Analys

SEB – Råvarukommentarer vecka 21 2012

Sammanfattning: Föregående vecka

Brett råvaruindex: -1,75 %

Brett råvaruindex: -1,75 %

UBS Bloomberg CMCI TR Index- Energi: -1,12 %

UBS Bloomberg CMCI Energy TR Index - Ädelmetaller: -2,22%

UBS Bloomberg CMCI Precious Metals TR Index - Industrimetaller: -0,98 %

UBS Bloomberg CMCI Industrial Metals TR Index - Jordbruk: -3,09 %

UBS Bloomberg CMCI Agriculture TR Index

Kortsiktig marknadsvy:

- Guld: Neutral/köp

- Olja: Sälj

- Koppar: Sälj

- Majs: Sälj

- Vete: Neutral

Guld

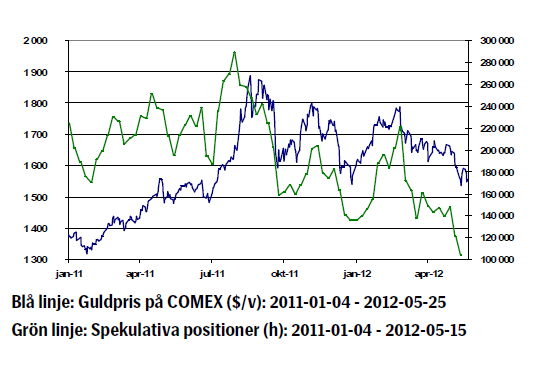

Guldet föll 1,9 procent under veckan. För första gången på länge ser vi ett betydande utflöde ur fysiska guld ETF: er. Samtidigt kan nämnas att under samma period som guldpriset sjunkit 20 procent sedan toppen 2011 har innehaven i världens största ETF, SPDR, stigit med tre procent.

Efterfrågan på guldsmycken i Indien förväntas sjunka för tredje kvartalet i rad efter att rupien försvagats till rekordlåg nivå mot dollarn.

Greklands f.d. premiärminister Papademos sa i veckan att det finns en betydande risk för att landet kommer att lämna euro-samarbetet. EU:s ledare blir allt mer medvetna om att försöken att rädda kvar Grekland i euron håller på att misslyckas. Helst ser man att Grekland behåller euron, så den politiska viljan finns, men fortsatt stöd förutsätter att Grekland följer överenskommelser om budgetmål. Allt görs nu för att få de grekiska väljarna att förstå att de i valet den 17 juni i praktiken kommer att rösta om euromedlemskapet snarare än om fortsatta åtstramningar. Guldet har alltså fortsatt stöd av Eurozon stress.

Skolbokens gamla ”sanningen ”ökad finansiell oro – guldpriset stiger”, ter sig alltmer avlägsen.

Den starkare dollarn har också bidragit till prisfallet i guld. Euron har letat sig ned mot den svagaste nivån mot dollarn sedan sommaren 2010.

