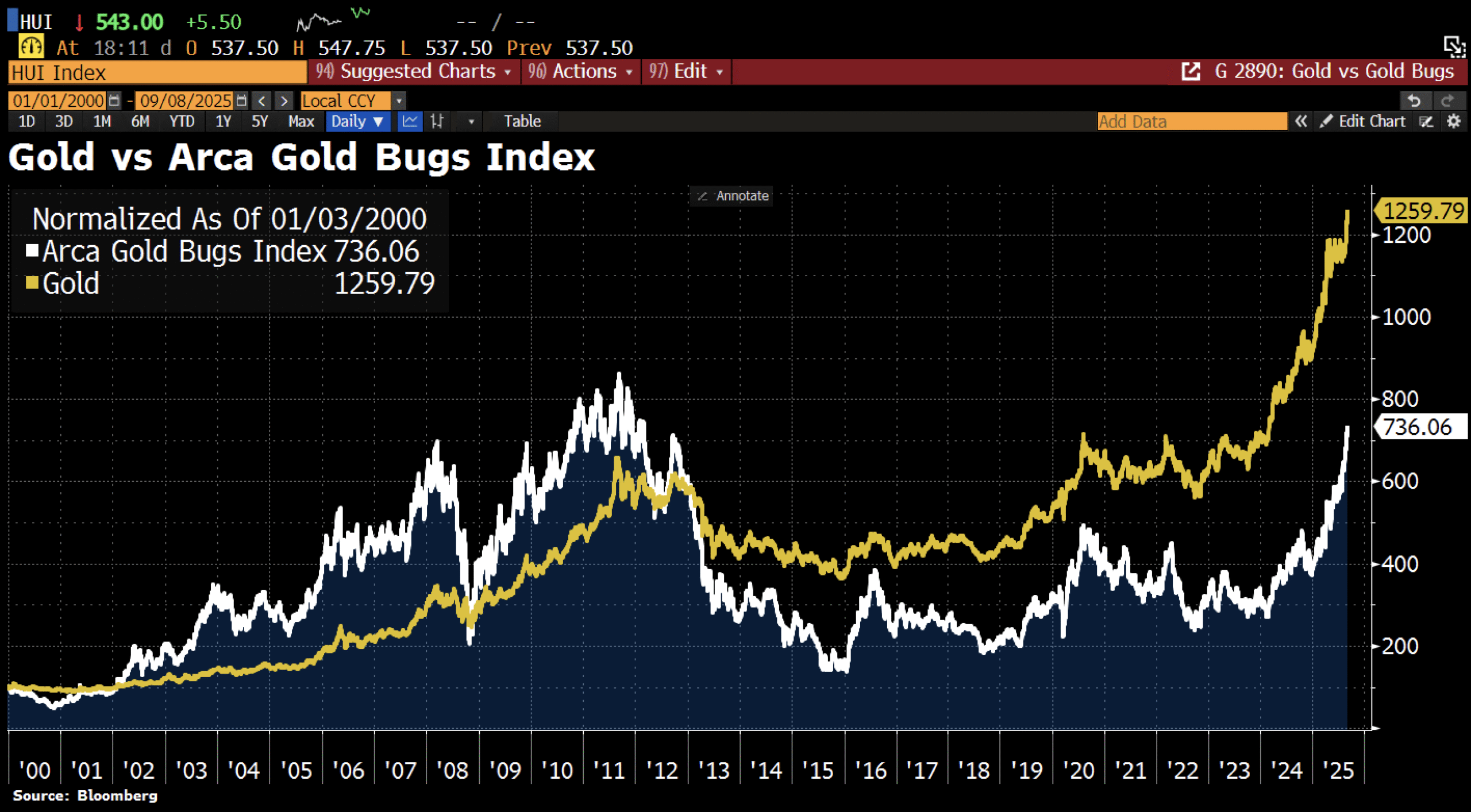

Aktier i guldbolag laggar priset på guld

Sedan år 2013 har aktierna i bolag som producerar guld inte alls hängt med prisutvecklingen på guld. I takt med att guldpriset har stigit så har avståndet bara blivit större. Detta trots att riskaptiten på aktiemarknaden i stort är högt.