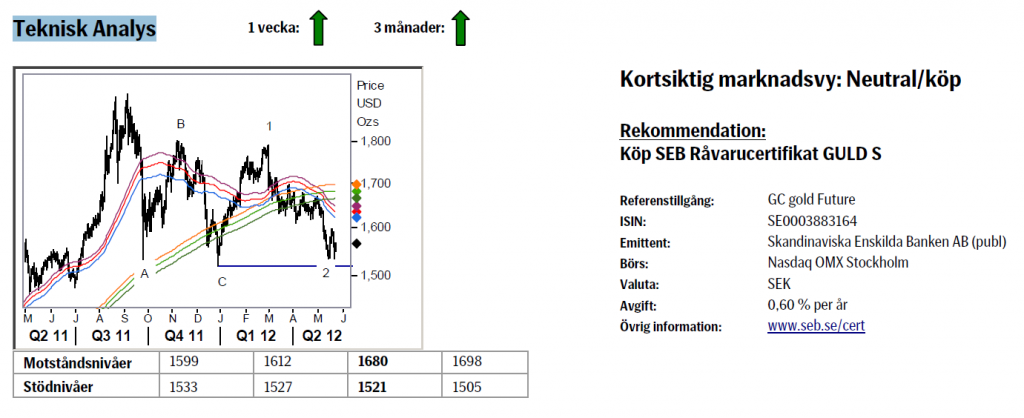

Teknisk analys: Som tidigare gäller att så länge inte C vågens botten, 1521, bryts ligger vi i startblocken för nästa uppgångsfas. Givet närheten till huvudstödet krävs en noggrannare bevakning. Dessutom anser vi att nuvarande läge är ett intressant köptillfälle för den mer spekulativt lagde. Ett köp på nuvarande nivå med en stopp loss under 1521 ger också en angenäm chans/riskprofil, om man är positiv till guldet dvs.

Olja

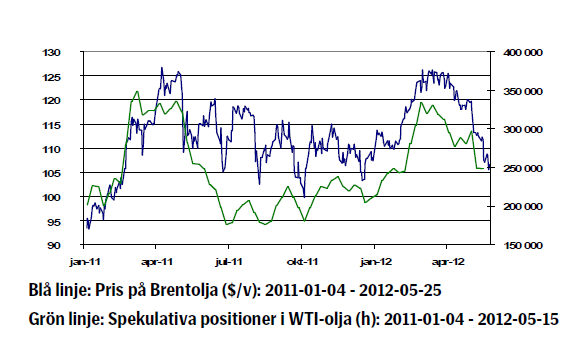

Oljan backade 0,29 procent och spekulativa långa positioner föll till fyra månaders lägsta. Oljan befinner sig fortfarande i en ”soft spot” pga. överproduktion (Saudiarabien försöker pressa ner oljepriset för att öka trycket på Iran) och ett negativt makrosentiment.

Chefen för International Atomic Energy Agency (IAEA) har sagt att han förväntar sig att teckna ett avtal med Iran om att få inspektera landets kärnenergianläggningar. Onsdagens möte i Bagdad där Iran och FN:s sex permanenta medlemmar i säkerhetsrådet + Tyskland möttes blev tämligen resultatlöst och resulterade främst i en sammanfattning av läget och inget nytt för framtiden. Förhoppningar fanns om en lösning på Irankonflikten efter mötet i Bagdad. Enlig API steg råoljelager med 1,5 miljoner fat och är nu på den högsta nivån sedan 1990.

Enligt onsdagens statistik från DOE steg råoljelagren med 0,8 miljoner fat.

Enligt SEB:s analytiker kommer överskottet på olja att minska redan under det tredje kvartalet i år när efterfrågan ökar säsongsmässigt.

Orkansäsongen i USA börjar nu återigen utgöra ett hot mot oljeproduktionen i Mexikanska golfen.

I USA är det långhelg och Memorial Day firas på måndag och inleder amerikanska ”driving season” vilket vanligtvis leder till en ökad efterfrågan på drivmedel. På kort sikt anser vi emellertid att mycket talar för ett fallande oljepris.

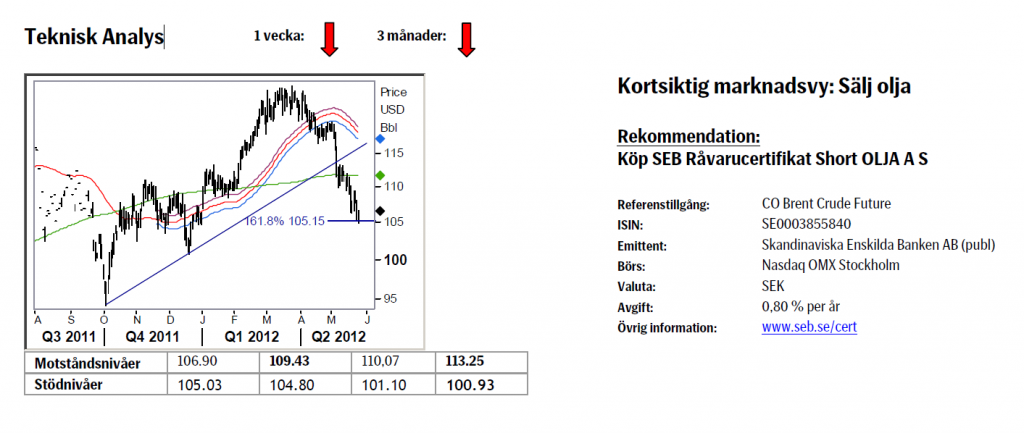

Teknisk analys: I och med brottet av 233dagars medelvärdet utlöstes en ny medelsiktig säljsignal. Sedan dess har marknaden fortsatt att falla ned till 105.15-stödet där i alla fall en mindre rekyl bör uppkomma. Väl avklarad (sälj tillfälle) ska marknaden fortsätta falla ned emot 100/101 området där nästa huvudstöd återfinnes.

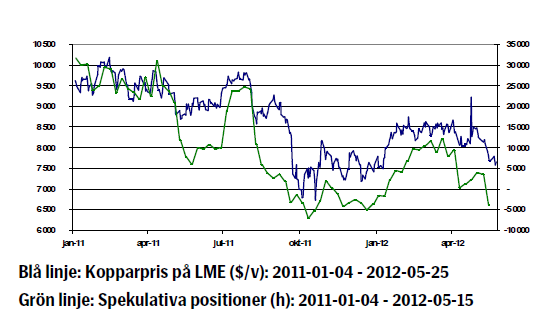

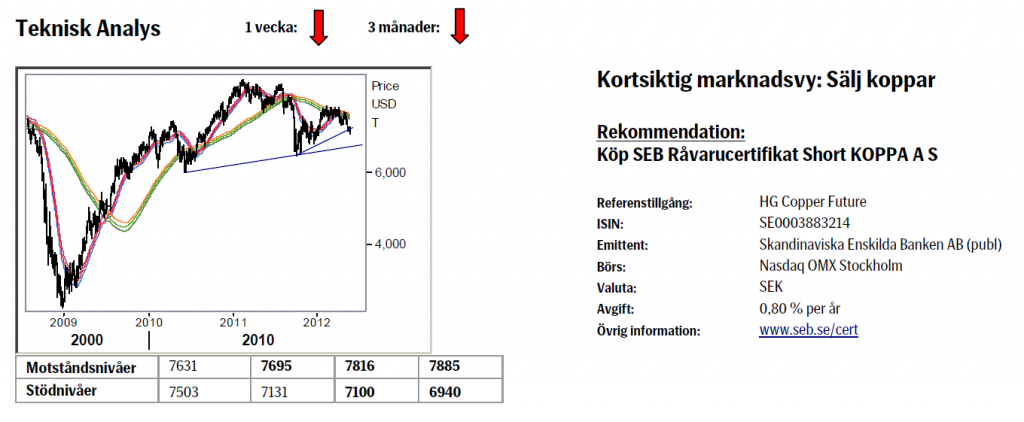

Koppar

Kopparpriset föll 0,44 procent under veckan och handlade som lägst på 7500 dollar. Spekulativa långa positioner föll till ringa fem tusen kontrakt. Positiva data från amerikansk husförsäljning påverkade inte kopparpriset. Försäljningen steg till en säsongsjusterad pristakt på 343 000 enheter vilken var mer än vad analytiker räknat med.

Igår påvisade kinesiskt preliminärt inköpschefsindex för tillverkningsindustrin för maj, ett index som HSBC publicerar, en kontraktion till 48,7 från 49,3 i april. Tillverkningsindustrin gick tillbaka mot bakgrund av svagare export. Kopparn faller i takt med den europeiska krisen eftersom Europa är Kinas största handelspartner

I Kina fortsätter fastighetspriser att falla. Enligt premiärminister Wen Jiabao kommer Kina fokusera framöver på att öka fokus på tillväxt igen. Detta skulle innebära en lättad penningpolitik, något som är positivt för koppar men på kortsikt är osäkerheten stor och vi tror att priserna kan sjunka något ytterligare.