I diagrammet jämförs priset på guld med Arca Gold Bugs Index, där indexet består av flera av de största guldbolagen.

Nyheter

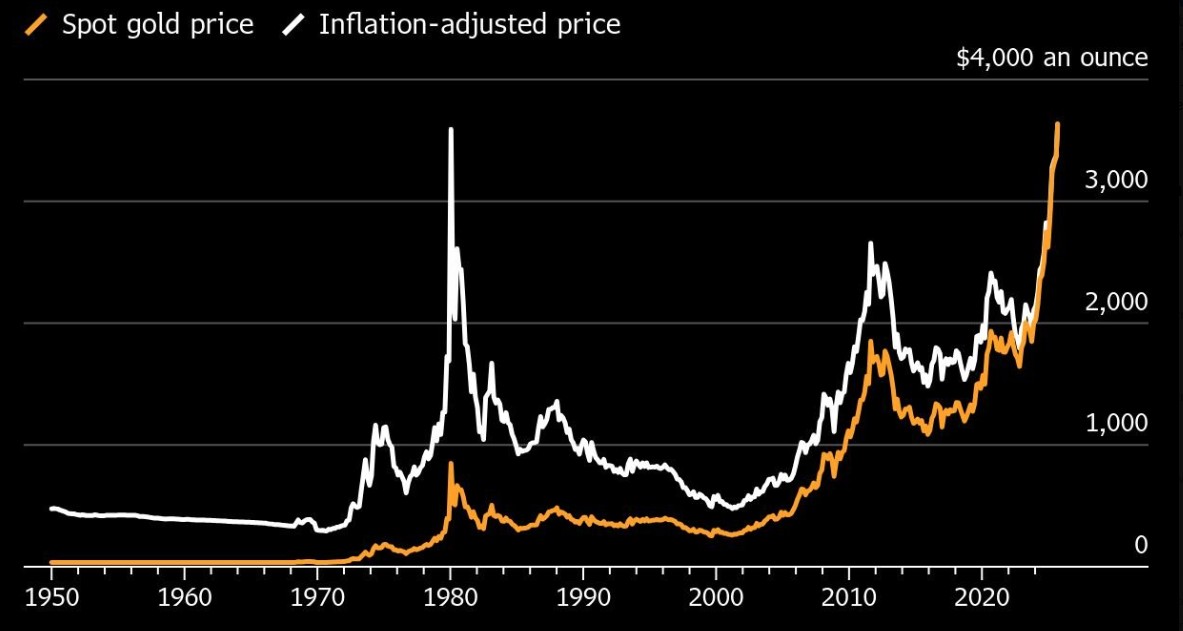

Guld når sin högsta nivå någonsin, nu även justerat för inflation

Guld har slagit prisrekord efter prisrekord det senaste året och nu har ädelmetallen tagit det hela till en ny nivå. När man mäter priser över längre tid kan det vara relevant att justera för inflation. Inflation kan mätas på många olika sätt, men vad guldet nu har gjort är att passera alla sätt och nå sin högsta nivå någonsin oavsett vad.

Det har varit en pristopp från år 1980 som har varit högre när man justerat för inflation, men även den har alltså nu fått se sig överträffad.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanMeta bygger ett AI-datacenter på 5 GW och 2,25 GW gaskraftverk

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanAker BP gör ett av Norges största oljefynd på ett decennium, stärker resurserna i Yggdrasilområdet

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanEtt samtal om koppar, kaffe och spannmål

-

Analys4 veckor sedan

Analys4 veckor sedanBrent sideways on sanctions and peace talks

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanSommarens torka kan ge högre elpriser i höst

-

Analys3 veckor sedan

Analys3 veckor sedanBrent edges higher as India–Russia oil trade draws U.S. ire and Powell takes the stage at Jackson Hole

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanMahvie Minerals är verksamt i guldrikt område i Finland

-

Analys3 veckor sedan

Analys3 veckor sedanIncreasing risk that OPEC+ will unwind the last 1.65 mb/d of cuts when they meet on 7 September