Världsbanken sänkte utsikterna för Kinas BNP till 8,2 procent 2012 från 9,2 procent 2011. Siffran är högre än Kinas egen prognos som hamnade på 7,5 procent. Landet är nu på väg mot ett sjätte kvartal med fallande tillväxt.

Kopparn har fått visst stöd av uttalande från Codelco, som bekräftade att produktionen under första kvartalet är 10 procent lägre jämfört med förra året p.g.a. låga metallhalter i malmen.

Rykten säger att JP Morgan ska lansera en ETC med fysiskt koppar som underliggande vilket skulle kunna driva upp priset. Samtidigt har vi noterat att produkter med fysiska industrimetaller (alltså inte terminskontrakt) inte varit en kommersiell framgång än så länge.

Teknisk analys: Marknaden har nu också brutit under 7885 stödet och därigenom utlöst ytterligare försäljningar. Vi kan inte se annat än att fortsatt nedgång är att vänta och att vi härnäst tar sikte på nacklinjen, 6940, på den stora huvud skuldra topp formationen.

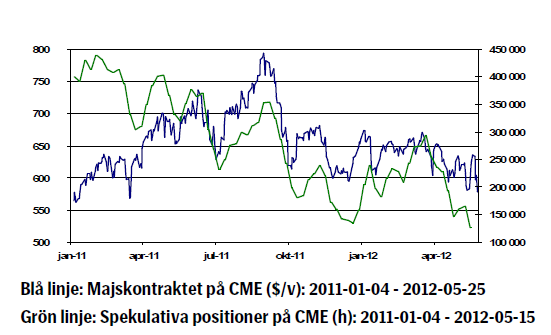

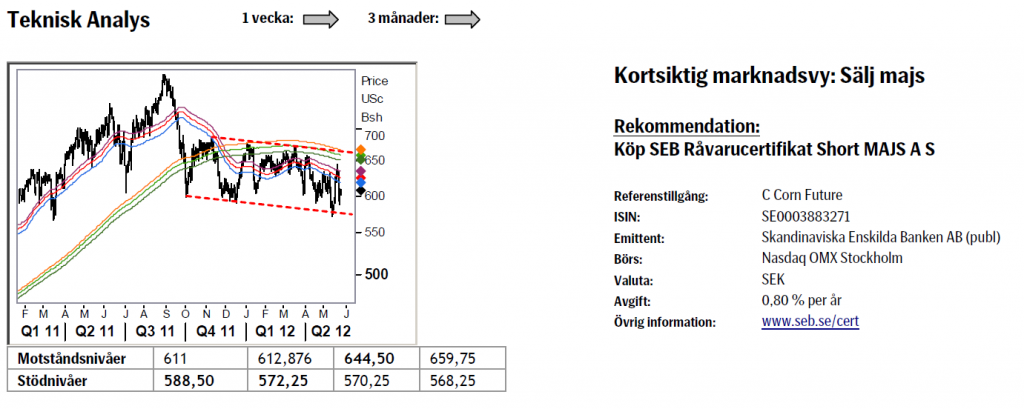

Majs

Även jordbruksprodukterna drogs med ner av det negativa marknadssentimentet och krisen i Europa.

Majspriset föll 7,5 procent under veckan efter prognoser om nederbörd vilka gett förhoppningar om att den nyplanterade amerikanska skörden kommer att bli god. USA är världens största producent och konsument av majs.

Fokus är på väderförhållanden de närmaste veckorna och enligt Global Weather Monitoring förväntas regn i flera amerikanska delstater där man odlar majs vilket alltså är behövligt och positivt för skörden.

Enligt USDA var 77 procent av amerikansk majs i ”good or excellent condition” den 20:e maj vilket är den högsta nivån sedan 2007. Sådden i USA är nu i princip avklarad, rekordtidigt. Kortsiktigt står vi fast vid vår negativa syn men skulle torkan istället hålla i sig är det onekligen ett riskmoment.

Teknisk analys: Reaktionen från botten in kanalen renderade en mycket kraftig studs, vilken, i alla fall kortsiktigt, förhindrat det potentiella ras vi tidigare varnat för. Dock gäller även framgent att dessa kraftiga svängningar gör kortsiktiga vyer utmanande varför vi rekommenderar stor försiktighet och en mer eller mindre neutral vy.

Vete

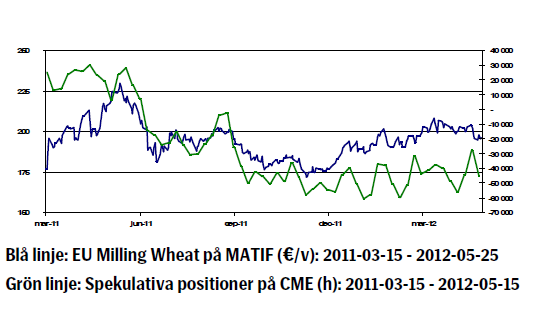

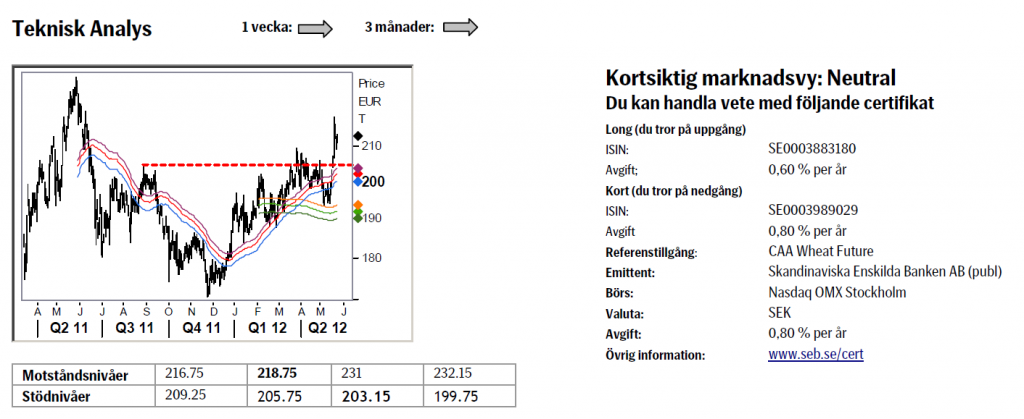

Vi har sett stora rörelser i vetemarknaden och vetepriset föll 1,16 procent under veckan som gått.

Föregående veckas prisuppgång berodde på torrt väder i Ryssland och USA. Det är även torrt i Kina, Europa och Ukraina. Den långdragna torka som varit hotar att orsaka en sämre skörd än förväntat. Matifvetet med novemberleverans steg med tio procent på rapporterna.

Nu innehåller nya prognoser regn i USA och Europa (även om t ex Tyskland, utom de södra delarna, blir utan regn) vilket fått vetepriset att falla tillbaka. Egentligen borde risken för torka avta eftersom omfattande väderstörningar (ENSO) är neutrala och onormala väderförhållanden (La Niña- Sydostasien och Oceanien får betydligt mer nederbörd än vanligt medan delar av Sydamerika får torka) borde klinga av.

Regn förväntas nu även i Ryssland och Ukraina vilket förbättrar förutsättningarna för skörden även där.

Kvalitén för höstvetet i USA, som rapporterades i måndags, ligger på 58 procent “good /excellent” och det är två procent lägre än förra veckan. Kvalitén har alltså fallit under 60 procent “good/excellent”. Det är en nedrevidering på veckobasis men betydligt bättre än förra årets siffror.

Skörden av höstvete är nu redan klar i Louisiana, vilket är rekordtidigt. Skörden är väsentligt mindre än förväntat.

Frågan är om priset på Matif vetet kommer att falla tillbaka i spåren av mer nederbörd, eller kommer nya rapporter om torka att få priset att vända uppåt. Vi förhåller oss neutrala till vetet under kommande vecka.

Teknisk analys: Den senaste uppgången (som tog sin början ifrån strax ovanför 233dagars bandet) gick lite väl fort varför vi nu befinner oss i en kortare konsolidering. Väl avslutad, vilket vi tror att den redan kan vara, bör vi se marknaden åter stiga upp till nya toppar (och till slut också kliva upp över toppen från förra våren).

[box]SEB Veckobrev Veckans råvarukommentar är producerat av SEB Merchant Banking och publiceras i samarbete och med tillstånd på Råvarumarknaden.se[/box]

Disclaimer

The information in this document has been compiled by SEB Merchant Banking, a division within Skandinaviska Enskilda Banken AB (publ) (“SEB”).

Opinions contained in this report represent the bank’s present opinion only and are subject to change without notice. All information contained in this report has been compiled in good faith from sources believed to be reliable. However, no representation or warranty, expressed or implied, is made with respect to the completeness or accuracy of its contents and the information is not to be relied upon as authoritative. Anyone considering taking actions based upon the content of this document is urged to base his or her investment decisions upon such investigations as he or she deems necessary. This document is being provided as information only, and no specific actions are being solicited as a result of it; to the extent permitted by law, no liability whatsoever is accepted for any direct or consequential loss arising from use of this document or its contents.

About SEB

SEB is a public company incorporated in Stockholm, Sweden, with limited liability. It is a participant at major Nordic and other European Regulated Markets and Multilateral Trading Facilities (as well as some non-European equivalent markets) for trading in financial instruments, such as markets operated by NASDAQ OMX, NYSE Euronext, London Stock Exchange, Deutsche Börse, Swiss Exchanges, Turquoise and Chi-X. SEB is authorized and regulated by Finansinspektionen in Sweden; it is authorized and subject to limited regulation by the Financial Services Authority for the conduct of designated investment business in the UK, and is subject to the provisions of relevant regulators in all other jurisdictions where SEB conducts operations. SEB Merchant Banking. All rights reserved.

Analys

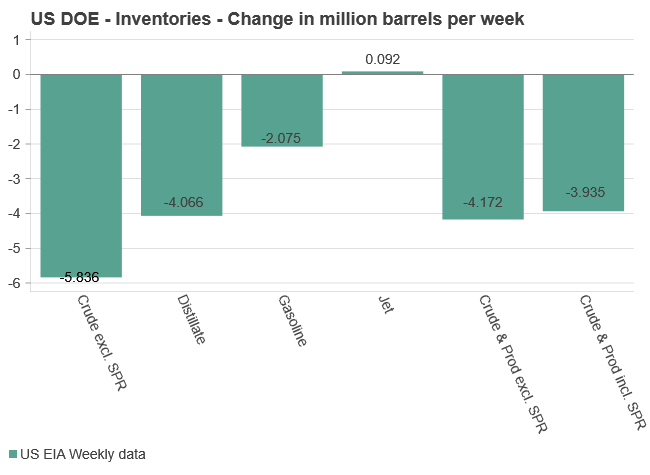

Tightening fundamentals – bullish inventories from DOE

The latest weekly report from the US DOE showed a substantial drawdown across key petroleum categories, adding more upside potential to the fundamental picture.

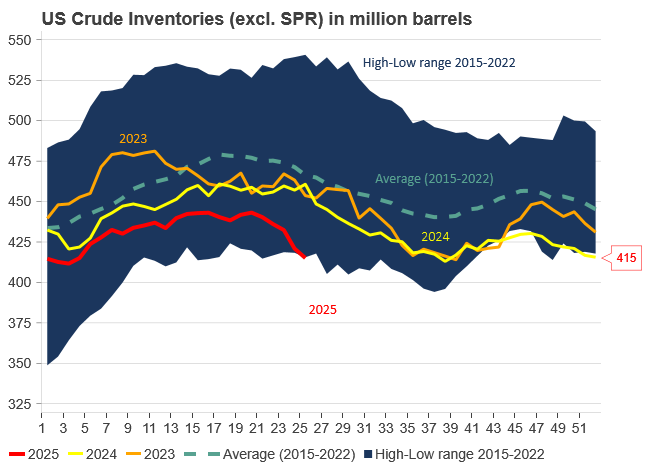

Commercial crude inventories (excl. SPR) fell by 5.8 million barrels, bringing total inventories down to 415.1 million barrels. Now sitting 11% below the five-year seasonal norm and placed in the lowest 2015-2022 range (see picture below).

Product inventories also tightened further last week. Gasoline inventories declined by 2.1 million barrels, with reductions seen in both finished gasoline and blending components. Current gasoline levels are about 3% below the five-year average for this time of year.

Among products, the most notable move came in diesel, where inventories dropped by almost 4.1 million barrels, deepening the deficit to around 20% below seasonal norms – continuing to underscore the persistent supply tightness in diesel markets.

The only area of inventory growth was in propane/propylene, which posted a significant 5.1-million-barrel build and now stands 9% above the five-year average.

Total commercial petroleum inventories (crude plus refined products) declined by 4.2 million barrels on the week, reinforcing the overall tightening of US crude and products.

Analys

Bombs to ”ceasefire” in hours – Brent below $70

A classic case of “buy the rumor, sell the news” played out in oil markets, as Brent crude has dropped sharply – down nearly USD 10 per barrel since yesterday evening – following Iran’s retaliatory strike on a U.S. air base in Qatar. The immediate reaction was: “That was it?” The strike followed a carefully calibrated, non-escalatory playbook, avoiding direct threats to energy infrastructure or disruption of shipping through the Strait of Hormuz – thus calming worst-case fears.

After Monday morning’s sharp spike to USD 81.4 per barrel, triggered by the U.S. bombing of Iranian nuclear facilities, oil prices drifted sideways in anticipation of a potential Iranian response. That response came with advance warning and caused limited physical damage. Early this morning, both the U.S. President and Iranian state media announced a ceasefire, effectively placing a lid on the immediate conflict risk – at least for now.

As a result, Brent crude has now fallen by a total of USD 12 from Monday’s peak, currently trading around USD 69 per barrel.

Looking beyond geopolitics, the market will now shift its focus to the upcoming OPEC+ meeting in early July. Saudi Arabia’s decision to increase output earlier this year – despite falling prices – has drawn renewed attention considering recent developments. Some suggest this was a response to U.S. pressure to offset potential Iranian supply losses.

However, consensus is that the move was driven more by internal OPEC+ dynamics. After years of curbing production to support prices, Riyadh had grown frustrated with quota-busting by several members (notably Kazakhstan). With Saudi Arabia cutting up to 2 million barrels per day – roughly 2% of global supply – returns were diminishing, and the risk of losing market share was rising. The production increase is widely seen as an effort to reassert leadership and restore discipline within the group.

That said, the FT recently stated that, the Saudis remain wary of past missteps. In 2018, Riyadh ramped up output at Trump’s request ahead of Iran sanctions, only to see prices collapse when the U.S. granted broad waivers – triggering oversupply. Officials have reportedly made it clear they don’t intend to repeat that mistake.

The recent visit by President Trump to Saudi Arabia, which included agreements on AI, defense, and nuclear cooperation, suggests a broader strategic alignment. This has fueled speculation about a quiet “pump-for-politics” deal behind recent production moves.

Looking ahead, oil prices have now retraced the entire rally sparked by the June 13 Israel–Iran escalation. This retreat provides more political and policy space for both the U.S. and Saudi Arabia. Specifically, it makes it easier for Riyadh to scale back its three recent production hikes of 411,000 barrels each, potentially returning to more moderate increases of 137,000 barrels for August and September.

In short: with no major loss of Iranian supply to the market, OPEC+ – led by Saudi Arabia – no longer needs to compensate for a disruption that hasn’t materialized, especially not to please the U.S. at the cost of its own market strategy. As the Saudis themselves have signaled, they are unlikely to repeat previous mistakes.

Conclusion: With Brent now in the high USD 60s, buying oil looks fundamentally justified. The geopolitical premium has deflated, but tensions between Israel and Iran remain unresolved – and the risk of missteps and renewed escalation still lingers. In fact, even this morning, reports have emerged of renewed missile fire despite the declared “truce.” The path forward may be calmer – but it is far from stable.

Analys

A muted price reaction. Market looks relaxed, but it is still on edge waiting for what Iran will do

Brent crossed the 80-line this morning but quickly fell back assigning limited probability for Iran choosing to close the Strait of Hormuz. Brent traded in a range of USD 70.56 – 79.04/b last week as the market fluctuated between ”Iran wants a deal” and ”US is about to attack Iran”. At the end of the week though, Donald Trump managed to convince markets (and probably also Iran) that he would make a decision within two weeks. I.e. no imminent attack. Previously when when he has talked about ”making a decision within two weeks” he has often ended up doing nothing in the end. The oil market relaxed as a result and the week ended at USD 77.01/b which is just USD 6/b above the year to date average of USD 71/b.

Brent jumped to USD 81.4/b this morning, the highest since mid-January, but then quickly fell back to a current price of USD 78.2/b which is only up 1.5% versus the close on Friday. As such the market is pricing a fairly low probability that Iran will actually close the Strait of Hormuz. Probably because it will hurt Iranian oil exports as well as the global oil market.

It was however all smoke and mirrors. Deception. The US attacked Iran on Saturday. The attack involved 125 warplanes, submarines and surface warships and 14 bunker buster bombs were dropped on Iranian nuclear sites including Fordow, Natanz and Isfahan. In response the Iranian Parliament voted in support of closing the Strait of Hormuz where some 17 mb of crude and products is transported to the global market every day plus significant volumes of LNG. This is however merely an advise to the Supreme leader Ayatollah Ali Khamenei and the Supreme National Security Council which sits with the final and actual decision.

No supply of oil is lost yet. It is about the risk of Iran closing the Strait of Hormuz or not. So far not a single drop of oil supply has been lost to the global market. The price at the moment is all about the assessed risk of loss of supply. Will Iran choose to choke of the Strait of Hormuz or not? That is the big question. It would be painful for US consumers, for Donald Trump’s voter base, for the global economy but also for Iran and its population which relies on oil exports and income from selling oil out of that Strait as well. As such it is not a no-brainer choice for Iran to close the Strait for oil exports. And looking at the il price this morning it is clear that the oil market doesn’t assign a very high probability of it happening. It is however probably well within the capability of Iran to close the Strait off with rockets, mines, air-drones and possibly sea-drones. Just look at how Ukraine has been able to control and damage the Russian Black Sea fleet.

What to do about the highly enriched uranium which has gone missing? While the US and Israel can celebrate their destruction of Iranian nuclear facilities they are also scratching their heads over what to do with the lost Iranian nuclear material. Iran had 408 kg of highly enriched uranium (IAEA). Almost weapons grade. Enough for some 10 nuclear warheads. It seems to have been transported out of Fordow before the attack this weekend.

The market is still on edge. USD 80-something/b seems sensible while we wait. The oil market reaction to this weekend’s events is very muted so far. The market is still on edge awaiting what Iran will do. Because Iran will do something. But what and when? An oil price of 80-something seems like a sensible level until something do happen.

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanStor uppsida i Lappland Guldprospekterings aktie enligt analys

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanBrookfield ska bygga ett AI-datacenter på hela 750 MW i Strängnäs

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanSilverpriset släpar efter guldets utveckling, har mer uppsida

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanTradingfirman XTX Markets bygger datacenter i finska Kajana för 1 miljard euro

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanUppgången i oljepriset planade ut under helgen

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanLåga elpriser i sommar – men mellersta Sverige får en ökning

-

Analys2 veckor sedan

Analys2 veckor sedanVery relaxed at USD 75/b. Risk barometer will likely fluctuate to higher levels with Brent into the 80ies or higher coming 2-3 weeks

-

Nyheter1 vecka sedan

Nyheter1 vecka sedanMahvie Minerals växlar spår – satsar fullt ut på guld